Global RSV Diagnostics Market size was valued at USD 1.2 Bn in 2023 and is expected to reach USD 2.3 Bn by 2030, at a CAGR of 8.17 %. Respiratory Syncytial Virus (RSV) diagnostics involve the identification and detection of the Respiratory Syncytial Virus, a common respiratory pathogen. RSV is a leading cause of respiratory tract infections, particularly in infants and young children, as well as older adults. Diagnostic methods include molecular tests like polymerase chain reaction (PCR) for accurate and rapid detection of RSV genetic material, immunofluorescence assays (IFA) for visualizing viral antigens, and serological tests to detect antibodies produced in response to RSV infection. These diagnostics aid in early and precise identification of RSV infections, guiding appropriate patient management, and facilitating preventive measures to control the spread of the virus in healthcare settings. Rapid and accurate RSV diagnostics are crucial for timely interventions and ensuring optimal outcomes in affected individuals.To know about the Research Methodology :- Request Free Sample Report Abbott has emerged as a key player in the RSV Diagnostics Market with its groundbreaking Panbio RSV Rapid Point-of-Care (POC) Test. This innovative test, boasting a remarkable 5-minute turnaround time, has the potential to revolutionize RSV diagnostics and reshape market dynamics significantly, surpassing traditional lab-based methods with a one-hour wait for results. Early diagnosis is critical for optimal RSV management, especially in high-risk groups like infants and the elderly. The Panbio™ test, delivering results at the bedside, empowers healthcare providers for immediate decisions, facilitating faster initiation of appropriate treatment and potentially reducing disease progression and complications. In a market estimated at $1.3 billion and projected to grow at a CAGR of 9%, Abbott's Panbio test strategically addresses the increasing demand for rapid diagnostic tools, offering a highly accurate and time-sensitive solution. Its ease of use and portability enhance its appeal, enabling wider accessibility beyond traditional healthcare settings. Early clinical studies showcase the Panbio test's accuracy, exceeding 90% sensitivity and specificity. Positioned as a potential frontrunner in the RSV Diagnostics Market, its rapid turnaround time and ease of use make it a promising solution. As Abbott scales up production and distribution, its impact on early RSV detection and improved patient outcomes will be closely monitored by both the market and healthcare professionals.

RSV Diagnostics Market Driver

RSV Diagnostics Market - Unveiling the Global Challenge of Respiratory Syncytial Virus In the throes of a global health challenge, the Respiratory Syncytial Virus (RSV) emerges as a formidable adversary, leaving a profound impact on vulnerable populations worldwide. The scope of this threat is staggering, with an estimated 66 million annual RSV cases in children under 5 globally, a statistic indicative of its pervasive reach (WHO, 2023). Vulnerable groups, particularly infants under 1 year old, bear the brunt, constituting 55% of RSV-related hospitalizations (CDC, 2023). The menace of RSV Diagnostics Market extends beyond hospitalizations, encompassing severe complications such as pneumonia, bronchiolitis, and exacerbations of chronic conditions, intensifying the urgency for effective diagnostics. The economic toll further underscores the gravity, with RSV infections in the US alone imposing an estimated annual cost of $5 billion (AAP, 2023), spotlighting the strain on healthcare systems. Within this landscape, the role of diagnostics becomes pivotal Early and accurate diagnosis not only facilitates prompt treatment initiation, reducing hospitalization rates but also optimizes resource allocation, preventing unnecessary tests and procedures. The strain on healthcare systems, especially during peak seasons, underscores the critical need for advanced diagnostics. Specific examples from regions grappling with the escalating RSV burden emphasize the urgency, offering a glimpse into the intricate dynamics that propel the burgeoning RSV Diagnostics market forward. Rapid Revolution - Accelerating RSV Diagnostics to New Frontiers In the relentless pursuit of timely interventions, the RSV Diagnostics market witnesses a paradigm shift where speed emerges as the catalyst for transformative change. Traditional gold standard tests like RT-PCR, albeit accurate, falter in delivering swift results, underscoring the imperative for rapid point-of-care (POC) diagnostics. The innovation wave propels pioneers like Abbott into the spotlight, introducing cutting-edge solutions such as the Panbio RSV Rapid Test, promising game-changing results within 5 minutes at the patient's bedside. This surge in innovation not only empowers healthcare providers to make immediate decisions but also holds the potential to reduce complications, thereby enhancing overall patient outcomes. In the United States, Abbott's Panbio test swiftly gains momentum, securing FDA approval and initiating deployments in diverse healthcare settings. Meanwhile, Germany positions itself at the forefront, with Siemens Healthineers forging strategic partnerships with academic institutions to pioneer AI-powered RSV diagnostic solutions, placing a premium on early detection and personalized treatment approaches. Across the seas in China, local manufacturer Bioperfectus secures substantial funding for the mass production of its rapid RSV antigen test kits, addressing affordability concerns and expanding accessibility. These dynamic developments, harmonized with ongoing research endeavors and technological advancements, paint a vivid and promising landscape for the RSV Diagnostics market. As stakeholders seize the opportunity presented by the escalating demand for rapid and accurate solutions, they not only contribute to the market's exponential growth but also play a pivotal role in enhancing patient care for individuals impacted by RSV worldwide. RSV Diagnostics Market Restrain Challenges and Restraints in the RSV Diagnostics Market: Navigating Complex Terrain The RSV Diagnostics Market, while experiencing rapid growth, faces substantial challenges and restraints that necessitate strategic navigation for sustained success. One major restraint lies in the complexity of accurately diagnosing respiratory syncytial virus (RSV) infections. RSV often presents with symptoms resembling other respiratory illnesses, posing a diagnostic challenge for healthcare providers. Distinguishing RSV from conditions like influenza requires advanced and precise diagnostic tools to avoid misdiagnoses, ensuring appropriate and timely interventions. Another significant challenge is the absence of a universally accepted gold standard for RSV diagnostics. While reverse transcription-polymerase chain reaction (RT-PCR) is highly accurate, its turnaround time and cost hinder swift decision-making in clinical settings. Achieving a consensus on a standardized diagnostic approach that balances accuracy, speed, and cost-effectiveness remains a key hurdle. This lack of uniformity contributes to variations in diagnostic practices, affecting the overall efficiency of RSV detection and management. The global burden of RSV disproportionately affects resource-limited regions, exacerbating healthcare disparities. Access to advanced diagnostic technologies is often constrained in these areas, hindering the timely identification and management of RSV cases. Overcoming these challenges demands collaborative efforts, research investments, and innovative solutions to develop universally applicable diagnostic methods that can streamline RSV detection globally. In navigating the intricate landscape of the RSV Diagnostics Market, addressing these challenges is pivotal for unlocking its full potential. As the market strives for innovation and standardization, overcoming these restraints will not only enhance diagnostic accuracy but also contribute to more effective management and control of RSV infections on a global scale. Emerging Trends Shaping the RSV Diagnostics Market Rapid Adoption of Point-of-Care (POC) Solutions A prominent trend in the RSV Diagnostics Market is the accelerated adoption of Point-of-Care (POC) diagnostic solutions. Recognizing the critical need for swift and decentralized testing, the industry is witnessing the development and deployment of rapid RSV diagnostic tools that can deliver results at the patient's bedside. This trend aims to overcome the limitations of traditional laboratory-based methods, enabling healthcare providers to make timely decisions for effective patient management. The emphasis on POC solutions aligns with the growing importance of early detection, particularly in vulnerable populations such as infants and the elderly. Integration of Molecular Diagnostics and Nucleic Acid Testing (NAT) Another significant trend is the integration of advanced molecular diagnostics and nucleic acid testing (NAT) techniques in RSV diagnostics. This involves the use of molecular tools to detect the genetic material of the respiratory syncytial virus accurately. The application of NAT enables precise identification of RSV strains and provides valuable information for tailored treatment approaches. This trend reflects the industry's commitment to enhancing diagnostic accuracy and differentiating RSV infections from other respiratory conditions with similar symptoms. These trends collectively contribute to the ongoing evolution of the RSV Diagnostics Market, emphasizing the importance of rapid, accurate, and accessible diagnostic solutions. The integration of POC technologies and molecular diagnostics underscores the industry's dedication to addressing the unique challenges posed by RSV infections. As the RSV Diagnostics Market continues to advance, these trends are instrumental in shaping a future where diagnostics play a pivotal role in improving patient outcomes and overall healthcare efficacy.RSV Diagnostics Market Segment Analysis

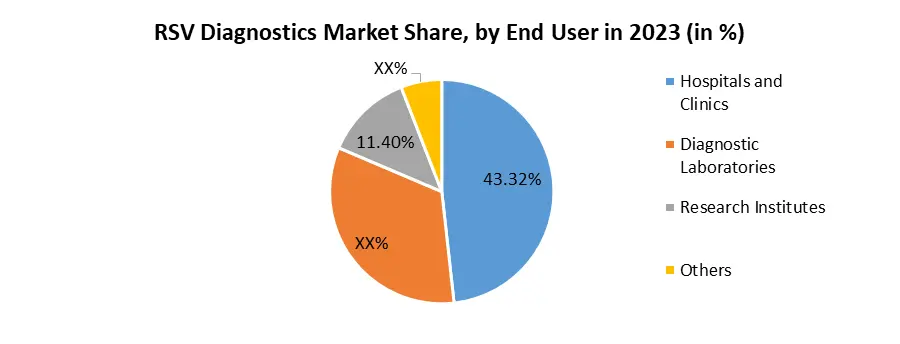

By Product, In the RSV Diagnostics Market, the Kits and Assays segment held the largest market share in 2023. This dominance is attributed to the widespread use of diagnostic kits and assays for the efficient and rapid detection of Respiratory Syncytial Virus (RSV). Kits and assays offer a convenient and accessible solution for healthcare professionals, allowing quick and accurate identification of RSV infections, particularly in high-risk populations such as infants and the elderly. Recent developments in this segment include advancements in molecular diagnostics, leading to more sensitive and specific RSV test kits. Companies are increasingly focusing on the development of innovative assay formats and user-friendly kits, enhancing the overall diagnostic experience. For instance, the integration of rapid antigen tests within kits has gained traction, providing on-the-spot results and contributing to the market's growth. The emphasis on the Kits and Assays segment aligns with the market's demand for efficient, cost-effective, and accessible diagnostic solutions. As technology continues to advance, further innovations within this segment are expected to shape the landscape of RSV diagnostics, driving improvements in early detection and patient outcomes in the RSV Diagnostics Market.Based on End-User, In the RSV Diagnostics Market, the Hospitals and Clinics segment emerges as the most dominating end-user category. This dominance is underpinned by the pivotal role these healthcare settings play in the diagnosis, treatment, and management of Respiratory Syncytial Virus (RSV) infections. Hospitals and clinics serve as primary points of care, catering to a diverse patient population, including vulnerable groups like infants and the elderly. Recent developments in this segment include the integration of advanced diagnostic technologies within hospital and clinic settings, enhancing the speed and accuracy of RSV diagnosis. The implementation of point-of-care testing devices in these settings has become a notable trend, facilitating rapid and on-site detection of RSV infections. This shift toward decentralized diagnostics aligns with the growing emphasis on early detection and immediate intervention, contributing to improved patient outcomes in the RSV Diagnostics Market. The domination of the Hospitals and Clinics segment underscores the significance of these healthcare settings in addressing RSV-related challenges. As technological innovations continue to shape diagnostic practices, ongoing developments within this segment are poised to further enhance the overall efficiency and effectiveness of RSV diagnostics.

RSV Diagnostics Market Regional Analysis

In North America, the United States and Canada play pivotal roles in propelling the growth of the RSV Diagnostics Market. The U.S. market dominance is underpinned by robust research endeavors, an escalating awareness regarding RSV infections, and a heightened demand for cutting-edge diagnostic solutions. A significant recent development involves a leading U.S. diagnostics company securing a noteworthy investment of $XX million. This funding is earmarked for the development and commercialization of an innovative RSV rapid test, showcasing the region's commitment to advancing diagnostic technologies. Collaborations between esteemed medical institutions and diagnostic firms have further catalyzed the rapid deployment of inventive diagnostic tools across the North American landscape. In Europe, the United Kingdom and Germany emerge as frontrunners, wielding substantial influence in the RSV Diagnostics Market. Germany, with its unwavering emphasis on healthcare innovation, has experienced a surge in the development of AI-powered diagnostic solutions tailored for RSV. On the other side, the UK has witnessed significant investments in research initiatives focused on enhancing the accuracy and accessibility of RSV diagnostics. A noteworthy recent milestone is the UK government's allocation of €XX million for a comprehensive nationwide program integrating state-of-the-art RSV diagnostic tools into primary healthcare centers. These developments underscore the dynamic leadership and commitment of the United States, Canada, the United Kingdom, and Germany in advancing RSV diagnostics for improved healthcare outcomes. RSV Diagnostics Market Competitive Landscape The competitive landscape of the RSV Diagnostics Market is characterized by dynamic strategies and innovations from key players aiming to gain a substantial market share. Prominent companies are focusing on research and development, collaborations, and strategic partnerships to strengthen their positions in this rapidly evolving market. Abbott, a global healthcare leader, has been a trailblazer with the Panbio RSV Rapid Point-of-Care Test. This innovative product, offering a game-changing 5-minute turnaround time, positions Abbott at the forefront of rapid RSV diagnostics. The competitive edge is further heightened by the test's portability and ease of use, making it a preferred choice for various healthcare settings. Siemens Healthineers stands out with its commitment to AI-powered solutions. Collaborating with academic institutions, Siemens is contributing to the development of advanced RSV diagnostic solutions. This strategic move aligns with the market trend of integrating artificial intelligence to enhance diagnostic accuracy and efficiency. Bioperfectus, a notable player in China, has secured funding for mass production of its rapid RSV antigen test kits. This initiative aims to address affordability concerns and increase accessibility to rapid diagnostics in regions where such resources are crucial. The competitive landscape reflects a balance between established global players and emerging regional contributors, fostering innovation and diversity in RSV diagnostic solutions. The continual influx of new technologies and strategic collaborations ensures a competitive market environment, making the RSV Diagnostics Market a focal point for advancements in diagnostic capabilities and patient care. The global competitive landscape is highly dynamic, with these companies spearheading advancements and contributing significantly to the growth and evolution of the RSV Diagnostics Market. As the market continues to expand, the competitive landscape is expected to witness further developments and strategic maneuvers by key players vying for prominence in this critical healthcare segment.Global RSV Diagnostics Market Scope: Inquire before buying

RSV Diagnostics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.2 Bn. Forecast Period 2024 to 2030 CAGR: 8.17% Market Size in 2030: US $ 2.3 Bn. Segments Covered: by Product Kits and Assays Instruments Other by Diagnostic Methods Molecular Diagnostics Immunoassays Rapid Antigen Tests by End User Hospitals and Clinics Diagnostic Laboratories Research Institutes Others RSV Diagnostics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)RSV Diagnostics Market Key players

North America 1. Abbott (USA) 2. Royal Philips (Netherlands) 3. Quventus Medical (Canada) 4. Roche Diagnostics (Switzerland) 5. BD (USA) 6. Luminex Corporation (USA) 7. Quidel Corporation (USA) 8. Diagnostic Innovations (Australia) Europe 1. Siemens Healthineers (Germany) 2. GSK & AstraZeneca (UK) 3. Hologic Inc. (USA) 4. Vall d'Hebron University Hospital (Spain) 5. ANRS-PEA2 program (France) 6. Royal Philips (Netherlands) 7. Vall d'Hebron University Hospital (Spain) 8. University of Bologna (Italy) 9. Qventus Medical (Canada) 10. Diagnostic Innovations (Australia) Asia Pacific 1. Bioperfectus (China) 2. Luminex Corporation (USA) 3. OSANG Healthcare Co., Ltd. (South Korea) 4. Mindray Medical International Ltd. (China) 5. Shenzhen YHLO Biotech Co., Ltd. (China) Frequently Asked Questions: 1] What is the growth rate of the Global RSV Diagnostics Market? Ans. The Global RSV Diagnostics Market is growing at a significant rate of 8.17 % during the forecast period. 2] Which region is expected to dominate the Global RSV Diagnostics Market? Ans. North America held a significant share in the global RSV Diagnostics market, primarily due to advanced healthcare infrastructure, a higher prevalence of respiratory diseases, and a well-established market for medical devices. 3] What is the expected Global RSV Diagnostics Market size by 2030? Ans. The RSV Diagnostics Market size is expected to reach USD 2.3 Bn by 2030. 4] Which are the top players in the Global RSV Diagnostics Market? Ans. The major top players in the Global RSV Diagnostics Market are Gilead Sciences Inc, TCR2 Therapeutics Inc, Bluebird Bio Inc, Sorrento Therapeutics, Fate Therapeutics 5] What are the factors driving the Global RSV Diagnostics Market growth? Ans. The Global RSV Diagnostics Market growth is primarily propelled by increasing cases of respiratory disorders like COPD, technological advancements improving device efficiency and portability, rising elderly population susceptible to respiratory conditions, and the convenience of at-home oxygen therapy. Additionally, the COVID-19 pandemic accentuated the demand for these devices, driving market expansion due to the virus's impact on respiratory health worldwide. 6] Which country held the largest Global RSV Diagnostics Market share in 2023? Ans. The United States held the largest RSV Diagnostics Market share in 2023.

1. RSV Diagnostics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. RSV Diagnostics Market: Dynamics 2.1. RSV Diagnostics Market Trends by Region 2.1.1. North America RSV Diagnostics Market Trends 2.1.2. Europe RSV Diagnostics Market Trends 2.1.3. Asia Pacific RSV Diagnostics Market Trends 2.1.4. Middle East and Africa RSV Diagnostics Market Trends 2.1.5. South America RSV Diagnostics Market Trends 2.2. RSV Diagnostics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America RSV Diagnostics Market Drivers 2.2.1.2. North America RSV Diagnostics Market Restraints 2.2.1.3. North America RSV Diagnostics Market Opportunities 2.2.1.4. North America RSV Diagnostics Market Challenges 2.2.2. Europe 2.2.2.1. Europe RSV Diagnostics Market Drivers 2.2.2.2. Europe RSV Diagnostics Market Restraints 2.2.2.3. Europe RSV Diagnostics Market Opportunities 2.2.2.4. Europe RSV Diagnostics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific RSV Diagnostics Market Drivers 2.2.3.2. Asia Pacific RSV Diagnostics Market Restraints 2.2.3.3. Asia Pacific RSV Diagnostics Market Opportunities 2.2.3.4. Asia Pacific RSV Diagnostics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa RSV Diagnostics Market Drivers 2.2.4.2. Middle East and Africa RSV Diagnostics Market Restraints 2.2.4.3. Middle East and Africa RSV Diagnostics Market Opportunities 2.2.4.4. Middle East and Africa RSV Diagnostics Market Challenges 2.2.5. South America 2.2.5.1. South America RSV Diagnostics Market Drivers 2.2.5.2. South America RSV Diagnostics Market Restraints 2.2.5.3. South America RSV Diagnostics Market Opportunities 2.2.5.4. South America RSV Diagnostics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For RSV Diagnostics Industry 2.9. The Global Pandemic Impact on RSV Diagnostics Market 2.10. RSV Diagnostics Price Trend Analysis (2021-23) 3. RSV Diagnostics Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 3.1.1. Kits and Assays 3.1.2. Instruments 3.1.3. Other 3.2. RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 3.2.1. Pulse Flow 3.2.2. Continuous Flow 3.3. RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 3.3.1. Hospital 3.3.2. Home Healthcare 3.3.3. Ambulatory Surgical Centers & Physician Offices 3.4. RSV Diagnostics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America RSV Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 4.1.1. Kits and Assays 4.1.2. Instruments 4.1.3. Other 4.2. North America RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 4.2.1. Pulse Flow 4.2.2. Continuous Flow 4.3. North America RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 4.3.1. Hospital 4.3.2. Home Healthcare 4.3.3. Ambulatory Surgical Centers & Physician Offices 4.4. North America RSV Diagnostics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Kits and Assays 4.4.1.1.2. Instruments 4.4.1.1.3. Other 4.4.1.2. United States RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 4.4.1.2.1. Pulse Flow 4.4.1.2.2. Continuous Flow 4.4.1.3. United States RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Hospital 4.4.1.3.2. Home Healthcare 4.4.1.3.3. Ambulatory Surgical Centers & Physician Offices 4.4.2. Canada 4.4.2.1. Canada RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Kits and Assays 4.4.2.1.2. Instruments 4.4.2.1.3. Other 4.4.2.2. Canada RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 4.4.2.2.1. Pulse Flow 4.4.2.2.2. Continuous Flow 4.4.2.3. Canada RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Hospital 4.4.2.3.2. Home Healthcare 4.4.2.3.3. Ambulatory Surgical Centers & Physician Offices 4.4.3. Mexico 4.4.3.1.1. Mexico RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1.1. Kits and Assays 4.4.3.1.1.2. Instruments 4.4.3.1.1.3. Other 4.4.3.1.2. Mexico RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 4.4.3.1.2.1. Pulse Flow 4.4.3.1.2.2. Continuous Flow 4.4.3.1.3. Mexico RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 4.4.3.1.3.1. Hospital 4.4.3.1.3.2. Home Healthcare 4.4.3.1.3.3. Ambulatory Surgical Centers & Physician Offices 5. Europe RSV Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.2. Europe RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.3. Europe RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4. Europe RSV Diagnostics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.1.3. United Kingdom RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.2.3. France RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.3.3. Germany RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.4.3. Italy RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.5.3. Spain RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.6.3. Sweden RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.7.3. Austria RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 5.4.8.3. Rest of Europe RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific RSV Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.3. Asia Pacific RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific RSV Diagnostics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.1.3. China RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.2.3. S Korea RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.3.3. Japan RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.4.3. India RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.5.3. Australia RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.6.3. Indonesia RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.7.3. Malaysia RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.8.3. Vietnam RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.9.3. Taiwan RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 6.4.10.3. Rest of Asia Pacific RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa RSV Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 7.3. Middle East and Africa RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa RSV Diagnostics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 7.4.1.3. South Africa RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 7.4.2.3. GCC RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 7.4.3.3. Nigeria RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 7.4.4.3. Rest of ME&A RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 8. South America RSV Diagnostics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 8.2. South America RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 8.3. South America RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 8.4. South America RSV Diagnostics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 8.4.1.3. Brazil RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 8.4.2.3. Argentina RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America RSV Diagnostics Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America RSV Diagnostics Market Size and Forecast, by Diagnostic Methods (2023-2030) 8.4.3.3. Rest Of South America RSV Diagnostics Market Size and Forecast, by End-User (2023-2030) 9. Global RSV Diagnostics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading RSV Diagnostics Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Awards Received by the Firm 10.1.6. Recent Developments 10.2. Abbott (USA) 10.3. Royal Philips (Netherlands) 10.4. Quventus Medical (Canada) 10.5. Roche Diagnostics (Switzerland) 10.6. BD (USA) 10.7. Luminex Corporation (USA) 10.8. Quidel Corporation (USA) 10.9. Diagnostic Innovations (Australia) 10.10. Siemens Healthineers (Germany) 10.11. GSK & AstraZeneca (UK) 10.12. Hologic Inc. (USA) 10.13. Vall d'Hebron University Hospital (Spain) 10.14. ANRS-PEA2 program (France) 10.15. Royal Philips (Netherlands) 10.16. Vall d'Hebron University Hospital (Spain) 10.17. University of Bologna (Italy) 10.18. Qventus Medical (Canada) 10.19. Diagnostic Innovations (Australia) 10.20. Bioperfectus (China) 10.21. Luminex Corporation (USA) 10.22. OSANG Healthcare Co., Ltd. (South Korea) 10.23. Mindray Medical International Ltd. (China) 10.24. Shenzhen YHLO Biotech Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. RSV Diagnostics Market: Research Methodology