The Transparent Ceramics Market size was valued at USD 665.49 Million in 2023 and the total Transparent Ceramics revenue is expected to grow at a CAGR of 17.6 % from 2024 to 2030, reaching nearly USD 1760.29 Million by 2030. Transparent ceramics are advanced materials that possess optical transparency similar to glass but with superior mechanical and thermal properties, making them suitable for applications requiring high durability and optical clarity. The increasing demand for advanced materials with superior optical properties and mechanical strength across various industries driving the growth of Transparent Ceramics Market. The market's current scenario reflects a growing adoption of transparent ceramics in applications such as optics and optoelectronics, aerospace and defense, healthcare, and energy. The rising need for durable and high-performance materials in optics and laser technologies, where transparent ceramics offer advantages over traditional materials like glass and plastics due to their exceptional transparency, thermal stability, and resistance to harsh environments driving the growth of Transparent Ceramics Market.To know about the Research Methodology :- Request Free Sample Report The increasing application scope of transparent ceramics in sectors such as medical imaging devices, transparent armor for military vehicles, and solid-state lighting systems further propels market growth. Key players in the transparent ceramics market continue to focus on research and development to enhance product performance and increase their product portfolios. For instance, CeramTec, a leading manufacturer, recently introduced transparent ceramic materials for infrared (IR) applications, offering improved transmission and thermal properties for use in thermal imaging systems and sensors. Similarly, Surmet Corporation has developed transparent ceramics with high hardness and scratch resistance, catering to the demand for protective covers and windows in aerospace and defense applications. These developments underscore the dynamic nature of the transparent ceramics market and its pivotal role in enabling technological advancements across various industries.

Transparent Ceramics Market Dynamics:

Increased Demand in Optics and Optoelectronics Driving Transparent Ceramics Market Growth The growing need for high-performance materials in optics and optoelectronic devices drives the Transparent Ceramics Market. For example, CeramTec's transparent ceramics find application in laser gain media, enabling high-power laser systems for industrial cutting and medical procedures due to their superior thermal conductivity and optical transparency. Transparent ceramics are increasingly utilized in aerospace and defense for windows, canopies, and sensor housings due to their exceptional durability and resistance to harsh environments. Surmet Corporation's ALON transparent ceramic is used in fighter jet canopies, offering superior scratch resistance and ballistic protection compared to traditional materials like glass or acrylic. The demand for transparent ceramics in medical imaging devices such as X-ray tubes and CT scanner components is on the rise due to their ability to withstand high temperatures and ionizing radiation. Toshiba's transparent ceramics are utilized in X-ray tubes, providing improved image quality and reliability for diagnostic procedures. Transparent ceramics play a crucial role in the energy sector for high-temperature applications like solid-state lasers and solar panels. II-VI Incorporated's transparent ceramics are used in laser fusion experiments, facilitating research into clean energy production through nuclear fusion. High production cost Hinders the Transparent Ceramics Market Growth The high production costs associated with manufacturing processes, limiting widespread adoption hindering the growth of Transparent Ceramics Market. For example, the complex synthesis methods required for producing transparent ceramics such as ALON result in higher production expenses, hindering market growth by making the final products less cost-competitive compared to alternatives such as glass or plastics. Scalability issues pose a restraint on market growth as transparent ceramics manufacturing processes may struggle to meet the demands of large-scale applications. For instance, while transparent ceramics offer superior properties for use in aerospace and defense, the limited scalability of production methods hinders their widespread adoption in these industries for large-scale production of components like fighter jet canopies. Transparent ceramics present difficulties in machining and shaping due to their extreme hardness and brittleness, impacting manufacturing efficiency and increasing costs. Companies such as Surmet Corporation face challenges in machining ALON ceramics for use in transparent armor, requiring specialized equipment and processes that add to production costs and lead times. The limited availability of materials suitable for transparent ceramics production constrains market growth. For example, while ALON is a highly desirable transparent ceramic for its exceptional properties, its production relies on scarce raw materials like aluminum and oxygen, posing challenges in material sourcing and cost management.Transparent Ceramics Market Segment Analysis:

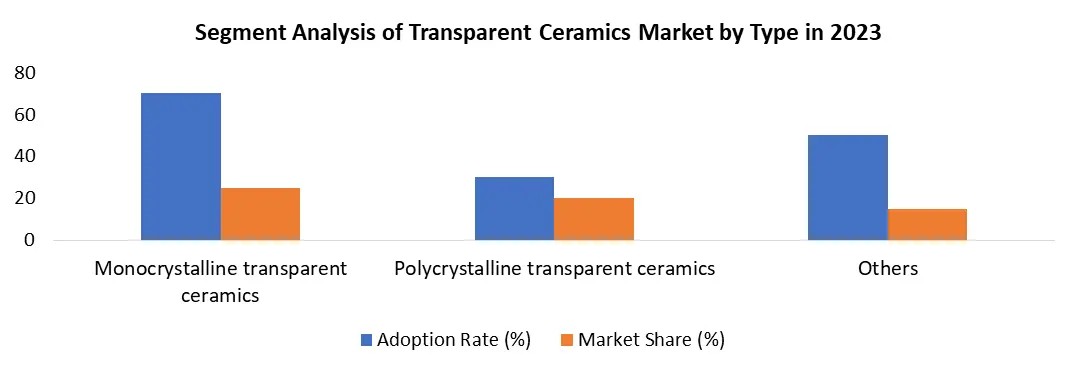

Based on Type, Monocrystalline transparent ceramics dominated the Transparent Ceramics Market in 2023 as it exhibits uniform crystal structure, offering exceptional optical clarity and mechanical properties suitable for high-performance applications like optics, lasers, and medical imaging devices. Polycrystalline transparent ceramics, while less uniform in structure, are cost-effective and find applications in aerospace, defense, and industrial sectors for components like windows, armor, and sensor housings. Other types of transparent ceramics encompass specialized formulations tailored for specific applications, such as transparent armor or thermal management systems. Adoption of monocrystalline ceramics is prominent in precision optics and laser technologies, while polycrystalline ceramics are favored for their affordability in industries like aerospace and defense. Overall, each type of transparent ceramic offers unique advantages and is adopted based on its suitability for specific applications, driving diversity and innovation within the market segment.

Transparent Ceramics Market Regional Insights:

Asia-Pacific Dominance in the Transparent Ceramics Market Asia-Pacific dominated countries like Japan, China, and South Korea lead the market due to their strong presence in electronics manufacturing, aerospace, and defense industries. Japan, known for its technological prowess, particularly dominates in high-tech applications like optics, medical imaging, and semiconductor manufacturing, contributing significantly to regional market growth. Similarly, China's rapid industrialization and investments in advanced materials drive demand for transparent ceramics in diverse sectors, including optics, energy, and consumer electronics. North America, the United States spearheads market growth with a strong focus on aerospace, defense, and semiconductor industries, driven by robust R&D investments and technological innovations. Europe follows suit, with countries such as Germany and the UK driving market growth through advancements in optics, automotive, and renewable energy sectors. Stringent regulations promoting sustainable practices and eco-friendly materials favor the adoption of transparent ceramics in European markets.Transparent Ceramics Market Scope: Inquire before buying

Global Transparent Ceramics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 665.49 Mn. Forecast Period 2024 to 2030 CAGR: 17.6% Market Size in 2030: US $ 1760.29 Mn. Segments Covered: by Type Monocrystalline transparent ceramics Polycrystalline transparent ceramics Others by Material Sapphire Spinel Yttrium Aluminum Garnet Aluminum Oxynitride Others by End-use Industry Optics & Optoelectronics Mechanical/Chemical Aerospace, Defense & Security Healthcare Sensors & Instrumentation Energy Others Transparent Ceramics Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Transparent Ceramics Market Key Players:

Major Contributors in the Transparent Ceramics Industry in North America: 1. Surmet Corporation, Burlington, Massachusetts, USA 2. II-VI Incorporated, Saxonburg, Pennsylvania, USA 3. Rubis Precis Inc., Quebec, Canada 4. CoorsTek, Golden, Colorado, USA Leading Figures in the European and Asian Transparent Ceramics Sector: 1. CeramTec, Plochingen, Germany 2. Morgan Advanced Materials plc, Windsor, United Kingdom 3. Schott AG , Mainz, Germany 4. Crystal GmbH, Berlin, Germany 5. CILAS, Orleans, France 6. Bright Crystals Technology Inc., Xiamen, China 7. Konoshima Chemical Co., Ltd., Tokyo, Japan 8. Murata Manufacturing Co., Ltd., Nagaokakyo, Japan 9. Crystalwise Technology Inc., Hsinchu, Taiwan FAQs: 1] What Major Key players in the Global Market report? Ans. The Major Key players covered in the Market report are Surmet Corporation, II-VI Incorporated,CeramTec, Morgan Advanced Materials plc,Schott AG,Crystal GmbH 2] Which region is expected to hold the highest share in the Global Market? Ans. North America region is expected to hold the highest share in the Market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Transparent Ceramics Market by 2030 is expected to reach US$ 1760.29 Million. 4] What is the forecast period for the Global Transparent Ceramics Market? Ans. The forecast period for the Transparent Ceramics Market is 2024-2030. 5] What was the market size of the Global Transparent Ceramics Market in 2023? Ans. The market size of the Transparent Ceramics Market in 2023 was valued at US$ 665.49 Million.

1. Transparent Ceramics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Transparent Ceramics Market: Dynamics 2.1. Transparent Ceramics Market Trends by Region 2.1.1. North America Transparent Ceramics Market Trends 2.1.2. Europe Transparent Ceramics Market Trends 2.1.3. Asia Pacific Transparent Ceramics Market Trends 2.1.4. Middle East and Africa Transparent Ceramics Market Trends 2.1.5. South America Transparent Ceramics Market Trends 2.2. Transparent Ceramics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Transparent Ceramics Market Drivers 2.2.1.2. North America Transparent Ceramics Market Restraints 2.2.1.3. North America Transparent Ceramics Market Opportunities 2.2.1.4. North America Transparent Ceramics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Transparent Ceramics Market Drivers 2.2.2.2. Europe Transparent Ceramics Market Restraints 2.2.2.3. Europe Transparent Ceramics Market Opportunities 2.2.2.4. Europe Transparent Ceramics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Transparent Ceramics Market Drivers 2.2.3.2. Asia Pacific Transparent Ceramics Market Restraints 2.2.3.3. Asia Pacific Transparent Ceramics Market Opportunities 2.2.3.4. Asia Pacific Transparent Ceramics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Transparent Ceramics Market Drivers 2.2.4.2. Middle East and Africa Transparent Ceramics Market Restraints 2.2.4.3. Middle East and Africa Transparent Ceramics Market Opportunities 2.2.4.4. Middle East and Africa Transparent Ceramics Market Challenges 2.2.5. South America 2.2.5.1. South America Transparent Ceramics Market Drivers 2.2.5.2. South America Transparent Ceramics Market Restraints 2.2.5.3. South America Transparent Ceramics Market Opportunities 2.2.5.4. South America Transparent Ceramics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Transparent Ceramics Industry 2.8. Analysis of Government Schemes and Initiatives For Transparent Ceramics Industry 2.9. Transparent Ceramics Market Trade Analysis 2.10. The Global Pandemic Impact on Transparent Ceramics Market 3. Transparent Ceramics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 3.1.1. Monocrystalline transparent ceramics 3.1.2. Polycrystalline transparent ceramics 3.1.3. Others 3.2. Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 3.2.1. Sapphire 3.2.2. Spinel 3.2.3. Yttrium Aluminum Garnet 3.2.4. Aluminum 3.2.5. Oxynitride 3.2.6. Others 3.3. Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. Optics & Optoelectronics 3.3.2. Mechanical/Chemical 3.3.3. Aerospace, Defense & Security 3.3.4. Healthcare 3.3.5. Sensors & Instrumentation 3.3.6. Energy 3.3.7. Others 3.4. Transparent Ceramics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 4.1.1. Monocrystalline transparent ceramics 4.1.2. Polycrystalline transparent ceramics 4.1.3. Others 4.2. North America Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 4.2.1. Sapphire 4.2.2. Spinel 4.2.3. Yttrium Aluminum Garnet 4.2.4. Aluminum 4.2.5. Oxynitride 4.2.6. Others 4.3. North America Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1. Optics & Optoelectronics 4.3.2. Mechanical/Chemical 4.3.3. Aerospace, Defense & Security 4.3.4. Healthcare 4.3.5. Sensors & Instrumentation 4.3.6. Energy 4.3.7. Others 4.4. North America Transparent Ceramics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Monocrystalline transparent ceramics 4.4.1.1.2. Polycrystalline transparent ceramics 4.4.1.1.3. Others 4.4.1.2. United States Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Sapphire 4.4.1.2.2. Spinel 4.4.1.2.3. Yttrium Aluminum Garnet 4.4.1.2.4. Aluminum 4.4.1.2.5. Oxynitride 4.4.1.2.6. Others 4.4.1.3. United States Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1.3.1. Optics & Optoelectronics 4.4.1.3.2. Mechanical/Chemical 4.4.1.3.3. Aerospace, Defense & Security 4.4.1.3.4. Healthcare 4.4.1.3.5. Sensors & Instrumentation 4.4.1.3.6. Energy 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Monocrystalline transparent ceramics 4.4.2.1.2. Polycrystalline transparent ceramics 4.4.2.1.3. Others 4.4.2.2. Canada Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Sapphire 4.4.2.2.2. Spinel 4.4.2.2.3. Yttrium Aluminum Garnet 4.4.2.2.4. Aluminum 4.4.2.2.5. Oxynitride 4.4.2.2.6. Others 4.4.2.3. Canada Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.2.3.1. Optics & Optoelectronics 4.4.2.3.2. Mechanical/Chemical 4.4.2.3.3. Aerospace, Defense & Security 4.4.2.3.4. Healthcare 4.4.2.3.5. Sensors & Instrumentation 4.4.2.3.6. Energy 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Monocrystalline transparent ceramics 4.4.3.1.2. Polycrystalline transparent ceramics 4.4.3.1.3. Others 4.4.3.2. Mexico Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Sapphire 4.4.3.2.2. Spinel 4.4.3.2.3. Yttrium Aluminum Garnet 4.4.3.2.4. Aluminum 4.4.3.2.5. Oxynitride 4.4.3.2.6. Others 4.4.3.3. Mexico Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.3.3.1. Optics & Optoelectronics 4.4.3.3.2. Mechanical/Chemical 4.4.3.3.3. Aerospace, Defense & Security 4.4.3.3.4. Healthcare 4.4.3.3.5. Sensors & Instrumentation 4.4.3.3.6. Energy 4.4.3.3.7. Others 5. Europe Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.2. Europe Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.3. Europe Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4. Europe Transparent Ceramics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.1.3. United Kingdom Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.2. France 5.4.2.1. France Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4. Asia Pacific Transparent Ceramics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4. Middle East and Africa Transparent Ceramics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 7.4.1.3. South Africa Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 7.4.2.3. GCC Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 7.4.3.3. Nigeria Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 7.4.4.3. Rest of ME&A Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 8.2. South America Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 8.3. South America Transparent Ceramics Market Size and Forecast, by End Use Industry(2023-2030) 8.4. South America Transparent Ceramics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Transparent Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Transparent Ceramics Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Transparent Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Transparent Ceramics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Transparent Ceramics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Surmet Corporation, Burlington, Massachusetts, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. II-VI Incorporated, Saxonburg, Pennsylvania, USA 10.3. Rubis Precis Inc., Quebec, Canada 10.4. CoorsTek, Golden, Colorado, USA 10.5. CeramTec, Plochingen, Germany 10.6. Morgan Advanced Materials plc, Windsor, United Kingdom 10.7. Schott AG, Mainz, Germany 10.8. Crystal GmbH, Berlin, Germany 10.9. CILAS, Orleans, France 10.10. Bright Crystals Technology Inc., Xiamen, China 10.11. Konoshima Chemical Co., Ltd., Tokyo, Japan 10.12. Murata Manufacturing Co., Ltd., Nagaokakyo, Japan 10.13. Crystalwise Technology Inc., Hsinchu, Taiwan 11. Key Findings 12. Industry Recommendations 13. Transparent Ceramics Market: Research Methodology 14. Terms and Glossary