The Automotive V2X Market size was valued at USD 4.94 Billion in 2024 and the total Automotive V2X revenue is expected to grow at a CAGR of 38.2% from 2025 to 2032, reaching nearly USD 65.81 Billion.Automotive V2X Market Overview:

According to the WHO, more than 1.36 million road accident deaths occur every year and these road accidents can be reduced by 80% by using V2X technology. The primary goals of V2X technology are to improve traffic efficiency, energy conservation, and road safety by allowing cars to communicate their position, speed, and direction to each other over a mesh network. The automotive V2X market is huge and more and more companies are getting involved and investing in the V2X technology. The concept of “vehicle intelligentialization” has been introduced to the V2X, which promises huge commercial interest. According to the U.S. National Highway Traffic Safety Administration (NHTSA), nearly 615,000 vehicle crashes could be prevented with the help of V2X technology. Over 90 % of drivers in the United States have expressed a desire to use a vehicle equipped with a V2X system. The integration of 5G and AI along with the growing popularity of autonomous and semi-autonomous vehicles has provided a considerable boost to the adoption of V2X technology in recent years.To know about the Research Methodology:-Request Free Sample Report

Report Scope:

The Automotive V2X report provides a quantitative analysis of the market drivers, restraints, trends, and estimations to identify the prevailing opportunities in the Automotive V2X market during the forecast period. PORTER's five forces analysis shows the ability of buyers and suppliers to make profit-oriented strategic decisions and build their supplier-buyer network. In-depth analysis as well as the market size and segmentation assist in determining the current Automotive V2X market potential. The report also includes the factors that are supposed to affect the business positively or negatively and will give a clear futuristic view of the industry to the decision-makers. The report presents a comprehensive analysis of the global Automotive V2X market to the stakeholders who want to invest in the Automotive V2X market. Past and current scenarios of the Automotive V2X market with the forecasted market size are also included in this report. The report covers all the aspects of the market with a thorough study of key players that include market leaders, followers, and new entrants. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the internal or local market make the report investor’s guide. They are continuously strategizing on mergers & acquisitions for the expansion of their market share and growth opportunities during the forecast period.Research Methodology:

The research is carried out by using an in-depth analysis of the market insights, facts, historical data, and industry-validated market statistics. The estimates are based on an appropriate set of assumptions and methodologies. We used the bottom-up approach to collect the data and analyze the market to figure out the market size by volume and value with mentioned segments. Major Key Players in the Automotive V2X market are identified through secondary research and their market revenues are determined through a study of the top manufacturers' annual and financial reports, interviews with company key persons, and industry professionals such as experienced front-line staff, CEOs, and marketing executives. By understanding the scope of the market our analyst has segmented the market based on Vehicle Type, Application, Communication Type, Offering, Connectivity Type, and region. The growth amongst these segments will help to analyze the industries and provide the users with a valuable market overview and market insights to make strategic decisions for identifying core market applications.Automotive V2X Market Dynamics:

Innovations in Connected Vehicle Technology and Growing Collaborations The automobile industry is undergoing a huge transformation with OEMs increasingly focusing on advanced mobility such as connected and autonomous vehicles. To remain competitive, multinational manufacturers like Ford (US), GM (US), Mercedes-Benz (Germany), and Volkswagen (Germany) are boosting their investments in R&D of hardware, software, and related services to vehicle connectivity and autonomous driving. Hyundai Motor (South Korea) formed a strategic agreement with Autotalks in August with a direct investment to speed up the development and implementation of the next-generation chipset for connected vehicles. This technology would increase vehicle and road safety as well as mobility, which is critical for autonomous driving. According to Yunseong Hwang (Director of Open Innovation Business Group, Hyundai Motor Company), connectivity is one of the essential technologies that may be applied to smart city business models, as well as autonomous driving and infotainment. Hyundai Motor will continue to invest in innovative technologies that line with its present plans. General Motors will introduce 5G onboard connectivity on all new Cadillac vehicles in . By , it is predicted that the majority of Chevrolet and Buick vehicles would be sold in China. The 5G service would offer higher internet speeds than the existing OnStar 4G LTE Wi-Fi in its vehicles. The future potential of 5G and AI technology combined with advancements in cellular-V2X technology Artificial intelligence (AI) and 5G are playing an essential part in the automotive industry's future because predictive capabilities become more prevalent in customizing the driving experience. Furthermore, 5G and AI are better prepared with V2X to carry out critical communications for safer and more secure driving. cellular-V2X is a vital contributor to the growth of vehicle automation by providing lines of communication between cars, roadside units, and pedestrians, making the vehicle more aware of its surroundings. The C-V2X technology is designed to be compatible with future 5G network technologies, allowing mission-critical V2X and C-V2X to act as ultimate platforms to enable cooperative intelligent transportation systems (C-ITS) services and technology. Thus, rapidly emerging use cases such as autonomous driving, platooning, vehicle safety, and traffic efficiency have created a need for operationally efficient communication technology to achieve the desired output level, which is expected to offer lucrative growth opportunities for the automotive V2X market. At the moment, 5G-enabled V2X communication activities are incompatible with actual network traffic measurement. Thus, the 5G-enabled technology adoption in V2X technology is expected to offer potential growth opportunities for the market. Rapid urbanization and industrialization. Industrialization and urbanization have risen as a result of the fast economic growth in various developed countries around the world. Furthermore, in recent years, the V2X-based intelligent transport system (ITS) has been developed which is considered the critical enabling technology for improving road safety, traffic efficiency, and driving experience. the Furthermore, macroeconomic reasons such as an increase in disposable income, an increase in employment rates, and an increase in total GDP are driving developments such as smart cities with smart infrastructures which are expected to fuel the growth of the automotive V2X market. Furthermore, the continued development and commercialization of mobile networks and supporting infrastructure are driving worldwide growth. These include 5G, LTE, and radio access technology (RAT), which provide smart transportation applications including collision warning and avoidance, lane keeping assistance, and obstacle detection.Lack of Infrastructure may hamper the market growth In the V2X ecosystem, high-speed communication is critical. Cars on highways need information such as lane change, object recognition, the distance between vehicles, traffic statuses, and services such as navigation and connectivity. However, due to restricted network access on roads, vehicles are not connected or the cloud. Highway connection infrastructure development is slower in Mexico, Brazil, and India than in developed economies. 3G and 4G-LTE communication networks are largely available in urban and semi-urban regions. As a result, a lack of IT and communication infrastructure in emerging nations, as well as a gap in government rules, may hamper the growth of the automotive V2X market in these countries. Industry participants may be subject to country-specific telecommunications regulations such as legal intercept and in-country entity requirements. The interoperability of the various platforms and cross-border use cases should be regulated. The reliance on data networks creates the issue of network neutrality, in which internet service providers provide some data transmission priority.

Automotive V2X Market Segment Analysis:

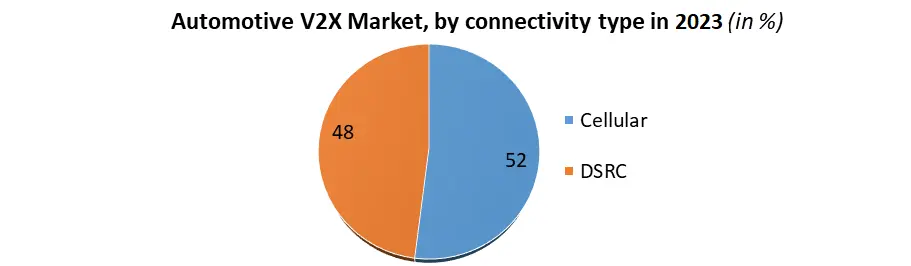

By vehicle type, the Passenger Information System segment is expected to have the greatest CAGR during the projection period. The factors that may be attributed to an increase in demand for connected car technologies in passenger cars, a larger market share, and an increase in the number of passenger electric vehicles are to boost demand for the Passenger Information System segment. By Communication type, V2G is a technology that enables electric cars to connect with the power grid in order to regulate charging rates or return electricity to the grid. The three major components of V2G are the location where the vehicle connects to the electrical grid, the EVSE, and the electric vehicle that manages SOC. V2G allows people to charge their electric vehicles and monitor costs using mobile phones. Governments in the Asia Pacific area are also working on the deployment of electric commercial vehicles. The Indian government announced plans in September to give incentives of USD 4.6 billion to firms that establish advanced battery manufacturing facilities to cut oil imports while switching to EVs. Similarly, China is concentrating on boosting the number of electric cars in order to fight the country's rising emissions. The Chinese government is offering substantial subsidies for car electrification, which has increased sales of electric vehicle charging stations in China. Because of these factors, V2G is expected to emerge as a promising market throughout the forecast period. By offering, the software segment is expected to grow at the highest rate during the projected period. The software segment is also expected to be the largest market because of the introduction of 5G technology and the expansion of features in vehicle V2X. With increased V2X adoption, the need for V2X software is expected to increase rapidly throughout the forecast period. The forthcoming V2X software technologies should be interoperable with DSRC and C-V2X. Some of the major players in the Automotive V2X Market provide software solutions that are compatible with DSRC and C-V2X. For example, Commsignia provides hardware and software components that can handle both DSRC and C-V2X. By Connectivity Type, the Cellular segment is expected to be the fastest-growing market in terms of connectivity over the forecast period. Cellular vehicle-to-everything (C-V2X) is one of the innovative technologies that has lately attracted global attention due to improved efficiency and mobility safety. It is a cutting-edge wireless technology that allows cars to stay connected and interact with nearly everything around them, including other vehicles (V2V), pedestrians (V2P), roadside infrastructure (V2I), networks (V2N), and the cloud (V2C). The main benefits of C-V2X are improved security and real-time and low-latency communications. 5G technological advances would enhance transmission speed and quality. Another major aspect of C-V2X is that it facilitates both short- and long-range transmission between automobiles and other connected devices.

Automotive V2X Market Regional Insights

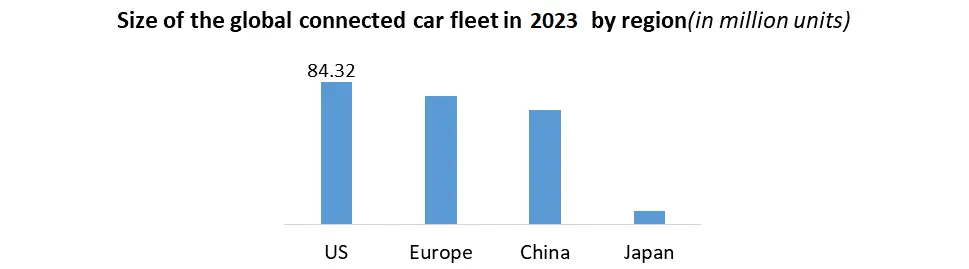

The Asia Pacific is expected to be the largest Automotive V2X market over the forecast period. The Asia Pacific comprises both emerging countries such as China and India. In recent years, this region has grown as an automobile manufacturing hub. The growing purchasing power of the people, along with growing environmental concerns has fueled demand for V2X across the Asia Pacific. Asia pacific region will continue having the highest growth rates of new vehicle sales and connected vehicle penetration. China’s connected vehicle penetration rate stands at 45.2% as of now. Because South Korea and Japan are electronics leaders, it would enable them to create V2X products with higher performance at a lower price. Denso Corporation, Mitsubishi Corporation, Hitachi Solutions, Ltd, Huawei Technologies Co., Ltd, and Hyundai Motor Company (are all present in the Asia Pacific automotive V2X market. These companies' presence is expected to propel the Asia Pacific automobile V2X industry in the coming years. The European automotive V2X market is expected to grow at a significant CAGR throughout the forecast period. Leading automakers in the region are realizing the benefits of V2X technology. Significant progress has been achieved in Europe toward the general commercialization of connected car technology, providing V2X developers with significant potential. Qualcomm stated in March that numerous products using its 9150 C-V2X chipsets had gained European Radio Equipment Directive (RED) certification in Europe. The addition of V2X to the EuroNCAP roadmap will boost the Europe V2X market forward throughout the forecast period. Over 97% of all new vehicles sold in the region are EuroNCAP certified. Automotive OEMs are expected to integrate V2X into their vehicles in order to improve their EuroNCAP rating.

Automotive V2X Market Scope: Inquire before buying

Global Automotive V2X Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.94 Bn. Forecast Period 2025 to 2032 CAGR: 38.2 % Market Size in 2032: USD 65.81 Bn. Segments Covered: by vehicle type Commercial Passenger by application Predictive Maintenance Remote Monitoring and Diagnostics Parking Management System Fleet and Asset Management Passenger Information System Emergency Vehicle Notification Intelligent Traffic System Automated Driver Assistance by communication type Vehicle-to-Vehicle Vehicle-to-Network Vehicle-to-Home Vehicle-to-Grid Vehicle-to-Pedestrian Vehicle-to-Infrastructure by offering Hardware Software by connectivity type Cellular DSRC Automotive V2X Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Global Leaders in the Automotive V2X Market are:

1. Intel Corporation (US) 2. Qualcomm Technologies Inc.(US) 3. Harman International Industries, Inc.(US) 4. Nvidia Corporation(US) 5. NXP Semiconductors N.V.(Netherland) 6. TomTom International BV.(Netherland) 7. Autotalks ltd. (Israel) 8. Cohda Wireless (Australia) 9. Continental AG(Germany) 10.Daimler AG(Germany) 11.Audi AG(Germany) 12.Infineon Technologies AG (Germany) 13.Robert Bosch GmBH (Germany) FAQs: 1. Which is the potential market for Automotive V2X in terms of the region? Ans. In the Asia Pacific region, the growing purchasing power of the people, along with growing environmental concerns is expected to drive the market. 2. What is expected to drive the growth of the Automotive V2X market in the forecast period? Ans. Innovations in Connected Vehicle Technology and Growing Collaborations are major factors driving the market growth during the forecast period. 3. What was the Global Automotive V2X Market size in 2024? Ans: The Global Automotive V2X Market size was USD 4.94 Billion in 2024. 4. What segments are covered in the Automotive V2X Market report? Ans. The segments covered are vehicle type, application, communication type, offering, connectivity type, and region.

1. Automotive V2X Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive V2X Market: Dynamics 2.1. Automotive V2X Market Trends by Region 2.1.1. North America Automotive V2X Market Trends 2.1.2. Europe Automotive V2X Market Trends 2.1.3. Asia Pacific Automotive V2X Market Trends 2.1.4. Middle East and Africa Automotive V2X Market Trends 2.1.5. South America Automotive V2X Market Trends 2.2. Automotive V2X Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive V2X Market Drivers 2.2.1.2. North America Automotive V2X Market Restraints 2.2.1.3. North America Automotive V2X Market Opportunities 2.2.1.4. North America Automotive V2X Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive V2X Market Drivers 2.2.2.2. Europe Automotive V2X Market Restraints 2.2.2.3. Europe Automotive V2X Market Opportunities 2.2.2.4. Europe Automotive V2X Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive V2X Market Drivers 2.2.3.2. Asia Pacific Automotive V2X Market Restraints 2.2.3.3. Asia Pacific Automotive V2X Market Opportunities 2.2.3.4. Asia Pacific Automotive V2X Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive V2X Market Drivers 2.2.4.2. Middle East and Africa Automotive V2X Market Restraints 2.2.4.3. Middle East and Africa Automotive V2X Market Opportunities 2.2.4.4. Middle East and Africa Automotive V2X Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive V2X Market Drivers 2.2.5.2. South America Automotive V2X Market Restraints 2.2.5.3. South America Automotive V2X Market Opportunities 2.2.5.4. South America Automotive V2X Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive V2X Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive V2X Industry 2.9. Automotive V2X Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive V2X Market 3. Automotive V2X Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 3.1.1. Commercial 3.1.2. Passenger 3.2. Automotive V2X Market Size and Forecast, by Application (2024-2032) 3.2.1. Predictive Maintenance 3.2.2. Remote Monitoring and Diagnostics 3.2.3. Parking Management System 3.2.4. Fleet and Asset Management 3.2.5. Passenger Information System 3.2.6. Emergency Vehicle Notification 3.2.7. Intelligent Traffic System 3.2.8. Automated Driver Assistance 3.3. Automotive V2X Market Size and Forecast, by communication type (2024-2032) 3.3.1. Vehicle-to-Vehicle 3.3.2. Vehicle-to-Network 3.3.3. Vehicle-to-Home 3.3.4. Vehicle-to-Grid 3.3.5. Vehicle-to-Pedestrian 3.3.6. Vehicle-to-Infrastructure 3.4. Automotive V2X Market Size and Forecast, by Offering (2024-2032) 3.4.1. Hardware 3.4.2. Software 3.5. Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 3.5.1. Cellular 3.5.2. DSRC 3.6. Automotive V2X Market Size and Forecast, by Region (2024-2032) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Automotive V2X Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 4.1.1. Commercial 4.1.2. Passenger 4.2. North America Automotive V2X Market Size and Forecast, by Application (2024-2032) 4.2.1. Predictive Maintenance 4.2.2. Remote Monitoring and Diagnostics 4.2.3. Parking Management System 4.2.4. Fleet and Asset Management 4.2.5. Passenger Information System 4.2.6. Emergency Vehicle Notification 4.2.7. Intelligent Traffic System 4.2.8. Automated Driver Assistance 4.3. North America Automotive V2X Market Size and Forecast, by communication type (2024-2032) 4.3.1. Vehicle-to-Vehicle 4.3.2. Vehicle-to-Network 4.3.3. Vehicle-to-Home 4.3.4. Vehicle-to-Grid 4.3.5. Vehicle-to-Pedestrian 4.3.6. Vehicle-to-Infrastructure 4.4. North America Automotive V2X Market Size and Forecast, by Offering (2024-2032) 4.4.1. Hardware 4.4.2. Software 4.5. North America Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 4.5.1. Cellular 4.5.2. DSRC 4.7. North America Automotive V2X Market Size and Forecast, by Country (2024-2032) 4.6.1. United States 4.6.1.1. United States Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 4.6.1.1.1. Commercial 4.6.1.1.2. Passenger 4.6.1.2. United States Automotive V2X Market Size and Forecast, by Application (2024-2032) 4.6.1.2.1. Predictive Maintenance 4.6.1.2.2. Remote Monitoring and Diagnostics 4.6.1.2.3. Parking Management System 4.6.1.2.4. Fleet and Asset Management 4.6.1.2.5. Passenger Information System 4.6.1.2.6. Emergency Vehicle Notification 4.6.1.2.7. Intelligent Traffic System 4.6.1.2.8. Automated Driver Assistance 4.6.1.3. United States Automotive V2X Market Size and Forecast, by communication type (2024-2032) 4.6.1.3.1. Vehicle-to-Vehicle 4.6.1.3.2. Vehicle-to-Network 4.6.1.3.3. Vehicle-to-Home 4.6.1.3.4. Vehicle-to-Grid 4.6.1.3.5. Vehicle-to-Pedestrian 4.6.1.3.6. Vehicle-to-Infrastructure 4.6.1.4. United States Automotive V2X Market Size and Forecast, by Offering (2024-2032) 4.6.1.4.1. Hardware 4.6.1.4.2. Software 4.6.1.5. United States Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 4.6.1.5.1. Cellular 4.6.1.5.2. DSRC 4.6.2. Canada 4.6.2.1. Canada Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 4.6.2.1.1. Commercial 4.6.2.1.2. Passenger 4.6.2.2. Canada Automotive V2X Market Size and Forecast, by Application (2024-2032) 4.6.2.2.1. Predictive Maintenance 4.6.2.2.2. Remote Monitoring and Diagnostics 4.6.2.2.3. Parking Management System 4.6.2.2.4. Fleet and Asset Management 4.6.2.2.5. Passenger Information System 4.6.2.2.6. Emergency Vehicle Notification 4.6.2.2.7. Intelligent Traffic System 4.6.2.2.8. Automated Driver Assistance 4.6.2.3. Canada Automotive V2X Market Size and Forecast, by communication type (2024-2032) 4.6.2.3.1. Vehicle-to-Vehicle 4.6.2.3.2. Vehicle-to-Network 4.6.2.3.3. Vehicle-to-Home 4.6.2.3.4. Vehicle-to-Grid 4.6.2.3.5. Vehicle-to-Pedestrian 4.6.2.3.6. Vehicle-to-Infrastructure 4.6.2.4. Canada Automotive V2X Market Size and Forecast, by Offering (2024-2032) 4.6.2.4.1. Hardware 4.6.2.4.2. Software 4.6.2.5. Canada Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 4.6.2.5.1. Cellular 4.6.2.5.2. DSRC 4.6.3. Mexico 4.6.3.1. Mexico Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 4.6.3.1.1. Commercial 4.6.3.1.2. Passenger 4.6.3.2. Mexico Automotive V2X Market Size and Forecast, by Application (2024-2032) 4.6.3.2.1. Predictive Maintenance 4.6.3.2.2. Remote Monitoring and Diagnostics 4.6.3.2.3. Parking Management System 4.6.3.2.4. Fleet and Asset Management 4.6.3.2.5. Passenger Information System 4.6.3.2.6. Emergency Vehicle Notification 4.6.3.2.7. Intelligent Traffic System 4.6.3.2.8. Automated Driver Assistance 4.6.3.3. Mexico Automotive V2X Market Size and Forecast, by communication type (2024-2032) 4.6.3.3.1. Vehicle-to-Vehicle 4.6.3.3.2. Vehicle-to-Network 4.6.3.3.3. Vehicle-to-Home 4.6.3.3.4. Vehicle-to-Grid 4.6.3.3.5. Vehicle-to-Pedestrian 4.6.3.3.6. Vehicle-to-Infrastructure 4.6.3.4. Mexico Automotive V2X Market Size and Forecast, by Offering (2024-2032) 4.6.3.4.1. Hardware 4.6.3.4.2. Software 4.6.3.5. Mexico Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 4.6.3.5.1. Cellular 4.6.3.5.2. DSRC 5. Europe Automotive V2X Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.2. Europe Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.3. Europe Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.4. Europe Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.5. Europe Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6. Europe Automotive V2X Market Size and Forecast, by Country (2024-2032) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.1.2. United Kingdom Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.1.3. United Kingdom Automotive V2X Market Size and Forecast, by communication type(2024-2032) 5.6.1.4. United Kingdom Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.1.5. United Kingdom Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.2. France 5.6.2.1. France Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.2.2. France Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.2.3. France Automotive V2X Market Size and Forecast, by communication type(2024-2032) 5.6.2.4. France Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.2.5. France Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.3. Germany 5.6.3.1. Germany Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.3.2. Germany Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.3.3. Germany Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.6.3.4. Germany Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.3.5. Germany Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.4. Italy 5.6.4.1. Italy Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.4.2. Italy Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.4.3. Italy Automotive V2X Market Size and Forecast, by communication type(2024-2032) 5.6.4.4. Italy Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.4.5. Italy Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.5. Spain 5.6.5.1. Spain Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.5.2. Spain Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.5.3. Spain Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.6.5.4. Spain Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.5.5. Spain Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.6. Sweden 5.6.6.1. Sweden Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.6.2. Sweden Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.6.3. Sweden Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.6.6.4. Sweden Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.6.5. Sweden Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.7. Austria 5.6.7.1. Austria Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.7.2. Austria Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.7.3. Austria Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.6.7.4. Austria Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.7.5. Austria Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 5.6.8.2. Rest of Europe Automotive V2X Market Size and Forecast, by Application (2024-2032) 5.6.8.3. Rest of Europe Automotive V2X Market Size and Forecast, by communication type (2024-2032) 5.6.8.4. Rest of Europe Automotive V2X Market Size and Forecast, by Offering (2024-2032) 5.6.8.5. Rest of Europe Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6. Asia Pacific Automotive V2X Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.2. Asia Pacific Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.4. Asia Pacific Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.5. Asia Pacific Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6. Asia Pacific Automotive V2X Market Size and Forecast, by Country (2024-2032) 6.6.1. China 6.6.1.1. China Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.1.2. China Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.1.3. China Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.1.4. China Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.1.5. China Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.2. S Korea 6.6.2.1. S Korea Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.2.2. S Korea Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.2.3. S Korea Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.2.4. S Korea Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.2.5. S Korea Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.3. Japan 6.6.3.1. Japan Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.3.2. Japan Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.3.3. Japan Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.3.4. Japan Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.3.5. Japan Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.4. India 6.6.4.1. India Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.4.2. India Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.4.3. India Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.4.4. India Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.4.5. India Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.5. Australia 6.6.5.1. Australia Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.5.2. Australia Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.5.3. Australia Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.5.4. Australia Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.5.5. Australia Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.6. Indonesia 6.6.6.1. Indonesia Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.6.2. Indonesia Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.6.3. Indonesia Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.6.4. Indonesia Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.6.5. Indonesia Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.7. Malaysia 6.6.7.1. Malaysia Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.7.2. Malaysia Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.7.3. Malaysia Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.7.4. Malaysia Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.7.5. Malaysia Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.8. Vietnam 6.6.8.1. Vietnam Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.8.2. Vietnam Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.8.3. Vietnam Automotive V2X Market Size and Forecast, by communication type(2024-2032) 6.6.8.4. Vietnam Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.8.5. Vietnam Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.9. Taiwan 6.6.9.1. Taiwan Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.9.2. Taiwan Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.9.3. Taiwan Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.9.4. Taiwan Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.9.5. Taiwan Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 6.6.10.2. Rest of Asia Pacific Automotive V2X Market Size and Forecast, by Application (2024-2032) 6.6.10.3. Rest of Asia Pacific Automotive V2X Market Size and Forecast, by communication type (2024-2032) 6.6.10.4. Rest of Asia Pacific Automotive V2X Market Size and Forecast, by Offering (2024-2032) 6.6.10.5. Rest of Asia Pacific Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 7. Middle East and Africa Automotive V2X Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 7.2. Middle East and Africa Automotive V2X Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa Automotive V2X Market Size and Forecast, by communication type (2024-2032) 7.4. Middle East and Africa Automotive V2X Market Size and Forecast, by Offering (2024-2032) 7.5. Middle East and Africa Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 7.6. Middle East and Africa Automotive V2X Market Size and Forecast, by Country (2024-2032) 7.6.1. South Africa 7.6.1.1. South Africa Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 7.6.1.2. South Africa Automotive V2X Market Size and Forecast, by Application (2024-2032) 7.6.1.3. South Africa Automotive V2X Market Size and Forecast, by communication type (2024-2032) 7.6.1.4. South Africa Automotive V2X Market Size and Forecast, by Offering (2024-2032) 7.6.1.5. South Africa Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 7.6.2. GCC 7.6.2.1. GCC Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 7.6.2.2. GCC Automotive V2X Market Size and Forecast, by Application (2024-2032) 7.6.2.3. GCC Automotive V2X Market Size and Forecast, by communication type (2024-2032) 7.6.2.4. GCC Automotive V2X Market Size and Forecast, by Offering (2024-2032) 7.6.2.5. GCC Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 7.6.3. Nigeria 7.6.3.1. Nigeria Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 7.6.3.2. Nigeria Automotive V2X Market Size and Forecast, by Application (2024-2032) 7.6.3.3. Nigeria Automotive V2X Market Size and Forecast, by communication type (2024-2032) 7.6.3.4. Nigeria Automotive V2X Market Size and Forecast, by Offering (2024-2032) 7.6.3.5. Nigeria Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 7.6.4.2. Rest of ME&A Automotive V2X Market Size and Forecast, by Application (2024-2032) 7.6.4.3. Rest of ME&A Automotive V2X Market Size and Forecast, by communication type (2024-2032) 7.6.4.4. Rest of ME&A Automotive V2X Market Size and Forecast, by Offering (2024-2032) 7.6.4.5. Rest of ME&A Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 8. South America Automotive V2X Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 8.2. South America Automotive V2X Market Size and Forecast, by Application (2024-2032) 8.3. South America Automotive V2X Market Size and Forecast, by communication type(2024-2032) 8.4. South America Automotive V2X Market Size and Forecast, by Offering (2024-2032) 8.5. South America Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 8.6. South America Automotive V2X Market Size and Forecast, by Country (2024-2032) 8.7.1. Brazil 8.6.1.1. Brazil Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 8.6.1.2. Brazil Automotive V2X Market Size and Forecast, by Application (2024-2032) 8.6.1.3. Brazil Automotive V2X Market Size and Forecast, by communication type (2024-2032) 8.6.1.4. Brazil Automotive V2X Market Size and Forecast, by Offering (2024-2032) 8.6.1.5. Brazil Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 8.7.2. Argentina 8.6.2.1. Argentina Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 8.6.2.2. Argentina Automotive V2X Market Size and Forecast, by Application (2024-2032) 8.6.2.3. Argentina Automotive V2X Market Size and Forecast, by communication type (2024-2032) 8.6.2.4. Argentina Automotive V2X Market Size and Forecast, by Offering (2024-2032) 8.6.2.5. Argentina Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 8.7.3. Rest Of South America 8.6.3.1. Rest Of South America Automotive V2X Market Size and Forecast, by vehicle type (2024-2032) 8.6.3.2. Rest Of South America Automotive V2X Market Size and Forecast, by Application (2024-2032) 8.6.3.3. Rest Of South America Automotive V2X Market Size and Forecast, by communication type (2024-2032) 8.6.3.4. Rest Of South America Automotive V2X Market Size and Forecast, by Offering (2024-2032) 8.6.3.5. Rest Of South America Automotive V2X Market Size and Forecast, by connectivity type (2024-2032) 9. Global Automotive V2X Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Automotive V2X Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Intel Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Qualcomm Technologies Inc.(US) 10.3. Harman International Industries, Inc.(US) 10.4. Nvidia Corporation(US) 10.5. NXP Semiconductors N.V.(Netherland) 10.6. TomTom International BV.(Netherland) 10.7. Autotalks ltd. (Israel) 10.8. Cohda Wireless (Australia) 10.9. Continental AG(Germany) 10.10. Daimler AG(Germany) 10.11. Audi AG(Germany) 10.12. Infineon Technologies AG (Germany) 10.13. Robert Bosch GmBH (Germany) 11. Key Findings 12. Industry Recommendations 13. Automotive V2X Market: Research Methodology 14. Terms and Glossary