The Thermal Ceramics Market size was valued at USD 5.01 Billion in 2023 and the total Thermal Ceramics revenue is expected to grow at a CAGR of 9.05 % from 2024 to 2030, reaching nearly USD 9.19 Billion by 2030. Thermal ceramics is specifically designed to provide insulation and heat resistance in high-temperature applications, including furnaces, kilns, boilers, and other industrial equipment. These materials offer excellent thermal stability, low thermal conductivity, and resistance to thermal shock, making them crucial for maintaining energy efficiency and safety in various industries. The increasing demand for energy efficiency and stringent regulations regarding industrial emissions have propelled the adoption of thermal ceramics in various end-use industries such as metallurgy, glass, cement, power generation, and aerospace driving the growth of Thermal Ceramics Market.To know about the Research Methodology:- Request Free Sample Report The expanding automotive sector, coupled with the rising need for lightweight and high-temperature-resistant materials, further boosts Thermal Ceramics Market growth. Technological advancements in thermal insulation materials, such as the development of advanced ceramic fibers and innovative manufacturing processes, contribute to enhanced product performance and durability. Key market players are investing significantly in research and development to introduce novel products and expand their product portfolios. For instance, Morgan Advanced Materials PLC recently introduced a new range of lightweight insulating firebricks with improved thermal conductivity properties, catering to the growing demand for high-performance insulation solutions. Strategic collaborations, mergers, and acquisitions among market players are driving market consolidation and fostering innovation. For example, in a recent development, 3M Company acquired the thermal ceramics division of Aremco Products Inc., enhancing its product offerings and market presence in the thermal ceramics sector. The Asia Pacific region is witnessing substantial growth in the thermal ceramics market due to rapid industrialization, infrastructural development, and increasing investments in the manufacturing sector. With the growing emphasis on sustainable manufacturing practices and the rising demand for high-temperature insulation solutions across various industries, the thermal ceramics market is poised for continued growth in the forecast period.

Thermal Ceramics Market Dynamics:

Increased infrastructure development projects globally are driving demand for thermal ceramics in construction materials like refractory bricks and insulation boards Increasing regulations aimed at improving energy efficiency in industries drive the demand for thermal ceramics driving the growth of Thermal Ceramics Market. For instance, the EU's Energy Efficiency Directive mandates energy-efficient practices in industries, boosting the adoption of thermal ceramics for insulation in furnaces and kilns, thus reducing energy consumption and emissions. The rising industrialization, particularly in emerging economies such as China and India, is bolstering demand for thermal ceramics across sectors such as metallurgy, where they are integral for lining converters and ladles to support expanding steel production capacities. The automotive industry's shift towards lightweight materials for improved fuel efficiency and reduced emissions is spurring demand for thermal ceramics. Ceramic fiber insulation in exhaust systems is gaining traction for its weight reduction benefits and enhanced engine performance, evidenced by its adoption in catalytic converters by automotive manufacturers. These growth drivers, alongside advancements in technology, infrastructure development projects globally, and increased emphasis on workplace safety, collectively underscore the expanding role and significance of thermal ceramics across diverse industries. High initial investment requirements deter small and medium-sized enterprises from adopting thermal ceramics infrastructure The thermal ceramics market faces several constraints and challenges that impact its growth trajectory. Fluctuating raw material prices, exemplified by the volatility of alumina prices, pose significant challenges for manufacturers such0 Unifrax Corporation and Morgan Advanced Materials PLC, affecting production costs and profit margins. Environmental concerns surrounding the production and disposal of thermal ceramics raise regulatory scrutiny and stakeholder concerns, necessitating sustainable manufacturing practices to mitigate adverse impacts. High initial investment requirements deter small and medium-sized enterprises from adopting thermal ceramics infrastructure, limiting market penetration and growth potential. Challenges such as limited product differentiation and competition from alternative materials further intensify market competition, leading to pricing pressures and reduced profit margins for manufacturers such as Rath AG and Pyrotek Inc. Complex installation processes, a shortage of skilled labor, and long replacement cycles add to the market's challenges, impacting installation efficiency, maintenance costs, and overall market demand. Despite these constraints, addressing environmental concerns, enhancing product innovation, and improving cost-efficiency in production processes are essential for overcoming market challenges and fostering sustainable growth in the thermal ceramics industry.Thermal Ceramics Market Segment Analysis:

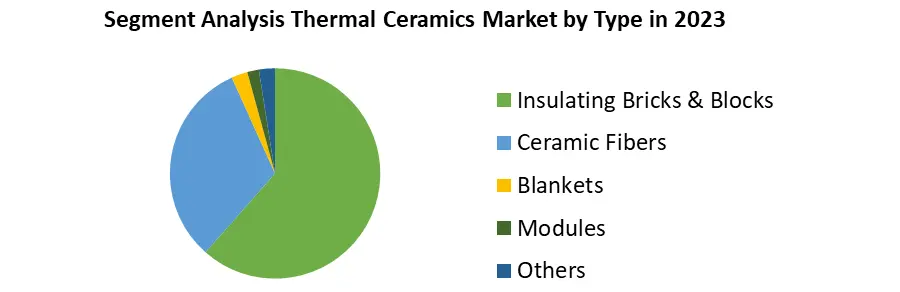

Based on Type, insulating bricks & blocks dominated the Thermal Ceramics Market in 2023, it finds extensive use in industries requiring high-temperature insulation for furnaces and kilns due to their excellent thermal conductivity properties. Ceramic fibers, on the other hand, offer flexibility and are widely adopted in applications where space constraints or complex shapes are involved, such as in the aerospace and automotive sectors. Blankets are preferred for their ease of installation and versatility, making them suitable for insulation in diverse industrial equipment and processes. Modules, pre-assembled units, are commonly used for lining industrial furnaces, boilers, and heaters, offering convenient installation and maintenance. Other thermal ceramics types, including boards, papers, and coatings, cater to specialized applications such as insulation in electronics manufacturing or fire protection in construction, albeit with relatively niche adoption rates compared to the aforementioned types.

Thermal Ceramics Market Regional Insights:

North America Dominated the Thermal Ceramics Market In North America, technical ceramics are widely utilized in electronics applications due to their exceptional heat stability and electrical insulation properties. The region boasts a thriving electronics industry, particularly in the United States, where electronic components, sensors, and subassemblies extensively incorporate technical ceramics. Moreover, the growing demand for power electronics further drives the adoption of technical ceramics, which can function at high temperatures without compromising structural integrity. Additionally, North America benefits from a robust manufacturing base for electronic products, including smartphones, TVs, and portable computing devices, supporting the steady growth of the electronics segment in the region. In Europe, technical ceramics play a crucial role in various industries, including electronics, where they are valued for their heat stability and electrical insulation capabilities. The region's electronics sector benefits from innovations in technical ceramics, facilitating advancements in power electronics and high-voltage applications. Furthermore, European countries like Germany and France are prominent players in the electronics market, contributing to the steady demand for technical ceramics in electronic components and devices. With a focus on innovation and sustainability, Europe remains a key market for technical ceramics, particularly in electronics, automotive, and aerospace applications.Thermal Ceramics Market Scope: Inquire before buying

Global Thermal Ceramics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.01 Bn. Forecast Period 2024 to 2030 CAGR: 9.05% Market Size in 2030: US $ 9.19 Bn. Segments Covered: by Type Insulating Bricks & Blocks Ceramic Fibers Blankets Modules Others by Temperature Range Low Temperature (<1000°C) Medium Temperature (1000°C - 1600°C) High Temperature (>1600°C) by End Use Industry Metallurgy & Foundry Glass Cement Power Generation Chemical & Petrochemical Aerospace & Automotive Thermal Ceramics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Thermal Ceramics Market Key Players:

Major Contributors in the Thermal Ceramics Industry in North America: 1. Unifrax - United States 2. 3M Company - United States 3. Zircar Ceramics Inc. - United States 4. Unitherm Insulation Systems - United States 5. HarbisonWalker International - United States 6. BNZ Materials, Inc. - United States Leading Figures in the European and Asian Thermal Ceramics Sector: 1. Morgan Advanced Materials plc - United Kingdom 2. Rath AG - Austria 3. Saint-Gobain - France 4. Pyrotek Inc. - United States 5. Isolite Insulating Products Co., Ltd. - Japan 6. Luyang Energy-Saving Materials Co., Ltd. - China 7. Nutec Fibratec - Mexico 8. Ibiden Co., Ltd. - Japan 9. CeramTec GmbH - Germany FAQs: 1] What Major Key players in the Global Thermal Ceramics Market report? Ans. The Major Key players covered in the Thermal Ceramics Market report are Unifrax, 3M Company, Zircar Ceramics Inc., Unitherm Insulation Systems, HarbisonWalker International, and BNZ Materials, Inc. 2] Which region is expected to hold the highest share in the Global Thermal Ceramics Market? Ans. North America region is expected to hold the highest share in the Thermal Ceramics Market. 3] What is the market size of the Global Thermal Ceramics Market by 2030? Ans. The market size of the Thermal Ceramics Market by 2030 is expected to reach US$ 9.19 Billion. 4] What is the forecast period for the Global Thermal Ceramics Market? Ans. The forecast period for the Thermal Ceramics Market is 2024-2030. 5] What was the market size of the Global Thermal Ceramics Market in 2023? Ans. The market size of the Thermal Ceramics Market in 2023 was valued at US$ 5.01 Billion.

1. Thermal Ceramics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Thermal Ceramics Market: Dynamics 2.1. Thermal Ceramics Market Trends by Region 2.1.1. North America Thermal Ceramics Market Trends 2.1.2. Europe Thermal Ceramics Market Trends 2.1.3. Asia Pacific Thermal Ceramics Market Trends 2.1.4. Middle East and Africa Thermal Ceramics Market Trends 2.1.5. South America Thermal Ceramics Market Trends 2.2. Thermal Ceramics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Thermal Ceramics Market Drivers 2.2.1.2. North America Thermal Ceramics Market Restraints 2.2.1.3. North America Thermal Ceramics Market Opportunities 2.2.1.4. North America Thermal Ceramics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Thermal Ceramics Market Drivers 2.2.2.2. Europe Thermal Ceramics Market Restraints 2.2.2.3. Europe Thermal Ceramics Market Opportunities 2.2.2.4. Europe Thermal Ceramics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Thermal Ceramics Market Drivers 2.2.3.2. Asia Pacific Thermal Ceramics Market Restraints 2.2.3.3. Asia Pacific Thermal Ceramics Market Opportunities 2.2.3.4. Asia Pacific Thermal Ceramics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Thermal Ceramics Market Drivers 2.2.4.2. Middle East and Africa Thermal Ceramics Market Restraints 2.2.4.3. Middle East and Africa Thermal Ceramics Market Opportunities 2.2.4.4. Middle East and Africa Thermal Ceramics Market Challenges 2.2.5. South America 2.2.5.1. South America Thermal Ceramics Market Drivers 2.2.5.2. South America Thermal Ceramics Market Restraints 2.2.5.3. South America Thermal Ceramics Market Opportunities 2.2.5.4. South America Thermal Ceramics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Thermal Ceramics Industry 2.8. Analysis of Government Schemes and Initiatives For Thermal Ceramics Industry 2.9. Thermal Ceramics Market Trade Analysis 2.10. The Global Pandemic Impact on Thermal Ceramics Market 3. Thermal Ceramics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 3.1.1. Insulating Bricks & Blocks 3.1.2. Ceramic Fibers 3.1.3. Blankets 3.1.4. Modules 3.1.5. Others 3.2. Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 3.2.1. Low Temperature (<1000°C) 3.2.2. Medium Temperature (1000°C - 1600°C) 3.2.3. High Temperature (>1600°C) 3.3. Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. Metallurgy & Foundry 3.3.2. Glass 3.3.3. Cement 3.3.4. Power Generation 3.3.5. Chemical & Petrochemical 3.3.6. Aerospace & Automotive 3.4. Thermal Ceramics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Thermal Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 4.1.1. Insulating Bricks & Blocks 4.1.2. Ceramic Fibers 4.1.3. Blankets 4.1.4. Modules 4.1.5. Others 4.2. North America Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 4.2.1. Low Temperature (<1000°C) 4.2.2. Medium Temperature (1000°C - 1600°C) 4.2.3. High Temperature (>1600°C) 4.3. North America Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1. Metallurgy & Foundry 4.3.2. Glass 4.3.3. Cement 4.3.4. Power Generation 4.3.5. Chemical & Petrochemical 4.3.6. Aerospace & Automotive 4.4. North America Thermal Ceramics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Insulating Bricks & Blocks 4.4.1.1.2. Ceramic Fibers 4.4.1.1.3. Blankets 4.4.1.1.4. Modules 4.4.1.1.5. Others 4.4.1.2. United States Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 4.4.1.2.1. Low Temperature (<1000°C) 4.4.1.2.2. Medium Temperature (1000°C - 1600°C) 4.4.1.2.3. High Temperature (>1600°C) 4.4.1.3. United States Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1.3.1. Metallurgy & Foundry 4.4.1.3.2. Glass 4.4.1.3.3. Cement 4.4.1.3.4. Power Generation 4.4.1.3.5. Chemical & Petrochemical 4.4.1.3.6. Aerospace & Automotive 4.4.2. Canada 4.4.2.1. Canada Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Insulating Bricks & Blocks 4.4.2.1.2. Ceramic Fibers 4.4.2.1.3. Blankets 4.4.2.1.4. Modules 4.4.2.1.5. Others 4.4.2.2. Canada Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 4.4.2.2.1. Low Temperature (<1000°C) 4.4.2.2.2. Medium Temperature (1000°C - 1600°C) 4.4.2.2.3. High Temperature (>1600°C) 4.4.2.3. Canada Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.2.3.1. Metallurgy & Foundry 4.4.2.3.2. Glass 4.4.2.3.3. Cement 4.4.2.3.4. Power Generation 4.4.2.3.5. Chemical & Petrochemical 4.4.2.3.6. Aerospace & Automotive 4.4.3. Mexico 4.4.3.1. Mexico Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Insulating Bricks & Blocks 4.4.3.1.2. Ceramic Fibers 4.4.3.1.3. Blankets 4.4.3.1.4. Modules 4.4.3.1.5. Others 4.4.3.2. Mexico Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 4.4.3.2.1. Low Temperature (<1000°C) 4.4.3.2.2. Medium Temperature (1000°C - 1600°C) 4.4.3.2.3. High Temperature (>1600°C) 4.4.3.3. Mexico Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 4.4.3.3.1. Metallurgy & Foundry 4.4.3.3.2. Glass 4.4.3.3.3. Cement 4.4.3.3.4. Power Generation 4.4.3.3.5. Chemical & Petrochemical 4.4.3.3.6. Aerospace & Automotive 5. Europe Thermal Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.2. Europe Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.3. Europe Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4. Europe Thermal Ceramics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.1.3. United Kingdom Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.2. France 5.4.2.1. France Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.2.3. France Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.3.3. Germany Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.4.3. Italy Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.5.3. Spain Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.6.3. Sweden Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.7.3. Austria Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 5.4.8.3. Rest of Europe Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Thermal Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.3. Asia Pacific Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4. Asia Pacific Thermal Ceramics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.1.3. China Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.2.3. S Korea Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.3.3. Japan Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.4.3. India Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.5.3. Australia Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.6.3. Indonesia Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.7.3. Malaysia Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.8.3. Vietnam Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.9.3. Taiwan Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 6.4.10.3. Rest of Asia Pacific Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Thermal Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 7.3. Middle East and Africa Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4. Middle East and Africa Thermal Ceramics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 7.4.1.3. South Africa Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 7.4.2.3. GCC Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 7.4.3.3. Nigeria Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 7.4.4.3. Rest of ME&A Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Thermal Ceramics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 8.2. South America Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 8.3. South America Thermal Ceramics Market Size and Forecast, by End Use Industry(2023-2030) 8.4. South America Thermal Ceramics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 8.4.1.3. Brazil Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 8.4.2.3. Argentina Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Thermal Ceramics Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Thermal Ceramics Market Size and Forecast, by Temperature Range (2023-2030) 8.4.3.3. Rest Of South America Thermal Ceramics Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Thermal Ceramics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Thermal Ceramics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Unifrax - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. 3M Company - United States 10.3. Zircar Ceramics Inc. - United States 10.4. Unitherm Insulation Systems - United States 10.5. HarbisonWalker International - United States 10.6. BNZ Materials, Inc. - United States 10.7. Morgan Advanced Materials plc - United Kingdom 10.8. Rath AG - Austria 10.9. Saint-Gobain - France 10.10. Pyrotek Inc. - United States 10.11. Isolite Insulating Products Co., Ltd. - Japan 10.12. Luyang Energy-Saving Materials Co., Ltd. - China 10.13. Nutec Fibratec - Mexico 10.14. Ibiden Co., Ltd. - Japan 10.15. CeramTec GmbH - Germany 11. Key Findings 12. Industry Recommendations 13. Thermal Ceramics Market: Research Methodology 14. Terms and Glossary