Trailer Axle Market is anticipated to reach US$ 8.56 Bn by 2029 from US$ 6.73 Bn in 2022 at a CAGR of 3.5 % during a forecast period 2023-2029. A centre rod or spindle of a revolving wheel or gear is known as an axle. In wheeled vehicles, the axle can be attached to the wheels and rotate with them, or it can be attached to the vehicle and rotate around the wheels. The position and kind of axle determine how well it functions. Depending on the function and role of the vehicle, commercial vehicles such as big trucks and buses may have more than two live axles, but most passenger cars have one live axle and one dead axle. Significant chances are likely to emerge from the increasing demand for heavy-duty trailers in rising economies of Latin America, followed by Russia and China, with a significant additional $ potential facing the trailer axle market during the forecasted period.To know about the Research Methodology :- Request Free Sample Report

Trailer Axle Market Dynamics

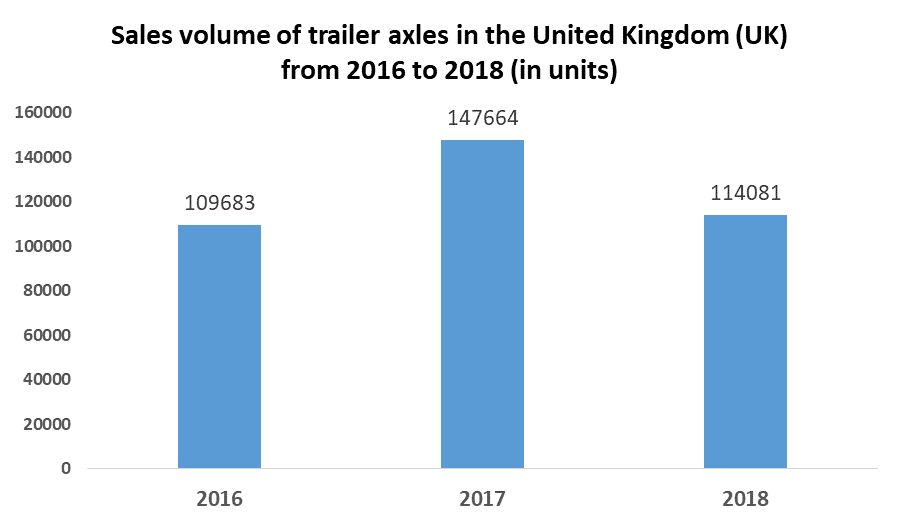

The global market increase in car sales and manufacturing drives the need for trailer axles. In addition, the desire for a quieter interior and more comfort in automobiles, as well as lower vehicle maintenance costs, are driving the market growth. However, the price of raw materials required to make trailer axles, such as steel and carbon and aluminium alloys, is volatile, limiting expansion. Besides, as demand for fuel-efficient cars grows, leading market participants are projected to be able to provide low-cost, fuel-efficient, and lightweight goods. In addition, the development of lightweight materials for axle manufacture, including steel, magnesium, aluminium, and glass fibre-reinforced polymer (GFRP), is expected to drive market growth. By the end of 2029, the construction sector is expected to reach US$ 15 trillion, presenting a substantial potential for trailer makers and, by extension, trailer axle producers. The primary element affecting demand for trailer axles in the construction sector will continue to be their high load-bearing ability, which makes transportation easier. Over the forecast period, construction and urbanisation are likely to have a mild influence on the trailer axle market, with a CAGR comparable to or below global GDP growth. This statistic shows the sales volume of axles for trailers, semi-trailers, and other non-mechanically powered vehicles in the UK between 2016 and 2018. Over this time period, sales volume in the United Kingdom fluctuated, hitting a low of 109 thousand units in 2016 and a high of 147.6 thousand units in 2017.Trailer Axle Market Segmentation Analysis

The segment above 15,000 pounds is expected to grow at a rate of 2.6 per cent per year. The United States, Canada, Japan, China, and Europe are expected to fuel the worldwide Above 15,000 lbs segment's 2.2% CAGR. By the end of the research period, these regional markets, which had a combined market value of US$653.8 million in 2020, will have grown to US$759.3 million. The Asia-Pacific market is expected to reach US$1.1 billion by 2027, led by nations like Australia, India, and South Korea, while Latin America will grow at a 3.4per cent CAGR during the forecast period. Up to 8,000 lbs, has the potential to increase at a rate of over 4.9 per cent. Up to 8,000 lbs will result in robust increases, giving considerable impetus to worldwide expansion, with a market value of over US$1.8 billion expected by 2027.

Trailer Axle Market Regional Insight

During the forecast period, the North American market is expected to grow at a reasonably stable pace. OEMs' rising need for trailer axles to fulfil growing demand from Brazil and the rest of Latin America is credited with significant growth in the Latin American market. The European market is expected to see a lot more trailer manufacturing. During the forecast period, the trailer axle market in Europe is expected to grow at a pretty steady pace. The market in the United States is estimated to be worth $1.7 billion, while China is expected to grow at a rate of 6.4 per cent each year. In the United States, the Trailer Axle market is expected to reach US$1.7 billion by 2022. China, the world's second-biggest economy, is expected to reach a market size of US$1.7 billion by 2029, with a compound annual growth rate of 6.4 per cent from 2022 to 2029. Japan and Canada are two more important geographic markets, with forecasted growth rates of 1.1 per cent and 2.7 per cent, respectively, from 2022 to 2029. Germany is expected to expand at a CAGR of around 1.8 per cent in Europe. Report Objectives: • Landscape analysis of the Trailer Axle Market • competitive benchmarking • Past and current status of the industry with the forecasted market size and trends • Evaluation of potential key players that include market leaders, followers, and new entrants • Technology trends • The potential impact of micro-economic factors on the market • External and Internal factors affecting the market have been analyzed The report also helps in understanding the Trailer Axle Market dynamics, structure by analysing the market segments project the Trailer Axle Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Trailer Axle Market make the report investor’s guide.Trailer Axle Market Scope: Inquiry Before Buying

Trailer Axle Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 6.73 Bn. Forecast Period 2023 to 2029 CAGR: 3.5 % Market Size in 2029: US $ 8.56 Bn. Segments Covered: by Capacity • Lower than 8,000 lbs • 8,000-15,000 lbs • 15,000-25,000 lbs • More than 25,000 lbs by Application • Lightweight Trailers • Medium-weight Trailers • Heavy Trailers Trailer Axle Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Trailer Axle Market, Key Players are:

• BPW Group • DexKo Global Inc. • Meritor, Inc. • Hendrickson Corporation • FUWA K Hitch • Shandong Huayue • TND Trailer Axle • JOST Axle Systems • SAF-Ho Hendrickson USA, L.L.C. • JOST Achsen Systeme GmbH • Meritor, Inc. • Rogers Axle & Spring Works Pty Ltd. • SAF-HOLLAND GmbH • Schmitz Cargobull AG • York Transport Equipment (Asia) Pte Ltd. Frequently Asked Questions 1. What is the projected market size & growth rate of the Trailer Axle Market? Ans- Trailer Axle Market was valued at USD 6.73 billion in 2022 and is projected to reach USD 8.56 billion by 2029, growing at a CAGR of 3.5 % during the forecast period. 2. What is the key driving factor for the growth of the Trailer Axle Market? Ans- The global increase in car sales and manufacturing drives the need for trailer axles. 3. Which Region accounted for the largest Trailer Axle Market share? Ans- During the forecast period, the North American market is expected to grow at a reasonably stable pace. 4. What makes the Brazil a Lucrative Market for Trailer Axle Market? Ans- OEMs' rising need for trailer axles to fulfil growing demand from Brazil and the rest of Latin America is credited with significant growth in the Latin American market. 5. What are the top players operating in Trailer Axle Market? Ans- BPW Group, DexKo Global Inc., Meritor, Inc., Hendrickson Corporation, and FUWA K Hitch

1. Global Trailer Axle Market: Research Methodology 2. Global Trailer Axle Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Trailer Axle Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Trailer Axle Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Trailer Axle Market Segmentation 4.1 Global Trailer Axle Market, By Capacity (2023-2029) • Lower than 8,000 lbs • 8,000-15,000 lbs • 15,000-25,000 lbs • More than 25,000 lbs 4.2 Global Trailer Axle Market, By Application (2023-2029) • Lightweight Trailers • Medium-weight Trailers • Heavy Trailers 5. North America Trailer Axle Market (2023-2029) 5.1 North American Trailer Axle Market, By Capacity (2023-2029) • Lower than 8,000 lbs • 8,000-15,000 lbs • 15,000-25,000 lbs • More than 25,000 lbs 5.2 North America Trailer Axle Market, By Application (2023-2029) • Lightweight Trailers • Medium-weight Trailers • Heavy Trailers 5.3. North America Trailer Axle Market, by Country (2023-2029) • United States • Canada • Mexico 6. Asia Pacific Trailer Axle Market (2023-2029) 6.1. Asia Pacific Trailer Axle Market, By Capacity (2023-2029) 6.2. Asia Pacific Trailer Axle Market, By Application (2023-2029) 6.3. Asia Pacific Trailer Axle Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. The Middle East and Africa Trailer Axle Market (2023-2029) 7.1. Middle East and Africa Trailer Axle Market, By Capacity (2023-2029) 7.2. Middle East and Africa Trailer Axle Market, By Application (2023-2029) 7.3. Middle East and Africa Trailer Axle Market, By Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Trailer Axle Market (2023-2029) 8.1. Latin America Trailer Axle Market, By Capacity (2023-2029) 8.2. Latin America Trailer Axle Market, By Application (2023-2029) 8.3. Latin America Trailer Axle Market, By Country (2023-2029) • Brazil • Argentina • Rest Of Latin America 9. European Trailer Axle Market (2023-2029) 9.1. European Trailer Axle Market, By Capacity (2023-2029) 9.2. European Trailer Axle Market, By Application (2023-2029) 9.3. European Trailer Axle Market, By Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. BPW Group 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.3. BPW Group 10.4. DexKo Global Inc. 10.5. Meritor, Inc. 10.6. Hendrickson Corporation 10.7. FUWA K Hitch 10.8. Shandong Huayue 10.9. TND Trailer Axle 10.10. JOST Axle Systems 10.11. SAF-Ho Hendrickson USA, L.L.C. 10.12. JOST Achsen Systeme GmbH 10.13. Meritor, Inc. 10.14. Rogers Axle & Spring Works Pty Ltd. 10.15. SAF-HOLLAND GmbH 10.16. Schmitz Cargobull AG 10.17. York Transport Equipment (Asia) Pte Ltd.