The Silicon Wafer Reclaim Market size was valued at USD 0.76 Billion in 2023 and the total Silicon Wafer Reclaim revenue is expected to grow at a CAGR of 18 % from 2024 to 2030, reaching nearly USD 2.3 Billion by 2030.Silicon Wafer Reclaim Market Overview:

Wafer reclamation is commonly characterized as "a silicon wafer that has been treated, then stripped, occasionally polished, and finally cleaned; reused for a different usage." Wafer reclamation converts a used wafer with numerous layers of different materials into a usable test or qualification wafer at a cheaper cost than purchasing a new test wafer. While recovered wafers are frequently thinner than fresh wafers, they typically provide the same performance and are suited for many of the same applications. Silicon is by far the most important semiconductor material. This element provides an unrivaled mix of abundance and simplicity of manufacture, resulting in a surge in technological advancement during the previous 50 years. There's a reason why this time of consistent progress is dubbed "The Silicon Age." Wafer World is happy to contribute to technical advancements by providing silicon wafer services. Both primary and secondary data sources are significantly used in the study report. Government policy, Silicon Wafer Reclaim Market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and the technical progress in related industries, as well as Silicon Wafer Reclaim Market risks, opportunities, Silicon Wafer Reclaim Market barriers, and challenges, are all investigated during the research process. To produce the final quantitative and qualitative data, all possible components impacting the Silicon Wafer Reclaim Market covered in this research study were investigated, thoroughly researched, validated through primary research, and assessed. The market size for top-level markets and sub-segments is normalized, and the influence of inflation, economic downturns, regulatory & policy changes, and other variables is accounted for in market forecasting. This information is supplemented with extensive inputs and analysis and given in the report. Extensive primary research was carried out to gather information and check and confirm the critical numbers arrived at after extensive market engineering and calculations for market statistics such as market size estimations, market forecasts, market segmentation, and analysis and interpretation of data. Bottom-up techniques, as well as numerous data triangulation procedures, are commonly used in the whole market engineering process to do market estimation and forecasting for the overall market segments and sub-segments included in this research. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Silicon Wafer Reclaim Market.To know about the Research Methodology :- Request Free Sample Report

Silicon Wafer Reclaim Market Dynamics

The rising demand for low-cost consumer electronic goods across the globe driving the market growth. Rapid economic growth in recent years has transformed lifestyle to massively produce, consume, and dispose of products, especially consumer electronics. Millions of high-performance, ultra-low-power devices are precisely integrated into extremely tiny regions on hard and brittle but low-cost bulk monocrystalline silicon (100) wafers in today's typical electronics, such as computers or mobile phones. Silicon accounts for 90% of all global electronics. As a result, manufacturers developed a generic low-cost regenerative batch fabrication process to convert such wafers full of devices into thin (5 m), mechanically flexible, optically semitransparent silicon fabric with devices, and then recycle the remaining wafer to generate multiple silicon fabrics with chips and devices, ensuring low-cost and optimal utilization of the entire substrate. Designers demonstrate monocrystalline, amorphous, and polycrystalline silicon and silicon dioxide fabric fabricated from low-cost bulk silicon (100) wafers with the semiconductor industry's most advanced high-/metal gate stack-based high-performance, ultra-low-power capacitors, field effect transistors, energy harvesters, and storage to highlight the effectiveness and versatility of this process in transforming traditional electronics into flexible and semitransparent ones for multipurpose applications. This attracts the consumers and enables multiple purchases of the goods. Hence it is a primary driver for Silicon Wafer Reclaim Market growth. A rising need for a cost-effective method of efficiently reclaiming test wafers. Test wafers are often used by semiconductor manufacturers to optimize and monitor their production processes. A big fab spends USD 2 million per month on test wafers, which cost more than USD 100 apiece. Silicon is by far the most expensive material in semiconductor production fabs due to the massive amounts of test wafers needed. More than 27 million test wafers are utilized yearly in the industry, thus chip makers are now working on prolonging the useable life of test wafers by aiming to reuse them as many times as possible through a reclamation process. Wafer reclamation consists of three steps i.e. chemically removing undesirable coatings from the wafer surface, physically polishing to eliminate any surface damage, and cleaning to verify that customers' ultralow defect criteria are satisfied. The combination of strip and polish procedures physically lowers the thickness of the substrate by tens of microns, limiting the number of times a wafer is recovered. The test wafers eventually grow too thin to be retrieved and are discarded and replaced. As a result, a low-cost technique of efficiently reclaiming test wafers is widely desired, which restrains Silicon Wafer Reclaim Market growth. The rising government's investments in the development of different technologically advanced infrastructures is a key opportunity for market growth. Semiconductor manufacturing is one of the most complicated manufacturing processes in any sector, involving unprecedented capital investment, ongoing and costly R&D, and a supply chain comprising innumerable enterprises producing components and materials. The supply chain is highly integrated and globally interconnected. With the limited extra capacity to absorb disruptions and rising demand, supply interruptions have far-reaching and cascading consequences across a wide range of industries in the Silicon Wafer Reclaim Market. Supply restrictions, whether in devices, equipment, or materials, influence the whole supply chain and result in semiconductor shortages, which cause line-down situations at downstream electronics companies and have a ripple effect on the digital economy. Due to this scenario, Governments in emerging economies increasing investment for the establishment of various technologically advanced infrastructures is the key opportunity for market growth. For instance, Pure Wafer, America's market leader in reclaimed prime silicon wafers, thin film deposition, and parts cleaning services to the global semiconductor manufacturing sector, announced that it has been authorized by the System for Award Management (SAM). The Defence Logistics Information Services awarded the firm its CAGE Code (DLIS). The CAGE Code is used to identify eligible contractors who conduct business with the federal government and other international governments. Pure Wafer maintains its position as a trusted source of high-quality wafers, thin films, and wafer fabrication services by investing in research & development, and innovation in Silicon Wafer Reclaim Market.Silicon Wafer Reclaim Market Segment Analysis

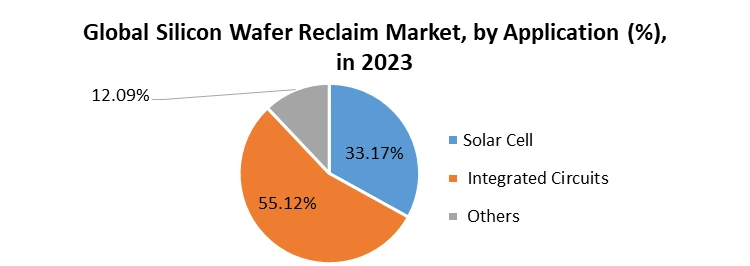

By Reclaim Capacity, the 300 mm segment held the largest Silicon Wafer Reclaim Market share of about xx% and dominated the market in 2023 and is expected to maintain its dominance at the end of the forecast period. The 300 mm Silicon Wafer is commonly utilized in the manufacture of solar cells and computer chips. They are the most productive and have the lowest cost per watt. 300mm silicon wafers are utilized in a variety of applications. They are also used in the manufacturing of high-power LEDs and energy-saving gadgets. Indeed, the more precise the measurements, the more precise the final output. And the smaller the size of a silicon sag, the higher the price. However, the size of a semiconductor wafer is an essential component in semiconductor fabrication. Also, bigger size means that it carry more dies. Moreover, the bigger the wafer, the more chips it manufacture. Due to the wide applications of this segment, the growth of this segment is expected to increase.The 200 mm segment is experiencing exponential growth during the forecast period. SiC is now experiencing a transition to bigger substrates to allow increased manufacture of power devices, particularly those used in electric vehicles. Twenty years ago, manufacturers of this foundation only provided a limited supply of 50 mm substrates; today, 150 mm is the standard, and there are well-publicized efforts to make diodes and MOSFETs on a 200 mm variety. Cree's Wolfspeed division is already constructing a large fab at that diameter, while STMicroelectronics entered the ranks of businesses that print SiC substrates of this scale this summer. Infineon's strategic outreach to the increasing demand for GaN power semiconductors is marked by outstanding performance and reliability, as well as the capacity of 200 mm GaN-on-silicon wafer fabrication. And this is driving the segment Silicon Wafer Reclaim Market growth. By Application, the Solar Cells segment held the biggest revenue share of about xx% in 2022 and is expected to lead the Silicon Wafer Reclaim Market at the end of the forecast period. The demand for Solar Cells is increasing rapidly all across the globe due to rising awareness about renewable energy, government initiatives regarding renewable energy production, etc. This is the primary driver for the segment growth. The fact that the recovered wafer has no substantial effect on the yield and efficiency of the silicon wafer leads to increased use of the product by the solar energy sector. Growing global investment in the solar energy industry is expected to increase the potential for reclaimed wafers as technological advances allow the use of discarded wafers in the fabrication of high-performance solar cells. The Integrated Circuits segment is expected to grow significantly during the Silicon Wafer Reclaim Market forecast period. Because of the semiconductor industry's increased efforts in recovering the product, the production cost of integrated circuits has decreased to counteract the semiconductor industry's lackluster development over the previous two years.

Silicon Wafer Reclaim Market Regional Insights

The North American market held the largest Silicon Wafer Reclaim Market share of about xx% and is expected to dominate the market at the end of the forecast period. Growing solar panel installations in North America are driving the demand for silicon wafers to reclaim services. In addition, Emerging advanced technologies, rising demand for low-cost silicon wafers for the semiconductor industry, and the presence of well-established manufacturers in the silicon wafer reclaim market in countries such as the United States are all factors further driving the regional growth during the forecast period. Because of the vast availability of technical knowledge, the country is home to numerous prominent organizations involved in supplying reclamation wafer services. The growing market demand for this country is driven by the increased penetration of several major industry participants, as well as the growing number of solar panel installations. A silicon wafer is used in the production of semiconductors, which are present in a wide range of electrical products that improve lives. The semiconductor industry in the United States dominates several aspects of the semiconductor supply chain, including chip design. Semiconductors are also a significant US export. Semiconductor design and manufacture is a global operation that spans national borders in terms of materials, design, fabrication, assembly, testing, and packaging. Six US-based or foreign-owned semiconductor businesses now operate 20 fabrication facilities (fabs) in the US and hence are expected to dominate the Silicon Wafer Reclaim market. Some US-based semiconductor companies that design and produce in the US have also constructed fabrication facilities in other countries. Similarly, design businesses based in the United States that do not own or run their facilities contract with foreign enterprises based overseas to construct their designs. Much of this global capacity is concentrated in Taiwan, South Korea, Japan, and, increasingly, China. The APAC market is expected to grow substantially during the forecast period. The fastest developing region, increasing development in the consumer electronics market in countries like Taiwan, China, South Korea, India, and Thailand, and a huge shift of consumers toward renewable energy are the factors responsible for the growth of the market during the forecast period. The extent and size of China's state-led attempts to establish an indigenous vertically integrated semiconductor sector are unparalleled. Many officials are concerned that if these initiatives are successful, they considerably transfer global semiconductor production and related design and research skills to China, eroding the dominant positions of the United States and other international enterprises. Despite China's present modest proportion of the worldwide market and its businesses producing largely low-end chips, China's industrial strategies seek to gain global supremacy in semiconductor design and Silicon Wafer Reclaim Market manufacture by 2030.Moreover, Chinese semiconductor capabilities might aid in a variety of technological developments, including military uses. Another difficulty for policymakers is balancing opposing interests: China is an important US semiconductor business, yet US and foreign industry is assisting China in developing its capabilities. China's government expenditures (estimated at USD 150 billion to date) and status as a primary production center for global consumer electronics are creating tremendous incentives and pressures for US and international corporations to focus on China. In the short term, the Chinese government sees access to foreign skills as a critical road to accelerating China's domestic Silicon Wafer Reclaim Market growth.

Silicon Wafer Reclaim Market Scope: Inquire before buying

Silicon Wafer Reclaim Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 0.76 Bn. Forecast Period 2024 to 2030 CAGR: 17% Market Size in 2030: US $ 2.3 Bn. Segments Covered: by Reclaim Capacity 150 mm 200 mm 300 mm Others by Application Solar Cell Integrated Circuits Others by Industry Vertical Aerospace & Defence Automotive Mining & Construction Electronics Others (Medical and Sports) Silicon Wafer Reclaim Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Silicon Wafer Reclaim Market, Key Players are

Major Global Key Players: 1. Silicon Quest International (US) 2. Nano Silicon Inc (US) 3. Rockwood Wafer Reclaim (US) 4. WRS Materials (US) 5. Silicon Materials Inc (US) 6. Polishing Corporation of America (US) Leading Key Players in North America: 1. Silicon Valley Microelectronics (US) 2. Noel Technologies (US) 3. Pure Wafer PLC (US) 4. R S Technologies (US) 5. Nova Electronic Materials (US) Market Follower key Players in Europe: 1. Phoenix Silicon International Corporation (Europe) 2. Global Silicon Technologies (Europe) 3. Microtech System Inc (Europe) 4. Optim Wafer Services (Europe) Prominent Key player Asia Pacific: 1. DSK Technologies (Singapore) 2. Shinryo Corporation (Asia Pacific) 3. Kemi Silicon Inc (Asia Pacific) 4. ST Microelectronics (Asia Pacific) 5. AnySilicon (Asia Pacific) Leading Key players in Middle East & Africa: 1. Naura-Akrion (Middle East & Africa) 2. KINIK COMPANY (Middle East & Africa) 3. Silicon Specialist LLC (Middle East & Africa) 4. Nippon Chemi-Con Corporation (Middle East & Africa) FAQ’s: 1. Which is the potential the Silicon Wafer Reclaim market in terms of the region? Ans: North America is the potential the Silicon Wafer Reclaim market in terms of the region. 2. What are the opportunities for new market entrants? Ans: The rising government's investments in the development of different technologically advanced infrastructures is a key opportunity for market growth. 3. What is expected to drive the growth of the Silicon Wafer Reclaim market in the forecast period? Ans: The rising demand for low-cost consumer electronic goods across the globe driving the market growth. 4. What is the projected market size & growth rate of the Silicon Wafer Reclaim Market? Ans: Silicon Wafer Reclaim Market size was valued at USD 0.76 Bn. in 2023 and the total Silicon Wafer Reclaim revenue is expected to grow by 18% from 2024 to 2030, reaching nearly USD 2.3 Bn. 5. What segments are covered in the Silicon Wafer Reclaim Market report? Ans: The segments covered are Reclaim Capacity, Application, Industry Vertical, and Region.

1. Silicon Wafer Reclaim Market: Research Methodology 2. Silicon Wafer Reclaim Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Silicon Wafer Reclaim Market: Dynamics 3.1. Silicon Wafer Reclaim Market Trends by Region 3.1.1. North America Silicon Wafer Reclaim Market Trends 3.1.2. Europe Silicon Wafer Reclaim Market Trends 3.1.3. Asia Pacific Silicon Wafer Reclaim Market Trends 3.1.4. Middle East and Africa Silicon Wafer Reclaim Market Trends 3.1.5. South America Silicon Wafer Reclaim Market Trends 3.2. Silicon Wafer Reclaim Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Silicon Wafer Reclaim Market Drivers 3.2.1.2. North America Silicon Wafer Reclaim Market Restraints 3.2.1.3. North America Silicon Wafer Reclaim Market Opportunities 3.2.1.4. North America Silicon Wafer Reclaim Market Challenges 3.2.2. Europe 3.2.2.1. Europe Silicon Wafer Reclaim Market Drivers 3.2.2.2. Europe Silicon Wafer Reclaim Market Restraints 3.2.2.3. Europe Silicon Wafer Reclaim Market Opportunities 3.2.2.4. Europe Silicon Wafer Reclaim Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Silicon Wafer Reclaim Market Drivers 3.2.3.2. Asia Pacific Silicon Wafer Reclaim Market Restraints 3.2.3.3. Asia Pacific Silicon Wafer Reclaim Market Opportunities 3.2.3.4. Asia Pacific Silicon Wafer Reclaim Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Silicon Wafer Reclaim Market Drivers 3.2.4.2. Middle East and Africa Silicon Wafer Reclaim Market Restraints 3.2.4.3. Middle East and Africa Silicon Wafer Reclaim Market Opportunities 3.2.4.4. Middle East and Africa Silicon Wafer Reclaim Market Challenges 3.2.5. South America 3.2.5.1. South America Silicon Wafer Reclaim Market Drivers 3.2.5.2. South America Silicon Wafer Reclaim Market Restraints 3.2.5.3. South America Silicon Wafer Reclaim Market Opportunities 3.2.5.4. South America Silicon Wafer Reclaim Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Silicon Wafer Reclaim Market 3.8. Analysis of Government Schemes and Initiatives For Silicon Wafer Reclaim Market 3.9. The Global Pandemic Impact on Silicon Wafer Reclaim Market 4. Silicon Wafer Reclaim Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 4.1.1. 150 mm 4.1.2. 200 mm 4.1.3. 300 mm 4.1.4. Others 4.2. Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 4.2.1. Solar Cell 4.2.2. Integrated Circuits 4.2.3. Others 4.3. Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 4.3.1. Aerospace & Defense 4.3.2. Automotive 4.3.3. Mining & Construction 4.3.4. Electronics 4.3.5. Others (Medical and Sports) 4.4. Silicon Wafer Reclaim Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Silicon Wafer Reclaim Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 5.1.1. 150 mm 5.1.2. 200 mm 5.1.3. 300 mm 5.1.4. Others 5.2. North America Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 5.2.1. Solar Cell 5.2.2. Integrated Circuits 5.2.3. Others 5.3. North America Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 5.3.1. Aerospace & Defence 5.3.2. Automotive 5.3.3. Mining & Construction 5.3.4. Electronics 5.3.5. Others (Medical and Sports) 5.4. North America Silicon Wafer Reclaim Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 5.4.1.1.1. 150 mm 5.4.1.1.2. 200 mm 5.4.1.1.3. 300 mm 5.4.1.1.4. Others 5.4.1.2. United States Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 5.4.1.2.1. Solar Cell 5.4.1.2.2. Integrated Circuits 5.4.1.2.3. Others 5.4.2. United States Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 5.4.2.1.1. Aerospace & Defence 5.4.2.1.2. Automotive 5.4.2.1.3. Mining & Construction 5.4.2.1.4. Electronics 5.4.2.1.5. Others (Medical and Sports) 5.4.3. Canada 5.4.3.1. Canada Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 5.4.3.1.1. 150 mm 5.4.3.1.2. 200 mm 5.4.3.1.3. 300 mm 5.4.3.1.4. Others 5.4.3.2. Canada Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 5.4.3.2.1. Solar Cell 5.4.3.2.2. Integrated Circuits 5.4.3.2.3. Others 5.4.4. Canada Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 5.4.4.1.1. Aerospace & Defence 5.4.4.1.2. Automotive 5.4.4.1.3. Mining & Construction 5.4.4.1.4. Electronics 5.4.4.1.5. Others (Medical and Sports) 5.4.5. Mexico 5.4.5.1. Mexico Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 5.4.5.1.1. 150 mm 5.4.5.1.2. 200 mm 5.4.5.1.3. 300 mm 5.4.5.1.4. Others 5.4.5.2. Mexico Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 5.4.5.2.1. Solar Cell 5.4.5.2.2. Integrated Circuits 5.4.5.2.3. Others 5.4.5.3. Mexico Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 5.4.5.3.1. Aerospace & Defence 5.4.5.3.2. Automotive 5.4.5.3.3. Mining & Construction 5.4.5.3.4. Electronics 5.4.5.3.5. Others (Medical and Sports) 6. Europe Silicon Wafer Reclaim Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.2. Europe Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.3. Europe Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4. Europe Silicon Wafer Reclaim Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.1.2. United Kingdom Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.1.3. United Kingdom Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.2. France 6.4.2.1. France Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.2.2. France Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.2.3. France Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.3.2. Germany Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.3.3. Germany Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.4.2. Italy Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.4.3. Italy Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.5.2. Spain Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.5.3. Spain Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.6.2. Sweden Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.6.3. Sweden Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.7.2. Austria Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.7.3. Austria Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 6.4.8.2. Rest of Europe Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 6.4.8.3. Rest of Europe Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7. Asia Pacific Silicon Wafer Reclaim Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.2. Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4. Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.1.2. China Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.1.3. China Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.2.2. S Korea Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.2.3. S Korea Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.3.2. Japan Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.3.3. Japan Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.4. India 7.4.4.1. India Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.4.2. India Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.4.3. India Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.5.2. Australia Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.5.3. Australia Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.6.2. Indonesia Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.6.3. Indonesia Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.7.2. Malaysia Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.7.3. Malaysia Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.8.2. Vietnam Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.8.3. Vietnam Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.9.2. Taiwan Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.9.3. Taiwan Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 7.4.10.2. Rest of Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 7.4.10.3. Rest of Asia Pacific Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 8. Middle East and Africa Silicon Wafer Reclaim Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 8.2. Middle East and Africa Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 8.4. Middle East and Africa Silicon Wafer Reclaim Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 8.4.1.2. South Africa Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 8.4.1.3. South Africa Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 8.4.2.2. GCC Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 8.4.2.3. GCC Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 8.4.3.2. Nigeria Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 8.4.3.3. Nigeria Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 8.4.4.2. Rest of ME&A Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 8.4.4.3. Rest of ME&A Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 9. South America Silicon Wafer Reclaim Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 9.2. South America Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 9.3. South America Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 9.4. South America Silicon Wafer Reclaim Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 9.4.1.2. Brazil Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 9.4.1.3. Brazil Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 9.4.2.2. Argentina Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 9.4.2.3. Argentina Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Silicon Wafer Reclaim Market Size and Forecast, By Reclaim Capacity (2023-2030) 9.4.3.2. Rest Of South America Silicon Wafer Reclaim Market Size and Forecast, By Application (2023-2030) 9.4.3.3. Rest Of South America Silicon Wafer Reclaim Market Size and Forecast, By Industry Vertical (2023-2030) 10. Global Silicon Wafer Reclaim Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Silicon Wafer Reclaim Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Silicon Quest International (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Nano Silicon Inc (US) 11.3. Rockwood Wafer Reclaim (US) 11.4. WRS Materials (US) 11.5. Silicon Materials Inc (US) 11.6. Polishing Corporation of America (US) 11.7. Silicon Valley Microelectronics (US) 11.8. Noel Technologies (US) 11.9. Pure Wafer PLC (US) 11.10. R S Technologies (US) 11.11. Nova Electronic Materials (US) 11.12. Phoenix Silicon International Corporation (Europe) 11.13. Global Silicon Technologies (Europe) 11.14. Microtech System Inc (Europe) 11.15. Optim Wafer Services (Europe) 11.16. DSK Technologies (Singapore) 11.17. Shinryo Corporation (Asia Pacific) 11.18. Kemi Silicon Inc (Asia Pacific) 11.19. ST Microelectronics (Asia Pacific) 11.20. AnySilicon (Asia Pacific) 11.21. Naura-Akrion (Middle East & Africa) 11.22. KINIK COMPANY (Middle East & Africa) 11.23. Silicon Specialist LLC (Middle East & Africa) 11.24. Nippon Chemi-Con Corporation (Middle East & Africa) 12. Key Findings 13. Industry Recommendations 14. Research methodology