The Sensormatic Labels Market Size was valued at USD 1.45 Bn in 2024 and is projected to reach USD 4.62 Bn by 2032, growing at a CAGR of 15.6%Sensormatic Labels Market Overview

Sensormatic Labels is a natural oil extracted from flaxseeds. It is commonly used as a drying oil in paints, varnishes, and wood finishes due to its ability to harden into a tough, protective film. It is also used in woodworking and as a nutritional supplement. The Sensormatic labels market is experiencing strong growth, driven by rising retail theft and shrinkage, which cost retailers over $100 billion globally in 2024. The increasing adoption of RFID and EAS technologies to prevent losses is a key factor fueling this expansion. North America dominates the market, accounting for over 40% of global revenue, due to high retail security investments and stringent loss prevention regulations. A major market driver is the growth of organised retail crime (ORC), prompting retailers to invest in advanced anti-theft solutions. Government data from the FBI 2023 shows a 15% YoY increase in retail theft cases, further boosting demand for Sensormatic solutions. Additionally, Asia-Pacific is the fastest-growing region, driven by expanding retail sectors in India and China, supported by government retail security policies. The report also helps in understanding the global Sensormatic Labels market dynamics, structure by analysing the market segments and projecting the global Sensormatic Labels market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Sensormatic Labels market makes the report an investor’s guide.To know about the Research Methodology :- Request Free Sample Report

Global Sensormatic Labels Market Dynamics

Increasing demand from anti-theft protection for retail and industrial goods to drive the Sensormatic Labels Market Growth

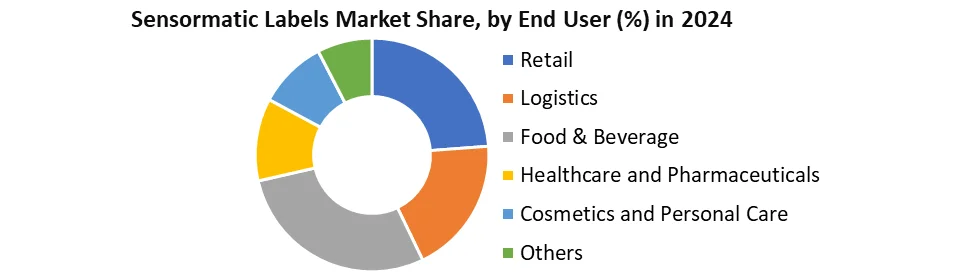

Due to a variety of variables, the market for Sensormatic labels has the potential to grow. The increasing use of these items in a variety of industries indicates that demand is likely to rise. Retail, logistics, cosmetics and personal care, food and beverage, healthcare, and pharmaceuticals are several of the areas that are seeing increasingly more use of their products. Sensormatic labels are gaining in popularity as a result of their capacity to provide anti-theft protection for retail and industrial goods. Furthermore, labels on a variety of products can resist any climatic conditions as well as transportation. These labels can be found in a variety of sizes and shapes. All of these considerations increase the likelihood of various firms using sensormatic labelling. As a result, the global sensormatic labels market is expected to rise rapidly in the future years. Furthermore, the labels are vulnerable to environmental stress during transportation due to their revolutionary sturdy designs. This functionality will almost certainly increase the popularity of these labels among the general public. The nearest competitor for labels is barcodes, and the high cost of a Sensormatic label printer compared to barcode printers is the primary obstacle limiting the global revenues of Sensormatic labels.Global Sensormatic Labels Market Segment Analysis

Based on the End-Use Industry, the food and beverages segment had a market share of xx%, and it is expected to reach USD$ XX Mn by 2032. The Indian packaging sector is worth around xx billion dollars. For major food and beverage firms, finding high-quality ingredients in safe packaging is a major difficulty. Consumers all across the world are increasingly willing to pay a premium for safe, organic, and ecologically friendly products. Using this equation, large organisations may anticipate consumer needs, improve lives, and lessen their environmental footprints. To improve the economic prospects of developing countries to expand economic opportunities in underdeveloped countries, the food, and beverage industries are collaborating with non-profits and government organisations on three levels developing business models that include the suppliers, poor as entrepreneurs, customers and retailers; and building the poor's human & physical capital to enable them to participate in these models, and addressing institutional apathy.

Global Sensormatic Labels Market Regional Insights

North America currently leads the Sensormatic labels market due to its advanced retail infrastructure and high adoption of anti-theft technologies. The region's dominance stems from significant investments in loss prevention systems by major retailers combating organised retail crime. Europe follows as a key market, driven by stringent retail security regulations and sustainability requirements for labelling solutions. Meanwhile, Asia-Pacific shows the fastest growth potential as expanding retail chains and modernising stores increase demand for electronic article surveillance. Latin America and the Middle East are emerging markets where rising retail theft is gradually driving the adoption of Sensormatic solutions. The regional differences reflect varying levels of retail maturity, security challenges, and technological adoption rates.Sensormatic Labels Market Competitive Landscape

The global Sensormatic labels market is experiencing robust growth, projected to reach $X billion by 2032, driven by escalating retail theft concerns and the rapid adoption of RFID and AI-powered inventory tracking solutions. Johnson Controls (Sensormatic Solutions) leads the market with ~30% share, leveraging its Shoppertrak analytics platform and IoT-enabled RFID tags, which reduce shrinkage by up to 60%. Close behind, Checkpoint Systems (CCL Industries) holds ~25% share, specialising in hybrid EAS-RFID labels deployed by retailers like Walmart and Zara. Avery Dennison and Zebra Technologies are disrupting the space with dual-frequency RFID labels and cloud-based SmartTag solutions, capturing 15-20% of the market, while Sato Holdings dominates Asia-Pacific with low-cost RFID inlays. Strategic moves abound: Johnson Controls’ $200M R&D investment in AI-driven loss prevention and Avery Dennison’s partnership with Amazon’s Just Walk Out technology underscore the race for innovation. Government mandates are accelerating adoption; China’s 2025 RFID apparel tagging rule alone is expected to drive 40 M+ label deployments annually. This report delivers in-depth competitive benchmarking, analysing how top players are scaling ultra-thin RFID labels, battery-free sensor tags, and blockchain-integrated anti-counterfeiting solutions. It reveals Sensormatic’s V2 micro-tag reduces false alarms by 35%, while Zebra’s FX9600 printer boosts label encoding speed by 50%. The study tracks $ 1.2 B+ in collective R&D spending, with 40% allocated to sustainable materials like biodegradable antennas. Regional insights highlight North America’s 45% market share (fueled by retail ORC laws) versus Asia-Pacific’s 30% CAGR (led by Alibaba’s RFID mandates). M&A activity is scrutinised, including CCL’s acquisition of Checkpoint for $400M and Avery Dennison’s purchase of Vestcom for smart shelf labels. Emerging opportunities in pharma serialisation and luxury goods authentication are evaluated alongside challenges like tag collision rates and EU data privacy regulations.Sensormatic Labels Market Key Trends

Trend Description Examples AI & Smart Labels AI-powered labels use machine learning to analyse theft patterns, reducing false alarms. Some integrate with IoT sensors for real-time tracking. Walmart's AI-based inventory systems, Amazon’s Just Walk Out technology. Sustainability Focus Brands are shifting to recyclable or DE-activatable labels to reduce waste. Some use bio-based materials. Zara’s RFID tags with recycled materials, Tesco’s biodegradable security labels. Hybrid RFID-EAS Solutions Combines RFID’s inventory tracking with EAS’s theft deterrence. Lowers costs by replacing separate systems. Macy’s “RFID + EAS” pilot reduced shrinkage by 30%. Omnichannel Security Labels are designed for e-commerce (e.g., tamper-proof packaging tags) and in-store theft prevention. Tackles “brick-and-mortar vs. online” return fraud. Best Buy’s dual-use labels are Alibaba’s smart packaging. Sensormatic Labels Market Recent Development

• On Feb 13, 2025, Johnson Controls Through Sensormatic, launched SPX Sustainable AM label at EuroCIS 2025 with >90% plastic-free content and RFID compatibility. • On Jun 23, 2025, Checkpoint Systems sponsored the AIPIA Congress 2025, showcasing new RFID tags for global supply chain transparency and authentication. • On May 14, 2025, Avery Dennison Corporation announced global expansion of RFID tagging solutions with new AD Max dTags for omnichannel retail at RetailX. • On Mar 4, 2025, Smartrac N.V. rolled out Smartrac Circus Pro RFID inlays optimised for wearables and flexible packaging across EU markets. • On Apr 9, 2025, Zebra Technologies released updated ZD411 desktop printers to support higher-speed RFID label encoding and retail EAS compatibility.Global Sensormatic Labels Market Scope: Inquire before buying

Global Sensormatic Labels Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5 Bn. Forecast Period 2025 to 2032 CAGR: 15.6% Market Size in 2032: USD 10 Bn. Segments Covered: by Labelling EAS Labels RFID Labels Sensing Labels Others by Printing Technology Flexographic Digital Gravure Others by End-Use Industry Retail Logistics Food & Beverage Healthcare and Pharmaceuticals Cosmetics and Personal Care Others Sensormatic Labels Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Sensormatic Labels Market Key Players

North America 1. Johnson Controls (USA) 2. Checkpoint Systems (USA) 3. Avery Dennison Corporation (USA) 4. Zebra Technologies Corporation (USA) 5. Alien Technology Inc (USA) 6. Intermec Inc – Honeywell (USA) 7. Graphic Label, Inc. (USA) 8. Sentry Technology Corporation (USA) 9. Custom Security Industries (USA) Europe 10. Tageos (France) 11. Smartrac N.V. (Netherlands) 12. Muhlbauer Holding AG & Co. Ltd (Germany) 13. ASK SA (France) 14. Thin Film Electronics ASA (Norway) 15. All Tag Corporation (France) 16. IVITS (Germany) Asia Pacific 17. Sato Holdings Corporation (Japan) 18. Invengo Information Technology Co., Ltd (China) 19. Changzhou Yasen Electronic Co., Ltd (China) 20. Shanghai RFID & Wireless IoT Institute (China) Middle East & Africa 21. Labelling Solutions, ME (UAE) 22. Secure Labelling Services (South Africa) South America 23. Etiquetas Autoadheribles (Argentina) 24. Smart Label Solutions LATAM (Chile)Frequently Asked Questions:

1. Which region has the largest share in the Global Sensormatic Labels Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Sensormatic Labels Market? Ans: The global market is growing at a CAGR of 15.6% during the forecasting period 2025-2032. 3. What is the scope of the Global Sensormatic Labels market report? Ans: Global market report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Sensormatic Labels market? Ans: Top key players in the Sensormatic Labels Market in 2025 include Johnson Controls, Checkpoint Systems, Avery Dennison Corporation, Zebra Technologies Corporation, Alien Technology Inc., Tageos, and Sato Holdings Corporation. 5. What is the study period of this market? Ans: The Global Sensormatic Labels Market is studied from 2024 to 2032.

1. Sensormatic Labels Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Sensormatic Labels Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Sensormatic Labels Market: Dynamics 3.1. Region-wise Trends of the Sensormatic Labels Market 3.1.1. North America Sensormatic Labels Market Trends 3.1.2. Europe Sensormatic Labels Market Trends 3.1.3. Asia Pacific Sensormatic Labels Market Trends 3.1.4. Middle East and Africa Sensormatic Labels Market Trends 3.1.5. South America Sensormatic Labels Market Trends 3.2. Sensormatic Labels Market Dynamics 3.2.1. Sensormatic Labels Market Drivers 3.2.1.1. Multi-industry adoption 3.2.1.2. Climate-resistant design 3.2.2. Sensormatic Labels Market Restraints 3.2.3. Sensormatic Labels Market Opportunities 3.2.3.1. E-commerce logistics growth 3.2.3.2. Smart packaging trend 3.2.3.3. RFID technology upgrades 3.2.4. Sensormatic Labels Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Retail sector growth 3.4.2. RFID investment surge 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Sensormatic Labels Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 4.1.1. EAS Labels 4.1.2. RFID Labels 4.1.3. Sensing Labels 4.1.4. Others 4.2. Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 4.2.1. Flexographic 4.2.2. Digital 4.2.3. Gravure 4.2.4. Others 4.3. Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 4.3.1. Retail 4.3.2. Logistics 4.3.3. Food & Beverage 4.3.4. Healthcare and Pharmaceuticals 4.3.5. Cosmetics and Personal Care 4.3.6. Others 4.4. Sensormatic Labels Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Sensormatic Labels Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 5.1.1. EAS Labels 5.1.2. RFID Labels 5.1.3. Sensing Labels 5.1.4. Others 5.2. North America Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 5.2.1. Flexographic 5.2.2. Digital 5.2.3. Gravure 5.2.4. Others 5.3. North America Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 5.3.1. Retail 5.3.2. Logistics 5.3.3. Food & Beverage 5.3.4. Healthcare and Pharmaceuticals 5.3.5. Cosmetics and Personal Care 5.3.6. Others 5.4. North America Sensormatic Labels Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 5.4.1.1.1. EAS Labels 5.4.1.1.2. RFID Labels 5.4.1.1.3. Sensing Labels 5.4.1.1.4. Others 5.4.1.2. United States Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 5.4.1.2.1. Flexographic 5.4.1.2.2. Digital 5.4.1.2.3. Gravure 5.4.1.2.4. Others 5.4.1.3. United States Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 5.4.1.3.1. Retail 5.4.1.3.2. Logistics 5.4.1.3.3. Food & Beverage 5.4.1.3.4. Healthcare and Pharmaceuticals 5.4.1.3.5. Cosmetics and Personal Care 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 5.4.2.1.1. EAS Labels 5.4.2.1.2. RFID Labels 5.4.2.1.3. Sensing Labels 5.4.2.1.4. Others 5.4.2.2. Canada Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 5.4.2.2.1. Flexographic 5.4.2.2.2. Digital 5.4.2.2.3. Gravure 5.4.2.2.4. Others 5.4.2.3. Canada Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 5.4.2.3.1. Retail 5.4.2.3.2. Logistics 5.4.2.3.3. Food & Beverage 5.4.2.3.4. Healthcare and Pharmaceuticals 5.4.2.3.5. Cosmetics and Personal Care 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 5.4.3.1.1. EAS Labels 5.4.3.1.2. RFID Labels 5.4.3.1.3. Sensing Labels 5.4.3.1.4. Others 5.4.3.2. Mexico Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 5.4.3.2.1. Flexographic 5.4.3.2.2. Digital 5.4.3.2.3. Gravure 5.4.3.2.4. Others 5.4.3.3. Mexico Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 5.4.3.3.1. Retail 5.4.3.3.2. Logistics 5.4.3.3.3. Food & Beverage 5.4.3.3.4. Healthcare and Pharmaceuticals 5.4.3.3.5. Cosmetics and Personal Care 5.4.3.3.6. Others 6. Europe Sensormatic Labels Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.2. Europe Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.3. Europe Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4. Europe Sensormatic Labels Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.1.2. United Kingdom Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.1.3. United Kingdom Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.2. France 6.4.2.1. France Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.2.2. France Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.2.3. France Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.3.2. Germany Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.3.3. Germany Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.4.2. Italy Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.4.3. Italy Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.5.2. Spain Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.5.3. Spain Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.6.2. Sweden Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.6.3. Sweden Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.7.2. Russia Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.7.3. Russia Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 6.4.8.2. Rest of Europe Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 6.4.8.3. Rest of Europe Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7. Asia Pacific Sensormatic Labels Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.2. Asia Pacific Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.3. Asia Pacific Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4. Asia Pacific Sensormatic Labels Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.1.2. China Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.1.3. China Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.2.2. S Korea Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.2.3. S Korea Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.3.2. Japan Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.3.3. Japan Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.4. India 7.4.4.1. India Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.4.2. India Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.4.3. India Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.5.2. Australia Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.5.3. Australia Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.6.2. Indonesia Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.6.3. Indonesia Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.7.2. Malaysia Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.7.3. Malaysia Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.8.2. Philippines Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.8.3. Philippines Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.9.2. Thailand Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.9.3. Thailand Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.10.2. Vietnam Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.10.3. Vietnam Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 7.4.11.2. Rest of Asia Pacific Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8. Middle East and Africa Sensormatic Labels Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.2. Middle East and Africa Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.3. Middle East and Africa Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8.4. Middle East and Africa Sensormatic Labels Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.4.1.2. South Africa Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4.1.3. South Africa Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.4.2.2. GCC Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4.2.3. GCC Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.4.3.2. Egypt Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4.3.3. Egypt Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.4.4.2. Nigeria Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4.4.3. Nigeria Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 8.4.5.2. Rest of ME&A Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 8.4.5.3. Rest of ME&A Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9. South America Sensormatic Labels Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.2. South America Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.3. South America Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9.4. South America Sensormatic Labels Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.4.1.2. Brazil Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4.1.3. Brazil Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.4.2.2. Argentina Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4.2.3. Argentina Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.4.3.2. Colombia Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4.3.3. Colombia Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.4.4.2. Chile Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4.4.3. Chile Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Sensormatic Labels Market Size and Forecast, By Labelling (2024-2032) 9.4.5.2. Rest Of South America Sensormatic Labels Market Size and Forecast, By Printing Technology (2024-2032) 9.4.5.3. Rest Of South America Sensormatic Labels Market Size and Forecast, By End-use Industry (2024-2032) 10. Company Profile: Key Players 10.1. Johnson Controls (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Checkpoint Systems (USA) 10.3. Avery Dennison Corporation (USA) 10.4. Zebra Technologies Corporation (USA) 10.5. Alien Technology Inc (USA) 10.6. Intermec Inc – Honeywell (USA) 10.7. Graphic Label, Inc. (USA) 10.8. Sentry Technology Corporation (USA) 10.9. Custom Security Industries (USA) 10.10. Tageos (France) 10.11. Smartrac N.V. (Netherlands) 10.12. Muhlbauer Holding AG & Co. Ltd (Germany) 10.13. ASK SA (France) 10.14. Thin Film Electronics ASA (Norway) 10.15. All Tag Corporation (France) 10.16. IVITS (Germany) 10.17. Sato Holdings Corporation (Japan) 10.18. Invengo Information Technology Co., Ltd (China) 10.19. Changzhou Yasen Electronic Co., Ltd (China) 10.20. Shanghai RFID & Wireless IoT Institute (China) 10.21. Labelling Solutions, ME (UAE) 10.22. Secure Labelling Services (South Africa) 10.23. Etiquetas Autoadheribles (Argentina) 10.24. Smart Label Solutions LATAM (Chile) 11. Key Findings 12. Industry Recommendations 13. Sensormatic Labels Market: Research Methodology