Global Plastic Packaging Market size was valued at USD 410.33 Bn in 2024 and the total Plastic Packaging Market revenue is expected to grow at 4.2% through 2025 to 2032, reaching nearly USD 570.26 Bn.Plastic Packaging Market Overview

Plastic packaging refers to use of synthetic or semi synthetic polymer-based material to enclose, protect, preserve, market and distribute goods across industries like food & beverage, pharmaceuticals, cosmetics and consumer product. Plastic packaging market growth has been fuelled by rising demand across food & beverage, pharmaceutical and consumer goods sector by convenience, durability and cost efficiency. Flexible packaging dominated by its lightweight, space saving benefit and adaptability to ecommerce need while rigid packaging remain critical for product protection and shelf appeal. Sustainability concern is reshaping global plastic packaging industry with biobased plastic, recyclable material and circular economy initiative gaining attraction amid stricter regulation and eco conscious consumer preference. Asia Pacific led market supported by rapid urbanization and expanding retail sector while North America and Europe focus on innovation in sustainable packaging solution. Key player like Amcor, Berry Global and Mondi are investing in advanced material and smart packaging technology to enhance functionality and reduce environmental impact. This dynamic landscape underscore plastic packaging evolving role in balancing practicality with sustainability in a resource conscious world. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data, and projections with a suitable set of assumptions and methodology. The report also helps in understanding global plastic packaging market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence.To know about the Research Methodology :- Request Free Sample Report

Plastic Packaging Market Dynamics

ROI of Packaging to Drive Plastic Packaging Market Large brands are focusing on personalized and customized plastic packaging to create an impact on consumers and enhance brand consciousness. Packaging enables companies to differentiate brands and offer personalization. Packaging can offer links to information about the product, both enhancing the product and providing details about its provenance. Plastic packaging enables enhancement of brand power for global brands and offers an effective method to compete with private labels and developing local players. Growth in digitalization offers consumers access to huge and detailed information. Communicating brand values effectively and enabling product differentiation is a major factor driving the growth of the plastic packaging industry. Rising Raw Material Cost to Restrain Plastic Packaging Market Few restraining factors are anticipated to frighten demand in the global plastic packaging market. One of the key restraints is the high prices of raw material that generate from crude oil or petrochemicals are used to produce plastics. Furthermore, increasing prices of crude oil are also fluctuating at the global level that further raises the cost of transportation and exploration. This factor is also likely to obstruct growth in the global plastic packaging market. Flexible Packaging to Create Opportunities in Plastic Packaging Market In the global plastic packaging market, the demand for rigid packaging is anticipated to increase at a high rate over the projected period. But there are also high chances that flexible packaging might lead the market because of the increasing demand for flexible packaging. As flexible packaging increases toughness and tensile strength and is capable of storing a large volume of products, its demand is boosted across the globe.Plastic Packaging Market Segment Analysis

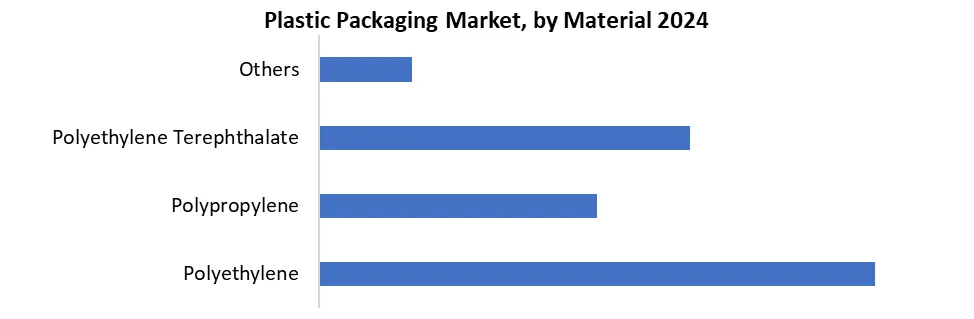

Based on Product, plastic packaging market is segmented into flexible and rigid packaging. In 2024 flexible plastic packaging dominated global market driven by its cost efficiency, lightweight properties and sustainability advantages. The segment includes pouches, films and bags which are increasingly favoured by brands and consumers due to its lower material usage, reduced transportation costs and ability to extend product shelf life (e.g., in food packaging). The rise of e-commerce and demand for convenient, single serve packaging further boosts its adoption. Based on Material, plastic packaging market is segmented into polyethylene, polyethylene terephthalate, polypropylene, etc. Polyethylene (PE) dominated plastic packaging market in 2024, by its variety, cost effectiveness and wide range of application. As most commonly used plastic PE is favoured for its durability, flexibility and resistance to moisture making it ideal for packaging product like food & beverages, consumer goods and pharmaceutical. Its two primary forms high density polyethylene for rigid packaging and low-density polyethylene for flexible packaging cater to diverse industry needs.

Plastic Packaging Market Regional Insights:

Asia Pacific Dominated Plastic Packaging Market in 2024 and is Expected to Dominate During the Forecast Period (2025-2032) Geographically, Asia Pacific held a dominant share in the global plastic packaging market. High consumption of packaged food and increasing consumerism have made this region led the global market. However, the demand for plastic packaging is diminishing in Europe and North America, caused by the problem faced during its disposal.Report for global plastic packaging market comprises of wide primary research along with the complete analysis of qualitative as well as quantitative aspects by numerous industry experts, key opinion leaders to gain the deeper perception of the market and industry performance. The report gives a clear picture of present market scenario which contains historical and projected market size in terms of value and volume, technological advancement, macroeconomic, and governing factors in the market. The report delivers detailed information and strategies of the top key players in the industry. The report also gives a comprehensive study of the different market segments and regions.

Plastic Packaging Market Competitive Landscape

Sealed Air Corporation is global leader in protective and specialty packaging solutions renowned for its Cryovac food packaging and Bubble Wrap cushioning, serving industries like food, ecommerce and healthcare. It competes with dominant players like Amcor (US/AU), Berry Global (US) and Sonoco (US) in rigid and flexible packaging while facing disruption from emerging innovator such as TIPA (compostable films) and Notpla in sustainable alternatives. Sealed Air maintain an edge through R&D in high barrier film, automation ready packaging and recyclable solution but face pressure from cost efficient Asian manufacturers and circular economy focused startup. Strategic acquisition and partnership with recyclers, position it as a resilient yet evolving player in a market increasingly driven by ESG demands.Plastic Packaging Market Key Trends

• Sustainability-Driven Innovation: Startups like TIPA and Notpla are scaling seaweed-based and PHA (polyhydroxyalkanoate) packaging as fossil-fuel alternatives. • Smart & Connected Packaging: Brands used digital triggers for traceability, anti-counterfeiting, and consumer engagement (e.g., Berry Global’s smart medicine bottles). • Cost-Efficiency & Hybrid Solutions: Advanced materials (e.g., Dow’s PE resins) reduce plastic use without compromising barrier properties. Plastic Packaging Market Key Developments • Ampac Holdings LLC (US)- March 2024: Launched RecycAll, a fully recyclable stand-up pouch for snacks and pet food, addressing the demand for sustainable flexible packaging. • CCL Industries, Inc. (Canada)- November 2024: Acquired EcoLabel Solutions, a European sustainable label manufacturer, to expand its eco-friendly packaging portfolio. • Mondi plc (UK)- June 2025: Partnered with SABIC to introduce barrier-coated paper packaging for dry foods, replacing plastic laminates in retail. • Amcor Ltd. (Switzerland)- September 2024: Unveiled Amcor Lift-Off, a patented recyclable blister pack for pharmaceuticals, meeting EU’s 2025 recyclability targets. • Reynolds Group (New Zealand)- February 2025: Scaled production of OceanGuard, a marine-degradable food wrap, after securing contracts with Australasian supermarkets.Plastic Packaging Market Scope: Inquire before buying

Plastic Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 410.33 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 570.26 Bn. Segments Covered: by Product Rigid Packaging Flexible Packaging by Material Polyethylene (PE) Polyethylene terephthalate (PET) Polypropylene (PP) Others by Application Food & Beverages Industrial Household Products Medical/Pharmaceuticals Others Plastic Packaging Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Key Players Operating in the Plastic Packaging Market

North America 1. Ampac Holdings LLC (US) 2. Bemis Company, Inc (US) 3. Sealed Air Corporation (US) 4. Sonoco Products Company (US) 5. Berry Plastic Corporation (US) 6. NatureWorks LLC (US) 7. BALL CORPORATION, (US) 8. PROLAMINA PACKAGING (US) 9. CCL Industries, Inc. (Canada) 10. CCC Packaging, (Canada) Europe 11. Notpla (UK) 12. Mondi plc (UK) 13. DS Smith, (UK) 14. Amcor Ltd. (Switzerland) 15. Tetra Laval International S.A (Switzerland) 16. Huhtamaki Oyj (Finland) 17. Wipak Group (Finland) 18. Ukrplastic Corporation (Ukraine) 19. Constantia Flexibles International GmbH. (Austria) 20. Coveris (Austria) 21. ALPLA, (Austria) Asia Pacific 22. Reynolds Pens, (New Zealand) 23. TIPA (Israel)Frequently Asked Questions:

1. Which region has the largest share in Global Plastic Packaging Market? Ans: Asia Pacific region holds the highest share in 2024. 2. What is the growth rate of Global Plastic Packaging Market? Ans: The Global Plastic Packaging Market is growing at a CAGR of 4.2% during forecasting period 2025-2032. 3. What is scope of the Global Market report? Ans: Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Market? Ans: The important key players in the Market are – Amcor Ltd., Ampac Holdings LLC, Bemis Company, Inc, Huhtamaki Oyj, Mondi plc, Sealed Air Corporation, Ukrplastic Corporation, Wipak Group, Sonoco Products Company.

1. Plastic Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Plastic Packaging Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Plastic Packaging Market: Dynamics 3.1. Plastic Packaging Market Trends 3.1.1. North America Plastic Packaging Market Trends 3.1.2. Europe Plastic Packaging Market Trends 3.1.3. Asia Pacific Plastic Packaging Market Trends 3.1.4. Middle East and Africa Plastic Packaging Market Trends 3.1.5. South America Plastic Packaging Market Trends 3.2. Global Plastic Packaging Market Dynamics 3.2.1. Global Plastic Packaging Market Drivers 3.2.1.1. ROI of Packaging 3.2.2. Global Plastic Packaging Market Restraints 3.2.3. Global Plastic Packaging Market Opportunities 3.2.3.1. Flexible Packaging 3.2.4. Global Plastic Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Regulatory Impact 3.4.2. Material Innovations 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Plastic Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Plastic Packaging Market Size and Forecast, By Product (2024-2032) 4.1.1. Rigid Packaging 4.1.2. Flexible Packaging 4.2. Plastic Packaging Market Size and Forecast, By Material (2024-2032) 4.2.1. Polyethylene (PE) 4.2.2. Polyethylene terephthalate (PET) 4.2.3. Polypropylene (PP) 4.2.4. Others 4.3. Plastic Packaging Market Size and Forecast, By Application (2024-2032) 4.3.1. Food & Beverages 4.3.2. Industrial 4.3.3. Household Products 4.3.4. Medical/Pharmaceuticals 4.3.5. Others 4.4. Plastic Packaging Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Plastic Packaging Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Plastic Packaging Market Size and Forecast, By Product (2024-2032) 5.1.1. Rigid Packaging 5.1.2. Flexible Packaging 5.2. North America Plastic Packaging Market Size and Forecast, By Material (2024-2032) 5.2.1. Polyethylene (PE) 5.2.2. Polyethylene terephthalate (PET) 5.2.3. Polypropylene (PP) 5.2.4. Others 5.3. North America Plastic Packaging Market Size and Forecast, By Application (2024-2032) 5.3.1. Food & Beverages 5.3.2. Industrial 5.3.3. Household Products 5.3.4. Medical/Pharmaceuticals 5.3.5. Others 5.4. North America Plastic Packaging Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Plastic Packaging Market Size and Forecast, By Product (2024-2032) 5.4.1.1.1. Rigid Packaging 5.4.1.1.2. Flexible Packaging 5.4.1.2. United States Plastic Packaging Market Size and Forecast, By Material (2024-2032) 5.4.1.2.1. Polyethylene (PE) 5.4.1.2.2. Polyethylene terephthalate (PET) 5.4.1.2.3. Polypropylene (PP) 5.4.1.2.4. Others 5.4.1.3. United States Plastic Packaging Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Food & Beverages 5.4.1.3.2. Industrial 5.4.1.3.3. Household Products 5.4.1.3.4. Medical/Pharmaceuticals 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Plastic Packaging Market Size and Forecast, By Product (2024-2032) 5.4.2.1.1. Rigid Packaging 5.4.2.1.2. Flexible Packaging 5.4.2.2. Canada Plastic Packaging Market Size and Forecast, By Material (2024-2032) 5.4.2.2.1. Polyethylene (PE) 5.4.2.2.2. Polyethylene terephthalate (PET) 5.4.2.2.3. Polypropylene (PP) 5.4.2.2.4. Others 5.4.2.3. Canada Plastic Packaging Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Food & Beverages 5.4.2.3.2. Industrial 5.4.2.3.3. Household Products 5.4.2.3.4. Medical/Pharmaceuticals 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Plastic Packaging Market Size and Forecast, By Product (2024-2032) 5.4.3.1.1. Rigid Packaging 5.4.3.1.2. Flexible Packaging 5.4.3.2. Mexico Plastic Packaging Market Size and Forecast, By Material (2024-2032) 5.4.3.2.1. Polyethylene (PE) 5.4.3.2.2. Polyethylene terephthalate (PET) 5.4.3.2.3. Polypropylene (PP) 5.4.3.2.4. Others 5.4.3.3. Mexico Plastic Packaging Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Food & Beverages 5.4.3.3.2. Industrial 5.4.3.3.3. Household Products 5.4.3.3.4. Medical/Pharmaceuticals 5.4.3.3.5. Others 6. Europe Plastic Packaging Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.2. Europe Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.3. Europe Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4. Europe Plastic Packaging Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.1.2. United Kingdom Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.1.3. United Kingdom Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.2.2. France Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.2.3. France Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.3.2. Germany Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.3.3. Germany Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.4.2. Italy Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.4.3. Italy Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.5.2. Spain Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.5.3. Spain Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.6.2. Sweden Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.6.3. Sweden Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.7.2. Russia Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.7.3. Russia Plastic Packaging Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Plastic Packaging Market Size and Forecast, By Product (2024-2032) 6.4.8.2. Rest of Europe Plastic Packaging Market Size and Forecast, By Material (2024-2032) 6.4.8.3. Rest of Europe Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Plastic Packaging Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.3. Asia Pacific Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Plastic Packaging Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.1.2. China Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.1.3. China Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.2.2. S Korea Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.2.3. S Korea Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.3.2. Japan Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.3.3. Japan Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.4.2. India Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.4.3. India Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.5.2. Australia Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.5.3. Australia Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.6.2. Indonesia Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.6.3. Indonesia Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.7.2. Malaysia Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.7.3. Malaysia Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.8.2. Philippines Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.8.3. Philippines Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.9.2. Thailand Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.9.3. Thailand Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.10.2. Vietnam Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.10.3. Vietnam Plastic Packaging Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Plastic Packaging Market Size and Forecast, By Product (2024-2032) 7.4.11.2. Rest of Asia Pacific Plastic Packaging Market Size and Forecast, By Material (2024-2032) 7.4.11.3. Rest of Asia Pacific Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Plastic Packaging Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.3. Middle East and Africa Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Plastic Packaging Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.4.1.2. South Africa Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.4.1.3. South Africa Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.4.2.2. GCC Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.4.2.3. GCC Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.4.3.2. Egypt Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.4.3.3. Egypt Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.4.4.2. Nigeria Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.4.4.3. Nigeria Plastic Packaging Market Size and Forecast, By Application (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Plastic Packaging Market Size and Forecast, By Product (2024-2032) 8.4.5.2. Rest of ME&A Plastic Packaging Market Size and Forecast, By Material (2024-2032) 8.4.5.3. Rest of ME&A Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9. South America Plastic Packaging Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.2. South America Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.3. South America Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9.4. South America Plastic Packaging Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.4.1.2. Brazil Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.4.1.3. Brazil Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.4.2.2. Argentina Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.4.2.3. Argentina Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.4.3.2. Colombia Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.4.3.3. Colombia Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.4.4.2. Chile Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.4.4.3. Chile Plastic Packaging Market Size and Forecast, By Application (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Plastic Packaging Market Size and Forecast, By Product (2024-2032) 9.4.5.2. Rest Of South America Plastic Packaging Market Size and Forecast, By Material (2024-2032) 9.4.5.3. Rest Of South America Plastic Packaging Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. Ampac Holdings LLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Bemis Company, Inc 10.3. Sealed Air Corporation 10.4. Sonoco Products Company 10.5. Berry Plastic Corporation 10.6. NatureWorks LLC 10.7. BALL CORPORATION, 10.8. PROLAMINA PACKAGING 10.9. CCL Industries, Inc. 10.10. CCC Packaging, 10.11. Notpla 10.12. Mondi plc 10.13. DS Smith, 10.14. Amcor Ltd. 10.15. Tetra Laval International S.A 10.16. Huhtamaki Oyj 10.17. Wipak Group 10.18. Ukrplastic Corporation 10.19. Constantia Flexibles International GmbH. 10.20. Coveris 10.21. ALPLA, 10.22. Reynolds Pens, 10.23. TIPA 11. Key Findings 12. Industry Recommendations 13. Plastic Packaging Market: Research Methodology