Sodium Bicarbonate Market was valued at USD 4.60 Bn in 2023 and is expected to reach USD 6.56 Bn by 2030, at a CAGR of 5.2 percent during the forecast period.Sodium Bicarbonate Market Overview

Sodium bicarbonate or baking soda is a chemical compound dissolved in water that is widely used as an additive in foods and mineral water and as a medicine. It is a versatile chemical compound with alkaline properties and is used in food and beverage, pharmaceuticals, personal care, and industrial processes. The Sodium Bicarbonate Market is driven by its widespread use in various applications due to its buffering, leavening, and neutralizing properties. Sodium bicarbonate is extensively used as a leavening agent in baking, contributing to the rise and texture of baked goods. It serves as a pH regulator and a buffering agent in food and beverage products. Increasing awareness of the environmentally friendly and multipurpose nature of sodium bicarbonate has contributed to its demand. The global sodium bicarbonate market has witnessed steady growth, driven by its diverse applications and increasing demand from various industries.To know about the Research Methodology :- Request Free Sample Report

Sodium Bicarbonate Market Dynamics

Food and Beverage Industry to boost the Sodium Bicarbonate Market growth The steady growth of the food and beverage industry, especially the baking and confectionery sectors, is a primary driver. Sodium bicarbonate serves as a crucial leavening agent in baking, contributing to the rise and texture of various food products. Sodium bicarbonate serves as a crucial leavening agent, contributing to the rise and texture of baked goods. Its ability to release carbon dioxide gas during the baking process creates a desirable light and fluffy texture in bread, cakes, and other bakery products. As consumer preferences for baked goods continue to rise globally, the demand for sodium bicarbonate remains strong, driving growth in the Sodium Bicarbonate market. In the pharmaceutical industry, sodium bicarbonate finds applications in the formulation of antacids and effervescent tablets. As an alkaline compound, it helps neutralize excess stomach acid, providing relief from conditions such as heartburn and indigestion. Additionally, sodium bicarbonate is used in certain medical treatments, including urinary alkalinization. The pharmaceutical sector's continuous demand for sodium bicarbonate significantly boosts the Sodium Bicarbonate Market growth. The growing focus on health and wellness, coupled with an increasing preference for natural and clean-label products, has boosted the popularity of sodium bicarbonate. Consumers are seeking alternatives to chemical additives, and sodium bicarbonate, with its naturally derived properties, aligns well with these trends. It is used in certain nutritional supplements and is consumed as a dietary supplement for its alkalizing effects on the body. The household and cleaning segment is a significant driver for Sodium Bicarbonate Market demand. It is a common ingredient in household cleaning products due to its abrasive and odor-neutralizing properties. Consumers appreciate its effectiveness in removing stains, cleaning surfaces, and deodorizing various household items, leading to its consistent use in cleaning applications. Ongoing research and development efforts have led to technological advancements in sodium bicarbonate formulations and applications. Innovations in its use, such as in carbon capture technologies, showcase the compound's potential for addressing contemporary environmental challenges. These advancements contribute to the expanding scope of sodium bicarbonate in diverse industries. The increasing emphasis on green and sustainable practices has opened avenues for sodium bicarbonate in environmentally friendly applications. Its natural properties and low environmental impact make it an attractive choice for industries and consumers seeking sustainable alternatives. Fluctuating Raw Material Prices to restrain Sodium Bicarbonate Market growth The cost of raw materials, particularly sodium carbonate, can be subject to fluctuations. These variations in prices impact the overall production costs for sodium bicarbonate manufacturers, potentially affecting profitability. Some alternative chemicals and compounds serve similar functions in various applications. The availability and use of these alternatives pose a restraint on the demand for sodium bicarbonate in certain markets. Environmental regulations and concerns related to the production processes of sodium bicarbonate, as well as its waste disposal, pose challenges for sodium bicarbonate manufacturers, which significantly restrain the sodium bicarbonate market growth. Compliance with stringent environmental standards requires additional investments. Sodium bicarbonate is generally safe when used as directed. There are health and safety regulations in place, especially in industries where exposure is more significant. Compliance with these regulations adds operational complexities. Economic conditions, both globally and regionally, impact the overall demand for sodium bicarbonate. Economic downturns lead to reduced production and consumption across various industries, affecting the market. Advances in alternative technologies or the development of more efficient substitutes for certain applications impact the demand for sodium bicarbonate. Industries adopt new technologies that reduce reliance on traditional chemical compounds. Disruptions in the supply chain, such as interruptions in the availability of key raw materials or transportation issues, affect the manufacturing and distribution of sodium bicarbonate, leading to potential shortages. Industries that heavily rely on sodium bicarbonate, such as the food and beverage industry, experience price volatility due to changes in supply and demand dynamics or disruptions in the sodium bicarbonate market. Opportunities in Sodium Bicarbonate Market: Various market participants are working to increase production capacity as well as invest in the creation of high-quality sodium bicarbonate variants. For example, in 2021, the top five producers accounted for about 49% of installed sodium bicarbonate capacity; the majority of them operate multiple sites in various locations. Solvay came in second with 16.5 percent of the total, followed by Henan Zhongyuan with 16.5 percent (15.8 percent). Over the forecast period, capacity is expected to grow at a 3 percent annual average pace. New materials are being developed in the global Sodium Bicarbonate Market to suit the need for high-quality culinary and pharmaceutical-grade sodium bicarbonate. The expansion of activities in end-use industries such as food and beverage, pharmaceuticals, and chemical industries could enhance opportunities for sodium bicarbonate producers.Sodium Bicarbonate Market Segment Analysis

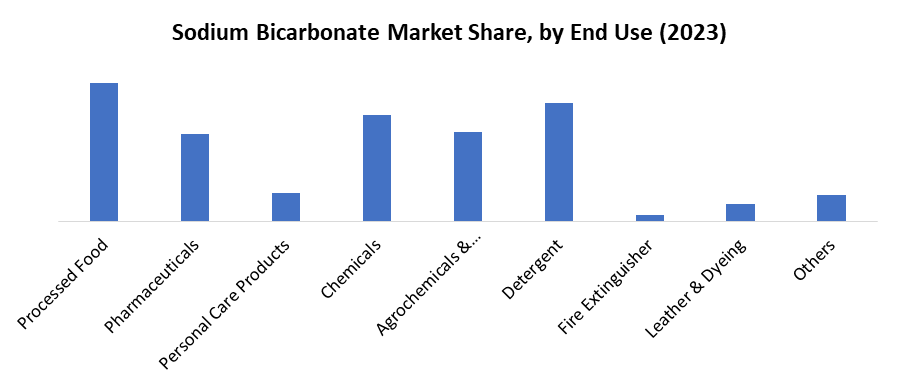

Based on Grade Type, the market is segmented into Pharmaceutical Grade, Technical Grade, Food Grade, and Feed Grade. Technical Grade segment dominated the market in 2023 and is expected to hold the largest Sodium Bicarbonate Market share over the forecast period. The Technical grading system helps differentiate sodium bicarbonate products based on their intended use, purity, and specific characteristics. Technical Grade sodium bicarbonate is produced and marketed for industrial and technical applications rather than for use in food, pharmaceuticals, or other sectors that require higher purity standards. Technical Grade sodium bicarbonate finds applications in a variety of industrial processes. It is often used in sectors where the exact purity level is not as critical as in food or pharmaceutical applications. Common applications include water treatment, flue gas desulfurization, waste treatment, metal surface treatment, and chemical manufacturing. Technical Grade sodium bicarbonate is designed to meet the requirements of industrial users and is often formulated for ease of handling and storage in various manufacturing environments, which significantly boosts the Sodium Bicarbonate Market growth. This includes bulk packaging options suitable for industrial settings.Based on Form, the market is segmented into Powder, Pellets, Slurry, and Liquid. The powder segment is expected to hold the largest Sodium Bicarbonate Market share over the forecast period. Powdered sodium bicarbonate is a dry, fine powder or granular substance. The particle size vary, but in general, it is finely ground to facilitate easy dissolution or dispersion in various applications. Powdered sodium bicarbonate is versatile and used in a wide range of applications due to its ability to dissolve or mix easily in various solutions, which significantly boosts the Sodium Bicarbonate Market growth. This form is suitable for applications where rapid dispersion and uniform mixing are essential. Powdered sodium bicarbonate is typically highly soluble in water. This solubility property makes it convenient for use in applications where a rapid reaction or dissolution is required. Powdered sodium bicarbonate generally exhibits good stability during storage. Proper packaging and storage conditions are essential to maintain its quality and prevent moisture absorption, which affect its properties. Based on End-Use, the market is segmented into Processed Food, Pharmaceuticals, Personal Care Products, Chemicals, Agrochemicals & Nutrients, Detergent, Fire Extinguisher, Leather & dyeing, and Others. Processed Food segment dominated the market in 2023 and is expected to hold the largest Sodium Bicarbonate Market share over the forecast period. Sodium bicarbonate, also known as baking soda, plays a crucial role in the food industry, particularly in the preparation and processing of various food items. Sodium bicarbonate is often included in dough formulations to improve dough conditioning. It enhances the handling properties of the dough and contribute to the final texture of baked goods, which boosts the Sodium Bicarbonate Market growth.

Sodium Bicarbonate Market Regional Insights

Food and Beverage Industry to boost the Sodium Bicarbonate Market growth The burgeoning population and changing consumer preferences in the Asia Pacific region drive the demand for processed and convenience foods. Sodium bicarbonate, as a leavening agent and pH regulator, is extensively used in the food and beverage industry. The expanding food processing sector boosts the consumption of sodium bicarbonate. Growing awareness of health and hygiene, coupled with a rising focus on environmentally friendly cleaning solutions, has led to an increased use of sodium bicarbonate in household cleaning products. Consumers in the Asia Pacific region is increasingly opting for eco-friendly and sustainable cleaning agents, contributing to the demand for sodium bicarbonate. Sodium bicarbonate is utilized in agriculture for soil amendment and as a feed additive in the animal feed industry. The emphasis on sustainable agricultural practices and the need for efficient animal nutrition positively impact the demand for sodium bicarbonate in the Asia Pacific agricultural sector. The escalating need for clean and safe water, driven by concerns about water pollution and scarcity, has led to an increased use of sodium bicarbonate in water treatment processes. The Asia Pacific region's focus on environmental conservation and sustainable water management practices contributes to the growth of sodium bicarbonate in this application. In India, it is widely used in the food and beverage industry, Agricultural applications for soil amendment, and growing awareness of sodium bicarbonate's uses in households, significantly boosts the India Sodium Bicarbonate Market growth. Sodium bicarbonate is utilized in various pharmaceutical and healthcare applications, such as antacid formulations and medicinal products. The expanding healthcare sector in the Asia Pacific, driven by increasing healthcare awareness and infrastructure development, positively impacts the sodium bicarbonate market. The Asia Pacific region has witnessed a growing emphasis on renewable energy sources. Sodium bicarbonate is used in certain applications related to renewable energy technologies, such as flue gas desulfurization in power plants. Government initiatives promoting clean energy contribute to the demand for sodium bicarbonate in these applications. Sodium bicarbonate plays a role in the textile and leather industries, contributing to processes such as dyeing and tanning. The expanding textile and leather sectors in the Asia Pacific, driven by increased consumer demand for apparel and goods, boost the demand for sodium bicarbonate.Sodium Bicarbonate Market Scope: Inquiry Before Buying

Sodium Bicarbonate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.60 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 6.56 Bn. Segments Covered: by Grade Type Pharmaceutical Grade Technical Grade Food Grade Feed Grade by Form Powder Pellets Slurry Liquid by End-use Processed Food Pharmaceuticals Personal Care Products Chemicals Agrochemicals & Nutrients Detergent Fire Extinguisher Leather & Dyeing Others Sodium Bicarbonate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Sodium Bicarbonate Manufacturers Include:

Global: 1. FMC Corporation (Philadelphia, Pennsylvania, USA) 2. Soda Sanayii A.S`. ( Istanbul, Turkey) 3. Natrium Products, Inc. ( Chattanooga, Tennessee, USA) 4. CIECH S.A. (Warsaw, Poland) North America: 5. Church & Dwight Co., Inc. (Ewing, New Jersey, USA) 6. Natrium Products, Inc. (Chattanooga, Tennessee, USA) 7. Genesis Alkali, LLC (Green River, Wyoming, USA) 8. Natural Soda Holdings, Inc. (Rifle, Colorado, USA) Europe: 9. Solvay S.A. Brussels, Belgium 10. Novacarb (Novacap Group) (Le Vésinet, France) 11. CIECH S.A. (Warsaw, Poland) Asia-Pacific: 12. Tata Chemicals Limited (Mumbai, India) 13. Inner Mongolia Yuanxing Energy Co., Ltd (Inner Mongolia, China) 14. Shandong Haihua Group Co., Ltd. (Zibo, Shandong, China) 15. Tosoh Corporation (Tokyo, Japan) 16. Tianjin Bohai Chemical Industry Group Co., Ltd. (Tianjin, China) 17. Nirma ltd. - Headquarters: Ahmedabad, India Frequently Asked Questions: 1. What is sodium bicarbonate, and where is it commonly used? Ans: Sodium bicarbonate, or baking soda, is a chemical compound with alkaline properties. It is widely used in foods, mineral water, medicine, and various industries such as food and beverage, pharmaceuticals, personal care, and industrial processes. 2. What drives the Sodium Bicarbonate Market? Ans: The market is driven by its versatile applications in buffering, leavening, and neutralizing. Widely used in baking, food and beverage, pharmaceuticals, and cleaning, its demand is fueled by environmental awareness and multipurpose utility. 3. What are the drivers of sodium bicarbonate demand in the household and cleaning segment? Ans: Sodium bicarbonate is a common ingredient in household cleaning products due to its abrasive and odor-neutralizing properties. It is effective in stain removal, surface cleaning, and deodorizing household items, contributing to consistent use. 4. How do fluctuations in raw material prices impact the Sodium Bicarbonate Market? Ans: Fluctuations in the cost of raw materials, particularly sodium carbonate, affect production costs and impact profitability for manufacturers of sodium bicarbonate.

1. Sodium Bicarbonate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sodium Bicarbonate Market: Dynamics 2.1. Sodium Bicarbonate Market Trends by Region 2.1.1. North America Sodium Bicarbonate Market Trends 2.1.2. Europe Sodium Bicarbonate Market Trends 2.1.3. Asia Pacific Sodium Bicarbonate Market Trends 2.1.4. Middle East and Africa Sodium Bicarbonate Market Trends 2.1.5. South America Sodium Bicarbonate Market Trends 2.2. Sodium Bicarbonate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sodium Bicarbonate Market Drivers 2.2.1.2. North America Sodium Bicarbonate Market Restraints 2.2.1.3. North America Sodium Bicarbonate Market Opportunities 2.2.1.4. North America Sodium Bicarbonate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sodium Bicarbonate Market Drivers 2.2.2.2. Europe Sodium Bicarbonate Market Restraints 2.2.2.3. Europe Sodium Bicarbonate Market Opportunities 2.2.2.4. Europe Sodium Bicarbonate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sodium Bicarbonate Market Drivers 2.2.3.2. Asia Pacific Sodium Bicarbonate Market Restraints 2.2.3.3. Asia Pacific Sodium Bicarbonate Market Opportunities 2.2.3.4. Asia Pacific Sodium Bicarbonate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sodium Bicarbonate Market Drivers 2.2.4.2. Middle East and Africa Sodium Bicarbonate Market Restraints 2.2.4.3. Middle East and Africa Sodium Bicarbonate Market Opportunities 2.2.4.4. Middle East and Africa Sodium Bicarbonate Market Challenges 2.2.5. South America 2.2.5.1. South America Sodium Bicarbonate Market Drivers 2.2.5.2. South America Sodium Bicarbonate Market Restraints 2.2.5.3. South America Sodium Bicarbonate Market Opportunities 2.2.5.4. South America Sodium Bicarbonate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis for Sodium Bicarbonate Industry 2.7. The Global Pandemic Impact on Sodium Bicarbonate Market 3. Sodium Bicarbonate Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 3.1.1. Pharmaceutical Grade 3.1.2. Technical Grade 3.1.3. Food Grade 3.1.4. Feed Grade 3.2. Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 3.2.1. Powder 3.2.2. Pellets 3.2.3. Slurry 3.2.4. Liquid 3.3. Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 3.3.1. Processed Food 3.3.2. Pharmaceuticals 3.3.3. Personal Care Products 3.3.4. Chemicals 3.3.5. Agrochemicals & Nutrients 3.3.6. Detergent 3.3.7. Fire Extinguisher 3.3.8. Leather & Dyeing 3.3.9. Others 3.4. Sodium Bicarbonate Market Size and Forecast, by region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Sodium Bicarbonate Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 4.1.1. Pharmaceutical Grade 4.1.2. Technical Grade 4.1.3. Food Grade 4.1.4. Feed Grade 4.2. North America Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 4.2.1. Powder 4.2.2. Pellets 4.2.3. Slurry 4.2.4. Liquid 4.3. North America Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 4.3.1. Processed Food 4.3.2. Pharmaceuticals 4.3.3. Personal Care Products 4.3.4. Chemicals 4.3.5. Agrochemicals & Nutrients 4.3.6. Detergent 4.3.7. Fire Extinguisher 4.3.8. Leather & Dyeing 4.3.9. Others 4.4. North America Sodium Bicarbonate Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 4.4.1.1.1. Pharmaceutical Grade 4.4.1.1.2. Technical Grade 4.4.1.1.3. Food Grade 4.4.1.1.4. Feed Grade 4.4.1.2. United States Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 4.4.1.2.1. Powder 4.4.1.2.2. Pellets 4.4.1.2.3. Slurry 4.4.1.2.4. Liquid 4.4.1.3. United States Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 4.4.1.3.1. Processed Food 4.4.1.3.2. Pharmaceuticals 4.4.1.3.3. Personal Care Products 4.4.1.3.4. Chemicals 4.4.1.3.5. Agrochemicals & Nutrients 4.4.1.3.6. Detergent 4.4.1.3.7. Fire Extinguisher 4.4.1.3.8. Leather & Dyeing 4.4.1.3.9. Others 4.4.2. Canada 4.4.2.1. Canada Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 4.4.2.1.1. Pharmaceutical Grade 4.4.2.1.2. Technical Grade 4.4.2.1.3. Food Grade 4.4.2.1.4. Feed Grade 4.4.2.2. Canada Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 4.4.2.2.1. Powder 4.4.2.2.2. Pellets 4.4.2.2.3. Slurry 4.4.2.2.4. Liquid 4.4.2.3. Canada Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 4.4.2.3.1. Processed Food 4.4.2.3.2. Pharmaceuticals 4.4.2.3.3. Personal Care Products 4.4.2.3.4. Chemicals 4.4.2.3.5. Agrochemicals & Nutrients 4.4.2.3.6. Detergent 4.4.2.3.7. Fire Extinguisher 4.4.2.3.8. Leather & Dyeing 4.4.2.3.9. Others 4.4.3. Mexico 4.4.3.1. Mexico Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 4.4.3.1.1. Pharmaceutical Grade 4.4.3.1.2. Technical Grade 4.4.3.1.3. Food Grade 4.4.3.1.4. Feed Grade 4.4.3.2. Mexico Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 4.4.3.2.1. Powder 4.4.3.2.2. Pellets 4.4.3.2.3. Slurry 4.4.3.2.4. Liquid 4.4.3.3. Mexico Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 4.4.3.3.1. Processed Food 4.4.3.3.2. Pharmaceuticals 4.4.3.3.3. Personal Care Products 4.4.3.3.4. Chemicals 4.4.3.3.5. Agrochemicals & Nutrients 4.4.3.3.6. Detergent 4.4.3.3.7. Fire Extinguisher 4.4.3.3.8. Leather & Dyeing 4.4.3.3.9. Others 5. Europe Sodium Bicarbonate Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.2. Europe Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.3. Europe Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4. Europe Sodium Bicarbonate Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.1.2. United Kingdom Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.1.3. United Kingdom Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.2. France 5.4.2.1. France Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.2.2. France Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.2.3. France Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.3.2. Germany Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.3.3. Germany Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.4.2. Italy Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.4.3. Italy Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.5.2. Spain Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.5.3. Spain Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.6.2. Sweden Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.6.3. Sweden Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.7.2. Austria Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.7.3. Austria Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 5.4.8.2. Rest of Europe Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 5.4.8.3. Rest of Europe Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6. Asia Pacific Sodium Bicarbonate Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.2. Asia Pacific Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.3. Asia Pacific Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4. Asia Pacific Sodium Bicarbonate Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.1.2. China Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.1.3. China Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.2.2. S Korea Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.2.3. S Korea Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.3.2. Japan Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.3.3. Japan Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.4. India 6.4.4.1. India Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.4.2. India Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.4.3. India Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.5.2. Australia Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.5.3. Australia Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.6.2. Indonesia Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.6.3. Indonesia Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.7.2. Malaysia Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.7.3. Malaysia Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.8.2. Vietnam Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.8.3. Vietnam Sodium Bicarbonate Market Size and Forecast, By End Use(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.9.2. Taiwan Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.9.3. Taiwan Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 6.4.10.3. Rest of Asia Pacific Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 7. Middle East and Africa Sodium Bicarbonate Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 7.2. Middle East and Africa Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 7.3. Middle East and Africa Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 7.4. Middle East and Africa Sodium Bicarbonate Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 7.4.1.2. South Africa Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 7.4.1.3. South Africa Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 7.4.2.2. GCC Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 7.4.2.3. GCC Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 7.4.3.2. Nigeria Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 7.4.3.3. Nigeria Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 7.4.4.2. Rest of ME&A Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 7.4.4.3. Rest of ME&A Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 8. South America Sodium Bicarbonate Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 8.2. South America Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 8.3. South America Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 8.4. South America Sodium Bicarbonate Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 8.4.1.2. Brazil Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 8.4.1.3. Brazil Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 8.4.2.2. Argentina Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 8.4.2.3. Argentina Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Sodium Bicarbonate Market Size and Forecast, By Grade Type (2023-2030) 8.4.3.2. Rest Of South America Sodium Bicarbonate Market Size and Forecast, By Form (2023-2030) 8.4.3.3. Rest Of South America Sodium Bicarbonate Market Size and Forecast, By End Use (2023-2030) 9. Global Sodium Bicarbonate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Sodium Bicarbonate Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1.1. FMC Corporation (Philadelphia, Pennsylvania, USA) 10.1.2. Company Overview 10.1.3. Business Portfolio 10.1.4. Financial Overview 10.1.5. SWOT Analysis 10.1.6. Strategic Analysis 10.1.7. Recent Developments 10.2. Ciner Resources LP (Atlanta, Georgia, USA) 10.3. Soda Sanayii A.S. ( Istanbul, Turkey) 10.4. Natrium Products, Inc. ( Chattanooga, Tennessee, USA) 10.5. CIECH S.A. (Warsaw, Poland) 10.6. Church & Dwight Co., Inc. (Ewing, New Jersey, USA) 10.7. Natrium Products, Inc. (Chattanooga, Tennessee, USA) 10.8. Genesis Alkali, LLC (Green River, Wyoming, USA) 10.9. Natural Soda Holdings, Inc. (Rifle, Colorado, USA) 10.10. Solvay S.A. Brussels, Belgium 10.11. Novacarb (Novacap Group) (Le Vésinet, France) 10.12. CIECH S.A. (Warsaw, Poland) 10.13. Tata Chemicals Limited (Mumbai, India) 10.14. Inner Mongolia Yuanxing Energy Co., Ltd (Inner Mongolia, China) 10.15. Shandong Haihua Group Co., Ltd. (Zibo, Shandong, China) 10.16. Tosoh Corporation (Tokyo, Japan) 10.17. Tianjin Bohai Chemical Industry Group Co., Ltd. (Tianjin, China) 10.18. Nirma Limited - Headquarters: Ahmedabad, India 11. Key Findings 12. Industry Recommendations 13. Sodium Bicarbonate Market: Research Methodology