The global smartphone market size was valued at USD 502.3 billion in 2025 and is expected to reach USD 669.94 billion by 2032, growing at a CAGR of 4.2 % due to rising disposable income, frequent device upgrades, and expanding 5G penetration.Smartphone Market Overview:

Smartphones are essential digital tools, driving global connectivity and enabling access to services, commerce, and communication. They serve as the primary device for consumers across developed and emerging markets. The global smartphone market plays a critical role in digital connectivity, enabling communication, commerce, and access to online services across developed and emerging economies. Market growth is driven by 5G smartphone adoption, rising disposable income, and the rapid expansion of direct-to-consumer (D2C) and e-commerce sales channels. However, supply chain disruptions and semiconductor shortages continue to pose operational challenges.To know about the Research Methodology :- Request Free Sample Report

Key Highlights:

• Global 5G smartphone adoption reached more than 1.6 billion connections in 2025 and is expected to exceed 5.5 billion by 2030, accelerating demand for high-performance smartphones. • Over 2.3 billion consumers engaged in online shopping by 2025, with 19% of global retail sales online, positioning smartphones as the primary device for digital commerce. • Asia Pacific smartphone penetration is expected at 94% by 2030, with the mobile economy contributing USD 950 billion in 2024, rising to USD 1.4 trillion. • Sub-Saharan Africa’s unique mobile subscribers are expected to reach 751 million by 2030, creating opportunities for mid-range and entry-level smartphone adoption. • Device segmentation drives adoption, with Android at 72% global market share, premium foldable and OLED/AMOLED displays capturing high-end users while LCDs sustain mid-range growthKey Market Trend: Rapid Adoption of 5G-Compatible Smartphones Across Emerging and Developed Markets.

The global smartphone industry is undergoing a structural transformation, boosted by the rapid deployment of 5G networks and rising adoption of 5G-compatible smartphones. By 2025, global 5G connections reached 1.6 billion, expected to hit 5.5 billion by 2030. Developed markets such as North America and Northeast Asia lead adoption, while emerging economies experience accelerated growth due to expanding coverage, declining device costs, and government digital infrastructure initiatives. This 5G expansion drives device upgrades, premium smartphone sales, and enables high-definition streaming, mobile cloud computing, and enterprise mobility solutions. • Commercial 5G networks operated in over 100 countries as of 2025. • More than 260 mobile operators offer live 5G services globally. • 5G subscriptions account for roughly one-third of global mobile broadband. • Over 50% of the global population is expected to be covered by 5G by 2025. • By 2032, 5G is expected to represent a substantial share of total mobile connections in emerging economies.Key Growth Driver: Rising Disposable Income in Emerging Economies Boosting Smartphone Adoption.

• The Global Smartphone Market is increasingly driven by rising disposable income across emerging and developing economies, expanding the addressable consumer base and adoption of mid-range and advanced smartphones. Strengthened household earnings, higher per-capita income, and improved access to financial services are accelerating device replacement cycles, enabling discretionary spending on higher-value and feature-rich smartphones. • As of 2024, average GDP per capita in these regions reached Nearly USD 6,700, expected to rise to USD 8,800 by 2032. Over two-thirds of adults already own smartphones, supporting sustained income-led demand and making it a critical structural growth lever for the Global Smartphone Market.Opportunity: Expansion of Direct-to-Consumer and E-Commerce Channels

The Global Smartphone Industry is positioned to capture structural growth through direct-to-consumer (D2C) and e-commerce channels. By 2021, digital buyers exceeded 2.3 billion globally, reflecting a rapid adoption of online purchasing as a primary consumer behavior. Online retail accounted for 19% of total global retail sales in 2021, up from 16% in 2020, a permanent shift in distribution dynamics. Smartphones serve as the principal access point for commerce, enabling seamless browsing, payment, comparison, and post-purchase engagement. Manufacturers leveraging these channels can optimize operational efficiency, strengthen consumer relationships, and respond dynamically to market demand, establishing a high-impact pathway for revenue growth in both developed and emerging markets. • Expansion of D2C and e-commerce channels enhances market reach, operational agility, and enables direct consumer engagement, allowing manufacturers to respond rapidly to evolving demand patterns.Restraint: Global Semiconductor Shortages and Supply Chain Disruptions

• Concentration of Semiconductor Production: Nearly 75% of global semiconductor value-added comes from the top five producing economies, creating systemic supply risks for smartphones. • High Complexity and Lead Times: Fabrication of advanced integrated circuits involves up to 500 specialized materials, extending production lead times and limiting flexibility. • Fragmented Global Value Chains: Geographic fragmentation increases exposure to logistics, infrastructure, and trade-related disruptions. • Operational Impact: Semiconductor shortages increase production uncertainty, constrain device availability, and raise costs, compelling manufacturers to diversify sourcing and manage inventory strategically.Global Smartphone Market Segmentation Analysis:

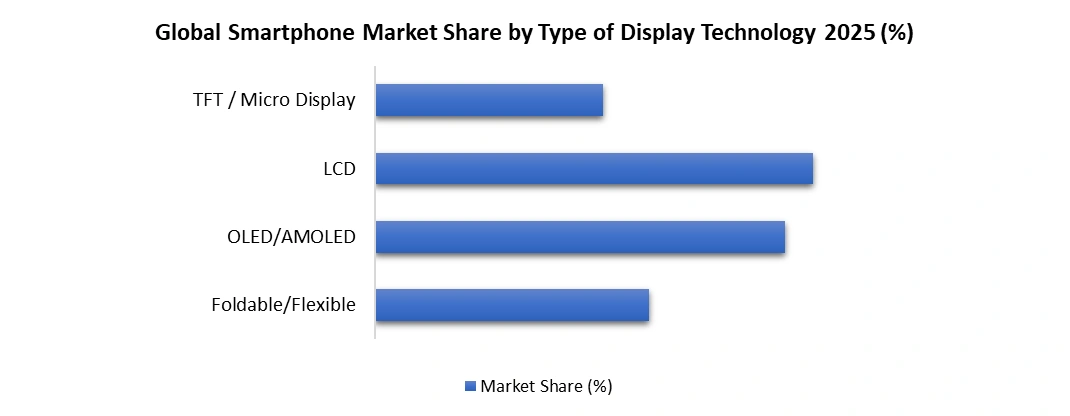

The global smartphone market is strategically segmented across operating systems, display types, RAM, screen size, price range, and distribution channels, reflecting diverse consumer needs and technological preferences. This structured segmentation enables targeted product positioning, optimized distribution, and tailored marketing strategies across global markets. By Operating System: The android segment dominated the operating system segment in year 2025, representing Nearly 72% of active devices due to broad manufacturer adoption and flexibility across emerging and developed markets. iOS accounts for nearly 28%, distinguished by Apple’s exclusive ecosystem, long-term updates, and software-hardware integration. Other operating systems occupy a minimal share, serving niche or institutional needs.By Type of Display: LCD segment dominated the display segment in year 2025. Foldable/flexible displays target premium and ultra-premium segments. LCDs are prevalent in entry-level and mid-range devices for cost efficiency. OLED/AMOLED displays dominate mid-range to flagship models with superior performance, while TFT and micro-displays serve legacy or specialized applications.

Regional Insight:

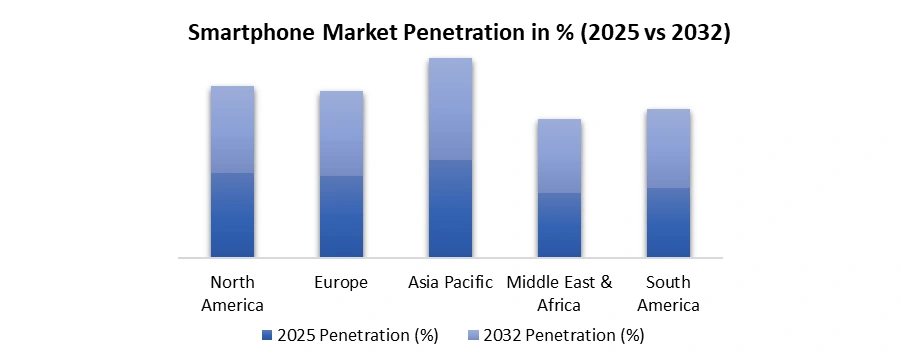

• Asia Pacific leads the global smartphone market in year 2025, and adoption expected at 94% by 2032 and a mobile economy contribution of USD 950 billion in 2024, rising to USD 1.4 trillion, while Europe and North America maintain Strong market position with penetration above 75% and high 5G usage. • North America and Middle East region show steady adoption and network expansion, and Sub-Saharan Africa presents emerging growth potential with mobile subscribers expected to reach 751 million by 2032, highlighting significant opportunities for smartphone demand in developing regions.

Competitive Landscape – Global Smartphone Market

The global smartphone Industry is shaped by key players, challengers, and niche brands. Samsung and Apple lead with premium offerings and strong distribution. Growth challengers such as Xiaomi, OPPO, Vivo, Realme, and Transsion target emerging markets with value-driven products, while niche brands such as Google, Sony, Nokia, and Fairphone serve specialized segments. Competitiveness relies on innovation, strategic pricing, and regional adaptability. • Samsung and Apple dominate with premium portfolios, while growth challengers focus on emerging markets and value-driven products. • Niche players target specialized segments, with innovation, strategic pricing, and regional adaptability driving overall market competitiveness.Recent Development:

Company Name Year Recent Development Impact / Strategic Implication Apple Inc. 2025 Apple achieved 20% of global smartphone shipments, leading the market. Reinforces leadership in premium devices; ensures stable revenue streams and strong brand positioning across mature and emerging markets. Samsung Electronics Co. Ltd. 2026 Launched Galaxy Z TriFold, a tri-fold display smartphone at CES 2026. Strengthens innovation leadership; enhances differentiation in the high-end segment and foldable smartphone category. Xiaomi Corporation 2026 Expanded local production and ecosystem strategy in India (100% locally made, 35% local sourcing). Enhances regional market penetration; improves consumer loyalty and competitiveness through localization and ecosystem expansion. vivo 2025 Maintained shipment growth, strengthening global rankings. Validates effectiveness of diversified portfolio and retail strategy; supports sustainable mid-tier and premium demand. OPPO 2025 Experienced moderate shipment decline due to regional competitive pressures. Highlights need for stronger regional execution and product differentiation to regain momentum in key markets. Smartphone Market Scope: Inquire before buying

Global Smartphone Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 502.3 Bn. Forecast Period 2025 to 2032 CAGR: 4.2% Market Size in 2032: USD 669.94 Bn. Segments Covered: by Operating System Android iOS Others by Type of Display Foldable/Flexible LCD OMLED/AMOLED Others by RAM Less than 4 GB 4GB-8GB 8GB-16GB 16GB-24GB by Screen Size Below 4.0" 4.0""–5.0"" Up to 6.8” by Price Range Less than $100 $100–200 $200–300 $300–500 $500–700 $700 and above by Distribution Channel Online Sales Offline Multi-brand Retail OEM Stores Large Format Retail (LFR) Others Smartphone Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smartphone Market, Key players:

1. Apple Inc. 2. Samsung Electronics Co. Ltd. 3. Xiaomi Corporation 4. OPPO 5. Vivo 6. Huawei Technologies Co. Ltd. 7. Realme 8. Motorola (Lenovo) 9. Google (Pixel) 10. Tecno Mobile 11. Infinix 12. Itel Mobile 13. OnePlus 14. Honor 15. Sony Corporation 16. Nokia (HMD Global) 17. ASUS 18. ZTE 19. LG 20. BlackBerry 21. Nothing Technology Ltd. 22. Sharp 23. Meizu 24. POCO 25. iQOO 26. Unihertz 27. Fairphone 28. Kyocera 29. Panasonic Others.FAQs of Smartphone Market:

Q1: What are the key growth drivers of the global smartphone market in 2025–2032? A: The global smartphone market growth is fueled by 5G smartphone adoption, rising disposable income, premium device upgrades, and expanding e-commerce and D2C sales channels. Q2: How does 5G technology impact global smartphone demand? A: Rapid 5G network expansion increases demand for high-performance smartphones, supporting faster connectivity, mobile cloud computing, streaming, and enterprise mobility solutions. Q3: Why does Asia Pacific dominate the global smartphone market? A: Asia Pacific smartphone market leadership is driven by high smartphone penetration, large consumer base, strong mobile economy growth, and widespread 5G infrastructure deployment. Q4: How are e-commerce and direct-to-consumer channels reshaping smartphone sales? A: Smartphone e-commerce and D2C distribution improve market reach, enhance customer engagement, reduce intermediaries, and accelerate online smartphone sales globally. Q5: What challenges restrain global smartphone market Growth? A: Smartphone market challenges include global semiconductor shortages, supply chain disruptions, rising component costs, and extended production lead times.

1. Smartphone Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Smartphone Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Smartphone Market: Dynamics 3.1. Smartphone Market Trends 3.2. Smartphone Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Tier-Wise Global Market Landscape 4.1. Active smartphone user base by income tier and regional maturity 4.2. Tier-wise contribution to global smartphone revenue versus shipment volume 4.3. Brand share shifts by tier highlighting global premiumization versus mass-market commoditization 4.4. ASP trends segmented by income tier and regional purchasing power parity 4.5. Top global cities and metropolitan clusters driving incremental demand by tier 5. Global Price Trend Analysis (2025) 5.1. Share of global shipments by price bucket across USD 100–700+ bands 5.2. Volume-to-value contribution ratio by global price segment 5.3. Price trend by display technology type (LCD, OLED, AMOLED, Foldable), 2020–2025 5.4. Price elasticity and product substitution dynamics below USD 200 across regions 5.5. Brand dominance and pricing overlap across key global price bands 6. Channel Performance and Global Distribution Structure 6.1. Channel share by region split into online and offline sales models 6.2. Platform-level shipment share by Amazon, Alibaba, JD.com, Flipkart, others 6.3. Offline retail format breakdown the OEM stores, multi-brand retail, large format retail 6.4. ASP and margin differentials across channels and price bands 6.5. Channel inventory cycles, sell-through velocity, and return rate benchmarks 7. Brand-Level Competitive Dynamics 7.1. Global brand ranking by shipment volume and revenue value 7.2. ASP positioning shifts by brand over the last three years 7.3. Channel strategy divergence e-commerce-first versus physical retail-led brands 7.4. Brand-wise share in fast-growing global price segments 7.5. Entry of new and regional brands and impact on incumbent volume share 8. Consumer Insights & Global Purchase Behavior 8.1. Key drivers of smartphone purchase price, features, brand equity, camera, battery, 5G 8.2. Channel preferences by consumer segment — youth, professionals, enterprise, first-time buyers 8.3. Urban versus semi-urban and rural purchase triggers across regions 8.4. Role of financing, trade-in programs, subsidies, and promotional incentives 8.5. Influence of social media, online reviews, and global tech influencers 9. Global Demand–Supply Gap Analysis 9.1. Supply bottlenecks linked to lost sales and unmet global demand 9.2. Inventory buildup versus sell-through performance by channel and region 9.3. Delayed product launches in peak demand cycles and missed market windows 9.4. Regional mismatch between demand intensity and SKU availability 9.5. Demand spikes during global festivals, mega sales events, and product launch cycles 10. Global Production & Manufacturing Landscape 10.1. Share of locally assembled units in total regional smartphone shipments 10.2. Manufacturing concentration by global hubs like China, India, Vietnam, Brazil, Mexico 10.3. Production uplift driven by localization policies, incentives, and infrastructure investments 10.4. EMS versus OEM share in global smartphone assembly 10.5. Import dependence across key bill-of-materials categories 11. Technology & Product Innovation Trends 11.1. 5G smartphone mix by region, tier, and price bracket 11.2. Fast-charging, battery technology, and energy efficiency adoption by ASP band 11.3. Camera stack innovation and its role in premium price justification 11.4. Form-factor evolution foldables, minimal bezel, ruggedized devices 11.5. Brand differentiation through UI layers, OS update policies, and bloatware optimization 12. Smartphone Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2025-2032) 12.1. Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 12.1.1. Android 12.1.2. iOS 12.1.3. Others 12.2. Smartphone Market Size and Forecast, By Type of Display (2025-2032) 12.2.1. Foldable/Flexible 12.2.2. LCD 12.2.3. OMLED/AMOLED 12.2.4. Others 12.3. Smartphone Market Size and Forecast, By RAM (2025-2032) 12.3.1. Less than 4 GB 12.3.2. 4GB-8GB 12.3.3. 8GB-16GB 12.3.4. 16GB-24GB 12.4. Smartphone Market Size and Forecast, By Screen Size (2025-2032) 12.4.1. Below 4.0" 12.4.2. 4.0""–5.0"" 12.4.3. Up to 6.8” 12.5. Smartphone Market Size and Forecast, By Price Range (2025-2032) 12.5.1. Less than $100 12.5.2. $100–200 12.5.3. $200–300 12.5.4. $300–500 12.5.5. $500–700 12.5.6. $700 and above 12.6. Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 12.6.1. Online Sales 12.6.2. Offline 12.6.2.1. Multi-brand Retail 12.6.2.2. OEM Stores 12.6.2.3. Large Format Retail (LFR) 12.6.2.4. Others 12.7. Smartphone Market Size and Forecast, By Region (2025-2032) 12.7.1. North America 12.7.2. Europe 12.7.3. Asia Pacific 12.7.4. Middle East and Africa 12.7.5. South America 13. North America Smartphone Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2025-2032) 13.1. Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 13.1.1. Android 13.1.2. iOS 13.1.3. Others 13.2. Smartphone Market Size and Forecast, By Type of Display (2025-2032) 13.2.1. Foldable/Flexible 13.2.2. LCD 13.2.3. OMLED/AMOLED 13.2.4. Others 13.3. Smartphone Market Size and Forecast, By RAM (2025-2032) 13.3.1. Less than 4 GB 13.3.2. 4GB-8GB 13.3.3. 8GB-16GB 13.3.4. 16GB-24GB 13.4. Smartphone Market Size and Forecast, By Screen Size (2025-2032) 13.4.1. Below 4.0" 13.4.2. 4.0""–5.0"" 13.4.3. Up to 6.8” 13.5. Smartphone Market Size and Forecast, By Price Range (2025-2032) 13.5.1. Less than $100 13.5.2. $100–200 13.5.3. $200–300 13.5.4. $300–500 13.5.5. $500–700 13.5.6. $700 and above 13.6. Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 13.6.1. Online Sales 13.6.2. Offline 13.6.2.1. Multi-brand Retail 13.6.2.2. OEM Stores 13.6.2.3. Large Format Retail (LFR) 13.6.2.4. Others 13.7. North America Smartphone Market Size and Forecast, by Country (2025-2032) 13.7.1. United States 13.7.2. Canada 13.7.3. Mexico 14. Europe Smartphone Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2025-2032) 14.1. Europe Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.2. Europe Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.3. Europe Smartphone Market Size and Forecast, By RAM (2025-2032) 14.4. Europe Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.5. Europe Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.6. Europe Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7. Europe Smartphone Market Size and Forecast, by Country (2025-2032) 14.7.1. United Kingdom 14.7.1.1. United Kingdom Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.1.2. United Kingdom Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.1.3. United Kingdom Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.1.4. United Kingdom Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.1.5. United Kingdom Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.1.6. United Kingdom Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.2. France 14.7.2.1. France Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.2.2. France Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.2.3. France Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.2.4. France Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.2.5. France Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.2.6. France Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.3. Germany 14.7.3.1. Germany Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.3.2. Germany Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.3.3. Germany Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.3.4. Germany Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.3.5. Germany Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.3.6. Germany Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.4. Italy 14.7.4.1. Italy Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.4.2. Italy Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.4.3. Italy Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.4.4. Italy Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.4.5. Italy Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.4.6. Italy Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.5. Spain 14.7.5.1. Spain Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.5.2. Spain Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.5.3. Spain Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.5.4. Spain Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.5.5. Spain Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.5.6. Spain Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.6. Sweden 14.7.6.1. Sweden Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.6.2. Sweden Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.6.3. Sweden Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.6.4. Sweden Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.6.5. Sweden Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.6.6. Sweden Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.7. Russia 14.7.7.1. Russia Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.7.2. Russia Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.7.3. Russia Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.7.4. Russia Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.7.5. Russia Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.7.6. Russia Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 14.7.8. Rest of Europe 14.7.8.1. Rest of Europe Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 14.7.8.2. Rest of Europe Smartphone Market Size and Forecast, By Type of Display (2025-2032) 14.7.8.3. Rest of Europe Smartphone Market Size and Forecast, By RAM (2025-2032) 14.7.8.4. Rest of Europe Smartphone Market Size and Forecast, By Screen Size (2025-2032) 14.7.8.5. Rest of Europe Smartphone Market Size and Forecast, By Price Range (2025-2032) 14.7.8.6. Rest of Europe Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15. Asia Pacific Smartphone Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2025-2032) 15.1. Asia Pacific Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.2. Asia Pacific Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.3. Asia Pacific Smartphone Market Size and Forecast, By RAM (2025-2032) 15.4. Asia Pacific Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.5. Asia Pacific Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.6. Asia Pacific Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7. Asia Pacific Smartphone Market Size and Forecast, by Country (2025-2032) 15.7.1. China 15.7.1.1. China Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.1.2. China Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.1.3. China Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.1.4. China Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.1.5. China Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.1.6. China Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.2. S Korea 15.7.2.1. S Korea Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.2.2. S Korea Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.2.3. S Korea Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.2.4. S Korea Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.2.5. S Korea Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.2.6. S Korea Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.3. Japan 15.7.3.1. Japan Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.3.2. Japan Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.3.3. Japan Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.3.4. Japan Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.3.5. Japan Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.3.6. Japan Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.4. India 15.7.4.1. India Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.4.2. India Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.4.3. India Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.4.4. India Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.4.5. India Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.4.6. India Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.5. Australia 15.7.5.1. Australia Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.5.2. Australia Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.5.3. Australia Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.5.4. Australia Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.5.5. Australia Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.5.6. Australia Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.6. Indonesia 15.7.6.1. Indonesia Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.6.2. Indonesia Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.6.3. Indonesia Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.6.4. Indonesia Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.6.5. Indonesia Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.6.6. Indonesia Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.7. Malaysia 15.7.7.1. Malaysia Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.7.2. Malaysia Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.7.3. Malaysia Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.7.4. Malaysia Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.7.5. Malaysia Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.7.6. Malaysia Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.8. Philippines 15.7.8.1. Philippines Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.8.2. Philippines Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.8.3. Philippines Smartphone Market Size and Forecast, By RAM Philippines Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.8.4. Philippines Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.8.5. Philippines Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.9. Thailand 15.7.9.1. Thailand Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.9.2. Thailand Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.9.3. Thailand Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.9.4. Thailand Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.9.5. Thailand Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.9.6. Thailand Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.10. Vietnam 15.7.10.1. Vietnam Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.10.2. Vietnam Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.10.3. Vietnam Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.10.4. Vietnam Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.10.5. Vietnam Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.10.6. Vietnam Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 15.7.11. Rest of Asia Pacific 15.7.11.1. Rest of Asia Pacific Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 15.7.11.2. Rest of Asia Pacific Smartphone Market Size and Forecast, By Type of Display (2025-2032) 15.7.11.3. Rest of Asia Pacific Smartphone Market Size and Forecast, By RAM (2025-2032) 15.7.11.4. Rest of Asia Pacific Smartphone Market Size and Forecast, By Screen Size (2025-2032) 15.7.11.5. Rest of Asia Pacific Smartphone Market Size and Forecast, By Price Range (2025-2032) 15.7.11.6. Rest of Asia Pacific Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16. Middle East and Africa Smartphone Market Size and Forecast (by Value in USD Million and Volume in 000’ Units) (2025-2032 16.1. Middle East and Africa Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.2. Middle East and Africa Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.3. Middle East and Africa Smartphone Market Size and Forecast, By RAM (2025-2032) 16.4. Middle East and Africa Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.5. Middle East and Africa Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.6. Middle East and Africa Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16.7. Middle East and Africa Smartphone Market Size and Forecast, by Country (2025-2032) 16.7.1. South Africa 16.7.1.1. South Africa Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.7.1.2. South Africa Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.7.1.3. South Africa Smartphone Market Size and Forecast, By RAM (2025-2032) 16.7.1.4. South Africa Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.7.1.5. South Africa Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.7.1.6. South Africa Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16.7.2. GCC 16.7.2.1. GCC Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.7.2.2. GCC Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.7.2.3. GCC Smartphone Market Size and Forecast, By RAM (2025-2032) 16.7.2.4. GCC Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.7.2.5. GCC Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.7.2.6. GCC Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16.7.3. Egypt 16.7.3.1. Egypt Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.7.3.2. Egypt Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.7.3.3. Egypt Smartphone Market Size and Forecast, By RAM (2025-2032) 16.7.3.4. Egypt Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.7.3.5. Egypt Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.7.3.6. Egypt Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16.7.4. Nigeria 16.7.4.1. Nigeria Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.7.4.2. Nigeria Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.7.4.3. Nigeria Smartphone Market Size and Forecast, By RAM (2025-2032) 16.7.4.4. Nigeria Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.7.4.5. Nigeria Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.7.4.6. Nigeria Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 16.7.5. Rest of ME&A 16.7.5.1. Rest of ME&A Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 16.7.5.2. Rest of ME&A Smartphone Market Size and Forecast, By Type of Display (2025-2032) 16.7.5.3. Rest of ME&A Smartphone Market Size and Forecast, By RAM (2025-2032) 16.7.5.4. Rest of ME&A Smartphone Market Size and Forecast, By Screen Size (2025-2032) 16.7.5.5. Rest of ME&A Smartphone Market Size and Forecast, By Price Range (2025-2032) 16.7.5.6. Rest of ME&A Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17. South America Smartphone Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2025-2032) 17.1. South America Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.2. South America Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.3. South America Smartphone Market Size and Forecast, By RAM (2025-2032) 17.4. South America Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.5. South America Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.6. South America Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17.7. South America Smartphone Market Size and Forecast, by Country (2025-2032) 17.7.1. Brazil 17.7.1.1. Brazil Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.7.1.2. Brazil Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.7.1.3. Brazil Smartphone Market Size and Forecast, By RAM (2025-2032) 17.7.1.4. Brazil Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.7.1.5. Brazil Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.7.1.6. Brazil Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17.7.2. Argentina 17.7.2.1. Argentina Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.7.2.2. Argentina Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.7.2.3. Argentina Smartphone Market Size and Forecast, By RAM (2025-2032) 17.7.2.4. Argentina Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.7.2.5. Argentina Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.7.2.6. Argentina Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17.7.3. Colombia 17.7.3.1. Colombia Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.7.3.2. Colombia Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.7.3.3. Colombia Smartphone Market Size and Forecast, By RAM (2025-2032) 17.7.3.4. Colombia Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.7.3.5. Colombia Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.7.3.6. Colombia Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17.7.4. Chile 17.7.4.1. Chile Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.7.4.2. Chile Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.7.4.3. Chile Smartphone Market Size and Forecast, By RAM (2025-2032) 17.7.4.4. Chile Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.7.4.5. Chile Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.7.4.6. Chile Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 17.7.5. Rest Of South America 17.7.5.1. Rest Of South America Smartphone Market Size and Forecast, By Operating Systems (2025-2032) 17.7.5.2. Rest Of South America Smartphone Market Size and Forecast, By Type of Display (2025-2032) 17.7.5.3. Rest Of South America Smartphone Market Size and Forecast, By RAM (2025-2032) 17.7.5.4. Rest Of South America Smartphone Market Size and Forecast, By Screen Size (2025-2032) 17.7.5.5. Rest Of South America Smartphone Market Size and Forecast, By Price Range (2025-2032) 17.7.5.6. Rest Of South America Smartphone Market Size and Forecast, By Distribution Channel (2025-2032) 18. Company Profile: Key Players 18.1. Apple Inc. 18.1.1. Company Overview 18.1.2. Business Portfolio 18.1.3. Financial Overview 18.1.4. SWOT Analysis 18.1.5. Strategic Analysis 18.1.6. Recent Development 18.2. Samsung Electronics Co. Ltd. 18.3. Xiaomi Corporation 18.4. OPPO 18.5. Vivo 18.6. Huawei Technologies Co. Ltd. 18.7. Realme 18.8. Motorola (Lenovo) 18.9. Google (Pixel) 18.10. Tecno Mobile 18.11. Infinix 18.12. Itel Mobile 18.13. OnePlus 18.14. Honor 18.15. Sony Corporation 18.16. Nokia (HMD Global) 18.17. ASUS 18.18. ZTE 18.19. LG 18.20. BlackBerry 18.21. Nothing Technology Ltd. 18.22. Sharp 18.23. Meizu 18.24. POCO 18.25. iQOO 18.26. Unihertz 18.27. Fairphone 18.28. Kyocera 18.29. Panasonic 19. Key Findings 20. Analyst Recommendations 21. Smartphone Market: Research Methodology