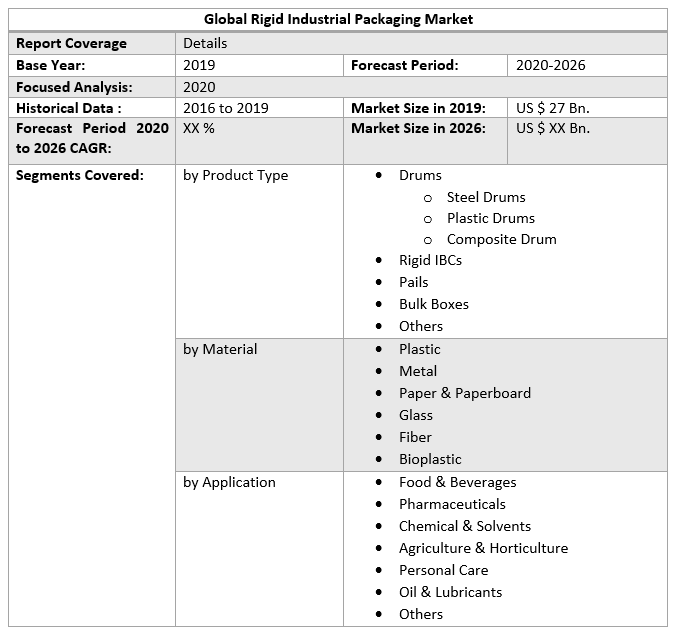

Global Rigid Industrial Packaging Market size was valued at US$ XX Bn in 2019 and the total revenue is expected to grow at XX% through 2020 to 2026, reaching nearly US$ 27 Bn. The global Rigid Industrial Packaging market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global Rigid Industrial Packaging report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Global Rigid Industrial Packaging Market Overview:

The process of enclosing or safeguarding produced items or products for distribution, storage, sale, and eventual use is known as packaging. Rigid Industrial packaging is suitable for long-distance shipping since it keeps finished items safer for longer. The worldwide rigid industrial packaging market has experienced an increase in demand in recent years for a variety of reasons. These include a surge in customer demand for a wide range of items, some of which are dangerous or ecologically sensitive, to be shipped to far-flung areas.Global Rigid Industrial Packaging Market Dynamics:

Drivers:

Rigid industrial packaging has gained a lot of popularity as a practical technique for protecting produced items that need to be stored for a long time. The rise of the rigid industrial packaging market has been primarily attributed to the worldwide urbanization of people, expanding globalization, and international commerce that promotes the rise of commercial enterprises. Inter-continental commerce is one of the key growth factors in the worldwide rigid industrial packaging industry. It has required the usage of the aforementioned sort of packaging by other businesses. Cosmetics and processed foods are the most common industries. A shift in lifestyle has resulted in a rise in awareness about personal grooming, which has increased the demand for cosmetics from the greatest companies all over the world. Similarly, busy lives are driving demand for more processed food varieties. The market for rigid industrial packaging is predicted to grow in response to the rising demand for industrial bulk packaging across a variety of sectors. The increased usage of pails, drums, and kegs in bulk packaging is likely to drive rigid industrial packaging market growth. Furthermore, the market is predicted to grow due to the increasing use of paperboard in rigid industrial packaging for environmental reasons. As a result, the increased requirement for environmental sustainability is boosting demand for paper-based rigid industrial packaging, which is driving rigid industrial packaging market growth.Restraints:

The usage of rigid industrial packaging is projected to be limited as the demand for flexible packaging materials grows. This issue is projected to restrict the growth of the rigid Industrial packaging industry. Moreover, strict restrictions and regulations are projected to hamper market growth due to rising concerns about the usage of single-use plastic and other grades of plastic in rigid industrial packaging.Opportunities:

Increased consumer expenditure on cosmetics items is predicted to fuel growth in the cosmetic and personal care business. Because of rising disposable income, emerging economies in the Asia Pacific, such as China and India, have seen tremendous expansion in the consumer goods and logistics industries. Furthermore, rigid industrial packaging is predicted to benefit from the expanding food supply sector, as well as the long-term preservation of food. To meet consumer concerns about food safety, there is an increasing demand for efficient rigid industrial packaging solutions. As a result, numerous food manufacturers are using hard packaging in the food supply business to ensure that food is delivered efficiently to customers.Global Rigid Industrial Packaging Market Segment Analysis:

Based on the Material, the market is majorly driven by plastic, over the forecast period. Plastic's advantages, such as its great strength and stability, have made it a preferred material for rigid packaging. Furthermore, it may be shaped into a variety of forms and sizes without sacrificing quality. Aluminum, stainless steel, and tin are among the metals utilized. Aluminum is the most common metal used in rigid industrial packaging. Metals are used to make a variety of packaging items, including containers and cans. Because of their exceptional strength and durability, metals are frequently utilized. Based on the Application, the food & beverages segment dominated the market with 36.7% of sales share, in 2019, owing to rising demand for food and drinks, such as alcoholic and non-alcoholic drinks. Safe and contamination-proof packaging is necessary for the storage and shipping of such drinks, which are supplied by rigid industrial packaging. For example, Kraft Heinz Company's net sales climbed by 3.3 percent in the first quarter of 2020 compared to the first quarter of 2019, owing to a surge in packaged food demand caused by the pandemic. Furthermore, rigid packaging is commonly utilized in the healthcare and pharmaceutical industries to package drugs, vaccines, and other products. These reasons have boosted the rigid packaging market's demand.

Global Rigid Industrial Packaging Market Regional Insights:

In terms of revenue, Asia Pacific dominated the worldwide rigid industrial packaging market in 2019, accounting for 38.8% of the total, followed by Europe and North America, respectively. In terms of economic development, East Asia will take the lead. Because of rising globalization, the rigid industrial packaging industry in this area is seeing tremendous growth. As a result, there is a greater requirement to improve logistics in global freight distribution. Growth will be strong as the region sees a rise in original equipment manufacturers and strong expansion in the construction industry. Furthermore, the rapid adoption of modern technology, as well as favorable government regulations, are fueling it even more.The objective of the report is to present a comprehensive analysis of the global Rigid Industrial Packaging market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Rigid Industrial Packaging market dynamics, structure by analyzing the market segments and project the global Rigid Industrial Packaging market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Rigid Industrial Packaging market make the report investor’s guide.

Global Rigid Industrial Packaging Market Key Developments:

In June 2020, Amcor Rigid Packaging Caribbean Limited has teamed up with Hillview Renegades to deliver emergency food kits and support to families in Trinidad and Tobago who have been impacted by the Coronavirus. In July 2019, Berry finalized its USD 6.5 billion acquisition of RPC to become a major player in the global rigid industrial packaging market. While the latter is knowledgeable about recycling, the former is knowledgeable about dispenser technology. Berry can achieve its Impact 2025 Sustainability Goals and accelerate growth in the advantaged goods area with the aid of RPC. In June 2019, Bemis Company was bought by Amcor. This purchase provided the firm with more capabilities and scale, allowing it to improve its market position.Global Rigid Industrial Packaging Market Scope: Inquire before buying

Global Rigid Industrial Packaging Market, by Region

• North America • Europe • Asia Pacific • The Middle East and Africa • South AmericaGlobal Rigid Industrial Packaging Market Key Players

• Reynolds Group Holding • Amcor Limited • Bemis Company, Inc. • Sealed Air Corporation • Plastipak Holdings, Inc. • Berry Plastics Corporation • DS Smith Plc • Holmen AB • Georgia-Pacific LLC • MeadWestvaco Corporation • BASF SE • The Dow Chemical Company • RESILUX NV • Ball Corporation • Consolidated Container Company • Coveris Holdings S.A. • Other Key Players

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Rigid Industrial Material Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Rigid Industrial Material Type Market 3.4. Geographical Snapshot of the Rigid Industrial Packaging Type Market, By Manufacturer share 4. Global Rigid Industrial Packaging Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Types 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Rigid Industrial Packaging Type Market 5. Supply Side and Demand Side Indicators 6. Global Rigid Industrial Packaging Market Analysis and Forecast, 2019-2026 6.1. Global Rigid Industrial Packaging Market Size & Y-o-Y Growth Analysis. 7. Global Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 7.1.1. Drums 7.1.1.1. Steel Drums 7.1.1.2. Plastic Drums 7.1.1.3. Composite Drum 7.1.2. Composite Drum 7.1.3. Rigid IBCs 7.1.4. Pails 7.1.5. Bulk Boxes 7.1.6. Others 7.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 7.2.1. Plastic 7.2.2. Metal 7.2.3. Paper & Paperboard 7.2.4. Glass 7.2.5. Fiber 7.2.6. Bioplastic 7.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.3.1. Food & Beverages 7.3.2. Pharmaceuticals 7.3.3. Chemical & Solvents 7.3.4. Agriculture & Horticulture 7.3.5. Personal Care 7.3.6. Oil & Lubricants 7.3.7. Others 8. Global Rigid Industrial Packaging Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 9.1.1. Drums 9.1.1.1. Steel Drums 9.1.1.2. Plastic Drums 9.1.1.3. Composite Drum 9.1.2. Composite Drum 9.1.3. Rigid IBCs 9.1.4. Pails 9.1.5. Bulk Boxes 9.1.6. Others 9.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 9.2.1. Plastic 9.2.2. Metal 9.2.3. Paper & Paperboard 9.2.4. Glass 9.2.5. Fiber 9.2.6. Bioplastic 9.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 9.3.1. Food & Beverages 9.3.2. Pharmaceuticals 9.3.3. Chemical & Solvents 9.3.4. Agriculture & Horticulture 9.3.5. Personal Care 9.3.6. Oil & Lubricants 9.3.7. Others 10. North America Rigid Industrial Packaging Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 11.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 12. Canada Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 12.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 13. Mexico Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 13.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 14. Europe Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 14.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 15. Europe Rigid Industrial Packaging Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 16.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 17. France Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 17.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 18. Germany Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 18.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 19. Italy Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 19.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 20. Spain Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 20.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 21. Sweden Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 21.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 22. CIS Countries Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 22.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 23. Rest of Europe Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 23.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 24. Asia Pacific Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 24.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 25. Asia Pacific Rigid Industrial Packaging Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 26.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 27. India Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 27.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 28. Japan Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 28.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 29. South Korea Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 29.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 30. Australia Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 30.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 31. ASEAN Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 31.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 32. Rest of Asia Pacific Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 32.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 33. Middle East Africa Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 33.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 34. Middle East Africa Rigid Industrial Packaging Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 35.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 36. GCC Countries Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 36.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 37. Egypt Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 37.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 38. Nigeria Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 38.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 39. Rest of ME&A Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 39.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 40. South America Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 40.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 41. South America Rigid Industrial Packaging Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 42.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 43. Argentina Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 43.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 44. Rest of South America Rigid Industrial Packaging Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By Material, 2019-2026 44.3. Market Size (Value) Estimates & Forecast By Application, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Rigid Industrial Packaging Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Capacity and R&D Investment 45.2.2. New Product Type Launches and Product Type Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Reynolds Group Holding 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Type Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Amcor Limited 45.3.3. Bemis Company, Inc. 45.3.4. Sealed Air Corporation 45.3.5. Plastipak Holdings, Inc. 45.3.6. Berry Plastics Corporation 45.3.7. DS Smith Plc 45.3.8. Holmen AB 45.3.9. Georgia-Pacific LLC 45.3.10. MeadWestvaco Corporation 45.3.11. BASF SE 45.3.12. The Dow Chemical Company 45.3.13. RESILUX NV 45.3.14. Ball Corporation 45.3.15. Consolidated Container Company 45.3.16. Coveris Holdings S.A. 45.3.17. Other Key Players 46. Primary Key Insights