Global Sodium Metasilicate Pentahydrate Market size was valued at US$ 581.22 Mn. in 2022 and the total revenue is expected to grow at 3.00% through 2023 to 2029, reaching nearly US$ 714.83 Mn. by 2029. The global Sodium Metasilicate Pentahydrate market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global Sodium Metasilicate Pentahydrate market report also provides trends by market segments, technology, and investment with a competitive landscape.Global Sodium Metasilicate Pentahydrate Market Overview:

Sodium Metasilicate Pentahydrate is a hydrous form of Sodium Metasilicate with the chemical formula Na2Sio3.5H2o. Sodium Metasilicate is commonly abbreviated as Metso and is formed by the process of high-temperature synthesis of silicon dioxide and sodium carbonate. Sodium Metasilicate foods highly alkaline solutions when dissolved into water. Sodium Metasilicate is frequently used as a cleaner component, such as dishwasher detergent and laundry detergent.Sodium Metasilicate Pentahydrate Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Sodium Metasilicate Pentahydrate is widely used as a builder in detergents and soaps. A builder is a material that preserves or enhances the cleaning capability of the surfactant, mostly through the inactivation of water hardness. Sodium Metasilicate Pentahydrate is used in the production of highly well-organized metal cleaners and detergents, wherein sodium Metasilicate Pentahydrate discoveries bulging usage. Food and Drug Administration (FDA) considers sodium Metasilicate Pentahydrate safe for use in the boiler water, sanitizing solutions for food-contact surfaces, as washing blends for fruits and vegetables, hog scald agent for hair removal, and removing agent for garbage. Sodium Metasilicate Pentahydrate is also used as a cooling and response water agent for discolouration of outer surfaces of preserved goods.

Global Sodium Metasilicate Pentahydrate Market Dynamics:

The factor expected to drive the Sodium Metasilicate Pentahydrate market is swelling demand for the cement industry in developing countries. The growing construction and infrastructure project in emerging countries are increasing the practice of cement in the region, thereby expanding the demand for Sodium Metasilicate Pentahydrate. There has been a noteworthy upsurge in the disposable income of the people. Alongside, people have become progressively mindful about their health. These factors have powered the growth of the world market for sodium Metasilicate Pentahydrate. The shopping preferences of consumers have improved over the years. With the remarkable escalation in the number of working women, the petition for laundry detergent has amplified. Sodium Metasilicate Pentahydrate is used as a building agent and it prevents the gathering of minerals on washed surfaces. As such mounting laundry detergent industry is likely to boost the growth of sodium Metasilicate Pentahydrate. Consumer electronics and housing requirement segment have been getting higher and these two industries have encouraged the demand for acceptance of ceramic tiles and ceramic. Enlarged usages of ceramic and ceramic tiles are estimated to boost the global market for Sodium Metasilicate Pentahydrate. High-performance yet cost-effective electronic gadgets require the usage of ceramic and, as such, it impulses for increased usage of sodium Metasilicate Pentahydrate. The contrary effect related to Sodium Metasilicate Pentahydrate is expected to act as a market restrain. Sodium Metasilicate Pentahydrate is known to be corrosive and can cause severe burns on the skin. It also possesses threats towards the eyes and throat. The above reasons are expected to decline the market.Global Sodium Metasilicate Pentahydrate Market Segment Analysis:

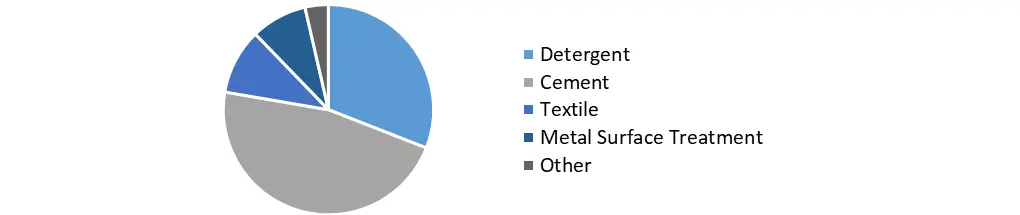

By Type, The segment is divided into Purity 29%, Purity 50%, and Purity 99%. In Germany, 29% of sodium metasilicate pentahydrate industry demand from cosmetic applications is likely to register improvements of about 3.4% by 2025. Momentous health awareness among young consumers and women along with the easy availability of cost-competitive and high-quality products are likely to promote market growth. U.S. 50% sodium metasilicate pentahydrate market size from cement applications is likely to register over 4.6% gains in the forecasted time. Growing government creativities to upsurge infrastructure spending and introduce tax reforms should stimulate the demand for cement, whereby this substance is lengthily used to enhance strength. The rise in construction of non-residential buildings along with transportation infrastructures such as bridges and overpasses should further speed up market growth. China's 99% sodium metasilicate pentahydrate market demand from flameproofing applications exceeded USD 12.5 million in 2018 affecting strict government regulations for fire-proof safety gear. Thriving chemicals, mining, construction, and oil & gas segments have increased the necessity for flameproof fabrics, in which the product is widely used due to its effective fire slow down property and aptitude to form a defensive barrier between the flame and the product. Growing demand for fireguard materials in the walls, joints, and floors of manufacturing, warehousing, and oil & gas industries should supplementary boost the growth of the market. By Application, Sodium Metasilicate Pentahydrate detergent, cement, textile, metal surface treatment, and others. The cement market size was valued at US$ 384.84 billion in 2022 is projected to reach US$ 552.39 billion by 2029, exhibiting a CAGR of 5.3% during the forecast period.Sodium Metasilicate Pentahydrate Market, by Application in 2022 (%)

Global Sodium Metasilicate Pentahydrate Market Regional Insights:

Among the regions, Asia-Pacific is predicted to anticipate encouraging growth for the market during the forecast period. This is due to factors such as collective construction activities in countries such as India, Japan, South Korea, and China. North America, on the other side, will register extensive growth for the market owing to increasing oil investigation activities in the forthcoming years. The market in Europe will eyewitness important growth during the forecast period. This is accredited to the rising demand for silica gel from the packaging industry. For instance, sodium Metasilicate Pentahydrate is used as a chemical in-between for the silica gel catalysts. Latin America is expected to witness flow in textile applications that will pay to the growth of the market during the projected skyline. The market in the Middle East and Africa will register promising growth supported by the growing need for protecting metals from corrosion between 2023 and 2029. The objective of the report is to present a comprehensive analysis of the global Sodium Metasilicate Pentahydrate market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Sodium Metasilicate Pentahydrate market dynamics, structure by analyzing the market segments and project the global Sodium Metasilicate Pentahydrate market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the global Sodium Metasilicate Pentahydrate market make the report investor’s guide.Global Sodium Metasilicate Pentahydrate Market Scope: Inquire before buying

Global Sodium Metasilicate Pentahydrate Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 581.22 Mn. Forecast Period 2023 to 2029 CAGR: 3.0% Market Size in 2029: US $ 714.83 Mn. Segments Covered: by Type Purity 29% Purity 50% Purity 99% by Application Detergent Cement Textile Metal Surface Treatment Other Global Sodium Metasilicate Pentahydrate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Sodium Metasilicate Pentahydrate Market, Key Players are

1. American Elements 2. Henny Enterprises 3. Jay Dinesh Chemicals 4. Mistral Industrial Chemicals 5. Nippon Chemical Industrial Co. Ltd. 6. Qingdao Darun Chemical Industrial Co. Ltd. 7. Qingdao Hai Wan Chemical (Group) Co. Ltd. 8. Shanghai Yueda Industry Co. Ltd. 9. Sigma-Aldrich Corporation 10. Silmaco Frequently Asked Questions: 1. Which region has the largest share in Global Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Market? Ans: The Global Sodium Metasilicate Pentahydrate Market is growing at a CAGR of 3% during forecasting period 2023-2029. 3. What is scope of the Global Market report? Ans: Global Sodium Metasilicate Pentahydrate Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Market? Ans: The important key players in the Global Sodium Metasilicate Pentahydrate Market are – American Elements, Henny Enterprises, Jay Dinesh Chemicals, Mistral Industrial Chemicals, Nippon Chemical Industrial Co. Ltd., Qingdao Darun Chemical Industrial Co. Ltd., Qingdao Hai Wan Chemical (Group) Co. Ltd., Shanghai Yueda Industry Co. Ltd., Sigma-Aldrich Corporation, Silmaco. 5. What is the study period of this Market? Ans: The Global Sodium Metasilicate Pentahydrate Market is studied from 2022 to 2029.

1. Sodium Metasilicate Pentahydrate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sodium Metasilicate Pentahydrate Market: Dynamics 2.1. Sodium Metasilicate Pentahydrate Market Trends by Region 2.1.1. North America Sodium Metasilicate Pentahydrate Market Trends 2.1.2. Europe Sodium Metasilicate Pentahydrate Market Trends 2.1.3. Asia Pacific Sodium Metasilicate Pentahydrate Market Trends 2.1.4. Middle East and Africa Sodium Metasilicate Pentahydrate Market Trends 2.1.5. South America Sodium Metasilicate Pentahydrate Market Trends 2.2. Sodium Metasilicate Pentahydrate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sodium Metasilicate Pentahydrate Market Drivers 2.2.1.2. North America Sodium Metasilicate Pentahydrate Market Restraints 2.2.1.3. North America Sodium Metasilicate Pentahydrate Market Opportunities 2.2.1.4. North America Sodium Metasilicate Pentahydrate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sodium Metasilicate Pentahydrate Market Drivers 2.2.2.2. Europe Sodium Metasilicate Pentahydrate Market Restraints 2.2.2.3. Europe Sodium Metasilicate Pentahydrate Market Opportunities 2.2.2.4. Europe Sodium Metasilicate Pentahydrate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sodium Metasilicate Pentahydrate Market Drivers 2.2.3.2. Asia Pacific Sodium Metasilicate Pentahydrate Market Restraints 2.2.3.3. Asia Pacific Sodium Metasilicate Pentahydrate Market Opportunities 2.2.3.4. Asia Pacific Sodium Metasilicate Pentahydrate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sodium Metasilicate Pentahydrate Market Drivers 2.2.4.2. Middle East and Africa Sodium Metasilicate Pentahydrate Market Restraints 2.2.4.3. Middle East and Africa Sodium Metasilicate Pentahydrate Market Opportunities 2.2.4.4. Middle East and Africa Sodium Metasilicate Pentahydrate Market Challenges 2.2.5. South America 2.2.5.1. South America Sodium Metasilicate Pentahydrate Market Drivers 2.2.5.2. South America Sodium Metasilicate Pentahydrate Market Restraints 2.2.5.3. South America Sodium Metasilicate Pentahydrate Market Opportunities 2.2.5.4. South America Sodium Metasilicate Pentahydrate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Sodium Metasilicate Pentahydrate Industry 2.8. Analysis of Government Schemes and Initiatives For Sodium Metasilicate Pentahydrate Industry 2.9. Sodium Metasilicate Pentahydrate Market Trade Analysis 2.10. The Global Pandemic Impact on Sodium Metasilicate Pentahydrate Market 3. Sodium Metasilicate Pentahydrate Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 3.1.1. Purity 29% 3.1.2. Purity 50% 3.1.3. Purity 99% 3.2. Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 3.2.1. Detergent 3.2.2. Cement 3.2.3. Textile 3.2.4. Metal Surface Treatment 3.2.5. Other 3.3. Sodium Metasilicate Pentahydrate Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Sodium Metasilicate Pentahydrate Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 4.1.1. Purity 29% 4.1.2. Purity 50% 4.1.3. Purity 99% 4.2. North America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 4.2.1. Detergent 4.2.2. Cement 4.2.3. Textile 4.2.4. Metal Surface Treatment 4.2.5. Other 4.3. North America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 4.3.1.1.1. Purity 29% 4.3.1.1.2. Purity 50% 4.3.1.1.3. Purity 99% 4.3.1.2. United States Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 4.3.1.2.1. Detergent 4.3.1.2.2. Cement 4.3.1.2.3. Textile 4.3.1.2.4. Metal Surface Treatment 4.3.1.2.5. Other 4.3.2. Canada 4.3.2.1. Canada Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 4.3.2.1.1. Purity 29% 4.3.2.1.2. Purity 50% 4.3.2.1.3. Purity 99% 4.3.2.2. Canada Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 4.3.2.2.1. Detergent 4.3.2.2.2. Cement 4.3.2.2.3. Textile 4.3.2.2.4. Metal Surface Treatment 4.3.2.2.5. Other 4.3.3. Mexico 4.3.3.1. Mexico Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 4.3.3.1.1. Purity 29% 4.3.3.1.2. Purity 50% 4.3.3.1.3. Purity 99% 4.3.3.2. Mexico Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 4.3.3.2.1. Detergent 4.3.3.2.2. Cement 4.3.3.2.3. Textile 4.3.3.2.4. Metal Surface Treatment 4.3.3.2.5. Other 5. Europe Sodium Metasilicate Pentahydrate Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.2. Europe Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3. Europe Sodium Metasilicate Pentahydrate Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.1.2. United Kingdom Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.2. France 5.3.2.1. France Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.2.2. France Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.3.2. Germany Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.4.2. Italy Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.5.2. Spain Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.6.2. Sweden Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.7.2. Austria Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 5.3.8.2. Rest of Europe Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.1.2. China Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.2.2. S Korea Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.3.2. Japan Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.4. India 6.3.4.1. India Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.4.2. India Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.5.2. Australia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.6.2. Indonesia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.7.2. Malaysia Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.8.2. Vietnam Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.9.2. Taiwan Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Sodium Metasilicate Pentahydrate Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Sodium Metasilicate Pentahydrate Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 7.3.1.2. South Africa Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 7.3.2.2. GCC Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 7.3.3.2. Nigeria Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 7.3.4.2. Rest of ME&A Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 8. South America Sodium Metasilicate Pentahydrate Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 8.2. South America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 8.3. South America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 8.3.1.2. Brazil Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 8.3.2.2. Argentina Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Type (2022-2029) 8.3.3.2. Rest Of South America Sodium Metasilicate Pentahydrate Market Size and Forecast, by Application (2022-2029) 9. Global Sodium Metasilicate Pentahydrate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Sodium Metasilicate Pentahydrate Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. American Elements 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Henny Enterprises 10.3. Jay Dinesh Chemicals 10.4. Mistral Industrial Chemicals 10.5. Nippon Chemical Industrial Co. Ltd. 10.6. Qingdao Darun Chemical Industrial Co. Ltd. 10.7. Qingdao Hai Wan Chemical (Group) Co. Ltd. 10.8. Shanghai Yueda Industry Co. Ltd. 10.9. Sigma-Aldrich Corporation 10.10. Silmaco 11. Key Findings 12. Industry Recommendations 13. Sodium Metasilicate Pentahydrate Market: Research Methodology 14. Terms and Glossary