Global Thermoelectric Generators Market size was valued at USD 1.03 Bn in 2024 and the total Thermoelectric Generators Market revenue is expected to grow by 12.64% from 2025 to 2032, reaching nearly USD 2.67 Bn by 2032. Advancements in materials science and increasing adoption of energy harvesting technologies are driving this exponential growth.Thermoelectric Generators Market Overview:

The machinery that transforms heat flux into electric power is known as a thermoelectric generator. The demand for the thermoelectric generator market is fueled by the thermoelectric generator's wide range of applications in the energy, oil, and gas sectors.To know about the Research Methodology:-Request Free Sample Report Thermoelectric Generators Market dynamics are thoroughly studied and explained in the MMR report, which helps readers to understand emerging market trends, drivers, restraints, opportunities, and challenges at the global and regional levels for the Thermoelectric Generators Market. Some of the drivers and restraints are illustrated below, their detailed explanation is discussed in the MMR report with other supporting: One of the main drivers of market growth is the rising number of research and development projects aimed at improving the performance of thermoelectric generators. The low efficiency of TEGs and the use of conventional technologies are impeding their growth. As a result, producers and researchers are attempting to overcome the three main obstacles: boosting ZT, expanding the operating range of materials to operate with greater temperature differences, and finding reasonably priced materials to offset the negative effects of the TEGs' lack of competence. Market Opportunities: Growing industrialization and disposable money present excellent potential for market expansion. By investing in R&D, many large firms are expanding their market potential by developing technology for the use of high-power thermoelectric generators, which will improve heat exchanger efficiency and help them cope with the strain of high-temperature gradients. Trending Factors: 1. To further enhance the efficiency of heat exchangers and manage the stress of increasing temperature gradients, several large manufacturers are investing in R&D to advance the technology for high-power thermoelectric generators. Moreover, recent research is concentrating on creating lightweight thermoelectric generators. 2. Institutions are conducting research to lower the price of thermoelectric generators and boost their effectiveness. The demand for thermoelectric generators is anticipated to rise throughout the forecast period along with the increase in research and development activities. 3. Low power thermoelectric generators (100 watt) are typically used for outdoor activities like trekking, mountaineering, camping, and as a backup source of electricity in houses during blackouts, mainly to charge electronics like tablets, phones, and lighting equipment.

Thermoelectric Generators Market Segmentation:

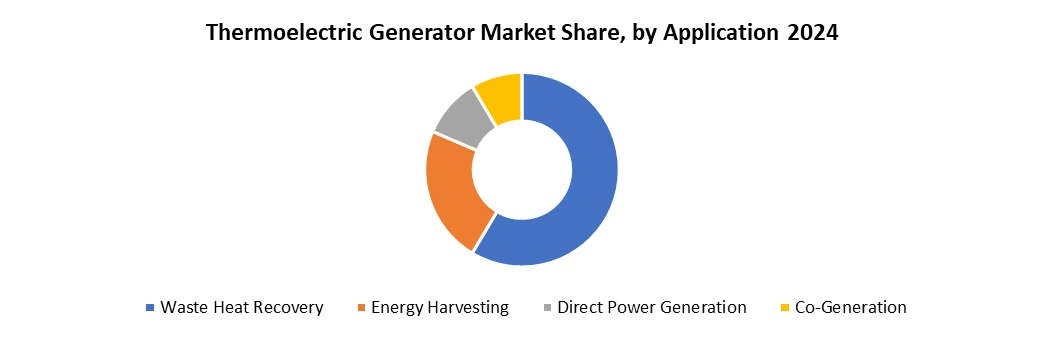

MMR provides an analysis of the key trends in each sub-segment of the Thermoelectric Generators Market, along with forecasts at the global, regional, and country levels from 2025-2032. Our report has categorized the market based on Material, End-use Industry, and Application. Based on material, the bismuth telluride segment is expected to grow at the highest ~CAGR of 13.05% during the forecast period. This is attributed to the fact that bismuth telluride, which has the highest merit score and demonstrates good performance, is the material that is employed the most frequently. By application, the waste energy heat recovery segment is expected to witness significant growth during the forecast period thanks to the increasing demand for backup power. Residential, commercial, and industrial areas, which present growth potential for these generators, are places where significant investments are being made to maintain an uninterrupted power supply.

Regional Insights:

North America is the global leader in Thermoelectric Generators Market. In terms of revenue, North America dominated the global market in 2023. It is projected that the market demand would increase due to the growing number of technological advances in North America and the growing demand for generators across numerous industries, including aerospace, automotive, healthcare, and many others. Additionally, the existence of the major market players and the escalating rivalry among them is creating a variety of growth prospects for the market. Along with the region's growing industrialization and increasing need for generators from the car industry, which is increasingly motivated to increase fuel efficiency, the market demand is expected to rise more quickly in the years to come. The Second-Highest Revenue Share in The Global Market is Accounted for By the Europe Market. A substantial portion of the income for the market for thermoelectric generators in Europe is anticipated to remain stable thanks to growing government initiatives for waste heat recovery. As an illustration, the ECOMARINE project, which the European Union (European Social Fund) and Greek national funds jointly funded, aims to build a thermoelectric energy recovery unit to enhance the quality of electrical energy and optimize power output through waste heat recovery. The main region in the world that has a strong preference for using renewable energy in Europe. For instance, according to Eurostat, the EU obtains nearly 17% of its power, 26% of its electricity for heating and cooling, and 6% of its energy for transportation from renewable sources. Additionally, Europe makes significant investments in total renewable energy due to the increased use of renewable electrical energy across a range of end-use industries and the region's growing demand for it. As a result, it is projected that this factor will increase regional demand for thermoelectric generators. Key players operating in the thermoelectric generators market are involved in adopting sustainable strategies to gain competitive edges such as new product launches, partnerships, collaborations, and agreements. Such as, NASA's Jet Propulsion Laboratory in California has scheduled and will test the Mars 2020 rover mission launch in July 2020. The rover is planned to land on Mars in 2021. The spacecraft's lander is run by the multi-mission radioisotope thermoelectric generator (MMRTG). The objective of the report is to present a comprehensive analysis of the global Thermoelectric Generators Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Thermoelectric Generators Market dynamic, and structure by analyzing the market segments and projecting the Thermoelectric Generators Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Thermoelectric Generators Market make the report investor’s guide.Thermoelectric Generators Market Scope: Inquire before buying

Global Thermoelectric Generators Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.03 Bn. Forecast Period 2025 to 2032 CAGR: 12.64% Market Size in 2032: USD 2.67 Bn. Segments Covered: by Material Bismuth Telluride Lead Telluride Others by Type Multistage Single-Stage by Temperature < 80 °C 80 – 500 °C > 500 °C by Application Waste Heat Recovery Energy Harvesting Direct Power Generation Co-generation by End Use Industry Automotive Aerospace Industrial Consumer Healthcare Thermoelectric Generators Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Thermoelectric Generators Market, Key Players:

Thermoelectric Generator companies are bolstering their market positions through significant growth, mergers, acquisitions, and strategic partnerships. The focus is on advancing TEG technology, scaling production capabilities, and integrating TEGs into emerging applications. These efforts aim to solidify their presence and address the growing global demand for efficient and sustainable energy solutions. 1. GENTHERM, INC. 2. II-VI INCORPORATED 3. FERROTEC CORPORATION 4. LAIRD THERMAL SYSTEM 5. TECTEG MFR 6. KOMATSU LTD. 7. YAMAHA CORPORATION 8. TOSHIBA CORPORATION 9. MAHLE GROUP 10.MURATA MANUFACTURING CO. LTD 11.CUI DEVICES 12.ANALOG DEVICES 13.FAURECIA 14.KYOCERA CORPORATION 15.TEC MICROSYSTEMS 16.RIF CORPORATION 17.PHONONIC INC. 18.RMT LTD 19.KRYOTHERM 20.EVERREDTRONICS LTD. 21.HI-Z TECHNOLOGY 22.KELK LTD. 23.PERPETUA POWER SOURCE TECHNOLOGIES, INC. 24.PRODUCT/SOLUTIONS/SERVICES OFFERED 25.ALIGN SOURCING LLC 26.TELEDYNE ENERGY SYSTEMS, INC. Frequently asked questions: 1. What is the market growth of the Thermoelectric Generators Market? Ans. The Thermoelectric Generators Market was valued at USD 1.03 Bn in 2024 and is expected to reach USD 2.67 Bn by 2032, at a CAGR of 12.64 % during the forecast period. 2. Which are the major key players in the Thermoelectric Generators Market? Ans. The key players in this market GENTHERM, INC., II-VI INCORPORATED and FERROTEC CORPORATION. 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Thermoelectric Generators Market. 4. What is the forecast period for the Thermoelectric Generators Market? Ans. The forecast period for the Thermoelectric Generators Market is from 2025 to 2032. 5. What is the segment in which the Thermoelectric Generators Market is divided? Ans. The Thermoelectric Generators Market is fragmented based on type, temperature, Material, End-use Industry, and Application.

1. Thermoelectric Generators Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Thermoelectric Generators Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Thermoelectric Generators Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Thermoelectric Generators Market: Dynamics 3.1. Thermoelectric Generators Market Trends by Region 3.1.1. North America Thermoelectric Generators Market Trends 3.1.2. Europe Thermoelectric Generators Market Trends 3.1.3. Asia Pacific Thermoelectric Generators Market Trends 3.1.4. Middle East and Africa Thermoelectric Generators Market Trends 3.1.5. South America Thermoelectric Generators Market Trends 3.2. Thermoelectric Generators Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Thermoelectric Generators Market Drivers 3.2.1.2. North America Thermoelectric Generators Market Restraints 3.2.1.3. North America Thermoelectric Generators Market Opportunities 3.2.1.4. North America Thermoelectric Generators Market Challenges 3.2.2. Europe 3.2.2.1. Europe Thermoelectric Generators Market Drivers 3.2.2.2. Europe Thermoelectric Generators Market Restraints 3.2.2.3. Europe Thermoelectric Generators Market Opportunities 3.2.2.4. Europe Thermoelectric Generators Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Thermoelectric Generators Market Drivers 3.2.3.2. Asia Pacific Thermoelectric Generators Market Restraints 3.2.3.3. Asia Pacific Thermoelectric Generators Market Opportunities 3.2.3.4. Asia Pacific Thermoelectric Generators Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Thermoelectric Generators Market Drivers 3.2.4.2. Middle East and Africa Thermoelectric Generators Market Restraints 3.2.4.3. Middle East and Africa Thermoelectric Generators Market Opportunities 3.2.4.4. Middle East and Africa Thermoelectric Generators Market Challenges 3.2.5. South America 3.2.5.1. South America Thermoelectric Generators Market Drivers 3.2.5.2. South America Thermoelectric Generators Market Restraints 3.2.5.3. South America Thermoelectric Generators Market Opportunities 3.2.5.4. South America Thermoelectric Generators Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Thermoelectric Generators Industry 3.8. Analysis of Government Schemes and Initiatives For Thermoelectric Generators Industry 3.9. Thermoelectric Generators Market Trade Analysis 3.10. The Global Pandemic Impact on Thermoelectric Generators Market 4. Thermoelectric Generators Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 4.1.1. Bismuth Telluride 4.1.2. Lead Telluride 4.1.3. Others 4.2. Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 4.2.1. Multistage 4.2.2. Single-Stage 4.3. Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 4.3.1. < 80 °C 4.3.2. 80 – 500 °C 4.3.3. > 500 °C 4.4. Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 4.4.1. Waste Heat Recovery 4.4.2. Energy Harvesting 4.4.3. Direct Power Generation 4.4.4. Co-generation 4.5. Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 4.5.1. Automotive 4.5.2. Aerospace 4.5.3. Industrial 4.5.4. Consumer Healthcare 4.6. Thermoelectric Generators Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Thermoelectric Generators Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 5.1.1. Bismuth Telluride 5.1.2. Lead Telluride 5.1.3. Others 5.2. North America Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 5.2.1. Multistage 5.2.2. Single-Stage 5.3. North America Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 5.3.1. < 80 °C 5.3.2. 80 – 500 °C 5.3.3. > 500 °C 5.4. North America Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 5.4.1. Waste Heat Recovery 5.4.2. Energy Harvesting 5.4.3. Direct Power Generation 5.4.4. Co-generation 5.5. North America Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 5.5.1. Automotive 5.5.2. Aerospace 5.5.3. Industrial 5.5.4. Consumer Healthcare 5.6. North America Thermoelectric Generators Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 5.6.1.1.1. Bismuth Telluride 5.6.1.1.2. Lead Telluride 5.6.1.1.3. Others 5.6.1.2. United States Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 5.6.1.2.1. Multistage 5.6.1.2.2. Single-Stage 5.6.1.3. United States Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 5.6.1.3.1. < 80 °C 5.6.1.3.2. 80 – 500 °C 5.6.1.3.3. > 500 °C 5.6.1.4. United States Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Waste Heat Recovery 5.6.1.4.2. Energy Harvesting 5.6.1.4.3. Direct Power Generation 5.6.1.4.4. Co-generation 5.6.1.5. United States Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 5.6.1.5.1. Automotive 5.6.1.5.2. Aerospace 5.6.1.5.3. Industrial 5.6.1.5.4. Consumer Healthcare 5.6.2. Canada 5.6.2.1. Canada Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 5.6.2.1.1. Bismuth Telluride 5.6.2.1.2. Lead Telluride 5.6.2.1.3. Others 5.6.2.2. Canada Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 5.6.2.2.1. Multistage 5.6.2.2.2. Single-Stage 5.6.2.3. Canada Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 5.6.2.3.1. < 80 °C 5.6.2.3.2. 80 – 500 °C 5.6.2.3.3. > 500 °C 5.6.2.4. Canada Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Waste Heat Recovery 5.6.2.4.2. Energy Harvesting 5.6.2.4.3. Direct Power Generation 5.6.2.4.4. Co-generation 5.6.2.5. Canada Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 5.6.2.5.1. Automotive 5.6.2.5.2. Aerospace 5.6.2.5.3. Industrial 5.6.2.5.4. Consumer Healthcare 5.6.3. Mexico 5.6.3.1. Mexico Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 5.6.3.1.1. Bismuth Telluride 5.6.3.1.2. Lead Telluride 5.6.3.1.3. Others 5.6.3.2. Mexico Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 5.6.3.2.1. Multistage 5.6.3.2.2. Single-Stage 5.6.3.3. Mexico Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 5.6.3.3.1. < 80 °C 5.6.3.3.2. 80 – 500 °C 5.6.3.3.3. > 500 °C 5.6.3.4. Mexico Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Waste Heat Recovery 5.6.3.4.2. Energy Harvesting 5.6.3.4.3. Direct Power Generation 5.6.3.4.4. Co-generation 5.6.3.5. Mexico Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 5.6.3.5.1. Automotive 5.6.3.5.2. Aerospace 5.6.3.5.3. Industrial 5.6.3.5.4. Consumer Healthcare 6. Europe Thermoelectric Generators Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.2. Europe Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.3. Europe Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.4. Europe Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.5. Europe Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6. Europe Thermoelectric Generators Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.1.2. United Kingdom Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.1.3. United Kingdom Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.1.4. United Kingdom Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.2. France 6.6.2.1. France Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.2.2. France Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.2.3. France Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.2.4. France Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.3.2. Germany Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.3.3. Germany Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.3.4. Germany Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.4.2. Italy Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.4.3. Italy Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.4.4. Italy Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.5.2. Spain Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.5.3. Spain Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.5.4. Spain Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.6.2. Sweden Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.6.3. Sweden Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.6.4. Sweden Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.7.2. Austria Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.7.3. Austria Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.7.4. Austria Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 6.6.8.2. Rest of Europe Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 6.6.8.3. Rest of Europe Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 6.6.8.4. Rest of Europe Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7. Asia Pacific Thermoelectric Generators Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.2. Asia Pacific Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.4. Asia Pacific Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6. Asia Pacific Thermoelectric Generators Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.1.2. China Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.1.3. China Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.1.4. China Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.2.2. S Korea Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.2.3. S Korea Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.2.4. S Korea Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.3.2. Japan Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.3.3. Japan Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.3.4. Japan Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.4. India 7.6.4.1. India Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.4.2. India Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.4.3. India Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.4.4. India Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.5.2. Australia Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.5.3. Australia Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.5.4. Australia Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.6.2. Indonesia Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.6.3. Indonesia Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.6.4. Indonesia Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.7.2. Malaysia Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.7.3. Malaysia Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.7.4. Malaysia Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.8.2. Vietnam Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.8.3. Vietnam Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.8.4. Vietnam Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.9.2. Taiwan Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.9.3. Taiwan Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.9.4. Taiwan Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 7.6.10.2. Rest of Asia Pacific Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 7.6.10.4. Rest of Asia Pacific Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 8. Middle East and Africa Thermoelectric Generators Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 8.2. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 8.4. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 8.6. Middle East and Africa Thermoelectric Generators Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 8.6.1.2. South Africa Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 8.6.1.3. South Africa Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 8.6.1.4. South Africa Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 8.6.2.2. GCC Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 8.6.2.3. GCC Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 8.6.2.4. GCC Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 8.6.3.2. Nigeria Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 8.6.3.3. Nigeria Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 8.6.3.4. Nigeria Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 8.6.4.2. Rest of ME&A Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 8.6.4.3. Rest of ME&A Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 8.6.4.4. Rest of ME&A Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 9. South America Thermoelectric Generators Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 9.2. South America Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 9.3. South America Thermoelectric Generators Market Size and Forecast, by Temperature(2024-2032) 9.4. South America Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 9.5. South America Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 9.6. South America Thermoelectric Generators Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 9.6.1.2. Brazil Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 9.6.1.3. Brazil Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 9.6.1.4. Brazil Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 9.6.2.2. Argentina Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 9.6.2.3. Argentina Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 9.6.2.4. Argentina Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Thermoelectric Generators Market Size and Forecast, by Material (2024-2032) 9.6.3.2. Rest Of South America Thermoelectric Generators Market Size and Forecast, by Type (2024-2032) 9.6.3.3. Rest Of South America Thermoelectric Generators Market Size and Forecast, by Temperature (2024-2032) 9.6.3.4. Rest Of South America Thermoelectric Generators Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Thermoelectric Generators Market Size and Forecast, by End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. GENTHERM, INC. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. II-VI INCORPORATED 10.3. FERROTEC CORPORATION 10.4. LAIRD THERMAL SYSTEM 10.5. TECTEG MFR 10.6. KOMATSU LTD. 10.7. YAMAHA CORPORATION 10.8. TOSHIBA CORPORATION 10.9. MAHLE GROUP 10.10. MURATA MANUFACTURING CO. LTD 10.11. CUI DEVICES 10.12. ANALOG DEVICES 10.13. FAURECIA 10.14. KYOCERA CORPORATION 10.15. TEC MICROSYSTEMS 10.16. RIF CORPORATION 10.17. PHONONIC INC. 10.18. RMT LTD 10.19. KRYOTHERM 10.20. EVERREDTRONICS LTD. 10.21. HI-Z TECHNOLOGY 10.22. KELK LTD. 10.23. PERPETUA POWER SOURCE TECHNOLOGIES, INC. 10.24. PRODUCT/SOLUTIONS/SERVICES OFFERED 10.25. ALIGN SOURCING LLC 10.26. TELEDYNE ENERGY SYSTEMS, INC. 11. Key Findings 12. Industry Recommendations 13. Thermoelectric Generators Market: Research Methodology 14. Terms and Glossary