Sodium Nitrate Market size was valued at USD 3.1 Billion in 2023 and the Sodium Nitrate Market revenue is expected to reach USD 5.81 Billion by 2030, at a CAGR of 9.4 % over the forecast period.Sodium Nitrate Market Overview

Sodium Nitrate or Chile Saltpeter is a chemical compound that holds a wide-scale application in the industrial and commercial sectors. Sodium Nitrate is an alkali metal nitrate salt that is white in color and has a high water solubility rate. Sodium Nitrate holds properties that increase the burning rate of combustible materials. Naturally, occurring Sodium Nitrate is obtained by mining and is found predominantly in South American countries. With the development in science and technology, Sodium Nitrate is now manufactured in laboratories. Sodium Nitrate is used on a large scale as a food additive by the food and beverages industry.To know about the Research Methodology :- Request Free Sample Report The combustible properties of Sodium Nitrate have increased its consumption by the Chemical and Explosives manufacturing industries. The presence of medicinal properties has resulted in increased use by the pharmaceutical industry for manufacturing medicine for heart, digestion, and mental health-related issues. Increased preference for multipurpose additives by different industries has resulted in increased demand for Sodium Nitrate. The rise in health concerns, the presence of medicinal and preservative properties, and a wide-scale application in the industrial sector have resulted in a growth in the Global Sodium Nitrate Market. Sodium Nitrates are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Sodium Nitrate Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Sodium Nitrate Market report showcases the Sodium Nitrate market situation with Dynamics, Market Segment, Regional Analysis, and Top competitor's Market Position.

Sodium Nitrate Market Dynamics

Pharmaceutical and Food Industry’s Gaining Interest and Number of End Users are Expected to Drive the Sodium Nitrate Market Growth The rising demand for sodium nitrite along with organic products has propelled small-scale farmers in developing countries to adopt organic farming practices which also pulls the sales of sodium nitrite. Sodium nitrite market growth is particularly strong in emerging potential countries such as China, India, and Argentina, in arrears to growing farmer awareness of the dangers of harmful chemical fertilizers also surging the sodium nitrite market key trends. In these countries, particular investments are being made in natural production to changeover from artificial farming practices. Organic preserved food products had a substantial sodium nitrite market in Asia-Pacific, specifically in Japan and South Korea. Still, significant sodium nitrite market opportunities have been observed in countries such as China and India. In such countries, the agricultural sector's focus is diverting from exports to national consumption in the Sodium Nitrate Market. The government's encouragement of organic farming is also important resulting in the escalating adoption of sodium nitrite and therefore soaring the sodium nitrite adoption trends. Sodium Nitrate or Chile Saltpeter is a chemical compound that holds a large-scale application in the industrial and commercial sectors. Sodium Nitrate is an alkali metal nitrate salt that is white in color and has a high-water solubility rate. Sodium Nitrate holds properties that increase the burning rate of combustible materials. Naturally, occurring Sodium Nitrate is gained by mining and is found predominantly in South American countries. With the development in science and technology, Sodium Nitrate is now manufactured in laboratories. Sodium Nitrate is used on a large scale as a food additive by the food and beverages industry. The combustible properties of Sodium Nitrate have increased its consumption by the Chemical and Explosives manufacturing industries. The presence of medicinal properties has resulted in increased use by the pharmaceutical industry for manufacturing medicine for heart, digestion, and mental health-related issues. Increased preference for multipurpose additives by different industries has resulted in augmented demand for Sodium Nitrate. The upsurge in health concerns, the presence of medicinal and preservative properties, and a wide-scale application in the industrial sector have resulted in a growth in the Global Sodium Nitrate Market. Rapid variations in consumer tastes and preferences, united with changing lifestyles, have resulted in a high reliance on convenience snacks such as hot dogs and bacon in recent years affecting the sodium nitrite adoption trends together with sodium nitrite market opportunities. The consumption of convenience snacks began in Western countries and has rapidly covered other regions in turn influencing the sodium nitrite market future trends. Due to its role in the production of diazo dyes, sodium nitrite is an important component of the textile industry. Given that the global textile industry is expected to grow steadily over the next few years, the demand for sodium nitrite majorly dying materials is expected to rise in tandem. This is expected to propel the global sodium nitrite market and sales of sodium nitrite on a higher growth trajectory during the forecast period and also boost the sodium nitrite market trends and forecast.Sodium Nitrate Market Segment Analysis:

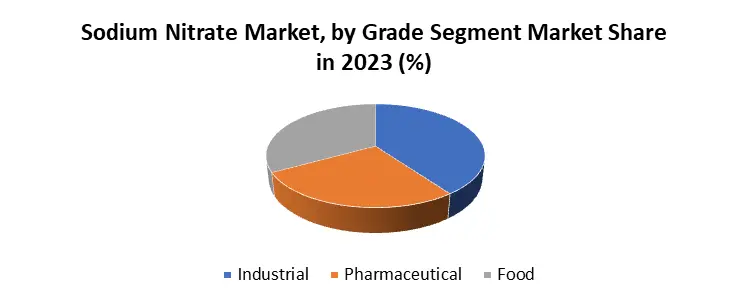

The Food & Beverages Segment Accounted the Largest Revenue Share in Sodium Nitrate Market in 2023. Based on application, the market is divided into food & beverages, pharmaceuticals, dyes & pigments, corrosion inhibitors, and other applications. Among these types, the food & beverages segment is expected to be the most lucrative in the global sodium nitrate market, with the largest revenue share during the estimated period. In the production of cured foods like bacon, sausage, and ham sodium nitrate is used to inhibit bacterial growth & improve the color of the meat. The sodium nitrate market also plays a major role in the production process of certain types of cheeses & fish products like smoked Salmon. Its preservative qualities make it a key component in the food industry it also helps to extend the shelf-life of many perishable items. It is utilized & added during the curing process of meat to prevent bacteria from growing and keep the meat fresh. It can remove germs from meat that develop in the presence of moisture & limit bacterial growth. The wearable patch/data recorder segment is projected as the fastest-growing component segment in the Sodium Nitrate market from 2023 to 2030. Owing to the wearable patch/data recorder segment is likely to grow because of the increasing adoption of the patch by patients for disease monitoring. According to the (Canadian Diabetes Association) CDA, the prevalence of diabetes is increasing in Canada & It is forecasted that nearly 5 Mn people will be affected by the disease by 2025 because that segment is expected to grow due to the increasing incidence of chronic diseases like diabetes, arthritis, Alzheimer’s, chronic kidney disease and chronic pain. Food Grade Holds the Majority Shares in Grade Segment of Sodium Nitrate Market Based on grade, the market for sodium nitrate is divided into food grade and industrial grade. Among these, the food-grade segment holds the majority share in the sodium nitrate market. Owing to Sodium nitrate is commonly used as a food preservative & color fixative in processed meats like ham, bacon, and hot dogs. It is also used in the production of curd meat products like corned beef and salami. Additionally, sodium nitrate is a cost-effective & efficient preservative which makes it an attractive option for food manufacturers. It is also approved for use by regulatory agencies like the US Food and Drug Administration and the European Food Safety Authority. The Industrial Grade Segment is Expected to Grow at a Hing Rate in the Sodium Nitrate Market Industrial-grade sodium nitrate is also an important segment and it is the fastest growing in recent years, it accounted for the fastest growth in the forecasted period. Owing to the expansion of the oil & gas industry driving the growth of this segment in the Sodium Nitrate Market. Sodium nitrate is used as a corrosion inhibitor in the oil & gas industry to protect metal equipment from corrosion caused by harsh chemicals & environments encountered during drilling & production. Additionally, the increasing demand for other industrial applications like metal treatment & dye production also driving the growth of the segment in the Sodium Nitrate Market.

Sodium Nitrate Market Regional Analysis

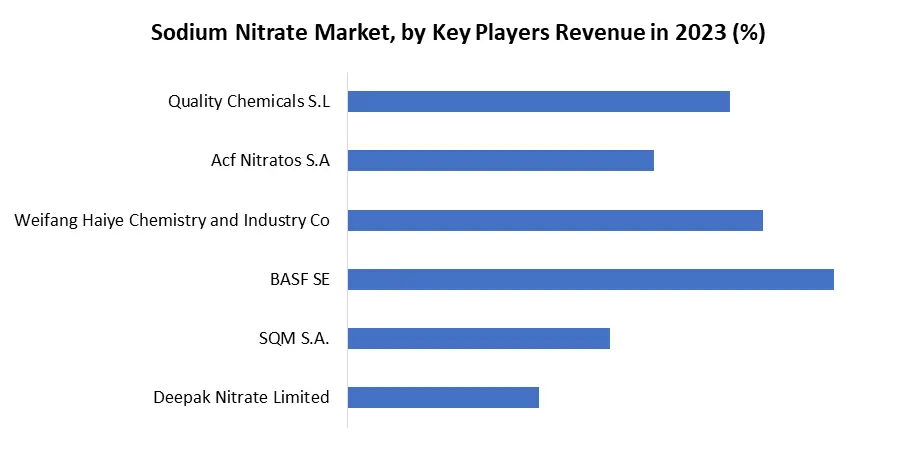

China is the world's largest consumer of food and beverages. Population growth and rising per capita disposable income are expected to drive growth in the food and beverage industry. Due to their hectic lifestyles, Chinese consumers' eating habits have shifted. They prefer to eat packaged foods rather than prepare their meals. This has an escalated impact on the sodium nitrite market's future trends. India is the world's largest generic drug provider for the sodium nitrite market. India accounts for half of the world's supply of various drugs. The production of the COVID-19 vaccine has elevated India to the forefront of the pharmaceutical industry. Many top pharmaceutical companies are headquartered in India. Medicines are expected to boost the pharmaceutical market in India as manufacturing advances. This is expected to have a positive impact on demand for sodium nitrite along with the sodium nitrite adoption trends in the coming years and will witness encouraging emerging trends in the sodium nitrite market. In terms of revenue, Europe held the second-largest sodium nitrite market share in 2023. Numerous regulations, particularly in North America and Europe, limit the use of chemically derived products in food and beverages. Due to the associated health concerns, government bodies have established regulations. Over the forecast period, this is likely to increase demand for sodium nitrite sources such as lettuce, celery, and other vegetables in Europe and North America for the Sodium Nitrate Market.Sodium Nitrate Market Recent Development In Thailand, the government launched a large project in 2017 to provide farmers with financial assistance for purchasing organic seeds, reducing their reliance on pesticides, and erecting physical barriers to prevent contamination from adjacent farmlands. The standard rice cultivation area is expected to be reduced by 1 million rai (160,000 ha) by 2023 as a result of this program. Deepak, India's largest sodium nitrite manufacturer produces and supplies over 80% of the product used in pharmaceuticals, agro-based chemicals, and other industries. BASF SE is one of the largest manufacturers of chemicals in the world, with its headquarters located in Ludwigshafen, Germany. Having been in business since 1865, BASF has grown to become one of the world's leading companies in the chemical sector, serving a variety of markets including materials, chemicals, surface technologies, nutrition and care, and agricultural solutions. The business is renowned for its dedication to sustainability and innovation, with a focus on creating solutions for worldwide concerns. Products for a broad range of industries, including consumer goods, construction, automotive, and agriculture, are part of BASF's diverse portfolio. In line with its corporate mission of "We create chemistry for a sustainable future," BASF, a major player in the chemical industry, places a strong emphasis on research and development to propel technological advancements and sustainable practices. In August 2023, Shares in BASF Shanshan Battery Materials Co., Ltd. have been owned by both BASF and Shanshan, a Chinese supplier of materials for lithium-ion batteries.

Global Sodium Nitrate Market Scope: Inquire before buying

Global Sodium Nitrate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.1 Bn. Forecast Period 2024 to 2030 CAGR: 9.4% Market Size in 2030: US $ 5.81 Bn. Segments Covered: by Grade Industrial Pharmaceutical Food by Application Chemicals Fertilizers Explosives Glass Pharmaceuticals Food & Beverages Others Sodium Nitrate Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Sodium Nitrate Key Players Includes

1. SQM (Chile) 2. Deepak Nitrite Limited (India) 3. Nitrochemie (Germany) 4. Rashtriya Chemicals and Fertilizers (India) 5. Shandong Haihua Group Co., Ltd. (China) 6. BASF SE (Germany) 7. Liuzhou Chemical Industry Co., Ltd. (China) 8. Sasol Nitro (South Africa) 9. Sumitomo Chemical Co., Ltd. (Japan) 10. Shandong Xinlong Group Co., Ltd. (China) 11. Ciner Resources Corporation (US) 12. Sichuan Nitrocell Corporation (China) 13. UBE Industries, Ltd. (Japan) 14. Hualong Ammonium Nitrate Co., Ltd. (China) 15. Rashtriya Chemicals & Fertilizers Ltd. (India) 16. Shanxi Jiaocheng Hongxing Chemicals Co., Ltd. (China) 17. Jiangsu Huaihe Chemicals Co., Ltd. (China) 18. Hangzhou Xinlong Chemical Co., Ltd. (China) 19. Hongcheng Chemicals (China) 20. Shandong Hualu-Hengsheng Chemical Co., Ltd. (China) 21. Hebei Dongfang Chemical Co., Ltd. (China) 22. Weifang Haiye Chemistry And Industry Co. 23. ACF Nitratos S.A 24. Quality Chemicals S.L 25. Shijiazhuang Fengshan Chemical Co. Ltd. Frequently Asked Questions in Sodium Nitrates Market: 1. Who are the key players in the sodium nitrate market? Ans: Some of the prominent players in the sodium nitrate market include Deepak, SQM S.A., BASF SE, Weifang Haiye Chemistry And Industry Co, Acf Nitratos S.A, Quality Chemicals S.L, Shijizhuang Fengshan Chemical Co. Ltd., Ural Chem JSC. 2. What are the factors driving the sodium nitrate market? Ans: The sodium nitrate market is anticipated to be driven by the growth of fertilizers products in the agriculture industry and their ability to provide necessary nitrogen nutrients to the crops. 3. What would be the forecast period in the market report? Ans: The forecast period for the patient warmer market is 2024 to 2030. 4. What is the key market trend for Global Sodium Nitrate Market? Ans: Sodium nitrate is an important part of the textile industry. It is used for production of diazo dyes. The textile industry is anticipated to grow at a steady pace over the next few years.

1. Sodium Nitrate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sodium Nitrate Market: Dynamics 2.1. Sodium Nitrate Market Trends by Region 2.1.1. North America Sodium Nitrate Market Trends 2.1.2. Europe Sodium Nitrate Market Trends 2.1.3. Asia Pacific Sodium Nitrate Market Trends 2.1.4. Middle East and Africa Sodium Nitrate Market Trends 2.1.5. South America Sodium Nitrate Market Trends 2.2. Sodium Nitrate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sodium Nitrate Market Drivers 2.2.1.2. North America Sodium Nitrate Market Restraints 2.2.1.3. North America Sodium Nitrate Market Opportunities 2.2.1.4. North America Sodium Nitrate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sodium Nitrate Market Drivers 2.2.2.2. Europe Sodium Nitrate Market Restraints 2.2.2.3. Europe Sodium Nitrate Market Opportunities 2.2.2.4. Europe Sodium Nitrate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sodium Nitrate Market Drivers 2.2.3.2. Asia Pacific Sodium Nitrate Market Restraints 2.2.3.3. Asia Pacific Sodium Nitrate Market Opportunities 2.2.3.4. Asia Pacific Sodium Nitrate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sodium Nitrate Market Drivers 2.2.4.2. Middle East and Africa Sodium Nitrate Market Restraints 2.2.4.3. Middle East and Africa Sodium Nitrate Market Opportunities 2.2.4.4. Middle East and Africa Sodium Nitrate Market Challenges 2.2.5. South America 2.2.5.1. South America Sodium Nitrate Market Drivers 2.2.5.2. South America Sodium Nitrate Market Restraints 2.2.5.3. South America Sodium Nitrate Market Opportunities 2.2.5.4. South America Sodium Nitrate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Sodium Nitrate Industry 2.8. Analysis of Government Schemes and Initiatives For Sodium Nitrate Industry 2.9. Sodium Nitrate Market Trade Analysis 2.10. The Global Pandemic Impact on Sodium Nitrate Market 3. Sodium Nitrate Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 3.1.1. Industrial 3.1.2. Pharmaceutical 3.1.3. Food 3.2. Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 3.2.1. Chemicals 3.2.2. Fertilizers 3.2.3. Explosives 3.2.4. Glass 3.2.5. Pharmaceuticals 3.2.6. Food & Beverages 3.2.7. Others 3.3. Sodium Nitrate Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Sodium Nitrate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 4.1.1. Industrial 4.1.2. Pharmaceutical 4.1.3. Food 4.2. North America Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 4.2.1. Chemicals 4.2.2. Fertilizers 4.2.3. Explosives 4.2.4. Glass 4.2.5. Pharmaceuticals 4.2.6. Food & Beverages 4.2.7. Others 4.3. North America Sodium Nitrate Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 4.3.1.1.1. Industrial 4.3.1.1.2. Pharmaceutical 4.3.1.1.3. Food 4.3.1.2. United States Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Chemicals 4.3.1.2.2. Fertilizers 4.3.1.2.3. Explosives 4.3.1.2.4. Glass 4.3.1.2.5. Pharmaceuticals 4.3.1.2.6. Food & Beverages 4.3.1.2.7. Others 4.3.2. Canada 4.3.2.1. Canada Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 4.3.2.1.1. Industrial 4.3.2.1.2. Pharmaceutical 4.3.2.1.3. Food 4.3.2.2. Canada Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Chemicals 4.3.2.2.2. Fertilizers 4.3.2.2.3. Explosives 4.3.2.2.4. Glass 4.3.2.2.5. Pharmaceuticals 4.3.2.2.6. Food & Beverages 4.3.2.2.7. Others 4.3.3. Mexico 4.3.3.1. Mexico Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 4.3.3.1.1. Industrial 4.3.3.1.2. Pharmaceutical 4.3.3.1.3. Food 4.3.3.2. Mexico Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Chemicals 4.3.3.2.2. Fertilizers 4.3.3.2.3. Explosives 4.3.3.2.4. Glass 4.3.3.2.5. Pharmaceuticals 4.3.3.2.6. Food & Beverages 4.3.3.2.7. Others 5. Europe Sodium Nitrate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.2. Europe Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3. Europe Sodium Nitrate Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.1.2. United Kingdom Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.2.2. France Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.3.2. Germany Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.4.2. Italy Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.5.2. Spain Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.6.2. Sweden Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.7.2. Austria Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 5.3.8.2. Rest of Europe Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Sodium Nitrate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.2. Asia Pacific Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Sodium Nitrate Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.1.2. China Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.2.2. S Korea Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.3.2. Japan Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.4.2. India Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.5.2. Australia Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.6.2. Indonesia Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.7.2. Malaysia Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.8.2. Vietnam Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.9.2. Taiwan Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 6.3.10.2. Rest of Asia Pacific Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Sodium Nitrate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 7.2. Middle East and Africa Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Sodium Nitrate Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 7.3.1.2. South Africa Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 7.3.2.2. GCC Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 7.3.3.2. Nigeria Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 7.3.4.2. Rest of ME&A Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 8. South America Sodium Nitrate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 8.2. South America Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 8.3. South America Sodium Nitrate Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 8.3.1.2. Brazil Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 8.3.2.2. Argentina Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Sodium Nitrate Market Size and Forecast, by Grade (2023-2030) 8.3.3.2. Rest Of South America Sodium Nitrate Market Size and Forecast, by Application (2023-2030) 9. Global Sodium Nitrate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Sodium Nitrate Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. SQM (Chile) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Deepak Nitrite Limited (India) 10.3. Nitrochemie (Germany) 10.4. Rashtriya Chemicals and Fertilizers (India) 10.5. Shandong Haihua Group Co., Ltd. (China) 10.6. BASF SE (Germany) 10.7. Liuzhou Chemical Industry Co., Ltd. (China) 10.8. Sasol Nitro (South Africa) 10.9. Sumitomo Chemical Co., Ltd. (Japan) 10.10. Shandong Xinlong Group Co., Ltd. (China) 10.11. Ciner Resources Corporation (US) 10.12. Sichuan Nitrocell Corporation (China) 10.13. UBE Industries, Ltd. (Japan) 10.14. Hualong Ammonium Nitrate Co., Ltd. (China) 10.15. Rashtriya Chemicals & Fertilizers Ltd. (India) 10.16. Shanxi Jiaocheng Hongxing Chemicals Co., Ltd. (China) 10.17. Jiangsu Huaihe Chemicals Co., Ltd. (China) 10.18. Hangzhou Xinlong Chemical Co., Ltd. (China) 10.19. Hongcheng Chemicals (China) 10.20. Shandong Hualu-Hengsheng Chemical Co., Ltd. (China) 10.21. Hebei Dongfang Chemical Co., Ltd. (China) 10.22. Weifang Haiye Chemistry And Industry Co. 10.23. ACF Nitratos S.A 10.24. Quality Chemicals S.L 10.25. Shijiazhuang Fengshan Chemical Co. Ltd. 11. Key Findings 12. Industry Recommendations 13. Sodium Nitrate Market: Research Methodology 14. Terms and Glossary