The Global Warehouse Racking Market size was valued at USD 9.70 Bn. in 2024, and the total Global Warehouse Racking Market revenue is expected to grow by 4.1% from 2024 to 2032, reaching nearly USD 13.38 Bn.Global Warehouse Racking Market Overview

Warehouse racking is a sort of steel structure that includes metal frames, beams, and connections that is used to store items in warehouses. Clipping, welding, and bolting are some of the methods used to build and create warehouse racking systems. In the global Warehouse Racking Market, racking systems are available in multiple sizes, widths, and load-bearing capacities, designed to optimize storage space and efficiently support diverse materials and products across industries. The main goals are to make the most use of warehouse floor space, increase worker productivity, and reduce inventory handling expenses. Various industries are using a variety of pallet systems to better fulfill their demands in terms of warehouse architecture, the types of items and materials kept, desired capacity, and hence the specific picking procedure used.To know about the Research Methodology :- Request Free Sample Report The rapid rise in e-commerce, the acceleration of supply chain automation, and the growing need for more effective utilization of space in urban areas drive Warehouse Racking Market growth. There has been a trend towards modular racking and high-density racking, which are used in conjunction with robotics and sensors integrated into the warehousing management system (WMS). The implementation of sustainability initiatives is gaining traction, including the use of recycled materials in racking systems and energy-efficient warehouse design. North America dominates the market given robust logistics infrastructure and trends in labor automation, while Asia Pacific, led by China, India, and Southeast Asia, is growing quickly due to mature industrial environments and growth in third-party logistics. The market is competitive with Warehouse Racking key players such as Kardex, Dematic, AutoStore, Nucor, and Constructor Group driving growth and participation with innovation, integration of AI, and global alliances.

Global Warehouse Racking Market Dynamics

Growing E-Commerce, Logistics Expansion, and Automation to Drive Warehouse Racking Market In 2025, e-commerce sales are expected to reach $6.8 trillion, highlighting the transformative impact of digital retail on storage and distribution networks. The share of retail purchases made online is expected to account for 21% in 2025, with this figure forecast to rise further to 22.6% by 2027, underscoring the sustained demand for efficient warehousing infrastructure. The consumer behavior is evolving as 52% of online shoppers are now looking for products internationally, driving cross-border transactions and compelling companies to invest in larger, more sophisticated warehouses to manage growing inventory volumes. This surge in online retail and international commerce is creating heightened requirements for advanced racking solutions that maximize space utilization, enhance inventory accessibility, and support faster order fulfillment. The logistics providers are expanding their networks and investing in state-of-the-art facilities to keep pace with rising demand, particularly in urban centers where last-mile delivery capabilities are critical. The integration of automation, robotics, and AI-driven warehouse management systems is reshaping storage needs, making flexible and modular racking systems a necessity to align with dynamic operations, thereby boosting the Warehouse Racking Market growth. The sustainability initiatives and the push for greener logistics are driving the adoption of durable, recyclable, and energy-efficient racking materials, catering to both operational efficiency and environmental compliance. Lack of Efficient Racking Systems to Restraints the Warehouse Racking sMarket Warehousing plays a critical role in modern supply chains, particularly with the expansion of e-commerce, retail, and manufacturing. However, many enterprises face significant challenges due to poorly designed or outdated racking structures, which result in inefficient space utilization, difficulty in managing inventory, and delays in order fulfillment. These inefficiencies lead to irregularities in operations, causing businesses to struggle in meeting customer expectations such as timely delivery, accurate shipments, and consistent product availability. For retail enterprises, in particular, the lack of proper racking solutions increases operational costs and reduces competitiveness in fast-paced markets. Inadequate systems compromise worker safety and limit scalability, creating bottlenecks in expanding warehousing operations, which hamper Warehouse Racking Market growth.Global Warehouse Racking Market Segment Analysis

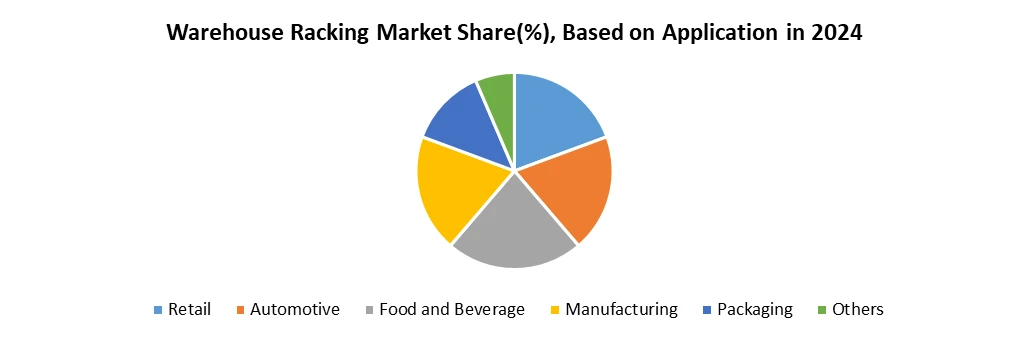

Based on Type, the selective pallet racking system dominated the Warehouse Racking Market in 2024. Its popularity lies in its versatility and cost-effectiveness, making it an ideal choice for warehouses of all sizes. This system features a simple yet robust design, allowing businesses to maximize storage capacity while maintaining easy accessibility to each pallet. They have flexibility damaged components quickly repaired or replaced, and the height of racks or pallet positions easily adjusted to suit different inventory requirements. Such adaptability ensures that warehouses accommodate diverse products without major structural changes. In addition to operational flexibility, selective pallet racking enhances efficiency in material handling. Its straightforward layout enables forklifts and automated systems to access stored goods safely and conveniently, thereby reducing downtime and ensuring smooth logistics operations. The system supports secure item handling, a critical factor for industries such as food, retail, and pharmaceuticals where product safety and integrity are paramount. Based on Application, the Warehouse Racking Industry is segmented into the Retail, Automotive, Food and Beverage, Manufacturing, Packaging and Others. Retail is expeted to dominate Warehouse Racking Market over the forecast period. Modern retail operations demand efficient storage solutions that handle large product assortments, high order volumes, and fast-changing inventory. The warehouse racking systems are playing a critical role in ensuring streamlined logistics, faster order fulfillment, and optimized use of space. Global retail giants such as Amazon, Walmart, and Flipkart are heavily investing in advanced racking infrastructure as they expand their fulfillment centers and distribution hubs. These systems support high-density storage while enabling quick and accurate picking, a necessity for same-day or next-day delivery services that are now a standard in online retail. The ability of racking systems to accommodate varied product categories—from small consumer electronics to bulky household goods—further enhances their importance in retail supply chains.

Global Warehouse Racking Market Regional Insights

North America dominated the Warehouse Racking Market in 2024 and is expected to continue its dominance over the forecast period. The U.S., in particular, leads the region’s growth as companies such as Amazon, Walmart, and Target continue to expand their fulfillment centers and distribution networks, driving large-scale demand for advanced racking systems that support high-density storage, automation, and real-time inventory tracking. The region’s focus on operational efficiency, worker safety, and adherence to regulatory standards has accelerated the adoption of selective pallet racking, drive-in systems, and automated storage and retrieval solutions across industries such as retail, food and beverage, pharmaceuticals, and automotive. In Europe, the a strong growth in intraregional trade, advanced manufacturing, and the push toward sustainable logistics infrastructure, with countries such as Germany, the UK, and France investing in high-capacity warehouse systems to meet increasing demand from both traditional industries and e-commerce. The Asia-Pacific region is the fastest-growing region for the Warehouse Racking Market, boosted by booming online retail markets in China, India, and Southeast Asia, where companies are expanding warehouse facilities to manage unprecedented order volumes and diverse product categories. Government investments in smart logistics hubs, rapid urbanization, and growth in the automotive and manufacturing sectors further amplify regional demand. Global Warehouse Racking Market Competitive Landscape The global Warehouse Racking Market is highly competitive, characterized by the presence of numerous multinational and regional players offering a wide range of storage and material handling solutions tailored to different industries such as retail, e-commerce, automotive, food and beverage, healthcare, and logistics. Leading companies are focusing on innovation, automation integration, and modular designs to address the growing demand for space optimization and operational efficiency in warehouses. Strategic initiatives such as mergers, acquisitions, and partnerships are common, enabling firms to expand product portfolios, strengthen geographic presence, and cater to evolving customer needs. North American players emphasize advanced racking systems integrated with robotics and IoT for smart warehousing, while European manufacturers are investing heavily in sustainable materials and energy-efficient designs in line with stringent environmental regulations. In Asia-Pacific, rapid e-commerce growth and industrial expansion are driving investments in cost-effective yet scalable racking solutions, giving regional players a competitive edge with localized manufacturing and pricing strategies. Customization, flexibility, and after-sales services remain key differentiators as customers seek durable systems capable of adapting to high-volume operations. Additionally, the trend toward automated storage and retrieval systems (AS/RS) has created opportunities for companies that deliver integrated racking solutions with advanced software and warehouse management systems. Global Warehouse Racking Market Recent Developments • Bradford Systems (USA): In February 2025, Bradford Systems announced the release of new selective racking systems targeting retail, healthcare, automotive, and e-commerce sectors. The product line focuses on maximizing space efficiency, improving safety, and offering adaptable configurations to meet diverse storage needs. These selective racking systems are designed with flexibility in mind, allowing for adjustments in height and load capacity, making them suitable for both high-volume warehouses and smaller facilities. • Nucor Warehouse Systems (USA): In March 2025, Nucor Warehouse Systems expanded its portfolio by delivering a state-of-the-art cold-chain automatic storage and retrieval system (AS/RS). The facility, standing 96 feet high, features 7,700 pallet positions and is designed specifically for temperature-controlled storage environments. This development marks the company’s entry into the cold-chain segment, which is witnessing rapid growth due to the rising demand for frozen and refrigerated goods. • Dexion (UK/Germany): Dexion has expanded its offerings with the launch of the MOVO mobile pallet racking system, designed to significantly enhance warehouse efficiency. The system increases storage capacity by up to 80% while reducing floor space usage by as much as 50%. MOVO enables operators to move pallet racks on mobile bases, allowing flexible aisle creation and better space optimization. This solution is particularly suitable for cold-storage warehouses, high-density facilities, and industries with diverse inventory requirements. • AutoStore (Norway): In 2025, AutoStore introduced its Multi-Temperature Solution alongside the launch ofC arouselAI, an AI-powered robotic piece-picking technology. The Multi-Temperature Solution allows goods to be stored at varying climate zones within the same grid, supporting cold-chain logistics and diverse product categories. CarouselAI enhances picking accuracy and throughput by using artificial intelligence to optimize robot selection and movement. • Kardex Group (Switzerland): In 2025, Kardex Group strengthened its automation portfolio through the acquisition of Rocket Solution GmbH, a company known for automated shuttle systems. This acquisition expands Kardex’s capabilities in intelligent storage and retrieval solutions, enhancing its ability to serve industries requiring high-speed and compact material handling. Additionally, Kardex opened its first U.S. production facility in West Columbia, South Carolina, marking a significant step toward increasing its manufacturing presence in North America. • KION Group (Germany): In January 2025, KION Group announced a strategic collaboration with NVIDIA and Accenture to develop AI-powered digital twins for warehouse operations. Using NVIDIA’s Omniverse platform, the partnership will enable simulation and optimization of logistics processes in real time. These digital twins will replicate entire warehouse environments, allowing predictive analytics, testing of new workflows, and efficiency improvements before implementation. Global Warehouse Racking Market Trends

Trend Description Key Examples Impact Area Drone + Blockchain Inventory Auditing Companies are trialing drones with RFID and blockchain integration for real-time pallet tracking and tamper-proof audit trails, minimizing human inventory errors. Refibotics blockchain-secured drone systems in pilot tests across North American 3PL warehouses in 2025 Audit Accuracy, Warehouse Automation Self-Healing Coatings in Racking Systems Advanced racking now features nanomaterial-based coatings that automatically seal micro-cracks, extending durability in high-usage and cold-storage environments. Europe-based trials by Nordic Racks and East Asian adoption in large food logistics centers Maintenance Cost Reduction, Long-Term Asset Lifespan AR/VR Integration in Rack Planning AR/VR is being used for layout simulation, error-free rack setup, and virtual worker training, especially in new automated fulfillment centers. Virtual rack planning tools by RackSim360 are used by major clients in Germany and the UAE, with immersive VR training in India and Singapore in late 2024–2025 Faster Deployment, Reduced Setup Errors Warehouse Racking Market Scope: Inquire before buying

Global Warehouse Racking Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.70 Bn. Forecast Period 2025 to 2032 CAGR: 4.1% Market Size in 2032: USD 13.38 Bn. Segments Covered: by Type Selective Pallet Push Back Drive-In Pallet Flow Cantilever Others by Carrying Capacity Light Duty Medium Duty Heavy Duty by Application Retail Automotive Food and Beverage Manufacturing Packaging Others Warehouse Racking Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Warehouse Racking Key Players

North America Key Players 1. Nucor Warehouse Systems (USA) 2. Bradford Systems (USA) 3. Steel King Industries (USA) 4. Interlake Mecalux Inc. (USA) 5. Ridg-U-Rak, Inc. (USA) 6. Advance Storage Products (USA) 7. Hannibal Industries (USA) 8. Frazier Industrial Company (USA) 9. UNARCO Material Handling, Inc. (USA) 10. North American Steel Equipment Inc. (Canada) Europe Key Players 1. Dexion GmbH (Germany/UK) 2. SSI Schäfer Group (Germany) 3. Jungheinrich AG (Germany) 4. Stow Group (Belgium) 5. Mecalux S.A. (Spain, ) 6. Kardex Group (Switzerland) 7. Constructor Group (Norway/Germany) 8. BITO Lagertechnik Bittmann GmbH (Germany) 9. Polypal Storage Systems (Spain/UK) 10. AR Racking (Spain) Asia-Pacific Key Players 1. Daifuku Co., Ltd. (Japan) 2. Schaefer Systems International Asia (Singapore) 3. Godrej Storage Solutions (India) 4. Mecalux Asia (India) 5. Shan Dong Yingda Co., Ltd. (China) 6. Nanjing Inform Storage Equipment Co., Ltd. (China) 7. Jiangsu NOVA Intelligent Logistics Equipment Co., Ltd. (China) 8. Dongguan Xinmiao Storage Equipment Co., Ltd. (China) 9. Heda Shelves Group Co., Ltd. (China)Frequently Asked Questions

1. Which region has the largest share in the Global Warehouse Racking Market? Ans: The Asia Pacific held the largest Warehouse Racking Market share in 2024. 2. What is the growth rate of the Global Warehouse Racking Market? Ans: The Global Warehouse Racking Market is expected to grow at a CAGR of 4.1% during the forecast period 2025-2032. 3. What is the scope of the Global Warehouse Racking Market report? Ans: The Global Warehouse Racking Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Warehouse Racking Market? Ans: The important key players in the Global Warehouse Racking Market are Nucor Warehouse Systems, Bradford Systems, Steel King Industries, Interlake Mecalux, Ridg-U-Rak, Advance Storage Products, Hannibal Industries, Frazier Industrial, UNARCO Material Handling and others. 5. What is the study period of this market? Ans: The Global Warehouse Racking Market is studied from 2024 to 2032.

1. Warehouse Racking Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Warehouse Racking Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Warehouse Racking Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Warehouse Racking Market: Dynamics 3.1. Warehouse Racking Market Trends by Region 3.1.1. North America Warehouse Racking Market Trends 3.1.2. Europe Warehouse Racking Market Trends 3.1.3. Asia Pacific Warehouse Racking Market Trends 3.1.4. Middle East and Africa Warehouse Racking Market Trends 3.1.5. South America Warehouse Racking Market Trends 3.2. Warehouse Racking Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Warehouse Racking Market Drivers 3.2.1.2. North America Warehouse Racking Market Restraints 3.2.1.3. North America Warehouse Racking Market Opportunities 3.2.1.4. North America Warehouse Racking Market Challenges 3.2.2. Europe 3.2.2.1. Europe Warehouse Racking Market Drivers 3.2.2.2. Europe Warehouse Racking Market Restraints 3.2.2.3. Europe Warehouse Racking Market Opportunities 3.2.2.4. Europe Warehouse Racking Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Warehouse Racking Market Drivers 3.2.3.2. Asia Pacific Warehouse Racking Market Restraints 3.2.3.3. Asia Pacific Warehouse Racking Market Opportunities 3.2.3.4. Asia Pacific Warehouse Racking Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Warehouse Racking Market Drivers 3.2.4.2. Middle East and Africa Warehouse Racking Market Restraints 3.2.4.3. Middle East and Africa Warehouse Racking Market Opportunities 3.2.4.4. Middle East and Africa Warehouse Racking Market Challenges 3.2.5. South America 3.2.5.1. South America Warehouse Racking Market Drivers 3.2.5.2. South America Warehouse Racking Market Restraints 3.2.5.3. South America Warehouse Racking Market Opportunities 3.2.5.4. South America Warehouse Racking Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Warehouse Racking Industry 3.8. Analysis of Government Schemes and Initiatives For Warehouse Racking Industry 3.9. Warehouse Racking Market Trade Analysis 3.10. The Global Pandemic Impact on Warehouse Racking Market 4. Warehouse Racking Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Warehouse Racking Market Size and Forecast, by Type (2024-2032) 4.1.1. Selective Pallet 4.1.2. Push Back 4.1.3. Drive-In 4.1.4. Pallet Flow 4.1.5. Cantilever 4.1.6. Others 4.2. Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 4.2.1. Light Duty 4.2.2. Medium Duty 4.2.3. Heavy Duty 4.3. Warehouse Racking Market Size and Forecast, by Application (2024-2032) 4.3.1. Retail 4.3.2. Automotive 4.3.3. Food and Beverage 4.3.4. Manufacturing 4.3.5. Packaging 4.3.6. Others 4.4. Warehouse Racking Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Warehouse Racking Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Warehouse Racking Market Size and Forecast, by Type (2024-2032) 5.1.1. Selective Pallet 5.1.2. Push Back 5.1.3. Drive-In 5.1.4. Pallet Flow 5.1.5. Cantilever 5.1.6. Others 5.2. North America Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 5.2.1. Light Duty 5.2.2. Medium Duty 5.2.3. Heavy Duty 5.3. North America Warehouse Racking Market Size and Forecast, by Application (2024-2032) 5.3.1. Retail 5.3.2. Automotive 5.3.3. Food and Beverage 5.3.4. Manufacturing 5.3.5. Packaging 5.3.6. Others 5.4. North America Warehouse Racking Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Warehouse Racking Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Selective Pallet 5.4.1.1.2. Push Back 5.4.1.1.3. Drive-In 5.4.1.1.4. Pallet Flow 5.4.1.1.5. Cantilever 5.4.1.1.6. Others 5.4.1.2. United States Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 5.4.1.2.1. Light Duty 5.4.1.2.2. Medium Duty 5.4.1.2.3. Heavy Duty 5.4.1.3. United States Warehouse Racking Market Size and Forecast, by Application (2024-2032) 5.4.1.3.1. Retail 5.4.1.3.2. Automotive 5.4.1.3.3. Food and Beverage 5.4.1.3.4. Manufacturing 5.4.1.3.5. Packaging 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Warehouse Racking Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Selective Pallet 5.4.2.1.2. Push Back 5.4.2.1.3. Drive-In 5.4.2.1.4. Pallet Flow 5.4.2.1.5. Cantilever 5.4.2.1.6. Others 5.4.2.2. Canada Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 5.4.2.2.1. Light Duty 5.4.2.2.2. Medium Duty 5.4.2.2.3. Heavy Duty 5.4.2.3. Canada Warehouse Racking Market Size and Forecast, by Application (2024-2032) 5.4.2.3.1. Retail 5.4.2.3.2. Automotive 5.4.2.3.3. Food and Beverage 5.4.2.3.4. Manufacturing 5.4.2.3.5. Packaging 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Warehouse Racking Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Selective Pallet 5.4.3.1.2. Push Back 5.4.3.1.3. Drive-In 5.4.3.1.4. Pallet Flow 5.4.3.1.5. Cantilever 5.4.3.1.6. Others 5.4.3.2. Mexico Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 5.4.3.2.1. Light Duty 5.4.3.2.2. Medium Duty 5.4.3.2.3. Heavy Duty 5.4.3.3. Mexico Warehouse Racking Market Size and Forecast, by Application (2024-2032) 5.4.3.3.1. Retail 5.4.3.3.2. Automotive 5.4.3.3.3. Food and Beverage 5.4.3.3.4. Manufacturing 5.4.3.3.5. Packaging 5.4.3.3.6. Others 6. Europe Warehouse Racking Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.2. Europe Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.3. Europe Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4. Europe Warehouse Racking Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.1.3. United Kingdom Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.2. France 6.4.2.1. France Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.2.3. France Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.3.3. Germany Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.4.3. Italy Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.5.3. Spain Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.6.3. Sweden Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.7.3. Austria Warehouse Racking Market Size and Forecast, by Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Warehouse Racking Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 6.4.8.3. Rest of Europe Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Warehouse Racking Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.3. Asia Pacific Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Warehouse Racking Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.1.3. China Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.2.3. S Korea Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.3.3. Japan Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.4. India 7.4.4.1. India Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.4.3. India Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.5.3. Australia Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.6.3. Indonesia Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.7.3. Malaysia Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.8.3. Vietnam Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.9.3. Taiwan Warehouse Racking Market Size and Forecast, by Application (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Warehouse Racking Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 7.4.10.3. Rest of Asia Pacific Warehouse Racking Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Warehouse Racking Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Warehouse Racking Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 8.3. Middle East and Africa Warehouse Racking Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Warehouse Racking Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Warehouse Racking Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 8.4.1.3. South Africa Warehouse Racking Market Size and Forecast, by Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Warehouse Racking Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 8.4.2.3. GCC Warehouse Racking Market Size and Forecast, by Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Warehouse Racking Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 8.4.3.3. Nigeria Warehouse Racking Market Size and Forecast, by Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Warehouse Racking Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 8.4.4.3. Rest of ME&A Warehouse Racking Market Size and Forecast, by Application (2024-2032) 9. South America Warehouse Racking Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Warehouse Racking Market Size and Forecast, by Type (2024-2032) 9.2. South America Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 9.3. South America Warehouse Racking Market Size and Forecast, by Application(2024-2032) 9.4. South America Warehouse Racking Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Warehouse Racking Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 9.4.1.3. Brazil Warehouse Racking Market Size and Forecast, by Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Warehouse Racking Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 9.4.2.3. Argentina Warehouse Racking Market Size and Forecast, by Application (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Warehouse Racking Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Warehouse Racking Market Size and Forecast, by Carrying Capacity (2024-2032) 9.4.3.3. Rest Of South America Warehouse Racking Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Nucor Warehouse Systems (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bradford Systems (USA) 10.3. Steel King Industries (USA) 10.4. Interlake Mecalux Inc. (USA) 10.5. Ridg-U-Rak, Inc. (USA) 10.6. Advance Storage Products (USA) 10.7. Hannibal Industries (USA) 10.8. Frazier Industrial Company (USA) 10.9. UNARCO Material Handling, Inc. (USA) 10.10. North American Steel Equipment Inc. (Canada) 10.11. Dexion GmbH (Germany/UK) 10.12. SSI Schäfer Group (Germany) 10.13. Jungheinrich AG (Germany) 10.14. Stow Group (Belgium) 10.15. Mecalux S.A. (Spain, ) 10.16. Kardex Group (Switzerland) 10.17. Constructor Group (Norway/Germany) 10.18. BITO Lagertechnik Bittmann GmbH (Germany) 10.19. Polypal Storage Systems (Spain/UK) 10.20. AR Racking (Spain) 10.21. Daifuku Co., Ltd. (Japan) 10.22. Schaefer Systems International Asia (Singapore) 10.23. Godrej Storage Solutions (India) 10.24. Mecalux Asia (India) 10.25. Shan Dong Yingda Co., Ltd. (China) 10.26. Nanjing Inform Storage Equipment Co., Ltd. (China) 10.27. Jiangsu NOVA Intelligent Logistics Equipment Co., Ltd. (China) 10.28. Dongguan Xinmiao Storage Equipment Co., Ltd. (China) 10.29. Heda Shelves Group Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. Warehouse Racking Market: Research Methodology 14. Terms and Glossary