The Socks Market size was valued at USD 54.57 Billion in 2024 and the total Socks revenue is expected to grow at a CAGR of 6.41% from 2025 to 2032, reaching nearly USD 89.71 Billion.Global Socks Market Overview:

A sock is a garment designed to envelop the foot, ankle, and, at times, the lower portion of the leg. Typically, socks are worn within footwear, and they can serve as insoles to enhance the fit of shoes. Historically, socks were fashioned from materials such as leather or matted animal hair. It wasn't until the late 16th century that machine-knit socks were first manufactured. Socks play a multifaceted role in foot comfort and well-being. They offer protection by creating a barrier between the foot and the shoe, thereby mitigating friction and preventing the formation of blisters. The graphical representation and structural exclusive information showed the dominating region of the Global Socks Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Socks Market.To know about the Research Methodology :- Request Free Sample Report

Socks Market Dynamics

Increasing Fashion Trends in Athletic and Sports Sector and Growing E-Commerce driving the Socks Market The socks market experiences continuous growth due to the ever-changing landscape of fashion trends. Socks, whether designer socks or athletic socks, have evolved from being purely functional to a fashion statement. Consumers seek socks with various colors, patterns, and designs to complement their outfits, making designer socks a hot commodity. The demand for stylish and designer socks is driven by the desire to make a fashion statement and showcase individual style. The proliferation of e-commerce has significantly impacted the socks market, allowing consumers to explore and purchase socks, including designer and athletic socks, from the comfort of their homes. Online retail platforms have made it convenient for consumers to access a wide array of sock options, compare prices, and read reviews, further boosting the market. Athletic socks are a pivotal part of the socks market, as the rise in sports and fitness activities has a direct impact. Athletes and fitness enthusiasts require specialized socks with features like moisture-wicking, arch support, and cushioning to enhance their performance and comfort. This trend creates a substantial demand for sports-specific socks, such as running socks or compression socks. There is a growing awareness among consumers about the importance of foot health and comfort, particularly in the context of designer and athletic socks. Socks are no longer viewed solely as a fashion accessory but as a functional garment that contributes to overall well-being. Socks with features like moisture control, temperature regulation, and additional comfort padding are sought after to ensure a comfortable and healthy experience for the wearer. Advancements in textile technology have led to innovations in sock materials, benefiting both designer and athletic socks. Manufacturers are now able to produce socks using materials that offer benefits such as antimicrobial properties to combat odour, sustainability through eco-friendly fabrics, and temperature regulation for enhanced comfort. These innovations provide consumers with more choices and contribute to market growth. Sustainable Socks Material and International Expansion creating huge opportunities for the Socks Market A significant opportunity in the socks market, including designer and athletic socks, lies in the demand for sustainability. Consumers are increasingly concerned about the environmental impact of their purchases. Sock manufacturers can seize this opportunity by producing eco-friendly, sustainable socks using materials like organic cotton, bamboo, or recycled fibers. Eco-conscious consumers are willing to pay a premium for socks that align with their environmental values. The growing trend of personalization and customization presents a unique opportunity for sock manufacturers. Consumers are interested in creating custom-designed socks, whether they are designer or athletic, with their preferred colors, patterns, and even personalized messages or images. This trend not only adds a personal touch but also provides a platform for niche businesses to cater to specific consumer preferences. Emerging markets with rising disposable incomes and increasing fashion awareness provide an excellent opportunity for international expansion in the socks industry. Manufacturers can tap into these markets by adapting their product offerings to cater to the unique preferences and demands of consumers in these regions, opening up new avenues for growth and revenue. As the global population continues to age, there is a growing opportunity to address the specific needs of older consumers, including those seeking diabetic or non-slip socks. Specialized socks can meet the comfort and safety requirements of elderly individuals, representing a niche market that is poised for growth. Intense Competition and Supply Chain Disruptions are the key factors that restraining the Socks Market The socks market, encompassing designer and athletic socks, is highly competitive, with numerous manufacturers vying for consumer attention. Intense competition can result in pricing pressures, potentially leading to reduced profit margins for brands. Therefore, companies must continuously innovate and differentiate their products to maintain a competitive edge. Global supply chain disruptions, including factors like raw material shortages, transportation issues, and labor disputes, can hamper the production and distribution of socks, whether they are designer or athletic. These disruptions may lead to delays in product availability and increased costs for manufacturers, affecting the overall industry. Economic downturns and fluctuations can significantly impact consumer spending, affecting the socks market, including designer and athletic socks. During periods of economic instability, consumers may prioritize essential expenses over discretionary items like fashion socks, leading to reduced sales and profitability for sock manufacturers. The presence of counterfeit or substandard sock products in the market poses a significant challenge for the socks industry, including designer and athletic socks. Counterfeit items not only infringe on intellectual property but can also harm brand reputation and consumer trust. Manufacturers must invest in brand protection and authentication measures to combat this issue. Increasing awareness of the environmental impact of the fashion industry presents a restraint for traditional sock materials and manufacturing processes, affecting the entire socks industry, including designer and athletic socks. Sock manufacturers are under pressure to adopt sustainable practices and materials, which may require investment and adjustment to their operations, impacting costs and product development timelines.Socks Market Segment Analysis

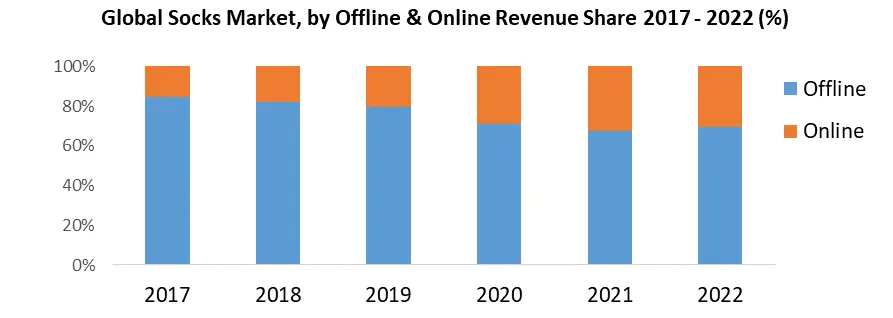

Application: In the dynamic realm of the socks market, fashion socks stand as a testament to style and aesthetics. Fashion socks are designed to captivate consumers who view socks not merely as functional attire but as a fashion accessory. They manifest in various captivating colors, patterns, and designs, often mirroring the latest trends in the fashion world, catering to the desires of those seeking a style statement in their sock choices. Athletic and sports socks represent the pinnacle of performance-oriented hosiery. Engineered with features like moisture-wicking, arch support, and cushioning, these socks are meticulously crafted to enhance the athletic and sporting endeavours of individuals. They serve as the go-to choice for athletes, fitness enthusiasts, and those engaged in a wide spectrum of sports and physical activities. Within the socks market, the realm of medical and therapeutic socks plays a crucial role in addressing specific health concerns. This category includes specialized socks like diabetic socks, designed to enhance circulation, and compression socks, aimed at reducing swelling. Often recommended and prescribed by healthcare professionals, these socks serve as vital aids for individuals dealing with various medical conditions. Fashion socks are at the forefront of the Socks Market's drive for market growth. These socks prioritize style and aesthetics, making them a favourite among consumers who view socks as a fashion accessory. Athletic and sports socks represent a pivotal segment in the Socks Industry. Designed with performance in mind, these socks offer features like moisture-wicking, arch support, and cushioning, thereby meeting the specific needs of athletes, fitness enthusiasts, and individuals engaged in various sports and physical activities. This segment significantly contributes to market expansion. Medical and therapeutic socks are an essential component of the Socks Market, addressing specific health issues. This segment, which includes diabetic socks and compression socks, is recommended and prescribed by healthcare professionals to assist in various medical conditions, underscoring its significance in market penetration. Type: Within the diverse landscape of sock types, crew socks take the spotlight. These socks are typically longer, covering the calf and making them a versatile choice. They seamlessly transition from casual and athletic wear to work wear, accommodating a broad spectrum of consumer preferences. Crew socks, renowned for their versatility, are longer and cover the calf. They serve various purposes, making them a preferred choice for casual, athletic, and work wear. The diversity of applications for crew socks contributes to their market share and value. Ankle socks, a staple in the socks market, are shorter and rest just above or below the ankle. They are commonly chosen for casual and athletic activities due to their unobtrusive fit and comfort, catering to various lifestyles and preferences. Ankle socks, resting just above or below the ankle, are commonly worn for casual and athletic activities. These socks have garnered popularity due to their comfort and discreet appearance, enriching the market's offerings and appeal. Knee-high socks, celebrated for their distinctive length, extend up the leg to the knee. These socks offer a blend of warmth and style and are frequently paired with skirts and dresses, providing a touch of elegance to the attire. This segment adds a layer of elegance to the Socks Market. The no-show or low-cut socks category is designed with the intention of remaining concealed inside the shoe. This makes them a popular choice, particularly for casual and athletic footwear, where the focus is on functionality without compromising style. No-show or low-cut socks are engineered to remain hidden inside the shoe, making them a popular choice for casual and athletic footwear. They have gained favour due to their discreet nature, contributing to market value by offering a solution for those seeking inconspicuous comfort. In the realm of specialty socks, compression socks play a vital role. These socks are meticulously engineered to enhance blood circulation and are often utilized in medical and therapeutic applications, providing support and comfort for individuals with specific health needs. Whether it's enhancing performance, addressing medical concerns, or making a fashion statement, the socks market caters to a diverse array of consumer preferences, ensuring that there is a perfect pair for every need and style. This segment is instrumental in addressing health concerns, aligning with the market's commitment to both comfort and well-being. Sales Channel: In the ever-evolving world of the socks market, online retail platforms play a pivotal role. Online retail, a burgeoning sales channel, facilitates the exploration and purchase of a wide variety of socks, including designer and athletic socks, from the comfort of consumers' homes. These platforms provide an extensive selection, ranging from everyday basics to high-end designer and specialty socks, catering to a diverse range of preferences. Online retail has become a cornerstone of the Socks Industry's market growth. Consumers now have the convenience of browsing and purchasing a wide range of socks from the comfort of their homes, enhancing market penetration. This channel offers a vast selection of socks, including designer and athletic socks, providing consumers with a convenient and comprehensive shopping experience. Specialized sock stores and boutiques, designed exclusively for sock enthusiasts, offer a unique shopping experience. These stores curate a selection of fashionable, designer, and unique socks. For those with a particular penchant for socks, these establishments provide a personalized journey, whether in search of designer or athletic sock options. Specialty sock stores and boutiques are a unique and niche segment within the Socks Industry, catering exclusively to sock enthusiasts. These stores offer a curated selection of fashionable, designer, and unique sock options, contributing to market share by providing a personalized and specialized shopping experience for consumers with a particular interest in socks.

Socks Market Regional Analysis

The Asia-Pacific region stands as a thriving hub for the Socks Market, characterized by its vast population, diverse consumer preferences, and rapidly growing economies. The Asia-Pacific region exhibits robust market growth, driven by increasing disposable incomes, urbanization, and a rising middle class. Consumers in countries like China, India, and Japan are increasingly embracing socks as both fashion accessories and functional garments. Socks have high market penetration in this region, with a strong cultural emphasis on footwear and fashion. In many Asian countries, socks are considered an essential element of the wardrobe, offering a wide range of opportunities for manufacturers and retailers. Local and international sock brands vie for market share in the Asia-Pacific region. Brands that offer a blend of quality, style, and affordability tend to capture significant market share. Additionally, designer and fashion socks have gained traction, particularly among the younger demographic. The market value of the sock industry in Asia-Pacific continues to grow due to the sheer size of the regional population. With a growing preference for higher-quality and innovative sock options, the market's overall value is on the rise. The Socks Market in Asia-Pacific is expanding into various sub-segments, such as eco-friendly socks and specialized socks tailored to specific regional needs. Online retail is a significant driver of market expansion, making it convenient for consumers to access a wide variety of sock options. The North American Socks Market is shaped by evolving consumer trends, technological advancements, and a focus on sustainability. The North American market demonstrates steady growth due to consumers' desire for comfort and style. Athleisure trends have propelled the demand for athletic socks, while fashion-forward designs contribute to the growth of designer socks. Socks have high market penetration in North America, with consumers valuing both fashion and functionality. The market caters to a diverse consumer base, ranging from fashion-conscious urban dwellers to those seeking specialized socks for athletic pursuits. Leading brands in North America often prioritize quality and eco-friendly practices, which resonates with environmentally conscious consumers. The market is shared by established brands, emerging labels, and niche manufacturers offering innovative sock designs. The European Socks Market blends tradition with innovation, offering a variety of sock styles to diverse consumer preferences. The European socks market experiences continuous growth, with socks evolving into a fashion staple. Consumers seek quality and style, fuelling the demand for designer and fashion socks. Additionally, the emergence of performance-oriented socks is driven by the active lifestyle of European consumers. Socks enjoy high market penetration in Europe, with varying preferences across countries. The market is characterized by consumers valuing not only comfort but also fashion. Socks are considered a crucial element of European wardrobes. European consumers tend to favour brands with a rich heritage, quality craftsmanship, and eco-friendly practices. The market features a blend of established sock manufacturers, luxury brands, and emerging sustainable sock labels, each vying for socks market share.

Socks Market Competitive Landscape

In a dynamic move that resonates strongly with both the Socks Market and Socks Industry, Nike has joined hands with Dove to introduce an innovative initiative called Body Confident Sport. This ground breaking project is designed to foster market growth while addressing an essential societal concern. Specifically, Body Confident Sport offers a unique set of coaching tools catered to 11- to 17-year-old girls, with a focus on building their body confidence. It signifies a compelling step forward in enhancing market penetration and nurturing the self-esteem of young girls, making them feel at home in the world of sports. The collaboration is a result of a two-year partnership between Nike and Dove, alongside contributions from world-renowned experts and thousands of adolescents from various countries. It underscores the commitment of these two industry giants to not only capture market share but also positively impact lives and instill a sense of belonging within the realm of athletics. In another exciting venture aimed at inspiring and empowering girls, Nike has expanded its reach in the UK, further catalysing Socks Market expansion. On the occasion of World Mental Health Day, Nike has teamed up with Spotify to introduce the Make Moves Fund. This innovative initiative is designed to harness the power of music to encourage girls aged 10 to 17 to engage in physical activity and improve their mental well-being. The Make Moves Fund, co-funded by Nike and Spotify, will provide grants to community organizations in the UK that propose creative, girl-centric programs combining music and dance. By embarking on this venture, Nike and Spotify are not only focusing on market value but also championing the cause of inspiring young girls to lead active, empowered lives on their own terms. Shifting our attention to the realm of swimming, Adidas has announced an exciting partnership with SOUL CAP, a step that reflects a commitment to promoting diversity and inclusivity in a sport that transcends geographical boundaries. This partnership is set to break down social barriers and foster market growth in the swimming sector.The center piece of this collaboration is the introduction of a debut swim cap specially designed for individuals with long or voluminous hair, catering to both adults and children. The exclusive linen green swim cap, a symbol of this partnership's dedication to inclusivity, will be accessible through Adidas channels, underlining their aim to embrace a more diverse audience and expand their market share. Lastly, Adidas is making strides in celebrating its past, present, and future by joining forces with the iconic band KoRn, a cultural influencer whose impact transcends music alone. This collaboration not only celebrates a trailblazing legacy but also brings together two influential forces that have continuously challenged conventions. From KoRn's ground breaking emergence in the music scene to their bold aesthetic choices, they have maintained a deep-rooted connection with Adidas. This association, later immortalized by their song "A.D.I.D.A.S.," signifies the enduring bond between the band and the Trefoil. In this partnership, Adidas reaffirms its role in preserving cultural heritage and creating a platform for market expansion, strengthening their market value, and leaving an indelible mark on the industry.

Socks Market Scope: Inquiry Before Buying

Socks Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 54.57 Bn. Forecast Period 2025 to 2032 CAGR: 6.41% Market Size in 2032: USD 89.71 Bn. Segments Covered: by Type Crew Socks Ankle Socks Knee-High Socks No-Show or Low-Cut Socks Compression Socks by Application Fashion Socks Athletic and Sports Socks Medical and Therapeutic Socks by Sales Channel Online Retail Offline Stores by End-User Men Women Children Socks Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Socks Market

1. Nike, Inc. 2. Adidas AG 3. Hanesbrands Inc. 4. Puma SE 5. Under Armour, Inc. 6. Berkshire Hathaway Inc. (Fruit of the Loom) 7. Gildan Activewear Inc. 8. Skechers USA, Inc. 9. Calvin Klein, Inc. 10. H&M Hennes & Mauritz AB 11. Stance, Inc. 12. Burlington Socks (by Kappa) 13. Thorlos, Inc. 14. Smartwool (by VF Corporation) 15. Socksmith Design, Inc. 16. Anta 17. UNIQLO 18. SHEIN 19. ZARA 20. The North Face 21. Vans Frequently Asked Questions 1. What was the Global Socks Market size in 2024? Ans: The Global Socks Market size was USD 54.57 Billion in 2024. 2. How is market share distributed among established and emerging sock brands? Ans: Established brands maintain a significant market share, but emerging brands are gaining ground, particularly in the designer and sustainable sock segments. 3. What role does sustainability play in the Socks Market's expansion? Ans: Sustainability is a catalyst for market expansion, with eco-friendly sock options attracting environmentally conscious consumers. 4. How are regional markets contributing to the overall value of the Socks Market? Ans: Asia-Pacific, North America, and Europe are key regions driving the market's overall value due to diverse consumer preferences and market penetration. 5. What are the emerging trends in specialized socks for specific end-users? Ans: Specialized socks for the elderly and individuals with unique needs, such as non-slip or diabetic socks, are emerging trends addressing specific end-user requirements.

1. Socks Market: Research Methodology 2. Socks Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Socks Market: Dynamics 3.1. Socks Market Trends by Region 3.1.1. Global Socks Market Trends 3.1.2. North America Socks Market Trends 3.1.3. Europe Socks Market Trends 3.1.4. Asia Pacific Socks Market Trends 3.1.5. Middle East and Africa Socks Market Trends 3.1.6. South America Socks Market Trends 3.2. Socks Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Socks Market Drivers 3.2.1.2. North America Socks Market Restraints 3.2.1.3. North America Socks Market Opportunities 3.2.1.4. North America Socks Market Challenges 3.2.2. Europe 3.2.2.1. Europe Socks Market Drivers 3.2.2.2. Europe Socks Market Restraints 3.2.2.3. Europe Socks Market Opportunities 3.2.2.4. Europe Socks Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Socks Market Drivers 3.2.3.2. Asia Pacific Socks Market Restraints 3.2.3.3. Asia Pacific Socks Market Opportunities 3.2.3.4. Asia Pacific Socks Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Socks Market Drivers 3.2.4.2. Middle East and Africa Socks Market Restraints 3.2.4.3. Middle East and Africa Socks Market Opportunities 3.2.4.4. Middle East and Africa Socks Market Challenges 3.2.5. South America 3.2.5.1. South America Socks Market Drivers 3.2.5.2. South America Socks Market Restraints 3.2.5.3. South America Socks Market Opportunities 3.2.5.4. South America Socks Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Socks Industry 3.8. Analysis of Government Schemes and Initiatives For Socks Industry 3.9. The Global Pandemic Impact on Socks Market 4. Socks Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 4.1. Socks Market Size and Forecast, by Type (2024-2032) 4.1.1. Crew Socks 4.1.2. Ankle Socks 4.1.3. Knee-High Socks 4.1.4. No-Show or Low-Cut Socks 4.1.5. Compression Socks 4.2. Socks Market Size and Forecast, by Application (2024-2032) 4.2.1. Fashion Socks 4.2.2. Athletic and Sports Socks 4.2.3. Medical and Therapeutic Socks 4.3. Socks Market Size and Forecast, by Sales Channel (2024-2032) 4.3.1. Online Retail 4.3.2. Offline Stores 4.4. Socks Market Size and Forecast, by End-User (2024-2032) 4.4.1. Men 4.4.2. Women 4.4.3. Children 4.5. Socks Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Socks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 5.1. North America Socks Market Size and Forecast, by Type (2024-2032) 5.1.1. Crew Socks 5.1.2. Ankle Socks 5.1.3. Knee-High Socks 5.1.4. No-Show or Low-Cut Socks 5.1.5. Compression Socks 5.2. North America Socks Market Size and Forecast, by Application (2024-2032) 5.2.1. Fashion Socks 5.2.2. Athletic and Sports Socks 5.2.3. Medical and Therapeutic Socks 5.3. North America Socks Market Size and Forecast, by Sales Channel (2024-2032) 5.3.1. Online Retail 5.3.2. Offline Stores 5.4. Socks Market Size and Forecast, by End-User (2024-2032) 5.4.1. Men 5.4.2. Women 5.4.3. Children 5.5. North America Socks Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Socks Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Crew Socks 5.5.1.1.2. Ankle Socks 5.5.1.1.3. Knee-High Socks 5.5.1.1.4. No-Show or Low-Cut Socks 5.5.1.1.5. Compression Socks 5.5.1.2. United States Socks Market Size and Forecast, by Application (2024-2032) 5.5.1.2.1. Fashion Socks 5.5.1.2.2. Athletic and Sports Socks 5.5.1.2.3. Medical and Therapeutic Socks 5.5.1.3. United States Socks Market Size and Forecast, by Sales Channel (2024-2032) 5.5.1.3.1. Online Retail 5.5.1.3.2. Offline Stores 5.5.1.4. Socks Market Size and Forecast, by End-User (2024-2032) 5.5.1.4.1. Men 5.5.1.4.2. Women 5.5.1.4.3. Children 5.5.2. Canada 5.5.2.1. Canada Socks Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Crew Socks 5.5.2.1.2. Ankle Socks 5.5.2.1.3. Knee-High Socks 5.5.2.1.4. No-Show or Low-Cut Socks 5.5.2.1.5. Compression Socks 5.5.2.2. Canada Socks Market Size and Forecast, by Application (2024-2032) 5.5.2.2.1. Fashion Socks 5.5.2.2.2. Athletic and Sports Socks 5.5.2.2.3. Medical and Therapeutic Socks 5.5.2.3. Canada Socks Market Size and Forecast, by Sales Channel (2024-2032) 5.5.2.3.1. Online Retail 5.5.2.3.2. Offline Stores 5.5.2.4. Socks Market Size and Forecast, by End-User (2024-2032) 5.5.2.4.1. Men 5.5.2.4.2. Women 5.5.2.4.3. Children 5.5.3. Mexico 5.5.3.1. Mexico Socks Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Crew Socks 5.5.3.1.2. Ankle Socks 5.5.3.1.3. Knee-High Socks 5.5.3.1.4. No-Show or Low-Cut Socks 5.5.3.1.5. Compression Socks 5.5.3.2. Mexico Socks Market Size and Forecast, by Application (2024-2032) 5.5.3.2.1. Fashion Socks 5.5.3.2.2. Athletic and Sports Socks 5.5.3.2.3. Medical and Therapeutic Socks 5.5.3.3. Mexico Socks Market Size and Forecast, by Sales Channel (2024-2032) 5.5.3.3.1. Online Retail 5.5.3.3.2. Offline Stores 5.5.3.4. Socks Market Size and Forecast, by End-User (2024-2032) 5.5.3.4.1. Men 5.5.3.4.2. Women 5.5.3.4.3. Children 6. Europe Socks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 6.1. Europe Socks Market Size and Forecast, by Type (2024-2032) 6.2. Europe Socks Market Size and Forecast, by Application (2024-2032) 6.3. Europe Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.4. Europe Socks Market Size and Forecast, by End-User (2024-2032) 6.5. Europe Socks Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Socks Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Socks Market Size and Forecast, by Application (2024-2032) 6.5.1.3. United Kingdom Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.1.4. United Kingdom Socks Market Size and Forecast, by End-User (2024-2032) 6.5.2. France 6.5.2.1. France Socks Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Socks Market Size and Forecast, by Application (2024-2032) 6.5.2.3. France Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.2.4. France Socks Market Size and Forecast, by End-User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Socks Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Socks Market Size and Forecast, by Application (2024-2032) 6.5.3.3. Germany Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.3.4. Germany Socks Market Size and Forecast, by End-User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Socks Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Socks Market Size and Forecast, by Application (2024-2032) 6.5.4.3. Italy Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.4.4. Italy Socks Market Size and Forecast, by End-User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Socks Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Socks Market Size and Forecast, by Application (2024-2032) 6.5.5.3. Spain Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.5.4. Spain Socks Market Size and Forecast, by End-User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Socks Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Socks Market Size and Forecast, by Application (2024-2032) 6.5.6.3. Sweden Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.6.4. Sweden Socks Market Size and Forecast, by End-User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Socks Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Socks Market Size and Forecast, by Application (2024-2032) 6.5.7.3. Austria Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.7.4. Austria Socks Market Size and Forecast, by End-User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Socks Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Socks Market Size and Forecast, by Application (2024-2032) 6.5.8.3. Rest of Europe Socks Market Size and Forecast, by Sales Channel(2024-2032) 6.5.8.4. Rest of Europe Socks Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Socks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Socks Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Socks Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.4. Asia Pacific Socks Market Size and Forecast, by End-User (2024-2032) 7.5. Asia Pacific Socks Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Socks Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Socks Market Size and Forecast, by Application (2024-2032) 7.5.1.3. China Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.1.4. China Socks Market Size and Forecast, by End-User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Socks Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Socks Market Size and Forecast, by Application (2024-2032) 7.5.2.3. S Korea Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.2.4. S Korea Socks Market Size and Forecast, by End-User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Socks Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Socks Market Size and Forecast, by Application (2024-2032) 7.5.3.3. Japan Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.3.4. Japan Socks Market Size and Forecast, by End-User (2024-2032) 7.5.4. India 7.5.4.1. India Socks Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Socks Market Size and Forecast, by Application (2024-2032) 7.5.4.3. India Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.4.4. India Socks Market Size and Forecast, by End-User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Socks Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Socks Market Size and Forecast, by Application (2024-2032) 7.5.5.3. Australia Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.5.4. Australia Socks Market Size and Forecast, by End-User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Socks Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Socks Market Size and Forecast, by Application (2024-2032) 7.5.6.3. Indonesia Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.6.4. Indonesia Socks Market Size and Forecast, by End-User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Socks Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Socks Market Size and Forecast, by Application (2024-2032) 7.5.7.3. Malaysia Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.7.4. Malaysia Socks Market Size and Forecast, by End-User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Socks Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Socks Market Size and Forecast, by Application (2024-2032) 7.5.8.3. Vietnam Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.8.4. Vietnam Socks Market Size and Forecast, by End-User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Socks Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Socks Market Size and Forecast, by Application (2024-2032) 7.5.9.3. Taiwan Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.9.4. Taiwan Socks Market Size and Forecast, by End-User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Socks Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Socks Market Size and Forecast, by Application (2024-2032) 7.5.10.3. Rest of Asia Pacific Socks Market Size and Forecast, by Sales Channel(2024-2032) 7.5.10.4. Rest of Asia Pacific Socks Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Socks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Socks Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Socks Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Socks Market Size and Forecast, by Sales Channel(2024-2032) 8.4. Middle East and Africa Socks Market Size and Forecast, by End-User (2024-2032) 8.5. Middle East and Africa Socks Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Socks Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Socks Market Size and Forecast, by Type (2024-2032) 8.5.1.3. South Africa Socks Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Socks Market Size and Forecast, by Sales Channel(2024-2032) 8.5.1.5. South Africa Socks Market Size and Forecast, by End-User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Socks Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Socks Market Size and Forecast, by Application (2024-2032) 8.5.2.3. GCC Socks Market Size and Forecast, by Sales Channel(2024-2032) 8.5.2.4. GCC Socks Market Size and Forecast, by End-User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Socks Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Socks Market Size and Forecast, by Application (2024-2032) 8.5.3.3. Nigeria Socks Market Size and Forecast, by Sales Channel(2024-2032) 8.5.3.4. Nigeria Socks Market Size and Forecast, by End-User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Socks Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Socks Market Size and Forecast, by Application (2024-2032) 8.5.4.3. Rest of ME&A Socks Market Size and Forecast, by Sales Channel(2024-2032) 8.5.4.4. Rest of ME&A Socks Market Size and Forecast, by End-User (2024-2032) 9. South America Socks Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 9.1. South America Socks Market Size and Forecast, by Type (2024-2032) 9.2. South America Socks Market Size and Forecast, by Application (2024-2032) 9.3. South America Socks Market Size and Forecast, by Sales Channel(2024-2032) 9.4. South America Socks Market Size and Forecast, by End-User (2024-2032) 9.5. South America Socks Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Socks Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Socks Market Size and Forecast, by Application (2024-2032) 9.5.1.3. Brazil Socks Market Size and Forecast, by Sales Channel(2024-2032) 9.5.1.4. Brazil Socks Market Size and Forecast, by End-User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Socks Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Socks Market Size and Forecast, by Application (2024-2032) 9.5.2.3. Argentina Socks Market Size and Forecast, by Sales Channel(2024-2032) 9.5.2.4. Argentina Socks Market Size and Forecast, by End-User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Socks Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Socks Market Size and Forecast, by Application (2024-2032) 9.5.3.3. Rest Of South America Socks Market Size and Forecast, by Sales Channel(2024-2032) 9.5.3.4. Rest Of South America Socks Market Size and Forecast, by End-User (2024-2032) 10. Global Socks Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Socks Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Nike, Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Adidas AG 11.3. Hanesbrands Inc. 11.4. Puma SE 11.5. Under Armour, Inc. 11.6. Berkshire Hathaway Inc. (Fruit of the Loom) 11.7. Gildan Activewear Inc. 11.8. Skechers USA, Inc. 11.9. Calvin Klein, Inc. 11.10. H&M Hennes & Mauritz AB 11.11. Stance, Inc. 11.12. Burlington Socks (by Kappa) 11.13. Thorlos, Inc. 11.14. Smartwool (by VF Corporation) 11.15. Socksmith Design, Inc. 11.16. Anta 11.17. UNIQLO 11.18. SHEIN 11.19. ZARA 11.20. The North Face 11.21. Vans 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary