The Residential Air Purifiers Market size was valued at USD 4.16 Bn. in 2022 and the total Insulation revenue is expected to grow by 6.3 % from 2023 to 2029, reaching nearly USD 6.39 Bn. Residential air purifiers and air cleaners are machines that remove airborne contaminants including dust, smoke, pollen, and pet dander to enhance the quality of the air indoors. The primary part of a home air purifier is the high-efficiency air filter. Residential air purifiers come in two primary categories: stand-alone and in-duct. Stand-alone, as the name implies, is a portable room system made to purify and cleanse the air in a specific room at home or work. The majority of the materials used to construct stand-alone air purifier cases are plastic, typically high-impact polystyrene, polyvinyl chloride, high-density polyethylene, or polypropylene. On the other hand, an in-duct air purifier system filters all the air passing in the house while working with the furnace and central air conditioning. Several companies are expanding the sales of the air and ventilation products; develioping and launching new differentiated products and creating solutions on global level to thoroughly capture the growing demand resulting from greater awareness for air quality and ventilation. The global interest of the Residental Air Purifiers grew amid the the Covid-19 pandemic. Production of the Residental Air Purifiers has greatly expanded amid a sharp increase in demand in all operating regions.The market environment of the Reseidental Air Purifer in the U.S is similar to japan and relies mainly on replacement demand. As Europe, is highly environmentally conscious, market key players are taking initative to enhance several Residental Air Purifiers models, satyind step ahead of competitiors.Scope of the Report:

This study aids in understanding the industry and then making strategies for the business growth accordingly. In the strategy analysis it offers insights from marketing channels and the industry positioning to the potential power growth strategies offering in-depth analysis for the new participants or existing key players in the Residential air purifiers market. The Research aims to provide users with an detailed analysis of the Residential Air Purifiers Market. The study looks at the markets recent, ongoing, and future changes. It also provides a simple analysis of complex data. New entrants, industry titans, and followers are some of the primary forces that actively and carefully perform research. The study displays the results of the PORTER and PESTEL analyses as well as probable outcomes of the microeconomic market elements. After accounting for internal and external variables that can have a favorable or unfavorable impact on the firm, decision-makers will have a clear futuristic perspective of the market. The market segmentation analysis and market size forecast in the research help investors better understand the dynamics and structure of the Residential air purifiers market. The report acts as a buyer's guide by clearly outlining the comparative analysis of the top Residential air purifiers businesses by price, financial position, product, product portfolio, growth strategies, and regional presence.To know about the Research Methodology :- Request Free Sample Report

Residential Air Purifiers Market Dynamics:

Poor Indoor air quality and its causes Americans still live in the countries where ozone or the air particle pollution levels makes the air breathe unhealthy, allergies triggered by dust, pollen, pet dander involves regular wiping surfaces, washing bedding, a good Residental air purifier helps in mitigating the spread of bacteria and viruses. Several Residental Air Purifiers are proven to be 99% effective in killing germs, viruses, bacteria, throughout the home. The prevention of the healthcare associated infections has been a top strategic priority for the Center for Disease Control and Prevention. An estimatied 90000 deaths occur per year in United States, owing to the recent pandemic manifested an urgent need to implement design, maintenance and opeartions that ensures indoor air quality in healthcare facilities, owing to increase in demand for the installation of the Residental Air Purifiers. Increasing industrialization, strict environmental protection legislation, and awareness of pollution control have a beneficial impact on market growth, particularly in the United States. Since it has been shown to be the most effective technology for capturing the dangerous airborne particles, the High-Efficiency Particulate Air (HEPA) technology segment is anticipated to dominate the United States market during the course of the analysis. Due to the large number of industries and increased traffic in the area, the United States is predicted to be the most polluted nation on earth which further contributed towards the increase growth of the Residental Air Purifer market. According to MMR analysis, Consumer Perception plays a vital role in the consumption behavior thereby affecting the demand for a product. This has forced the manfacturers to understand the demand and manfcature the products according to the taste of the consumers. By studing the demand of the consumer perception manfacturers has increased the innovaton which has further driven the Residental Air Purifer market.Limitation Of Air Purifers The filters used in the Residental Air Purifiers, don’t last forever. Depending on the usage, the filter are mandatory to change every six months. Morever the majority of standalone or portable air purifiers can only monitor a small area's air quality, and they lack the ability to acquire three-dimensional data. Instead of using active monitoring sensor nodes, many air quality monitoring systems use passive monitoring sensor nodes, which necessitate human data update on a regular basis. Active monitoring sensor nodes have the ability to automatically collect, send, and store data across wireless or other networks. Lack of active monitoring sensor nodes can lead to technical restrictions with particular air purifiers, which negatively affect the adoption and perhaps restrain the Residental Air Purifer market's growth. Emerging Technologies and Startups The US based startup Molekule has developed PECO (Petroelectrochemical oxidation) which addresses air contamination issues by oxidizing and removing organic particles, especially indoor allergens purifiers.These new revolutionary technology has provided a exclusive purification solution, moreover this PECO air purification technology has contributed a great opportunity in Resdiental Air Purifer market. Manufacturers and distributors of household air purifiers have plenty of chances in the upcoming years thanks to emerging countries like China, India, Brazil, and Russia. This can be attributed to the rising levels of air pollution in these nations, as well as rising public awareness, an increase in the number of diseases brought on by air pollution, increased consumer spending due to population growth and rising disposable incomes, and increased government spending for efficient air quality monitoring are creating the growth opportunity for the Residental Air Purifier Market.

Residential Air Purifiers Market Segment Analysis:

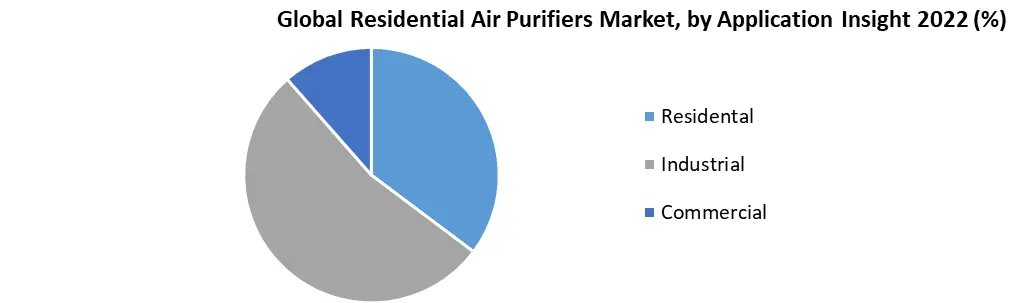

By Technology Insights, In 2022, HEPA was the market leader and was responsible for over 41.1% of global sales. Pollen, dust, smoke, and bio-contaminants are just a few of the airborne particles that HEPA filters are very effective at capturing. HEPA filters' superior performance and dependability in removing airborne particles will probably help them gain traction on the world market. Small bits of carbon in the form of powdered blocks or granules that have been properly treated with oxygen to open the pores of the carbon atoms make up activated carbon or activated charcoal filters. The ionic filters segment is anticipated to grow at a CAGR of 6.8%. Since ionic filters do not need to be changed frequently, their market share is growing. However, the production of ionised air and ozone during the purification process is to blame for the development of respiratory conditions like asthma, which is likely to restrict the use of the technology. Ozone generation, photocatalytic oxidation, UV radiation, non-thermal plasma, and electrostatic precipitators are further air purification techniques. With the use of photocatalytic oxidation, harmful gases and tiny particles as small as 0.1 micron can be changed into harmless substances. By Application Insights, In 2022, the commercial sector dominated the market and contributed for almost 55.5% of total revenue. Hospitals, workplaces, hotels, schools, theatres, malls, conference centres, and other leisure facilities are among the commercial settings where air purifiers are used. Hotels and restaurants utilise air purifiers with activated carbon and HEPA to remove smoke, odour, and airborne particles from the air, enhancing the quality of the air in the spaces. In order to maintain indoor air quality for both patients and staff working in these facilities, allergens, airborne pathogens, and odour are removed from the air using air purifiers in dentistry and medical laboratories, veterinary hospitals, boarding kennels, animal kennels, clinics, and hospitals. Air purifiers' capacity to prevent the spread of infectious diseases.

Regional Insights:

Due to a number of variables, including a growing population with more disposable income, increasing urbanisation and industrialization, and market dominance, the Asia Pacific region accounted for approximately 41.1% of worldwide sales in 2022. Additionally, it is anticipated that rising smog and air pollution incidents, particularly in nations like China and India, will raise the usage of air purifiers and support regional market expansion. The ecological balance and air quality in South Korea have been harmed by reasons such as expanding urbanisation, governmental decisions, and increasing industrialization. Growing public awareness of illnesses and health risks brought on by exposure to dangerous particles at work or home is projected to have a favourable effect on the country's market expansion. The North American market is expected to grow at a CAGR of 7.2%. Manufacturers of air purifiers might anticipate new business prospects as a result of air quality regulations including the U.S. EPA's establishment of national ambient air quality standards, the U.S. Clean Air Act, and Environment Canada's comprehensive programmes for emission reduction. Over the next few years, it is anticipated that the demand for air purifiers in Mexico will increase due to the increasing installation of comprehensive ambient air quality monitoring systems, the development and implementation of regulatory actions, and the organisation of air quality management programmes to raise public awareness.Residential Air Purifiers Market Scope: Inquire before buying

Residential Air Purifiers Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.16 Bn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 6.39 Bn. Segments Covered: by Technology Insights 1.High Efficiency Particulate Air (HEPA) 2. Activated Carbon 3. Ionic Filters 4. Others by Application Insights 1. Residental 2.Industrial 3. Commercial 3.1 Retail Shops 3.2 Offices 3.3 Healthcare Facilities 3.4 Hospitality 3.5 School 3.6 Educational Institutions 3.7 Laboratories 3.8 Transport 3.9Others by Type 1. Stand-alone 2.Duct Residential Air Purifiers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players are:

1. Daikin Industries Ltd..(Japan) 2. Sharp Corporation(Japan) 3. Panasonic Corporation(Japan) 4. Honeywell International Inc.(US) 5. Whirlpool Corporation(US) 6. Dyson(US) 7. Alen Corporation(US) 8. Airgle Corporation(US) 9. Hunter Pure Air(US) 10.Samsung Electronics Co. Ltd.(South Korea) 11.WINIX Co. Ltd.(South Korea) 12.LG Electronics Inc.(South Korea) 13.Koninklijke Philips N.V.(Netherlands) 14.Unilever Group(UK) 15.AllerAir Industries Inc.(Canada) 16.IQAir(Switzerland) 17.Xiaomi Corporation(China) 18.Camfil AB(Sweden) 19.Kent RO Systems Ltd.(India) 20.HSIL Limited(India) FAQs: 1. What is the study period of the market? Ans. The Global Residential Air Purifiers Market is studied from 2017-2029. 2. What is the growth rate of Residential Air Purifiers Market? Ans. The Residential Air Purifiers Market is growing at a CAGR of 6.3 % over forecast period. 3. What is the market size of the Residential Air Purifiers Market by 2029? Ans. The market size of the Residential Air Purifiers Market by 2029 is expected to reach at USD 6.39 Bn. 4. What is the forecast period for the Residential Air Purifiers Market? Ans. The forecast period for the Residential Air Purifiers Market is 2023-2029. 5. What was the market size of the Residential Air Purifiers Market in 2022? Ans. The market size of the Residential Air Purifiers Market in 2022 was valued at USD 4.16 Bn.

1. Global Residential Air Purifiers Market: Research Methodology 2. Global Residential Air Purifiers Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Residential Air Purifiers Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Residential Air Purifiers Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Residential Air Purifiers Market Segmentation 4.1 Global Residential Air Purifiers Market, by Technology Insights (2022-2029) • High Efficiency Particulate Air (HEPA) • Activated Carbon • Ionic Filters • Others 4.2 Global Residential Air Purifiers Market, by Application Insights (2022-2029) • Commercial o Retail Shops o Offices o Healthcare Facilities o Hospitality o School o Educational Institutions o Laboratories o Transport o Others • Residental • Industrial 4.3 Global Residential Air Purifiers Market, by Type (2022-2029) • Stand-alone • Duct 5. North America Residential Air Purifiers Market(2022-2029) 5.1 North America Residential Air Purifiers Market, by Technology Insights (2022-2029) • High Efficiency Particulate Air (HEPA) • Activated Carbon • Ionic Filters • Others 5.2 North America Residential Air Purifiers Market, by Application Insights (2022-2029) • Commercial o Retail Shops o Offices o Healthcare Facilities o Hospitality o School o Educational Institutions o Laboratories o Transport o Others • Residental • Industrial 5.3 North America Residential Air Purifiers Market, by Type (2022-2029) • Stand-alone • Duct 5.4 North America Residential Air Purifiers Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Residential Air Purifiers Market (2022-2029) 6.1. Europe Residential Air Purifiers Market, by Technology Insights (2022-2029) 6.2. Europe Residential Air Purifiers Market, by Application Insights (2022-2029) 6.3. Europe Residential Air Purifiers Market, by Type (2022-2029) 6.4. Europe Residential Air Purifiers Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Residential Air Purifiers Market (2022-2029) 7.1. Asia Pacific Residential Air Purifiers Market, by Technology Insights (2022-2029) 7.2. Asia Pacific Residential Air Purifiers Market, by Application Insights (2022-2029) 7.3. Asia Pacific Residential Air Purifiers Market, by Type (2022-2029) 7.4. Asia Pacific Residential Air Purifiers Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Residential Air Purifiers Market (2022-2029) 8.1 Middle East and Africa Residential Air Purifiers Market, by Technology Insights (2022-2029) 8.2. Middle East and Africa Residential Air Purifiers Market, by Application Insights (2022-2029) 8.3. Middle East and Africa Residential Air Purifiers Market, by Type (2022-2029) 8.4. Middle East and Africa Residential Air Purifiers Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Residential Air Purifiers Market (2022-2029) 9.1. South America Residential Air Purifiers Market, by Technology Insights (2022-2029) 9.2. South America Residential Air Purifiers Market, by Application Insights (2022-2029) 9.3. South America Residential Air Purifiers Market, by Type (2022-2029) 9.4. South America Residential Air Purifiers Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Daikin Industries Ltd. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Sharp Corporation 10.3 Honeywell International Inc. 10.4 Samsung Electronics Co. Ltd. 10.5 LG Electronics Inc. 10.6 Koninklijke Philips N.V. 10.7 Dyson 10.8 Unilever Group 10.9 Panasonic Corporation 10.10 Whirlpool Corporation 10.11 AllerAir Industries Inc. 10.12 IQAir 10.13 WINIX Co. Ltd. 10.14 Xiaomi Corporation 10.15 Camfil AB 10.16 Alen Corporation 10.17 Airgle Corporation 10.18 Hunter Pure Air 10.19 Kent RO Systems Ltd. 10.20 HSIL Limited