The RegTech Market size was valued at USD 12.28 Billion in 2025 and the total RegTech revenue is expected to grow at a CAGR of 16.06% from 2025 to 2032, reaching nearly USD 34.84 Billion by 2032.RegTech Market Overview:

The RegTech Market, a subset of FinTech, harnesses emerging technologies to address regulatory challenges within the financial sector. These technologies include cloud computing, big data, SI, ML, and NLP. However, the scope of RegTech extends beyond financial institutions, as non-financial businesses are increasingly embracing it. The versatility of RegTech lies in its ability to leverage these technologies to address unmet needs across various industries.To know about the Research Methodology :- Request Free Sample Report RegTech solutions streamline and expedite compliance processes, making it simpler and quicker for businesses to meet regulatory obligations. The overarching aim of the RegTech Market is to enhance transparency, consistency, and standardization in regulatory procedures, offering reliable interpretations of complex legislation at a cost-effective rate. In rapidly growing economies like China, Japan, Singapore, and India, FinTech solutions are being integrated across a multitude of corporate operations to provide efficient solutions tailored to local regulatory frameworks.

RegTech Market Dynamics:

The growth of GDPR concerns across countries is driving financial institutions to enforce mandatory guidelines, serving as a pivotal driver for the RegTech market's growth. RegTech solutions are gaining prominence across diverse sectors such as BFSI, Healthcare, Manufacturing, and Transportation & Logistics. The surge in RegTech market growth stems from an uptick in fraudulent activities, the imperative to automate regulatory compliance processes, and the necessity for expedited transactions. Prioritizing transparency in financial regulations and policy enhancement emerges as a significant growth catalyst for the regulatory technology market. RegTech industry offers manifold advantages, ensuring real-time compliance with regulations and requirements. Leveraging cutting-edge technologies and tools, RegTech fosters innovation in regulation, enhances customer experience, and augments risk management while providing sound recommendations. Furthermore, amidst evolving government policies and country-specific regulations, the demand to enhance data quality across various methodologies and jurisdictions incessantly rises, thereby bolstering the RegTech market. Nevertheless, the high costs associated with RegTech solutions/dashboards restrain market growth. Ensuring secure management and privacy of customer data, alongside conflicting regulations in different jurisdictions, pose constraints on RegTech Market growth. As the expense of software maintenance rapidly escalates, with maintenance accounting for 70% of the total software cost, managing the burgeoning array of software solutions becomes increasingly challenging over time. Manufacturers actively engaged in the RegTech Market are innovating their products to leverage cutting-edge technological advancements. Key players in RegTech are channeling increased investments into robust systems, aiming to develop more contemporary, efficient, and cost-effective solutions that positively influence the RegTech market. In August 2022, Blockchain technology has emerged as a notable trend in the RegTech industry. Blockchain, functioning as a distributed ledger shared among computer network nodes, digitally stores information in an electronic format. RegTech industry participants are concentrating efforts on introducing blockchain-based platforms as regulatory solutions. For instance, in February 2022, Ireland-based regulation technology platform Sekuritance unveiled Mainnet, designed to empower government entities, businesses, and individuals to adopt blockchain as a regulatory solution. Sekuritance Portal, a blockchain-based compliance platform, facilitates secure transaction verification and identification for individuals, SMEs, and businesses online. Regulations are rapidly evolving and becoming more intricate, leading to a surge in compliance costs for regulated entities as they expand their operational scope and handle larger volumes of data. Consequently, the RegTech market dynamics are shifting towards heightened aggressiveness, underscoring the urgent necessity for compliance. The advent of new technologies has accelerated in recent years, presenting solutions to previously insurmountable challenges or those deemed too costly to address. RegTech emerges as a solution that harnesses emerging technology to meet the demands and adapt to the complexities of the ever-evolving regulatory environment.Regtech Market Segment Analysis:

Based on Deployment Mode, Cloud-based Deployments sub segment held the largest market share of nearly 60.22% in 2025. The segment's growth is primarily propelled by its capacity to convert fixed costs into variable costs, allowing consumers to pay based on their consumption patterns, and providing the flexibility to initiate or terminate services as needed. Moreover, the adoption of cloud-based solutions is increasing owing to their array of advantages, such as reduced maintenance expenses, smaller physical infrastructure requirements, and seamless access to data from any location and at any time. This trend is further bolstered by the continuous efforts of key RegTech market service providers to enhance their offerings and introduce new products/services globally. For instance, in February 2021, Plenitude unveiled RegSight, empowering institutions and organizations to enhance operational efficiency and manage FCC obligations effectively.By Organization Size, the Small & Medium-sized Enterprises, commanding a largest revenue share in 2025 within the RegTech market globally. While the adoption of RegTech has historically been limited among SMEs, this pattern is expected to shift as SMEs recognize the cost-saving benefits of implementing RegTech solutions. Given that SMEs typically operate on tighter budgets compared to larger enterprises, the cost-effectiveness of RegTech is poised to be particularly attractive to them. Additionally, the application of RegTech is expected to streamline processes and save time for SMEs.

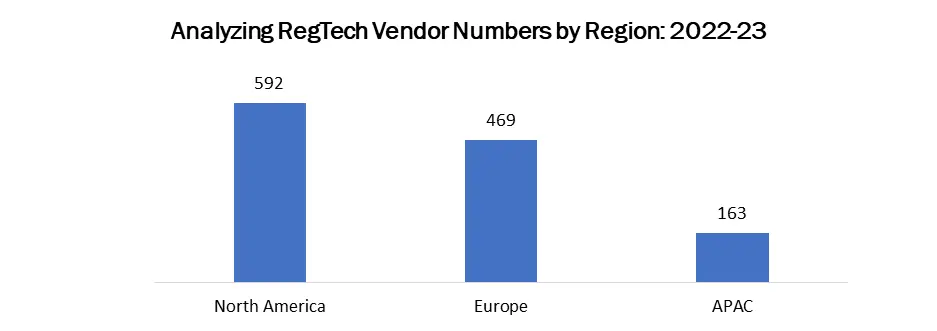

Regtech Market Regional Overview:

The Asia-Pacific region is projected to experience the fastest Compound Annual Growth Rate (CAGR) of 17.15% from 2024 to 2030, emerging as the dominant force in the market throughout the forecast period. The RegTech market in this region is characterized by high fragmentation due to the involvement of numerous market players engaged in various developments such as partnerships, acquisitions, and collaborations to expand the RegTech market in the Asia-Pacific region. For example, in August 2021, Wolters Kluwer RegTech highlighted the support for granular data reporting in the Asia Pacific, indicating a shift towards modern regulatory reporting practices. Traditional form-based reporting methods are being replaced by new platforms, prompting financial institutions to adapt to these changes. On the other hand, North America held the highest revenue market share in 2025, driven by the significant presence of RegTech providers in the U.S. and Canada. The enterprises in these regions are increasingly adopting RegTech solutions. For instance, in October 2022, investment in RegTech solutions surged in North America, signaling a growing recognition of the value these technologies offer in navigating complex regulatory environments. Regtech Market Deployment Strategies: Deployment strategies for the RegTech market typically involve various approaches tailored to the specific needs and objectives of the businesses and organizations implementing these solutions. Collaboration and partnership among multiple stakeholders, including regulators, industry associations, and technology providers, facilitate the deployment of RegTech solutions on a broader scale. Collaborative deployment efforts help drive industry-wide adoption of RegTech solutions and promote standardization of regulatory compliance practices. Actico, a leading provider of artificial intelligence-powered digital decision-making solutions, forged a partnership with Coinfirm in March 2022, a prominent firm specializing in cryptocurrency anti-money laundering and analytics. Through this collaboration, financial service providers, including banks, gain the capability to promptly investigate and assess the risks associated with money laundering in crypto transactions within the ACTICO Compliance Suite.Reg Tech Market Scope: Inquire before buying

Global Reg Tech Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 12.28 Bn. Forecast Period 2026 to 2032 CAGR: 16.06% Market Size in 2032: USD 34.84 Bn. Segments Covered: by Component Solutions Services by Deployment On-premises Cloud by Organization Size Small & Medium-sized Enterprises Large Enterprises by End User BFSI Manufacturing IT & Telecom Healthcare Government Others RegTech Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)RegTech Market, Key Players are

1. Accuity - United States 2. Broadridge - United States 3. Compliance Solutions Strategies (CSS) - United States 4. Deloitte - United States 5. IBM - United States 6. MetricStream - United States 7. Nasdaq BWise - United States 8. Nice Actimize - United States 9. Jumio - United States 10. Rimes Technologies - United States 11. Thomson Reuters - United States 12. Trulioo - Canada 13. Abside Smart Financial Technologies – France 14. Actico – Germany 15. PWC - United Kingdom 16. Wolters Kluwer - Netherlands 17. Alto Advisory - United Kingdom 18. Compendor – Germany 19. Fenergo – Ireland 20. VERMEG (acquired Lombard Risk) - France 21. London Stock Exchange Group (LSEG) - United Kingdom 22. Sysnet Global Solutions - Ireland 23. Infrasoft Technologies – India 24. Sai Global - Australia 25. Eastnets - United Arab EmiratesFAQs:

1. What are the growth drivers for the RegTech Market? Ans: Increasing Regulatory Complexity is expected to be the major drivers for the RegTech Market. 2. What is the major restraint for the RegTech Market growth? Ans. Regulatory Uncertainty is expected to be the major restraining factor for the RegTech Market growth. 3. Which region is expected to lead the global RegTech Market during the forecast period? Ans. North America is expected to lead the global RegTech Market during the forecast period. 4. What is the projected market size & and growth rate of the RegTech Market? Ans. The RegTech Market size was valued at USD 12.28 Billion in 2025 and the total RegTech revenue is expected to grow at a CAGR of 16.06% from 2025 to 2032, reaching nearly USD 34.84 Billion by 2032. 5. What segments are covered in the RegTech Market report? Ans. The segments covered in the RegTech Market report are Component, Organization Size, Deployment Mode and Vertical.

1. Regtech Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.3.1. Market Size (2025) & Forecast (2024-2032), and Y-O-Y (%) 1.3.2. Market Size (USD) and Market Share (%) - By Segments, Regions and Country 2. Regtech Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Service Segment 2.3.3. End-User Segment 2.3.4. Revenue USD (2025) 2.3.5. Headquarters 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Patent Analysis 3.1. Top 10 Companies With Highest Number of Patent Application 3.2. Top 20 Patent Owners in the United States 3.3. Number of Patents Granted in 2022-2025 4. Technological Analysis 4.1. Artificial Intelligence (AI) - Simulating Human Intelligence by Machines 4.2. Block chain - Immutable Decentralized Ledger Technology 4.3. Cloud Computing - Internet-Based Flexible Computing Services 4.4. Technological Roadmap 4.5. Robotic Process Automation (RPA) - Automating Repetitive Tasks with Software Robots 4.6. Predictive Analytics - Forecasting with Historical Data and Machine Learning 4.7. Application Programming Interface (API) - Protocols for Software Communication and Integration 4.8. Technological Roadmap 5. Regtech Market: Dynamics 5.1. Regtech Market Trends 5.2. Regtech Market Dynamics 5.2.1. Drivers 5.2.1.1. Growing Adoption of Advanced Technologies 5.2.1.2. Enhanced Emphasis on Financial Regulations 5.2.1.3. Strengthened Collaboration between National Regulators and Financial Institutions 5.2.2. Restraints 5.2.2.1. Diverse and Conflicting Regulatory Frameworks across Different Jurisdictions 5.2.2.2. Heightened Concerns Over Privacy and Security 5.2.3. Opportunities 5.2.3.1. Escalating GDPR and Data Privacy Concerns Globally 5.2.3.2. Demand for Real-Time Monitoring and Reporting 5.2.4. Challenges 5.2.4.1. Rapidly Evolving Regulations 5.2.4.2. High Implementation Costs 5.3. PORTER’s Five Forces Analysis 5.4. Strategic Actions and Recommendations for Suppliers 5.5. PESTLE Analysis 5.6. Regulatory Landscape by Region 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 5.7. Key Opinion Leader Analysis for the Regtech Industry 6. Regtech Market: Global Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 6.1. Global Regtech Market Size and Forecast, by Component (2025-2032) 6.1.1. Solutions 6.1.2. Services 6.2. Global Regtech Market Size and Forecast, by Deployment (2025-2032) 6.2.1. On-premises 6.2.2. Cloud 6.3. Global Regtech Market Size and Forecast, by Organization Size (2025-2032) 6.3.1. Small & Medium-sized Enterprises 6.3.2. Large Enterprises 6.4. Global Regtech Market Size and Forecast, by End-User (2025-2032) 6.4.1. BFSI 6.4.2. Manufacturing 6.4.3. IT & Telecom 6.4.4. Healthcare 6.4.5. Government 6.4.6. Others 6.5. Global Regtech Market Size and Forecast, by Region (2025-2032) 6.5.1. North America 6.5.2. Europe 6.5.3. Asia Pacific 6.5.4. Middle East and Africa 6.5.5. South America 7. North America Regtech Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 7.1. North America Regtech Market Size and Forecast, by Component (2025-2032) 7.1.1. Solutions 7.1.2. Services 7.2. North America Regtech Market Size and Forecast, by Deployment (2025-2032) 7.2.1. On-premises 7.2.2. Cloud 7.3. North America Regtech Market Size and Forecast, by Organization Size (2025-2032) 7.3.1. Small & Medium-sized Enterprises 7.3.2. Large Enterprises 7.4. North America Regtech Market Size and Forecast, by End-User (2025-2032) 7.4.1. BFSI 7.4.2. Manufacturing 7.4.3. IT & Telecom 7.4.4. Healthcare 7.4.5. Government 7.4.6. Others 7.5. North America Regtech Market Size and Forecast, by Country (2025-2032) 7.5.1. United States 7.5.1.1. United States Regtech Market Size and Forecast, by Component (2025-2032) 7.5.1.2. United States Regtech Market Size and Forecast, by Deployment (2025-2032) 7.5.1.3. United States Regtech Market Size and Forecast, by Organization Size (2025-2032) 7.5.1.4. United States Regtech Market Size and Forecast, by End-User (2025-2032) 7.5.2. Canada 7.5.3. Mexico 8. Europe Regtech Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 8.1. Europe Regtech Market Size and Forecast, by Component (2025-2032) 8.1.1. Solutions 8.1.2. Services 8.2. Europe Regtech Market Size and Forecast, by Deployment (2025-2032) 8.2.1. On-premises 8.2.2. Cloud 8.3. Europe Regtech Market Size and Forecast, by Organization Size (2025-2032) 8.3.1. Small & Medium-sized Enterprises 8.3.2. Large Enterprises 8.4. Europe Regtech Market Size and Forecast, by End-User (2025-2032) 8.4.1. BFSI 8.4.2. Manufacturing 8.4.3. IT & Telecom 8.4.4. Healthcare 8.4.5. Government 8.4.6. Others 8.5. Europe Regtech Market Size and Forecast, by Country (2025-2032) 8.5.1. United Kingdom 8.5.1.1. United Kingdom Regtech Market Size and Forecast, by Component (2025-2032) 8.5.1.2. United Kingdom Regtech Market Size and Forecast, by Deployment (2025-2032) 8.5.1.3. United Kingdom Regtech Market Size and Forecast, by Organization Size (2025-2032) 8.5.1.4. United Kingdom Regtech Market Size and Forecast, by End-User (2025-2032) 8.5.2. France 8.5.3. Germany 8.5.4. Italy 8.5.5. Spain 8.5.6. Sweden 8.5.7. Russia 8.5.8. Rest of Europe 9. Asia Pacific Regtech Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 9.1. Asia Pacific Regtech Market Size and Forecast, by Component (2025-2032) 9.1.1. Solutions 9.1.2. Services 9.2. Asia Pacific Regtech Market Size and Forecast, by Deployment (2025-2032) 9.2.1. On-premises 9.2.2. Cloud 9.3. Asia Pacific Regtech Market Size and Forecast, by Organization Size (2025-2032) 9.3.1. Small & Medium-sized Enterprises 9.3.2. Large Enterprises 9.4. Asia Pacific Regtech Market Size and Forecast, by End-User (2025-2032) 9.4.1. BFSI 9.4.2. Manufacturing 9.4.3. IT & Telecom 9.4.4. Healthcare 9.4.5. Government 9.4.6. Others 9.5. Asia Pacific Regtech Market Size and Forecast, by Country (2025-2032) 9.5.1. China 9.5.1.1. China Regtech Market Size and Forecast, by Component (2025-2032) 9.5.1.2. China Regtech Market Size and Forecast, by Deployment (2025-2032) 9.5.1.3. China Regtech Market Size and Forecast, by Organization Size (2025-2032) 9.5.1.4. China Regtech Market Size and Forecast, by End-User (2025-2032) 9.5.2. South Korea 9.5.3. Japan 9.5.4. India 9.5.5. Australia 9.5.6. ASEAN 9.5.7. Rest of Asia Pacific 10. Middle East and Africa Regtech Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 10.1. Middle East and Africa Regtech Market Size and Forecast, by Component (2025-2032) 10.1.1. Solutions 10.1.2. Services 10.2. Middle East and Africa Regtech Market Size and Forecast, by Deployment (2025-2032) 10.2.1. On-premises 10.2.2. Cloud 10.3. Middle East and Africa Regtech Market Size and Forecast, by Organization Size (2025-2032) 10.3.1. Small & Medium-sized Enterprises 10.3.2. Large Enterprises 10.4. Middle East and Africa Regtech Market Size and Forecast, by End-User (2025-2032) 10.4.1. BFSI 10.4.2. Manufacturing 10.4.3. IT & Telecom 10.4.4. Healthcare 10.4.5. Government 10.4.6. Others 10.5. Middle East and Africa Regtech Market Size and Forecast, by Country (2025-2032) 10.5.1. South Africa 10.5.1.1. South Africa Regtech Market Size and Forecast, by Component (2025-2032) 10.5.1.2. South Africa Regtech Market Size and Forecast, by Deployment (2025-2032) 10.5.1.3. South Africa Regtech Market Size and Forecast, by Organization Size (2025-2032) 10.5.1.4. South Africa Regtech Market Size and Forecast, by End-User (2025-2032) 10.5.2. GCC 10.5.3. Rest of ME&A 11. South America Regtech Market Size and Forecast by Segmentation (by Value in USD) (2025-2032) 11.1. South America Regtech Market Size and Forecast, by Component (2025-2032) 11.1.1. Solutions 11.1.2. Services 11.2. South America Regtech Market Size and Forecast, by Deployment (2025-2032) 11.2.1. On-premises 11.2.2. Cloud 11.3. South America Regtech Market Size and Forecast, by Organization Size (2025-2032) 11.3.1. Small & Medium-sized Enterprises 11.3.2. Large Enterprises 11.4. South America Regtech Market Size and Forecast, by End-User (2025-2032) 11.4.1. BFSI 11.4.2. Manufacturing 11.4.3. IT & Telecom 11.4.4. Healthcare 11.4.5. Government 11.4.6. Others 11.5. South America Regtech Market Size and Forecast, by Country (2025-2032) 11.5.1. Brazil 11.5.1.1. Brazil Regtech Market Size and Forecast, by Component (2025-2032) 11.5.1.2. Brazil Regtech Market Size and Forecast, by Deployment (2025-2032) 11.5.1.3. Brazil Regtech Market Size and Forecast, by Organization Size (2025-2032) 11.5.1.4. Brazil Regtech Market Size and Forecast, by End-User (2025-2032) 11.5.2. Argentina 11.5.3. Rest of South America 12. Company Profile: Key Players 12.1. Accuity - United States 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.1.6. Recent Developments 12.2. Broadridge - United States 12.3. Compliance Solutions Strategies (CSS) - United States 12.4. Deloitte - United States 12.5. IBM - United States 12.6. MetricStream - United States 12.7. Nasdaq BWise - United States 12.8. Nice Actimize - United States 12.9. Jumio - United States 12.10. Rimes Technologies - United States 12.11. Infrasoft Technologies - India 12.12. ACI Worldwide - United States 12.13. Oracle - United States 12.14. SAS Institute - United States 13. Key Findings 14. Analyst Recommendations 15. RegTech Market – Research Methodology