The Global Photonic Sensor Market size was valued at USD 42.32 Billion in 2023 and the total Photonic Sensor revenue is expected to grow at a CAGR of 16.75% from 2024 to 2030, reaching nearly USD 125.13 Billion. Photonics is the science of light generation, detection, and manipulation and is used to develop technologies spanning sources and sensors to quantum computers. It serves as the backbone of the internet and is extensively used in autonomous vehicles, healthcare diagnostics and treatments, and the 5G network. A photonic sensor is a device designed to capture light and convert it into an electrical signal. It is commonly employed in integrated light emission detection and transmission through fiber optics and other optical components. Photonic sensors are widely utilized in solar and photovoltaic (PV) cells, light-emitting diodes (LEDs), light detection and ranging (LIDAR), Laser-Induced Fluorescence (LIF), calorimetry, scintillation detection, spectrometry, and biological fluorescence detection. As a result, they have widespread use in aerospace and defense, energy and power, healthcare, and manufacturing industries for early detection and warning systems related to structural flaws, biological hazards, and security threats. The photonic sensor market is experiencing substantial growth due to various factors that are covered in the MMR global report. The increasing industrialization in developing economies, coupled with a rising demand for advanced safety and security solutions are expected to be the key drivers driving the global photonic sensor industry. Photonic sensors offer self-operated monitoring of industrial processes and accurate data collection on centralized servers, further boosting their adoption. The widespread use of wireless sensing technology is expected to further support the photonic sensor market growth during the forecast period. Additionally, the popularity of photonic sensors in manufacturing image and illumination sensors, lasers, LED flashes, and other electro-optical instruments is on the rise, driven by advancements in fiber optics technology. Technological advancements play a significant role in photonic sensor market growth, with the development of high-performance devices and multi-wavelength light generation capabilities. Besides that, the Industry 4.0 revolution has spurred the adoption of photonic sensors for applications like early warning systems, wind measurement, and turbine structural health monitoring, further driving the photonic sensor market growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Photonic Sensor Market Competition:

Opportunities and Integration in the Growing Photonics Sensor Industry Drive M&A Activity As the photonic sensor market and integrated devices sectors grow, mergers and acquisitions (M&A) are gaining significance. Despite recent deal activity, the laser-device industry remains fragmented, with many small players focusing on specialized niches. This fragmentation presents opportunities for operators, board members, and investors to explore synergistic combinations and partnerships. Some laser manufacturers and end customers are already pursuing such deals to create devices that integrate precision optics, sensors, and lasers. For example, a major lithography systems supplier acquired a precision-optics company to enhance its capabilities in extreme-ultraviolet and deep-ultraviolet products. Another leading industrial applications company acquired minority stakes in laser-technology firms to strengthen its materials-processing capabilities. It also acquired a company manufacturing photonics components and products used in sensors for autonomous driving, smartphones, and digital data transmission.As integration among lasers, sensors, and optics becomes crucial for next-generation systems, operators and board members need to rethink their product strategies and position themselves in the value chain. Software is gaining importance in this traditionally hardware-driven industry, with effective integration and real-time monitoring requiring robust software solutions. Remote diagnostics, adjustments, and calibration are becoming essential serviceability requirements, creating opportunities for offering services throughout the system's life. As OEMs embrace photonics systems to meet customer needs, the boundaries between component suppliers, subsystem providers, and device integrators are expected to increase during the forecast periods.

Date Company One Company Two Type of Investment Description February 15, 2021 II-VI Incorporated CoAdna Holdings Inc. Acquisition II-VI Incorporated, a global leader in engineered materials and optoelectronic components, completed the acquisition of CoAdna Holdings Inc., a provider of compact coherent optics solutions for the data center and telecommunications markets. This acquisition enhances II-VI's portfolio of photonic sensor technologies, allowing them to cater to the growing demand in the industry. January 4, 2021 Honeywell Sparta Systems Acquisition Honeywell, a multinational conglomerate, acquired Sparta Systems, a provider of quality management software solutions, including software for managing compliance and risk in the life sciences industry. This acquisition allowed Honeywell to integrate advanced photonics sensors and technologies into Sparta Systems' offerings, facilitating enhanced data monitoring and analysis capabilities. May 8, 2020 ams AG OSRAM Licht AG Acquisition ams AG, a leading provider of high-performance sensor solutions, successfully acquired OSRAM Licht AG, a global photonics company. This merger created a comprehensive supplier of advanced photonic sensors and solutions, enabling ams AG to expand its presence in various industries, including automotive, consumer electronics, and industrial applications. Photonic Sensor Market Dynamics:

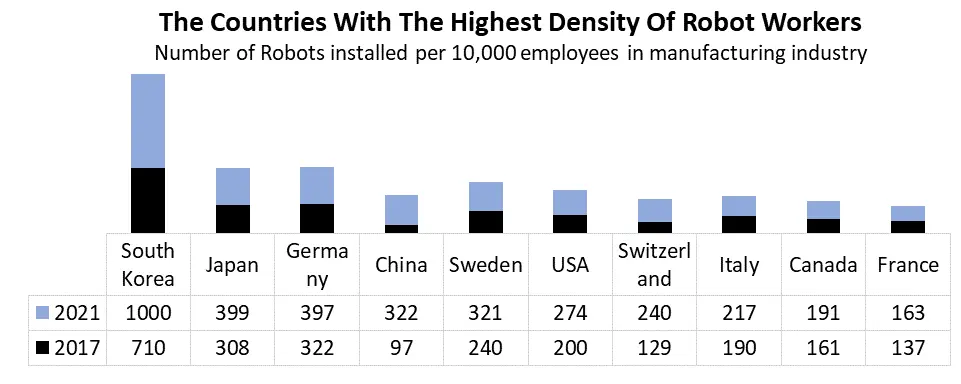

Photonic Sensor Integration Drives Versatility and Efficiency across Industries The integration of photonic sensor technologies, such as silicon photodiodes, CCD sensors, and CMOS sensors, is blurring the lines between component suppliers, subsystem providers, and device integrators. Original equipment manufacturers (OEMs) are increasingly adopting photonics systems to meet customer demands, leading to the exploration of new methods to integrate multiple functionalities into a single device, providing improved capabilities and efficiency. Silicon photodiodes, including silicon photomultipliers, are extensively used in applications requiring numerous detectors. In LiDAR and time-of-flight sensing, these photodiodes accurately measure distance and depth using pulsed lasers. As these technologies become more prevalent in areas like autonomous vehicles and distance measurement systems, the demand for integrated photonics solutions is anticipated to grow significantly, fostering the growth of the photonic sensor market in the forecast period. CCD sensors and CMOS sensors, both utilizing silicon photodiodes, find extensive use in spectroscopy, machine vision, and defense applications. The integration of these sensors with precision optics and other components allows for advanced imaging and detection systems with improved sensitivity and resolution. In the industrial sector, the integration of photonic sensors with precision optics has resulted in enhanced capabilities for cutting lasers used in manufacturing. By incorporating sensors that can detect parameters such as surface finish, density, depth of cut, and thermal stress on materials, these lasers can make real-time adjustments during the cutting process, optimizing efficiency and quality. The use of beam-splitting filters and other optical elements enables simultaneous laser cutting and measurement in the same optical path. Thus, the trend toward integration is driven by the desire to create more compact, efficient, and versatile devices. As a result, the demand has increased significantly, driving the photonic sensor market growth. Manufacturers are expected to minimize complexity, enhance performance, and open up new possibilities for diverse applications, by combining multiple functionalities into a single system. This integration of photonic sensor technologies across various industries is likely to continue as advancements in photonics and optical engineering enable further miniaturization and performance improvements, thereby supporting the photonic sensor market growth. Increasing Adoption Photonic Sensor in Industrial Automation In the manufacturing industry, automation of manufacturing, especially the introduction of robots, is being actively promoted because of labor shortages and rising labor costs. In recent years, as the situation where the issues of labor shortages and rising labor costs increase in severity in the manufacturing industry, then automation of assembly, inspection, and carrying processes that essentially require experience, and a sense of reliance on humans are urgent needs. In addition, the improvement of productivity by substituting machines (robots) for human work is increasingly demanded at manufacturing sites. The increasing adoption of photonic sensors in industrial automation has become imperative, especially in the manufacturing industry. Photonic sensors play a crucial role in this automation drive by enabling robots and machines to gather real-time data and make precise decisions based on optical inputs. These sensors facilitate accurate measurements, detection, and monitoring of various parameters, ensuring that automated processes maintain the required quality standards and precision. By integrating photonic sensors into automated manufacturing processes, industries achieve improved productivity and cost-effectiveness. Thus, the demand for photonic sensors increased significantly, thereby driving the photonic sensor market growth. Robots are expected to effectively substitute human labor in repetitive and physically demanding tasks, leading to increased production rates and reduced operational expenses in the long run. The demand for photonic sensors in manufacturing sites is escalating as industries seek to optimize their operations and remain competitive in the face of labor-related challenges. As a result, the adoption of photonic sensors in industrial automation is becoming a pivotal factor in driving advancements and innovation in the manufacturing sector.

Photonic Sensor Market Segment Analysis:

Based on End-use Industry, the energy and power segment led the global photonic sensor market with the highest market share of more than 30% in 2023 and is expected to maintain its growth trend during the forecast period. Optical and photonic sensors play essential roles in three distinct applications related to energy harvesting and power production: solar thermal and PV systems, the oil and gas industry, and wind turbines. The United States and global electricity generation from wind energy are experiencing rapid growth, with the potential to contribute at least 20% of the nation's electricity by 2030. This increasing trend is leading to the demand for larger multi-megawatt wind turbines for onshore and offshore utility-scale operations, featuring rotor diameters surpassing 100 to 120 meters. As wind turbines continue to grow in size and cost, there is a rising necessity to integrate early-warning wind shear measurements and turbine structural health monitoring. This integration aims to optimize wind turbine design, operation, and maintenance while safeguarding against hazardous wind gusts. Similarly, the oil and gas industry faces the task of taking measurements under extreme temperatures and pressures. The exploration and extraction of oil and gas resources in challenging operating environments, such as deep seawater, present numerous technical difficulties. To ensure safety and maximize profitability in these fields, real-time and permanent wellbore and reservoir monitoring technology plays a crucial role.The transportation segment is expected to grow at the highest growth rate and offer lucrative growth prospects for photonic sensor market players during the forecast period. In recent times, the transportation sector has shown rapid adoption of LiDAR technologies. These technologies are being increasingly integrated into autonomous vehicles, transforming them into automated systems. Adaptive cruise control (ACC) systems are being developed for automobiles, and LiDAR devices are installed in the front of the vehicles to monitor the distance and speed between cars. This enables them to respond effectively to changing conditions. LiDAR finds significant application in advanced driving assistance systems (ADAS) in vehicles, providing drivers with convenience through a human-machine interface that ensures safe navigation and efficient operation. Moreover, governments all across the world have been actively promoting the installation of ADAS features in vehicles, which is expected to drive the growth of the photonic sensor market.

Photonic Sensor Market Regional Insights:

Asia Pacific held a market share of more than 30% in the global photonic sensor market in 2023 and is expected to grow at the highest CAGR of around 17.3% during the forecast period. The rapidly expanding industrial sector and growing implementation of different manufacturing and telecommunications technologies in industrial sectors is expected to be the major driver driving the photonic sensor industry growth. Besides that, the rising demand for fiber optic systems/solutions and components, and the rapid expansion of the regional IT and telecommunications sector have increased the demand for fiber-optic photonics. The Asia-Pacific region has witnessed significant growth in 3D imaging technology due to increasing demand for security and defense applications like facial recognition, weapons, and explosives detection. Additionally, the healthcare sector extensively uses 3D imaging technology for various healthcare and medical devices. Photonic sensors play a vital role in 3D imaging technology and are further expected to contribute significantly to market growth.The increase in military and defense spending in China and India, along with the growing trend of industrial automation in these countries is expected to support the regional market growth. China's government, as part of reforms by the Chinese communist party, has allocated substantial budgets for modern technology incorporation in its military. In recent years, Asian countries such as South Korea and China experienced substantial growth in photonics and laser technology. Thus, these economies are expected to provide lucrative growth prospects for photonic sensor market players throughout the forecast period. The manufacturing sectors of these economies are undergoing significant transformations, with automotive, consumer electronics and industrial manufacturing being particularly fast-growing businesses. The Asia-Pacific region as a whole is experiencing significant growth in photonics and lasers, owing to the region's strong economic growth and increasing utilization of lasers in manufacturing processes. Furthermore, there is an increasing need for fiber optic sensors in countries throughout Asia-Pacific, which is expected to drive the growth of the photonic sensor market in this region.

Photonic Sensor Market Scope: Inquire before buying

Photonic Sensor Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 42.32 Bn. Forecast Period 2024 to 2030 CAGR: 16.75% Market Size in 2030: USD 125.13 Bn. Segments Covered: by Product Type Fiber Optic Sensors Image Sensors Biophotonic Sensors Other Product Types by Application Industrial Healthcare Automotive And Transportation Safety And Security Others by End-use Industry Aerospace and Defense Transportation Manufacturing Healthcare Energy and Power Other Industries Photonic Sensor Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Photonic Sensor Market Key Players:

1. STMicroelectronics (Switzerland) 2. Sony Corporation (Japan) 3. Hewlett Packard Enterprise (HPE) (US) 4. Texas Instruments (US) 5. Infineon Technologies AG (Germany) 6. Taiwan Semiconductor Manufacturing Company Limited (Taiwan) 7. Microchip Technology Inc. (US) 8. Qualcomm Technologies, Inc. (US) 9. NXP Semiconductors (Netherlands) 10. Panasonic Corporation (Japan) 11. Banner Engineering Corp. (US) 12. Baumer Holding AG (Germany) 13. DataLogic (Italy) 14. Omron Corporation (Japan) 15. Sick AG (Germany) 16. Keyence Corporation (US) 17. Pepperl+Fuchs GmbH (Germany) 18. Rockwell Automation (US) 19. Autonics Corporation (Russia) 20. Hytera Communications Corporation Ltd. (Malaysia) 21. Omnisys (Thales Group) (Brazil) 22. BAE Systems plc. (US) 23. General Dynamics Corporation (US) 24. L3 Harris (US) 25. Motorola Solutions (US) 26. BK Technologies Corporation (US) 27. ICOM Incorporation (Japan) 28. MCS Digital (Australia) 29. Leonardo S.R.L. (US) 30. Hamamatsu Photonics (Japan)FAQs:

1. What are the growth drivers for the Photonic Sensor market? Ans. The increasing industrialization in developing economies, coupled with rising demand for advanced safety and security solutions, is expected to be the major driver for the Photonic Sensor market. 2. What is the major restraint for the Photonic Sensor market growth? Ans. The lack of regulatory standards is expected to be the major restraining factor for the Photonic Sensor market growth. 3. Which region is expected to lead the Global Photonic Sensor market during the forecast period? Ans. Asia Pacific is expected to lead the global Photonic Sensor market during the forecast period. 4. What was the Global Photonic Sensor Market size in 2023? Ans. The Global Photonic Sensor Market size was valued at USD 42.32 Billion in 2023. 5. What segments are covered in the Photonic Sensor Market report? Ans. The segments covered in the Photonic Sensor market report are Product Type, Applications, End-use Industry, and Region.

1. Photonic Sensor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Photonic Sensor Market: Dynamics 2.1. Photonic Sensor Market Trends by Region 2.1.1. North America Photonic Sensor Market Trends 2.1.2. Europe Photonic Sensor Market Trends 2.1.3. Asia Pacific Photonic Sensor Market Trends 2.1.4. Middle East and Africa Photonic Sensor Market Trends 2.1.5. South America Photonic Sensor Market Trends 2.2. Photonic Sensor Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Photonic Sensor Market Drivers 2.2.1.2. North America Photonic Sensor Market Restraints 2.2.1.3. North America Photonic Sensor Market Opportunities 2.2.1.4. North America Photonic Sensor Market Challenges 2.2.2. Europe 2.2.2.1. Europe Photonic Sensor Market Drivers 2.2.2.2. Europe Photonic Sensor Market Restraints 2.2.2.3. Europe Photonic Sensor Market Opportunities 2.2.2.4. Europe Photonic Sensor Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Photonic Sensor Market Drivers 2.2.3.2. Asia Pacific Photonic Sensor Market Restraints 2.2.3.3. Asia Pacific Photonic Sensor Market Opportunities 2.2.3.4. Asia Pacific Photonic Sensor Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Photonic Sensor Market Drivers 2.2.4.2. Middle East and Africa Photonic Sensor Market Restraints 2.2.4.3. Middle East and Africa Photonic Sensor Market Opportunities 2.2.4.4. Middle East and Africa Photonic Sensor Market Challenges 2.2.5. South America 2.2.5.1. South America Photonic Sensor Market Drivers 2.2.5.2. South America Photonic Sensor Market Restraints 2.2.5.3. South America Photonic Sensor Market Opportunities 2.2.5.4. South America Photonic Sensor Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Photonic Sensor Industry 2.8. Analysis of Government Schemes and Initiatives For Photonic Sensor Industry 2.9. Photonic Sensor Market Trade Analysis 2.10. The Global Pandemic Impact on Photonic Sensor Market 3. Photonic Sensor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Fiber Optic Sensors 3.1.2. Image Sensors 3.1.3. Biophotonic Sensors 3.1.4. Other Product Types 3.2. Photonic Sensor Market Size and Forecast, by Application (2023-2030) 3.2.1. Industrial 3.2.2. Healthcare 3.2.3. Automotive And Transportation 3.2.4. Safety And Security 3.2.5. Others 3.3. Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 3.3.1. Aerospace and Defense 3.3.2. Transportation 3.3.3. Manufacturing 3.3.4. Healthcare 3.3.5. Energy and Power 3.3.6. Other Industries 3.4. Photonic Sensor Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Photonic Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Fiber Optic Sensors 4.1.2. Image Sensors 4.1.3. Biophotonic Sensors 4.1.4. Other Product Types 4.2. North America Photonic Sensor Market Size and Forecast, by Application (2023-2030) 4.2.1. Industrial 4.2.2. Healthcare 4.2.3. Automotive And Transportation 4.2.4. Safety And Security 4.2.5. Others 4.3. North America Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 4.3.1. Aerospace and Defense 4.3.2. Transportation 4.3.3. Manufacturing 4.3.4. Healthcare 4.3.5. Energy and Power 4.3.6. Other Industries 4.4. North America Photonic Sensor Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Fiber Optic Sensors 4.4.1.1.2. Image Sensors 4.4.1.1.3. Biophotonic Sensors 4.4.1.1.4. Other Product Types 4.4.1.2. United States Photonic Sensor Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Industrial 4.4.1.2.2. Healthcare 4.4.1.2.3. Automotive And Transportation 4.4.1.2.4. Safety And Security 4.4.1.2.5. Others 4.4.1.3. United States Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 4.4.1.3.1. Aerospace and Defense 4.4.1.3.2. Transportation 4.4.1.3.3. Manufacturing 4.4.1.3.4. Healthcare 4.4.1.3.5. Energy and Power 4.4.1.3.6. Other Industries 4.4.2. Canada 4.4.2.1. Canada Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Fiber Optic Sensors 4.4.2.1.2. Image Sensors 4.4.2.1.3. Biophotonic Sensors 4.4.2.1.4. Other Product Types 4.4.2.2. Canada Photonic Sensor Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Industrial 4.4.2.2.2. Healthcare 4.4.2.2.3. Automotive And Transportation 4.4.2.2.4. Safety And Security 4.4.2.2.5. Others 4.4.2.3. Canada Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 4.4.2.3.1. Aerospace and Defense 4.4.2.3.2. Transportation 4.4.2.3.3. Manufacturing 4.4.2.3.4. Healthcare 4.4.2.3.5. Energy and Power 4.4.2.3.6. Other Industries 4.4.3. Mexico 4.4.3.1. Mexico Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Fiber Optic Sensors 4.4.3.1.2. Image Sensors 4.4.3.1.3. Biophotonic Sensors 4.4.3.1.4. Other Product Types 4.4.3.2. Mexico Photonic Sensor Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Industrial 4.4.3.2.2. Healthcare 4.4.3.2.3. Automotive And Transportation 4.4.3.2.4. Safety And Security 4.4.3.2.5. Others 4.4.3.3. Mexico Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 4.4.3.3.1. Aerospace and Defense 4.4.3.3.2. Transportation 4.4.3.3.3. Manufacturing 4.4.3.3.4. Healthcare 4.4.3.3.5. Energy and Power 4.4.3.3.6. Other Industries 5. Europe Photonic Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.3. Europe Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 5.4. Europe Photonic Sensor Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Photonic Sensor Market Size and Forecast, by End-use Industry(2023-2030) 5.4.2. France 5.4.2.1. France Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Photonic Sensor Market Size and Forecast, by End-use Industry(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Photonic Sensor Market Size and Forecast, by End-use Industry(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Photonic Sensor Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6. Asia Pacific Photonic Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4. Asia Pacific Photonic Sensor Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Photonic Sensor Market Size and Forecast, by End-use Industry(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Photonic Sensor Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 7. Middle East and Africa Photonic Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Photonic Sensor Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 7.4. Middle East and Africa Photonic Sensor Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Photonic Sensor Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Photonic Sensor Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Photonic Sensor Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Photonic Sensor Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 8. South America Photonic Sensor Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Photonic Sensor Market Size and Forecast, by Application (2023-2030) 8.3. South America Photonic Sensor Market Size and Forecast, by End-use Industry(2023-2030) 8.4. South America Photonic Sensor Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Photonic Sensor Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Photonic Sensor Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Photonic Sensor Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Photonic Sensor Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Photonic Sensor Market Size and Forecast, by End-use Industry (2023-2030) 9. Global Photonic Sensor Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Photonic Sensor Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. STMicroelectronics (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sony Corporation (Japan) 10.3. Hewlett Packard Enterprise (HPE) (US) 10.4. Texas Instruments (US) 10.5. Infineon Technologies AG (Germany) 10.6. Taiwan Semiconductor Manufacturing Company Limited (Taiwan) 10.7. Microchip Technology Inc. (US) 10.8. Qualcomm Technologies, Inc. (US) 10.9. NXP Semiconductors (Netherlands) 10.10. Panasonic Corporation (Japan) 10.11. Banner Engineering Corp. (US) 10.12. Baumer Holding AG (Germany) 10.13. DataLogic (Italy) 10.14. Omron Corporation (Japan) 10.15. Sick AG (Germany) 10.16. Keyence Corporation (US) 10.17. Pepperl+Fuchs GmbH (Germany) 10.18. Rockwell Automation (US) 10.19. Autonics Corporation (Russia) 10.20. Hytera Communications Corporation Ltd. (Malaysia) 10.21. Omnisys (Thales Group) (Brazil) 10.22. BAE Systems plc. (US) 10.23. General Dynamics Corporation (US) 10.24. L3 Harris (US) 10.25. Motorola Solutions (US) 10.26. BK Technologies Corporation (US) 10.27. ICOM Incorporation (Japan) 10.28. MCS Digital (Australia) 10.29. Leonardo S.R.L. (US) 10.30. Hamamatsu Photonics (Japan) 11. Key Findings 12. Industry Recommendations 13. Photonic Sensor Market: Research Methodology 14. Terms and Glossary