The Thermal Paper Market size was valued at USD 5.12 Billion in 2025 and the total Thermal Paper revenue is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 7.21 Billion by 2032.Thermal Paper Market Overview

Thermal paper is a special fine paper that is coated with a material formulated to change color locally when exposed to heat. It is used in thermal printers, particularly in inexpensive devices such as adding machines, cash registers, and credit card terminals and small, lightweight portable printers. The surface of the paper is coated with a substance that changes color when heated above a certain temperature. The printer essentially consists of a transport mechanism which drags the paper across a thermal dot matrix print head. The (very small) dots of the head heat up very quickly to imprint a dot, then cool equally quickly.To know about the Research Methodology :- Request Free Sample Report The thermal paper market is growing rapidly, due to the increasing demand for labeling in verticals such as automotive, healthcare, and pharmaceuticals. Another factor driving the market is the use of thermal paper as a medium for printing educational and training materials, which is gaining popularity in various educational institutions. There is an increase in demand for thermal paper across various industries, especially in the healthcare vertical. The market for the thermal paper market is driven by the growth in packaged food & retail industries. Packaged food & retail is the largest end-user of thermal paper.

Thermal Paper Market Dynamics

Growing demand for labeling in the food and beverage sector to boost Thermal Paper Market growth Thermal paper has become increasingly important in recent years, owing to the growing demand for labeling in the food and beverage sector, standardizing the quality of packaged items. Improved thermal paper utilization in applications like label printing is a critical factor driving market growth. According to Label Insight and the Food Marketing Institute, 86% of supermarket buyers value transparency and place more trust in food makers and retailers who provide complete, easy-to-understand ingredient information. Increasing awareness related to the benefits of POS terminals, due to technological advancements such as mobile wallets, online banking demand has secure ways for making transactions. The potential use of thermal paper for transactions between retailers and current government initiatives to boost cashless transactions are certain factors impelling the thermal paper demand, which significantly boost the Thermal Paper Market growth. Up surging demand for point of sale (POS) terminals as an alternative to cash registers in the hospitality, warehouse and medical sectors is likely to be a complementary factor for the overall revenue in the coming years. A development in thermal transfer technology is projected to fuel probable growth opportunities throughout the forecast period because of its ability to provide multi-color paper. The increased use of precise labeling in the pharmaceutical industry is expected to boost the thermal paper market. These labels are used in paper form and with a trademark to convey nutritional component facts while avoiding copycat practices. Thermal paper is used in the pharmaceutical industry to communicate information about expiration and production dates, bar codes, composition, and associated data of items such as injections, medications, and pharmaceutical equipment.Thermal Paper Market Trends

Booming e-commerce sector The rising demand for thermal paper due to the growth e-commerce sector is fueling the growth of the Thermal Paper market. People are increasingly preferring online shopping on account of its enhanced convenience, doorstep delivery, and wide accessibility to a variety of products. The growing need for shipping labels, packing slips, and invoices is offering a positive Thermal Paper industry outlook. Apart from this, thermal paper offers improved speed and efficiency in generating these essential documents. E-commerce companies depend on thermal printing technology to ensure accurate order fulfilment and shipping while enhancing the satisfaction of buyers. Thermal paper is resistant to smudging and fading, making it a preferred choice for printing shipping labels, which need to withstand various environmental conditions during the logistics process. Thermal paper provides a vital link in the supply chain of the digital shopping era, which is strengthening the market growth. Advancements in printing technology Advancements in printing technology assist in offering improved quality, efficiency, and versatility. These technological developments encompass various aspects of the printing process, ranging from hardware to software, resulting in several notable advancements. In addition, digital innovations allow on-demand printing with minimal setup and cost. It enables the production of high-quality prints with precision, consistency, and customization, which is significantly expected to boost the Thermal Paper Market growth. This technology is widely used for marketing materials, personalized documents, and short-run production. Besides this, inkjet technology offers faster printing speeds, higher resolutions, and broader color gamuts. Three-dimensional (3D) printing, also known as additive manufacturing, creates 3D objects layer by layer. It finds applications in various industries, including aerospace, healthcare, and automotive, enabling rapid prototyping and customization. Furthermore, ultraviolet (UV)-curable ink technology improves print durability and versatility. UV printers print on a wide range of surfaces, including glass, metal, and plastics, making them valuable for signage, promotional products, and packaging. Besides this, offset printing reduces setup time and waste while maintaining high-quality output. Growth in Online and Paperless E-transaction to limit the acceptance of Thermal Paper The concept of paperless 'e-receipts' has become more feasible, as large number of retail merchants and businesses are making their transactions online. Growing usage of monetary transaction services such as PayPal, Unified Payment Interface (UPI) and bank cards in everyday purchases are likely to replace paper receipts with e-receipts, which is expected to restrain Thermal Paper Market growth. Rising consumer awareness against harms caused by ingestion of BPA lead to an adoption of e-receipts instead of paper receipts, limiting the market growth. Environmental constraints established on the dye's manufacturing plant have limited dye output and hampered the overall expansion of the thermal paper business. As a result, the fluctuation in the cost of raw materials in the thermal paper sector is regarded as the key constraint to thermal paper market development.Thermal Paper Market Segment Analysis

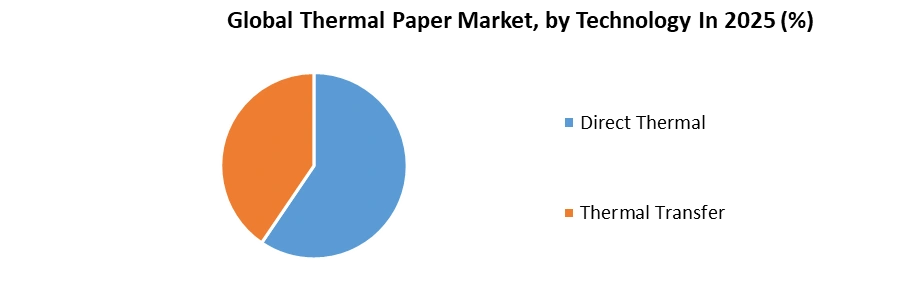

Based on Application, the market is segmented into Point of Sale, Tags & labels, Lottery and Gaming, and Others. Point of Sale segment dominated the market in 2025 and is expected to hold the largest Thermal Paper Market share over the forecast period. A POS machine is an electronic terminal used for the processing of transactions with the help of a card (debit/credit/other) by end-users in several locations, which contain retail stores, multiplexes, banks, and health centers. Besides, the rising acceptance of debit card/credit cards is likely to promote the demand for POS machines worldwide. The upsurge in the number of departmental, retail stores and the rapid transition to digitalization in developing countries is between factors stimulating the demand for POS machines. The demand for POS machines is anticipated to rise further in proportion to the implementation of advanced technologies.Based on Technology, the market is segmented into Direct Thermal and Thermal Transfer. Direct Thermal segment dominated the market in 2025 and is expected to hold the largest Thermal Paper Market share over the forecast period. Direct thermal technology involves a simple and cost-effective process where thermal paper is coated with a heat-sensitive layer. When heat is applied through a thermal printhead, the paper changes color, creating images, text, or barcodes without the need for ribbons or ink. This technology is commonly used for applications like receipt printing, shipping labels, and point-of-sale (POS) systems due to its ease of use and cost efficiency. It is preferred for applications where short-term print durability is sufficient, as direct thermal prints fade over time when exposed to heat, light, or friction.

Thermal Paper Market Regional Insight

Rapid expansion of retail chains to boost Asia Pacific Thermal Paper Market growth Rapid expansion of retail chains across the region is a key driver to boost the Thermal Paper Market growth. Consumers in this region strongly prefer easily accessible consumer goods, leading to the establishment of numerous retail outlets and stores to cater to their demands. This proliferation of retail establishments has substantially increased the demand for thermal paper used in point-of-sale (POS) terminal transactions, as these terminals rely on thermal paper for printing receipts and transaction records. Escalating industrial activities is pivotal in boosting the demand for thermal paper in labeling applications. As industries grow and expand, efficient labeling and identification of products becomes crucial. The thermal paper finds extensive use in producing labels for various industrial applications, ensuring clear and legible information representation. The Thermal Paper market for Fast-Moving Consumer Goods (FMCG) goods in developing regional economies contributes significantly to the surge in thermal paper demand. The growing consumer base and increased consumption of everyday products have prompted Thermal Paper manufacturers to expand their production capacities to meet the rising demand. For instance, the National Bureau of Statistics of China estimates that in 2021, China's consumer goods industry had total retail sales of about USD 6.3 trillion. Retail sales in China's cities totaled USD 5.5 trillion while they totaled USD 0.8 trillion in the country's rural areas. Thus, the aforementioned facts supported the market growth in the Asia Pacific region. Europe grow at the fastest pace due to the increasing adoption of thermal paper in various end-uses within the region plays a pivotal role. Thermal paper finds applications in diverse industries, including supplement packaging, labeling, and the gaming sector. The pharmaceutical and supplement industries require clear and informative labels for their products, driving the demand for thermal paper with efficient printing capabilities, which is expected to boost the Thermal Paper market growth. As the region emphasizes environmental consciousness, manufacturers likely shift their focus toward more sustainable production methods and materials. This shift entail exploring alternatives to traditional thermal paper production processes that have a lower environmental impact. This change aligns with Europe's sustainability goals and regulations, which lead to the development of eco-friendly thermal paper options. Thermal Paper Market Competitive Landscape Major players have a strong local presence in the form of production units in various regions to support an efficient consumer supply chain. The high degree of forward and backward integration of dominant players persists in the global market, which has intensified the rivalry and competition, thus making an entry for new players difficult. 1. In March 2022, Oji Imaging Media Co. Ltd., a subsidiary of Oji Holdings Corporation announced its decision to expand the thermal paper production at KANZAN Spezialpapiere GmbH, in Germany. This help them increase their production outputs and strengthen their position in the market. 2. In November 2022, Koehler Paper, a Germany based thermal paper manufacturer, increased its thermal papers prices by 8%. The increased price was applicable for the purchases held from 1st February 2023. The reason given by the company for the raising thermal paper prices is the increasing development cost of chemicals, pulps, logistics, and personnel.Thermal Paper Market Scope: Inquire before buying

Global Thermal Paper Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 5.21 Bn. Forecast Period 2026 to 2032 CAGR: 5% Market Size in 2032: USD 7.21 Bn. Segments Covered: by Type Conventional Thermal Paper Top-coated Thermal Paper Synthetic-base Thermal Paper by Technology Direct Thermal Thermal Transfer by Application Point of Sale Tags & labels Lottery and Gaming Others Thermal Paper Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Thermal Paper Manufacturers include:

1. Domtar Corporation (Fort Mill, South Carolina) 2. NAKAGAWA Manufacturing (USA), Inc. (Newark, CA) 3. Xiandai Paper Production (China) 4. Telepaper (Shah Alam, Malaysia) 5. Ricoh Industrie France SAS (Europe) 6. Koehler Paper (Oberkirch) 7. Hansol Paper Co Ltd (South Korea) 8. Henan Province JiangHe Paper Co. Ltd. (China) 9. Shandong Chenming Paper Holdings Ltd (Weifang, China) 10. Jujo Thermal Ltd. (Kauttua, Finland) 11. Oji Holdings Corporation (Tokyo, Japan) 12. Mitsubishi Paper Mills (MPM) Limited (Japan) 13. Appvion Incorporated (Appleton, WI) 14. Kanzaki Specialty Papers Inc. (Ware, Massachusetts) 15. Domtar Corporation (Montreal, Quebec) 16. Lecta Group (Spain) 17. Iconex LLC (USA) 18. Twin Rivers Paper Company (US) 19. Rotolificio Bergamasco Srl (Lombardia, Italy) Frequently asked Questions: 1] What segments are covered in the Global Thermal Paper Market report? Ans. The segments covered in the Thermal Paper Market report are based on Type, Technology, Application and Regions. 2] Which region is expected to hold the highest share of the Global Thermal Paper Market? Ans. The Asia Pacific region is expected to hold the highest share of the Thermal Paper Market. 3] What is the market size of the Global Thermal Paper Market by 2032? Ans. The market size of the Linear Motion System Market by 2032 is expected to reach USD 7.21 Bn. 4] What was the market size of the Global Thermal Paper Market in 2025? Ans. The market size of the Thermal Paper Market in 2025 was valued at USD 5.21 Bn. 5] Key players in the Thermal Paper Market. Ans. Domtar Corporation, NAKAGAWA Manufacturing, Inc., Xiandai Paper Production, Telepaper, Ricoh Industrie France SAS, etc.

1. Thermal Paper Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Thermal Paper Market: Dynamics 2.1. Thermal Paper Market Trends by Region 2.1.1. North America Thermal Paper Market Trends 2.1.2. Europe Thermal Paper Market Trends 2.1.3. Asia Pacific Thermal Paper Market Trends 2.1.4. Middle East and Africa Thermal Paper Market Trends 2.1.5. South America Thermal Paper Market Trends 2.2. Thermal Paper Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Thermal Paper Market Drivers 2.2.1.2. North America Thermal Paper Market Restraints 2.2.1.3. North America Thermal Paper Market Opportunities 2.2.1.4. North America Thermal Paper Market Challenges 2.2.2. Europe 2.2.2.1. Europe Thermal Paper Market Drivers 2.2.2.2. Europe Thermal Paper Market Restraints 2.2.2.3. Europe Thermal Paper Market Opportunities 2.2.2.4. Europe Thermal Paper Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Thermal Paper Market Drivers 2.2.3.2. Asia Pacific Thermal Paper Market Restraints 2.2.3.3. Asia Pacific Thermal Paper Market Opportunities 2.2.3.4. Asia Pacific Thermal Paper Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Thermal Paper Market Drivers 2.2.4.2. Middle East and Africa Thermal Paper Market Restraints 2.2.4.3. Middle East and Africa Thermal Paper Market Opportunities 2.2.4.4. Middle East and Africa Thermal Paper Market Challenges 2.2.5. South America 2.2.5.1. South America Thermal Paper Market Drivers 2.2.5.2. South America Thermal Paper Market Restraints 2.2.5.3. South America Thermal Paper Market Opportunities 2.2.5.4. South America Thermal Paper Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Thermal Paper Industry 2.8. Analysis of Government Schemes and Initiatives For Thermal Paper Industry 2.9. Thermal Paper Market Trade Analysis 2.10. The Global Pandemic Impact on Thermal Paper Market 3. Thermal Paper Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 3.1. Thermal Paper Market Size and Forecast, by Type (2025-2032) 3.1.1. Conventional Thermal Paper 3.1.2. Top-coated Thermal Paper 3.1.3. Synthetic-base Thermal Paper 3.2. Thermal Paper Market Size and Forecast, by Technology (2025-2032) 3.2.1. Direct Thermal 3.2.2. Thermal Transfer 3.3. Thermal Paper Market Size and Forecast, by Application (2025-2032) 3.3.1. Point of Sale 3.3.2. Tags & labels 3.3.3. Lottery and Gaming 3.3.4. Others 3.4. Thermal Paper Market Size and Forecast, by Region (2025-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Thermal Paper Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 4.1. North America Thermal Paper Market Size and Forecast, by Type (2025-2032) 4.1.1. Conventional Thermal Paper 4.1.2. Top-coated Thermal Paper 4.1.3. Synthetic-base Thermal Paper 4.2. North America Thermal Paper Market Size and Forecast, by Technology (2025-2032) 4.2.1. Direct Thermal 4.2.2. Thermal Transfer 4.3. North America Thermal Paper Market Size and Forecast, by Application (2025-2032) 4.3.1. Point of Sale 4.3.2. Tags & labels 4.3.3. Lottery and Gaming 4.3.4. Others 4.4. North America Thermal Paper Market Size and Forecast, by Country (2025-2032) 4.4.1. United States 4.4.1.1. United States Thermal Paper Market Size and Forecast, by Type (2025-2032) 4.4.1.1.1. Conventional Thermal Paper 4.4.1.1.2. Top-coated Thermal Paper 4.4.1.1.3. Synthetic-base Thermal Paper 4.4.1.2. United States Thermal Paper Market Size and Forecast, by Technology (2025-2032) 4.4.1.2.1. Direct Thermal 4.4.1.2.2. Thermal Transfer 4.4.1.3. United States Thermal Paper Market Size and Forecast, by Application (2025-2032) 4.4.1.3.1. Point of Sale 4.4.1.3.2. Tags & labels 4.4.1.3.3. Lottery and Gaming 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Thermal Paper Market Size and Forecast, by Type (2025-2032) 4.4.2.1.1. Conventional Thermal Paper 4.4.2.1.2. Top-coated Thermal Paper 4.4.2.1.3. Synthetic-base Thermal Paper 4.4.2.2. Canada Thermal Paper Market Size and Forecast, by Technology (2025-2032) 4.4.2.2.1. Direct Thermal 4.4.2.2.2. Thermal Transfer 4.4.2.3. Canada Thermal Paper Market Size and Forecast, by Application (2025-2032) 4.4.2.3.1. Point of Sale 4.4.2.3.2. Tags & labels 4.4.2.3.3. Lottery and Gaming 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Thermal Paper Market Size and Forecast, by Type (2025-2032) 4.4.3.1.1. Conventional Thermal Paper 4.4.3.1.2. Top-coated Thermal Paper 4.4.3.1.3. Synthetic-base Thermal Paper 4.4.3.2. Mexico Thermal Paper Market Size and Forecast, by Technology (2025-2032) 4.4.3.2.1. Direct Thermal 4.4.3.2.2. Thermal Transfer 4.4.3.3. Mexico Thermal Paper Market Size and Forecast, by Application (2025-2032) 4.4.3.3.1. Point of Sale 4.4.3.3.2. Tags & labels 4.4.3.3.3. Lottery and Gaming 4.4.3.3.4. Others 5. Europe Thermal Paper Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. Europe Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.2. Europe Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.3. Europe Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4. Europe Thermal Paper Market Size and Forecast, by Country (2025-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.1.2. United Kingdom Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.1.3. United Kingdom Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.2. France 5.4.2.1. France Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.2.2. France Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.2.3. France Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.3. Germany 5.4.3.1. Germany Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.3.2. Germany Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.3.3. Germany Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.4. Italy 5.4.4.1. Italy Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.4.2. Italy Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.4.3. Italy Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.5. Spain 5.4.5.1. Spain Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.5.2. Spain Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.5.3. Spain Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.6. Sweden 5.4.6.1. Sweden Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.6.2. Sweden Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.6.3. Sweden Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.7. Austria 5.4.7.1. Austria Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.7.2. Austria Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.7.3. Austria Thermal Paper Market Size and Forecast, by Application (2025-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Thermal Paper Market Size and Forecast, by Type (2025-2032) 5.4.8.2. Rest of Europe Thermal Paper Market Size and Forecast, by Technology (2025-2032) 5.4.8.3. Rest of Europe Thermal Paper Market Size and Forecast, by Application (2025-2032) 6. Asia Pacific Thermal Paper Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Asia Pacific Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.3. Asia Pacific Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4. Asia Pacific Thermal Paper Market Size and Forecast, by Country (2025-2032) 6.4.1. China 6.4.1.1. China Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.1.2. China Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.1.3. China Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.2. S Korea 6.4.2.1. S Korea Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.2.2. S Korea Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.2.3. S Korea Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.3. Japan 6.4.3.1. Japan Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.3.2. Japan Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.3.3. Japan Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.4. India 6.4.4.1. India Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.4.2. India Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.4.3. India Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.5. Australia 6.4.5.1. Australia Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.5.2. Australia Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.5.3. Australia Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.6.2. Indonesia Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.6.3. Indonesia Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.7.2. Malaysia Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.7.3. Malaysia Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.8.2. Vietnam Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.8.3. Vietnam Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.9.2. Taiwan Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.9.3. Taiwan Thermal Paper Market Size and Forecast, by Application (2025-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Thermal Paper Market Size and Forecast, by Type (2025-2032) 6.4.10.2. Rest of Asia Pacific Thermal Paper Market Size and Forecast, by Technology (2025-2032) 6.4.10.3. Rest of Asia Pacific Thermal Paper Market Size and Forecast, by Application (2025-2032) 7. Middle East and Africa Thermal Paper Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Middle East and Africa Thermal Paper Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Thermal Paper Market Size and Forecast, by Technology (2025-2032) 7.3. Middle East and Africa Thermal Paper Market Size and Forecast, by Application (2025-2032) 7.4. Middle East and Africa Thermal Paper Market Size and Forecast, by Country (2025-2032) 7.4.1. South Africa 7.4.1.1. South Africa Thermal Paper Market Size and Forecast, by Type (2025-2032) 7.4.1.2. South Africa Thermal Paper Market Size and Forecast, by Technology (2025-2032) 7.4.1.3. South Africa Thermal Paper Market Size and Forecast, by Application (2025-2032) 7.4.2. GCC 7.4.2.1. GCC Thermal Paper Market Size and Forecast, by Type (2025-2032) 7.4.2.2. GCC Thermal Paper Market Size and Forecast, by Technology (2025-2032) 7.4.2.3. GCC Thermal Paper Market Size and Forecast, by Application (2025-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Thermal Paper Market Size and Forecast, by Type (2025-2032) 7.4.3.2. Nigeria Thermal Paper Market Size and Forecast, by Technology (2025-2032) 7.4.3.3. Nigeria Thermal Paper Market Size and Forecast, by Application (2025-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Thermal Paper Market Size and Forecast, by Type (2025-2032) 7.4.4.2. Rest of ME&A Thermal Paper Market Size and Forecast, by Technology (2025-2032) 7.4.4.3. Rest of ME&A Thermal Paper Market Size and Forecast, by Application (2025-2032) 8. South America Thermal Paper Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. South America Thermal Paper Market Size and Forecast, by Type (2025-2032) 8.2. South America Thermal Paper Market Size and Forecast, by Technology (2025-2032) 8.3. South America Thermal Paper Market Size and Forecast, by Application(2025-2032) 8.4. South America Thermal Paper Market Size and Forecast, by Country (2025-2032) 8.4.1. Brazil 8.4.1.1. Brazil Thermal Paper Market Size and Forecast, by Type (2025-2032) 8.4.1.2. Brazil Thermal Paper Market Size and Forecast, by Technology (2025-2032) 8.4.1.3. Brazil Thermal Paper Market Size and Forecast, by Application (2025-2032) 8.4.2. Argentina 8.4.2.1. Argentina Thermal Paper Market Size and Forecast, by Type (2025-2032) 8.4.2.2. Argentina Thermal Paper Market Size and Forecast, by Technology (2025-2032) 8.4.2.3. Argentina Thermal Paper Market Size and Forecast, by Application (2025-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Thermal Paper Market Size and Forecast, by Type (2025-2032) 8.4.3.2. Rest Of South America Thermal Paper Market Size and Forecast, by Technology (2025-2032) 8.4.3.3. Rest Of South America Thermal Paper Market Size and Forecast, by Application (2025-2032) 9. Global Thermal Paper Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Thermal Paper Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Domtar Corporation (Fort Mill, South Carolina) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. NAKAGAWA Manufacturing (USA), Inc. (Newark, CA) 10.3. Xiandai Paper Production (China) 10.4. Telepaper (Shah Alam, Malaysia) 10.5. Ricoh Industrie France SAS (Europe) 10.6. Koehler Paper (Oberkirch) 10.7. Hansol Paper Co Ltd (South Korea) 10.8. Henan Province JiangHe Paper Co. Ltd. (China) 10.9. Shandong Chenming Paper Holdings Ltd (Weifang, China) 10.10. Jujo Thermal Ltd. (Kauttua, Finland) 10.11. Oji Holdings Corporation (Tokyo, Japan) 10.12. Mitsubishi Paper Mills Limited (Japan) 10.13. Appvion Incorporated (Appleton, WI) 10.14. Kanzaki Specialty Papers Inc. (Ware, Massachusetts) 10.15. Domtar Corporation (Montreal, Quebec) 10.16. Lecta Group (Spain) 10.17. Iconex LLC (USA) 10.18. Twin Rivers Paper Company (US) 10.19. Rotolificio Bergamasco Srl (Lombardia, Italy) 11. Key Findings 12. Industry Recommendations 13. Thermal Paper Market: Research Methodology 14. Terms and Glossary