The Laboratory Equipment Services Market size was valued at USD 14.49 Billion in 2023 and the total Laboratory Equipment Services revenue is expected to grow at a CAGR of 9.8 % from 2024 to 2030, reaching nearly USD 27.88 Billion by 2030. Laboratory Equipment Services are repair, calibration, and validation of scientific instruments, ensuring accuracy and reliability in various industries like biological, pharmaceutical, industrial, and commercial settings. Increasing demand for precise and reliable scientific instrumentation across various industries driving the growth of Laboratory Equipment Services Market. The current scenario reflects a robust market landscape characterized by a rising emphasis on ensuring equipment functionality, adherence to stringent regulatory standards, and cost-effective maintenance solutions. Continuous advancements in laboratory technologies, growing investments in research and development activities, and the increasing adoption of outsourcing services to streamline operations and focus on core competencies are some major key growth factors contributing to the Laboratory Equipment Services Market growth.To know about the Research Methodology:-Request Free Sample Report The expanding biotechnology and pharmaceutical sectors, coupled with the need for accurate diagnostic solutions, are boosting the demand for laboratory equipment services. Recent developments by Laboratory Equipment Services Market key players underscore innovation and strategic collaborations aimed at enhancing service offerings and expanding global presence. Leading Laboratory Equipment Services Market players such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., and Waters Corporation have been actively engaged in acquisitions, partnerships, and product launches to strengthen their market position and cater to evolving customer needs. For instance, Agilent Technologies' acquisition of BioTek Instruments, Inc. in 2019 expanded its life sciences portfolio, enabling the company to offer a comprehensive range of laboratory equipment and services. Similarly, Thermo Fisher Scientific's collaboration with Illumina, Inc. in 2020 aimed to develop FDA-approved next-generation sequencing (NGS) based oncology companion diagnostics, highlighting the strategic focus on innovation and market expansion. The Laboratory Equipment Services Market is expected rapid growth, driven by technological advancements, increasing research activities, and strategic initiatives by key market players to capitalize on emerging opportunities and address evolving customer demands.

Laboratory Equipment Services Market Dynamics:

Development of Biotechnology and Pharmaceutical Sectors with Advancements in Laboratory Technologies Driving Laboratory Equipment Services Market Growth Continuous innovation in laboratory equipment boosting the growth of Laboratory Equipment Services Market, for instance- the advancement in analytical instruments such as mass spectrometers and high-performance liquid chromatography (HPLC) systems, drives the need for specialized servicing. These sophisticated instruments require expert calibration and maintenance services to ensure optimal performance and accurate results. Stringent regulatory standards in industries such as pharmaceuticals and healthcare mandate regular calibration and validation of laboratory equipment. For example, adherence to ISO 17025 certification standards for calibration laboratories boosts demand for accredited calibration services, driving the growth of the calibration services market.Worldwide forecast of pharmaceutical sector growth between 2018 and 2030, by Country

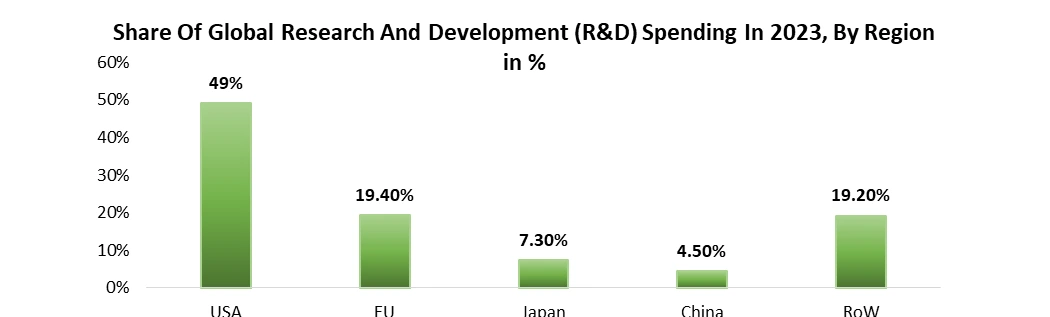

The expanding biopharmaceutical market boosts demand for laboratory equipment services to support research, development, and manufacturing activities. The increasing adoption of bioprocessing technologies, such as bioreactors for cell culture applications, underscores the need for specialized maintenance and validation services to ensure product quality and regulatory compliance. Rising investments in research and development across industries drive demand for laboratory equipment services. For example, the expansion of genomics research, facilitated by advancements in DNA sequencing technologies such as next-generation sequencing (NGS), necessitates calibration and maintenance services to ensure accurate and reliable experimental results. Globally, research and development spending reached $1.92 trillion in 2021, with the pharmaceutical industry accounting for a significant portion of this expenditure.

Genome UK: 2022 to 2025 implementation plan for England

The integration of artificial intelligence (AI) with advancements in laboratory technologies has catalyzed a transformative era in healthcare. Traditionally, laboratory medicine relied on manual processes, but recent technological strides have revolutionized diagnostics and monitoring, enhancing patient care. Automation, exemplified by total laboratory automation (TLA) systems, streamlines processes, reducing errors and improving efficiency across clinical chemistry, hematology, and microbiology testing. Additionally, digitization and AI-driven analysis of culture plate images have automated microbiology, enhancing efficiency and accuracy. Meanwhile, omics technologies, including genomics and transcriptomics, have advanced with AI-driven data mining, enabling personalized medicine through single-cell sequencing and liquid biopsy for cancer detection and treatment prediction. Furthermore, advancements in metabolomics and proteomics, facilitated by AI-enabled analysis of mass spectrometry and nuclear magnetic resonance spectroscopy data, offer insights into disease biomarkers and therapeutic targets. Microfluidic devices, such as lab-on-a-chip systems, leverage AI for rapid and precise diagnostics, including single-cell analysis for cancer prognosis and immune cell profiling. The synergy between AI and laboratory technologies not only optimizes healthcare delivery but also paves the way for a future of precision and personalized medicine, enriching the critical role of the laboratory in patient care.

Investment Description Funding (£ million) Landmark research programme for studying the effectiveness of using WGS to speed up diagnosis and treatment of rare genetic diseases in newborns £105 Tackling health inequalities in genomic medicine through tailored sequencing of participants from diverse backgrounds £22 Innovative cancer programme to evaluate cutting-edge genomic sequencing technology and use AI for analysis £26 Medical Research Council-led funding for a 4-year functional genomics initiative Up to £25 Balancing High Costs of Equipment Maintenance Contracts with Uncertain Healthcare Funding Impeding Growth of the Laboratory Equipment Services Market The high cost of equipment maintenance contracts, particularly for specialized equipment such as mass spectrometers hindering the growth of Laboratory Equipment Services Market. These intricate servicing needs often lead to expensive service agreements, deterring smaller laboratories from investing in regular maintenance and risking equipment breakdowns, impacting their research or diagnostic capabilities. For instance, the average annual cost of maintenance contracts for specialized equipment exceeds $50,000, presenting a substantial financial burden for laboratories.

Managing High Costs of Laboratory Equipment and Services Amidst Pricing Variability

Limited budget allocations for service contracts pose a challenge for many laboratories, especially academic research institutions. These institutions often prioritize research grants for equipment purchases over long-term service contracts, leading to ad-hoc repairs or in-house maintenance. Consequently, the efficiency and lifespan of critical laboratory equipment may be compromised. Data shows that over 40% of laboratories allocate less than 10% of their annual budgets to equipment maintenance contracts, highlighting the constraints they face in ensuring the reliability of their equipment. Compliance with complex regulatory standards, such as ISO 13485, presents another significant challenge for laboratory equipment services providers. Adhering to these stringent standards requires extensive documentation, audits, and employee training, increasing operational overheads and impacting profit margins. Furthermore, rapid technological advancements in laboratory equipment demand specialized technical expertise for maintenance and calibration, posing logistical challenges and increasing operational costs for service providers. These challenges collectively hinder the growth and efficiency of the laboratory equipment services market, impacting both service providers and their clients.

Equipment/Service Average Pricing Description Mass Spectrometer $200,000 - $500,000 A sophisticated analytical instrument used for identifying compounds in a sample based on their molecular masses. Maintenance costs include calibration and system checks. High-Performance Liquid Chromatography (HPLC) System $50,000 - $150,000 Advanced analytical technique used to separate, identify, and quantify components in a mixture. Maintenance involves column replacement, pump calibration, and detector checks. Next-Generation Sequencing (NGS) Platform $500,000 - $1,000,000 Cutting-edge technology for analyzing DNA and RNA sequences. Maintenance includes regular system calibration, reagent replenishment, and instrument validation. Nuclear Magnetic Resonance (NMR) Spectrometer $300,000 - $700,000 Powerful analytical tool used for molecular structure determination. Maintenance includes cryogen refills, probe tuning, and software updates. Automated Cell Culture System $100,000 - $300,000 Automated platform for growing and maintaining cell cultures. Maintenance involves routine system cleaning, sensor calibration, and software upgrades. Laboratory Information Management System (LIMS) $50,000 - $200,000 Software solution for managing laboratory workflows, data, and resources. Maintenance includes system updates, database backups, and user training. Laboratory Equipment Services Market Segment Analysis:

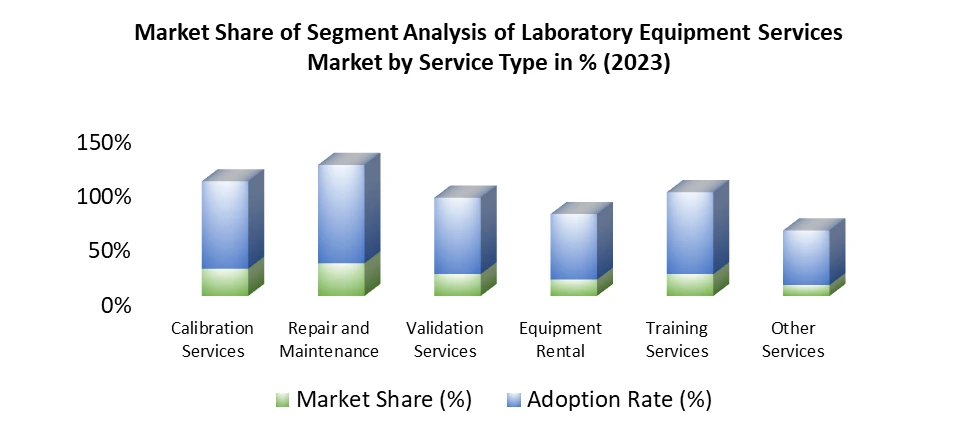

Based on Service Types, Calibration services dominated the Laboratory Equipment Services Market in 2023 as they are crucial for ensuring accurate measurements and compliance with regulatory standards across industries such as pharmaceuticals and environmental monitoring. Repair and maintenance services are widely adopted, particularly in healthcare and research settings, to minimize equipment downtime and maintain operational efficiency. Validation services are essential for verifying the performance and reliability of laboratory equipment, especially in highly regulated sectors like biotechnology and food testing. Equipment rental services are gaining traction among smaller laboratories and startups seeking cost-effective access to advanced equipment without substantial capital investment. Training services are increasingly in demand to enhance the proficiency of laboratory staff in operating and troubleshooting complex instruments. Other services, encompassing customizations, consulting, and technical support, cater to specific needs and challenges faced by laboratories across diverse sectors, contributing to the overall growth and functionality of the laboratory equipment services market.

Laboratory Equipment Services Market Regional Insights:

North America Dominance in the Laboratory Equipment Services Market North America dominated the Laboratory Equipment Services Market led by the presence of major manufacturers such as Thermo Fisher Scientific and Agilent Technologies, stands out as a key producer of laboratory equipment services. The region benefits from robust research and development infrastructure, particularly in biotechnology and pharmaceuticals. For instance, biopharmaceutical companies in North America invested over a trillion dollars in R&D until 2025, driving the demand for laboratory equipment services. The region's governments, such as Canada, are investing heavily in research, with initiatives like the JDRF-CIHR partnership receiving up to USD 15 million for diabetes research. Frequent product developments and launches by key market players, such as the Baker Company's launch of the ReCO2ver rapid recovery cell culture incubator, further contribute to market growth. The region is also witnessing strategic activities like the establishment of manufacturing facilities by companies like American Nitrile, further boosting the market. Europe emerges as a major consumer of laboratory equipment services, particularly in countries such as Germany, France, and the UK, driven by advanced healthcare systems and extensive academic and industrial research facilities. The European biotechnology sector is expected to reach US$ 150 billion by 2025, highlighting the region's significant demand for laboratory equipment and services. Asia-Pacific, driven by rapid industrialization and healthcare infrastructure investments, plays a prominent role in both production and consumption. Countries like China, Japan, and South Korea are significant manufacturing hubs and consumers of laboratory equipment services. India, in particular, is witnessing substantial growth in its biotechnology sector, with investments in R&D and infrastructure. The country's biotechnology industry is expected to grow to around Rs. 440,000 crores (US$ 70.84 billion) by 2020, indicating a significant demand for laboratory equipment services. Initiatives like India's Genome Valley, a hub for life sciences R&D and manufacturing operations, are driving investments and innovation in the sector. The Genome Valley, with its world-class infrastructure and support from the government, is attracting investments from both domestic and international firms. For instance, Ferring Pharma plans to invest Rs. 500 crores (US$ 64.4 million) to set up a manufacturing facility, showcasing the region's potential for growth in laboratory equipment services.

Laboratory Equipment Services Market Scope: Inquire before buying

Global Laboratory Equipment Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 14.49 Bn. Forecast Period 2024 to 2030 CAGR: 9.8% Market Size in 2030: US $ 27.88 Bn. Segments Covered: by Service Type Calibration Services Repair and Maintenance Services Validation Services Equipment Rental Services Training Services Other Services by Equipment Type Analytical Equipment General Equipment Specialty Equipment Others by Application Clinical Diagnostics Drug Discovery & Development Biotechnology & Life Sciences Research Environmental Testing Food & Beverage Testing Academic Research Others by End-User Industry Pharmaceutical & Biotechnology Companies Contract Research Organizations (CROs) Academic & Research Institutes Hospitals & Diagnostic Laboratories Environmental Testing Laboratories Food & Beverage Companies Others Laboratory equipment services market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Laboratory Equipment Services Market Key Players:

Major Contributors in the Laboratory Equipment Services Industry in North America: 1. Thermo Fisher Scientific Inc. - Headquarters: Waltham, Massachusetts, United States 2. Agilent Technologies, Inc. - Headquarters: Santa Clara, California, United States 3. Waters Corporation - Headquarters: Milford, Massachusetts, United States 4. PerkinElmer, Inc. - Headquarters: Waltham, Massachusetts, United States 5. Bio-Rad Laboratories, Inc. - Headquarters: Hercules, California, United States 6. Bruker Corporation - Headquarters: Billerica, Massachusetts, United States Leading Figures in the European Laboratory Equipment Services Sector: 1. Merck KGaA - Headquarters: Darmstadt, Germany 2. Eppendorf AG - Headquarters: Hamburg, Germany 3. Sartorius AG - Headquarters: Göttingen, Germany 4. F. Hoffmann-La Roche Ltd - Headquarters: Basel, Switzerland 5. Qiagen N.V. - Headquarters: Venlo, Netherlands Key players driving the Asia-Pacific Laboratory Equipment Services Market: 1. Shimadzu Corporation - Headquarters: Kyoto, Japan 2. Hitachi High-Tech Corporation - Headquarters: Tokyo, Japan 3. PerkinElmer Pty Ltd. - Headquarters: Glen Waverley, Australia 4. Luminex Corporation - Headquarters: North Ryde, Australia FAQs: 1] Which region is expected to hold the highest share in the Global Laboratory Equipment Services Market? Ans. North America region is expected to hold the highest share in the Laboratory Equipment Services Market. 2] What is the market size of the Global Laboratory Equipment Services Market by 2030? Ans. The market size of the Laboratory Equipment Services Market by 2030 is expected to reach US$ 27.88 Billion. 3] What is the forecast period for the Global Laboratory Equipment Services Market? Ans. The forecast period for the Laboratory Equipment Services Market is 2024-2030. 4] What was the market size of the Global Laboratory Equipment Services Market in 2023? Ans. The market size of the Laboratory Equipment Services Market in 2023 was valued at US$ 14.49 Billion.

1. Laboratory Equipment Services Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Laboratory Equipment Services Market: Dynamics 2.1. Laboratory Equipment Services Market Trends by Region 2.1.1. North America Laboratory Equipment Services Market Trends 2.1.2. Europe Laboratory Equipment Services Market Trends 2.1.3. Asia Pacific Laboratory Equipment Services Market Trends 2.1.4. Middle East and Africa Laboratory Equipment Services Market Trends 2.1.5. South America Laboratory Equipment Services Market Trends 2.2. Laboratory Equipment Services Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Laboratory Equipment Services Market Drivers 2.2.1.2. North America Laboratory Equipment Services Market Restraints 2.2.1.3. North America Laboratory Equipment Services Market Opportunities 2.2.1.4. North America Laboratory Equipment Services Market Challenges 2.2.2. Europe 2.2.2.1. Europe Laboratory Equipment Services Market Drivers 2.2.2.2. Europe Laboratory Equipment Services Market Restraints 2.2.2.3. Europe Laboratory Equipment Services Market Opportunities 2.2.2.4. Europe Laboratory Equipment Services Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Laboratory Equipment Services Market Drivers 2.2.3.2. Asia Pacific Laboratory Equipment Services Market Restraints 2.2.3.3. Asia Pacific Laboratory Equipment Services Market Opportunities 2.2.3.4. Asia Pacific Laboratory Equipment Services Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Laboratory Equipment Services Market Drivers 2.2.4.2. Middle East and Africa Laboratory Equipment Services Market Restraints 2.2.4.3. Middle East and Africa Laboratory Equipment Services Market Opportunities 2.2.4.4. Middle East and Africa Laboratory Equipment Services Market Challenges 2.2.5. South America 2.2.5.1. South America Laboratory Equipment Services Market Drivers 2.2.5.2. South America Laboratory Equipment Services Market Restraints 2.2.5.3. South America Laboratory Equipment Services Market Opportunities 2.2.5.4. South America Laboratory Equipment Services Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Laboratory Equipment Services Industry 2.8. Analysis of Government Schemes and Initiatives For Laboratory Equipment Services Industry 2.9. Laboratory Equipment Services Market Trade Analysis 2.10. The Global Pandemic Impact on Laboratory Equipment Services Market 3. Laboratory Equipment Services Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 3.1.1. Calibration Services 3.1.2. Repair and Maintenance Services 3.1.3. Validation Services 3.1.4. Equipment Rental Services 3.1.5. Training Services 3.1.6. Other Services 3.2. Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 3.2.1. Analytical Equipment 3.2.2. General Equipment 3.2.3. Specialty Equipment 3.2.4. Others 3.3. Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 3.3.1. Clinical Diagnostics 3.3.2. Drug Discovery & Development 3.3.3. Biotechnology & Life Sciences Research 3.3.4. Environmental Testing 3.3.5. Food & Beverage Testing 3.3.6. Academic Research 3.3.7. Others 3.4. Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 3.4.1. Pharmaceutical & Biotechnology Companies 3.4.2. Contract Research Organizations (CROs) 3.4.3. Academic & Research Institutes 3.4.4. Hospitals & Diagnostic Laboratories 3.4.5. Environmental Testing Laboratories 3.4.6. Food & Beverage Companies 3.4.7. Others 3.5. Laboratory Equipment Services Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Laboratory Equipment Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 4.1.1. Calibration Services 4.1.2. Repair and Maintenance Services 4.1.3. Validation Services 4.1.4. Equipment Rental Services 4.1.5. Training Services 4.1.6. Other Services 4.2. North America Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 4.2.1. Analytical Equipment 4.2.2. General Equipment 4.2.3. Specialty Equipment 4.2.4. Others 4.3. North America Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 4.3.1. Clinical Diagnostics 4.3.2. Drug Discovery & Development 4.3.3. Biotechnology & Life Sciences Research 4.3.4. Environmental Testing 4.3.5. Food & Beverage Testing 4.3.6. Academic Research 4.3.7. Others 4.4. North America Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 4.4.1. Pharmaceutical & Biotechnology Companies 4.4.2. Contract Research Organizations (CROs) 4.4.3. Academic & Research Institutes 4.4.4. Hospitals & Diagnostic Laboratories 4.4.5. Environmental Testing Laboratories 4.4.6. Food & Beverage Companies 4.4.7. Others 4.5. North America Laboratory Equipment Services Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 4.5.1.1.1. Calibration Services 4.5.1.1.2. Repair and Maintenance Services 4.5.1.1.3. Validation Services 4.5.1.1.4. Equipment Rental Services 4.5.1.1.5. Training Services 4.5.1.1.6. Other Services 4.5.1.2. United States Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 4.5.1.2.1. Analytical Equipment 4.5.1.2.2. General Equipment 4.5.1.2.3. Specialty Equipment 4.5.1.2.4. Others 4.5.1.3. United States Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Clinical Diagnostics 4.5.1.3.2. Drug Discovery & Development 4.5.1.3.3. Biotechnology & Life Sciences Research 4.5.1.3.4. Environmental Testing 4.5.1.3.5. Food & Beverage Testing 4.5.1.3.6. Academic Research 4.5.1.3.7. Others 4.5.1.4. United States Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 4.5.1.4.1. Pharmaceutical & Biotechnology Companies 4.5.1.4.2. Contract Research Organizations (CROs) 4.5.1.4.3. Academic & Research Institutes 4.5.1.4.4. Hospitals & Diagnostic Laboratories 4.5.1.4.5. Environmental Testing Laboratories 4.5.1.4.6. Food & Beverage Companies 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 4.5.2.1.1. Calibration Services 4.5.2.1.2. Repair and Maintenance Services 4.5.2.1.3. Validation Services 4.5.2.1.4. Equipment Rental Services 4.5.2.1.5. Training Services 4.5.2.1.6. Other Services 4.5.2.2. Canada Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 4.5.2.2.1. Analytical Equipment 4.5.2.2.2. General Equipment 4.5.2.2.3. Specialty Equipment 4.5.2.2.4. Others 4.5.2.3. Canada Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Clinical Diagnostics 4.5.2.3.2. Drug Discovery & Development 4.5.2.3.3. Biotechnology & Life Sciences Research 4.5.2.3.4. Environmental Testing 4.5.2.3.5. Food & Beverage Testing 4.5.2.3.6. Academic Research 4.5.2.3.7. Others 4.5.2.4. Canada Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 4.5.2.4.1. Pharmaceutical & Biotechnology Companies 4.5.2.4.2. Contract Research Organizations (CROs) 4.5.2.4.3. Academic & Research Institutes 4.5.2.4.4. Hospitals & Diagnostic Laboratories 4.5.2.4.5. Environmental Testing Laboratories 4.5.2.4.6. Food & Beverage Companies 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 4.5.3.1.1. Calibration Services 4.5.3.1.2. Repair and Maintenance Services 4.5.3.1.3. Validation Services 4.5.3.1.4. Equipment Rental Services 4.5.3.1.5. Training Services 4.5.3.1.6. Other Services 4.5.3.2. Mexico Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 4.5.3.2.1. Analytical Equipment 4.5.3.2.2. General Equipment 4.5.3.2.3. Specialty Equipment 4.5.3.2.4. Others 4.5.3.3. Mexico Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Clinical Diagnostics 4.5.3.3.2. Drug Discovery & Development 4.5.3.3.3. Biotechnology & Life Sciences Research 4.5.3.3.4. Environmental Testing 4.5.3.3.5. Food & Beverage Testing 4.5.3.3.6. Academic Research 4.5.3.3.7. Others 4.5.3.4. Mexico Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 4.5.3.4.1. Pharmaceutical & Biotechnology Companies 4.5.3.4.2. Contract Research Organizations (CROs) 4.5.3.4.3. Academic & Research Institutes 4.5.3.4.4. Hospitals & Diagnostic Laboratories 4.5.3.4.5. Environmental Testing Laboratories 4.5.3.4.6. Food & Beverage Companies 4.5.3.4.7. Others 5. Europe Laboratory Equipment Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.3. Europe Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.4. Europe Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5. Europe Laboratory Equipment Services Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.1.2. United Kingdom Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.1.3. United Kingdom Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.2. France 5.5.2.1. France Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.2.2. France Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.2.3. France Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.3.2. Germany Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.3.3. Germany Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.4.2. Italy Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.4.3. Italy Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.5.2. Spain Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.5.3. Spain Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.6.2. Sweden Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.6.3. Sweden Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.7.2. Austria Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.7.3. Austria Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 5.5.8.2. Rest of Europe Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 5.5.8.3. Rest of Europe Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Laboratory Equipment Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.3. Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5. Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.1.2. China Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.1.3. China Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.2.2. S Korea Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.2.3. S Korea Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.3.2. Japan Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.3.3. Japan Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.4. India 6.5.4.1. India Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.4.2. India Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.4.3. India Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.5.2. Australia Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.5.3. Australia Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.6.2. Indonesia Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.6.3. Indonesia Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.7.2. Malaysia Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.7.3. Malaysia Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.8.2. Vietnam Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.8.3. Vietnam Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.9.2. Taiwan Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.9.3. Taiwan Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Laboratory Equipment Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 7.3. Middle East and Africa Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 7.5. Middle East and Africa Laboratory Equipment Services Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 7.5.1.2. South Africa Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 7.5.1.3. South Africa Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 7.5.2.2. GCC Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 7.5.2.3. GCC Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 7.5.3.2. Nigeria Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 7.5.3.3. Nigeria Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 7.5.4.2. Rest of ME&A Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 7.5.4.3. Rest of ME&A Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 8. South America Laboratory Equipment Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 8.2. South America Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 8.3. South America Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 8.4. South America Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 8.5. South America Laboratory Equipment Services Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 8.5.1.2. Brazil Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 8.5.1.3. Brazil Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 8.5.2.2. Argentina Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 8.5.2.3. Argentina Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Laboratory Equipment Services Market Size and Forecast, by Service Type (2023-2030) 8.5.3.2. Rest Of South America Laboratory Equipment Services Market Size and Forecast, by Equipment Type (2023-2030) 8.5.3.3. Rest Of South America Laboratory Equipment Services Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Laboratory Equipment Services Market Size and Forecast, by End User Industry (2023-2030) 9. Global Laboratory Equipment Services Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Laboratory Equipment Services Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific Inc. - Headquarters: Waltham, Massachusetts, United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Agilent Technologies, Inc. - Headquarters: Santa Clara, California, United States 10.3. Waters Corporation - Headquarters: Milford, Massachusetts, United States 10.4. PerkinElmer, Inc. - Headquarters: Waltham, Massachusetts, United States 10.5. Bio-Rad Laboratories, Inc. - Headquarters: Hercules, California, United States 10.6. Bruker Corporation - Headquarters: Billerica, Massachusetts, United States 10.7. Merck KGaA - Headquarters: Darmstadt, Germany 10.8. Eppendorf AG - Headquarters: Hamburg, Germany 10.9. Sartorius AG - Headquarters: Göttingen, Germany 10.10. F. Hoffmann-La Roche Ltd - Headquarters: Basel, Switzerland 10.11. Qiagen N.V. - Headquarters: Venlo, Netherlands 10.12. Shimadzu Corporation - Headquarters: Kyoto, Japan 10.13. Hitachi High-Tech Corporation - Headquarters: Tokyo, Japan 10.14. PerkinElmer Pty Ltd. - Headquarters: Glen Waverley, Australia 10.15. Luminex Corporation - Headquarters: North Ryde, Australia 11. Key Findings 12. Industry Recommendations 13. Laboratory Equipment Services Market: Research Methodology 14. Terms and Glossary