The Utility Terrain Vehicle Market size was valued at USD 1.2 Bn in 2023. The Utility Terrain Vehicle Market revenue is growing at a CAGR of 5.4 % from 2024 to 2030, reaching nearly USD 1.73 Bn by 2030.Global Utility Terrain Vehicle Market

Utility Terrain Vehicles (UTVs) have become indispensable tools for transporting materials and people, gaining traction across diverse sectors. The Utility Terrain Vehicle Market growth is driven by rising consumer interest in off-road recreation, agricultural applications, and industrial utility. These vehicles are not only sought after for leisure activities but also serve utilitarian purposes in farming, construction, and land maintenance. Their versatility extends across agriculture, forestry, construction, and public services, facilitated by features such as cargo beds, towing capacities, and off-road capabilities. The Utility Terrain Vehicle Market is evident in continuous innovation, with advancements such as more powerful engines, improved suspension systems, and enhanced safety features. The emergence of electric and hybrid UTV models aligns with the broader trend of electrification in the automotive industry. Consumers are increasingly drawn to multi-purpose UTVs that provide to both recreational and work-related needs. The popularity of customization options and aftermarket accessories underscores users' desire to personalize UTVs according to specific requirements. In essence, UTVs have evolved beyond recreational vehicles, becoming essential, versatile tools across industries due to their adaptability, technological advancements, and alignment with changing consumer preferences.To know about the Research Methodology :- Request Free Sample Report

Utility Terrain Vehicle Market Dynamics:

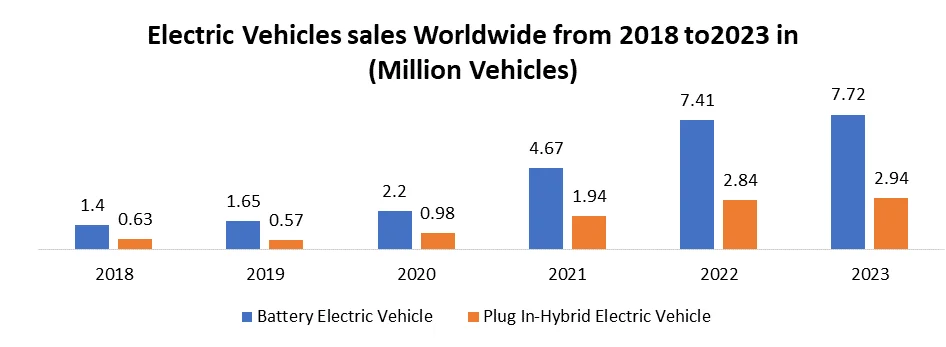

Driver Increasing Demand for Recreational Activities Boosts Market Growth The increasing interest in recreational activities, growing agricultural requirements, and expanding military needs are driving the demand for Utility Terrain Vehicles (UTVs). The boost in demand is particularly evident in the rise of recreational events, including national-level off-road vehicle competitions organized by sports experts. This surge in recreational activities significantly contributes to the heightened demand for UTVs. These vehicles are well-known for their outstanding performance and capability to navigate off-road terrains, providing an exciting and versatile outdoor experience. UTVs are favored in events and competitions for their agility and adaptability across various terrains. As more consumers seek adventure and engage in recreational pursuits, the Utility Terrain Vehicle market experiences substantial growth, boosted by the adventurous spirit of off-road enthusiasts and the expanding community of recreational UTV users. For Example, Major players in industries, such as John Deere, a leading agricultural and farm equipment manufacturer, have acknowledged the versatile applications of UTVs. In response to growing demand from customers in the farming sector, John Deere has recently introduced UTV models tailored for agricultural applications. An example is the significant upgrade to its well-known line of Gator Utility Vehicles (UVs), reflecting the industry's responsiveness to evolving customer needs. The UTV market is receiving a boost from increased military spending across nations. The multifaceted capabilities and functionality of off-road vehicles make them crucial in military operations. With governments allocating higher budgets to military endeavors, the demand for UTVs in military applications is expected to increase, thereby boosting the Utility Terrain Vehicle Market. The convergence of these various factors positions UTVs as versatile and sought-after solutions across different sectors, ensuring sustained growth in the market. Restrain Rise in the Number of Accidents Limits the Utility Terrain Vehicle Market Growth The growth of the Utility Terrain Vehicle (UTV) market is constrained by an increasing number of accidents, casting a shadow over the industry’s growth. The upsurge in incidents has intensified concerns regarding the safety of both passengers and vehicles. This rising issue has prompted governments globally to implement stringent regulations, underscoring the imperative for heightened safety standards. Accidents often stem from operator negligence or off-road vehicle overturns, posing significant threats such as injuries. The widespread misconception of allowing rear passengers adds an extra layer of risk. The stringent safety measures are being enforced by regulatory authorities, reshaping the landscape of the Utility Terrain Vehicle market. The focus on safety not only influences consumer perceptions but also invites increased regulatory scrutiny, thereby limiting the potential growth of the Utility Terrain Vehicle sector. Technological Advancement creates lucrative growth Opportunities for Market Growth Increasing Demand of Electric Utility Terrain Vehicles Creates Lucrative Growth Opportunities for the Market Growth. The increasing demand for electric off-road vehicles, particularly in such as China, the US, and Germany, presents a lucrative opportunity for Electric Utility Terrain Vehicles market growth. With a heightened focus on reducing greenhouse gas emissions in response to global regulations, original equipment manufacturers are directing substantial investments toward research and development activities for off-road electric vehicles. Polaris, a prominent player in this space, has unveiled its electric off-road vehicle, the Ranger XP Kinetic, showcasing the industry's commitment to sustainable solutions. The partnership with Zero Bikes and Qmerit for private EV charging infrastructure underscores the collaborative efforts to support the evolving landscape. In the UK, Ecocharger has emerged as an all-electric off-road vehicle manufacturer, leveraging lead-acid or lithium-ion batteries. The company's expansion plans across southern and central Europe signify the growing geographical footprint of electric UTVs. Consumer demand for these vehicles stems from both environmental consciousness and adherence to stringent national regulations. The introduction of innovative models with features such as a 14.9kWH battery and a 45-mile range on a single charge by industry leaders such as Polaris boost Utility Terrain Vehicle market growth

Utility Terrain Vehicle Market Segment Analysis:

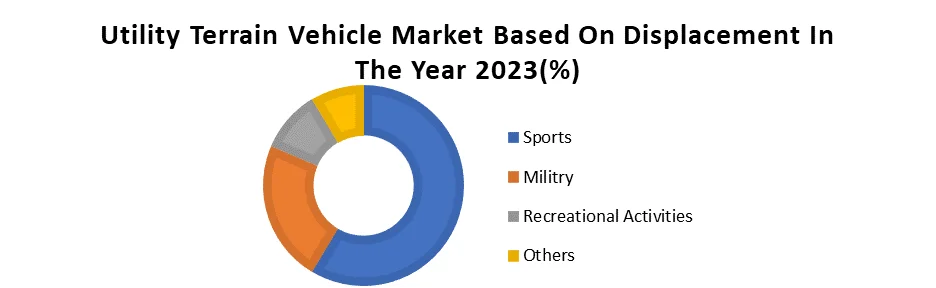

Based on Displacement: The 400-800 CC segment dominated the Displacement segment of the Utility Terrain Vehicle Market in the year 2023. The 400-800 CC range takes the top spot in the Utility Terrain Vehicle Market Displacement segment. This specific engine size strikes a balance between power and efficiency, making it a go-to choose for various off-road needs. UTVs in this range excel in diverse terrains, thanks to their optimal horsepower and maneuverability. Users favor the 400-800 CC UTVs due to their adaptability, handling both challenging off-road trails and less demanding terrains effectively. The engines in this segment offer a compelling mix of power and fuel efficiency, attracting a wide user base, from recreational users to those in utility and agriculture. The 400-800 CC range aligns well with users' diverse requirements, providing sufficient power for work tasks while ensuring accessibility and ease of use for recreational activities. This dominance underscores the Utility Terrain Vehicle Market acknowledgment of the 400-800 CC segment as a versatile choice in the UTV industry, meeting the demands of a broad audience seeking dependable and high-performing off-road vehicles.Based on Application: The Sports segment dominated the Application segment of the Utility Terrain Vehicle Market in the year 2023. Sports utility vehicles, resembling station wagons and estate vehicles, are typically equipped with four-wheel drive for both on-road and off-road capabilities. This versatile nature makes them highly sought after, as they blend the towing capacity of a pickup truck with the spaciousness of a minivan or larger vehicle. For Example, the prevalence of sports utility terrain vehicles in competitive events further underscores their dominance. These vehicles are key participants in renowned sports events such as the Dakar Rally, Baja 1000, FIA Cross-Country Rally World Cup, King of the Hammers, and Australasian Safari. Their participation in the Trophee Andros ice-racing series adds another dimension to their versatility. Therefore, the Utility Terrain Vehicle market application segment is driven by its adaptability, combining rugged off-road capabilities with the performance required in various competitive sports, making it a formidable player in the Utility Terrain Vehicle market.

Utility Terrain Vehicle Market Regional Analysis:

North America Dominated the Utility Terrain Vehicle Market in the year 2023. North America has dominated the Utility Terrain Vehicle (UTV) market due to a confluence of factors, including a robust recreational culture, expansive off-road terrains, and a growing demand for versatile, all-terrain vehicles. The region's vast landscapes, ranging from deserts to forests, make UTVs popular for both recreational and utilitarian purposes. A strong economic foundation allows for increased discretionary spending on leisure and outdoor activities, boosting the demand for UTVs. The presence of key market players, such as Polaris and Textron, has contributed to technological advancements, driving innovation in the sector. For instance, Polaris' introduction of the RZR lineup has redefined the recreational UTV segment, gaining widespread popularity. Also, stringent regulations regarding off-road vehicle safety in North America have influenced manufacturers to focus on incorporating advanced safety features, further solidifying the region's dominance in the utility terrain vehicle market.Competitive Landscape

The global utility terrain vehicle market is highly competitive, with industry giants competing for dominance. Numerous UTV manufacturing companies, both global players and emerging local entities, contribute to the competitive landscape. The constant evolution of cutting-edge technologies motivates corporations to lead the industry. Key players are strategically focusing on enhancing safety features, such as off-road airless tires, rollover-protected rooftops, seamless transitions between 2WD and 4WD, independent suspensions for improved stability, and sustainability in diverse weather conditions. This heightened emphasis on innovation and safety measures underscores the dynamic and fiercely contested nature of the global Utility Terrain Vehicle Market. Report Objective and Scope The objective of the report is to present a comprehensive analysis of the Utility Terrain Vehicle market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Utility Terrain Vehicle market dynamics, and structure by analyzing the market segments and projecting the Utility Terrain Vehicle market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Utility Terrain Vehicle market make the report an investor’s guide.Utility Terrain Vehicle Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.2 Bn. Forecast Period 2024 to 2030 CAGR: 5.4% Market Size in 2030: US $ 1.73 Bn. Segments Covered: by Displacement Upto 400 CC 400-800 CC Above 800 CC FCEV by Propulsion Gasoline Diesel Electric Liquid cooling by Application Sports, Military Recreational Activities Others Utility Terrain Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Utility Terrain Vehicle Market Key Players:

North America 1. Can-Am (BRP)(Canada) 2. Massimo Motor Sports, LLC (United States) 3. Hisun Motors Corp., (USA) 4. Bennche, LLC (United States) 5. ODES Industries (United States) 6. BMS Motor (United States) 7. Pioneer Powersports (United States) 8. Polaris Industries Inc. (United States) 9. BRP (Canada) 10. John Deere (United States) Asia Pacific 1. Suzuki Motor Corporation (Japan) 2. KYMCO(Taiwan) 3. Can-Am (BRP)(Canada) 4. Yamaha Motor Co., Ltd. (Japan) 5. Honda Motor Co., Ltd. (Japan) 6. Kawasaki Heavy Industries, Ltd. (Japan) 7. Kubota Corporation (Japan) Frequently Asked Questions: 1] What segments are covered in the Global Utility Terrain Vehicle Market report? Ans. The segments covered in the Market report are based on Displacement, Propulsion, Application, and Regions. 2] Which region is expected to hold the highest share in the Global Market? Ans. The North America region is expected to hold the largest share of the Market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Market by 2030 is expected to reach US$ 1.73 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2024-2030. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 1.2 Bn.

1. Utility Terrain Vehicle Market: Research Methodology 2. Utility Terrain Vehicle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Utility Terrain Vehicle Market: Dynamics 3.1. Utility Terrain Vehicle Market Trends by Region 3.1.1. North America Utility Terrain Vehicle Market Trends 3.1.2. Europe Utility Terrain Vehicle Market Trends 3.1.3. Asia Pacific Utility Terrain Vehicle Market Trends 3.1.4. Middle East and Africa Utility Terrain Vehicle Market Trends 3.1.5. South America Utility Terrain Vehicle Market Trends 3.2. Utility Terrain Vehicle Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Utility Terrain Vehicle Market Drivers 3.2.1.2. North America Utility Terrain Vehicle Market Restraints 3.2.1.3. North America Utility Terrain Vehicle Market Opportunities 3.2.1.4. North America Utility Terrain Vehicle Market Challenges 3.2.2. Europe 3.2.2.1. Europe Utility Terrain Vehicle Market Drivers 3.2.2.2. Europe Utility Terrain Vehicle Market Restraints 3.2.2.3. Europe Utility Terrain Vehicle Market Opportunities 3.2.2.4. Europe Utility Terrain Vehicle Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Utility Terrain Vehicle Market Drivers 3.2.3.2. Asia Pacific Utility Terrain Vehicle Market Restraints 3.2.3.3. Asia Pacific Utility Terrain Vehicle Market Opportunities 3.2.3.4. Asia Pacific Utility Terrain Vehicle Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Utility Terrain Vehicle Market Drivers 3.2.4.2. Middle East and Africa Utility Terrain Vehicle Market Restraints 3.2.4.3. Middle East and Africa Utility Terrain Vehicle Market Opportunities 3.2.4.4. Middle East and Africa Utility Terrain Vehicle Market Challenges 3.2.5. South America 3.2.5.1. South America Utility Terrain Vehicle Market Drivers 3.2.5.2. South America Utility Terrain Vehicle Market Restraints 3.2.5.3. South America Utility Terrain Vehicle Market Opportunities 3.2.5.4. South America Utility Terrain Vehicle Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Utility Terrain Vehicle Market 3.8. Analysis of Government Schemes and Initiatives for Utility Terrain Vehicle Market 3.9. The Global Pandemic Impact on Utility Terrain Vehicle Market 4. Utility Terrain Vehicle Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 4.1.1. Upto 400 CC 4.1.2. 400-800 CC 4.1.3. Above 800 CC FCEV 4.2. Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 4.2.1. Offline 4.2.2. Online 4.3. Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 4.3.1. Sports, 4.3.2. Military 4.3.3. Recreational Activities 4.3.4. Others 4.4. Utility Terrain Vehicle Market Size and Forecast, by region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Utility Terrain Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 5.1.1. Upto 400 CC 5.1.2. 400-800 CC 5.1.3. Above 800 CC FCEV 5.2. North America Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 5.2.1. Offline 5.2.2. Online 5.3. North America Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 5.3.1. Sports, 5.3.2. Military 5.3.3. Recreational Activities 5.3.4. Others 5.4. North America Utility Terrain Vehicle Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 5.4.1.1.1. Upto 400 CC 5.4.1.1.2. 400-800 CC 5.4.1.1.3. Above 800 CC FCEV 5.4.1.2. United States Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 5.4.1.2.1. Offline 5.4.1.2.2. Online 5.4.1.3. United States Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1. Sports, 5.4.1.3.2. Military 5.4.1.3.3. Recreational Activities 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 5.4.2.1.1. Upto 400 CC 5.4.2.1.2. 400-800 CC 5.4.2.1.3. Above 800 CC FCEV 5.4.2.2. Canada Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 5.4.2.2.1. Offline 5.4.2.2.2. Online 5.4.2.3. Canada Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1. Sports, 5.4.2.3.2. Military 5.4.2.3.3. Recreational Activities 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 5.4.3.1.1. Upto 400 CC 5.4.3.1.2. 400-800 CC 5.4.3.1.3. Above 800 CC FCEV 5.4.3.2. Mexico Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 5.4.3.2.1. Offline 5.4.3.2.2. Online 5.4.3.3. Mexico Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1. Sports, 5.4.3.3.2. Military 5.4.3.3.3. Recreational Activities 5.4.3.3.4. Others 6. Europe Utility Terrain Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.2. Europe Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.3. Europe Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4. Europe Utility Terrain Vehicle Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.1.2. United Kingdom Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.1.3. United Kingdom Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.2. France 6.4.2.1. France Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.2.2. France Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.2.3. France Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.3.2. Germany Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.3.3. Germany Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.4.2. Italy Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.4.3. Italy Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.5.2. Spain Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.5.3. Spain Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.6.2. Sweden Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.6.3. Sweden Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.7.2. Austria Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.7.3. Austria Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 6.4.8.2. Rest of Europe Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 6.4.8.3. Rest of Europe Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Utility Terrain Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.2. Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.3. Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4. Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.1.2. China Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.1.3. China Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.2.2. S Korea Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.2.3. S Korea Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.3.2. Japan Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.3.3. Japan Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.4. India 7.4.4.1. India Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.4.2. India Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.4.3. India Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.5.2. Australia Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.5.3. Australia Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.6.2. Indonesia Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.6.3. Indonesia Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.7.2. Malaysia Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.7.3. Malaysia Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.8.2. Vietnam Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.8.3. Vietnam Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.9.2. Taiwan Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.9.3. Taiwan Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 7.4.10.2. Rest of Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 7.4.10.3. Rest of Asia Pacific Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Utility Terrain Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 8.2. Middle East and Africa Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 8.3. Middle East and Africa Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 8.4. Middle East and Africa Utility Terrain Vehicle Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 8.4.1.2. South Africa Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 8.4.1.3. South Africa Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 8.4.2.2. GCC Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 8.4.2.3. GCC Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 8.4.3.2. Nigeria Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 8.4.3.3. Nigeria Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 8.4.4.2. Rest of ME&A Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 8.4.4.3. Rest of ME&A Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 9. South America Utility Terrain Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 9.2. South America Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 9.3. South America Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 9.4. South America Utility Terrain Vehicle Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 9.4.1.2. Brazil Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 9.4.1.3. Brazil Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 9.4.2.2. Argentina Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 9.4.2.3. Argentina Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Utility Terrain Vehicle Market Size and Forecast, by Displacement (2023-2030) 9.4.3.2. Rest Of South America Utility Terrain Vehicle Market Size and Forecast, by Propulsion (2023-2030) 9.4.3.3. Rest Of South America Utility Terrain Vehicle Market Size and Forecast, by Application (2023-2030) 10. Global Utility Terrain Vehicle Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Utility Terrain Vehicle Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Can-Am (BRP)(Canada) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Can-Am (BRP)(Canada) 11.3. Massimo Motor Sports, LLC (United States) 11.4. Hisun Motors Corp., (USA) 11.5. Bennche, LLC (United States) 11.6. ODES Industries (United States) 11.7. BMS Motor (United States) 11.8. Pioneer Powersports (United States) 11.9. Polaris Industries Inc. (United States) 11.10. BRP (Canada) 11.11. John Deere (United States) 11.12. Suzuki Motor Corporation (Japan) 11.13. KYMCO(Taiwan) 11.14. Can-Am (BRP)(Canada) 11.15. Yamaha Motor Co., Ltd. (Japan) 11.16. Honda Motor Co., Ltd. (Japan) 11.17. Kawasaki Heavy Industries, Ltd. (Japan) 11.18. Kubota Corporation (Japan) 12. Key Findings 13. Industry Recommendations