Sodium Chloride Market was worth US$ 29.96 Bn. in 2022 and total revenue is expected to grow at a rate of 2.3 % CAGR from 2023 to2029, reaching almost US$ 35.14 Bn. in 2029.Sodium Chloride Market Overview:

The ionic compound sodium chloride, or NaCl, has a chemical formula that represents a 1:1 ratio of sodium and chloride ions. It's also known as salt, table salt, or common salt, and it's easily soluble in water. The end-use in several industries – food, medicinal, industrial, and chemical – has a significant impact on the market. Sodium chloride is used to de-ice roadways and highways in numerous parts of North America and Europe during severe snowfall. The chemical formula for sodium chloride is NaCl, which is a white crystalline solid. Salt, table salt, and common salt are all terms for the same thing. It has a white color, a crystalline appearance, a saline flavor, and is water-soluble.To know about the Research Methodology :- Request Free Sample Report

Sodium Chloride Market Dynamics:

Sodium chloride is one of the largest-volume inorganic raw materials used by the chemical industry. The major chemical utilised products of salt is synthetic soda, chlorine caustic and ash for manufacturing of many chemical products includes both organic and inorganic. Also, huge quantities of salt are also have been used directly for ice and snow control, flavouring agent, food preservative, as a mineral in animal diets, and broadly as a reagent for water softening in many industrial processes, will boost the NACL demand and market growth during the forecast period. Sodium chlorides are further used for the production of dyes, detergents, soaps, PVC, among others. It is recorded that demand for NACL by numerous end-user has increased as, development is seen in dicing, food and beverages, chemicals, and others are propelling the market growth. The pharmaceutical industry is also stimulating the market growth during the forecast period as sodium chloride is the most preferred electrolyte solution amongst others. However, widespread use of salts in the dicing industries is expected to be an opportunity for the major competitors present in the market. Additionally, another noticeable factor is the easy process of solar evaporation and the low cost is expected to show a positive effect on the market growth. The global demand for industrial sodium chloride is also impacted by climatic conditions. On the other hand, NaCl as a chemical reagent is expected to rule the market. Conversely, rising health-consciousness, combined with dieticians and doctors' recommendations for balanced salt consumption, storage issues for sodium chloride, and a low-profit margin are all possible restraints to the overall market. Complications at the time of storage of sodium chloride and low-income margins are hindering the market growth during the forecast period.Sodium Chloride Market Segment Analysis:

Based on Application, the market is sub-segmented into Chemical Intermediate, Food Processing, Pharmaceuticals, Agriculture, Deicing, and Others. Chemical manufacturing is one of the most main usages for sodium chloride, accounting for more than half of the NaCl market share in 2022. Sodium chloride is utilized in the production of a wide range of chemical compounds, both organic and inorganic. The chemical industry is driving up demand for NaCl, which is widely utilized in the production of chlor-alkali chemicals like chlorine, soda ash, and caustic soda. These materials are also used to make polyvinyl chloride (PVC), detergents, glass, dyes, and soaps. Sodium chloride is mostly used in the food industry for seasoning, coloring, curing meats, preserving fish, and so on. Catheter flush injections or intravenous infusions are medical uses, as are cleaning things like contact lenses. Inhaling sodium chloride aids in the removal of microorganisms from bodily fluids. Sodium chloride is a key chemical in the chemical industry, used to make caustic soda, sodium chlorite, ammonium chlorite, and sodium bicarbonate, among other things. It is utilized as a feedstock in a variety of industrial processes as well as for water softening.

Sodium Chloride Market Regional Insights:

With increased demand from the chemical industry, Asia-Pacific dominated the global market share. China is a chemical processing powerhouse, producing the vast majority of the world’s largest chemicals. One of the largest users of sodium chloride was the chemical industry. Chlorine and other chemicals can be made from sodium chloride, which can also be used to make polyvinyl chloride (PVC). PVC is a type of plastic polymer that is mostly used in the building industry. Caustic soda, sodium carbonate, calcium chloride, and a variety of other compounds can be made from sodium chloride. China led the construction sector in 2019, with market size of USD 1,092.9 billion, up 14.71 % from the previous year. The Chinese pharmaceutical and medicine manufacturing business was valued at USD 399.65 billion in 2022, according to the National Bureau of Statistics of China. Furthermore, the value of pharmaceutical and medical exports in 2022 was estimated to be at USD 32.36 billion, down roughly 4% from the previous year. Objective of the report is to present a comprehensive analysis of the Global Sodium Chloride Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global market dynamics, structure by analyzing the market segments and project the Global Sodium Chloride Market size. Clear representation of competitive analysis of key players by Product, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Sodium Chloride Market make the report investor’s guideGlobal Sodium Chloride Market Scope: Inquire before buying

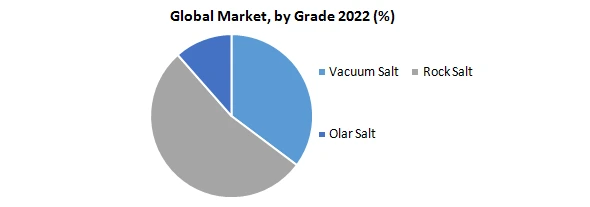

Global Sodium Chloride Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 29.96 Bn. Forecast Period 2023 to 2029 CAGR: 2.3% Market Size in 2029: US $ 35.14 Bn. Segments Covered: by Grade Vacuum Salt Rock Salt Olar Salt by Manufacturing Process Artificial Evaporation Solar Evaporation by Application Chemical Intermediate Food Processing Pharmaceuticals Agriculture Deicing Sodium Chloride Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sodium Chloride Market Key Players are:

1. China National Salt Industry Corporation 2. Compass Minerals International, Inc 3. Shijiazhuang Ligong Machinery Co., Ltd. 4. Hubei Aoks Bio-Tech Co., Ltd 5. Sudwestdeutsche Salzwerke AG 6. K+S AKTIENGESELLSCHAFT 7. Swiss Salt Works AG 8. Argill Incorporated 9. Tata Chemicals Ltd 10. Wacker Chemie AG 11. Akzo Nobel N.V 12. Dampier Salts 13. INEOS Salts 14. Cheetham Salt 15. Cargill Incorporated 16. Hindustan Ltd. 17. Nouryon 18. State enterprise Artyomsol 19. Mitsui Group 20. Salins GroupFrequently Asked Questions:

1.What was the market size of Global Sodium Chloride Market markets in 2022? Ans - Global Sodium Chloride Market was worth US$ 29.96 Bn in 2022. 2) What is the market segment of Global Sodium Chloride Market markets? Ans -The market segments are based on Grade ,Manufacturing Process and Application 3) What is forecast period consider for Global Sodium Chloride Market? Ans -The forecast period for Global Sodium Chloride Market is 2023 to 2029. 4) Which are the worldwide major key players covered for Global Sodium Chloride Market report? Ans - China National Salt Industry Corporation, Compass Minerals International, Inc, Shijiazhuang Ligong Machinery Co., Ltd., Hubei Aoks Bio-Tech Co., Ltd, Sudwestdeutsche Salzwerke AG, Swiss Salt Works AG, Argill Incorporated, Tata Chemicals Ltd, Wacker Chemie AG, Akzo Nobel N.V, Dampier Salts, INEOS Salts, Cheetham Salt, Cargill Incorporated, Hindustan Ltd., Nouryon, State enterprise Artyomsol, Mitsui Group, Salins Group. 5) Which region is dominated in Global Sodium Chloride Market? Ans - In 2022, Asia Pacific region dominated the Global Sodium Chloride Market.

1. Global Sodium Chloride Market: Research Methodology 2. Global Sodium Chloride Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Sodium Chloride Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Sodium Chloride Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Sodium Chloride Market Segmentation 4.1 Global Sodium Chloride Market, by Grade (2023-2029) • Vacuum Salt • Rock Salt • Solar Salt 4.2 Global Sodium Chloride Market, by Manufacturing Process (2023-2029) • Artificial Evaporation • Solar Evaporation 4.3 Global Sodium Chloride Market, by Application (2023-2029) • Chemical Intermediate • Food Processing • Pharmaceuticals • Agriculture • Deicing 5. North America Sodium Chloride Market(2023-2029) 5.1 North America Sodium Chloride Market, by Grade (2023-2029) • Vacuum Salt • Rock Salt • Solar Salt 5.2 North America Sodium Chloride Market, by Manufacturing Process (2023-2029) • Artificial Evaporation • Solar Evaporation 5.3 North America Sodium Chloride Market, by Application (2023-2029) • Chemical Intermediate • Food Processing • Pharmaceuticals • Agriculture • Deicing 5.4 North America Sodium Chloride Market, by Country (2023-2029) • United States • Canada • Mexico 6. Europe Sodium Chloride Market (2023-2029) 6.1. European Sodium Chloride Market, by Grade (2023-2029) 6.2. European Sodium Chloride Market, by Manufacturing Process (2023-2029) 6.3. European Sodium Chloride Market, by Application (2023-2029) 6.4. European Sodium Chloride Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Sodium Chloride Market (2023-2029) 7.1. Asia Pacific Sodium Chloride Market, by Grade (2023-2029) 7.2. Asia Pacific Sodium Chloride Market, by Manufacturing Process (2023-2029) 7.3. Asia Pacific Sodium Chloride Market, by Application (2023-2029) 7.4. Asia Pacific Sodium Chloride Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Sodium Chloride Market (2023-2029) 8.1 Middle East and Africa Sodium Chloride Market, by Grade (2023-2029) 8.2. Middle East and Africa Sodium Chloride Market, by Manufacturing Process (2023-2029) 8.3. Middle East and Africa Sodium Chloride Market, by Application (2023-2029) 8.4. Middle East and Africa Sodium Chloride Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Sodium Chloride Market (2023-2029) 9.1. South America Sodium Chloride Market, by Grade (2023-2029) 9.2. South America Sodium Chloride Market, by Manufacturing Process (2023-2029) 9.3. South America Sodium Chloride Market, by Application (2023-2029) 9.4 South America Sodium Chloride Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 China National Salt Industry Corporation 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Compass Minerals International, Inc 10.3 Shijiazhuang Ligong Machinery Co., Ltd. 10.4 Hubei Aoks Bio-Tech Co., Ltd 10.5 Sudwestdeutsche Salzwerke AG 10.6 K+S AKTIENGESELLSCHAFT 10.7 Swiss Salt Works AG 10.8 Argill Incorporated 10.9 Tata Chemicals Ltd 10.10 Wacker Chemie AG 10.11 Akzo Nobel N.V 10.12 Dampier Salts 10.13 INEOS Salts 10.14 Cheetham Salt 10.15 Cargill Incorporated 10.16 Hindustan Ltd. 10.17 Nouryon 10.18 State enterprise Artyomsol 10.19 Mitsui Group 10.20 Salins Group