The Aerospace 3D Printing Market size was valued at USD 2.37 Billion in 2023 and the total Aerospace 3D Printing Market revenue is expected to grow at 19.77 % from 2024 to 2030, reaching nearly USD 8.37 Billion in 2030. Aerospace 3D printing technology enables efficient, large-scale construction using in-site resources in other materials. Aerospace 3D printing makes it possible to build complex geometries and lightweight structures, improving performance and fuel efficiency. Aerospace 3D printing has the potential to revolutionize manufacturing in space, making it more sustainable, cost-efficient, and flexible.To know about the Research Methodology:- Request Free Sample Report The key driving factors for the Aerospace 3D printing market such as increased demand for lightweight aircraft components, Cost-effectiveness, the adoption of advanced manufacturing technologies, and Government investment are analysed in the report. Developing technology like fuel-efficient aircraft increases efficiency, and the adoption of 3D printing increased significantly in both aircraft and engine manufacturers. Increasing adoption in space industries creates new opportunities for the aerospace 3D printing market. The aerospace 3D printing market is segmented based on offerings, it is also categorized by technology, platform, spacecraft, and applications. The analysis conducted by Maximize market research for the Aerospace 3D printing market over the past 5 years and by using the data, concluded that Europe's Aerospace 3D printing market growing at a CAGR of 10-12 %, and is expected to continue its dominance during the forecast period. The major key players like TrumpF, Arcam AB, and Höganäs AB are driving the Europe aerospace 3D printing market.

Aerospace 3D Printing Market Dynamics:

Demand for Lightweight Components in Aerospace 3D Printing Market The aerospace 3D printing market is driven by the production of complex, lightweight parts and customized components that perform in both airplanes and spacecraft. The aerospace 3D printing technology in the aerospace industry has been used for many advantages, such as the ability to produce lightweight durable components and maximize performance with fuel efficiency while following safety standards. The aerospace industry is step by step switching some load-bearing and hot section components from traditional manufacturing methods to 3D printing, and more components are expected to be created using 3D printers as additive manufacturing technology continues to advance. The adoption of air vehicles and the retirement of older aircraft might happen more quickly, but regulatory approval remains a challenge. The aerospace 3D printing market is also being driven by the increasing demand for health, hygiene, and sanitation products. Some lightweight and complex structure components that aerospace 3D printed and also provide durable solutions such as Wing Brackets for Airplanes, Drone Rotor Blades, Fuel Nozzles, Combustion Chambers, and Air Duct and Wall Panels. Overall, the aerospace 3D printing market is being driven by technological advancements, adoption by the aerospace and space industries, cost-effective production, demand for lightweight components, partnerships and collaborations, and rising utilization of lightweight materials. The Lack of Suitable Materials Is a Challenge for the Aerospace 3D Printing Market The range of components that can be produced, particularly for aviation-specific applications this limitation restricts the market. The aerospace industry requires specialized materials that follow determined aviation and create a wider range of aircraft parts. The use of aerospace-specific regulations and the limited number of material options delays the technology to cr3D printing manufacturing has many advantages, such as the ability to manufacture lightweight, durable parts, but the lack of suitable materials remains a key challenge that the industry is working to address. The industry expects increased potential in producing 3D-printed parts meeting necessary criteria with the introduction of new materials, consequently growing the range of applications in aerospace. The Need for Supply Chain Optimization Is a Key Trend in the Aerospace 3D Printing Market The adoption of 3D printing in aircraft manufacturing is a key trend, driven by the increasing number of commercial aircraft orders and deliveries, also the rising adoption of advanced technologies in aircraft manufacturing. The aerospace industry is undergoing an increased demand for aircraft with lightweight components, and the demand for 3D printing technologies to manufacture these complex aerospace parts is driving the Market. The adoption of additive manufacturing in the aerospace industry, 3D printing is revolutionizing the supply chain industry, allowing businesses to rapidly and cost-effectively produce products on demand, reducing the need for large lists, improving production processes, and reducing principal time.Aerospace 3D Printing Market Segment Analysis:

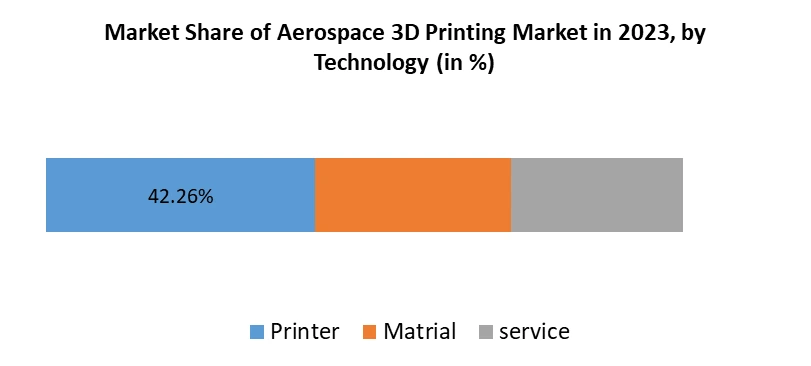

By Platform, The aircraft segment dominates the global market approximately 51.23% of the market share in 2023. According to MMR, the aircraft segment dominates the market. The rising demand for lightweight aircraft and the fast manufacturing of complex parts are driving aircraft manufacturing adoption with 3D printing technologies. The maximum number of developments in 3D printing are expected to occur in this segment. The aircraft segment's dominance is credited to the 3D printing technology, which enables to creation of complex and lightweight structures. The spacecraft segment is expected to grow at the fastest CAGR during the forecast period and approximately 25% to 30% of the market share of the aerospace 3D printing market in 2023. The UAV segment is also expected to grow significantly during the forecast period.By Technology, the technology segment market share in the market is segmented into printers, materials, and services. The printer segment has the largest share of 42.26% in 2023. The increasing demand for advanced material extrusion drives the materials segment, which is expected to grow at the fastest CAGR during the forecast period. The service providers of the aerospace 3D printing industry include Original Equipment Manufacturers, the aerospace 3D printing market is dominated by some key manufacturers such as 3D Systems, Stratasys, Materialise NV, Relativity Space, and Ultimaker BV, among others. The product portfolios, good relations with a wide range of aircraft manufacturers and airline operators, and significant investment in R&D for aerospace 3D printing advancements are strategies implemented by these key players.

Aerospace 3D Printing Market Regional Insights:

The North American region holds the largest market share in the global market with 40% of the market share in 2023. North America has a large aerospace manufacturing base, also substantial financial support from the U.S. government, and key players like Aerojet Rocketdyne, Relativity Space, Norsk Titanium AS, and Markforged are having major investments with the R&D department, which found the various novel technologies and increasing demand for aircraft and space exploration programs are driving the growth of the aerospace 3D printing market in North America. The North American market is projected to record a CAGR of 17.5% during the forecast period, and the increasing adoption of 3D printing technology for manufacturing complex 3D components drives the aerospace printing market. Followed by North America and Europe, the Asia-Pacific region is expected significant growth in the Aerospace 3D Printing Market, achieving a CAGR of 4.09 % during the forecast period. Key countries such as India, China, and Japan increasing the presence of Original Equipment Manufacturers (OEMs) and 2 tier players. Aerospace 3D Printing Market Competitive Landscapes: French Start-Up, Extended Its Collaboration with the French Air and Space Force in April 2023 In the dynamic landscape of 3D printing for aerospace and defense, notable players have made strategic moves to enhance their contributions. Handddle, a French start-up, extended its collaboration with the French Air and Space Force in April 2023, strengthening the force's capabilities with a renewed contract and the introduction of a cutting-edge 3D printing micro-factory. This move underscores the crucial role of 3D printing in enabling quick adaptability to new challenges on the ground. Mark3D UK, Made Significant Strides in January 2023 Another key player, Mark3D UK, made significant strides in January 2023 by launching an Aerospace and Defense Division at the iAero Centre in the United Kingdom. Specializing in Markforged technology, Mark3D UK aims to play a pivotal role in advancing additive manufacturing within the aerospace and defense sector. These strategic initiatives reflect the competitive landscape's dynamism, with companies actively positioning themselves to contribute to the evolution of 3D printing in this specialized industry.Aerospace 3D Printing Market Scope: Inquire before buying

Aerospace 3D Printing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.23 Bn. Forecast Period 2023 to 2029 CAGR: 20.77 %. Market Size in 2029: US $ 8.37 Bn. Segments Covered: by Offerings Printers Materials Services Software by Technology Polymerization Powder Bed Fusion Material Extrusion Or Fusion Deposition Modeling (Fdm) Others by Platform Aircraft UAVs Spacecraft by Application Prototyping Tooling Functional Parts by End Product Engine Components Structural Components Others Aerospace 3D Printing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Aerospace 3D Printing Market Key Players:

North America Aerospace 3D Printing Market Key Players 1. Stratasys Ltd. 2. 3D Systems Corporation 3. Norsk Titanium AS 4. Markforged 5. Relativity Space 6. General Electric 7. ExOne 8. Aerojet Rocketdyne Europe Aerospace 3D Printing Market Key Players 1. EOS GmbH 2. Renishaw PLC 3. TrumpF 4. Arcam AB 5. Höganäs AB 6. Ultimaker B.V. 7. EnvisionTEC GmbH 8. Materialise NV FAQs: 1. What are the growth drivers for the Global market in 2023? Ans. Increased demand for lightweight aircraft components, the adoption of advanced manufacturing technologies, and Government investment are the main drivers of the Global Market in 2023. 2. What are the different segments of the Global Market? Ans. The Global Market is divided into four segments i.e. By Offerings, By Technology, By Application, and By End-User. 3. What is the study period of this global market? Ans. The Global Aerospace 3D Printing Market will be studied from 2023 to 2030. 4. What is the projected market size and growth rate of the Market? Ans. The Market size was valued at 2.37 in 2023 and the total Tantalum revenue is expected to grow at a CAGR of 19.77 % from 2024 to 2030, reaching nearly 8.37 billion in 2030. 5. Which region is expected to hold the highest Global Market share? Ans. North American region dominates the market share in the global market.

1. Aerospace 3D Printing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Aerospace 3D Printing Market: Dynamics 2.1. Aerospace 3D Printing Market Trends by Region 2.1.1. North America Aerospace 3D Printing Market Trends 2.1.2. Europe Aerospace 3D Printing Market Trends 2.1.3. Asia Pacific Aerospace 3D Printing Market Trends 2.1.4. Middle East and Africa Aerospace 3D Printing Market Trends 2.1.5. South America Aerospace 3D Printing Market Trends 2.2. Aerospace 3D Printing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Aerospace 3D Printing Market Drivers 2.2.1.2. North America Aerospace 3D Printing Market Restraints 2.2.1.3. North America Aerospace 3D Printing Market Opportunities 2.2.1.4. North America Aerospace 3D Printing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Aerospace 3D Printing Market Drivers 2.2.2.2. Europe Aerospace 3D Printing Market Restraints 2.2.2.3. Europe Aerospace 3D Printing Market Opportunities 2.2.2.4. Europe Aerospace 3D Printing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Aerospace 3D Printing Market Drivers 2.2.3.2. Asia Pacific Aerospace 3D Printing Market Restraints 2.2.3.3. Asia Pacific Aerospace 3D Printing Market Opportunities 2.2.3.4. Asia Pacific Aerospace 3D Printing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Aerospace 3D Printing Market Drivers 2.2.4.2. Middle East and Africa Aerospace 3D Printing Market Restraints 2.2.4.3. Middle East and Africa Aerospace 3D Printing Market Opportunities 2.2.4.4. Middle East and Africa Aerospace 3D Printing Market Challenges 2.2.5. South America 2.2.5.1. South America Aerospace 3D Printing Market Drivers 2.2.5.2. South America Aerospace 3D Printing Market Restraints 2.2.5.3. South America Aerospace 3D Printing Market Opportunities 2.2.5.4. South America Aerospace 3D Printing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Aerospace 3D Printing Industry 2.8. Analysis of Government Schemes and Initiatives For Aerospace 3D Printing Industry 2.9. Aerospace 3D Printing Market Trade Analysis 2.10. The Global Pandemic Impact on Aerospace 3D Printing Market 3. Aerospace 3D Printing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 3.1.1. Printers 3.1.2. Materials 3.1.3. Services 3.1.4. Software 3.2. Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 3.2.1. Polymerization 3.2.2. Powder Bed Fusion 3.2.3. Material Extrusion 3.2.4. Others 3.3. Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 3.3.1. Aircraft 3.3.2. UAVs 3.3.3. Spacecraft 3.4. Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 3.4.1. Prototyping 3.4.2. Tooling 3.4.3. Functional Parts 3.5. Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 3.5.1. Engine Components 3.5.2. Structural Components 3.5.3. Others 3.6. Aerospace 3D Printing Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Aerospace 3D Printing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 4.1.1. Printers 4.1.2. Materials 4.1.3. Services 4.1.4. Software 4.2. North America Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 4.2.1. Polymerization 4.2.2. Powder Bed Fusion 4.2.3. Material Extrusion 4.2.4. Others 4.3. North America Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 4.3.1. Aircraft 4.3.2. UAVs 4.3.3. Spacecraft 4.4. North America Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 4.4.1. Prototyping 4.4.2. Tooling 4.4.3. Functional Parts 4.5. North America Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 4.5.1. Engine Components 4.5.2. Structural Components 4.5.3. Others 4.6. North America Aerospace 3D Printing Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 4.6.1.1.1. Printers 4.6.1.1.2. Materials 4.6.1.1.3. Services 4.6.1.1.4. Software 4.6.1.2. United States Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 4.6.1.2.1. Polymerization 4.6.1.2.2. Powder Bed Fusion 4.6.1.2.3. Material Extrusion 4.6.1.2.4. Others 4.6.1.3. United States Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 4.6.1.3.1. Aircraft 4.6.1.3.2. UAVs 4.6.1.3.3. Spacecraft 4.6.1.4. United States Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 4.6.1.4.1. Prototyping 4.6.1.4.2. Tooling 4.6.1.4.3. Functional Parts 4.6.1.5. United States Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 4.6.1.5.1. Engine Components 4.6.1.5.2. Structural Components 4.6.1.5.3. Others 4.6.2. Canada 4.6.2.1. Canada Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 4.6.2.1.1. Printers 4.6.2.1.2. Materials 4.6.2.1.3. Services 4.6.2.1.4. Software 4.6.2.2. Canada Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 4.6.2.2.1. Polymerization 4.6.2.2.2. Powder Bed Fusion 4.6.2.2.3. Material Extrusion 4.6.2.2.4. Others 4.6.2.3. Canada Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 4.6.2.3.1. Aircraft 4.6.2.3.2. UAVs 4.6.2.3.3. Spacecraft 4.6.2.4. Canada Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 4.6.2.4.1. Prototyping 4.6.2.4.2. Tooling 4.6.2.4.3. Functional Parts 4.6.2.5. Canada Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 4.6.2.5.1. Engine Components 4.6.2.5.2. Structural Components 4.6.2.5.3. Others 4.6.3. Mexico 4.6.3.1. Mexico Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 4.6.3.1.1. Printers 4.6.3.1.2. Materials 4.6.3.1.3. Services 4.6.3.1.4. Software 4.6.3.2. Mexico Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 4.6.3.2.1. Polymerization 4.6.3.2.2. Powder Bed Fusion 4.6.3.2.3. Material Extrusion 4.6.3.2.4. Others 4.6.3.3. Mexico Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 4.6.3.3.1. Aircraft 4.6.3.3.2. UAVs 4.6.3.3.3. Spacecraft 4.6.3.4. Mexico Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 4.6.3.4.1. Prototyping 4.6.3.4.2. Tooling 4.6.3.4.3. Functional Parts 4.6.3.5. Mexico Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 4.6.3.5.1. Engine Components 4.6.3.5.2. Structural Components 4.6.3.5.3. Others 5. Europe Aerospace 3D Printing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.2. Europe Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.4. Europe Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.5. Europe Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6. Europe Aerospace 3D Printing Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.1.2. United Kingdom Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.1.3. United Kingdom Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.1.4. United Kingdom Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.1.5. United Kingdom Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.2. France 5.6.2.1. France Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.2.2. France Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.2.3. France Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.2.4. France Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.2.5. France Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.3.2. Germany Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.3.3. Germany Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.3.4. Germany Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.3.5. Germany Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.4.2. Italy Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.4.3. Italy Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.4.4. Italy Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.4.5. Italy Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.5.2. Spain Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.5.3. Spain Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.5.4. Spain Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.5.5. Spain Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.6.2. Sweden Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.6.3. Sweden Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.6.4. Sweden Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.6.5. Sweden Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.7.2. Austria Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.7.3. Austria Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.7.4. Austria Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.7.5. Austria Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 5.6.8.2. Rest of Europe Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 5.6.8.3. Rest of Europe Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 5.6.8.4. Rest of Europe Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 5.6.8.5. Rest of Europe Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6. Asia Pacific Aerospace 3D Printing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.2. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.4. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6. Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.1.2. China Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.1.3. China Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.1.4. China Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.1.5. China Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.2.2. S Korea Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.2.3. S Korea Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.2.4. S Korea Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.2.5. S Korea Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.3.2. Japan Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.3.3. Japan Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.3.4. Japan Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Japan Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.4. India 6.6.4.1. India Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.4.2. India Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.4.3. India Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.4.4. India Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.4.5. India Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.5.2. Australia Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.5.3. Australia Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.5.4. Australia Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Australia Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.6.2. Indonesia Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.6.3. Indonesia Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.6.4. Indonesia Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Indonesia Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.7.2. Malaysia Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.7.3. Malaysia Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.7.4. Malaysia Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Malaysia Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.8.2. Vietnam Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.8.3. Vietnam Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.8.4. Vietnam Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Vietnam Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.9.2. Taiwan Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.9.3. Taiwan Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.9.4. Taiwan Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.9.5. Taiwan Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 6.6.10.2. Rest of Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 6.6.10.3. Rest of Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 6.6.10.4. Rest of Asia Pacific Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 6.6.10.5. Rest of Asia Pacific Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 7. Middle East and Africa Aerospace 3D Printing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 7.2. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 7.4. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 7.6. Middle East and Africa Aerospace 3D Printing Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 7.6.1.2. South Africa Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 7.6.1.3. South Africa Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 7.6.1.4. South Africa Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 7.6.1.5. South Africa Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 7.6.2.2. GCC Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 7.6.2.3. GCC Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 7.6.2.4. GCC Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 7.6.2.5. GCC Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 7.6.3.2. Nigeria Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 7.6.3.3. Nigeria Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 7.6.3.4. Nigeria Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Nigeria Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 7.6.4.2. Rest of ME&A Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 7.6.4.3. Rest of ME&A Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 7.6.4.4. Rest of ME&A Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 7.6.4.5. Rest of ME&A Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 8. South America Aerospace 3D Printing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 8.2. South America Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 8.3. South America Aerospace 3D Printing Market Size and Forecast, by Platform(2023-2030) 8.4. South America Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 8.5. South America Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 8.6. South America Aerospace 3D Printing Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 8.6.1.2. Brazil Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 8.6.1.3. Brazil Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 8.6.1.4. Brazil Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 8.6.1.5. Brazil Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 8.6.2.2. Argentina Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 8.6.2.3. Argentina Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 8.6.2.4. Argentina Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 8.6.2.5. Argentina Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Aerospace 3D Printing Market Size and Forecast, by Offerings (2023-2030) 8.6.3.2. Rest Of South America Aerospace 3D Printing Market Size and Forecast, by Technology (2023-2030) 8.6.3.3. Rest Of South America Aerospace 3D Printing Market Size and Forecast, by Platform (2023-2030) 8.6.3.4. Rest Of South America Aerospace 3D Printing Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Rest Of South America Aerospace 3D Printing Market Size and Forecast, by End Product (2023-2030) 9. Global Aerospace 3D Printing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Aerospace 3D Printing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Stratasys Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. 3D Systems Corporation 10.3. Norsk Titanium AS 10.4. Markforged 10.5. Relativity Space 10.6. General Electric 10.7. ExOne 10.8. Aerojet Rocketdyne 10.9. EOS GmbH 10.10. Renishaw PLC 10.11. TrumpF 10.12. Arcam AB 10.13. Höganäs AB 10.14. Ultimaker B.V. 10.15. EnvisionTEC GmbH 10.16. Materialise NV 11. Key Findings 12. Industry Recommendations 13. Aerospace 3D Printing Market: Research Methodology 14. Terms and Glossary