Global Transplantation Therapeutics Market is anticipated to reach US$ 1.44 Bn by 2029 from US$ 1.09 Bn in 2022 at a CAGR of 4 % during a forecast period. The transfer of human cells, tissues, or organs from a donor to a recipient with the goal of restoring function(s) in the body is known as transplantation. Organ transplantation is sometimes the only therapy option for end-stage organ failures, such as liver and heart failure. Region-wise, North America is likely to dominate the global transplantation therapeutics market during the forecast period.To know about the Research Methodology :- Request Free Sample Report In the report, 2022 is considered a base year however 2022’s numbers are on the real output of the companies in the market. Special attention is given to 2021 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

Transplantation Therapeutics Market Dynamics

A significant element driving the market growth is the rising need for innovative tissue transplantation products and organ transplantation for the treatment of organ failure. Organ failure can be caused by several things, including severe trauma, blood loss, poisoning, drug misuse, leukaemia, sepsis, and other acute disorders. Diabetes and high blood pressure, for example, are the most prevalent causes of end-stage renal disease, which requires a kidney transplant or dialysis to keep a patient alive. The need for tissue and organ transplantation, particularly kidney, heart, liver, and lungs transplantation, is quite high across the world. The market is also being driven by the launch of technologically improved goods and an increase in the number of tissue banks. However, several limitations, such as a scarcity of organ donors for transplantation, are expected to limit the market growth. The demand for organs for organ failure therapy is far greater than the supply, which can be linked to a variety of religious and traditional views, as well as a lack of knowledge regarding organ donation.Segmentation Analysis

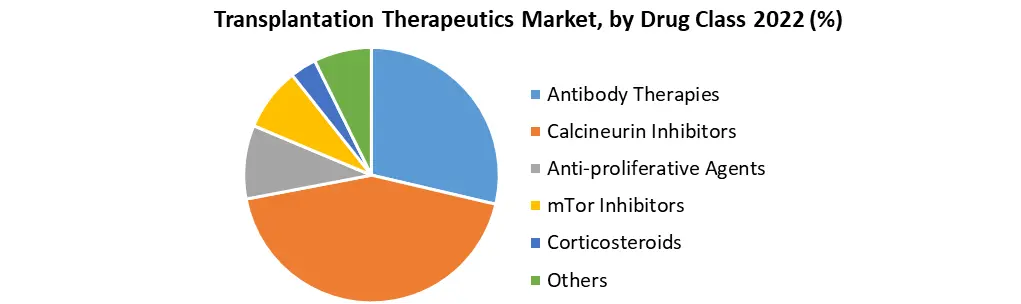

By Drug Class, Antibody therapies are important in the treatment of disorders involving cardiac dysfunction. Many investors are involved, and research facilities for transplant medication assessment and research are expanding, leading to the development of effective treatments to save patients' lives. The largest share xx percent of the antibody therapeutic segment in the worldwide market acknowledged optimization in clinical trial designs and discovery of promising therapeutic agents. The discovery of novel biomarkers, as well as the formation of the Transplantation Therapeutics Consortium (TTC), broadens the scope of research on the transplantation therapeutics market. By Distribution Channels, the involvement of hospital pharmacies in indirect patient care boosts the worldwide transplantation therapies market. Innovative research and prospective solutions to the organ transplant problem boost hospital pharmacists' sales of transplant medications. In the transplant multidisciplinary team, the hospital pharmacist is a key patient advocate who may assist patients with their medication to enhance medication adherence. Patient information given by hospital pharmacists and post-operative self-medication instruction was expected to account for xx% of the global market.

Regional Insight :

North America is expected to lead the global transplantation therapies market during the forecast period. The global market is expected to grow throughout the forecast period owing to an increase in the number of ongoing transplantation surgeries in North America. The presence of many governments and non-government research organizations, as well as highly renowned National Chemical Laboratories, drives the worldwide market in this field. The presence of significant transplantation therapy research parks, as well as the application of Good Manufacturing Practices (GMPs), results in FDA-approved drugs being commercialized. Report Objectives: Landscape analysis of the Transplantation Therapeutics Market competitive benchmarking Past and current status of the industry with the forecasted market size and trends Evaluation of potential key players that include market leaders, followers, and new entrants Technology trends Potential impact of micro-economic factors of the market External and Internal factors affecting market have been analyzed The report also helps in understanding the Transplantation Therapeutics Market dynamics, structure by analyzing the market segments and project the Transplantation Therapeutics Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Transplantation Therapeutics Market make the report investor’s guide.Transplantation Therapeutics Market Scope: Inquiry Before Buying

Transplantation Therapeutics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.09 Bn Forecast Period 2023 to 2029 CAGR: 4 % Market Size in 2029: US $ 1.44 Bn. Segments Covered: by Drug Class Antibody Therapies Calcineurin Inhibitors Anti-proliferative Agents mTor Inhibitors Corticosteroids Others by Distribution Channels Hospital Pharmacies Online Pharmacies Retail Pharmacies Transplantation Therapeutics Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Transplantation Therapeutics Market Key Players are:

1. Novartis International AG 2. GlaxoSmithKline Plc 3. AbbVie Inc 4. Pfizer Inc 5. Astellas Pharma Inc 6. Gilead Sciences Inc 7. Quark Pharmaceuticals Inc 8. Takeda Pharmaceutical Company Ltd 9. Sanofi 10. Boehringer Ingelheim 11. Stryker Corp. 12. Medtronic PLC 13. 21st Century Medicine 14. Biolife Solutions 15. Teva Pharmaceuticals 16. Veloxis Pharmaceuticals 17. F. Hoffmann-La Roche Ltd. 18. Mylan NV 19. Sun Pharmaceutical Industries Ltd 20. Cadila Healthcare Frequently Asked Questions 1. What is the projected market size & growth rate of Transplantation Therapeutics Market? Ans- Transplantation Therapeutics Market was valued at USD 1.09 billion in 2022 and is projected to reach USD 1.44 billion by 2029, growing at a CAGR of 4 % during the forecast period. 2. What are the key driving factors for the growth of Transplantation Therapeutics Market? Ans- The market is also being driven by the launch of technologically improved goods and an increase in the number of tissue banks. 3. Which Region accounted for the largest Transplantation Therapeutics Market share? Ans- North America is expected to lead the global transplantation therapies market during the forecast period. 4. What makes North America a Lucrative Market for Transplantation Therapeutics Market? Ans- The presence of many governments and non-government research organizations, as well as highly renowned National Chemical Laboratories, drives the global market in this field. 5. What are the top players operating in Transplantation Therapeutics Market? Ans- Novartis International AG, GlaxoSmithKline Plc, AbbVie Inc, Pfizer Inc, Astellas Pharma Inc, and Gilead Sciences Inc.

1. Global Transplantation Therapeutics Market: Research Methodology 2. Global Transplantation Therapeutics Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Transplantation Therapeutics Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Transplantation Therapeutics Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Transplantation Therapeutics Market Segmentation 4.1 Global Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) • Antibody Therapies • Calcineurin Inhibitors • Anti-proliferative Agents • mTor Inhibitors • Corticosteroids • Others 4.2 Global Transplantation Therapeutics Market, By End User (2022-2029) • Hospital Pharmacies • Online Pharmacies • Retail Pharmacies 5. North America Transplantation Therapeutics Market (2022-2029) 5.1 North American Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) • Antibody Therapies • Calcineurin Inhibitors • Anti-proliferative Agents • mTor Inhibitors • Corticosteroids • Others 5.2 North America Transplantation Therapeutics Market, By End User (2022-2029) • Hospital Pharmacies • Online Pharmacies • Retail Pharmacies 5.3 North America Transplantation Therapeutics Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Transplantation Therapeutics Market (2022-2029) 6.1. Asia Pacific Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) 6.2. Asia Pacific Transplantation Therapeutics Market, By End User (2022-2029) 6.2. Asia Pacific Transplantation Therapeutics Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Transplantation Therapeutics Market (2022-2029) 7.1. Middle East and Africa Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) 7.2. Middle East and Africa Transplantation Therapeutics Market, By End User (2022-2029) 7.3. Middle East and Africa Transplantation Therapeutics Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Transplantation Therapeutics Market (2022-2029) 8.1. Latin America Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) 8.2. Latin America Transplantation Therapeutics Market, By End User (2022-2029) 8.3 Latin America Transplantation Therapeutics Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Transplantation Therapeutics Market (2022-2029) 9.1. European Transplantation Therapeutics Market, By Circulating Biomarker (2022-2029) 9.2. European Transplantation Therapeutics Market, By End User (2022-2029) 9.3 European Transplantation Therapeutics Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Novartis International AG 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Novartis International AG 10.3. GlaxoSmithKline Plc 10.4. AbbVie Inc 10.5. Pfizer Inc 10.6. Astellas Pharma Inc 10.7. Gilead Sciences Inc 10.8. Quark Pharmaceuticals Inc 10.9. Takeda Pharmaceutical Company Ltd 10.10. Sanofi 10.11. Boehringer Ingelheim 10.12. Stryker Corp. 10.13. Medtronic PLC 10.14. 21st Century Medicine 10.15. Biolife Solutions 10.16. Teva Pharmaceuticals 10.17. Veloxis Pharmaceuticals 10.18. F. Hoffmann-La Roche Ltd. 10.19. Mylan NV 10.20. Sun Pharmaceutical Industries Ltd 10.21. Cadila Healthcare