The Sports Equipment and Apparel Market size was valued at USD 397 Billion in 2023 and the total Sports Equipment and Apparel revenue is expected to grow at a CAGR of 8.1% from 2024 to 2030, reaching nearly USD 684 Billion by 2030. Sports equipment and apparel have experienced significant shifts and trends in recent times, influenced by various factors such as celebrity endorsements, changing consumer preferences, and sustainable practices. Celebrity endorsements have played a crucial role in boosting the popularity and sales of sportswear brands, with icons like Beyoncé, Rihanna, and Serena Williams not only promoting these brands but also contributing to product design. The power of social media has amplified this influence, with millions of followers sharing images of celebrities sporting sportswear, thus enhancing brand visibility. The demand for women's sportswear has particularly surged, driven by factors such as increased participation in sports and fitness activities, as well as a growing awareness of the benefits of exercise. Brands have responded by offering a diverse range of stylish and functional clothing, catering to various activities and body types. Inclusivity in sizing and designs has become a priority, promoting body positivity and catering to a wider audience for the Sports Equipment and Apparel Market.To know about the Research Methodology:-Request Free Sample Report Trending colors in sportswear reflect a blend of nostalgia and contemporary fashion, with neon shades making a comeback alongside earthy tones and vibrant blues. Fabrics and garments are also evolving, with a focus on sustainability and performance. Eco-friendly materials like recycled polyester, bamboo, and organic cotton are gaining popularity, offering benefits such as moisture-wicking and breathability. Mesh fabrics, tie-dye patterns, and one-piece garments remain popular choices, combining comfort with style. In addition to traditional sportswear, brands are exploring exclusive collections through collaborations with designers and celebrities. Nike and Puma have launched specialized ranges inspired by themes like Australian landscapes, gender-neutral styling, and pop culture icons like The Smurfs. These collections offer a unique blend of fashion and functionality, catering to diverse tastes and preferences. Furthermore, innovations in sports apparel extend to third-kit collections for football clubs, featuring advanced technologies for both on-field performance and fan comfort which boost the Sports Equipment and Apparel Market. Adidas and Puma have introduced third-kit collections made from recycled materials, highlighting a commitment to sustainability in the sports industry.

Sports Equipment and Apparel Market Dynamics:

The Appeal of One-Piece Garments in Sportswear Drives the Sports Equipment and Apparel Market The trend driving the Sports Equipment and Apparel Market is the increasing reliance on celebrity endorsements, particularly in the sportswear segment. Celebrities like Beyoncé, Rihanna, and Serena Williams not only promote sportswear brands but also contribute to product design, making them functional, trendy, and fashionable. With millions of followers on social media platforms, celebrities have a massive influence on fashion trends, leading to heightened brand awareness and increased sales for sportswear companies. However, experts caution that careful selection of celebrities is crucial to align endorsements with brand values to prevent potential negative impacts on brand reputation. The demand for women's sportswear has surged, fueled by factors such as the pandemic-induced shift towards comfortable and functional clothing for home activities and increased female participation in sports and fitness. Sportswear brands are adapting their collections to meet the evolving needs of women, offering a diverse range of stylish and functional clothing beyond traditional workout attire. Apparel like yoga pants, running shorts, and crop tops are designed for multipurpose use, allowing women to wear their workout clothes beyond the gym. Brands are also incorporating inclusive sizing, promoting body positivity and inclusivity in the fitness world for Sports Equipment and Apparel Market. Trending colors in sportswear reflect a mix of nostalgia and contemporary preferences, with neon shades reminiscent of the 1980s and 90s making a comeback alongside earthy hues like sage and evergreen. High-waist leggings, sports bras, and track-suits with bold logos dominate the fashion landscape, catering to both the style and performance preferences of consumers. Moreover, the use of unconventional sustainable materials in sportswear fabrication is gaining momentum, driven by concerns over environmental impact and consumer preferences for eco-friendly products. Fabrics like recycled polyester, bamboo, and organic cotton offer superior comfort, durability, and performance, appealing to environmentally-conscious consumers. Innovations in garment design and functionality continue to shape the Sports Equipment and Apparel Market, with mesh fabric being a top choice for its breathability and style. One-piece garments like jumpsuits, rompers, and bike unitards remain popular for their versatility and practicality, catering to various activities from yoga to hiking. Collaborations with designers and celebrities further enhance the exclusivity of sportswear collections, offering consumers unique and trend-setting designs. For instance, Nike's collaborations with designers like Martine Rose and Yoon Ahn have resulted in gender-neutral tailored suiting and unisex jersey tops that blur traditional boundaries in sportswear fashion. Additionally, the emergence of third-kit collections in football exemplifies brands' commitment to sustainability, with Adidas and Puma launching kits made from 100% recycled materials. Integration of Technology into the Sports Industry Boost Sports Equipment and Apparel Market Demand The Sports Equipment and Apparel presents a dynamic landscape ripe with opportunities for innovation and growth. With a global shift towards active lifestyles and increased participation in sports and fitness activities, the demand for high-quality gear and apparel continues to rise. This Sports Equipment and Apparel Market covers a wide range of products, from athletic shoes and protective gear to fitness apparel and wearable technology, catering to athletes and enthusiasts across various sports and physical activities. One significant opportunity lies in the integration of technology into sports equipment and apparel. Wearable devices that monitor performance metrics such as heart rate, muscle activity, and even biomechanics offer athletes valuable insights into their training and performance. As technology advances, there is immense potential to develop more sophisticated and accurate wearable tech solutions that provide real-time feedback and personalized training programs, thereby enhancing athletic performance and injury prevention. Another area of opportunity lies in the advancement of materials used in sports equipment and apparel. Innovations such as graphene and carbon fiber offer the potential to create lighter, stronger, and more durable products, improving performance without sacrificing safety or comfort. Additionally, there is a growing trend towards sustainable and eco-friendly materials, driven by consumer demand for more environmentally conscious products. Manufacturers can capitalize on this trend by developing sports equipment and apparel made from recycled materials or renewable resources, thereby reducing the environmental impact of production. Furthermore, there is an opportunity to expand the Sports Equipment and Apparel Market reach by tapping into niche segments and emerging sports trends. As new sports and fitness activities gain popularity, there is a demand for specialized gear and apparel tailored to those pursuits. By identifying and catering to niche markets such as outdoor adventure sports, extreme sports, or e-sports, companies can carve out a competitive advantage and capture new revenue streams.Sports Equipment and Apparel Market Segment Analysis:

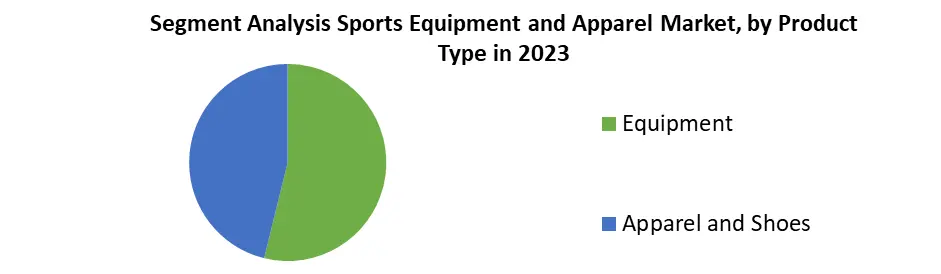

Based on Product Type, the market has been divided into Equipment and Apparel and Shoes. Among these, the Equipment sub-segment is projected to generate the maximum revenue. The Equipment sub-segment witnessed the highest market share in the global Sports Equipment and Apparel Market in 2023. The Equipment sub-segment of the Sports Equipment and Apparel Market represents a dynamic and multifaceted category catering to the diverse needs of athletes and enthusiasts worldwide. This segment encompasses an extensive range of products meticulously designed to enhance athletic performance, ensure safety, and provide optimal comfort across a plethora of sports and physical activities. Its high-tech fitness machines engineered to maximize workout efficiency or specialized protective gear engineered to mitigate injury risks, the Equipment category plays a pivotal role in facilitating athletic achievement across various sports. One of the defining characteristics of the sports Equipment is its versatility and adaptability to a wide range of sporting activities. From team sports like basketball and soccer to individual pursuits such as running and cycling, there exists a diverse array of equipment tailored to meet the specific demands of each sport. This adaptability underscores the segment's ability to cater to the multifaceted needs of athletes engaged in different disciplines.

Sports Equipment and Apparel Market Regional Insights:

North America currently leads the sports equipment and apparel market, holding approximately 37% of the share, followed by Europe and Asia-Pacific. The United States stands out in this region due to its growing emphasis on sports, rising participation rates, increased spending power, and technological innovations. According to the Open Access Journal of Sports Medicine, around 45 million children are involved in organized sports, yet approximately 18% of young athletes drop out after the age of 15. To cater to the growing interest in sports, particularly in activities like football and basketball, local authorities are investing in arena development and expanding sporting opportunities. This trend is expected to drive market growth in the foreseeable future. The heightened awareness of health and fitness, driven by the escalating rates of obesity and sedentary lifestyles, has prompted individuals to prioritize physical activity. As a result, there's a growing demand for innovative sports equipment that not only enhances performance but also promotes overall well-being.Competitive Landscape: 1. On July 3, 2023, Nike has introduced ReactX foam, a culmination of five years of testing, into its InfinityRN 4 model. The updated foam offers a higher energy return than its predecessor, Nike React foam, enhancing running performance. Additionally, ReactX reduces carbon footprint by 43% per pair of midsoles, with a 13% increase in energy return. Nike's focus on athlete-centric design and sustainable manufacturing methods underscores its commitment to innovation and environmental responsibility.

Sports Equipment and Apparel Market Scope: Inquire before buying

Global Sports Equipment and Apparel Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 397 Bn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US $ 684.81 Bn. Segments Covered: by Product Type Equipment Apparel and Shoes by Sports Type Bike Outdoor Tennis Running Other by Distribution Channel Online Offline Sports Equipment and Apparel Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sports Equipment and Apparel Market Key Players:

Major Contributors in the Sports Equipment and Apparel Market in North America: 1. Nike, Inc. (Beaverton, Oregon, United States) 2. Under Armour, Inc. (Baltimore, Maryland, United States) 3. New Balance Athletics, Inc. (Boston, Massachusetts, United States) 4. Columbia Sportswear Company (Portland, Oregon, United States) 5. VF Corporation (Greensboro, North Carolina, United States) 6. The North Face, Inc. (Alameda, California, United States) 7. Reebok International Ltd. (Boston, Massachusetts, United States) 8. Skechers USA, Inc. (Manhattan Beach, California, United States) 9. Wilson Sporting Goods Co. (Chicago, Illinois, United States) 10. Converse Inc. (Boston, Massachusetts, United States) Major Contributors in the Sports Equipment and Apparel Market in Europe: 1. Adidas AG (Herzogenaurach, Germany) 2. Puma SE (Herzogenaurach, Germany) 3. Amer Sports Corporation (Helsinki, Finland) Major Contributors in the Sports Equipment and Apparel Market in Asia Pacific: 1. ASICS Corporation (Kobe, Japan) 2. Yonex Co., Ltd. (Tokyo, Japan) 3. Mizuno Corporation (Osaka, Japan) 4. Anta Sports Products Limited (Jinjiang, Fujian, China) 5. Li-Ning Company Limited (Beijing, China) 6. Fila Holdings Corp. (Seoul, South Korea) FAQs: 1. What are the growth drivers for the Sports Equipment and Apparel Market? Ans. The growth drivers for the sports equipment and apparel market include increasing health awareness and fitness trends among consumers, rising participation in sports and recreational activities, and the growing popularity of athleisure wear for casual and everyday use. 2. What are the major restraints for the Sports Equipment and Apparel Market growth? Ans Major restraint for the sports equipment and apparel market growth include intense competition among key players, economic uncertainties affecting consumer spending patterns, and supply chain disruptions impacting manufacturing and distribution processes. Additionally, shifting consumer preferences and the emergence of counterfeit products pose challenges to market expansion. 3. Which region is expected to lead the global Sports Equipment and Apparel Market during the forecast period? Ans. North America is expected to lead the global Sports Equipment and Apparel Market during the forecast period. 4. What is the projected market size and growth rate of the Sports Equipment and Apparel Market? Ans. The Sports Equipment and Apparel Market size was valued at USD 397 Billion in 2023 and the total revenue is expected to grow at a CAGR of 8.1% from 2024 to 2030, reaching nearly USD 684.81 Billion by 2030. 5. What segments are covered in the Sports Equipment and Apparel Market report? Ans. The Sports Equipment and Apparel report covers Product Type, Sports Type, Distribution Channel, and Region.

1. Sports Equipment and Apparel Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sports Equipment and Apparel Market: Dynamics 2.1. Sports Equipment and Apparel Market Trends by Region 2.1.1. North America Sports Equipment and Apparel Market Trends 2.1.2. Europe Sports Equipment and Apparel Market Trends 2.1.3. Asia Pacific Sports Equipment and Apparel Market Trends 2.1.4. Middle East and Africa Sports Equipment and Apparel Market Trends 2.1.5. South America Sports Equipment and Apparel Market Trends 2.2. Sports Equipment and Apparel Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sports Equipment and Apparel Market Drivers 2.2.1.2. North America Sports Equipment and Apparel Market Restraints 2.2.1.3. North America Sports Equipment and Apparel Market Opportunities 2.2.1.4. North America Sports Equipment and Apparel Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sports Equipment and Apparel Market Drivers 2.2.2.2. Europe Sports Equipment and Apparel Market Restraints 2.2.2.3. Europe Sports Equipment and Apparel Market Opportunities 2.2.2.4. Europe Sports Equipment and Apparel Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sports Equipment and Apparel Market Drivers 2.2.3.2. Asia Pacific Sports Equipment and Apparel Market Restraints 2.2.3.3. Asia Pacific Sports Equipment and Apparel Market Opportunities 2.2.3.4. Asia Pacific Sports Equipment and Apparel Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sports Equipment and Apparel Market Drivers 2.2.4.2. Middle East and Africa Sports Equipment and Apparel Market Restraints 2.2.4.3. Middle East and Africa Sports Equipment and Apparel Market Opportunities 2.2.4.4. Middle East and Africa Sports Equipment and Apparel Market Challenges 2.2.5. South America 2.2.5.1. South America Sports Equipment and Apparel Market Drivers 2.2.5.2. South America Sports Equipment and Apparel Market Restraints 2.2.5.3. South America Sports Equipment and Apparel Market Opportunities 2.2.5.4. South America Sports Equipment and Apparel Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Sports Equipment and Apparel Industry 2.8. Analysis of Government Schemes and Initiatives For Sports Equipment and Apparel Industry 2.9. Sports Equipment and Apparel Market Trade Analysis 2.10. The Global Pandemic Impact on Sports Equipment and Apparel Market 3. Sports Equipment and Apparel Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Equipment 3.1.2. Apparel and Shoes 3.2. Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 3.2.1. Bike 3.2.2. Outdoor 3.2.3. Tennis 3.2.4. Running 3.2.5. Other 3.3. Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Online 3.3.2. Offline 3.4. Sports Equipment and Apparel Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Sports Equipment and Apparel Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Equipment 4.1.2. Apparel and Shoes 4.2. North America Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 4.2.1. Bike 4.2.2. Outdoor 4.2.3. Tennis 4.2.4. Running 4.2.5. Other 4.3. North America Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Online 4.3.2. Offline 4.4. North America Sports Equipment and Apparel Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Equipment 4.4.1.1.2. Apparel and Shoes 4.4.1.2. United States Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 4.4.1.2.1. Bike 4.4.1.2.2. Outdoor 4.4.1.2.3. Tennis 4.4.1.2.4. Running 4.4.1.2.5. Other 4.4.1.3. United States Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Online 4.4.1.3.2. Offline 4.4.2. Canada 4.4.2.1. Canada Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Equipment 4.4.2.1.2. Apparel and Shoes 4.4.2.2. Canada Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 4.4.2.2.1. Bike 4.4.2.2.2. Outdoor 4.4.2.2.3. Tennis 4.4.2.2.4. Running 4.4.2.2.5. Other 4.4.2.3. Canada Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Online 4.4.2.3.2. Offline 4.4.3. Mexico 4.4.3.1. Mexico Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Equipment 4.4.3.1.2. Apparel and Shoes 4.4.3.2. Mexico Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 4.4.3.2.1. Bike 4.4.3.2.2. Outdoor 4.4.3.2.3. Tennis 4.4.3.2.4. Running 4.4.3.2.5. Other 4.4.3.3. Mexico Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Online 4.4.3.3.2. Offline 5. Europe Sports Equipment and Apparel Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.3. Europe Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Sports Equipment and Apparel Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.1.3. United Kingdom Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.2.3. France Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.3.3. Germany Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.4.3. Italy Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.5.3. Spain Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.6.3. Sweden Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.7.3. Austria Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 5.4.8.3. Rest of Europe Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Sports Equipment and Apparel Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.3. Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.1.3. China Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.2.3. S Korea Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.3.3. Japan Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.4.3. India Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.5.3. Australia Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.6.3. Indonesia Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.7.3. Malaysia Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.8.3. Vietnam Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.9.3. Taiwan Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Sports Equipment and Apparel Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 7.3. Middle East and Africa Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Sports Equipment and Apparel Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 7.4.1.3. South Africa Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 7.4.2.3. GCC Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 7.4.3.3. Nigeria Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 7.4.4.3. Rest of ME&A Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Sports Equipment and Apparel Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 8.3. South America Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel(2023-2030) 8.4. South America Sports Equipment and Apparel Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 8.4.1.3. Brazil Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 8.4.2.3. Argentina Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Sports Equipment and Apparel Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Sports Equipment and Apparel Market Size and Forecast, by Sports Type (2023-2030) 8.4.3.3. Rest Of South America Sports Equipment and Apparel Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Sports Equipment and Apparel Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Sports Equipment and Apparel Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nike, Inc. (Beaverton, Oregon, United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Under Armour, Inc. (Baltimore, Maryland, United States) 10.3. New Balance Athletics, Inc. (Boston, Massachusetts, United States) 10.4. Columbia Sportswear Company (Portland, Oregon, United States) 10.5. VF Corporation (Greensboro, North Carolina, United States) 10.6. The North Face, Inc. (Alameda, California, United States) 10.7. Reebok International Ltd. (Boston, Massachusetts, United States) 10.8. Skechers USA, Inc. (Manhattan Beach, California, United States) 10.9. Wilson Sporting Goods Co. (Chicago, Illinois, United States) 10.10. Converse Inc. (Boston, Massachusetts, United States) 10.11. Adidas AG (Herzogenaurach, Germany) 10.12. Puma SE (Herzogenaurach, Germany) 10.13. Amer Sports Corporation (Helsinki, Finland) 10.14. ASICS Corporation (Kobe, Japan) 10.15. Yonex Co., Ltd. (Tokyo, Japan) 10.16. Mizuno Corporation (Osaka, Japan) 10.17. Anta Sports Products Limited (Jinjiang, Fujian, China) 10.18. Li-Ning Company Limited (Beijing, China) 10.19. Fila Holdings Corp. (Seoul, South Korea) 11. Key Findings 12. Industry Recommendations 13. Sports Equipment and Apparel Market: Research Methodology 14. Terms and Glossary