Global Platform as a Service (PaaS) Market size was valued at USD 81.30 Bn in 2023 and is expected to reach USD Bn by 2030, at a CAGR of 20.22%.Platform as a Service (PaaS) Market Overview

Platform as a Service (PaaS) redefines the landscape of cloud computing by providing developers a sanctuary to create, launch, and manage Verticals sans the complexities of infrastructure management. Within its structured framework brimming with tools, libraries, and middleware, PaaS seamlessly simplifies the development journey, liberating teams to focus their efforts on software creation rather than grappling with intricate hardware or software nuances. Nestled between Infrastructure as a Service (IaaS) and Software as a Service (SaaS), PaaS strikes an exquisite balance, granting both control and convenience. At its heart, PaaS extends a fertile platform where developers weave, assess, and deploy Verticals, harnessing pre-built tools and services that effortlessly navigate the development lifecycle. This rapid landscape encompasses an array of features like development tools, databases, middleware, operating systems, and runtime environments, all seamlessly accessible through web browsers or APIs. The real charm of the Platform as a Service (PaaS) Market shines through its scalability, effortlessly accommodating the ebb and flow of demand by automatically allotting resources to match varying workloads. This agility ensures peak performance sans the need for manual intervention, making it a preferred choice for businesses navigating unpredictable resource needs or dynamic fluctuations. PaaS fosters collaboration among development teams by erecting a centralized platform accessible by multiple users across diverse locations. This collaborative hub not only fosters version control and project management but also orchestrates the seamless integration of code changes among team members, catalyzing enhanced productivity and streamlined development timelines. From Vertical Development PaaS, Database PaaS, and Integration PaaS, to IoT PaaS, these varied offerings cater to a spectrum of Vertical needs, empowering developers to harness the precise tools and infrastructure to bring their visions to life. While the prowess of PaaS in fortifying security through rapid measures like data encryption, identity management, and access controls overstated, potential challenges like vendor lock-in and compliance requisites warrant careful consideration, especially in regulated industries handling sensitive information. PaaS, with stalwarts like Amazon Web Services (AWS) Elastic Beanstalk, Microsoft Azure App Service, Google App Engine, and Heroku, stands tall as a beacon of efficiency, offering tailored features and services that resonate with diverse Vertical development needs. Platform as a Service (PaaS) stands as the lodestar of simplicity in the Platform as a Service (PaaS) market, particularly in the Vertical development and deployment sphere, presenting a holistic platform teeming with tools, middleware, and infrastructure components. Its prowess in enabling scalability, bolstering collaboration, and optimizing efficiency makes it an irresistible choice for businesses seeking to expedite software development while alleviating the burdens of infrastructure management.To know about the Research Methodology :- Request Free Sample Report

Platform as a Service (PaaS) Market Dynamics

Integration Capabilities and Ecosystem Expansion to Boost Market Growth Integration capabilities serve as a cornerstone for PaaS platforms, enabling seamless connections with an extensive range of services, APIs, and tools. This interoperability not only enriches the platform's functionality and adaptability but also grants developers easy access to diverse features without extensive reengineering. The allure of this flexibility attracts a broader user base seeking platforms capable of accommodating diverse needs without demanding extensive customization. A PaaS platform equipped with rapid integration capabilities creates an environment that resonates with developers. Leveraging the existing suite of tools, services, and APIs within the ecosystem streamlines the development process significantly. This user-friendly convenience serves as a magnet for developers within the Platform as a Service (PaaS) Market, fostering a vibrant community that fuels innovation and propels the platform's growth trajectory. The expansion and interconnection of PaaS ecosystems trigger a network effect. As the ecosystem grows with the inclusion of additional services, tools, and users, it amplifies the platform's value for all participants. The interconnectedness solidifies the platform's allure, creating a continuous cycle where a larger ecosystem consistently enriches the platform's usefulness and appeal for both users and developers. With an expanded ecosystem come increased options, resources, and opportunities for businesses and developers, stimulating greater adoption and ongoing expansion. This expanded ecosystem serves as a breeding ground for collaboration and innovation. Seamless integration of diverse services and functionalities empowers developers to craft inventive Verticals and solutions. Collaborative efforts among various services and tools within the ecosystem often yield more sophisticated offerings, attracting a broader user base and propelling market growth. Platforms with rapid integration capabilities possess the agility to cater to diverse industry requirements. Tailoring integrations to specific sectors, such as healthcare, finance, or IoT, becomes a key strategy for PaaS providers to attract businesses within those sectors. This industry-focused approach facilitates the development of specialized solutions, extending the platform's influence across various sectors and boosting its market expansion. Rapid integration capabilities and a broad ecosystem serve as a significant competitive advantage within the Platform as a Service (PaaS) Market. Platforms that offer more integrations, services, and a vibrant ecosystem stand out among competitors. This differentiation attracts users looking for comprehensive solutions, contributing to the platform's growth. Trend Serverless Computing Adoption Serverless computing introduces a flexible payment structure, charging users based on actual resource usage. This model eliminates the need to pay for idle resources, potentially lowering costs. Developers focus on writing code without the hassle of managing servers or infrastructure, which optimizes resource use and cost-effectiveness. Serverless architectures automatically scale resources to handle varying workloads, allowing Verticals to seamlessly manage sudden surges in demand without manual intervention. This setup empowers developers to concentrate on building Verticals while the platform takes care of scaling, ensuring a smoother user experience. By handling server management tasks, serverless computing significantly reduces the operational burden on developers and IT teams. Tasks such as server maintenance, patching, and scaling become non-issues within the Platform as a Service (PaaS) market, enabling teams to prioritize Vertical development, innovation, and delivering tangible business value. The rapid deployment capability of serverless computing allows developers to swiftly deploy code without the complexities of server configuration, resulting in faster iterations and quicker time-to-market for Verticals and features. The design of serverless architectures aligns seamlessly with microservices and event-driven approaches, enabling developers to create Verticals as a collection of independent functions. This approach enhances modularity and agility, facilitating the development of complex Verticals that are easier to maintain and update. Serverless platforms dynamically manage resource allocation based on demand, ensuring optimal resource utilization. This dynamic management minimizes resource wastage, maximizing cost savings for users. Importantly, by relieving developers of infrastructure concerns, serverless computing allows them to concentrate solely on coding and implementing business logic. This simplified approach boosts developer productivity and fosters creativity in Vertical development. Restraint Vendor Lock-in Concerns Hinder Market Growth Businesses fear being overly reliant on a specific PaaS provider's proprietary tools, APIs, or infrastructure. This dependence restricts their flexibility and autonomy in making technology choices or migrating to alternative platforms. The deeper a business integrates and relies on a specific PaaS provider’s offering, the more challenging and costly it becomes to switch to another provider. This dependency poses risks of increased expenses during transitions. If a company decides to shift to a different PaaS provider or an alternate solution, substantial costs incur in redeveloping or reconfiguring Verticals and infrastructure to align with the new environment. Such expenses could discourage companies from exploring potentially better-suited or more cost-effective options. Certain Platform as a Service (PaaS) providers offer unique tools or technologies that don't easily fit with other platforms, making seamless integration a challenge. This lack of interoperability becomes a hurdle for businesses aiming to link Verticals and data across various environments, limiting their ability to adopt hybrid or multi-cloud strategies within the PaaS market. Worries about being tied to a specific vendor prevent companies from fully utilizing the distinct features and services offered by a particular PaaS provider. This reluctance to deeply integrate or utilize specialized functions could cap a company's innovation potential, restricting their access to advanced tools available through the platform. Concerns regarding vendor lock-in lead companies to approach a single PaaS provider cautiously. This cautious stance could influence the competitive landscape among PaaS vendors, potentially slowing down the pace of innovation and the introduction of improved services in the market.Platform as a Service (PaaS) Market Regional Insights

North America dominated the Platform as a Service (PaaS) Market share in 2023 and is expected to have the highest growth rate during the forecast period. North America, driven primarily by the United States, has spearheaded the adoption of cloud technology, particularly within Platform as a Service (PaaS). The region's swift integration of PaaS solutions stemmed from its robust IT infrastructure and a culture deeply rooted in embracing innovation. Notably, companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, all based in North America, wield substantial influence over the market's direction. Their significant investments in research, development, and comprehensive marketing initiatives have bolstered the region's standing, setting superior benchmarks and propelling innovation within PaaS technologies. North America's lively startup environment, deeply ingrained in an entrepreneurial spirit, fosters new businesses and fuels the demand for affordable cloud solutions offered by PaaS services. This ecosystem supports the birth of new ventures while driving the need for scalable, budget-friendly cloud solutions. Bolstered by ample venture capital and a plethora of investment opportunities, PaaS providers flourish, diversifying their offerings, refining their technologies, and making substantial strides into global markets. The seamless recognition of PaaS advantages by enterprises across North America ranging from large corporations to small and medium-sized entities stems from its prowess in scalability, flexibility, and cost efficiency. This profound awareness fuels an escalating demand for PaaS solutions across diverse industries, driving the region's continued dominance in the global PaaS market. North America's leadership in the Platform as a Service (PaaS) Market extends beyond just tech readiness; it fosters an environment nurturing growth and creativity. The early adoption of cloud tech, led by the United States, laid the foundation for a culture encouraging innovation. Major players including AWS, Microsoft Azure, and Google Cloud Platform, based here, greatly influence innovation benchmarks through hefty investments in research, development, and marketing. This collective push has driven the widespread adoption of PaaS solutions. North America's vibrant startup culture fosters a demand for cost-effective, scalable cloud solutions provided by PaaS providers. This demand is boosted by the availability of ample venture capital and diverse investment opportunities, giving PaaS companies the boost, they need to grow rapidly. The pervasive recognition of PaaS benefits among North American businesses ranging from mammoth enterprises to nimble SMEs based on its ability to scale, its adaptability, and its cost-effectiveness, amplifies the clamor for PaaS solutions across multifaceted industries. This collective understanding and demand serve as the bedrock of North America's continued dominance in the expansive global Platform as a Service (PaaS) Market.Platform as a Service (PaaS) Market Segment Analysis

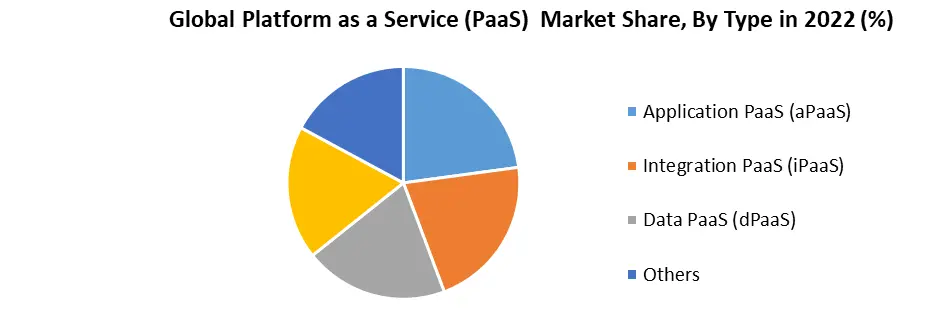

Based on type, the Application PaaS (aPaaS) is expected to dominate the Platform as a Service (PaaS) Market during the forecast period. aPaaS specializes in providing tailored tools, frameworks, and environments for developing Verticals, streamlining the process for a broader developer audience. Its user-friendly interfaces, pre-built components, and development environments simplify coding and Vertical creation, lowering entry barriers for developers. Its strength lies in expediting the development cycle by offering ready-made components, templates, and environments, enabling swift prototyping, testing, and deployment crucial in today's fast-paced market that demands rapid adaptation. Global spending on Platform as a Service (PaaS) varies by segment within the expansive PaaS market, reflecting diverse investment focuses across sectors like application PaaS, integration PaaS and Others. This segmentation underscores the nuanced allocation of resources across distinct PaaS offerings.Adaptable to various programming languages, databases, and frameworks, aPaaS seamlessly scales Verticals based on demand, ensuring they evolve with business needs without technological constraints. Operating on a pay-as-you-go model, it reduces infrastructure investments by abstracting complexities and minimizing hardware, software, and maintenance costs ideal for smaller businesses and startups striving to optimize budgets while fostering innovation. aPaaS platforms often provide centralized collaboration spaces, enhancing teamwork among developers for efficient code sharing, and version control, and fostering innovation across distributed teams, enabling seamless collaboration irrespective of locations.

Platform as a Service (PaaS) Market Scope: Inquire before buying

Global Platform as a Service (PaaS)Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 81.30 Bn. Forecast Period 2024 to 2030 CAGR: 20.22% Market Size in 2030: US $ 295.07 Bn. Segments Covered: By Type Application PaaS (aPaaS) Integration PaaS (iPaaS) Data PaaS (dPaaS) Others by Deployment Public Private Hybrid By Organization Size Small and Medium-sized Enterprises (SMEs) Large Enterprises by Vertical Banking & Financial Sector (BFSI) Consumer Goods & Retail Healthcare Logistics & Transportation Telecommunications & IT Others Platform as a Service (PaaS) Market Key Players

Global 1. Google (Mountain View, California, United States) 2. Microsoft (Redmond, Washington, United States) 3. Oracle (Redwood City, California, United States) 4. Amazon ( Seattle, Washington, United States) 5. IBM( Armonk, New York, United States) North America 1. Engine Yard (San Francisco, California, United States) 2. Gigaspaces (New York, United States) 3. Intuit (Mountain View, California, United States) 4. Longjump( Santa Clara, California, United States) 5. Netsuite( San Mateo, California, United States) 6. Red Hat (Raleigh, North Carolina, United States) 7. Salesforce( San Francisco, California, United States) 8. Tibco Software( Palo Alto, California, United States) 9. VMware( Palo Alto, California, United States 10. WSO2 (Mountain View, California, United States) 11. ActiveState( Vancouver, British Columbia, Canada) 12. Amazon( Seattle, Washington, United States) 13. AT&T Synaptic (Dallas, Texas, United States) 14. Bungee Labs( Orem, Utah, United States) 15. Citrix (Fort Lauderdale, Florida, United States) 16. Cloudbees Inc.(San Jose, California, United States) 17. Heroku (San Francisco, California, United States) 18. Pivotal Cloud Foundry( San Francisco, California, United States) 19. OpenShift by Red Hat( Raleigh, North Carolina, United States) Europe 1. Cordys( Putten, Netherlands) 2. SAP( Walldorf, Germany) Frequently Asked Questions: 1] What is the growth rate of the Global Platform as a Service (PaaS) Market? Ans. The Global Platform as a Service (PaaS) Market is growing at a significant rate of 20.22% during the forecast period. 2] Which region is expected to dominate the Global Platform as a Service (PaaS) Market? Ans. North America is expected to dominate the Platform as a Service (PaaS) Market during the forecast period. 3] What is the expected Global Platform as a Service (PaaS) Market size by 2030? Ans. The Platform as a Service (PaaS) Market size is expected to reach USD 295.07 Billion by 2030 4] Which are the top players in the Global Platform as a Service (PaaS) Market? Ans. The major top players in the Global Platform as a Service (PaaS) Market are Google (Mountain View, California, United States), Microsoft (Redmond, Washington, United States), Oracle (Redwood City, California, United States), Amazon ( Seattle, Washington, United States), IBM( Armonk, New York, United States), Gigaspaces (New York, United States) and others. 5] What are the factors driving the Global Platform as a Service (PaaS) Market growth? Ans. Technological advancements and Integration Capabilities and Ecosystem Expansion are expected to drive market growth during the forecast period.

1. Platform as a Service (PaaS) Market: Research Methodology 2. Platform as a Service (PaaS) Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Platform as a Service (PaaS) Market: Dynamics 3.1 Platform as a Service (PaaS) Market Trends by Region 3.1.1 North America Platform as a Service (PaaS) Market Trends 3.1.2 Europe Platform as a Service (PaaS) Market Trends 3.1.3 Asia Pacific Platform as a Service (PaaS) Market Trends 3.1.4 Middle East and Africa Platform as a Service (PaaS) Market Trends 3.1.5 South America Platform as a Service (PaaS) Market Trends 3.2 Platform as a Service (PaaS) Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Platform as a Service (PaaS) Market Drivers 3.2.1.2 North America Platform as a Service (PaaS) Market Restraints 3.2.1.3 North America Platform as a Service (PaaS) Market Opportunities 3.2.1.4 North America Platform as a Service (PaaS) Market Challenges 3.2.2 Europe 3.2.2.1 Europe Platform as a Service (PaaS) Market Drivers 3.2.2.2 Europe Platform as a Service (PaaS) Market Restraints 3.2.2.3 Europe Platform as a Service (PaaS) Market Opportunities 3.2.2.4 Europe Platform as a Service (PaaS) Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Platform as a Service (PaaS) Market Drivers 3.2.3.2 Asia Pacific Platform as a Service (PaaS) Market Restraints 3.2.3.3 Asia Pacific Platform as a Service (PaaS) Market Opportunities 3.2.3.4 Asia Pacific Platform as a Service (PaaS) Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Platform as a Service (PaaS) Market Drivers 3.2.4.2 Middle East and Africa Platform as a Service (PaaS) Market Restraints 3.2.4.3 Middle East and Africa Platform as a Service (PaaS) Market Opportunities 3.2.4.4 Middle East and Africa Platform as a Service (PaaS) Market Challenges 3.2.5 South America 3.2.5.1 South America Platform as a Service (PaaS) Market Drivers 3.2.5.2 South America Platform as a Service (PaaS) Market Restraints 3.2.5.3 South America Platform as a Service (PaaS) Market Opportunities 3.2.5.4 South America Platform as a Service (PaaS) Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives for the Platform as a Service (PaaS) Industry 3.7 The Global Pandemic and Redefining of The Platform as a Service (PaaS) Industry Landscape 3.8 Technological Road Map 4. Global Platform as a Service (PaaS) Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 4.1.1 Application PaaS (aPaaS) 4.1.2 Integration PaaS (iPaaS) 4.1.3 Data PaaS (dPaaS) 4.1.4 Others 4.2 Global Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 4.2.1 Public 4.2.2 Private 4.2.3 Hybrid 4.3 Global Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 4.3.1 Small and Medium-sized Enterprises (SMEs) 4.3.2 Large Enterprises 4.4 Global Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 4.4.1 Banking & Financial Sector (BFSI) 4.4.2 Consumer Goods & Retail 4.4.3 Healthcare 4.4.4 Logistics & Transportation 4.4.5 Telecommunications & IT 4.4.6 Others 4.5 Global Platform as a Service (PaaS) Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Platform as a Service (PaaS) Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 5.1.1 Application PaaS (aPaaS) 5.1.2 Integration PaaS (iPaaS) 5.1.3 Data PaaS (dPaaS) 5.1.4 Others 5.2 North America Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 5.2.1 Public 5.2.2 Private 5.2.3 Hybrid 5.3 North America Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 5.3.1 Small and Medium-sized Enterprises (SMEs) 5.3.2 Large Enterprises 5.4 North America Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 5.4.1 Banking & Financial Sector (BFSI) 5.4.2 Consumer Goods & Retail 5.4.3 Healthcare 5.4.4 Logistics & Transportation 5.4.5 Telecommunications & IT 5.4.6 Others 5.5 North America Platform as a Service (PaaS) Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 5.5.1.1.1 Application PaaS (aPaaS) 5.5.1.1.2 Integration PaaS (iPaaS) 5.5.1.1.3 Data PaaS (dPaaS) 5.5.1.1.4 Others 5.5.1.2 United States Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 5.5.1.2.1 Public 5.5.1.2.2 Private 5.5.1.2.3 Hybrid 5.5.1.3 United States Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 5.5.1.3.1 Small and Medium-sized Enterprises (SMEs) 5.5.1.3.2 Large Enterprises 5.5.1.4 United States Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 5.5.1.4.1 Banking & Financial Sector (BFSI) 5.5.1.4.2 Consumer Goods & Retail 5.5.1.4.3 Healthcare 5.5.1.4.4 Logistics & Transportation 5.5.1.4.5 Telecommunications & IT 5.5.1.4.6 Others 5.5.2 Canada 5.5.2.1 Canada Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 5.5.2.1.1 Application PaaS (aPaaS) 5.5.2.1.2 Integration PaaS (iPaaS) 5.5.2.1.3 Data PaaS (dPaaS) 5.5.2.1.4 Others 5.5.2.2 Canada Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 5.5.2.2.1 Public 5.5.2.2.2 Private 5.5.2.2.3 Hybrid 5.5.2.3 Canada Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 5.5.2.3.1 Small and Medium-sized Enterprises (SMEs) 5.5.2.3.2 Large Enterprises 5.5.2.4 Canada Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 5.5.2.4.1 Banking & Financial Sector (BFSI) 5.5.2.4.2 Consumer Goods & Retail 5.5.2.4.3 Healthcare 5.5.2.4.4 Logistics & Transportation 5.5.2.4.5 Telecommunications & IT 5.5.2.4.6 Others 5.5.3 Mexico 5.5.3.1 Mexico Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 5.5.3.1.1 Application PaaS (aPaaS) 5.5.3.1.2 Integration PaaS (iPaaS) 5.5.3.1.3 Data PaaS (dPaaS) 5.5.3.1.4 Others 5.5.3.2 Mexico Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 5.5.3.2.1 Public 5.5.3.2.2 Private 5.5.3.2.3 Hybrid 5.5.3.3 Mexico Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 5.5.3.3.1 Small and Medium-sized Enterprises (SMEs) 5.5.3.3.2 Large Enterprises 5.5.3.4 Mexico Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 5.5.3.4.1 Banking & Financial Sector (BFSI) 5.5.3.4.2 Consumer Goods & Retail 5.5.3.4.3 Healthcare 5.5.3.4.4 Logistics & Transportation 5.5.3.4.5 Telecommunications & IT 5.5.3.4.6 Others 6. Europe Platform as a Service (PaaS) Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.2 Europe Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.3 Europe Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.4 Europe Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030 6.5 Europe Platform as a Service (PaaS) Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.1.2 United Kingdom Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.1.3 United Kingdom Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.1.4 United Kingdom Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.2 France 6.5.2.1 France Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.2.2 France Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.2.3 France Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.2.4 France Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.3.2 Germany Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.3.3 Germany Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.3.4 Germany Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.4.2 Italy Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.4.3 Italy Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.4.4 Italy Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.5.2 Spain Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.5.3 Spain Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.5.4 Spain Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.6.2 Sweden Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.6.3 Sweden Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.6.4 Sweden Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.7.2 Austria Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 6.5.7.3 Austria Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.7.4 Austria Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 6.5.8.2 Rest of EuropePlatform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030). 6.5.8.3 Rest of Europe Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 6.5.8.4 Rest of Europe Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7. Asia Pacific Platform as a Service (PaaS) Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.2 Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.3 Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.4 Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2022- 7.5 Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.1.2 China Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.1.3 China Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.1.4 China Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.2.2 S Korea Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.2.3 S Korea Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.2.4 S Korea Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.3.2 Japan Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.3.3 Japan Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.3.4 Japan Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.4 India 7.5.4.1 India Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.4.2 India Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.4.3 India Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.4.4 India Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.5.2 Australia Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.5.3 Australia Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.5.4 Australia Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.6.2 Indonesia Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.6.3 Indonesia Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.6.4 Indonesia Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.7.2 Malaysia Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.7.3 Malaysia Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.7.4 Malaysia Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.8.2 Vietnam Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.8.3 Vietnam Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.8.4 Vietnam Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.9.2 Taiwan Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.9.3 Taiwan Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.9.4 Taiwan Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.10.2 Bangladesh Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.10.3 Bangladesh Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.10.4 Bangladesh Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.11.2 Pakistan Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.11.3 Pakistan Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.11.4 Pakistan Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 7.5.12.2 Rest of Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 7.5.12.3 Rest of Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 7.5.12.4 Rest of Asia Pacific Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8. Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.2 Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.3 Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.4 Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8.5 Middle East and Africa Platform as a Service (PaaS) Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.5.1.2 South Africa Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.5.1.3 South Africa Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.5.1.4 South Africa Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.5.2.2 GCC Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.5.2.3 GCC Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.5.2.4 GCC Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.5.3.2 Egypt Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.5.3.3 Egypt Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.5.3.4 Egypt Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.5.4.2 Nigeria Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.5.4.3 Nigeria Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.5.4.4 Nigeria Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 8.5.5.2 Rest of ME&A Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 8.5.5.3 Rest of ME&A Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 8.5.5.4 Rest of ME&A Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 9. South America Platform as a Service (PaaS) Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 9.2 South America Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 9.3 South America Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 9.4 South America Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 9.5 South America Platform as a Service (PaaS) Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 9.5.1.2 Brazil Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 9.5.1.3 Brazil Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 9.5.1.4 Brazil Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 9.5.2.2 Argentina Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 9.5.2.3 Argentina Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 9.5.2.4 Argentina Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Platform as a Service (PaaS) Market Size and Forecast, by Type (2023-2030) 9.5.3.2 Rest Of South America Platform as a Service (PaaS) Market Size and Forecast, by Deployment (2023-2030) 9.5.3.3 Rest Of South America Platform as a Service (PaaS) Market Size and Forecast, by Organization Size (2023-2030) 9.5.3.4 Rest Of South America Platform as a Service (PaaS) Market Size and Forecast, by Vertical (2023-2030) 10. Global Platform as a Service (PaaS) Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Platform as a Service (PaaS) Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Google (Mountain View, California, United States) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Microsoft (Redmond, Washington, United States) 11.3 Oracle (Redwood City, California, United States) 11.4 Amazon ( Seattle, Washington, United States) 11.5 IBM( Armonk, New York, United States) 11.6 Engine Yard (San Francisco, California, United States) 11.7 Gigaspaces (New York, United States) 11.8 Intuit (Mountain View, California, United States) 11.9 Longjump( Santa Clara, California, United States) 11.10 Netsuite( San Mateo, California, United States) 11.11 Red Hat (Raleigh, North Carolina, United States) 11.12 Salesforce( San Francisco, California, United States) 11.13 Tibco Software( Palo Alto, California, United States) 11.14 VMware( Palo Alto, California, United States 11.15 WSO2 (Mountain View, California, United States) 11.16 ActiveState( Vancouver, British Columbia, Canada) 11.17 Amazon( Seattle, Washington, United States) 11.18 AT&T Synaptic (Dallas, Texas, United States) 11.19 Bungee Labs( Orem, Utah, United States) 11.20 Citrix (Fort Lauderdale, Florida, United States) 11.21 Cloudbees Inc.(San Jose, California, United States) 11.22 Heroku (San Francisco, California, United States) 11.23 Pivotal Cloud Foundry( San Francisco, California, United States) 11.24 OpenShift by Red Hat( Raleigh, North Carolina, United States) 11.25 Cordys( Putten, Netherlands) 11.26 SAP( Walldorf, Germany) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary