The Vial Adaptors for Reconstitution Drug Market was valued at USD 1.05 Bn in 2024, and the total revenue of the Global Vial Adaptors for Reconstitution Drug Market is expected to grow at a CAGR of 8.53% from 2025 to 2032, reaching nearly USD 2.02 Bn by 2032.Vial Adaptors for Reconstitution Drug Market Overview:

Vial Adaptors for Reconstitution Drugs are medical devices that enable safe and efficient mixing of injectable drugs with diluents. They reduce contamination and medication errors, enhance operational efficiency, and support compliance with healthcare standards, making them vital in modern drug delivery. The global vial adaptors for reconstitution drug market has been growing steadily due to rising demand for efficient drug reconstitution solutions, aging healthcare infrastructure in some regions, and rapid urbanization of pharmaceutical supply chains, particularly in developing regions. Increased pharmaceutical vial adaptor demand from hospitals, clinics, and biopharma companies places significant stress on healthcare delivery systems, making needle-free vial adaptors, closed-system transfer devices, and advanced vial adaptor technology critical for safe reconstitution, contamination control, and improved workflow.To know about the Research Methodology :- Request Free Sample Report North America dominated the vial adaptors for reconstitution drug market, supported by a robust healthcare infrastructure, widespread adoption of advanced drug delivery systems, and stringent regulatory standards. The increasing prevalence of chronic diseases, injectable biologics, and the expanding geriatric population are additional factors driving regional demand. Pharmaceutical companies are increasingly adopting standardized single-use vial adaptors to ensure sterility and regulatory compliance, reinforcing North America’s leadership position. Key market drivers include regulatory emphasis on drug safety, higher hospital procurement of sterile vial adaptors, and rising awareness of contamination risks. Leading vial adaptor for reconstitution drug market players, such as Becton Dickinson, West Pharmaceutical Services, Terumo Corporation, and Gerresheimer AG, maintain top positions due to strong R&D, innovative vial adaptor product portfolios, and global distribution networks. Emerging trends like needle-free and closed-system vial adaptors are expected to improve safety, efficiency, and environmental sustainability, shaping global vial adaptors market growth forecast strategies.

Vial Adaptors for Reconstitution Drug Market Dynamics

Expanding Utilization of Vial Adaptors Across the Healthcare Ecosystem to Drive the Market The increasing adoption of vial adaptors in diverse medical applications is a key driver of the global vial adaptors for reconstitution drug market. These drug reconstitution devices are critical tools across a wide range of healthcare environments. In hospitals, they facilitate the reconstitution and administration of medications across oncology, anesthesia, and critical care. Long-term care facilities rely on vial adaptor devices for accurate and safe medication preparation, while home care providers utilize them for reconstituting lyophilized drugs. Pharmacists use vial adaptors during compounding to maintain sterility, and research laboratories employ them for the safe transfer of hazardous substances. Their versatility and reliability enhance operational efficiency, accuracy, and safety, driving sustained demand for vial adaptors worldwide. Cost Pressures and Technical Limitations to Impact Vial Adaptors for Reconstitution Drug Market Despite rising adoption, high procurement and operational costs associated with advanced vial adaptor systems act as a restraint for market penetration, particularly in price-sensitive regions. Smaller healthcare facilities and low-resource settings often find it challenging to justify investment in premium reconstitution devices, limiting widespread adoption. Technical concerns, such as compatibility issues with certain drug vials and the need for specialized training for safe handling, further hinder seamless integration. In addition, stringent regulatory requirements can delay the introduction of new adaptor designs. These costs and technical challenges create barriers that may slow the pace of adoption in emerging markets, tempering overall growth momentum.Vial Adaptors for Reconstitution Drug Market Segment Analysis

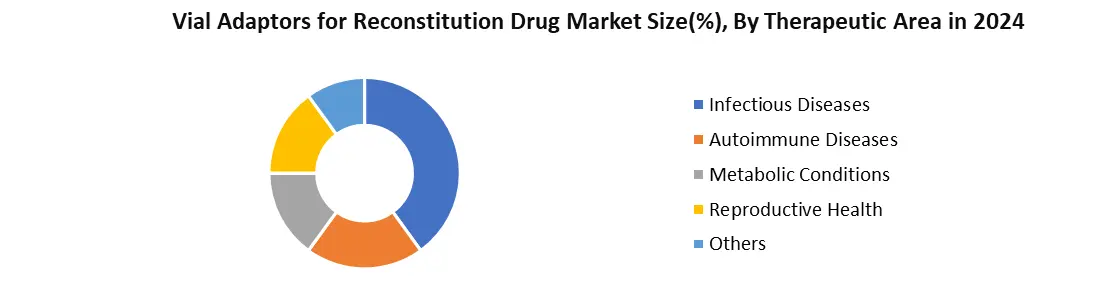

Based on Product Type, the Single Vial Adaptors emerged as the leading product type in the global vial adaptors for reconstitution drug market, driven by operational efficiency and compatibility with standard prefilled and single-dose vials. They reduce preparation time in high-volume clinical settings. Regulatory initiatives promoting safety-engineered medical devices have accelerated their adoption, ensured reduced contamination, and minimized needle-stick risks. Additionally, patient safety concerns, the rising prevalence of injectable therapies, and cost-effective vial adaptor solutions further cement their leadership. Based on Therapeutic Area, the Infectious Diseases segment dominated the therapeutic area landscape in 2024, driven by vaccination campaigns and demand for antiviral injectable therapies. Governments and international health organizations have emphasized pandemic preparedness and pharmaceutical vial adaptor procurement. Injectable drugs for infectious diseases require precise drug reconstitution adaptors to maintain potency and safety, making advanced closed-system vial adaptors critical for hospitals, clinics, and vaccination centers.

Vial Adaptors for Reconstitution Drug Market Regional Insight

North America led the global vial adaptors market in 2024, capturing 34.64% share and is projected to grow at a CAGR of xx% during the forecast period, driven by the presence of key vial adaptor manufacturers, advanced healthcare infrastructure, strong availability of branded drugs, robust research and development activities, and substantial government funding. The rising geriatric population and cancer prevalence in the United States are fueling vial adaptor adoption in oncology. High cancer incidence (1.93 million new cases in 2024) and infectious disease rates (20% ICU infections) further boost drug reconstitution device demand. The global vial adaptors for reconstitution drug market forecast remains strong, supported by FDA-approved vial adaptor standards, needle-free reconstitution technologies, and increasing pharmaceutical vial adaptor demand across hospitals and clinics.Vial Adaptors for Reconstitution Drug Market Competitive Landscape

The global vial adaptors for reconstitution drug market characterized by a dynamic competitive landscape, driven by stringent regulatory frameworks and the increasing demand for safe and efficient drug administration systems. Governments worldwide are implementing rigorous standards to ensure the safety and efficacy of medical devices, including vial adaptors. In India, the Directorate General of Foreign Trade (DGFT) has highlighted the need for regulated medical devices, including vial adaptors, to ensure public health safety. The Central Drugs Standard Control Organization (CDSCO) has also issued guidance documents outlining the regulatory requirements for medical devices, ensuring that manufacturers adhere to quality management standards. These regulatory frameworks are fostering a competitive environment where companies must innovate and comply with stringent standards to maintain market leadership. West Pharmaceutical Services (United States) has been at the forefront of innovation in the vial adaptor market. The company has invested heavily in research and development to create advanced vial adaptor systems that enhance safety and efficiency in drug reconstitution. Becton, Dickinson and Company- BD (United States) has focused on expanding its product portfolio to include a variety of vial adaptors designed for different drug reconstitution applications. The company's acquisition of C.R. Bard, a leading provider of medical devices, has strengthened BD's capabilities in the vial adaptor market.Vial Adaptors for Reconstitution Drug Market Recent Developments

B. Braun Melsungen AG (Germany) – October 18, 2024 B. Braun expanded IV fluid production across facilities to mitigate U.S. shortages, directly supporting the stability of reconstitution drug delivery systems. ICU Medical (United States) – November 12, 2024 ICU Medical formed a joint venture with Otsuka Pharmaceutical Factory to increase IV solution capacity, strengthening supply for drug reconstitution therapies in North America. Nipro Corporation (Japan) – October 1, 2024 Nipro introduced D2F™ glass vials using EZ-fill® technology to improve ready-to-use fill-finish operations, advancing vial adaptor compatibility in reconstitution processes.Vial Adaptors for Reconstitution Drug Market Key Trends

Trend Description Shift Toward Needle-Free & Closed-System Designs Hospitals and regulators are pushing for closed-system transfer devices (CSTDs) and needle-free adaptors to reduce contamination risks and needlestick injuries. Expansion in Home Healthcare & Self-Administration With more injectable therapies moving outside clinical settings, user-friendly adaptors are being designed for patients and caregivers to safely reconstitute drugs at home. Material & Filtration Innovations Manufacturers are adopting BPA-free plastics, advanced filters, and ergonomic features to improve compatibility, sterility, and ease of use for multiple vial types. Vial Adaptors for Reconstitution Drug Market Scope: Inquire before buying

Global Vial Adaptors for Reconstitution Drug Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.05 Bn. Forecast Period 2025 to 2032 CAGR: 8.53% Market Size in 2032: USD 2.02 Bn. Segments Covered: by Product Type Single Vial Adaptors Multi Vial Adaptors Needle-Free Vial Adaptors by Material Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) Metal-Based Adaptors Others by Therapeutic Area Autoimmune Diseases Infectious Diseases Metabolic Conditions Reproductive Health Others by End-User Hospitals & Clinics Ambulatory Surgical Centers Homecare Settings Pharmaceutical & Biotechnology Companies Vial Adaptors for Reconstitution Drug Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vial Adaptors for Reconstitution Drug Market: Key Players are

North America 1. Baxter International Inc. (United States) 2. Becton, Dickinson and Company – BD (United States) 3. West Pharmaceutical Services Inc. (United States) 4. Cardinal Health Inc. (United States) 5. ICU Medical (United States) 6. EQUASHIELD (United States) 7. Yukon Medical (United States) 8. Parasol Medical, LLC (United States) 9. Corvida Medical Inc. (United States) 10. MedXL Inc. (Canada) Europe 11. B. Braun Melsungen AG (Germany) 12. Miltenyi Biotec (Germany) 13. Sartorius AG (Germany) 14. Gerresheimer AG (Germany) 15. CODAN Medizinische Geräte GmbH (Germany) 16. Dedecke GmbH (Germany) 17. Vygon SA (France) 18. ARaymond (France) 19. Union Plastic S.A.S. (France) 20. Stevanato Group S.p.A. (Italy) 21. Sensile Medical AG (Switzerland) 22. Randox Laboratories Ltd (United Kingdom) Asia Pacific 23. Nipro Corporation / Nipro Pharma Packaging (Japan) 24. Taizhou Safefusion Medical Instruments (China) 25. Simplivia Healthcare Ltd. (India) 26. Hanna Equipments Pvt. Ltd. (India) Middle East & Africa 27. Helapet Ltd (Israel) 28. Unilife Corporation (Israel)Frequently Asked Questions:

Q1. What are vial adaptors for reconstitution drugs? Ans: They are medical devices used to safely mix injectable drugs with diluents, reducing contamination and medication errors. Q2. What is driving the growth of the vial adaptors market? Ans: Rising demand for injectable biologics, needle-free reconstitution, regulatory emphasis on safety, and increased hospital procurement. Q3. Which region leads the vial adaptors for reconstitution drug market? Ans: North America, due to strong healthcare infrastructure, chronic disease prevalence, and regulatory compliance. Q4. What are the emerging trends in this market? Ans: Needle-free and closed-system vial adaptors, eco-friendly materials, and increasing home-based drug administration. Q5. Who are the key players in the global vial adaptors market? Ans: Becton Dickinson, West Pharmaceutical Services, Terumo Corporation, and Gerresheimer AG.

1. Vial Adaptors for Reconstitution Drug Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Vial Adaptors for Reconstitution Drug Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Vial Adaptors for Reconstitution Drug Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Vial Adaptors for Reconstitution Drug Market: Dynamics 3.1. Vial Adaptors for Reconstitution Drug Market Trends by Region 3.1.1. North America Vial Adaptors for Reconstitution Drug Market Trends 3.1.2. Europe Vial Adaptors for Reconstitution Drug Market Trends 3.1.3. Asia Pacific Vial Adaptors for Reconstitution Drug Market Trends 3.1.4. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Trends 3.1.5. South America Vial Adaptors for Reconstitution Drug Market Trends 3.2. Vial Adaptors for Reconstitution Drug Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Vial Adaptors for Reconstitution Drug Market Drivers 3.2.1.2. North America Vial Adaptors for Reconstitution Drug Market Restraints 3.2.1.3. North America Vial Adaptors for Reconstitution Drug Market Opportunities 3.2.1.4. North America Vial Adaptors for Reconstitution Drug Market Challenges 3.2.2. Europe 3.2.2.1. Europe Vial Adaptors for Reconstitution Drug Market Drivers 3.2.2.2. Europe Vial Adaptors for Reconstitution Drug Market Restraints 3.2.2.3. Europe Vial Adaptors for Reconstitution Drug Market Opportunities 3.2.2.4. Europe Vial Adaptors for Reconstitution Drug Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Vial Adaptors for Reconstitution Drug Market Drivers 3.2.3.2. Asia Pacific Vial Adaptors for Reconstitution Drug Market Restraints 3.2.3.3. Asia Pacific Vial Adaptors for Reconstitution Drug Market Opportunities 3.2.3.4. Asia Pacific Vial Adaptors for Reconstitution Drug Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Drivers 3.2.4.2. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Restraints 3.2.4.3. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Opportunities 3.2.4.4. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Challenges 3.2.5. South America 3.2.5.1. South America Vial Adaptors for Reconstitution Drug Market Drivers 3.2.5.2. South America Vial Adaptors for Reconstitution Drug Market Restraints 3.2.5.3. South America Vial Adaptors for Reconstitution Drug Market Opportunities 3.2.5.4. South America Vial Adaptors for Reconstitution Drug Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Vial Adaptors for Reconstitution Drug Industry 3.8. Analysis of Government Schemes and Initiatives For Vial Adaptors for Reconstitution Drug Industry 3.9. Vial Adaptors for Reconstitution Drug Market Trade Analysis 3.10. The Global Pandemic Impact on Vial Adaptors for Reconstitution Drug Market 4. Vial Adaptors for Reconstitution Drug Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Single Vial Adaptors 4.1.2. Multi Vial Adaptors 4.1.3. Needle-Free Vial Adaptors 4.2. Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 4.2.1. Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) 4.2.2. Metal-Based Adaptors 4.2.3. Others 4.3. Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 4.3.1. Autoimmune Diseases 4.3.2. Infectious Diseases 4.3.3. Metabolic Conditions 4.3.4. Reproductive Health 4.3.5. Others 4.4. Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals & Clinics 4.4.2. Ambulatory Surgical Centers 4.4.3. Homecare Settings 4.4.4. Pharmaceutical & Biotechnology Companies 4.5. Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Single Vial Adaptors 5.1.2. Multi Vial Adaptors 5.1.3. Needle-Free Vial Adaptors 5.2. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 5.2.1. Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) 5.2.2. Metal-Based Adaptors 5.2.3. Others 5.3. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 5.3.1. Autoimmune Diseases 5.3.2. Infectious Diseases 5.3.3. Metabolic Conditions 5.3.4. Reproductive Health 5.3.5. Others 5.4. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals & Clinics 5.4.2. Ambulatory Surgical Centers 5.4.3. Homecare Settings 5.4.4. Pharmaceutical & Biotechnology Companies 5.5. North America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 5.5.1.1.1. Single Vial Adaptors 5.5.1.1.2. Multi Vial Adaptors 5.5.1.1.3. Needle-Free Vial Adaptors 5.5.1.2. United States Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 5.5.1.2.1. Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) 5.5.1.2.2. Metal-Based Adaptors 5.5.1.2.3. Others 5.5.1.3. United States Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.1.3.1. Autoimmune Diseases 5.5.1.3.2. Infectious Diseases 5.5.1.3.3. Metabolic Conditions 5.5.1.3.4. Reproductive Health 5.5.1.3.5. Others 5.5.1.4. United States Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals & Clinics 5.5.1.4.2. Ambulatory Surgical Centers 5.5.1.4.3. Homecare Settings 5.5.1.4.4. Pharmaceutical & Biotechnology Companies 5.5.2. Canada 5.5.2.1. Canada Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 5.5.2.1.1. Single Vial Adaptors 5.5.2.1.2. Multi Vial Adaptors 5.5.2.1.3. Needle-Free Vial Adaptors 5.5.2.2. Canada Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 5.5.2.2.1. Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) 5.5.2.2.2. Metal-Based Adaptors 5.5.2.2.3. Others 5.5.2.3. Canada Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.2.3.1. Autoimmune Diseases 5.5.2.3.2. Infectious Diseases 5.5.2.3.3. Metabolic Conditions 5.5.2.3.4. Reproductive Health 5.5.2.3.5. Others 5.5.2.4. Canada Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals & Clinics 5.5.2.4.2. Ambulatory Surgical Centers 5.5.2.4.3. Homecare Settings 5.5.2.4.4. Pharmaceutical & Biotechnology Companies 5.5.3. Mexico 5.5.3.1. Mexico Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 5.5.3.1.1. Single Vial Adaptors 5.5.3.1.2. Multi Vial Adaptors 5.5.3.1.3. Needle-Free Vial Adaptors 5.5.3.2. Mexico Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 5.5.3.2.1. Plastic-Based Adaptors (polycarbonate, polypropylene, etc.) 5.5.3.2.2. Metal-Based Adaptors 5.5.3.2.3. Others 5.5.3.3. Mexico Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.3.3.1. Autoimmune Diseases 5.5.3.3.2. Infectious Diseases 5.5.3.3.3. Metabolic Conditions 5.5.3.3.4. Reproductive Health 5.5.3.3.5. Others 5.5.3.4. Mexico Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals & Clinics 5.5.3.4.2. Ambulatory Surgical Centers 5.5.3.4.3. Homecare Settings 5.5.3.4.4. Pharmaceutical & Biotechnology Companies 6. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.3. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.4. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5. Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.1.2. United Kingdom Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.1.3. United Kingdom Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.1.4. United Kingdom Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.2.2. France Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.2.3. France Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.2.4. France Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.3.2. Germany Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.3.3. Germany Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.3.4. Germany Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.4.2. Italy Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.4.3. Italy Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.4.4. Italy Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.5.2. Spain Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.5.3. Spain Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.5.4. Spain Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.6.2. Sweden Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.6.3. Sweden Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.6.4. Sweden Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.7.2. Austria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.7.3. Austria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.7.4. Austria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 6.5.8.2. Rest of Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 6.5.8.3. Rest of Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.8.4. Rest of Europe Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.3. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.4. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.1.2. China Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.1.3. China Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.1.4. China Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.2.2. S Korea Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.2.3. S Korea Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.2.4. S Korea Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.3.2. Japan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.3.3. Japan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.3.4. Japan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.4.2. India Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.4.3. India Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.4.4. India Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.5.2. Australia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.5.3. Australia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.5.4. Australia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.6.2. Indonesia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.6.3. Indonesia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.6.4. Indonesia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.7.2. Malaysia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.7.3. Malaysia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.7.4. Malaysia Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.8.2. Vietnam Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.8.3. Vietnam Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.8.4. Vietnam Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.9.2. Taiwan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.9.3. Taiwan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.9.4. Taiwan Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 7.5.10.3. Rest of Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.10.4. Rest of Asia Pacific Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 8.3. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 8.4. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 8.5.1.2. South Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 8.5.1.3. South Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.1.4. South Africa Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 8.5.2.2. GCC Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 8.5.2.3. GCC Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.2.4. GCC Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 8.5.3.2. Nigeria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 8.5.3.3. Nigeria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.3.4. Nigeria Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 8.5.4.2. Rest of ME&A Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 8.5.4.3. Rest of ME&A Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.4.4. Rest of ME&A Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 9. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 9.3. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area(2024-2032) 9.4. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 9.5. South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 9.5.1.2. Brazil Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 9.5.1.3. Brazil Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.1.4. Brazil Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 9.5.2.2. Argentina Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 9.5.2.3. Argentina Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.2.4. Argentina Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Product Type (2024-2032) 9.5.3.2. Rest Of South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Material (2024-2032) 9.5.3.3. Rest Of South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.3.4. Rest Of South America Vial Adaptors for Reconstitution Drug Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Baxter International Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Becton, Dickinson and Company – BD (United States) 10.3. West Pharmaceutical Services Inc. (United States) 10.4. Cardinal Health Inc. (United States) 10.5. ICU Medical (United States) 10.6. EQUASHIELD (United States) 10.7. Yukon Medical (United States) 10.8. Parasol Medical, LLC (United States) 10.9. Corvida Medical Inc. (United States) 10.10. MedXL Inc. (Canada) 10.11. B. Braun Melsungen AG (Germany) 10.12. Miltenyi Biotec (Germany) 10.13. Sartorius AG (Germany) 10.14. Gerresheimer AG (Germany) 10.15. CODAN Medizinische Geräte GmbH (Germany) 10.16. Dedecke GmbH (Germany) 10.17. Vygon SA (France) 10.18. ARaymond (France) 10.19. Union Plastic S.A.S. (France) 10.20. Stevanato Group S.p.A. (Italy) 10.21. Sensile Medical AG (Switzerland) 10.22. Randox Laboratories Ltd (United Kingdom) 10.23. Nipro Corporation / Nipro Pharma Packaging (Japan) 10.24. Taizhou Safefusion Medical Instruments (China) 10.25. Simplivia Healthcare Ltd. (India) 10.26. Hanna Equipments Pvt. Ltd. (India) 10.27. Helapet Ltd (Israel) 10.28. Unilife Corporation (Israel) 11. Key Findings 12. Industry Recommendations 13. Vial Adaptors for Reconstitution Drug Market: Research Methodology 14. Terms and Glossary