The Quantum Computing Market size was valued at USD 801.19 Million in 2023 and the total Quantum Computing revenue is expected to grow at a CAGR of 30.56% from 2024 to 2030, reaching nearly USD 3976.14 Million by 2030. Quantum computing integrates computer science, physics, and mathematics, employing quantum mechanics to solve intricate problems faster than classical computers. The Quantum Computing Market represents an advanced edge in computer technology, rooted in quantum theory and mechanics. This revolutionary computing paradigm stands apart from classical computing by harnessing quantum bits or qubits, enabling faster computations and solving previously insurmountable problems. Unlike traditional computing's binary system of 0s and 1s, quantum computing utilizes all states in between, leading to superior processing speeds and outcomes. This transformational technology finds applications across diverse industries, including chemicals, energy, healthcare, and pharmaceuticals, driving innovative solutions and advancements. The quantum computing market is experiencing rapid growth, driven by intensive research, technological leaps, and substantial investments. Major quantum computing industry players such as IBM, Google, Microsoft, and Rigetti are driving quantum computing initiatives. IBM's cloud-accessible quantum computers have democratized quantum resources for global researchers and developers. Google's quantum supremacy achievement with the Sycamore processor demonstrated unprecedented computational capabilities, surpassing classical supercomputers. Microsoft's Azure Quantum platform and Rigetti's quantum processors further shape this dynamic landscape. Quantum Computing Market Key growth drivers include the pursuit of quantum advantage, where quantum systems outperform classical capabilities, boosted by advancements in qubit technologies. Quantum computing market applications span over finance, healthcare, cryptography, and optimization problems, driving its transformative potential.To know about the Research Methodology :- Request Free Sample Report

Quantum Computing Market Dynamics:

Record-Breaking Investments in Quantum Technology Coupled With Advancements in Bridging the Talent Gap Serve as Significant Drivers for Quantum Computing Market Growth The Quantum Computing Market growth driven by various factors such as augmented funding from governments and Quantum Computing Market major tech players such as Google and IBM. For instance, Google and IBM's substantial investment in a top Japanese university—partnering with the University of Chicago—injects USD 100 Billion each over 10 years, nurturing young talent and emphasizing the significance of pioneering university research. Breakthroughs in qubit stability from companies like Rigetti and IonQ significantly enhance processor reliability, shaping quantum system dependability and driving Quantum Computing Market growth.Accessible cloud-based quantum computing platforms by IBM and Microsoft democratize quantum resources, raising global experimentation and innovation, thereby amplifying Quantum Computing industry development. Quantum computing's exploration across diverse sectors such as finance, logistics, cryptography, and drug discovery is a major catalyst for Quantum Computing Market growth. Initiatives such as the U.S. National Quantum Initiative and the EU's Quantum Flagship Program propel collaboration and innovation, advancing the quantum computing ecosystem. Collaborations between tech companies, academia, and research institutions—similar to IBM's strategic alliances—accelerate technology development and commercialization in the Quantum Computing Market. Key innovations by companies such as Quantum Circuits Inc. and advancements in error-correcting codes address fundamental challenges in scaling quantum systems, further driving Quantum Computing Market growth. The rising interest in optimizing quantum algorithms and developing scalable quantum architectures by companies such as Intel and PsiQuantum mirrors the industry's growing demand for efficient algorithms and broader applications. These collective efforts, spanning funding injections, stability breakthroughs, collaborative initiatives, and algorithmic innovations, spearhead the expansive trajectory of the Quantum Computing Market, solidifying its position as a transformative technological force in various sectors. Integration and Standardization error with Skilled Workforce Shortage hinders the market growth

Building stable quantum devices capable of handling a large number of qubits while maintaining stability and coherence is a major hurdle in Quantum Computing adoption. Quantum systems are highly susceptible to noise and errors, impeding accurate computation. Achieving error correction and mitigation, vital for useful quantum computing, remains in early developmental stages, along with quantum communication technologies like teleportation and key distribution. The Quantum Computing industry grapples with a scarcity of skilled professionals proficient in quantum technology, impacting the workforce's capacity to handle quantum devices and software effectively. Integrating quantum technology seamlessly with existing classical systems is difficult, limiting practical applications. The absence of robust software and programming languages tailored for quantum computing poses challenges for its efficient utilization. Standardization in the quantum computing field is lacking, complicating device and technology comparisons. The high costs associated with building and operating quantum computers impede their widespread adoption. Maintaining qubit stability remains a significant concern in Quantum Computing market growth. The fragility of qubits and their susceptibility to errors and interference hinder large-scale computations. Current coherence times of qubits are under 100 microseconds, restricting practical applications. Error correction is complex in quantum systems, with current error rates standing at approximately 1%, demanding sophisticated error correction methods for fault-tolerant quantum computing. Developing efficient quantum algorithms, such as Shor's algorithm for prime factorization and Grover's algorithm for searching, demands significant optimization and adaptation for diverse industries. The uncertainty regarding quantum computers' commercial viability over classical systems, coupled with regulatory, ethical, and security concerns, slows down industry-wide adoption. Quantum computing market faces competition from established classical computing and emerging technologies such as AI and blockchain, challenging the transition toward quantum computing paradigms for industries. These collective challenges impede the Quantum Computing Market's growth and its seamless integration into various sectors.

Quantum Computing Market Segment Analysis:

Based on Components, Hardware segment dominated the Quantum Computing market in 2023 for qubit processing. Quantum computers require intricate infrastructure and advancements to handle a larger number of qubits while maintaining stability, restricting their immediate scalability. While Software segment is fast growing segment in Quantum Computing market, focusing on algorithms such as Shor's and Grover's for diverse applications, encounters challenges in optimization and adaptation for practical usage across sectors such as cryptography and optimization. Services in quantum computing, including consulting, maintenance, and training, facilitate quantum adoption, aiding industries in navigating this complex technology. As hardware advances to handle more qubits, software innovations and algorithmic refinements become crucial for practical applications, all of which rely on service provisions for effective integration. The Quantum Computing market growth depends on the convergence and advancements across these components, where each sector's progression interplays to drive quantum computing towards broader industry adoption and real-world applications. Based on Technology, Superconducting qubits dominated the Quantum Computing market with major market share due to their scalability potential, encounter stability and error rate challenges as they scale up, hindering their widespread adoption. While Trapped ion qubits, is emerging segment in Quantum Computing industry known for their coherence and precision, face constraints in scalability and control of interactions between qubits, limiting their immediate growth. Quantum annealing, focusing on optimization problems, demonstrates applicability in specific domains like logistics and finance, but it has limitations in solving general computational problems. Each technology brings unique advantages and hurdles; superconducting qubits strive for scalability, trapped ion qubits prioritize coherence, while quantum annealing excels in optimization. The adoption and evolution of these technologies remain pivotal for the quantum computing landscape, with ongoing efforts aimed at overcoming technological constraints to leverage the full potential of quantum computing in diverse industries.Quantum Computing Market Regional Insights:

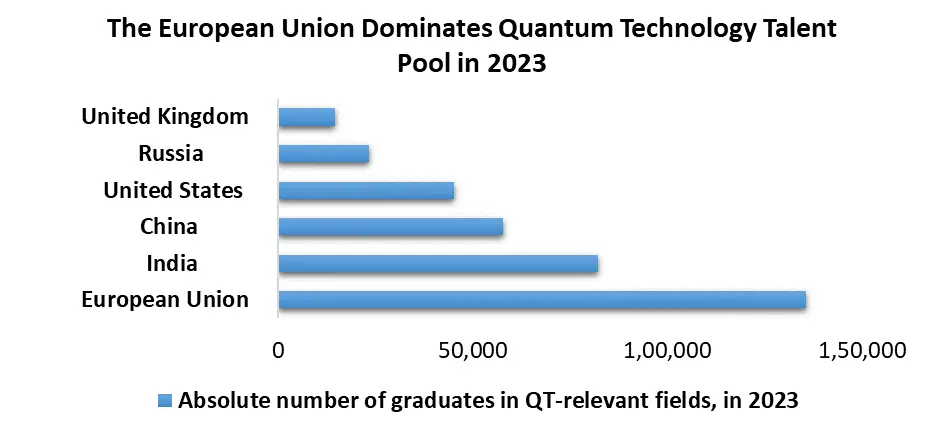

North America's Dominance in the Quantum Computing Market North America, dominated the Quantum Computing Market, by the United States, serves as a significant service provider, housing major companies such as IBM, Google, and Rigetti, driving technology advancements. In Europe, Germany and the UK, emerges as another fast growing hub for innovation, contributing significantly to global development. Asia Pacific, mainly China and Japan, is a prominent region which utilizes Quantum Computing services and experiencing a rise in investments and government initiatives. North America and Europe hold strong Quantum Computing service providing positions in quantum computing hardware, software, and services. The Quantum Computing industry experienced a 19 percent rise in job openings in quantum technologies from 2023 to 2025. Academic institutions' integration of quantum into curriculums and a 55 percent increase in master’s-level graduates in quantum technologies contribute to narrowing the talent gap. Formal master’s programs in quantum technologies rose from 29 to 50 universities between 2021 and 2022. Around 350,000 master’s-level graduates per year in related fields such as biochemistry, chemistry, electronics, information technology, mathematics, and physics have the potential to fill these roles. The European Union houses the highest number of quantum technology talents, with 303 newly minted master’s-level graduates per million residents in relevant fields in 2025. Existing talent with knowledge adaptable to quantum technologies upskilled. Professionals with coding and AI skills trained in six months to work on quantum algorithms. Amidst technology firms downsizing, this versatile talent remains in high demand.

Global Quantum Computing Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 801.19 Mn. Forecast Period 2024 to 2030 CAGR: 30.56% Market Size in 2030: US $ 3976.14 Mn. Segments Covered: By Component Hardware Software Services By Technology Superconducting qubits Trapped ion qubits Quantum Annealing By Application Simulation Optimization Sampling By End-User Defense Banking & Finance Energy & Power Chemicals Healthcare & Pharmaceuticals Quantum Computing Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Quantum Computing Market Key Players:

Major Contributors in the Quantum Computing Industry in North America 1. IBM, Armonk, New York, USA 2. D-Wave Systems, British Columbia, Canada 3. Rigetti Computing, Berkeley, California, USA 4. Google Quantum AI Lab, California, USA 5. Honeywell Quantum Solutions, Charlotte, North Carolina, USA Leading Players in the Quantum Computing Market in Europe 1. Airbus Quantum Computing, Ottobrunn, Germany 2. IQM, Espoo, Finland 3. PsiQuantum, Palo Alto, California, USA 4. Atos Quantum , Bezons, France 5. Qilimanjaro Quantum Tech, Lisbon, Portugal Key Players Driving the Quantum Computing Market in Asia Pacific 1. Alibaba Quantum Lab Hangzhou, China 2. Toshiba Quantum Solutions, Tokyo, Japan 3. Quantum Benchmark Kitchener, Ontario, Canada 4. Xanadu, Toronto, Ontario, Canada 5. QuantumCTek Hefei, China Major Players Shaping the Quantum Computing Landscape in Middle East & Africa 1. Qilimanjaro Quantum Tech, Johannesburg, South Africa 2. Quantum Benchmark, Cape Town, South Africa 3. Entanglement Partners, Johannesburg, South Africa 4. Atos Quantum Johannesburg, South Africa 5. IQM, Abu Dhabi, United Arab Emirates Quantum Computing Market Pioneers in South America 1. IBM Quantum, Sao Paulo, Brazil 2. D-Wave Systems,São Paulo, Brazil 3. Entanglement Partners, Santiago, Chile 4. Toshiba Quantum Solutions, Sao Paulo, Brazil 5. Atos Quantum Buenos Aires, ArgentinaFAQs:

1] What segments are covered in the Global Quantum Computing Market report? Ans. The segments covered in the Quantum Computing Market report are based on Component, Technology, Application, End-User and Region. 2] Which region is expected to hold the highest share in the Global Quantum Computing Market? Ans. North America region is expected to hold the highest share in the Quantum Computing market. 3] What is the market size of the Global Quantum Computing Market by 2030? Ans. The market size of the Quantum Computing Market by 2030 is expected to reach US$ 3976.14 Bn. 4] What is the forecast period for the Global Quantum Computing Market? Ans. The forecast period for the Quantum Computing Market is 2024-2030. 5] What was the market size of the Global Quantum Computing Market in 2023? Ans. The market size of the Quantum Computing Market in 2023 was valued at US$ 801.19 Bn.

1. Quantum Computing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Quantum Computing Market: Dynamics 2.1. Quantum Computing Market Trends by Region 2.1.1. North America Quantum Computing Market Trends 2.1.2. Europe Quantum Computing Market Trends 2.1.3. Asia Pacific Quantum Computing Market Trends 2.1.4. Middle East and Africa Quantum Computing Market Trends 2.1.5. South America Quantum Computing Market Trends 2.2. Quantum Computing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Quantum Computing Market Drivers 2.2.1.2. North America Quantum Computing Market Restraints 2.2.1.3. North America Quantum Computing Market Opportunities 2.2.1.4. North America Quantum Computing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Quantum Computing Market Drivers 2.2.2.2. Europe Quantum Computing Market Restraints 2.2.2.3. Europe Quantum Computing Market Opportunities 2.2.2.4. Europe Quantum Computing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Quantum Computing Market Drivers 2.2.3.2. Asia Pacific Quantum Computing Market Restraints 2.2.3.3. Asia Pacific Quantum Computing Market Opportunities 2.2.3.4. Asia Pacific Quantum Computing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Quantum Computing Market Drivers 2.2.4.2. Middle East and Africa Quantum Computing Market Restraints 2.2.4.3. Middle East and Africa Quantum Computing Market Opportunities 2.2.4.4. Middle East and Africa Quantum Computing Market Challenges 2.2.5. South America 2.2.5.1. South America Quantum Computing Market Drivers 2.2.5.2. South America Quantum Computing Market Restraints 2.2.5.3. South America Quantum Computing Market Opportunities 2.2.5.4. South America Quantum Computing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Quantum Computing Industry 2.8. Analysis of Government Schemes and Initiatives For Quantum Computing Industry 2.9. The Global Pandemic Impact on Quantum Computing Market 3. Quantum Computing Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Quantum Computing Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Quantum Computing Market Size and Forecast, by Technology (2023-2030) 3.2.1. Superconducting qubits 3.2.2. Trapped ion qubits 3.2.3. Quantum Annealing 3.3. Quantum Computing Market Size and Forecast, by Application (2023-2030) 3.3.1. Simulation 3.3.2. Optimization 3.3.3. Sampling 3.4. Quantum Computing Market Size and Forecast, by End-User (2023-2030) 3.4.1. Defense 3.4.2. Banking & Finance 3.4.3. Energy & Power 3.4.4. Chemicals 3.4.5. Healthcare & Pharmaceuticals 3.5. Quantum Computing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Quantum Computing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Quantum Computing Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Quantum Computing Market Size and Forecast, by Technology (2023-2030) 4.2.1. Superconducting qubits 4.2.2. Trapped ion qubits 4.2.3. Quantum Annealing 4.3. North America Quantum Computing Market Size and Forecast, by Application (2023-2030) 4.3.1. Simulation 4.3.2. Optimization 4.3.3. Sampling 4.4. North America Quantum Computing Market Size and Forecast, by End-User (2023-2030) 4.4.1. Defense 4.4.2. Banking & Finance 4.4.3. Energy & Power 4.4.4. Chemicals 4.4.5. Healthcare & Pharmaceuticals 4.5. North America Quantum Computing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Quantum Computing Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.2. United States Quantum Computing Market Size and Forecast, by Technology (2023-2030) 4.5.1.2.1. Superconducting qubits 4.5.1.2.2. Trapped ion qubits 4.5.1.2.3. Quantum Annealing 4.5.1.3. United States Quantum Computing Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Simulation 4.5.1.3.2. Optimization 4.5.1.3.3. Sampling 4.5.1.4. United States Quantum Computing Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Defense 4.5.1.4.2. Banking & Finance 4.5.1.4.3. Energy & Power 4.5.1.4.4. Chemicals 4.5.1.4.5. Healthcare & Pharmaceuticals 4.5.2. Canada 4.5.2.1. Canada Quantum Computing Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada Quantum Computing Market Size and Forecast, by Technology (2023-2030) 4.5.2.2.1. Superconducting qubits 4.5.2.2.2. Trapped ion qubits 4.5.2.2.3. Quantum Annealing 4.5.2.3. Canada Quantum Computing Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Simulation 4.5.2.3.2. Optimization 4.5.2.3.3. Sampling 4.5.2.4. Canada Quantum Computing Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Defense 4.5.2.4.2. Banking & Finance 4.5.2.4.3. Energy & Power 4.5.2.4.4. Chemicals 4.5.2.4.5. Healthcare & Pharmaceuticals 4.5.3. Mexico 4.5.3.1. Mexico Quantum Computing Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico Quantum Computing Market Size and Forecast, by Technology (2023-2030) 4.5.3.2.1. Superconducting qubits 4.5.3.2.2. Trapped ion qubits 4.5.3.2.3. Quantum Annealing 4.5.3.3. Mexico Quantum Computing Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Simulation 4.5.3.3.2. Optimization 4.5.3.3.3. Sampling 4.5.3.4. Mexico Quantum Computing Market Size and Forecast, by End-User (2023-2030) 4.5.3.4.1. Defense 4.5.3.4.2. Banking & Finance 4.5.3.4.3. Energy & Power 4.5.3.4.4. Chemicals 4.5.3.4.5. Healthcare & Pharmaceuticals 5. Europe Quantum Computing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.2. Europe Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.4. Europe Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5. Europe Quantum Computing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.1.3. United Kingdom Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.2.3. France Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.3.3. Germany Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.4.3. Italy Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.5.3. Spain Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.6.3. Sweden Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.7.3. Austria Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Quantum Computing Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Quantum Computing Market Size and Forecast, by Technology (2023-2030) 5.5.8.3. Rest of Europe Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Quantum Computing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific Quantum Computing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. China Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.2. China Quantum Computing Market Size and Forecast, by End-User (2023-2030) S Korea 6.5.2.1. S Korea Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. S Korea Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Japan Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. India Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Australia Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Indonesia Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Malaysia Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Vietnam Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.9.3. Taiwan Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Quantum Computing Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Quantum Computing Market Size and Forecast, by Technology (2023-2030) 6.5.10.3. Rest of Asia Pacific Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Quantum Computing Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Quantum Computing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Quantum Computing Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Quantum Computing Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa Quantum Computing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Quantum Computing Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. South Africa Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.5.2. South Africa Quantum Computing Market Size and Forecast, by End-User (2023-2030) GCC 7.5.2.1. GCC Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Quantum Computing Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. GCC Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Quantum Computing Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Quantum Computing Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Nigeria Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Quantum Computing Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Quantum Computing Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. Rest of ME&A Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Quantum Computing Market Size and Forecast, by End-User (2023-2030) 8. South America Quantum Computing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Quantum Computing Market Size and Forecast, by Component (2023-2030) 8.2. South America Quantum Computing Market Size and Forecast, by Technology (2023-2030) 8.3. South America Quantum Computing Market Size and Forecast, by Application (2023-2030) 8.4. South America Quantum Computing Market Size and Forecast, by End-User (2023-2030) 8.5. South America Quantum Computing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Quantum Computing Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Quantum Computing Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. Brazil Quantum Computing Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Quantum Computing Market Size and Forecast, by End-User (2023-2030)8.5.2. Argentina 8.5.2.1. Argentina Quantum Computing Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Quantum Computing Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. Argentina Quantum Computing Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Quantum Computing Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Quantum Computing Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Quantum Computing Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Rest Of South America Quantum Computing Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Quantum Computing Market Size and Forecast, by End-User (2023-2030) 9. Global Quantum Computing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Quantum Computing Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Airbus Quantum Computing, Ottobrunn, Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Alibaba Quantum Lab, Hangzhou, China 10.3. Atos Quantum, Bezons, France 10.4. D-Wave Systems, British Columbia, Canada 10.5. Entanglement Partners, Johannesburg, South Africa 10.6. Entanglement Partners, Santiago, Chile 10.7. Google Quantum AI Lab, California, USA 10.8. Honeywell Quantum Solutions, Charlotte, North Carolina, USA 10.9. IBM Quantum, Sao Paulo, Brazil 10.10. IQM, Espoo, Finland 10.11. PsiQuantum, Palo Alto, California, USA 10.12. Qilimanjaro Quantum Tech, Lisbon, Portugal 10.13. Quantum Benchmark Kitchener, Ontario, Canada 10.14. QuantumCTek Hefei, China 10.15. Rigetti Computing, Berkeley, California, USA 10.16. Toshiba Quantum Solutions, Tokyo, Japan 10.17. Xanadu Toronto, Ontario, Canada 11. Key Findings 12. Industry Recommendations 13. Quantum Computing Market: Research Methodology