The Vertical Farming Market size was valued at US 5.07 Bn in 2023 and market revenue is growing at a CAGR of 25.7 % from 2023 to 2030, reaching nearly USD 25.14 Bn by 2030.Vertical Farming Market Overview:

Vertical farming is on the rise due to factors such as urbanization, limited land availability, and climate change. This method involves stacking layers of crops in controlled environments, providing sustainable solutions to food production challenges. Technological advancements such as LED lighting and automation are enhancing efficiency. There's a growing consumer preference for locally sourced, fresh produce, which is driving demand.To know about the Research Methodology :- Request Free Sample Report According to MMR Study Report, the vertical farming market is witnessing significant growth. Organic food sales in the United States have surged, reaching approximately 57.5 billion USD in 2021 from 50.07 billion USD in 2019. Tomatoes, a staple crop, are increasingly grown using vertical farming techniques, particularly hydroponics for efficient production. Integrated systems enable year-round availability of strawberries, with production increasing from over 1.14 million tons in 2020 to 1.34 million tons in 2021, according to the US Department of Agriculture. Many farmers are adopting hydroponics for strawberry cultivation to meet market demands. Vertical farms are highly productive, yielding an average of 5.45 pounds of lettuce per square foot. Given these trends, the vertical farming market is poised to play a significant role in meeting the nation's demand for fresh produce. Its ability to consistently yield crops, optimize space, and address environmental concerns highlights its importance in the future of agriculture.

Vertical Farming Market: Research Methodology

The research report highly depends on both primary and secondary data sources. The research process involves the investigation of various factors affecting the vertical farming market, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalized, and the impact of inflation, economic downturns, regulatory & and policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics; market size estimations; market forecasts; market breakdown; and data triangulation. The bottom-up technique is widely employed in the whole market engineering process, along with multiple data triangulation methodologies, to perform market estimation and forecasting for the overall vertical farming market segments and sub-segments covered in this research.Vertical Farming Market: Dynamics

Driver Increasing global population and decreasing cultivable arable land in the World boost the Vertical Farming Market Growth. The vertical farming market is experiencing significant growth due to a combination of factors, primarily driven by the increasing global population and the diminishing availability of cultivable arable land. As the global population continues to expand, there is a growing demand for food to sustain human life. Traditional farming methods are facing challenges such as land degradation, water scarcity, and climate change, which adversely affect crop yields and productivity. Urbanization and infrastructure development are encroaching on agricultural land, further reducing the amount of available space for farming. In response to these challenges, vertical farming has emerged as a promising solution. Vertical farming involves growing crops in vertically stacked layers or vertically inclined surfaces, often in controlled indoor environments such as warehouses, shipping containers, or high-rise buildings. This innovative approach to agriculture offers several advantages over traditional farming methods. Vertical farming maximizes land use efficiency by utilizing vertical space, allowing for higher crop yields per square meter compared to conventional farming. This is particularly beneficial in urban areas where land is scarce and expensive. Vertical farming reduces the need for pesticides and herbicides, as crops are grown in a controlled environment that minimizes exposure to pests and diseases. Furthermore, vertical farming also significantly reduces water usage compared to traditional farming methods, as it often employs hydroponic or aeroponic systems that recycle water and nutrients efficiently. Vertical farming enables year-round cultivation regardless of external environmental conditions, providing a consistent and reliable food supply. This is particularly advantageous in regions with harsh climates or limited growing seasons. Vertical farms are located close to urban centers, reducing transportation costs and carbon emissions associated with food distribution. The increasing global population and diminishing cultivable arable land are driving the growth of the vertical farming market. As the demand for sustainable and efficient agricultural practices continues to rise, vertical farming is poised to play a crucial role in ensuring food security and environmental sustainability in the future.Restrain Limited Crop Variety Limits the Vertical Farming Market Growth The limited crop variety in vertical farming presents a significant constraint on the Vertical Farming market's growth potential. While vertical farming excels in cultivating certain types of crops, such as leafy greens and herbs, its capability to diversify into other crop categories remains restricted. This limitation stems from several factors inherent to vertical farming systems. The vertical farming environment, typically characterized by controlled indoor settings, imposes constraints on the types of crops that are effectively grown. Certain crops, such as grains, fruits, and root vegetables, require more space, specific growing conditions, and longer growth cycles that not align well with the vertical farming model's space-saving and high-density approach. Also, technological limitations hinder the cultivation of a broader range of crops. Each crop has unique requirements for light intensity, temperature, humidity, and nutrient levels. While advancements in agricultural technology have improved the adaptability of vertical farming systems, optimizing these variables for a diverse array of crops remains challenging. These factors are responsible for impeding the Vertical Farming Market Growth Opportunities Technological Innovation creates lucrative growth opportunities for the Vertical Farming Market Growth Technological innovation is instrumental in fostering lucrative growth opportunities for the vertical farming market. Advancements such as automated planting, monitoring, and harvesting systems enhance efficiency and productivity while reducing labor costs. Climate control technologies, including LED lighting and HVAC systems, optimize growing conditions, enabling year-round cultivation regardless of external weather. IoT sensors provide real-time data on environmental factors and crop health, empowering farmers to make data-driven decisions for improved yields and resource management. Integration of robotics streamlines operations, while closed-loop systems minimize waste and promote sustainability. Renewable energy solutions reduce reliance on traditional power sources, decreasing the environmental footprint of vertical farms. As these technologies continue to evolve, they unlock further potential for growth by enhancing scalability, reducing costs, and improving overall prof

Vertical Farming Market Technology and Description:

Technology/Component Description Controlled Environment Agriculture (CEA) Utilizes various technologies to create controlled environments for plant growth, including monitoring and adjusting parameters such as temperature, humidity, lighting, and nutrient levels. Smart Sensors Monitors technical variables like temperature, humidity, CO2 levels, lighting, nutrient concentration, pH, pest control, irrigation, and harvesting, providing real-time data for optimal plant growth. Dosing Systems Automated systems for delivering nutrients to plants and monitoring nutrient solutions, ensuring precise control over nutrient levels without manual intervention. Sterilization Systems Utilized for maintaining sanitation and preventing pest infestations, including methods such as chemical disinfection, UV-C sterilization, and ozone sanitation. Water Recapturing Systems Recycles irrigation water by capturing and treating water released during transpiration, reducing water consumption and conserving resources. Lighting Systems Replaces natural sunlight with artificial lighting, with options such as fluorescent grow lights, high-pressure sodium lights (HPS), and LED lights, each offering different benefits and efficiencies. Air Control Systems Manages air quality, CO2 enrichment, airflow, and humidity levels within the growing environment to optimize plant growth conditions. Internet of Things (IoT) Utilizes smart sensors and data analytics to monitor and control various parameters, enabling real-time adjustments and optimization of growing conditions. CO2 Enrichment Techniques Various methods for enriching the growing environment with carbon dioxide, including CO2 gassing, compressed CO2, and misting aqueous CO2, to promote photosynthesis and enhance plant growth. Vertical Farming Market Segment Analysis

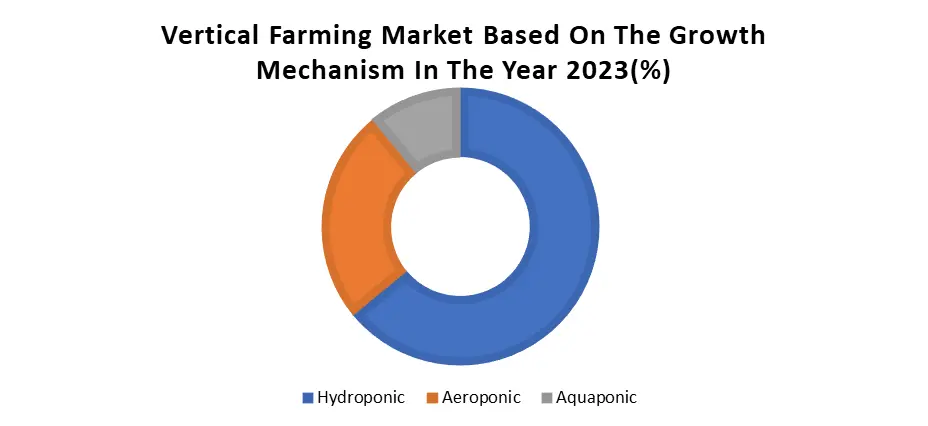

Based on Structure, the container-based segment dominated the structure segment of the vertical farming market in 2023. This surge is attributed to the containers' ability to facilitate crop cultivation irrespective of location. A significant advantage of container farming lies in its mobility and minimal space requirements, making it accessible for new entrants without the need for extensive land or dedicated facilities. Escalating competition has helped to a decline in shipping container prices, as old containers are readily available at low costs, further boosting the market growth. Despite these advantages, challenges persist, including lower comparative productivity and potential conflicts between light, heat, and layout management. Nonetheless, the shipping container market is poised for growth, driven by technological advancements and increased adoption of precision farming techniques. In regions like Japan, China, and other parts of Asia, building-based farming is gaining traction, becoming the fastest-growing revenue segment due to its cost-effectiveness and ability to ensure food security through larger agricultural fields. Notably, shipping container farming demonstrates significant water conservation benefits, utilizing 95% less water compared to conventional drip irrigation methods. The adaptability, stackability, and durability of shipping containers, along with their cost-effectiveness in recycling and repairs, further contribute to their appeal in the vertical farming market. The global oversupply of underutilized shipping containers is expected to bolster category growth in the foreseeable future.Based on the Growth Mechanism, the hydroponics segment dominated the Growth Mechanism of the Vertical Farming Market in the year 2023. The hydroponics segment has emerged as a powerhouse boosting market growth within vertical farming, driven by several factors. Hydroponics delivers unmatched efficiency by nurturing plants sans soil, relying on mineral solutions to directly nourish the roots. This methodology not only optimizes space utilization but also ensures the optimal allocation of resources, culminating in elevated yields when juxtaposed with conventional farming practices. Secondly, the inherent simplicity and user-friendliness of hydroponic systems render them highly accessible to a diverse spectrum of growers, spanning from hobbyists to commercial cultivators. Hydroponics mitigates the risk of soil-borne diseases and affords meticulous control over environmental factors such as pH and nutrient levels, thereby augmenting crop quality and consistency. Consequently, the hydroponics segment maintains its dominance in driving growth within the vertical farming market, steering both innovation and sustainability in agricultural methodologies. As consumer awareness regarding pesticide hazards burgeons, the trajectory indicates an uptick in demand for hydroponics, solidifying its position as a cornerstone of modern cultivation practices.

Vertical Farming Market Regional Analysis:

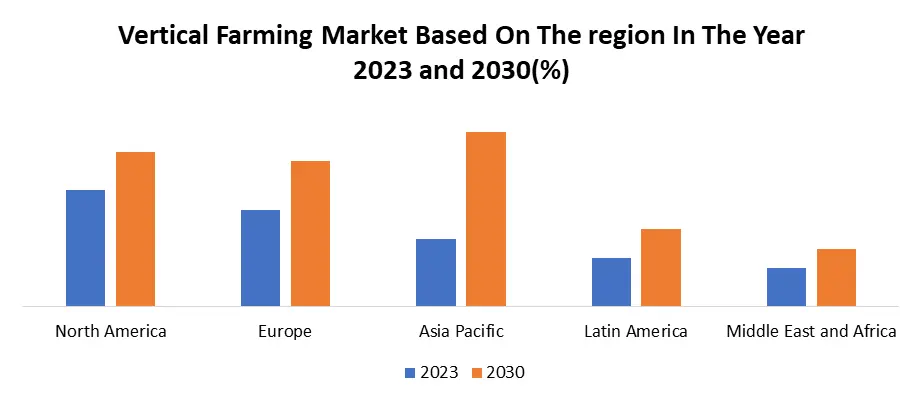

North America dominated the Vertical Farming Market in the year 2023. The continent boasts a strong technological landscape and infrastructure, fostering the rapid adoption of cutting-edge farming techniques. This technological prowess is further amplified by a culture of innovation and entrepreneurship, driving continuous advancements in vertical farming methodologies. North America faces inherent challenges in traditional agriculture, including limited arable land and increasing environmental pressures. Vertical farming offers a sustainable solution to these challenges by maximizing land use efficiency and minimizing resource consumption. The region benefits from a strong consumer demand for locally grown, fresh produce, coupled with a growing awareness of environmental sustainability and food security issues. This consumer sentiment creates a favorable market environment for vertical farming initiatives. Also, government support in the form of grants, subsidies, and favorable regulatory frameworks encourages investment and growth in the vertical farming sector, driving North America to the forefront of global market leadership. North America's dominance in the vertical farming market is driven by a combination of technological innovation, market demand, supportive policies, and a conducive entrepreneurial ecosystem.

Report Scope:

The Vertical Farming Market research report includes product categorization, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The study discusses the across-the-world market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and constraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of significant Vertical Farming Market firms in terms of production bases and technologies. The more precise research also contains the key application areas of market and consumption, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an analysis of the industry chain relationship. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organized by area, technology, and application.Vertical Farming Market Scope: Inquire before buying

Vertical Farming Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.07 Bn. Forecast Period 2024 to 2030 CAGR: 25.7% Market Size in 2030: US $ 25.14 Bn. Segments Covered: by Growth Mechanism Hydroponic Aeroponic Aquaponic by Structure Building based structure Container based structure by Application Indoor Outdoor Vertical Farming Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vertical Farming Market: Key Players

North America 1. AeroFarms (United States) 2. Plenty (United States) 3. Bowery Farming (United States) 4. BrightFarms (United States) 5. Gotham Greens (United States) 6. Lufa Farms (Canada) 7. Farm.One (United States) 8. Local Roots Farms (United States) 9. Green Sense Farms (United States) 10. Vertical Harvest (United States) 11. Freight Farms (United States) 12. Crop One Holdings (United States) 13. Fifth Season (United States) 14. AppHarvest (United States) 15. FarmBox Foods (United States) 16. Modular Farms (Canada) 17. Urban Grow Inc. (United States) Europe 1. Infarm (Germany) 2. Urban Crop Solutions (Belgium) 3. Jones Food Company (United Kingdom) 4. iFarm (Finland) 5. PlantLab (Netherlands) 6. Evergreen Farm Oy (Finland) Asia Pacific 1. Sky Greens (Singapore) 2. Spread Co., Ltd. (Japan) Frequently Asked Questions 1] What segments are covered in the Global Vertical Farming Market report? Ans. The segments covered in the Vertical Farming Market report are based on, Growth Mechanism, Structure, Application and Regions. 2] Which region is expected to hold the highest share of the Global Vertical Farming Market? Ans. The North America region is expected to hold the highest share of the Vertical Farming Market. 3] What is the market size of the Global Vertical Farming Market by 2030? Ans. The market size of the Vertical Farming Market by 2030 is expected to reach US$ 25.14 Bn. 4] What was the market size of the Global Vertical Farming Market in 2023? Ans. The market size of the Vertical Farming Market in 2023 was valued at US$ 5.07 Bn. 5] Key players in the Vertical Farming Market. Ans. AeroFarms (United States), Plenty (United States), Bowery Farming (United States, BrightFarms (United States), Gotham Greens (United States) and Lufa Farms (Canada)

1. Vertical Farming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vertical Farming Market: Dynamics 2.1. Vertical Farming Market Trends by Region 2.1.1. North America Vertical Farming Market Trends 2.1.2. Europe Vertical Farming Market Trends 2.1.3. Asia Pacific Vertical Farming Market Trends 2.1.4. Middle East and Africa Vertical Farming Market Trends 2.1.5. South America Vertical Farming Market Trends 2.2. Vertical Farming Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vertical Farming Market Drivers 2.2.1.2. North America Vertical Farming Market Restraints 2.2.1.3. North America Vertical Farming Market Opportunities 2.2.1.4. North America Vertical Farming Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vertical Farming Market Drivers 2.2.2.2. Europe Vertical Farming Market Restraints 2.2.2.3. Europe Vertical Farming Market Opportunities 2.2.2.4. Europe Vertical Farming Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vertical Farming Market Drivers 2.2.3.2. Asia Pacific Vertical Farming Market Restraints 2.2.3.3. Asia Pacific Vertical Farming Market Opportunities 2.2.3.4. Asia Pacific Vertical Farming Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vertical Farming Market Drivers 2.2.4.2. Middle East and Africa Vertical Farming Market Restraints 2.2.4.3. Middle East and Africa Vertical Farming Market Opportunities 2.2.4.4. Middle East and Africa Vertical Farming Market Challenges 2.2.5. South America 2.2.5.1. South America Vertical Farming Market Drivers 2.2.5.2. South America Vertical Farming Market Restraints 2.2.5.3. South America Vertical Farming Market Opportunities 2.2.5.4. South America Vertical Farming Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Vertical Farming Industry 2.8. Analysis of Government Schemes and Initiatives For Vertical Farming Industry 2.9. Vertical Farming Market Trade Analysis 2.10. The Global Pandemic Impact on Vertical Farming Market 3. Vertical Farming Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 3.1.1. Hydroponic 3.1.2. Aeroponic 3.1.3. Aquaponic 3.2. Vertical Farming Market Size and Forecast, by Structure (2023-2030) 3.2.1. Building based structure 3.2.2. Container based structure 3.3. Vertical Farming Market Size and Forecast, by Application (2023-2030) 3.3.1. Indoor 3.3.2. Outdoor 3.4. Vertical Farming Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 4.1.1. Hydroponic 4.1.2. Aeroponic 4.1.3. Aquaponic 4.2. North America Vertical Farming Market Size and Forecast, by Structure (2023-2030) 4.2.1. Building based structure 4.2.2. Container based structure 4.3. North America Vertical Farming Market Size and Forecast, by Application (2023-2030) 4.3.1. Indoor 4.3.2. Outdoor 4.4. North America Vertical Farming Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 4.4.1.1.1. Hydroponic 4.4.1.1.2. Aeroponic 4.4.1.1.3. Aquaponic 4.4.1.2. United States Vertical Farming Market Size and Forecast, by Structure (2023-2030) 4.4.1.2.1. Building based structure 4.4.1.2.2. Container based structure 4.4.1.3. United States Vertical Farming Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Indoor 4.4.1.3.2. Outdoor 4.4.2. Canada 4.4.2.1. Canada Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 4.4.2.1.1. Hydroponic 4.4.2.1.2. Aeroponic 4.4.2.1.3. Aquaponic 4.4.2.2. Canada Vertical Farming Market Size and Forecast, by Structure (2023-2030) 4.4.2.2.1. Building based structure 4.4.2.2.2. Container based structure 4.4.2.3. Canada Vertical Farming Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Indoor 4.4.2.3.2. Outdoor 4.4.3. Mexico 4.4.3.1. Mexico Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 4.4.3.1.1. Hydroponic 4.4.3.1.2. Aeroponic 4.4.3.1.3. Aquaponic 4.4.3.2. Mexico Vertical Farming Market Size and Forecast, by Structure (2023-2030) 4.4.3.2.1. Building based structure 4.4.3.2.2. Container based structure 4.4.3.3. Mexico Vertical Farming Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Indoor 4.4.3.3.2. Outdoor 5. Europe Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.2. Europe Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.3. Europe Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4. Europe Vertical Farming Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.1.2. United Kingdom Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.1.3. United Kingdom Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.2.2. France Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.2.3. France Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.3.2. Germany Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.3.3. Germany Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.4.2. Italy Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.4.3. Italy Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.5.2. Spain Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.5.3. Spain Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.6.2. Sweden Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.6.3. Sweden Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.7.2. Austria Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.7.3. Austria Vertical Farming Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 5.4.8.2. Rest of Europe Vertical Farming Market Size and Forecast, by Structure (2023-2030) 5.4.8.3. Rest of Europe Vertical Farming Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.2. Asia Pacific Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.3. Asia Pacific Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Vertical Farming Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.1.2. China Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.1.3. China Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.2.2. S Korea Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.2.3. S Korea Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.3.2. Japan Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.3.3. Japan Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.4.2. India Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.4.3. India Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.5.2. Australia Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.5.3. Australia Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.6.2. Indonesia Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.6.3. Indonesia Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.7.2. Malaysia Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.7.3. Malaysia Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.8.2. Vietnam Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.8.3. Vietnam Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.9.2. Taiwan Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.9.3. Taiwan Vertical Farming Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 6.4.10.2. Rest of Asia Pacific Vertical Farming Market Size and Forecast, by Structure (2023-2030) 6.4.10.3. Rest of Asia Pacific Vertical Farming Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 7.2. Middle East and Africa Vertical Farming Market Size and Forecast, by Structure (2023-2030) 7.3. Middle East and Africa Vertical Farming Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Vertical Farming Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 7.4.1.2. South Africa Vertical Farming Market Size and Forecast, by Structure (2023-2030) 7.4.1.3. South Africa Vertical Farming Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 7.4.2.2. GCC Vertical Farming Market Size and Forecast, by Structure (2023-2030) 7.4.2.3. GCC Vertical Farming Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 7.4.3.2. Nigeria Vertical Farming Market Size and Forecast, by Structure (2023-2030) 7.4.3.3. Nigeria Vertical Farming Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 7.4.4.2. Rest of ME&A Vertical Farming Market Size and Forecast, by Structure (2023-2030) 7.4.4.3. Rest of ME&A Vertical Farming Market Size and Forecast, by Application (2023-2030) 8. South America Vertical Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 8.2. South America Vertical Farming Market Size and Forecast, by Structure (2023-2030) 8.3. South America Vertical Farming Market Size and Forecast, by Application(2023-2030) 8.4. South America Vertical Farming Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 8.4.1.2. Brazil Vertical Farming Market Size and Forecast, by Structure (2023-2030) 8.4.1.3. Brazil Vertical Farming Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 8.4.2.2. Argentina Vertical Farming Market Size and Forecast, by Structure (2023-2030) 8.4.2.3. Argentina Vertical Farming Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Vertical Farming Market Size and Forecast, by Growth Mechanism (2023-2030) 8.4.3.2. Rest Of South America Vertical Farming Market Size and Forecast, by Structure (2023-2030) 8.4.3.3. Rest Of South America Vertical Farming Market Size and Forecast, by Application (2023-2030) 9. Global Vertical Farming Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Vertical Farming Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. AeroFarms (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Plenty (United States) 10.3. Bowery Farming (United States) 10.4. BrightFarms (United States) 10.5. Gotham Greens (United States) 10.6. Lufa Farms (Canada) 10.7. Farm.One (United States) 10.8. Local Roots Farms (United States) 10.9. Green Sense Farms (United States) 10.10. Vertical Harvest (United States) 10.11. Freight Farms (United States) 10.12. Crop One Holdings (United States) 10.13. Fifth Season (United States) 10.14. AppHarvest (United States) 10.15. FarmBox Foods (United States) 10.16. Modular Farms (Canada) 10.17. Urban Grow Inc. (United States) 10.18. Infarm (Germany) 10.19. Urban Crop Solutions (Belgium) 10.20. Jones Food Company (United Kingdom) 10.21. iFarm (Finland) 10.22. PlantLab (Netherlands) 10.23. Evergreen Farm Oy (Finland) 10.24. Sky Greens (Singapore) 10.25. Spread Co., Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Vertical Farming Market: Research Methodology 14. Terms and Glossary