Global Textile Chemical Market size was valued at USD 30.17 Bn in 2023 and is expected to reach USD 44.47 Bn by 2030, at a CAGR of 5.7%.Textile Chemical Market Overview

Textile Chemical is a dynamic part of the massive fabric industry, serving both fashion and industrial sectors with a wide range of fabrics. Its diverse compounds and formulations are carefully crafted for specific roles in the complex textile manufacturing process. These chemicals are personalized to serve various purposes, contributing significantly to the creation of different types of fabrics. These chemicals act as the support, enabling the attainment of desired fabric characteristics, elevating performance standards, and meeting the exacting expectations of consumers for quality and functionality. Factors such as increased adoption of eco-friendly chemicals, innovations in functional textiles, and a surge in research and development efforts contribute to this growth. The industry's emphasis on sustainability, coupled with evolving consumer preferences, boosts Textile Chemical Market growth. In the Textile Chemical Market, a multitude of chemicals such as surfactants, lubricants, and antistatic agents play pivotal roles in refining both natural and synthetic fibers, contributing to the enhancement of yarn quality during spinning and weaving processes. During the dyeing and printing stages within this textile chemical industry, a symphony of dyes, pigments, and colorants elegantly infuse fabrics with vibrant hues and intricate patterns. A variety of finishes, including softeners, water repellents, flame retardants, and antibacterial agents, are employed, imparting superior durability and enhanced performance to the final textile products.To know about the Research Methodology:-Request Free Sample Report The industry has witnessed a prominent surge in eco-friendly alternatives crafted through the principles of green chemistry, minimizing environmental footprints. In tandem, efforts to curtail water and energy usage in processing have spurred the development of chemicals requiring reduced water in dyeing and finishing procedures, aligning with overarching sustainability objectives. Future trends in this realm aim for a convergence between innovation and sustainability, with a focused exploration of bio-based, renewable chemicals, a deeper delve into nanotechnology applications, and the integration of digital technologies to optimize production processes, marking an exciting trajectory for the Textile Chemical Market. Trend Eco Friendly Textile There's a shift towards adopting green chemistry principles in textile chemical formulations. Manufacturers are developing eco-friendly chemicals that reduce environmental impact without compromising performance. This involves bio-based chemicals derived from renewable sources, reducing the reliance on petrochemicals and diminishing ecological footprints. Textile manufacturing is water and energy-intensive Within the Textile Chemical Market, a prominent trend towards sustainability incorporates the development of chemicals and processes aimed at minimizing water consumption and energy usage. Innovations like waterless dyeing techniques, decreased chemical usage, and the implementation of more efficient production methods are pivotal contributions to sustainable practices within the industry. These initiatives align with the market's drive towards environmentally friendly solutions and resource optimization. The industry is exploring ways to adopt a circular economy model, focusing on recycling and reusing textile materials. Chemical solutions play a role in developing processes for recycling textiles or incorporating recycled materials into new fabrics. This trend aligns with the growing demand for recycled and upcycled textile products. Certifications including OEKO-TEX or bluesign signify adherence to strict environmental and safety standards in textile production. The trend leans towards the increased adoption of certified chemicals and processes, ensuring that textiles meet eco-friendly criteria and consumer expectations. Textile chemical manufacturers are developing formulations that minimize hazardous chemical usage, reducing the impact on workers' health and the environment. This includes substituting harmful substances with safer alternatives and developing closed-loop processes to prevent chemical waste. Evolution in consumer preferences is propelling textile manufacturers within the Textile Chemical Market to embrace sustainable practices. Heightened consumer interest in eco-friendly products drives a willingness to pay more for textiles made through environmentally conscious methods. This growing demand underscores the industry's imperative to prioritize sustainability in chemical usage, aligning with evolving consumer values.

Textile Chemical Market Dynamics

Driver Increasing demand for technical textiles across various industries to boost market Growth Technical textiles find applications across diverse industries like automotive, healthcare, construction, sports, aerospace, and geotextiles. Engineered with precision, these fabrics are tailored within the realm of the Textile Chemical Market to deliver precise functionalities. They're designed to offer targeted characteristics such as exceptional durability, high strength, resistance to fire or chemicals, and antimicrobial properties. As industries increasingly adopt technical textiles for specialized purposes, the need for accompanying textile chemicals rises. Technological advancements drive the development of innovative textiles to provide niche applications. For instance, in the automotive sector, the demand for lightweight, high-strength materials for interior and exterior applications is on the rise. Also, in healthcare, there's a growing need for textiles with antibacterial coatings or moisture-wicking properties for medical garments. These advancements necessitate specialized chemical treatments to achieve the desired textile characteristics. Textile chemicals play a key role in improving and customizing the properties of technical textiles. Chemical treatments impart specific qualities such as water repellence, UV resistance, flame retardancy, or conductive properties, aligning textiles with the unique needs of different industries. Various industries impose stringent standards and regulations for safety, quality, and performance. Technical textiles meet these standards, necessitating precise chemical treatments to ensure compliance. For instance, flame-retardant textiles used in automotive or aerospace applications require specific chemical formulations to meet safety regulations. There's a growing focus on sustainable and eco-friendly textiles. The Textile Chemical Market responds to this demand by developing environmentally friendly chemicals, minimizing the ecological footprint of textile production processes. This includes the development of bio-based or recycled chemicals to align with sustainability initiatives across industries. End consumers are increasingly conscious of the functionalities and quality of products they use. Whether it's clothing, medical textiles, or geotextiles, consumers are seeking high-performance products. This consumer-driven demand for high-quality technical textiles prompts manufacturers to invest in advanced chemical solutions to meet these expectations. Restraint Volatility In Raw Material Price Hampers Market Growth Fluctuating raw material prices directly influence production costs. Textile chemicals constitute a significant portion of manufacturing expenses. Sudden price hikes strain profit margins for manufacturers, especially when they have not passed the increased costs onto consumers. Predicting and planning for production expenses becomes challenging due to price instability. This volatility disrupts budgeting and financial forecasting, affecting investment decisions and long-term planning for businesses in the sector. Volatile prices often accompany supply chain disruptions caused by several factors such as geopolitical tensions, natural disasters, or trade policy changes. These disruptions lead to shortages or delays in raw material procurement, impacting production schedules and delivery timelines. In a competitive Textile Chemical Market, maintaining stable prices for end products is crucial. Erratic raw material costs affect a company's competitiveness, especially if competitors manage to secure more stable or cheaper resources. Price fluctuations strain relationships between manufacturers and suppliers. Negotiating contracts or maintaining long-term supplier relationships becomes challenging when costs are unstable. Textile manufacturers need to pass increased costs to consumers, potentially affecting consumer demand if prices increase too high. Balancing competitive pricing and maintaining profit margins becomes a delicate task during periods of raw material price volatility. Opportunity Increasing Adoption of low VOC Pressure from governments, NGOs, and consumers compels textile suppliers to adopt sustainable practices, avoiding harmful chemicals in production. Restricted Substance Lists (RSLs) outline prohibited compounds, while Positive Lists suggest permissible chemicals. Bluesign, a Swiss company, curates a Positive List of partners, highlighting approved chemicals. Textile production, primarily reliant on dyes, poses environmental concerns, ranking among the highest water pollutants. Growing consumer awareness promotes eco-friendly clothing, pushing manufacturers to adopt sustainable dyeing and low-VOC technologies. Consumers increasingly favor environmentally conscious products, encouraging manufacturers to invest in eco-friendly technologies. Thus, the Textile Chemical Market perceives potential growth from the increasing demand for low-VOC and biodegradable alternatives.Textile Chemical Market Segment Analysis

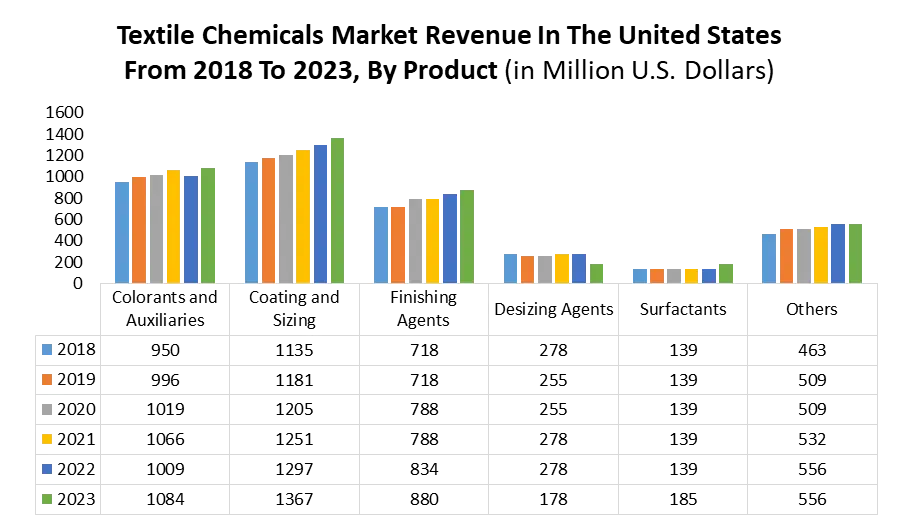

Based on Product Type, Colorants and Auxiliaries are expected to dominate the Textile Chemical Market during the forecast period. Colorants and auxiliaries play a vital role in enhancing the visual appeal of textiles. They provide an extensive array of vibrant colors, tones and shades, enabling the creation of attractive and eye-catching fabrics. These chemicals are versatile and find applications across several stages of textile manufacturing, from dyeing to printing. They are employed to achieve different effects, including solid colors, intricate patterns, and gradients, catering to diverse consumer preferences. Auxiliaries are essential for ensuring the quality and durability of coloration. They aid in enhancing dye penetration, color fastness, and the overall performance of dyes, ensuring that fabrics retain their color vibrancy and do not fade easily over time. Colorants and auxiliaries are fundamental in achieving consistent and high-quality results in the dyeing and printing processes. They assist in controlling dye behavior, optimizing dye application and enhancing the final appearance of the fabric. In an industry driven by consumer trends and preferences, the wide range of color choices and the capability to create unique patterns and designs contribute significantly to meeting consumer demands for innovative and aesthetically pleasing textiles. The textile industry's increasing focus on sustainability and eco-friendly practices has led to the development of colorants and auxiliaries that adhere to environmental standards, meeting the demand for eco-conscious products. Ongoing research and technological advancements continually improve colorants and auxiliaries, introducing new formulations that offer enhanced properties, such as better color retention, reduced environmental impact, and improved fabric performance. In the United States, the Textile Chemical Market generates substantial revenue across diverse product segments, including dyes, finishes, and treatments. The industry incorporates a wide array of chemical solutions tailored for various textile manufacturing processes, contributing significantly to the industry's financial landscape.

Textile Chemical Market Regional Insights

Asia Pacific dominated the largest Textile Chemical Market share and is expected to dominate the market over the forecast period. Countries including China, India, Bangladesh, and Vietnam are essential in the textile industry. These countries boast massive textile manufacturing capacities and are major exporters of textiles globally. The significant production in these countries inherently drives the demand for various textile chemicals necessary for dyeing, finishing, and treating textiles. The region has access to a rich array of raw materials essential for textile production such as cotton, silk, wool, and synthetic fibers. This abundance facilitates the manufacturing process and contributes to the extensive use of chemicals in textile treatments and processing. Lower labor costs and relatively economical production processes in Asia Pacific countries make them attractive manufacturing destinations. This cost efficiency encourages higher production levels, subsequently driving the demand for textile chemicals. Asia Pacific has been experiencing rapid industrialization, particularly in emerging economies. This growth stimulates the textile sector, leading to increased demand for textile chemicals to support the expanding manufacturing operations. The region hosts a massive consumer base with increasing purchasing power. The increase in disposable incomes has boosted demand for apparel, home textiles, and technical textiles. As a result, the need for a diverse range of textiles and, consequently, textile chemicals has surged which boost Textile Chemical Market growth. There's a growing awareness and emphasis on sustainable and eco-friendly practices in textile production. With increasing concerns about environmental impact, there's a shift towards adopting greener, eco-conscious processes and chemicals in textile manufacturing. This trend is particularly noteworthy in the Asia Pacific, encouraging innovation and the adoption of eco-friendly textile chemicals. Governments and industry bodies in the region have been taking strategic initiatives to promote the textile sector's growth. Supportive policies, incentives for innovation, and investments in research and development have all contributed to the expansion of the Textile Chemical Market in Asia Pacific.Textile Chemical Market Scope: Inquire before buying

Global Textile Chemical Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 30.17 Bn. Forecast Period 2024 to 2030 CAGR: 5.7% Market Size in 2030: US$ 44.47 Bn. Segments Covered: by Process Pre Treatment Coating Treatment of Finished Products by Product Coating &Sizing Chemicals Colorants & Auxiliaries Finishing Agents Surfactants Denim Finishing Agents by Application Apparel Home Furnishing Technical Textiles Textile Chemical Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Textile Chemical Key Players

The competitive landscape of the Textile Chemical Market such as BASF SE (Germany), a global leader in chemical manufacturing, and Huntsman Corporation (USA), recognized for its specialty chemicals and sustainable textile solutions. Solvay S.A. (Belgium) and Archroma (Switzerland) are key players, providing innovative chemical technologies for textile processing. Kemira Oyj (Finland) focuses on water-efficient chemicals, while Evonik Industries (Germany) delivers specialty chemicals with high-performance applications. Hexion Inc. (USA) and Kraton Corporation (USA) bring advanced polymers and resins to the market. Aether Industries (India) and Lonsen Inc. (China) provide strong regional competition. Companies like Tanatex Chemicals (Netherlands), DyStar International (Singapore), and Nouryon (Netherlands) are leaders in eco-friendly textile solutions. Brenntag AG (Germany) serves as a major distributor, while Huntsman Textile Effects (Singapore) focuses on innovative and sustainable products. Global 1. DyStar (Singapore) 2. Sumitomo Chemical Co., Ltd. (Japan) 3. Rudolf Group (Germany) 4. Croda International Plc (UK) 5. Tanatex Chemicals B.V. (Netherlands) North America 1. Kemin Industries, Inc. (US) 2. Solenis (US) Europe 1. Tanatex Chemicals B.V. (Netherlands) 2. Lamberti S.p.A. (Italy) Asia Pacific 1. NICCA Chemical Co., Ltd. (Japan) 2. Lonsen Inc. (China) 3. Everlight Chemical Industrial Corp. (Taiwan) 4. Transfar Group Co., Ltd. (China) 5. KISCO Ltd. (South Korea) 6. Sarex Chemicals (India) 7. Dystar Singapore Pte Ltd (Singapore) 8. Sinochem Group (China) 9. Jiangsu Sanfangxiang Group (China) Frequently Asked Questions: 1] What is the growth rate of the Global Textile Chemical Market? Ans. The Global Textile Chemical Market is growing at a significant rate of 5.7% during the forecast period. 2] Which region is expected to dominate the Global Textile Chemical Market? Ans. Asia Pacific is expected to dominate the Textile Chemical Market during the forecast period. 3] What is the expected Global Textile Chemical Market size by 2030? Ans. The Textile Chemical Market size is expected to reach USD 44.47 Billion by 2030 4] Which are the top players in the Global Textile Chemical Market? Ans. The major top players in the Global Textile Chemical Market are DyStar (Singapore), Sumitomo Chemical Co., Ltd. (Japan), Rudolf Group (Germany), Croda International Plc (UK), Tanatex Chemicals B.V. (Netherlands), Kemin Industries, Inc. (US), Clearon Corp. (US) and Others. 5] What are the factors driving the Global Textile Chemical Market growth? Ans. Increasing Demand for Functional Textiles and technological advancements are expected to drive market growth during the forecast period.

1. Textile Chemical Market: Research Methodology 2. Textile Chemical Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Textile Chemical Market: Dynamics 3.1. Textile Chemical Market Trends by Region 3.1.1. North America Textile Chemical Market Trends 3.1.2. Europe Textile Chemical Market Trends 3.1.3. Asia Pacific Textile Chemical Market Trends 3.1.4. Middle East and Africa Textile Chemical Market Trends 3.1.5. South America Textile Chemical Market Trends 3.2. Textile Chemical Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Textile Chemical Market Drivers 3.2.1.2. North America Textile Chemical Market Restraints 3.2.1.3. North America Textile Chemical Market Opportunities 3.2.1.4. North America Textile Chemical Market Challenges 3.2.2. Europe 3.2.2.1. Europe Textile Chemical Market Drivers 3.2.2.2. Europe Textile Chemical Market Restraints 3.2.2.3. Europe Textile Chemical Market Opportunities 3.2.2.4. Europe Textile Chemical Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Textile Chemical Market Drivers 3.2.3.2. Asia Pacific Textile Chemical Market Restraints 3.2.3.3. Asia Pacific Textile Chemical Market Opportunities 3.2.3.4. Asia Pacific Textile Chemical Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Textile Chemical Market Drivers 3.2.4.2. Middle East and Africa Textile Chemical Market Restraints 3.2.4.3. Middle East and Africa Textile Chemical Market Opportunities 3.2.4.4. Middle East and Africa Textile Chemical Market Challenges 3.2.5. South America 3.2.5.1. South America Textile Chemical Market Drivers 3.2.5.2. South America Textile Chemical Market Restraints 3.2.5.3. South America Textile Chemical Market Opportunities 3.2.5.4. South America Textile Chemical Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Textile Chemical Market 3.8. Analysis of Government Schemes and Initiatives For Textile Chemical Market 3.9. The Global Pandemic Impact on Textile Chemical Market 4. Textile Chemical Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 4.1. Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Colorants and Auxiliaries 4.1.2. Coating and Sizing 4.1.3. Finishing Agents 4.1.4. Desizing Agents 4.1.5. Surfactants 4.1.6. Others 4.2. Textile Chemical Market Size and Forecast, by Process (2022-2029) 4.2.1. Pre-treatment Process 4.2.2. Dyeing and Printing Process 4.2.3. Finishing Process 4.2.4. Others 4.3. Textile Chemical Market Size and Forecast, by Application (2022-2029) 4.3.1. Apparel 4.3.2. Home Textile 4.3.3. Technical Textile 4.3.4. Others 4.4. Textile Chemical Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Textile Chemical Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 5.1. North America Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 5.1.1. Colorants and Auxiliaries 5.1.2. Coating and Sizing 5.1.3. Finishing Agents 5.1.4. Desizing Agents 5.1.5. Surfactants 5.1.6. Others 5.2. North America Textile Chemical Market Size and Forecast, by Process (2022-2029) 5.2.1. Pre-treatment Process 5.2.2. Dyeing and Printing Process 5.2.3. Finishing Process 5.2.4. Others 5.3. North America Textile Chemical Market Size and Forecast, by Application (2022-2029) 5.3.1. Apparel 5.3.2. Home Textile 5.3.3. Technical Textile 5.3.4. Others 5.4. North America Textile Chemical Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 5.4.1.1.1. Colorants and Auxiliaries 5.4.1.1.2. Coating and Sizing 5.4.1.1.3. Finishing Agents 5.4.1.1.4. Desizing Agents 5.4.1.1.5. Surfactants 5.4.1.1.6. Others 5.4.1.2. United States Textile Chemical Market Size and Forecast, by Process (2022-2029) 5.4.1.2.1. Pre-treatment Process 5.4.1.2.2. Dyeing and Printing Process 5.4.1.2.3. Finishing Process 5.4.1.2.4. Others 5.4.1.3. United States Textile Chemical Market Size and Forecast, by Application (2022-2029) 5.4.1.3.1. Apparel 5.4.1.3.2. Home Textile 5.4.1.3.3. Technical Textile 5.4.1.3.4. Others 5.4.1.3.5. 5.4.2. Canada 5.4.2.1. Canada Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 5.4.2.1.1. Colorants and Auxiliaries 5.4.2.1.2. Coating and Sizing 5.4.2.1.3. Finishing Agents 5.4.2.1.4. Desizing Agents 5.4.2.1.5. Surfactants 5.4.2.1.6. Others 5.4.2.2. Canada Textile Chemical Market Size and Forecast, by Process (2022-2029) 5.4.2.2.1. Pre-treatment Process 5.4.2.2.2. Dyeing and Printing Process 5.4.2.2.3. Finishing Process 5.4.2.2.4. Others 5.4.2.3. Canada Textile Chemical Market Size and Forecast, by Application (2022-2029) 5.4.2.3.1. Apparel 5.4.2.3.2. Home Textile 5.4.2.3.3. Technical Textile 5.4.2.3.4. Others 5.4.2.3.5. 5.4.3. Mexico 5.4.3.1. Mexico Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 5.4.3.1.1. Colorants and Auxiliaries 5.4.3.1.2. Coating and Sizing 5.4.3.1.3. Finishing Agents 5.4.3.1.4. Desizing Agents 5.4.3.1.5. Surfactants 5.4.3.1.6. Others 5.4.3.2. Mexico Textile Chemical Market Size and Forecast, by Process (2022-2029) 5.4.3.2.1. Pre-treatment Process 5.4.3.2.2. Dyeing and Printing Process 5.4.3.2.3. Finishing Process 5.4.3.2.4. Others 5.4.3.3. Mexico Textile Chemical Market Size and Forecast, by Application (2022-2029) 5.4.3.3.1. Apparel 5.4.3.3.2. Home Textile 5.4.3.3.3. Technical Textile 5.4.3.3.4. Others 6. Europe Textile Chemical Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 6.1. Europe Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.2. Europe Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.3. Europe Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4. Europe Textile Chemical Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.1.2. United Kingdom Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.1.3. United Kingdom Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.2. France 6.4.2.1. France Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.2.2. France Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.2.3. France Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.3.2. Germany Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.3.3. Germany Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.4.2. Italy Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.4.3. Italy Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.5.2. Spain Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.5.3. Spain Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.6.2. Sweden Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.6.3. Sweden Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.7.2. Austria Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.7.3. Austria Textile Chemical Market Size and Forecast, by Application (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 6.4.8.2. Rest of Europe Textile Chemical Market Size and Forecast, by Process (2022-2029) 6.4.8.3. Rest of Europe Textile Chemical Market Size and Forecast, by Application (2022-2029) 7. Asia Pacific Textile Chemical Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 7.1. Asia Pacific Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.2. Asia Pacific Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.3. Asia Pacific Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4. Asia Pacific Textile Chemical Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.1.2. China Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.1.3. China Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.2.2. S Korea Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.2.3. S Korea Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.3.2. Japan Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.3.3. Japan Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.4. India 7.4.4.1. India Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.4.2. India Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.4.3. India Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.5.2. Australia Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.5.3. Australia Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.6.2. Indonesia Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.6.3. Indonesia Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.7.2. Malaysia Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.7.3. Malaysia Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.8.2. Vietnam Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.8.3. Vietnam Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.9.2. Taiwan Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.9.3. Taiwan Textile Chemical Market Size and Forecast, by Application (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Textile Chemical Market Size and Forecast, by Process (2022-2029) 7.4.10.3. Rest of Asia Pacific Textile Chemical Market Size and Forecast, by Application (2022-2029) 8. Middle East and Africa Textile Chemical Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029 8.1. Middle East and Africa Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 8.2. Middle East and Africa Textile Chemical Market Size and Forecast, by Process (2022-2029) 8.3. Middle East and Africa Textile Chemical Market Size and Forecast, by Application (2022-2029) 8.4. Middle East and Africa Textile Chemical Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 8.4.1.2. South Africa Textile Chemical Market Size and Forecast, by Process (2022-2029) 8.4.1.3. South Africa Textile Chemical Market Size and Forecast, by Application (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 8.4.2.2. GCC Textile Chemical Market Size and Forecast, by Process (2022-2029) 8.4.2.3. GCC Textile Chemical Market Size and Forecast, by Application (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 8.4.3.2. Nigeria Textile Chemical Market Size and Forecast, by Process (2022-2029) 8.4.3.3. Nigeria Textile Chemical Market Size and Forecast, by Application (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 8.4.4.2. Rest of ME&A Textile Chemical Market Size and Forecast, by Process (2022-2029) 8.4.4.3. Rest of ME&A Textile Chemical Market Size and Forecast, by Application (2022-2029) 9. South America Textile Chemical Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029 9.1. South America Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 9.2. South America Textile Chemical Market Size and Forecast, by Process (2022-2029) 9.3. South America Textile Chemical Market Size and Forecast, by Application (2022-2029) 9.4. South America Textile Chemical Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 9.4.1.2. Brazil Textile Chemical Market Size and Forecast, by Process (2022-2029) 9.4.1.3. Brazil Textile Chemical Market Size and Forecast, by Application (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 9.4.2.2. Argentina Textile Chemical Market Size and Forecast, by Process (2022-2029) 9.4.2.3. Argentina Textile Chemical Market Size and Forecast, by Application (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Textile Chemical Market Size and Forecast, by Product Type (2022-2029) 9.4.3.2. Rest Of South America Textile Chemical Market Size and Forecast, by Process (2022-2029) 9.4.3.3. Rest Of South America Textile Chemical Market Size and Forecast, by Application (2022-2029) 10. Global Textile Chemical Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Textile Chemical Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. DyStar (Singapore) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Recent Developments 11.2. Sumitomo Chemical Co., Ltd. (Japan) 11.3. Rudolf Group (Germany) 11.4. Croda International Plc (UK) 11.5. Tanatex Chemicals B.V. (Netherlands) 11.6. Kemin Industries, Inc. (US) 11.7. Clearon Corp. (US) 11.8. Textile Rubber & Chemical Company (US) 11.9. Tanatex Chemicals B.V. (Netherlands) 11.10. Lamberti S.p.A. (Italy) 11.11. NICCA Chemical Co., Ltd. (Japan) 11.12. Lonsen Inc. (China) 11.13. Everlight Chemical Industrial Corp. (Taiwan) 11.14. Transfar Group Co., Ltd. (China) 11.15. KISCO Ltd. (South Korea) 11.16. Sarex Chemicals (India) 11.17. Dystar Singapore Pte Ltd (Singapore) 11.18. Sinochem Group (China) 11.19. Jiangsu Sanfangxiang Group (China) 12. Key Findings 13. Industry Recommendations