Pouches Packaging Market size was valued at US$ 42.13 Bn in 2022 and the total revenue is expected to grow at 4.25% through 2023 to 2029, reaching nearly US$ 56.37 Bn. The global Pouches Packaging market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global Pouches Packaging report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Pouches Packaging Market Overview:

A pouch is a form of food packaging comprised of flexible plastic and metal foils laminated together. It is utilized as an alternative to standard industrial canning methods for the sterile packing of a wide variety of food and drinks handled by aseptic processing. A pouch is a simple physical object that may be used to transport anything. In other words, a pouch is a compact, flexible sack. Generally, a pouch is used to transport relatively few goods. Pouches can be worn on the belt or carried in the pocket.Pouches Packaging Market Dynamics:

Snacking is becoming more popular, as is the use of single-serve and re-usable packaging options. The consumer's need is met by pouch packing. Pouches are less in weight, resulting in lower shipping costs for products. As a result, pouch packaging has proven to be one of the most effective and cost-effective packaging options for brand owners in the packaged food business. Furthermore, the rising popularity of baked foods is driving the market's growth. According to the United States Department of Agriculture, India consumed 3.07 million metric tonnes of baked products in FY2019. In addition, the need for online pre-packaged food is propelling this industry forward. It also makes such meals readily available off the shelf. These pouches may also be vacuum-packed, making them suitable for items such as smoked fish. Moreover, pet food laws have improved over time and are now comparable to human food laws. Manufacturers are concentrating on delivering what customers want, such as clever pet food packaging. As a result, the market for plastic pouches is expected to be encouraged by characteristics that are intrinsically handy for customers, such as zippered closing mechanisms and lightweight, as well as lower shipping costs. In both the dry and wet pet food categories, pouch packaging is predicted to develop rapidly. The pouches packaging industry is hampered by a shortage of high-speed filling equipment, which influences mass manufacturing.Pouches Packaging Market Segment Analysis:

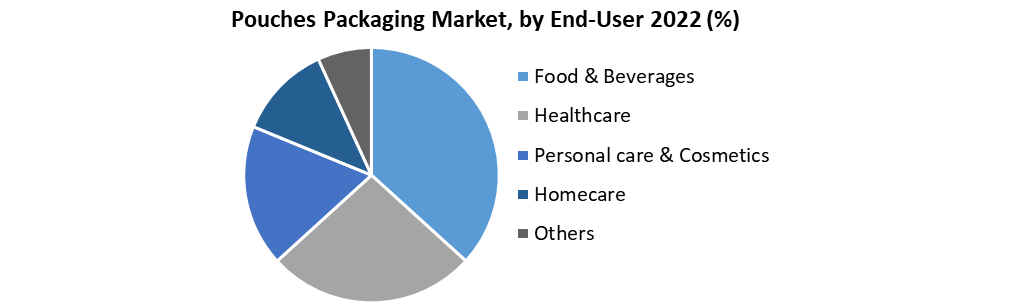

Based on Material, the plastic material segment accounted for the largest share of 65.2% of total shares revenue, in 2022. Plastic pouches keep packaged items fresher for longer because of their great resistance to moisture, dust, oxygen, and UV radiation; this aspect is primarily responsible for the plastic material segment's biggest share in 2022. Plastic is a popular material for pouch manufacture because of its low cost and durability. However, rising environmental concerns over plastic's non-degradability are likely to stifle segmental expansion throughout the projection period. Based on Treatment Type, the standard treatment type is expected to witness the highest share of 59.9%, in 2022. Because of their reduced cost and improved durability, standard treatment pouches are utilized in the food and beverage, as well as personal care and cosmetics industries. From 2023 to 2029, the aseptic treatment type is predicted to grow at the fastest rate of xx%. The aseptic treatment guarantees that the packed product is free of germs, and it also removes the need for refrigeration during product transit. As a result, end-user firms are increasingly using the aseptic treatment for their product packaging. Food goods such as milk, soup, tomato pudding, non-carbonated drinks, and medications are sterilized separately from packaging in the aseptic treatment process and then placed into the packaging under sterile conditions. Based on Type, the flat type segment dominated the market, in 2022. Flat pouches are commonly used in CPG items such as snacks, confectionery, dry fruits, detergents, fabric care, and medical equipment due to their low cost and ease of storage. In the pouches market, the stand-up pouch type segment is predicted to grow at the fastest rate in the coming years. Salad dressing, soup, yogurt, and baby food may all be enjoyed away from home when packaged in stand-up pouches. This mobility, along with easy-to-open closures built into the product type, is largely responsible for the segment's rapid rise. Based on End User, the food and beverage end-use category led the market in 2022, and it is predicted to grow at CAGR of xx% during the forecast period. The segment's growth is primarily driven by the increasing usage of the product for the packaging of alcoholic drinks due to its lightweight, long-lasting, and non-fragile nature. Snacks are widely packaged in pouches because they are inexpensive and easy to fill with nitrogen, which protects the color, flavor, and texture of the packed food product. In alternative packaging options, such as cardboard boxes and plastic jars, nitrogen filling is substantially more costly.

Pouches Packaging Market Regional Insights:

Due to the obvious existence of two densely populated nations, China and India, Asia-Pacific is predicted to grow at the quickest rate. The increase in disposable income in these two nations is projected to boost the expansion of businesses such as food and drinks, medicines, pet food, and cosmetics, which would, in turn, assist the pouch packaging industry to expand. Furthermore, the significant increase in demand for packaged foods and drinks, as well as the vital function of pouch packaging in keeping packaged goods fresh for longer periods are expected to drive the market in the area. Additionally, according to China's Ministry of Business and Information Technology, the food industry produced CNY 8.12 trillion in operating income in 2019. The need for processed food is predicted to rise as a result of rising urbanization, changing lifestyles, and rising yearly disposable income, resulting in increased demand for Retort Pouch packaging. According to the Packaging Industry Association of India (PIAI), the industry is increasing at a rate of 22 to 25 percent every year. As the demand for takeaway and ready-to-eat (RTE) food grows, so does the quantity of packaging waste. The majority of plastic packaging is non-biodegradable. As a result, China's government has enacted several rules and regulations to safeguard foods and drinks from the negative impacts of packaging materials. As a result, packaging businesses are shifting their focus to biodegradable pouches, such as paper pouches. The objective of the report is to present a comprehensive analysis of the global Pouches Packaging market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Pouches Packaging market dynamics, structure by analyzing the market segments and project the global Pouches Packaging market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Pouches Packaging market make the report investor’s guide.Pouches Packaging Market Key Development:

In August 2020, Bimbosan and ProAmpac, a flexible packaging company, collaborated on the ProActive renewable pouch for the infant food industry. The sealing layer of this new bag is made up of 65 percent bio-based resin, which helps to lessen the carbon impact on the environment. In July 2020, Coveris Holdings S.A. has officially launched its new Pack Innovation Centre in Halle, Germany, as part of its forward-thinking innovation strategy. Coveris' Pack Innovation Centre is positioned as a European center for technical product development, sustainable innovation, and education, assisting clients to 'innovate,' 'educate,' and 'validate' the flexible packaging of the future.Pouches Packaging Market Scope: Inquire before buying

Pouches Packaging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 42.13 Bn. Forecast Period 2023 to 2029 CAGR: 4.25% Market Size in 2029: US $ 56.37 Bn. Segments Covered: by Material • Plastics • Paper • Metal • Bioplastics by Treatment Type • Standard • Aseptic • Retort • Hot-Fill by Type • Flat • Stand-Up by End-User • Food & Beverages • Healthcare • Personal care & Cosmetics • Homecare • Others by Closure Type • Zipper • Spout • Tear Notch Pouches Packaging Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Pouches Packaging Market, Key Players are:

• Amcor PLC • Bischof + Klein SE & Co. KG • ProAmpac LLC • Constantia Flexibles Group GmbH • Coveris • FLAIR Flexible Packaging Corporation • Mondi Group • Scholle IPN • Sealed Air Corporation • Sonoco Products Company • Toppan Printing Co. Ltd • Huhtamaki Flexible Packaging • AEP Industries Inc • Alcoa Inc • Bemis Company Inc • Berry Plastics Corporation • Crown Holdings Incorporated Frequently Asked Questions: 1. Which region has the largest share in Global Pouches Packaging Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Pouches Packaging Market? Ans: The Global Pouches Packaging Market is growing at a CAGR of 4.25% during forecasting period 2023-2029. 3. What is scope of the Global Pouches Packaging Market report? Ans: Global Pouches Packaging Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Pouches Packaging Market? Ans: The important key players in the Global Pouches Packaging Market are – Amcor PLC, Bischof + Klein SE & Co. KG, ProAmpac LLC, Constantia Flexibles Group GmbH, Coveris, FLAIR Flexible Packaging Corporation, Mondi Group, Scholle IPN, Sealed Air Corporation, Sonoco Products Company, Toppan Printing Co. Ltd, Huhtamaki Flexible Packaging, AEP Industries Inc, Alcoa Inc, Bemis Company Inc, Berry Plastics Corporation, Crown Holdings Incorporated. 5. What is the study period of this Market? Ans: The Global Pouches Packaging Market is studied from 2022 to 2029.

1. Global Pouches Packaging Market: Research Methodology 2. Global Pouches Packaging Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Pouches Packaging Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Pouches Packaging Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Pouches Packaging Market Segmentation 4.1 Global Pouches Packaging Market, by Material (2022-2029) • Plastics • Paper • Metal • Bioplastics 4.2 Global Pouches Packaging Market, by Treatment Type (2022-2029) • Standard • Aseptic • Retort • Hot-Fill 4.3 Global Pouches Packaging Market, by Type (2022-2029) • Flat • Stand-Up 4.4 Global Pouches Packaging Market, by End-User (2022-2029) • Food & Beverages • Healthcare • Personal care & Cosmetics • Homecare • Others 4.5 Global Pouches Packaging Market, by Closure Type (2022-2029) • Zipper • Spout • Tear Notch 5. North America Pouches Packaging Market(2022-2029) 5.1 North America Pouches Packaging Market, by Material (2022-2029) • Plastics • Paper • Metal • Bioplastics 5.2 North America Pouches Packaging Market, by Treatment Type (2022-2029) • Standard • Aseptic • Retort • Hot-Fill 5.3 North America Pouches Packaging Market, by Type (2022-2029) • Flat • Stand-Up 5.4 North America Pouches Packaging Market, by End-User (2022-2029) • Food & Beverages • Healthcare • Personal care & Cosmetics • Homecare • Others 5.5 North America Pouches Packaging Market, by Closure Type (2022-2029) • Zipper • Spout • Tear Notch 5.6 North America Pouches Packaging Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Pouches Packaging Market (2022-2029) 6.1. European Pouches Packaging Market, by Material (2022-2029) 6.2. European Pouches Packaging Market, by Treatment Type (2022-2029) 6.3. European Pouches Packaging Market, by Type (2022-2029) 6.4. European Pouches Packaging Market, by End-User (2022-2029) 6.5. European Pouches Packaging Market, by Closure Type (2022-2029) 6.6. European Pouches Packaging Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Pouches Packaging Market (2022-2029) 7.1. Asia Pacific Pouches Packaging Market, by Material (2022-2029) 7.2. Asia Pacific Pouches Packaging Market, by Treatment Type (2022-2029) 7.3. Asia Pacific Pouches Packaging Market, by Type (2022-2029) 7.4. Asia Pacific Pouches Packaging Market, by End-User (2022-2029) 7.5. Asia Pacific Pouches Packaging Market, by Closure Type (2022-2029) 7.6. Asia Pacific Pouches Packaging Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Pouches Packaging Market (2022-2029) 8.1 Middle East and Africa Pouches Packaging Market, by Material (2022-2029) 8.2. Middle East and Africa Pouches Packaging Market, by Treatment Type (2022-2029) 8.3. Middle East and Africa Pouches Packaging Market, by Type (2022-2029) 8.4. Middle East and Africa Pouches Packaging Market, by End-User (2022-2029) 8.5. Middle East and Africa Pouches Packaging Market, by Closure Type (2022-2029) 8.6. Middle East and Africa Pouches Packaging Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Pouches Packaging Market (2022-2029) 9.1. South America Pouches Packaging Market, by Material (2022-2029) 9.2. South America Pouches Packaging Market, by Treatment Type (2022-2029) 9.3. South America Pouches Packaging Market, by Type (2022-2029) 9.4. South America Pouches Packaging Market, by End-User (2022-2029) 9.5. South America Pouches Packaging Market, by Closure Type (2022-2029) 9.6. South America Pouches Packaging Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Amcor PLC 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Bischof + Klein SE & Co. KG 10.3 ProAmpac LLC 10.4 Constantia Flexibles Group GmbH 10.5 Coveris 10.6 FLAIR Flexible Packaging Corporation 10.7 Mondi Group 10.8 Scholle IPN 10.9 Sealed Air Corporation 10.10 Sonoco Products Company 10.11 Toppan Printing Co. Ltd 10.12 Huhtamaki Flexible Packaging 10.13 AEP Industries Inc 10.14 Alcoa Inc 10.15 Bemis Company Inc 10.16 Berry Plastics Corporation 10.17 Crown Holdings Incorporated