Pentavalent Vaccine Market size was valued at US$ 2.55 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 3.3% through 2023 to 2029, reaching nearly US$ 3.21 Bn.Pentavalent Vaccine Market Overview:

A pentavalent vaccine is a five-in-one vaccine that protects against diphtheria, tetanus, and whooping cough, hepatitis B, and Haemophilus influenza type b with just one dosage. One of the most well-known and successful techniques of preventing paediatric diseases is vaccination. The Government of India has achieved tremendous progress in preventing and controlling vaccine-preventable diseases since implementing the Universal Immunization Programme (UIP) (VPDs). The introduction of a pentavalent vaccination will help to minimise the number of cases of pneumonia and meningitis caused by the germs Haemophilus influenzae type b (Hib).To know about the Research Methodology :- Request Free Sample Report Though market forecasting through 2029 is based on real output, demand and supply of 2022, 2023 numbers are also estimated on real numbers published by key players as well all-important players across the world. Market forecasting till 2029 is done based on past data from 2018 to 2022 with the impact of global lock down on the market in 2020 and 2021.

Pentavalent Vaccine Market Dynamics:

The market for pentavalent vaccines is quickly increasing due to the rising prevalence of Diphtheria, Tetanus, Pertussis, and Hepatitis B. In terms of equipment, delivery, and disposal, the pentavalent vaccine saves money. Emerging manufacturers are making significant investments in the industry, including component vaccine procurement, technology transfers, clinical and analytical development, registration and prequalification efforts, and growing manufacturing capacity to meet rising demand. Market interventions such as WHO technical help to manufacturers and PATH-facilitated technical assistance to numerous manufacturers financed by the BMGF are aimed at increasing production efficiency and improving production economics, mainly for older manufacturing methods for DTwP. Panacea Biotech won orders for pentavalent vaccine worth USD 24.32 million (about Rs 170 crores) from UN agencies including UNICEF in 2019. UN agencies (UNICEF and PAHO) have awarded Panacea Biotech USD 24.32 million for the supply of its Easyfive-TT, a totally liquid WHO prequalified wP-based pentavalent vaccination. UNICEF estimates that global pentavalent vaccination demand was reached at 449 million doses by 2019, averaging 150 million doses per year.Pentavalent Vaccine Market Segment Analysis:

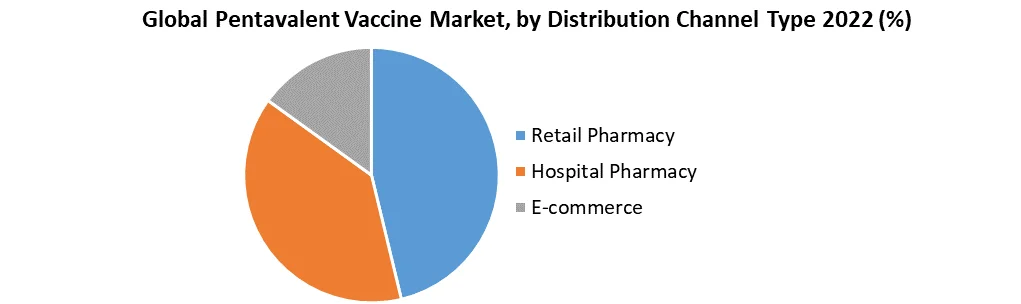

Based on the Formulation Type, the market is segmented into Lyophilized, and Liquid. Liquid formulation type segment is expected to hold the largest market share of xx% by 2029. Both liquid and Lyophilized pentavalent (DTP-Hep B-Hib) vaccines are available. However, because the combined DTP-Hep B component is available in liquid form and the Hib component is freeze dried, the latter must be reconstituted (blended) before use. Given the convenience of utilising liquid form Pentavalent (DTP-HepB-Hib) vaccine at busy immunisation clinics, it was agreed to employ liquid form Pentavalent (DTP-HepB-Hib) vaccine in the national EPI programme. Only a single dose liquid form of the Pentavalent (DTP-HepB-Hib) vaccination is now available. Hib vaccinations have been licenced in India for about a decade and are routinely used in the private sector. The powdered form's longer shelf life, precise formulation, and great effectiveness are all contributing to the segment's rise. Based on the Distribution Channel, the market is segmented into Retail Pharmacy, Hospital Pharmacy, and E-commerce. Retail Pharmacy segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Due to favourable demographic circumstances and an epidemiological change, India's pharmacy retail sector has grown significantly in recent years. Retail pharmacies are increasing their patient-care programmes. Patients prefer to buy pharmaceuticals from retail pharmacies rather than hospitals, therefore this segment is expected to maintain its dominance during the forecast period 2023-2029.

Pentavalent Vaccine Market Regional Insights:

North America region is expected to dominate the Pentavalent Vaccine market during the forecast period 2023-2029. North America region is expected to hold the largest market shares of xx% by 2029. The North American regional pentavalent vaccine market is booming due to increased insurance coverage, the presence of R&D centres and institutes, and government funding. The market's growth is additionally influenced by well-established healthcare infrastructure, simplicity of access, and increasing immunisation programmes. The market's growth has been aided by investments from key players in the industry. Europe is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. The increased acceptance of emerging advanced technologies, as well as the rising prevalence of Hep-B and tetanus, are expected to drive the market forward in Europe. Asia Pacific is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. This is due to increased health-care expenditures. The market demand is expected to be driven by the allocation of a significant amount of healthcare spending for hospitals and dispensing medicines to the elderly. Government-mandated and free immunisation programmes are also driving the market in the Asia Pacific region. The objective of the report is to present a comprehensive analysis of the Global Pentavalent Vaccine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Pentavalent Vaccine Market dynamic, structure by analyzing the market segments and project the Global Pentavalent Vaccine Market size. Clear representation of competitive analysis of key players by Type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Pentavalent Vaccine Market make the report investor’s guide.Pentavalent Vaccine Market Scope: Inquire before Buying

Global Pentavalent Vaccine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.55 Bn. Forecast Period 2022 to 2029 CAGR: 3.3% Market Size in 2029: US $ 3.21 Bn. Segments Covered: by Formulation Type Lyophilized Liquid by Distribution Channel Retail Pharmacy Hospital Pharmacy E-commerce Pentavalent Vaccine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pentavalent Vaccine Market Key Players

1.Serum Institute of India 2.Panacea Drugs Pvt. Ltd 3.Shantha Biotechnics 4.Biological E. Ltd. 5.Novartis AG 6.Crucell 7.Bio Farma Frequently Asked Questions: 1] What segments are covered in Pentavalent Vaccine Market report? Ans. The segments covered in Pentavalent Vaccine Market report are based on Formulation Type, and Distribution Channel. 2] Which region is expected to hold the highest share in the Pentavalent Vaccine Market? Ans. North America is expected to hold the highest share in the Pentavalent Vaccine Market. 3] Who are the top key players in the Pentavalent Vaccine Market? Ans. Serum Institute of India, Panacea Drugs Pvt. Ltd, Shantha Biotechnics, Biological E. Ltd., and Novartis AG are the top key players in the Pentavalent Vaccine Market. 4] Which segment holds the largest market share in the Pentavalent Vaccine market by 2029? Ans. Liquid formulation type segment hold the largest market share in the Pentavalent Vaccine market by 2029. 5] What is the market size of the Pentavalent Vaccine market by 2029? Ans. The market size of the Pentavalent Vaccine market is expected to reach US $ 3.21 Bn. by 2029. 6] What was the market size of the Pentavalent Vaccine market in 2022? Ans. The market size of the Pentavalent Vaccine market was worth US $ 2.55 Bn. in 2022.

1. Global Pentavalent Vaccine Market: Research Methodology 2. Global Pentavalent Vaccine Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Pentavalent Vaccine Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Pentavalent Vaccine Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Pentavalent Vaccine Market Segmentation 4.1 Global Pentavalent Vaccine Market, by Formulation Type (2022-2029) • Lyophilized • Liquid 4.2 Global Pentavalent Vaccine Market, by Distribution Channel (2022-2029) • Retail Pharmacy • Hospital Pharmacy • E-commerce 5. North America Pentavalent Vaccine Market (2022-2029) 5.1 Global Pentavalent Vaccine Market, by Formulation Type (2022-2029) • Lyophilized • Liquid 5.2 Global Pentavalent Vaccine Market, by Distribution Channel (2022-2029) • Retail Pharmacy • Hospital Pharmacy • E-commerce 5.3 North America Pentavalent Vaccine Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Pentavalent Vaccine Market (2022-2029) 6.1. Asia Pacific Pentavalent Vaccine Market, by Formulation Type (2022-2029) 6.2. Asia Pacific Pentavalent Vaccine Market, by Distribution Channel (2022-2029) 6.3. Asia Pacific Pentavalent Vaccine Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Pentavalent Vaccine Market (2022-2029) 7.1 Middle East and Africa Pentavalent Vaccine Market, by Formulation Type (2022-2029) 7.2. Middle East and Africa Pentavalent Vaccine Market, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Pentavalent Vaccine Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Pentavalent Vaccine Market (2022-2029) 8.1. Latin America Pentavalent Vaccine Market, by Formulation Type (2022-2029) 8.2. Latin America Pentavalent Vaccine Market, by Distribution Channel (2022-2029) 8.3. Latin America Pentavalent Vaccine Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Pentavalent Vaccine Market (2022-2029) 9.1. European Pentavalent Vaccine Market, by Formulation Type (2022-2029) 9.2. European Pentavalent Vaccine Market, by Distribution Channel (2022-2029) 9.3. European Pentavalent Vaccine Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Serum Institute of India 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Panacea Drugs Pvt. Ltd 10.3. Shantha Biotechnics 10.4. Biological E. Ltd. 10.5. Novartis AG 10.6. Crucell 10.7. Bio Farma