Global Rolling Stock Market was valued at US$ 56.66 Bn. in 2022 and the total revenue is expected to grow about 4.8% from 2023 to 2029, reaching US$ 78.68 Bn during a forecast period.Global Rolling Stock Market Overview

The vehicles that run on rail tracks are called Rolling Stock vehicles. Electric locomotives utilize electric power from batteries, fuel cells, or overhead lines. The Locomotive has various types such as diesel steam, diesel pneumatic, diesel-hydraulic, diesel-mechanical, and diesel-electric. The diesel-electric locomotive has the highest market share.To know about the Research Methodology:-Request Free Sample Report The high-speed trains used for intercity commutation have an average speed of 200- 300 Km/hr. The EMU (Electric Multiple Unit) is a self-propelled carriage run by electric power and DMU (Diesel Multiple Units) are the same as EMU but powered by an onboard diesel engine. The other popular Rolling Stock types are DEMU (Diesel Electric Multiple Unit), DHMU (Diesel Hydraulic Multiple Unit), and Diesel Mechanical Multiple Unit. In the report, each of the units, its market share, revenue generation, and the key trends are discussed separately with reference to the regions.

Global Rolling Stock Market Dynamics

Increasing urbanization and industrialization lead to the rapid demand in commutation is causing road traffic in major cities. The traffic problems rising market for alternative transportation such as rail transport, which will directly play a vital role in the growth of the Rolling Stock Market. The rail transport offers faster and convenient transport of goods and passenger. Governments also planning to increase rail connectivity for intercity transport will propel the Rolling Stock Market in the forecasted period. Rail transport is reliable, eco-friendly, and cost-effective, developed countries such as France, Germany, and the UK are promoting the use of the rail transport system to reduce road traffic congestion and ultimately pollution. High-Speed Connectivity and Comfort provided by the transit vehicle segment is anticipated to witness growth in the forecast period. In addition to that, the demand for magnetic levitation trains and automated trains, among the public is increased for public transportation, is expected to grow in the forecast period. The global rolling stock market is growing at a high pace thanks to increased acquisitions and mergers. CRRC formed by the merger of CSR and CNR in June 2015, now it is one of the top leading players in the global rolling stock market. Also, CRRC is the leading market in new vehicle segments such as metro cars, high-speed trains, diesel locomotives, and electric locomotives. The key players have introduced innovative ideas & concepts to improve the manufacturing technologies for enhancing the product portfolios.Global Rolling Stock Market Segment Analysis

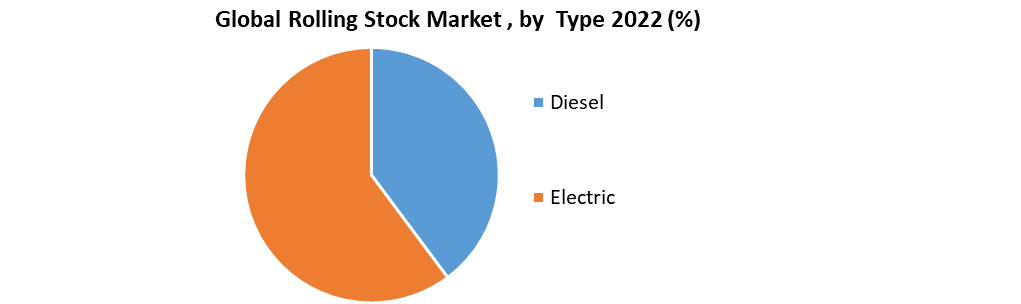

By type, the Diesel segment holds the major share of the global market in 2022 and is expected to maintain to grow at a CAGR of XX % during the forecast period. A surge in the adoption of Diesel vehicles for transportation of heavy goods applications such as oil & gas, mining, and manufacturing for transportation of goods has accredited the growth of the market. In addition, outdoor Diesel vehicles provide some benefits such as cost-effectiveness and high-torque engines, Manufacturers such as Bombardier Transportation CRRC, Alstom Transport, and Corporation Limited are developing turbocharged diesel to serve the demand for advanced rail vehicles.

Regional Analysis

The Rolling Stock Market is segmented into various regions such as North America, Europe, Middle East & Africa, South America, and the Asia Pacific. The Asia Pacific region is dominating the global market and estimated to maintain dominance over the forecast period owing to the adoption of rail transportation for passengers and goods. Also, the regional market growth can be attributed to the increasing investments in electric trains and metro trains in countries such as India, Taiwan, China, and other countries. The Middle East & Africa region is expected to be fast-growing over the forecast period. The mining and oil & gas industries are increasing applications for the transportation of goods is increasing growth of rolling stock market globally. The regional market is also driven by the increasing use of rolling stock owing to their high torque power and enhanced safety. The report also helps in understanding Rolling Stock Market dynamics, structure by analyzing the market segments and projects the Rolling Stock Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Rolling Stock Market make the report investor’s guide.Global Rolling Stock Market Key Highlights

Global market analysis and forecast, in terms of value. Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Global Rolling Stock Market Global market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. Global market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. Global market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Global Rolling Stock Market are also profiled.Global Rolling Stock Market Scope: Inquire before buying

Global Rolling Stock Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 56.66 Bn. Forecast Period 2023 to 2029 CAGR: 4.8% Market Size in 2029: US $ 78.68 Bn. Segments Covered: by Product Locomotive Rapid Transit Vehicle Wagon Other Product by Type Diesel Electric by Train Type Rail Freight Passenger Rail Global Rolling Stock Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. CRRC Corporation Limited 2. Bombardier Transportation 3. Alstom Transport 4. GE Transportation 5. Trinity Rail Group, LLC 6. Siemens Mobility 7. Stadler Rail AG 8. Hitachi Rail Systems 9. The Greenbrier Co 10. Hyundai Rotem. 11. CJSC Transmashholding 12. Kawasaki Heavy Industries Ltd. 13. Construcciones Y Auxiliar DE Ferrocarriles S.A. 14. Stadler Rail AG 15. TRANSMASHHOLDING Frequently Asked Questions: 1. Which region has the largest share in Global Rolling Stock Market? Ans: Asia Pacific region holds the highest share in 2022. 2. What is the growth rate of Global Rolling Stock Market? Ans: The Global market is growing at a CAGR of 4.8% during forecasting period 2023-2029. 3. What segments are covered in Global Rolling Stock market? Ans: Rolling Stock Market is segmented into product, type, train type and region. 4. Who are the key players in Global Rolling Stock market? Ans: The important key players in the global market are – CRRC Corporation Limited, Bombardier Transportation, Alstom Transport, GE Transportation, Trinity Rail Group, LLC, Siemens Mobility, Stadler Rail AG, Hitachi Rail Systems, The Greenbrier Co, Hyundai Rotem., CJSC Transmashholding, Kawasaki Heavy Industries Ltd., Stadler Rail AG, TRANSMASHHOLDING 5. What is the study period of this market? Ans: The Global Rolling Stock Market is studied from 2022 to 2029.

1. Rolling Stock Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rolling Stock Market: Dynamics 2.1. Rolling Stock Market Trends by Region 2.1.1. North America Rolling Stock Market Trends 2.1.2. Europe Rolling Stock Market Trends 2.1.3. Asia Pacific Rolling Stock Market Trends 2.1.4. Middle East and Africa Rolling Stock Market Trends 2.1.5. South America Rolling Stock Market Trends 2.2. Rolling Stock Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rolling Stock Market Drivers 2.2.1.2. North America Rolling Stock Market Restraints 2.2.1.3. North America Rolling Stock Market Opportunities 2.2.1.4. North America Rolling Stock Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rolling Stock Market Drivers 2.2.2.2. Europe Rolling Stock Market Restraints 2.2.2.3. Europe Rolling Stock Market Opportunities 2.2.2.4. Europe Rolling Stock Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rolling Stock Market Drivers 2.2.3.2. Asia Pacific Rolling Stock Market Restraints 2.2.3.3. Asia Pacific Rolling Stock Market Opportunities 2.2.3.4. Asia Pacific Rolling Stock Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rolling Stock Market Drivers 2.2.4.2. Middle East and Africa Rolling Stock Market Restraints 2.2.4.3. Middle East and Africa Rolling Stock Market Opportunities 2.2.4.4. Middle East and Africa Rolling Stock Market Challenges 2.2.5. South America 2.2.5.1. South America Rolling Stock Market Drivers 2.2.5.2. South America Rolling Stock Market Restraints 2.2.5.3. South America Rolling Stock Market Opportunities 2.2.5.4. South America Rolling Stock Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rolling Stock Industry 2.8. Analysis of Government Schemes and Initiatives For Rolling Stock Industry 2.9. Rolling Stock Market Trade Analysis 2.10. The Global Pandemic Impact on Rolling Stock Market 3. Rolling Stock Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Rolling Stock Market Size and Forecast, by Product (2022-2029) 3.1.1. Locomotive 3.1.2. Rapid Transit Vehicle 3.1.3. Wagon 3.1.4. Other Product 3.2. Rolling Stock Market Size and Forecast, by Type (2022-2029) 3.2.1. Diesel 3.2.2. Electric 3.3. Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 3.3.1. Rail Freight 3.3.2. Passenger Rail 3.4. Rolling Stock Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Rolling Stock Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Rolling Stock Market Size and Forecast, by Product (2022-2029) 4.1.1. Locomotive 4.1.2. Rapid Transit Vehicle 4.1.3. Wagon 4.1.4. Other Product 4.2. North America Rolling Stock Market Size and Forecast, by Type (2022-2029) 4.2.1. Diesel 4.2.2. Electric 4.3. North America Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 4.3.1. Rail Freight 4.3.2. Passenger Rail 4.4. North America Rolling Stock Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Rolling Stock Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Locomotive 4.4.1.1.2. Rapid Transit Vehicle 4.4.1.1.3. Wagon 4.4.1.1.4. Other Product 4.4.1.2. United States Rolling Stock Market Size and Forecast, by Type (2022-2029) 4.4.1.2.1. Diesel 4.4.1.2.2. Electric 4.4.1.3. United States Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 4.4.1.3.1. Rail Freight 4.4.1.3.2. Passenger Rail 4.4.2. Canada 4.4.2.1. Canada Rolling Stock Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Locomotive 4.4.2.1.2. Rapid Transit Vehicle 4.4.2.1.3. Wagon 4.4.2.1.4. Other Product 4.4.2.2. Canada Rolling Stock Market Size and Forecast, by Type (2022-2029) 4.4.2.2.1. Diesel 4.4.2.2.2. Electric 4.4.2.3. Canada Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 4.4.2.3.1. Rail Freight 4.4.2.3.2. Passenger Rail 4.4.3. Mexico 4.4.3.1. Mexico Rolling Stock Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Locomotive 4.4.3.1.2. Rapid Transit Vehicle 4.4.3.1.3. Wagon 4.4.3.1.4. Other Product 4.4.3.2. Mexico Rolling Stock Market Size and Forecast, by Type (2022-2029) 4.4.3.2.1. Diesel 4.4.3.2.2. Electric 4.4.3.3. Mexico Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 4.4.3.3.1. Rail Freight 4.4.3.3.2. Passenger Rail 5. Europe Rolling Stock Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.2. Europe Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.3. Europe Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 5.4. Europe Rolling Stock Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.1.3. United Kingdom Rolling Stock Market Size and Forecast, by Train Type(2022-2029) 5.4.2. France 5.4.2.1. France Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.2.3. France Rolling Stock Market Size and Forecast, by Train Type(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Germany Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.4.3. Italy Rolling Stock Market Size and Forecast, by Train Type(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.5.3. Spain Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.6.3. Sweden Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.7.3. Austria Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Rolling Stock Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Rolling Stock Market Size and Forecast, by Type (2022-2029) 5.4.8.3. Rest of Europe Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6. Asia Pacific Rolling Stock Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4. Asia Pacific Rolling Stock Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.2.3. S Korea Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Japan Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.4. India 6.4.4.1. India Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.4.3. India Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Australia Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Indonesia Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Malaysia Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Vietnam Rolling Stock Market Size and Forecast, by Train Type(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.9.3. Taiwan Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Rolling Stock Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Rolling Stock Market Size and Forecast, by Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 7. Middle East and Africa Rolling Stock Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Rolling Stock Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Rolling Stock Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 7.4. Middle East and Africa Rolling Stock Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Rolling Stock Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Rolling Stock Market Size and Forecast, by Type (2022-2029) 7.4.1.3. South Africa Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Rolling Stock Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Rolling Stock Market Size and Forecast, by Type (2022-2029) 7.4.2.3. GCC Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Rolling Stock Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Rolling Stock Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Nigeria Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Rolling Stock Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Rolling Stock Market Size and Forecast, by Type (2022-2029) 7.4.4.3. Rest of ME&A Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 8. South America Rolling Stock Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Rolling Stock Market Size and Forecast, by Product (2022-2029) 8.2. South America Rolling Stock Market Size and Forecast, by Type (2022-2029) 8.3. South America Rolling Stock Market Size and Forecast, by Train Type(2022-2029) 8.4. South America Rolling Stock Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Rolling Stock Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Rolling Stock Market Size and Forecast, by Type (2022-2029) 8.4.1.3. Brazil Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Rolling Stock Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Rolling Stock Market Size and Forecast, by Type (2022-2029) 8.4.2.3. Argentina Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Rolling Stock Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Rolling Stock Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Rest Of South America Rolling Stock Market Size and Forecast, by Train Type (2022-2029) 9. Global Rolling Stock Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rolling Stock Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. CRRC Corporation Limited 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bombardier Transportation 10.3. Alstom Transport 10.4. GE Transportation 10.5. Trinity Rail Group, LLC 10.6. Siemens Mobility 10.7. Stadler Rail AG 10.8. Hitachi Rail Systems 10.9. The Greenbrier Co 10.10. Hyundai Rotem. 10.11. CJSC Transmashholding 10.12. Kawasaki Heavy Industries Ltd. 10.13. Construcciones Y Auxiliar DE Ferrocarriles S.A. 10.14. Stadler Rail AG 10.15. TRANSMASHHOLDING 11. Key Findings 12. Industry Recommendations 13. Rolling Stock Market: Research Methodology 14. Terms and Glossary