The global demand for the Superluminescent Diodes market is expected to grow at a CAGR of xx%, xx% xx%, and xx% respectively in Europe, North America, APAC, and the Middle East. The Superluminescent Diodes market was valued at US$ xx Mn in 2019 is expected to reach US$ xx Mn by the end of 2026 at a CAGR of 10.1% from 2019 to 2026. Superluminescent diodes are also known as called superluminescence diodes or superluminescent light-emitting diodes or superluminescent LEDs. Superluminescent diodes are semiconductor devices that emit broadband optical radiation with a smooth spectrum. They are used for optical coherence tomography (OCT), chromatic dispersion measurements, testing of optoelectronic components, and fiber-optic sensors. Other primary applications of Superluminescent diodes are fiber optic gyroscopes (FOGs) and optical coherence tomography (OCT) imaging systems.Global Superluminescent Diodes Market Dynamics:

Development in optoelectronic devices and the growth in the semiconductor industry are fuelling the market growth. For instance, the semiconductor industry revenue is expected to rise 12% in 2021 to about $492 billion compared to $439 billion in 2020, bucking a challenging economic climate due to coronavirus pandemic. The rising adoption of advanced technology such as artificial intelligence, 5G wireless, and machine learning are further boosting the market growth. In the medical industry, optical coherence tomography imaging systems are used to obtain two-dimensional and three-dimensional images of medical imaging that provide a crystal & clear view of biological tissues. For instance, Optical coherence tomography (OCT) provides treatment guidance and earlier detection of the diseases such as glaucoma and diseases of the retina also, they achieve a high resolution compared to X-rays as result this is propelling the market growth of Superluminescent diodes. In December 2020, Nanox had launched Nanox ARC next-generation cold cathode X-ray prototype exhibited the demo version in the Radiology Society of North America (RSNA). The demonstration featured a range of 2-D and 3-D imaging procedures using its groundbreaking digital X-ray tube in a unique multi-source array structure. Manufacturers and researchers are focusing on devices that offer high bandwidth for communications, devices that consume less power, and provides a new outlook in designing thus, this has increased the demand for optoelectronic devices in the aerospace, automotive, military, and medical industry. In additions, companies are coming up with new advance superluminescent diodes and offering a wide variety of Superluminescent Light Emitting Diodes (SLED) for the Near Infrared Range (NIR) at different wavelengths range with different output power and bandwidth values. Technological challenges in developing reliable SLED devices for achieving high optical output powers (over 100 mW) with a smooth spectral profile but the problem can be overcome with proprietary titled waveguide designs and the application of anti-reflection coatings to the facets to suppress the cavity modes. Superluminescent diodes market is showing exponential growth as global key players operating in the Superluminescent diodes market are focusing on technological advancement and as Semiconductor Industry Mergers to continue, for instance, In September, Nvidia announced a plan to buy chip designer Arm for up to $40 billion in cash and stock. In July, Analog Devices announced an agreement to buy Maxim Integrated Products (MXIM) in an all-stock deal worth about $21 billion thus, this has accelerated the market growth. The report has profiled ten key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced technology, trusted vendors are analysis and report has come up with recommendations for a future hot spot in the Asia Pacific. Major country’s policies about manufacturing and their impact on Superluminescent Diodes demand are covered in the report.Global Superluminescent Diodes Market Segment Analysis

To know about the Research Methodology :- Request Free Sample Report

The Medical Diagnostics segment is expected grow at a CAGR of xx% during the forecast period.

By application, in 2019 the global Medical Diagnostics segment was xx% and it is estimated to maintain its position with a value of USD$ XX Mn by 2027. The market growth is attributed to increasing investment in health care sectors & continuous on-going research activity for the development and operational test of opto-electronics devices are driving the market growth. The rising prevalence of chronic and infectious diseases have made many researchers and educational institutions to adopt advances state-of-art facilities that are equipped with fully automated and advanced features which in turn has made a positive impact on the Superluminescent diodes market.Global Superluminescent Diodes Market Regional Insights:

North America is expected to grow at a CAGR of xx% during the forecast period and is expected to reach xx% market share by 2027

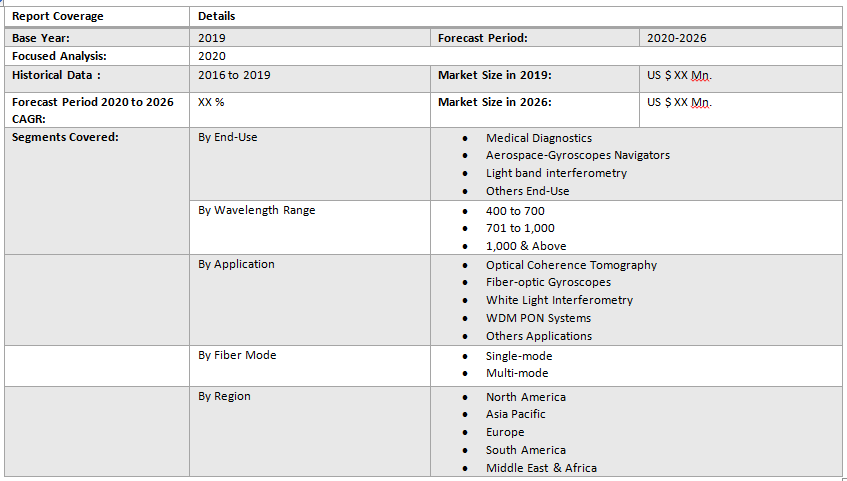

The North American Superluminescent Diodes market holds the leading market share during the forecast period. In North America, the market growth is attributed to the rising inclination towards advanced electric semiconductors such as spintronics optoelectronics, electroluminescent and quantum dots. In addition, increasing demand with quantum computing, miniaturization of devices, cloud computing, and others are a further contribution to the market growth. The Asia Pacific is expected to grow at a CAGR of xx% during the forecast period. Key players are targeting these regions as there is a rising consumer of electronics devices and market players are investing more in innovating new electronic devices this has increased the demand for the Superluminescent diodes market. The objective of the report is to present a comprehensive analysis of the global Superluminescent Diodes market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding global Superluminescent Diodes market dynamics, structure by analyzing the market segments and project global Superluminescent Diodes market clear representation of competitive analysis of key players by price, financial position, by detection and equipment portfolio, growth strategies, and regional presence in the global Superluminescent Diodes market make the report investor’s guide.Report Coverage Details : Inquire before Buying

Key players operating in Global Superluminescent Diodes Market

• Superlum • Thorlabs Inc. • Inphenix, Inc. • EXALOS AG • Anritsu Corporation • QPhotonics, LLC • IINNO Intelligent Innovations • Other

Global Superluminescent Diodes Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Superluminescent Diodes Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Superluminescent Diodes Market Analysis and Forecast 6.1. Superluminescent Diodes Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Superluminescent Diodes Market Analysis and Forecast, by End-Use 7.1. Introduction and Definition 7.2. Key Findings 7.3. Superluminescent Diodes Market Value Share Analysis, by End-Use 7.4. Superluminescent Diodes Market Size (US$ Mn) Forecast, by End-Use 7.5. Superluminescent Diodes Market Analysis, by End-Use 7.6. Superluminescent Diodes Market Attractiveness Analysis, by End-Use 8. Global Superluminescent Diodes Market Analysis and Forecast, by Wavelength Range 8.1. Introduction and Definition 8.2. Key Findings 8.3. Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 8.4. Superluminescent Diodes Market Size (US$ Mn) Forecast, by Wavelength Range 8.5. Superluminescent Diodes Market Analysis, by Wavelength Range 8.6. Superluminescent Diodes Market Attractiveness Analysis, by Wavelength Range 9. Global Superluminescent Diodes Market Analysis and Forecast, by Fiber Mode 9.1. Introduction and Definition 9.2. Key Findings 9.3. Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 9.4. Superluminescent Diodes Market Size (US$ Mn) Forecast, by Fiber Mode 9.5. Superluminescent Diodes Market Analysis, by Fiber Mode 9.6. Superluminescent Diodes Market Attractiveness Analysis, by Fiber Mode 10. Global Superluminescent Diodes Market Analysis and Forecast, by Application 10.1. Introduction and Definition 10.2. Key Findings 10.3. Superluminescent Diodes Market Value Share Analysis, by Application 10.4. Superluminescent Diodes Market Size (US$ Mn) Forecast, by Application 10.5. Superluminescent Diodes Market Analysis, by Application 10.6. Superluminescent Diodes Market Attractiveness Analysis, by Application 11. Global Superluminescent Diodes Market Analysis, by Region 11.1. Superluminescent Diodes Market Value Share Analysis, by Region 11.2. Superluminescent Diodes Market Size (US$ Mn) Forecast, by Region 11.3. Superluminescent Diodes Market Attractiveness Analysis, by Region 12. North America Superluminescent Diodes Market Analysis 12.1. Key Findings 12.2. North America Superluminescent Diodes Market Overview 12.3. North America Superluminescent Diodes Market Value Share Analysis, by End-Use 12.4. North America Superluminescent Diodes Market Forecast, by End-Use 12.4.1. Medical Diagnostics 12.4.2. Aerospace-Gyroscopes Navigators 12.4.3. Light band interferometry 12.4.4. Others End-Use 12.5. North America Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 12.6. North America Superluminescent Diodes Market Forecast, by Wavelength Range 12.6.1. 400 to 700 12.6.2. 701 to 1,000 12.6.3. 1,000 & Above 12.7. North America Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 12.8. North America Superluminescent Diodes Market Forecast, by Fiber Mode 12.8.1. Single-mode 12.8.2. Multi-mode 12.9. North America Superluminescent Diodes Market Value Share Analysis, by Application 12.10. North America Superluminescent Diodes Market Forecast, by Application 12.10.1. Optical Coherence Tomography 12.10.2. Fiber-optic Gyroscopes 12.10.3. White Light Interferometry 12.10.4. WDM PON Systems 12.10.5. Others Applications 12.11. North America Superluminescent Diodes Market Value Share Analysis, by Country 12.12. North America Superluminescent Diodes Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.12.3. Mexico 12.13. North America Superluminescent Diodes Market Analysis, by Country 12.14. U.S. Superluminescent Diodes Market Forecast, by End-Use 12.14.1. Medical Diagnostics 12.14.2. Aerospace-Gyroscopes Navigators 12.14.3. Light band interferometry 12.14.4. Others End-Use 12.15. U.S. Superluminescent Diodes Market Forecast, by Wavelength Range 12.15.1. 400 to 700 12.15.2. 701 to 1,000 12.15.3. 1,000 & Above 12.16. U.S. Superluminescent Diodes Market Forecast, by Fiber Mode 12.16.1. Single-mode 12.16.2. Multi-mode 12.17. U.S. Superluminescent Diodes Market Forecast, by Application 12.17.1. Optical Coherence Tomography 12.17.2. Fiber-optic Gyroscopes 12.17.3. White Light Interferometry 12.17.4. WDM PON Systems 12.17.5. Others Applications 12.18. Canada Superluminescent Diodes Market Forecast, by End-Use 12.18.1. Medical Diagnostics 12.18.2. Aerospace-Gyroscopes Navigators 12.18.3. Light band interferometry 12.18.4. Others End-Use 12.19. Canada Superluminescent Diodes Market Forecast, by Wavelength Range 12.19.1. 400 to 700 12.19.2. 701 to 1,000 12.19.3. 1,000 & Above 12.20. Canada Superluminescent Diodes Market Forecast, by Fiber Mode 12.20.1. Single-mode 12.20.2. Multi-mode 12.21. Canada Superluminescent Diodes Market Forecast, by Application 12.21.1. Optical Coherence Tomography 12.21.2. Fiber-optic Gyroscopes 12.21.3. White Light Interferometry 12.21.4. WDM PON Systems 12.21.5. Others Applications 12.22. Mexico Superluminescent Diodes Market Forecast, by End-Use 12.22.1. Medical Diagnostics 12.22.2. Aerospace-Gyroscopes Navigators 12.22.3. Light band interferometry 12.22.4. Others End-Use 12.23. Mexico Superluminescent Diodes Market Forecast, by Wavelength Range 12.23.1. 400 to 700 12.23.2. 701 to 1,000 12.23.3. 1,000 & Above 12.24. Mexico Superluminescent Diodes Market Forecast, by Fiber Mode 12.24.1. Single-mode 12.24.2. Multi-mode 12.25. Mexico Superluminescent Diodes Market Forecast, by Application 12.25.1. Optical Coherence Tomography 12.25.2. Fiber-optic Gyroscopes 12.25.3. White Light Interferometry 12.25.4. WDM PON Systems 12.25.5. Others Applications 12.26. North America Superluminescent Diodes Market Attractiveness Analysis 12.26.1. By End-Use 12.26.2. By Wavelength Range 12.26.3. By Fiber Mode 12.26.4. By Application 12.27. PEST Analysis 12.28. Key Trends 12.29. Key Developments 13. Europe Superluminescent Diodes Market Analysis 13.1. Key Findings 13.2. Europe Superluminescent Diodes Market Overview 13.3. Europe Superluminescent Diodes Market Value Share Analysis, by End-Use 13.4. Europe Superluminescent Diodes Market Forecast, by End-Use 13.4.1. Medical Diagnostics 13.4.2. Aerospace-Gyroscopes Navigators 13.4.3. Light band interferometry 13.4.4. Others End-Use 13.5. Europe Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 13.6. Europe Superluminescent Diodes Market Forecast, by Wavelength Range 13.6.1. 400 to 700 13.6.2. 701 to 1,000 13.6.3. 1,000 & Above 13.7. Europe Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 13.8. Europe Superluminescent Diodes Market Forecast, by Fiber Mode 13.8.1. Single-mode 13.8.2. Multi-mode 13.9. Europe Superluminescent Diodes Market Value Share Analysis, by Application 13.10. Europe Superluminescent Diodes Market Forecast, by Application 13.10.1. Optical Coherence Tomography 13.10.2. Fiber-optic Gyroscopes 13.10.3. White Light Interferometry 13.10.4. WDM PON Systems 13.10.5. Others Applications 13.11. Europe Superluminescent Diodes Market Value Share Analysis, by Country 13.12. Europe Superluminescent Diodes Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Sweden 13.12.7. CIS countries 13.12.8. Rest of Europe 13.13. Germany Superluminescent Diodes Market Forecast, by End-Use 13.13.1. Medical Diagnostics 13.13.2. Aerospace-Gyroscopes Navigators 13.13.3. Light band interferometry 13.13.4. Others End-Use 13.14. Germany Superluminescent Diodes Market Forecast, by Wavelength Range 13.14.1. 400 to 700 13.14.2. 701 to 1,000 13.14.3. 1,000 & Above 13.15. Germany Superluminescent Diodes Market Forecast, by Fiber Mode 13.15.1. Single-mode 13.15.2. Multi-mode 13.16. Germany Superluminescent Diodes Market Forecast, by Application 13.16.1. Optical Coherence Tomography 13.16.2. Fiber-optic Gyroscopes 13.16.3. White Light Interferometry 13.16.4. WDM PON Systems 13.16.5. Others Applications 13.17. U.K. Superluminescent Diodes Market Forecast, by End-Use 13.17.1. Medical Diagnostics 13.17.2. Aerospace-Gyroscopes Navigators 13.17.3. Light band interferometry 13.17.4. Others End-Use 13.18. U.K. Superluminescent Diodes Market Forecast, by Wavelength Range 13.18.1. 400 to 700 13.18.2. 701 to 1,000 13.18.3. 1,000 & Above 13.19. U.K. Superluminescent Diodes Market Forecast, by Fiber Mode 13.19.1. Single-mode 13.19.2. Multi-mode 13.20. U.K. Superluminescent Diodes Market Forecast, by Application 13.20.1. Optical Coherence Tomography 13.20.2. Fiber-optic Gyroscopes 13.20.3. White Light Interferometry 13.20.4. WDM PON Systems 13.20.5. Others Applications 13.21. France Superluminescent Diodes Market Forecast, by End-Use 13.21.1. Medical Diagnostics 13.21.2. Aerospace-Gyroscopes Navigators 13.21.3. Light band interferometry 13.21.4. Others End-Use 13.22. France Superluminescent Diodes Market Forecast, by Wavelength Range 13.22.1. 400 to 700 13.22.2. 701 to 1,000 13.22.3. 1,000 & Above 13.23. France Superluminescent Diodes Market Forecast, by Fiber Mode 13.23.1. Single-mode 13.23.2. Multi-mode 13.24. France Superluminescent Diodes Market Forecast, by Application 13.24.1. Optical Coherence Tomography 13.24.2. Fiber-optic Gyroscopes 13.24.3. White Light Interferometry 13.24.4. WDM PON Systems 13.24.5. Others Applications 13.25. Italy Superluminescent Diodes Market Forecast, by End-Use 13.25.1. Medical Diagnostics 13.25.2. Aerospace-Gyroscopes Navigators 13.25.3. Light band interferometry 13.25.4. Others End-Use 13.26. Italy Superluminescent Diodes Market Forecast, by Wavelength Range 13.26.1. 400 to 700 13.26.2. 701 to 1,000 13.26.3. 1,000 & Above 13.27. Italy Superluminescent Diodes Market Forecast, by Fiber Mode 13.27.1. Single-mode 13.27.2. Multi-mode 13.28. Italy Superluminescent Diodes Market Forecast, by Application 13.28.1. Optical Coherence Tomography 13.28.2. Fiber-optic Gyroscopes 13.28.3. White Light Interferometry 13.28.4. WDM PON Systems 13.28.5. Others Applications 13.29. Spain Superluminescent Diodes Market Forecast, by End-Use 13.29.1. Medical Diagnostics 13.29.2. Aerospace-Gyroscopes Navigators 13.29.3. Light band interferometry 13.29.4. Others End-Use 13.30. Spain Superluminescent Diodes Market Forecast, by Wavelength Range 13.30.1. 400 to 700 13.30.2. 701 to 1,000 13.30.3. 1,000 & Above 13.31. Spain Superluminescent Diodes Market Forecast, by Fiber Mode 13.31.1. Single-mode 13.31.2. Multi-mode 13.32. Spain Superluminescent Diodes Market Forecast, by Application 13.32.1. Optical Coherence Tomography 13.32.2. Fiber-optic Gyroscopes 13.32.3. White Light Interferometry 13.32.4. WDM PON Systems 13.32.5. Others Applications 13.33. Sweden Superluminescent Diodes Market Forecast, by End-Use 13.33.1. Medical Diagnostics 13.33.2. Aerospace-Gyroscopes Navigators 13.33.3. Light band interferometry 13.33.4. Others End-Use 13.34. Sweden Superluminescent Diodes Market Forecast, by Wavelength Range 13.34.1. 400 to 700 13.34.2. 701 to 1,000 13.34.3. 1,000 & Above 13.35. Sweden Superluminescent Diodes Market Forecast, by Fiber Mode 13.35.1. Single-mode 13.35.2. Multi-mode 13.36. Sweden Superluminescent Diodes Market Forecast, by Application 13.36.1. Optical Coherence Tomography 13.36.2. Fiber-optic Gyroscopes 13.36.3. White Light Interferometry 13.36.4. WDM PON Systems 13.36.5. Others Applications 13.37. CIS countries Superluminescent Diodes Market Forecast, by End-Use 13.37.1. Medical Diagnostics 13.37.2. Aerospace-Gyroscopes Navigators 13.37.3. Light band interferometry 13.37.4. Others End-Use 13.38. CIS countries Superluminescent Diodes Market Forecast, by Wavelength Range 13.38.1. 400 to 700 13.38.2. 701 to 1,000 13.38.3. 1,000 & Above 13.39. CIS countries Superluminescent Diodes Market Forecast, by Fiber Mode 13.39.1. Single-mode 13.39.2. Multi-mode 13.40. CIS countries Superluminescent Diodes Market Forecast, by Application 13.40.1. Optical Coherence Tomography 13.40.2. Fiber-optic Gyroscopes 13.40.3. White Light Interferometry 13.40.4. WDM PON Systems 13.40.5. Others Applications 13.41. Rest of Europe Superluminescent Diodes Market Forecast, by End-Use 13.41.1. Medical Diagnostics 13.41.2. Aerospace-Gyroscopes Navigators 13.41.3. Light band interferometry 13.41.4. Others End-Use 13.42. Rest of Europe Superluminescent Diodes Market Forecast, by Wavelength Range 13.42.1. 400 to 700 13.42.2. 701 to 1,000 13.42.3. 1,000 & Above 13.43. Rest of Europe Superluminescent Diodes Market Forecast, by Fiber Mode 13.43.1. Single-mode 13.43.2. Multi-mode 13.44. Rest of Europe Superluminescent Diodes Market Forecast, by Application 13.44.1. Optical Coherence Tomography 13.44.2. Fiber-optic Gyroscopes 13.44.3. White Light Interferometry 13.44.4. WDM PON Systems 13.44.5. Others Applications 13.45. Europe Superluminescent Diodes Market Attractiveness Analysis 13.45.1. By End-Use 13.45.2. By Wavelength Range 13.45.3. By Fiber Mode 13.45.4. By Application 13.46. PEST Analysis 13.47. Key Trends 13.48. Key Developments 14. Asia Pacific Superluminescent Diodes Market Analysis 14.1. Key Findings 14.2. Asia Pacific Superluminescent Diodes Market Overview 14.3. Asia Pacific Superluminescent Diodes Market Value Share Analysis, by End-Use 14.4. Asia Pacific Superluminescent Diodes Market Forecast, by End-Use 14.4.1. Medical Diagnostics 14.4.2. Aerospace-Gyroscopes Navigators 14.4.3. Light band interferometry 14.4.4. Others End-Use 14.5. Asia Pacific Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 14.6. Asia Pacific Superluminescent Diodes Market Forecast, by Wavelength Range 14.6.1. 400 to 700 14.6.2. 701 to 1,000 14.6.3. 1,000 & Above 14.7. Asia Pacific Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 14.8. Asia Pacific Superluminescent Diodes Market Forecast, by Fiber Mode 14.8.1. Single-mode 14.8.2. Multi-mode 14.9. Asia Pacific Superluminescent Diodes Market Value Share Analysis, by Application 14.10. Asia Pacific Superluminescent Diodes Market Forecast, by Application 14.10.1. Optical Coherence Tomography 14.10.2. Fiber-optic Gyroscopes 14.10.3. White Light Interferometry 14.10.4. WDM PON Systems 14.10.5. Others Applications 14.11. Asia Pacific Superluminescent Diodes Market Value Share Analysis, by Country 14.12. Asia Pacific Superluminescent Diodes Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. South Korea 14.12.5. Australia 14.12.6. ASEAN 14.12.7. Rest of Asia Pacific 14.13. China Superluminescent Diodes Market Forecast, by End-Use 14.13.1. Medical Diagnostics 14.13.2. Aerospace-Gyroscopes Navigators 14.13.3. Light band interferometry 14.13.4. Others End-Use 14.14. China Superluminescent Diodes Market Forecast, by Wavelength Range 14.14.1. 400 to 700 14.14.2. 701 to 1,000 14.14.3. 1,000 & Above 14.15. China Superluminescent Diodes Market Forecast, by Fiber Mode 14.15.1. Single-mode 14.15.2. Multi-mode 14.16. China Superluminescent Diodes Market Forecast, by Application 14.16.1. Optical Coherence Tomography 14.16.2. Fiber-optic Gyroscopes 14.16.3. White Light Interferometry 14.16.4. WDM PON Systems 14.16.5. Others Applications 14.17. India Superluminescent Diodes Market Forecast, by End-Use 14.17.1. Medical Diagnostics 14.17.2. Aerospace-Gyroscopes Navigators 14.17.3. Light band interferometry 14.17.4. Others End-Use 14.18. India Superluminescent Diodes Market Forecast, by Wavelength Range 14.18.1. 400 to 700 14.18.2. 701 to 1,000 14.18.3. 1,000 & Above 14.19. India Superluminescent Diodes Market Forecast, by Fiber Mode 14.19.1. Single-mode 14.19.2. Multi-mode 14.20. India Superluminescent Diodes Market Forecast, by Application 14.20.1. Optical Coherence Tomography 14.20.2. Fiber-optic Gyroscopes 14.20.3. White Light Interferometry 14.20.4. WDM PON Systems 14.20.5. Others Applications 14.21. Japan Superluminescent Diodes Market Forecast, by End-Use 14.21.1. Medical Diagnostics 14.21.2. Aerospace-Gyroscopes Navigators 14.21.3. Light band interferometry 14.21.4. Others End-Use 14.22. Japan Superluminescent Diodes Market Forecast, by Wavelength Range 14.22.1. 400 to 700 14.22.2. 701 to 1,000 14.22.3. 1,000 & Above 14.23. Japan Superluminescent Diodes Market Forecast, by Fiber Mode 14.23.1. Single-mode 14.23.2. Multi-mode 14.24. Japan Superluminescent Diodes Market Forecast, by Application 14.24.1. Optical Coherence Tomography 14.24.2. Fiber-optic Gyroscopes 14.24.3. White Light Interferometry 14.24.4. WDM PON Systems 14.24.5. Others Applications 14.25. South Korea Superluminescent Diodes Market Forecast, by End-Use 14.25.1. Medical Diagnostics 14.25.2. Aerospace-Gyroscopes Navigators 14.25.3. Light band interferometry 14.25.4. Others End-Use 14.26. South Korea Superluminescent Diodes Market Forecast, by Wavelength Range 14.26.1. 400 to 700 14.26.2. 701 to 1,000 14.26.3. 1,000 & Above 14.27. South Korea Superluminescent Diodes Market Forecast, by Fiber Mode 14.27.1. Single-mode 14.27.2. Multi-mode 14.28. South Korea Superluminescent Diodes Market Forecast, by Application 14.28.1. Optical Coherence Tomography 14.28.2. Fiber-optic Gyroscopes 14.28.3. White Light Interferometry 14.28.4. WDM PON Systems 14.28.5. Others Applications 14.29. Australia Superluminescent Diodes Market Forecast, by End-Use 14.29.1. Medical Diagnostics 14.29.2. Aerospace-Gyroscopes Navigators 14.29.3. Light band interferometry 14.29.4. Others End-Use 14.30. Australia Superluminescent Diodes Market Forecast, by Wavelength Range 14.30.1. 400 to 700 14.30.2. 701 to 1,000 14.30.3. 1,000 & Above 14.31. Australia Superluminescent Diodes Market Forecast, by Fiber Mode 14.31.1. Single-mode 14.31.2. Multi-mode 14.32. Australia Superluminescent Diodes Market Forecast, by Application 14.32.1. Optical Coherence Tomography 14.32.2. Fiber-optic Gyroscopes 14.32.3. White Light Interferometry 14.32.4. WDM PON Systems 14.32.5. Others Applications 14.33. ASEAN Superluminescent Diodes Market Forecast, by End-Use 14.33.1. Medical Diagnostics 14.33.2. Aerospace-Gyroscopes Navigators 14.33.3. Light band interferometry 14.33.4. Others End-Use 14.34. ASEAN Superluminescent Diodes Market Forecast, by Wavelength Range 14.34.1. 400 to 700 14.34.2. 701 to 1,000 14.34.3. 1,000 & Above 14.35. ASEAN Superluminescent Diodes Market Forecast, by Fiber Mode 14.35.1. Single-mode 14.35.2. Multi-mode 14.36. ASEAN Superluminescent Diodes Market Forecast, by Application 14.36.1. Optical Coherence Tomography 14.36.2. Fiber-optic Gyroscopes 14.36.3. White Light Interferometry 14.36.4. WDM PON Systems 14.36.5. Others Applications 14.37. Rest of Asia Pacific Superluminescent Diodes Market Forecast, by End-Use 14.37.1. Medical Diagnostics 14.37.2. Aerospace-Gyroscopes Navigators 14.37.3. Light band interferometry 14.37.4. Others End-Use 14.38. Rest of Asia Pacific Superluminescent Diodes Market Forecast, by Wavelength Range 14.38.1. 400 to 700 14.38.2. 701 to 1,000 14.38.3. 1,000 & Above 14.39. Rest of Asia Pacific Superluminescent Diodes Market Forecast, by Fiber Mode 14.39.1. Single-mode 14.39.2. Multi-mode 14.40. Rest of Asia Pacific Superluminescent Diodes Market Forecast, by Application 14.40.1. Optical Coherence Tomography 14.40.2. Fiber-optic Gyroscopes 14.40.3. White Light Interferometry 14.40.4. WDM PON Systems 14.40.5. Others Applications 14.41. Asia Pacific Superluminescent Diodes Market Attractiveness Analysis 14.41.1. By End-Use 14.41.2. By Wavelength Range 14.41.3. By Fiber Mode 14.41.4. By Application 14.42. PEST Analysis 14.43. Key Trends 14.44. Key Developments 15. Middle East & Africa Superluminescent Diodes Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Superluminescent Diodes Market Overview 15.3. Middle East & Africa Superluminescent Diodes Market Value Share Analysis, by End-Use 15.4. Middle East & Africa Superluminescent Diodes Market Forecast, by End-Use 15.4.1. Medical Diagnostics 15.4.2. Aerospace-Gyroscopes Navigators 15.4.3. Light band interferometry 15.4.4. Others End-Use 15.5. Middle East & Africa Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 15.6. Middle East & Africa Superluminescent Diodes Market Forecast, by Wavelength Range 15.6.1. 400 to 700 15.6.2. 701 to 1,000 15.6.3. 1,000 & Above 15.7. Middle East & Africa Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 15.8. Middle East & Africa Superluminescent Diodes Market Forecast, by Fiber Mode 15.8.1. Single-mode 15.8.2. Multi-mode 15.9. Middle East & Africa Superluminescent Diodes Market Value Share Analysis, by Application 15.10. Middle East & Africa Superluminescent Diodes Market Forecast, by Application 15.10.1. Optical Coherence Tomography 15.10.2. Fiber-optic Gyroscopes 15.10.3. White Light Interferometry 15.10.4. WDM PON Systems 15.10.5. Others Applications 15.11. Middle East & Africa Superluminescent Diodes Market Value Share Analysis, by Country 15.12. Middle East & Africa Superluminescent Diodes Market Forecast, by Country 15.12.1. GCC countries 15.12.2. Nigeria 15.12.3. Egypt 15.12.4. South Africa 15.12.5. Rest of Middle East & Africa 15.13. GCC countries Superluminescent Diodes Market Forecast, by End-Use 15.13.1. Medical Diagnostics 15.13.2. Aerospace-Gyroscopes Navigators 15.13.3. Light band interferometry 15.13.4. Others End-Use 15.14. GCC countries Superluminescent Diodes Market Forecast, by Wavelength Range 15.14.1. 400 to 700 15.14.2. 701 to 1,000 15.14.3. 1,000 & Above 15.15. GCC countries Superluminescent Diodes Market Forecast, by Fiber Mode 15.15.1. Single-mode 15.15.2. Multi-mode 15.16. GCC countries Superluminescent Diodes Market Forecast, by Application 15.16.1. Optical Coherence Tomography 15.16.2. Fiber-optic Gyroscopes 15.16.3. White Light Interferometry 15.16.4. WDM PON Systems 15.16.5. Others Applications 15.17. Nigeria Superluminescent Diodes Market Forecast, by End-Use 15.17.1. Medical Diagnostics 15.17.2. Aerospace-Gyroscopes Navigators 15.17.3. Light band interferometry 15.17.4. Others End-Use 15.18. Nigeria Superluminescent Diodes Market Forecast, by Wavelength Range 15.18.1. 400 to 700 15.18.2. 701 to 1,000 15.18.3. 1,000 & Above 15.19. Nigeria Superluminescent Diodes Market Forecast, by Fiber Mode 15.19.1. Single-mode 15.19.2. Multi-mode 15.20. Nigeria Superluminescent Diodes Market Forecast, by Application 15.20.1. Optical Coherence Tomography 15.20.2. Fiber-optic Gyroscopes 15.20.3. White Light Interferometry 15.20.4. WDM PON Systems 15.20.5. Others Applications 15.21. South Africa Superluminescent Diodes Market Forecast, by End-Use 15.21.1. Medical Diagnostics 15.21.2. Aerospace-Gyroscopes Navigators 15.21.3. Light band interferometry 15.21.4. Others End-Use 15.22. South Africa Superluminescent Diodes Market Forecast, by Wavelength Range 15.22.1. 400 to 700 15.22.2. 701 to 1,000 15.22.3. 1,000 & Above 15.23. South Africa Superluminescent Diodes Market Forecast, by Fiber Mode 15.23.1. Single-mode 15.23.2. Multi-mode 15.24. South Africa Superluminescent Diodes Market Forecast, by Application 15.24.1. Optical Coherence Tomography 15.24.2. Fiber-optic Gyroscopes 15.24.3. White Light Interferometry 15.24.4. WDM PON Systems 15.24.5. Others Applications 15.25. Rest of Middle East & Africa Superluminescent Diodes Market Forecast, by End-Use 15.25.1. Medical Diagnostics 15.25.2. Aerospace-Gyroscopes Navigators 15.25.3. Light band interferometry 15.25.4. Others End-Use 15.26. Rest of Middle East & Africa Superluminescent Diodes Market Forecast, by Wavelength Range 15.26.1. 400 to 700 15.26.2. 701 to 1,000 15.26.3. 1,000 & Above 15.27. Rest of Middle East & Africa Superluminescent Diodes Market Forecast, by Fiber Mode 15.27.1. Single-mode 15.27.2. Multi-mode 15.28. Rest of Middle East & Africa Superluminescent Diodes Market Forecast, by Application 15.28.1. Optical Coherence Tomography 15.28.2. Fiber-optic Gyroscopes 15.28.3. White Light Interferometry 15.28.4. WDM PON Systems 15.28.5. Others Applications 15.29. Middle East & Africa Superluminescent Diodes Market Attractiveness Analysis 15.29.1. By End-Use 15.29.2. By Wavelength Range 15.29.3. By Fiber Mode 15.29.4. By Application 15.30. PEST Analysis 15.31. Key Trends 15.32. Key Developments 16. South America Superluminescent Diodes Market Analysis 16.1. Key Findings 16.2. South America Superluminescent Diodes Market Overview 16.3. South America Superluminescent Diodes Market Value Share Analysis, by End-Use 16.4. South America Superluminescent Diodes Market Forecast, by End-Use 16.4.1. Medical Diagnostics 16.4.2. Aerospace-Gyroscopes Navigators 16.4.3. Light band interferometry 16.4.4. Others End-Use 16.5. South America Superluminescent Diodes Market Value Share Analysis, by Wavelength Range 16.6. South America Superluminescent Diodes Market Forecast, by Wavelength Range 16.6.1. 400 to 700 16.6.2. 701 to 1,000 16.6.3. 1,000 & Above 16.7. South America Superluminescent Diodes Market Value Share Analysis, by Fiber Mode 16.8. South America Superluminescent Diodes Market Forecast, by Fiber Mode 16.8.1. Single-mode 16.8.2. Multi-mode 16.9. South America Superluminescent Diodes Market Value Share Analysis, by Application 16.10. South America Superluminescent Diodes Market Forecast, by Application 16.10.1. Optical Coherence Tomography 16.10.2. Fiber-optic Gyroscopes 16.10.3. White Light Interferometry 16.10.4. WDM PON Systems 16.10.5. Others Applications 16.11. South America Superluminescent Diodes Market Value Share Analysis, by Country 16.12. South America Superluminescent Diodes Market Forecast, by Country 16.12.1. Brazil 16.12.2. Colombia 16.12.3. Argentina 16.12.4. Rest of South America 16.13. Brazil Superluminescent Diodes Market Forecast, by End-Use 16.13.1. Medical Diagnostics 16.13.2. Aerospace-Gyroscopes Navigators 16.13.3. Light band interferometry 16.13.4. Others End-Use 16.14. Brazil Superluminescent Diodes Market Forecast, by Wavelength Range 16.14.1. 400 to 700 16.14.2. 701 to 1,000 16.14.3. 1,000 & Above 16.15. Brazil Superluminescent Diodes Market Forecast, by Fiber Mode 16.15.1. Single-mode 16.15.2. Multi-mode 16.16. Brazil Superluminescent Diodes Market Forecast, by Application 16.16.1. Optical Coherence Tomography 16.16.2. Fiber-optic Gyroscopes 16.16.3. White Light Interferometry 16.16.4. WDM PON Systems 16.16.5. Others Applications 16.17. Argentina Superluminescent Diodes Market Forecast, by End-Use 16.17.1. Medical Diagnostics 16.17.2. Aerospace-Gyroscopes Navigators 16.17.3. Light band interferometry 16.17.4. Others End-Use 16.18. Argentina Superluminescent Diodes Market Forecast, by Wavelength Range 16.18.1. 400 to 700 16.18.2. 701 to 1,000 16.18.3. 1,000 & Above 16.19. Argentina Superluminescent Diodes Market Forecast, by Fiber Mode 16.19.1. Single-mode 16.19.2. Multi-mode 16.20. Argentina Superluminescent Diodes Market Forecast, by Application 16.20.1. Optical Coherence Tomography 16.20.2. Fiber-optic Gyroscopes 16.20.3. White Light Interferometry 16.20.4. WDM PON Systems 16.20.5. Others Applications 16.21. Colombia Superluminescent Diodes Market Forecast, by End-Use 16.21.1. Medical Diagnostics 16.21.2. Aerospace-Gyroscopes Navigators 16.21.3. Light band interferometry 16.21.4. Others End-Use 16.22. Colombia Superluminescent Diodes Market Forecast, by Wavelength Range 16.22.1. 400 to 700 16.22.2. 701 to 1,000 16.22.3. 1,000 & Above 16.23. Colombia Superluminescent Diodes Market Forecast, by Fiber Mode 16.23.1. Single-mode 16.23.2. Multi-mode 16.24. Colombia Superluminescent Diodes Market Forecast, by Application 16.24.1. Optical Coherence Tomography 16.24.2. Fiber-optic Gyroscopes 16.24.3. White Light Interferometry 16.24.4. WDM PON Systems 16.24.5. Others Applications 16.25. Rest of South America Superluminescent Diodes Market Forecast, by End-Use 16.25.1. Medical Diagnostics 16.25.2. Aerospace-Gyroscopes Navigators 16.25.3. Light band interferometry 16.25.4. Others End-Use 16.26. Rest of South America Superluminescent Diodes Market Forecast, by Wavelength Range 16.26.1. 400 to 700 16.26.2. 701 to 1,000 16.26.3. 1,000 & Above 16.27. Rest of South America Superluminescent Diodes Market Forecast, by Fiber Mode 16.27.1. Single-mode 16.27.2. Multi-mode 16.28. Rest of South America Superluminescent Diodes Market Forecast, by Application 16.28.1. Optical Coherence Tomography 16.28.2. Fiber-optic Gyroscopes 16.28.3. White Light Interferometry 16.28.4. WDM PON Systems 16.28.5. Others Applications 16.29. South America Superluminescent Diodes Market Attractiveness Analysis 16.29.1. By End-Use 16.29.2. By Wavelength Range 16.29.3. By Fiber Mode 16.29.4. By Application 16.30. PEST Analysis 16.31. Key Trends 16.32. Key Developments 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications, and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Application 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. Superlum 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Product Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Development Footprint 17.3.2. Thorlabs Inc. 17.3.3. Inphenix, Inc. 17.3.4. EXALOS AG 17.3.5. Anritsu Corporation 17.3.6. QPhotonics, LLC 17.3.7. IINNO Intelligent Innovations 17.3.8. Others 18. Primary key Insights