Ride Sharing Market was valued at USD 117.84 Billion in 2023, and it is expected to reach USD 357.93 Billion by 2030, exhibiting a CAGR of 17.2 % during the forecast period (2024-2030) Ridesharing is an alternative mode of transportation in which more than one person shares the use of a vehicle, such as a van or automobile, to complete a trip. Prior to the pandemic, ride-sharing services were the most popular because they provided a convenient and cost-effective way of personal mobility through the use of a transportation network infrastructure. Ride sharing services have several advantages, including quick booking choices, minimal carbon footprints, economical door-to-door ride services, and no parking hassles. Reduced demand for public transportation due to the danger of infection during the Covid-19 epidemic is supporting the rise of select ride sharing services. The introduction of big data analytics, IoT, and AI enables smart mobility alternatives and the expansion of cab booking services. With the passage of time and demand, mobility service providers (MSPs) developed many kinds of ride sharing services such as e-hailing, private vs. corporate vehicle sharing, carpooling, automobile leasing, and so on. Users may select from a wide range of choices based on their demands, distance travelled, and personal comfort. However, as a result of the pandemic, the ride-hailing sector has become one of the most hit industries in the automobile industry. All online and offline booking channels that link passengers and drivers are included in the Ride-hailing & Taxi market sector. Traditional taxi services that may be hired over the phone, Transportation Network Companies (TNCs) that offer trips in private automobiles, and Ride Pooling services are all included. When a passenger wants a ride, he or she is paired with a driver. TNCs include Uber and Lyft, which match customers with drivers and charge a fee for this service, as well as firms like Moia and Via, which offer Ride Pooling by combining passenger itineraries. Taxi firms that provide journeys via an app (for example, Free Now) are also included in this group.To know about the Research Methodology :- Request Free Sample Report.

Ride Sharing Market Dynamics

Increasing Internet and Smartphone Penetration: The fast acceptance of smart devices such as smartphones and smart wearables, as well as the increased usage of internet data, has generated several chances for Ride Sharing services all over the world, hence magnifying the global ride sharing market growth. The essential need for using ride-hailing services is internet access. Users must utilise the internet to download ride-providing programmes on their cellphones in order to obtain ride information and navigation. Internet access is required for V2V communication, navigation, and telematics to work properly. Furthermore, the smartphone applications give numerous security measures such as the driver's identity, number, and image, vehicle number, route tracing data, and records of previous trips. Carbon Emissions Regulations: Globally, the rate of automotive emissions has been steadily rising over the years. The car sector contributes significantly to global greenhouse gas emissions. Additional efforts are being made by the government, private groups, and automobile manufacturers to reduce growing CO2 emissions. Various organisations, including Canada's International Institute for Sustainable Development, India's Ministry of Environment and Climate Change, and the European Union's Paris Agreement on Climate Change, have set ambitious targets and norms, including expanding forest cover to reduce carbon footprints in the coming years. As a result, these norms are expected to encourage the adoption of these types of sharing services rather than private automobile ownership.Increase in cost of vehicle ownership Finance, fuel, maintenance, registration/taxes, and maintenance & repair, as well as depreciation, all contribute to the cost of owning a vehicle. The expense of automobile ownership rises year after year. Fuel prices and maintenance expenses have risen dramatically in recent years, and the similar trend is expected to continue. As cities become increasingly congested with people and automobiles, owning a car has become more of a liability than an asset. Because the millennial generation is uninterested in having a car, the rate of automobile ownership among those aged 18 to 35 has fallen over time. Other factors contributing to the fall in automobile ownership include poor public transit connection in major cities and the growing tendency of online shopping, among others. Ride-hailing service businesses may benefit from these demographics because the new tech-savvy generation is one of the largest users of these services.Rising Micromobility Demand to Drive Market Growth: Micro-mobility is defined as the capacity to travel short distances with vehicles that only seat one or two persons. Light vehicles such as mopeds, motorcycles, scooters, and longboards are included in this category. Shared micro-mobility is a sensible choice for city commuters looking for a fast journey without the hassle of public transit. The concept of micro-mobility has a significant influence on how to utilise scooters and bikes and generate money from them. As traffic congestion worsens, particularly in major cities, there is a huge opportunity for micro-mobility to help alleviate these issues. The Volkswagen Group, for example, is promoting micro-mobility as part of its electric mobility strategy. The company has introduced Cityskater and Streetmate electric scooters in Geneva. Daimler and BMW together are offering scooters on rent in more than 6 cities in Europe. Different nations' transportation policy and opposition to traditional transportation services: The operation of app-based mobility services is not controlled by a legal authority in many countries. As a result, their operations are not defined or regulated by the government. Taxi services must have their own permits and registration. Because many app-based taxi firms do not own vehicles, this makes it difficult for them to function. Regulators around the world have proposed or adopted requirements for the collection, use, transfer, security, storage, and other processing of personally identifiable information and other data relating to individuals, and the number, enforcement, fines, and other penalties associated with these laws is growing. The European Union's General Data Protection Legislation (GDPR), which went into effect in May 2018, is an example of such a regulation. The California Customer Privacy Act (CCPA), which goes into effect in January 2020, also governs consumer data collecting in the ride-sharing industry. Stringent vehicle registration and licence rules make it impossible for an app-based taxi fleet that provides ride-sharing services. This has hampered the expansion of ride-hailing services in numerous nations and areas

Ride Sharing Market Segment Analysis

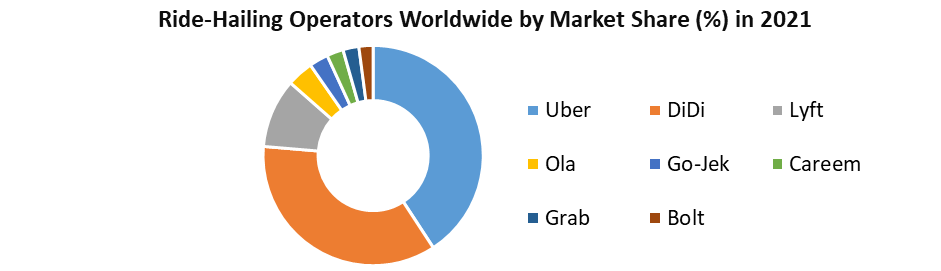

Based on Type, the e-hailing segment will hold a major share in the global market during the forecast period. E-hailing ride services provide transportation to clients by contracting or employing a personal driver. Furthermore, rising demand for e-hailing services as a result of increased government attempts to promote public awareness about air pollution, passenger comfort, increasing traffic congestion, and convenience of booking are driving demand for Ride Sharing, particularly e-hailing. Rides in e-hailing ride services are pre-booked and paid for using the transportation network company's smartphone app. Uber, Ola, Lyft, and Gett are all major participants in the ride-hailing industry. For example, Didi Chuxing, a top ride-hailing business, acquires 99, Brazil's biggest ride-hailing app. Through activities and partnerships, the corporation invests in smart mobility services and Al capabilities. BMW, for example, has created the car-sharing service Reach Now, which features BMW 370 series vehicles for short and long-term rental and delivery services.Based on Business Model, P2P segment dominated the market in 2023 and is expected to dominate during the forecast period. P2P car sharing is a sort of vehicle sharing in which individuals share their vehicles with other passengers. In addition, the P2P model places the owner in the car during the journey. The popularity of peer-to-peer automobile sharing is growing. A car becomes an asset that costs the owner a lot of money to drive in; one may save money by driving with other people and splitting the gasoline expenses or charging the customer accordingly. The primary motivators for peer-to-peer vehicle sharing are ease and availability, financial savings, and enhanced mobility alternatives. The introduction of additional platforms for peer-to-peer ride sharing has considerably expanded the reach of the shared commute concept among ordinary commuters. Increased smartphone penetration and consumer awareness of the dangerous environmental impact of rising emissions have considerably encouraged shared travel as a viable alternative to private commute.

Ride Sharing Market Regional Insights

In 2023, the North American market was worth USD 35.02 billion. Because of the rapid growth of electric vehicles in nations such as Canada, the United States, and Mexico, the area dominates the global market. In addition, transportation service companies are rapidly adopting technologically enhanced features. Uber's presence in Canada is quickly increasing. For example, Lyft was the first firm to announce the debut of green mode, which provides electric car ridesharing to its consumers, last year. Furthermore, the corporation announced this discovery in the context of the 'Green City Initiative,' which aims to reduce the usage of fossil fuels. As a result of these changes, the market in this region is gaining momentum.Developing countries in Asia Pacific are likely to have tremendous expansion, mainly in urban transportation. Furthermore, growing and developed nations like India, China, Indonesia, and Japan are expected to have significant expansion in Asia Pacific, mostly in urban transportation. Furthermore, factors such as an increased desire to save gasoline by giving a ride to colleagues and commuters travelling the same route, as well as an increase in the daily commute to urban workplaces, are likely to boost the Asia Pacific market. The region's rapid population expansion and expanding urbanisation have increased the demand for transportation. The majority of the region's nations are focusing on smart personal mobility to cut travel time and congestion. Because per capita income in most of these nations is lower than in Western countries, Asia Pacific has a much lower number of automobiles per 1,000 people. As a result, ride sharing provides consumers with the illusion of having a car at a far cheaper cost than really owning one. As a result, people prefer ride-hailing services to personal automobiles. Furthermore, factors such as an increase in the daily commute to urban workplaces and an increasing desire to conserve gasoline by offering a ride to commuters and coworkers travelling the same route are expected to drive the Asia Pacific ride sharing industry.

Report Scope:

The Ride Sharing Market research report includes product categorization, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The study discusses the global market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and constraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of significant Ride Sharing Market firms in terms of production bases and technologies. The more precise research also contains the key application areas of market and consumption, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an analysis of the industry chain relationship. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organised by area, technology, and application.Ride Sharing Market Scope: Inquire before buying

Ride Sharing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 117.84 Bn. Forecast Period 2024 to 2030 CAGR: 17.2% Market Size in 2030: US $ 357.93 Bn. Segments Covered: by Service Type E-hailing Car sharing Station-based mobility Car rental by Business Model P2P car sharing Corporate Car Sharing by Vehicle Type Sedan/Hatchback UV Van Buses & Coaches Bikes Electric Vehicle by Target Audience Corporate Families Daily commuters Others Ride Sharing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Leading Key Players Operating in the Ride Sharing Market are:

1. Uber Technologies Inc (US) 2. Lyft, Inc (US) 3. Wingz, Inc (US) 4. Curb Mobility (US) 5. GoKid Corporation (US) 6. Via Transportation, Inc. (US) 7. Hertz Corporation (US) 8. AVIS Budget Group (US) 9. Hitch Technologies, Inc (US) 10.Flywheel (US) 11.Ziro (US) 12.Alto (US) 13.Turo (US) 14.BlaBlaCar (France) 15.Gett (UK) 16.Cabify (Spain) 17.Bhuumi Ride (India) 18.OLA Cabs (India) 19.DiDi Global Inc (China) 20.Grab (Singapore) 21.Bridj (Australia) 22.Bolt Technology OÜ (Estonia) 23.GO-JEK (Indonesia) 24.Angkas (Philippine) 25.SafeBoda (Uganda) FAQs: 1. Which is the potential market for Ride Sharing in terms of the region? Ans. In the Asia Pacific region, the high population growth rate and growing urbanization have increased the demand for transportation is expected to drive the market. 2. What is expected to drive the growth of the Ride Sharing market in the forecast period? Ans. An increase in the cost of automobile ownership is a major factor driving market growth during the forecast period. 3. What is the projected market size & growth rate of the Ride Sharing Market? Ans. The Ride Sharing Market accounted for USD 117.84 billion in 2023 and is expected to reach USD 357.93 billion by 2030 at a CAGR of 17.2 % during the forecast period. 4. What segments are covered in the Ride Sharing Market report? Ans. The segments covered are Service Type, Business Model, Vehicle Type, Target Audience, and region.

1. Ride Sharing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Ride Sharing Market: Dynamics 2.1. Ride Sharing Market Trends by Region 2.1.1. North America Ride Sharing Market Trends 2.1.2. Europe Ride Sharing Market Trends 2.1.3. Asia Pacific Ride Sharing Market Trends 2.1.4. Middle East and Africa Ride Sharing Market Trends 2.1.5. South America Ride Sharing Market Trends 2.2. Ride Sharing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Ride Sharing Market Drivers 2.2.1.2. North America Ride Sharing Market Restraints 2.2.1.3. North America Ride Sharing Market Opportunities 2.2.1.4. North America Ride Sharing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Ride Sharing Market Drivers 2.2.2.2. Europe Ride Sharing Market Restraints 2.2.2.3. Europe Ride Sharing Market Opportunities 2.2.2.4. Europe Ride Sharing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Ride Sharing Market Drivers 2.2.3.2. Asia Pacific Ride Sharing Market Restraints 2.2.3.3. Asia Pacific Ride Sharing Market Opportunities 2.2.3.4. Asia Pacific Ride Sharing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Ride Sharing Market Drivers 2.2.4.2. Middle East and Africa Ride Sharing Market Restraints 2.2.4.3. Middle East and Africa Ride Sharing Market Opportunities 2.2.4.4. Middle East and Africa Ride Sharing Market Challenges 2.2.5. South America 2.2.5.1. South America Ride Sharing Market Drivers 2.2.5.2. South America Ride Sharing Market Restraints 2.2.5.3. South America Ride Sharing Market Opportunities 2.2.5.4. South America Ride Sharing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Ride Sharing Industry 2.8. Analysis of Government Schemes and Initiatives For Ride Sharing Industry 2.9. Ride Sharing Market Trade Analysis 2.10. The Global Pandemic Impact on Ride Sharing Market 3. Ride Sharing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 3.1.1. E-hailing 3.1.2. Car sharing 3.1.3. Station-based mobility 3.1.4. Car rental 3.2. Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 3.2.1. P2P car sharing 3.2.2. Corporate Car Sharing 3.3. Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 3.3.1. Sedan/Hatchback 3.3.2. UV 3.3.3. Van 3.3.4. Buses & Coaches 3.3.5. Bikes 3.3.6. Electric Vehicle 3.4. Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 3.4.1. Corporate 3.4.2. Families 3.4.3. Daily commuters 3.4.4. Others 3.5. Ride Sharing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Ride Sharing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 4.1.1. E-hailing 4.1.2. Car sharing 4.1.3. Station-based mobility 4.1.4. Car rental 4.2. North America Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 4.2.1. P2P car sharing 4.2.2. Corporate Car Sharing 4.3. North America Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.1. Sedan/Hatchback 4.3.2. UV 4.3.3. Van 4.3.4. Buses & Coaches 4.3.5. Bikes 4.3.6. Electric Vehicle 4.4. North America Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 4.4.1. Corporate 4.4.2. Families 4.4.3. Daily commuters 4.4.4. Others 4.7. North America Ride Sharing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 4.5.1.1.1. E-hailing 4.5.1.1.2. Car sharing 4.5.1.1.3. Station-based mobility 4.5.1.1.4. Car rental 4.5.1.2. United States Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 4.5.1.2.1. P2P car sharing 4.5.1.2.2. Corporate Car Sharing 4.5.1.3. United States Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.1.3.1. Sedan/Hatchback 4.5.1.3.2. UV 4.5.1.3.3. Van 4.5.1.3.4. Buses & Coaches 4.5.1.3.5. Bikes 4.5.1.3.6. Electric Vehicle 4.5.1.4. United States Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 4.5.1.4.1. Corporate 4.5.1.4.2. Families 4.5.1.4.3. Daily commuters 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 4.5.2.1.1. E-hailing 4.5.2.1.2. Car sharing 4.5.2.1.3. Station-based mobility 4.5.2.1.4. Car rental 4.5.2.2. Canada Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 4.5.2.2.1. P2P car sharing 4.5.2.2.2. Corporate Car Sharing 4.5.2.3. Canada Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.2.3.1. Sedan/Hatchback 4.5.2.3.2. UV 4.5.2.3.3. Van 4.5.2.3.4. Buses & Coaches 4.5.2.3.5. Bikes 4.5.2.3.6. Electric Vehicle 4.5.2.4. Canada Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 4.5.2.4.1. Corporate 4.5.2.4.2. Families 4.5.2.4.3. Daily commuters 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 4.5.3.1.1. E-hailing 4.5.3.1.2. Car sharing 4.5.3.1.3. Station-based mobility 4.5.3.1.4. Car rental 4.5.3.2. Mexico Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 4.5.3.2.1. P2P car sharing 4.5.3.2.2. Corporate Car Sharing 4.5.3.3. Mexico Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.3.3.1. Sedan/Hatchback 4.5.3.3.2. UV 4.5.3.3.3. Van 4.5.3.3.4. Buses & Coaches 4.5.3.3.5. Bikes 4.5.3.3.6. Electric Vehicle 4.5.3.4. Mexico Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 4.5.3.4.1. Corporate 4.5.3.4.2. Families 4.5.3.4.3. Daily commuters 4.5.3.4.4. Others 5. Europe Ride Sharing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.3. Europe Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.4. Europe Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5. Europe Ride Sharing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.1.2. United Kingdom Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.1.3. United Kingdom Ride Sharing Market Size and Forecast, by Vehicle Type(2023-2030) 5.5.1.4. United Kingdom Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.2. France 5.5.2.1. France Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.2.2. France Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.2.3. France Ride Sharing Market Size and Forecast, by Vehicle Type(2023-2030) 5.5.2.4. France Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.3.2. Germany Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.3.3. Germany Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.4. Germany Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.4.2. Italy Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.4.3. Italy Ride Sharing Market Size and Forecast, by Vehicle Type(2023-2030) 5.5.4.4. Italy Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.5.2. Spain Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.5.3. Spain Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.5.4. Spain Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.6.2. Sweden Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.6.3. Sweden Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.6.4. Sweden Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.7.2. Austria Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.7.3. Austria Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.7.4. Austria Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 5.5.8.2. Rest of Europe Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 5.5.8.3. Rest of Europe Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.8.4. Rest of Europe Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6. Asia Pacific Ride Sharing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.3. Asia Pacific Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.4. Asia Pacific Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5. Asia Pacific Ride Sharing Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.5.1.1. China Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.1.2. China Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.1.3. China Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.4. China Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.2.2. S Korea Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.2.3. S Korea Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.4. S Korea Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.3.2. Japan Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.3.3. Japan Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.4. Japan Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.4. India 6.5.4.1. India Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.4.2. India Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.4.3. India Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.4. India Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.5.2. Australia Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.5.3. Australia Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.4. Australia Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.6.2. Indonesia Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.6.3. Indonesia Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.4. Indonesia Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.7.2. Malaysia Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.7.3. Malaysia Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.4. Malaysia Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.8.2. Vietnam Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.8.3. Vietnam Ride Sharing Market Size and Forecast, by Vehicle Type(2023-2030) 6.5.8.4. Vietnam Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.9.2. Taiwan Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.9.3. Taiwan Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.9.4. Taiwan Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 6.5.10.3. Rest of Asia Pacific Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 7. Middle East and Africa Ride Sharing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 7.3. Middle East and Africa Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 7.4. Middle East and Africa Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 7.5. Middle East and Africa Ride Sharing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 7.5.1.2. South Africa Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 7.5.1.3. South Africa Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.4. South Africa Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 7.5.2.2. GCC Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 7.5.2.3. GCC Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.4. GCC Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 7.5.3.2. Nigeria Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 7.5.3.3. Nigeria Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.4. Nigeria Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 7.5.4.2. Rest of ME&A Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 7.5.4.3. Rest of ME&A Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.4. Rest of ME&A Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 8. South America Ride Sharing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 8.2. South America Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 8.3. South America Ride Sharing Market Size and Forecast, by Vehicle Type(2023-2030) 8.4. South America Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 8.5. South America Ride Sharing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 8.5.1.2. Brazil Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 8.5.1.3. Brazil Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.4. Brazil Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 8.5.2.2. Argentina Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 8.5.2.3. Argentina Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.4. Argentina Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Ride Sharing Market Size and Forecast, by Service Type (2023-2030) 8.5.3.2. Rest Of South America Ride Sharing Market Size and Forecast, by Business Model (2023-2030) 8.5.3.3. Rest Of South America Ride Sharing Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.4. Rest Of South America Ride Sharing Market Size and Forecast, by Target Audience (2023-2030) 9. Global Ride Sharing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Ride Sharing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Uber Technologies Inc (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lyft, Inc (US) 10.3. Wingz, Inc (US) 10.4. Curb Mobility (US) 10.5. GoKid Corporation (US) 10.6. Via Transportation, Inc. (US) 10.7. Hertz Corporation (US) 10.8. AVIS Budget Group (US) 10.9. Hitch Technologies, Inc (US) 10.10. Flywheel (US) 10.11. Ziro (US) 10.12. Alto (US) 10.13. Turo (US) 10.14. BlaBlaCar (France) 10.15. Gett (UK) 10.16. Cabify (Spain) 10.17. Bhuumi Ride (India) 10.18. OLA Cabs (India) 10.19. DiDi Global Inc (China) 10.20. Grab (Singapore) 10.21. Bridj (Australia) 10.22. Bolt Technology OÜ (Estonia) 10.23. GO-JEK (Indonesia) 10.24. Angkas (Philippine) 10.25. SafeBoda (Uganda) 11. Key Findings 12. Industry Recommendations 13. Ride Sharing Market: Research Methodology 14. Terms and Glossary