The Student Information System Market size was valued at USD 23.41 Bn in 2023 and market revenue is growing at a CAGR of 14.2 % from 2023 to 2030, reaching nearly USD 59.30 Bn by 2030.Student Information System Market Overview:

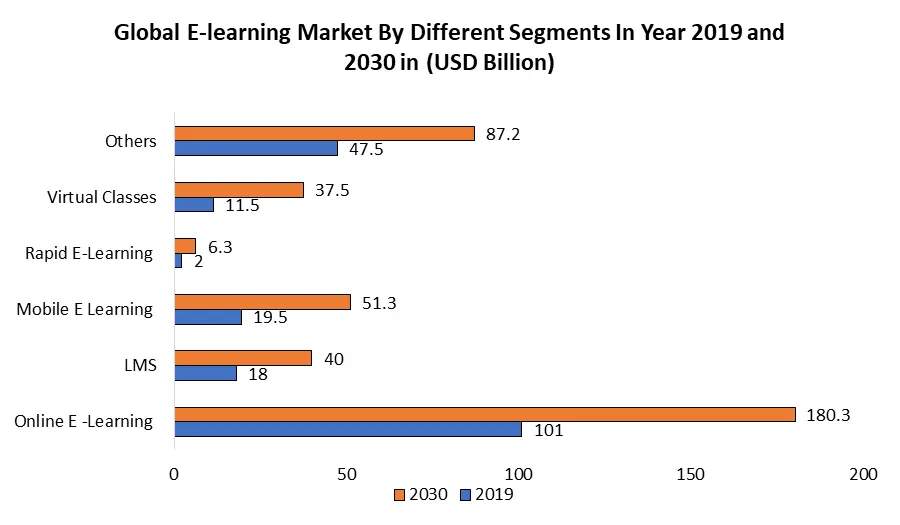

The Student Information System market is undergoing significant growth, driven by the transition from traditional paper-based systems to digital platforms. SIS solutions are increasingly favored by educational institutions across the globe for streamlining administrative tasks throughout the student lifecycle. These systems consolidate various aspects of student management into a single, user-friendly platform, offering features such as AI integration, mobile accessibility, and self-service capabilities to enhance the student experience.To know about the Research Methodology:-Request Free Sample Report The COVID-19 pandemic accelerated the demand for the Student Information System Market, with the sudden shift to online education prompting institutions to adopt digital solutions to sustain academic activities. According to the MMR Study report in March 2021, around 1.3 billion learners globally transitioned to online learning due to the closure of physical educational institutions. This surge in e-learning is expected to continue post-pandemic as organizations prioritize digital readiness to address future disruptions. Technological advancements, including internet accessibility and cloud computing, are important in facilitating the growth of Student Information System solutions. These advancements enable seamless access to student data from anywhere, at any time, contributing to operational efficiency and data security. Also, regulatory compliance requirements, such as those outlined by FERPA, have boosted the adoption of robust and secure SIS platforms to safeguard sensitive student information.

Student Information System Market Dynamics:

Diver Increasing Demand for automation Boost the Student Information System Market The increasing demand for automation is a significant driver behind the growth of the Student Information System market due to several reasons. Educational institutions face a myriad of administrative tasks, including enrollment, scheduling, grading, and reporting, which are often time-consuming and prone to errors when performed manually. SIS solutions automate these processes, leading to increased efficiency, reduced workload, and improved accuracy. Automation enables real-time data management and analysis, providing administrators with valuable insights into student performance, attendance, and behavior. This data-driven approach allows institutions to make informed decisions to enhance teaching and learning experiences, ultimately improving student outcomes. Also, automation facilitates seamless communication between stakeholders, including students, parents, teachers, and administrators, fostering collaboration and engagement within the educational community. By streamlining workflows and enhancing communication, SIS solutions contribute to overall organizational effectiveness and competitiveness in the education sector. The growing demand for automation in education drives the adoption of SIS solutions, driving the growth of the Student Information System Market as institutions seek to modernize their operations and stay ahead in a rapidly evolving landscape.Student Information System Features

Restrain Data Privacy and Security Concerns Limits the Student Information System Market Growth Data privacy and security concerns significantly limit the growth of the Student Information System market due to several reasons. Educational institutions are custodians of vast amounts of sensitive student data, including personal information, academic records, and sometimes even financial details. Any breach of this data lead to severe consequences, including legal liabilities, damage to reputation, and loss of trust among students, parents, and other stakeholders. The regulatory landscape governing data privacy and security in education is increasingly stringent. Institutions must comply with laws such as the Family Educational Rights and Privacy Act (FERPA) in the United States and the General Data Protection Regulation (GDPR) in the European Union, among others. Failure to meet these regulatory requirements results in fines, penalties, and other sanctions, further incentivizing institutions to prioritize data security. Also, the high-profile nature of data breaches in the education sector has heightened awareness and scrutiny surrounding data privacy and security practices. Educational institutions face constant threats from cyberattacks, phishing scams, and insider threats, making robust cybersecurity measures imperative. These concerns create hesitancy among educational institutions to adopt SIS solutions, especially if they perceive existing systems as more secure or if they lack confidence in the ability of SIS providers to safeguard their data adequately. As a result, addressing data privacy and security concerns is essential for SIS vendors to gain the trust and confidence of potential customers and unlock the full growth potential of the Student Information System Market. Opportunity Rising Adoption of Online Learning Creates Lucrative Growth Opportunities for The Student Information System Market Growth The rising adoption of online learning creates lucrative growth opportunities for the Student Information System market due to several key reasons. As educational institutions increasingly transition to online learning models, the demand for robust SIS solutions that support virtual classrooms, remote student engagement tools, and comprehensive online learning management features is on the rise. SIS platforms play a crucial role in facilitating the administration and management of online courses, including enrollment, scheduling, grading, and communication between students and instructors. The COVID-19 pandemic has accelerated the adoption of online learning solutions, prompting institutions to invest in technology infrastructure and digital platforms to ensure continuity of education. This sudden shift to online learning has highlighted the importance of reliable and efficient SIS solutions in supporting remote teaching and learning processes, creating a significant market opportunity for SIS vendors. Also, online learning environments generate vast amounts of data on student performance, engagement, and behaviour, which is leveraged to inform instructional design, personalize learning experiences, and identify at-risk students. SIS solutions with advanced analytics capabilities enable institutions to harness this data effectively, driving improvements in student outcomes and retention rates. The rising adoption of online learning presents a compelling growth opportunity for the Student Information System Market, as educational institutions seek to optimize their digital learning environments, enhance student engagement, and improve administrative efficiency through innovative technology solutions.

Student Information System Market Segment Analysis:

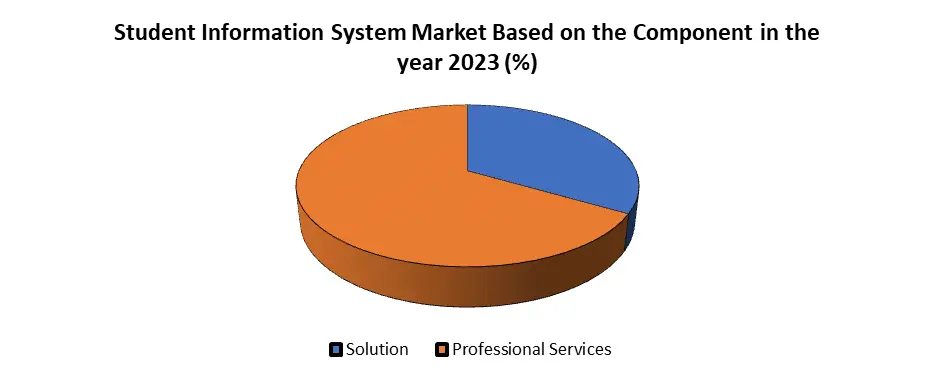

Based on the Component, the professional service segment dominated the Student Information System Market in the year 2023. The professional service segment dominates the Student Information System (SIS) market for several reasons. Implementing an SIS involves various complex tasks, including system customization, data migration, staff training, and ongoing support. Educational institutions often lack the internal expertise and resources to handle these tasks effectively, leading them to rely on professional services provided by SIS vendors or third-party consultants. Professional services offer institutions tailored solutions that align with their specific needs and requirements. Consultants and vendors work closely with institutions to understand their workflows, objectives, and challenges, ensuring that the implemented SIS solution meets their expectations and delivers maximum value. Also, professional services play a crucial role in ensuring the successful deployment and integration of SIS solutions within the institution's existing IT infrastructure. Consultants provide guidance and support throughout the implementation process, addressing any technical issues or challenges that arise and ensuring a smooth transition to the new system.

Student Information System Market Regional Analysis:

Asia Pacific region dominated the Student Information System Market in the year 2023. The dominance of the Asia Pacific region in the Student Information System industry stems from a convergence of pivotal factors. Foremost, the region's burgeoning education sector, buoyed by escalating literacy and enrollment rates, necessitates adept management tools like SIS. Concurrently, rapid technological strides in nations such as China, India, and Japan drive the assimilation of digital solutions, such as SIS, to streamline administrative workflows. Furthermore, the swift urbanization and industrialization across the region underscore the imperative for modern management systems to efficiently accommodate the expanding student populace. Government initiatives advocating education and technology adoption serve to amplify the demand for SIS. The robust IT infrastructure prevalent in countries such as Japan and Singapore facilitate the seamless implementation of the Student Information System, and the emergence of indigenous vendors offering customized SIS solutions intensifies market competition and uptake. The burgeoning emphasis on quality education motivates educational institutions to invest in technology-driven solutions such as SIS to bolster operational efficacy and enhance student outcomes. Collectively, these dynamics boost the Asia Pacific region to the forefront of the Student Information System market, with sustained growth prospects anticipated as the education landscape continues to evolve.Student Information System Market Competitive Analysis The Student Information System (SIS) market boasts a diverse landscape of providers, each offering unique solutions to cater to the evolving needs of educational institutions. Practically acquisition of Fedena positions it as a comprehensive player, offering both experiential learning content and administrative tools. Si6 Associates Pvt Limited stands out with its seamless integration with SAP solutions, simplifying program management for institutions. Monash University's collaboration with Oracle highlights the importance of practical skills for students in the digital era. Jenzabar's Campus Marketplace addresses the demand for non-traditional education options and skills-based courses. The collaboration between Skyward and Otus enhances educators' ability to utilize student data for improved performance. Renaissance's acquisition of Illuminate Education strengthens its portfolio with whole-child support platforms. Institutions evaluating SIS options consider factors like integration capabilities, ease of use, and alignment with educational goals. As technology continues to shape education, these providers offer vital tools to support student learning and administrative efficiency in schools across the Globe.

Student Information System Market Scope : Inquire before buying

Global Student Information System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.41 Bn. Forecast Period 2024 to 2030 CAGR: 14.2% Market Size in 2030: US $ 59.30 Bn. Segments Covered: by Component Software Service by Deployment Mode Cloud On-premise by End Use K-12 Higher Education Student Information System Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Student Information System Market Key Players

North America 1. PowerSchool - Folsom, California, USA 2. Ellucian - Reston, Virginia, USA 3. Blackbaud - Charleston, South Carolina, USA 4. Oracle Corporation - Redwood City, California, USA 5. Skyward - Stevens Point, Wisconsin, USA 6. Jenzabar - Boston, Massachusetts, USA 7. Campus Management Corp. - Boca Raton, Florida, USA 8. Infinite Campus - Blaine, Minnesota, USA 9. Edsby - Richmond Hill, Ontario, Canada 10. Tyler Technologies - Plano, Texas, USA 11. Campus Labs - Buffalo, New York, USA 12. Finalsite - Glastonbury, Connecticut, USA 13. Parchment - Scottsdale, Arizona, USA 14. Workday, Inc. - Pleasanton, California, USA 15. Alma - Portland, Oregon, USA 16. Follett Corporation - Westchester, Illinois, USA Europe 1. Unit4 - Utrecht, Netherlands 2. SAP SE - Walldorf, Germany 3. Tribal Group - Bristol, United Kingdom Frequently Asked Questions 1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on, Component Category, Deployment Mode, End Use, and Regions. 2] Which region is expected to hold the highest share of the Global Market? Ans. The Asia Pacific region is expected to hold the highest share of the Student Information System Market. 3] What is the market size of the Global Student Information System Market by 2030? Ans. The market size of the Student Information System Market by 2030 is expected to reach US$ 59.30 Bn. 4] What was the market size of the Global Student Information System Market in 2023? Ans. The market size of the Student Information System Market in 2023 was valued at US$ 23.41Bn. 5] Key players in the Student Information System Market. Ans. PowerSchool - Folsom, California, USA, Ellucian - Reston, Virginia, USA, Blackbaud - Charleston, South Carolina, USA, Oracle Corporation - Redwood City, California, USA and Skyward - Stevens Point, Wisconsin, USA.

1. Student Information System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Student Information System Market: Dynamics 2.1. Student Information System Market Trends by Region 2.1.1. North America Student Information System Market Trends 2.1.2. Europe Student Information System Market Trends 2.1.3. Asia Pacific Student Information System Market Trends 2.1.4. Middle East and Africa Student Information System Market Trends 2.1.5. South America Student Information System Market Trends 2.2. Student Information System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Student Information System Market Drivers 2.2.1.2. North America Student Information System Market Restraints 2.2.1.3. North America Student Information System Market Opportunities 2.2.1.4. North America Student Information System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Student Information System Market Drivers 2.2.2.2. Europe Student Information System Market Restraints 2.2.2.3. Europe Student Information System Market Opportunities 2.2.2.4. Europe Student Information System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Student Information System Market Drivers 2.2.3.2. Asia Pacific Student Information System Market Restraints 2.2.3.3. Asia Pacific Student Information System Market Opportunities 2.2.3.4. Asia Pacific Student Information System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Student Information System Market Drivers 2.2.4.2. Middle East and Africa Student Information System Market Restraints 2.2.4.3. Middle East and Africa Student Information System Market Opportunities 2.2.4.4. Middle East and Africa Student Information System Market Challenges 2.2.5. South America 2.2.5.1. South America Student Information System Market Drivers 2.2.5.2. South America Student Information System Market Restraints 2.2.5.3. South America Student Information System Market Opportunities 2.2.5.4. South America Student Information System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Student Information System Industry 2.8. Analysis of Government Schemes and Initiatives For Student Information System Industry 2.9. Student Information System Market Trade Analysis 2.10. The Global Pandemic Impact on Student Information System Market 3. Student Information System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Student Information System Market Size and Forecast, by Component (2023-2030) 3.1.1. Software 3.1.2. Service 3.2. Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 3.2.1. Cloud 3.2.2. On-premise 3.3. Student Information System Market Size and Forecast, by End Use (2023-2030) 3.3.1. K-12 3.3.2. Higher Education 3.4. Student Information System Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Student Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Student Information System Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Service 4.2. North America Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. Cloud 4.2.2. On-premise 4.3. North America Student Information System Market Size and Forecast, by End Use (2023-2030) 4.3.1. K-12 4.3.2. Higher Education 4.4. North America Student Information System Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Student Information System Market Size and Forecast, by Component (2023-2030) 4.4.1.1.1. Software 4.4.1.1.2. Service 4.4.1.2. United States Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 4.4.1.2.1. Cloud 4.4.1.2.2. On-premise 4.4.1.3. United States Student Information System Market Size and Forecast, by End Use (2023-2030) 4.4.1.3.1. K-12 4.4.1.3.2. Higher Education 4.4.2. Canada 4.4.2.1. Canada Student Information System Market Size and Forecast, by Component (2023-2030) 4.4.2.1.1. Software 4.4.2.1.2. Service 4.4.2.2. Canada Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 4.4.2.2.1. Cloud 4.4.2.2.2. On-premise 4.4.2.3. Canada Student Information System Market Size and Forecast, by End Use (2023-2030) 4.4.2.3.1. K-12 4.4.2.3.2. Higher Education 4.4.3. Mexico 4.4.3.1. Mexico Student Information System Market Size and Forecast, by Component (2023-2030) 4.4.3.1.1. Software 4.4.3.1.2. Service 4.4.3.2. Mexico Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 4.4.3.2.1. Cloud 4.4.3.2.2. On-premise 4.4.3.3. Mexico Student Information System Market Size and Forecast, by End Use (2023-2030) 4.4.3.3.1. K-12 4.4.3.3.2. Higher Education 5. Europe Student Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Student Information System Market Size and Forecast, by Component (2023-2030) 5.2. Europe Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.3. Europe Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4. Europe Student Information System Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.1.2. United Kingdom Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.1.3. United Kingdom Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.2. France 5.4.2.1. France Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.2.2. France Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.2.3. France Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.3.2. Germany Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.3.3. Germany Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.4.2. Italy Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.4.3. Italy Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.5.2. Spain Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.5.3. Spain Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.6.2. Sweden Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.6.3. Sweden Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.7.2. Austria Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.7.3. Austria Student Information System Market Size and Forecast, by End Use (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Student Information System Market Size and Forecast, by Component (2023-2030) 5.4.8.2. Rest of Europe Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 5.4.8.3. Rest of Europe Student Information System Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Student Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Student Information System Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Asia Pacific Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4. Asia Pacific Student Information System Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.1.2. China Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.1.3. China Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.2.2. S Korea Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.2.3. S Korea Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.3.2. Japan Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.3.3. Japan Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.4. India 6.4.4.1. India Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.4.2. India Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.4.3. India Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.5.2. Australia Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.5.3. Australia Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.6.2. Indonesia Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.6.3. Indonesia Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.7.2. Malaysia Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.7.3. Malaysia Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.8.2. Vietnam Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.8.3. Vietnam Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.9.2. Taiwan Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.9.3. Taiwan Student Information System Market Size and Forecast, by End Use (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Student Information System Market Size and Forecast, by Component (2023-2030) 6.4.10.2. Rest of Asia Pacific Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 6.4.10.3. Rest of Asia Pacific Student Information System Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Student Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Student Information System Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Middle East and Africa Student Information System Market Size and Forecast, by End Use (2023-2030) 7.4. Middle East and Africa Student Information System Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Student Information System Market Size and Forecast, by Component (2023-2030) 7.4.1.2. South Africa Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 7.4.1.3. South Africa Student Information System Market Size and Forecast, by End Use (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Student Information System Market Size and Forecast, by Component (2023-2030) 7.4.2.2. GCC Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 7.4.2.3. GCC Student Information System Market Size and Forecast, by End Use (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Student Information System Market Size and Forecast, by Component (2023-2030) 7.4.3.2. Nigeria Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 7.4.3.3. Nigeria Student Information System Market Size and Forecast, by End Use (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Student Information System Market Size and Forecast, by Component (2023-2030) 7.4.4.2. Rest of ME&A Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 7.4.4.3. Rest of ME&A Student Information System Market Size and Forecast, by End Use (2023-2030) 8. South America Student Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Student Information System Market Size and Forecast, by Component (2023-2030) 8.2. South America Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. South America Student Information System Market Size and Forecast, by End Use(2023-2030) 8.4. South America Student Information System Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Student Information System Market Size and Forecast, by Component (2023-2030) 8.4.1.2. Brazil Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 8.4.1.3. Brazil Student Information System Market Size and Forecast, by End Use (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Student Information System Market Size and Forecast, by Component (2023-2030) 8.4.2.2. Argentina Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 8.4.2.3. Argentina Student Information System Market Size and Forecast, by End Use (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Student Information System Market Size and Forecast, by Component (2023-2030) 8.4.3.2. Rest Of South America Student Information System Market Size and Forecast, by Deployment Mode (2023-2030) 8.4.3.3. Rest Of South America Student Information System Market Size and Forecast, by End Use (2023-2030) 9. Global Student Information System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Student Information System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. PowerSchool - Folsom, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ellucian - Reston, Virginia, USA 10.3. Blackbaud - Charleston, South Carolina, USA 10.4. Oracle Corporation - Redwood City, California, USA 10.5. Skyward - Stevens Point, Wisconsin, USA 10.6. Jenzabar - Boston, Massachusetts, USA 10.7. Campus Management Corp. - Boca Raton, Florida, USA 10.8. Infinite Campus - Blaine, Minnesota, USA 10.9. Edsby - Richmond Hill, Ontario, Canada 10.10. Tyler Technologies - Plano, Texas, USA 10.11. Campus Labs - Buffalo, New York, USA 10.12. Finalsite - Glastonbury, Connecticut, USA 10.13. Parchment - Scottsdale, Arizona, USA 10.14. Workday, Inc. - Pleasanton, California, USA 10.15. Alma - Portland, Oregon, USA 10.16. Follett Corporation - Westchester, Illinois, USA 10.17. Unit4 - Utrecht, Netherlands 10.18. SAP SE - Walldorf, Germany 10.19. Tribal Group - Bristol, United Kingdom 11. Key Findings 12. Industry Recommendations 13. Student Information System Market: Research Methodology 14. Terms and Glossary