Tissue Diagnostic Market size was valued at USD 6.02 Billion in 2023 and the total Tissue Diagnostic revenue is expected to grow at a CAGR of 7.2% from 2023 to 2030, reaching nearly USD 9.79 Billion in 2030. Tissue diagnostics is a technique to diagnose and classify diseases based on tissue from organs and tumors, such as determining whether a patient has cancer, its type (such as kidney or prostate cancer), and its features (such as Stage II, grade, or subtype of lung cancer). Tissue diagnostics play an important role in improving the treatment and health outcomes of cancer patients. The world is working together to fight against the rising incidence of cancer cases. As treatments improve rapidly, there is a greater need for tissue diagnostic testing, which driving demand for the tissue diagnostic market.To know about the Research Methodology :- Request Free Sample Report 1.According to MMR, Globally, more than 14 million individuals are diagnosed with cancer each year, and by 2030, that figure is expected to increase to more than 21 million. Major Key players are introducing new cancer diagnosis products. For instance, Roche introduced its innovative Benchmarks ULTRA PLUS system for cancer diagnostics in June 2022, Pathologists can deliver high-quality, time-sensitive results to doctors and patients due to the Benchmarks ULTRA PLUS tissue staining system's improved workflow, testing efficiency, and environmentally sustainable features. The tissue diagnostics market has been driven by advanced infrastructure for cancer diagnosis, government initiatives for cancer research, and the adoption of digital pathology and automation in tissue diagnostics Methods. Some of the key players operating in the infection control market are Agilent Technologies, Danaher Corporation, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Abbott Laboratories, Merck KGaA, General Electric Company (GE Healthcare), BioGenex, Cell Signaling Technology, Inc. Asia-Pacific is the fastest-growing region with a market share of over xx% in 2023. The region is expected to grow at a CAGR of 7.9 % during the forecast period and maintain its dominance by 2030. In the Asia-Pacific region, increasing awareness about early disease detection and regular screenings leads to higher demand for tissue diagnostics methods. Governments have taken initiatives to improve healthcare infrastructure and access to advanced medicines are expected to boost the growth of the tissue diagnostics market in the region.

Tissue Diagnostic Market Dynamics:

Rising Chronic Disease Incidences Boost Tissue Diagnostic Market Improved healthcare and living standards have increased life expectancy, but an aging population is more lying to chronic diseases like cancer, requiring tissue diagnostics for accurate diagnosis and treatment. With the increasing incidences of chronic diseases such as Cancer, cardiovascular diseases, diabetes, and neurological disorders for early detection, diagnosis, and treatment planning of a variety of chronic diseases, tissue diagnostics is mandatory. So, the demand for accurate diagnostic techniques, including the tissue diagnostics market. Advancements in technology have greatly improved the accuracy, efficiency, and accessibility of tissue diagnostics. Innovations such as digital pathology, molecular diagnostics, and immunohistochemistry have enhanced the speed and precision of tissue analysis, enabling earlier detection and personalized treatment strategies. The Immunohistochemistry technique is Tissue diagnostics plays a vital role in advancing personalized medicine. They help healthcare professionals identify specific biomarkers within the tissue, enabling them to customize treatments based on a patient's unique disease characteristics. This approach has been revolutionary in cancer treatment, leading to the development of targeted therapies with improved efficacy and fewer side effects than traditional treatments.High cost of advanced technologies & Reimbursement limitations The tissue diagnostic market is facing a major obstacle due to the high costs associated with advanced technologies. This financial barrier is limiting market growth and accessibility to state-of-the-art diagnostic tools and techniques. However advancements in digital pathology, next-generation sequencing, and AI-based software propelling market growth, pricing is still a major barrier to the widespread use of these cutting-edge technologies. Healthcare systems face challenges as a consequence of the cost of expensive tissue diagnostic solutions, especially in countries that are developing where financial restraints prevent the widespread adoption of these advanced technologies. Reimbursement policies play an important part in determining which products enter the market and affect investment decisions in product development. In the tissue diagnostic market, reimbursement limitations in certain regions impact the availability and adoption of diagnostic tests. Some regions only reimburse for specific patient subgroups with enhanced clinical benefits, affecting the commercial considerations for pharmaceutical and diagnostic supporters. The reimbursement practices for companion diagnostics, which are FDA-approved or cleared tests, are more straightforward than those for paired diagnostics outside the United States where the financier differs significantly. The clinical utility of tests is critical including benefits, risks, and real-life evidence capture post-approval.

Tissue Diagnostic Market Segment Analysis:

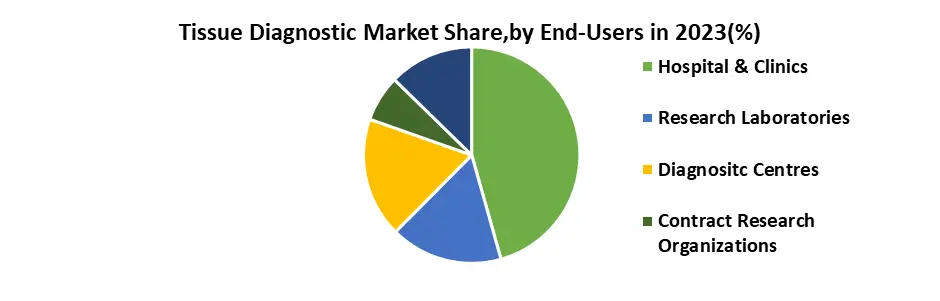

Based on Disease, the Breast Cancer segment hold the largest market share of about 49.56% in the Tissue Diagnostic Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 7.3% during the forecast period and maintain its dominance till 2030. The breast cancer market is dominated by factors like changes in lifestyles, age factors, as well as an increase in breast cancer activities. Breast cancer is a significant healthcare concern and the tissue diagnostic market plays a key role in its detection, diagnosis, and planning for a line of cancer treatment. Advanced techniques such as immunohistochemistry and in situ hybridization, are being increasingly used to analyze breast tissue samples, allowing specific characterization of tumours.Based on End Users, the Hospital segment hold the largest market share of about 44.56% in the Tissue Diagnostic Market in 2023 and is expected to maintain its dominance till 2030. In Hospital visit patients, an increase in internal diagnostic procedures within hospitals, and initial diagnosis of cancer by clinical tests are conducted in the presence of reimbursement in well-developed Hospitals. Hospitals are increasingly adopting tissue-based diagnostic testing techniques over conventional methods due to their ability to reduce timelines and improve disease diagnostics through agreement models. The Contract Research Organizations (CROs) segment is expected to see lucrative growth during the forecast period. CROs provide research support, and clinical trial services, and manage trials, and functions of companies that face budget restraints.

Tissue Diagnostic Market Regional Analysis

North America dominates the Tissue Diagnostic Market with the largest market share accounting for 47.3 % in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North America dominates the market with a strong presence of leading companies like Abbott Laboratories, Thermo Fisher Scientific., and Danaher Corporation. North America regularly spends more per person on healthcare than other regions. This means that there exists greater funds available for purchasing tissue diagnostic tools and services. The increasing healthcare expenditure and high–quality infrastructure for hospitals and clinical laboratories boost the tissue diagnostic market.Europe, the fastest-growing region in the Tissue Diagnostic Market hold a market share of 22.8% and is significantly growing during its forecast period. In Europe increasing awareness about cancer and chronic diseases, hence growing demands for diagnostic care centres. Automation in laboratory workflow integration by using advanced technologies and processes, which optimize the use of personnel and equipment, improves safety by reducing contact with biohazards and reducing errors giving accurate results. Competitive Landscape for Tissue Diagnostic Market: The competitive landscape of the Tissue Diagnostic market is constantly evolving, with new players emerging and established players adapting their strategies. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development. In February 2023, F. Hoffmann-La Roche Ltd launched its IDH1 R132H (MRQ-67) Rabbit Monoclonal Antibody and the ATRX Rabbit Polyclonal Antibody for use in the Benchmark series of instruments for the detection of brain cancer. In 2022, Leica Biosystems acquired Cell IDx, a leader in multiplexed tissue profiling, to advance its multiplexing menu and offer ready-to-use pre-kitted formulations. This acquisition aimed to expand Leica Biosystems' capabilities in translational research and provide researchers with tools to accelerate scientific exploration into translational outcomes. In 2022, F. Hoffmann-La Roche Ltd (Switzerland) invested USD 16.79 million in R&D activities focusing on product development and launches to maintain its market position In 2022, Danaher Corporation (US) with its subsidiary Leica Biosystems, invested USD 1.742 billion in research and development in 2021, demonstrating its commitment to innovation and expanding its diagnostic business In October 2022,F. Hoffman-La Roche Ltd received FDA approval for its PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody use as a companion diagnostic test to identify metastatic breast cancer patients with low HER2 expression. In 2021, to increase the availability of precision medication for lung cancer, QIAGEN released its first FDA-approved tissue companion diagnostic to detect the KRAS G12C mutation in NSCLC tumors. The Rotor-Gene Q MDx instrument, a part of the modular QIAsymphony family of automation solutions, is used with the real-time qualitative PCR kit.

Tissue Diagnostic Market Scope: Inquire before buying

Tissue Diagnostic Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.51 Bn. Forecast Period 2024 to 2030 CAGR: 7.3% Market Size in 2030: US $ 10.66 Bn. Segments Covered: by Product Instruments Consumables Reagent kits by Disease Breast Cancer Gastric Cancer Prostate Cancer Lymphoma Lung Cancer Others by Technology In-situ Hybridization Immunohistochemistry Digital Pathology Special staining Others by End-User Hospital & Clinics Diagnostic centres Contract Research Organizations Research Laboratories Others Tissue Diagnostic Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tissue Diagnostic Market Key Players:

North America: 1. Abbott Laboratories (USA) 2. Agilent Technologies (California) 3. Danaher Corporation (Washington) 4. Thermo Fisher Scientific Inc. (USA) 5. HOLOGIC, INC. (U.S.) 6. Ventana Medical Systems (USA) 7. BIO SB Inc. (California) 8. PerkinElmer Inc. (Massachusetts) 9. Sakura Finetek USA, Inc. (USA) 10. Cell Signaling Technology, Inc. (U.S.) 11. Becton, Dickinson, and Company ( New Jersey) 12. PHC Holdings Corporation (Japan) Europe: 1. F. Hoffmann-La Roche Ltd. (Switzerland) 2. Milestone Srl (Italy) 3. Merck KGaA (Germany) 4. QIAGEN N.V. (Netherlands) 5. Sysmex Corporation (Europe) Asia-Pacific Market: 1. Siemens Healthineers Asia Pacific 2. Roche Diagnostics Asia Pacific Pte Ltd. 3. Sakura Finetek Japan Co., Ltd. (Japan) South America: 4. Ventana Medical Systems, Inc., (Tucson) 5. BioGenex Laboratories (Brazil) Frequently Asked Questions: 1] What segments are covered in the Tissue Diagnostic Market report? Ans. The segments covered in the Tissue Diagnostic Market report are based on Product, Disease, Technology, and End Users. 2] Which region is expected to hold the highest share in the Tissue Diagnostic Market? Ans. The North America region is expected to hold the highest share of the Tissue Diagnostic Market. 3] What is the market size of the Tissue Diagnostic Market? Ans. The Tissue Diagnostic Market size was valued at USD 6.02 Billion in 2023 reaching nearly USD 9.79 Billion in 2030. 4] What is the forecast period for the Tissue Diagnostic Market? Ans. The forecast period for the Tissue Diagnostic Market is 2023-2030. 5] What is the growth rate of the Tissue Diagnostic Market? Ans. The Tissue Diagnostic market is expected to grow at a CAGR of 7.2% during the forecast period of 2023 to 2030.

1. Tissue Diagnostic Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Tissue Diagnostic Market: Dynamics 2.1. Tissue Diagnostic Market Trends by Region 2.1.1. North America Tissue Diagnostic Market Trends 2.1.2. Europe Tissue Diagnostic Market Trends 2.1.3. Asia Pacific Tissue Diagnostic Market Trends 2.1.4. Middle East and Africa Tissue Diagnostic Market Trends 2.1.5. South America Tissue Diagnostic Market Trends 2.2. Tissue Diagnostic Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Tissue Diagnostic Market Drivers 2.2.1.2. North America Tissue Diagnostic Market Restraints 2.2.1.3. North America Tissue Diagnostic Market Opportunities 2.2.1.4. North America Tissue Diagnostic Market Challenges 2.2.2. Europe 2.2.2.1. Europe Tissue Diagnostic Market Drivers 2.2.2.2. Europe Tissue Diagnostic Market Restraints 2.2.2.3. Europe Tissue Diagnostic Market Opportunities 2.2.2.4. Europe Tissue Diagnostic Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Tissue Diagnostic Market Drivers 2.2.3.2. Asia Pacific Tissue Diagnostic Market Restraints 2.2.3.3. Asia Pacific Tissue Diagnostic Market Opportunities 2.2.3.4. Asia Pacific Tissue Diagnostic Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Tissue Diagnostic Market Drivers 2.2.4.2. Middle East and Africa Tissue Diagnostic Market Restraints 2.2.4.3. Middle East and Africa Tissue Diagnostic Market Opportunities 2.2.4.4. Middle East and Africa Tissue Diagnostic Market Challenges 2.2.5. South America 2.2.5.1. South America Tissue Diagnostic Market Drivers 2.2.5.2. South America Tissue Diagnostic Market Restraints 2.2.5.3. South America Tissue Diagnostic Market Opportunities 2.2.5.4. South America Tissue Diagnostic Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Tissue Diagnostic Industry 2.8. Analysis of Government Schemes and Initiatives For Tissue Diagnostic Industry 2.9. Tissue Diagnostic Market Trade Analysis 2.10. The Global Pandemic Impact on Tissue Diagnostic Market 3. Tissue Diagnostic Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 3.1.1. Instruments 3.1.2. Consumables 3.1.3. Reagent kits 3.2. Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 3.2.1. Breast Cancer 3.2.2. Gastric Cancer 3.2.3. Prostate Cancer 3.2.4. Lymphoma 3.2.5. Lung Cancer 3.2.6. Others 3.3. Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 3.3.1. In-situ Hybridization 3.3.2. Immunohistochemistry 3.3.3. Digital Pathology 3.3.4. Special staining 3.3.5. Others 3.4. Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 3.4.1. Hospital & Clinics 3.4.2. Diagnostic centres 3.4.3. Contract Research Organizations Research Laboratories 3.4.4. Others 3.5. Tissue Diagnostic Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Tissue Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 4.1.1. Instruments 4.1.2. Consumables 4.1.3. Reagent kits 4.2. North America Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 4.2.1. Breast Cancer 4.2.2. Gastric Cancer 4.2.3. Prostate Cancer 4.2.4. Lymphoma 4.2.5. Lung Cancer 4.2.6. Others 4.3. North America Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 4.3.1. In-situ Hybridization 4.3.2. Immunohistochemistry 4.3.3. Digital Pathology 4.3.4. Special staining 4.3.5. Others 4.4. North America Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 4.4.1. Hospital & Clinics 4.4.2. Diagnostic centres 4.4.3. Contract Research Organizations Research Laboratories 4.4.4. Others 4.5. North America Tissue Diagnostic Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Instruments 4.5.1.1.2. Consumables 4.5.1.1.3. Reagent kits 4.5.1.2. United States Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 4.5.1.2.1. Breast Cancer 4.5.1.2.2. Gastric Cancer 4.5.1.2.3. Prostate Cancer 4.5.1.2.4. Lymphoma 4.5.1.2.5. Lung Cancer 4.5.1.2.6. Others 4.5.1.3. United States Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. In-situ Hybridization 4.5.1.3.2. Immunohistochemistry 4.5.1.3.3. Digital Pathology 4.5.1.3.4. Special staining 4.5.1.3.5. Others 4.5.1.4. United States Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 4.5.1.4.1. Hospital & Clinics 4.5.1.4.2. Diagnostic centres 4.5.1.4.3. Contract Research Organizations Research Laboratories 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Instruments 4.5.2.1.2. Consumables 4.5.2.1.3. Reagent kits 4.5.2.2. Canada Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 4.5.2.2.1. Breast Cancer 4.5.2.2.2. Gastric Cancer 4.5.2.2.3. Prostate Cancer 4.5.2.2.4. Lymphoma 4.5.2.2.5. Lung Cancer 4.5.2.2.6. Others 4.5.2.3. Canada Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. In-situ Hybridization 4.5.2.3.2. Immunohistochemistry 4.5.2.3.3. Digital Pathology 4.5.2.3.4. Special staining 4.5.2.3.5. Others 4.5.2.4. Canada Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 4.5.2.4.1. Hospital & Clinics 4.5.2.4.2. Diagnostic centres 4.5.2.4.3. Contract Research Organizations Research Laboratories 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Instruments 4.5.3.1.2. Consumables 4.5.3.1.3. Reagent kits 4.5.3.2. Mexico Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 4.5.3.2.1. Breast Cancer 4.5.3.2.2. Gastric Cancer 4.5.3.2.3. Prostate Cancer 4.5.3.2.4. Lymphoma 4.5.3.2.5. Lung Cancer 4.5.3.2.6. Others 4.5.3.3. Mexico Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. In-situ Hybridization 4.5.3.3.2. Immunohistochemistry 4.5.3.3.3. Digital Pathology 4.5.3.3.4. Special staining 4.5.3.3.5. Others 4.5.3.4. Mexico Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 4.5.3.4.1. Hospital & Clinics 4.5.3.4.2. Diagnostic centres 4.5.3.4.3. Contract Research Organizations Research Laboratories 4.5.3.4.4. Others 5. Europe Tissue Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.2. Europe Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.3. Europe Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5. Europe Tissue Diagnostic Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.1.3. United Kingdom Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.2. France 5.5.2.1. France Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.2.3. France Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.3.3. Germany Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.4.3. Italy Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.5.3. Spain Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.6.3. Sweden Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.7.3. Austria Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 5.5.8.3. Rest of Europe Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6. Asia Pacific Tissue Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.3. Asia Pacific Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5. Asia Pacific Tissue Diagnostic Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.1.3. China Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.1.4. China Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.2.3. S Korea Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.3.3. Japan Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.4. India 6.5.4.1. India Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.4.3. India Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.5.3. Australia Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.6.3. Indonesia Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.7.3. Malaysia Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.8.3. Vietnam Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.9.3. Taiwan Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 6.5.10.3. Rest of Asia Pacific Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 7. Middle East and Africa Tissue Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 7.3. Middle East and Africa Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 7.5. Middle East and Africa Tissue Diagnostic Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 7.5.1.3. South Africa Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 7.5.1.4. South Africa Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 7.5.2.3. GCC Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 7.5.3.3. Nigeria Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 7.5.4.3. Rest of ME&A Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 8. South America Tissue Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 8.2. South America Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 8.3. South America Tissue Diagnostic Market Size and Forecast, by Technology(2023-2030) 8.4. South America Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 8.5. South America Tissue Diagnostic Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 8.5.1.3. Brazil Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 8.5.2.3. Argentina Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Tissue Diagnostic Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Tissue Diagnostic Market Size and Forecast, by Disease (2023-2030) 8.5.3.3. Rest Of South America Tissue Diagnostic Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America Tissue Diagnostic Market Size and Forecast, by End Users (2023-2030) 9. Global Tissue Diagnostic Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Tissue Diagnostic Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Agilent Technologies Inc. (California) 10.3. Danaher Corporation (Washington) 10.4. Thermo Fisher Scientific Inc. (USA) 10.5. HOLOGIC, INC. (U.S.) 10.6. Ventana Medical Systems (USA) 10.7. BIO SB Inc. (California) 10.8. PerkinElmer Inc. (Massachusetts) 10.9. Sakura Finetek USA, Inc. (USA) 10.10. Cell Signaling Technology, Inc. (U.S.) 10.11. Becton, Dickinson, and Company ( New Jersey) 10.12. PHC Holdings Corporation (Japan) 10.13. F. Hoffmann-La Roche Ltd. (Switzerland) 10.14. Milestone Srl (Italy) 10.15. Merck KGaA (Germany) 10.16. QIAGEN N.V. (Netherlands) 10.17. Sysmex Corporation (Europe) 10.18. Siemens Healthineers Asia Pacific 10.19. Roche Diagnostics Asia Pacific Pte Ltd. 10.20. Sakura Finetek Japan Co., Ltd. (Japan) 10.21. Ventana Medical Systems, Inc., (Tucson) 10.22. BioGenex Laboratories (Brazil) 11. Key Findings 12. Industry Recommendations 13. Tissue Diagnostic Market: Research Methodology 14. Terms and Glossary