Patch Management Market size was valued at US$ 799.91 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 10.9% from 2023 to 2029, reaching nearly US$ 1650.29 Mn.Patch Management Market Overview:

Patch Management Market is expected to reach US$ 1,650.29 Mn. by 2029. Patch management refers to the process of distributing and installing software updates. These patches are frequently required to address software issues. This report focuses on the different segments of the Patch Management market (Component, Deployment, Vertical, and Region). This report examines the major market players and regions in depth (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It's a thorough examination of today's quick advances in a variety of sectors. Facts and figures, visualisations, and presentations are utilised to demonstrate the core data analysis from 2017 through 2022. The market drivers, restraints, opportunities, and challenges for Patch Management are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the Patch Management market.To know about the Research Methodology:-Request Free Sample Report

Patch Management Market Dynamics:

Automation is becoming more popular in the software sector. Software firms are attempting to develop comprehensive solutions. They are attempting to tie all of the manual tasks together using integrating measures. The traditional method necessitates substantial human involvement. For standards compliance, the software application must be updated with new features on a regular basis. The programme will always be updated with the newest standards, security, and system insights thanks to the automatic process. The market is expected to be driven by these advantages. Another important issue with patching is the requirement to upgrade security. Cyber-attacks for data breaches are a common occurrence for IT firms. To keep the systems safe, Software Applications are automatically updated with the current security requirements. As a result, another key market driver emerges. Governments are also extensively investing in patch management to keep their systems secure and defend them from external attacks. This is also a major market driver. Market growth is expected to be hampered by a lack of appropriate skill sets for complicated situations. There is also a lack of uniformity. However, the growing popularity of Smart phones, Tablets, and Laptops presents a lucrative market opportunity.Patch Management Market Segment Analysis:

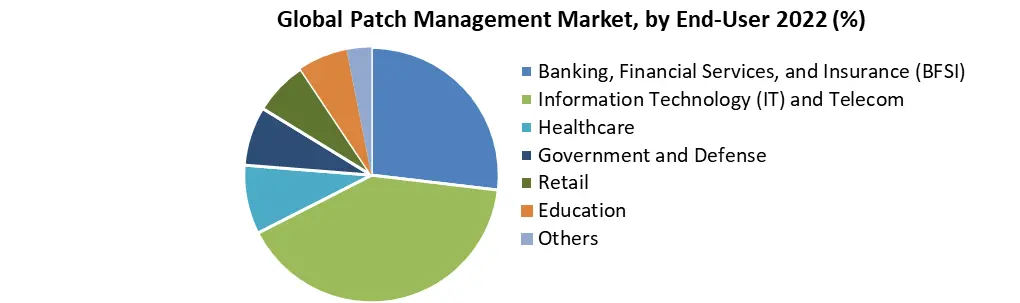

The Patch Management Market is segmented by Component, Deployment, and Vertical. Based on the Deployment, the market is segmented into On-premises, and Cloud. On-premises deployment segment is expected to hold the largest market share of xx% by 2029. On-premises solutions give businesses complete control over all of their platforms, apps, systems, and data, which they can manage themselves. The typical technique to deploying patch management solutions across companies is on-premises deployment. On-premises implementation is preferred by enterprises whose user credentials are crucial for business operations because it gives them more control over their IT systems. Because they cannot afford to lose their sensitive data, financial records, accounting information, or money transfers, the government and defence, as well as the BFSI verticals, choose on-premises protection. Based on the Vertical, the market is segmented into Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare, Government and Defense, Retail, Education, and Others. Banking, Financial Services, and Insurance (BFSI) segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Because it has all of the financial information of customers and businesses, the Banking, Financial Services, and Insurance (BFSI) vertical is vulnerable to cyber attacks. The financial services vertical is always introducing new and improved financial goods and services to boost corporate operations, which makes it appealing to fraudsters to target sensitive client data. As a result, banks and financial institutions' systems and software programs must be updated on a regular basis. Patch management software assists businesses in not just monitoring and reporting missing/operationally critical patches, but also in frequently updating system applications. Furthermore, the growing trend of cloud banking necessitates the real-time security of private commercial and financial data.

Patch Management Market Regional Insights:

Europe region is expected to dominate the Patch Management Market during the forecast period 2023-2029. Europe region is expected to hold the largest market share of xx% by 2029. Europe is made up of a number of economically stable and technologically advanced countries. In Europe, the United Kingdom, Germany, and France are major countries for market analysis. Europe's patch management market is booming, with the continent capturing a large share of the market. The European Union has established ENISA, a regulatory agency tasked with making Europe more cyber secure. In addition, the Information Commissioner's Office (ICO) enforced enforcement actions on non-compliant firms under the GDPR, which include an inquiry into the organization's activities and a directive to rectify any component of the GDPR's cybersecurity criteria that falls short. Furthermore, widespread acceptance of patch management solutions has resulted from increased understanding of the benefits of patching, as well as a growth in the number of applications and operating systems (OS). North America region is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Patch management is now considered an important part of maintaining IT services, especially with the rise in cybersecurity risks in these region. The United States holds the highest share of the market as a result of rapid adoption of the latest technology. When companies let their network security guard down, cybercriminals become simpler to target. During the forecast period, the patch management market in the United States is expected to grow at a CAGR of 9.2%. Furthermore, the IT industry has effectively supported the development of many software applications in the US market. The increasing number of data centres in this region, combined with technical advancement, is expected to drive up market demand for patch management. Asia Pacific region is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Several emerging countries are raising their capital income and building their IT industries and data centres, which is driving market growth in this region. During the forecast period, Japan is estimated to grow at a CAGR of 7.6%. Public cloud solutions are growing increasingly popular in the sector, providing market participants with more options. The internet's penetration is undoubtedly contributing to the market's exponential growth pace. The objective of the report is to present a comprehensive analysis of the Global Patch Management Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Patch Management Market dynamic and structure by analyzing the market segments and projecting the Global Patch Management Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Patch Management Market make the report investor’s guide.Patch Management Market Scope: Inquire before buying

Global Patch Management Market Report Coverage Details Base Year: 2022 Forecast Period: 2022-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 799.91 Mn. Forecast Period 2023 to 2029 CAGR: 10.9% Market Size in 2029: US $ 1650.29 Mn. Segments Covered: by Component Support and Integration Training and Education Consulting by Deployment On-premises Cloud by Vertical Banking, Financial Services, and Insurance (BFSI) Information Technology (IT) and Telecom Healthcare Government and Defense Retail Education Others Patch Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Patch Management Market, Key Players

1. IBM (US) 2. Microsoft (US) 3. Symantec (US) 4. Micro Focus (UK) 5. Qualys (US) 6. SolarWinds (US) 7. Ivanti (US) 8. ManageEngine (US) 9. ConnectWise (US) 10. Avast (Czech Republic) 11. Automox (US 12. SecPod (India) 13. GFI Software (US) 14. Jamf (US) 15. Chef Software (US) 16. SysAid Technologies (Israel) Frequently Asked Questions: 1] Which region is expected to held the highest share in the Patch Management Market? Ans. Europe is expected to held the highest share in the Patch Management Market. 2] Who are the top key players in the Patch Management Market? Ans. IBM (US), Microsoft (US), Symantec (US), Micro Focus (UK), and Qualys (US) are the top key players in the Patch Management Market. 3] Which segment is expected to held the largest market share in the Patch Management Market by 2029? Ans. On-premises deployment segment is expected to held the largest market share in the Patch Management Market by 2029. 4] What is the market size of the Patch Management Market by 2029? Ans. The market size of the Patch Management Market is expected to reach US $1650.29 Mn. by 2029. 5] What was the market size of the Patch Management Market in 2022? Ans. The market size of the Patch Management Market was worth US $ 799.91 Mn. in 2022.

1. Global Patch Management Market: Research Methodology 2. Global Patch Management Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to the Global Patch Management Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Patch Management Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Patch Management Market Segmentation 4.1 Global Patch Management Market, by Component (2022-2029) • Support and Integration • Training and Education • Consulting 4.2 Global Patch Management Market, by Deployment (2022-2029) • On-premises • Cloud 4.3 Global Patch Management Market, by Vertical (2022-2029) • Banking, Financial Services, and Insurance (BFSI) • Information Technology (IT) and Telecom • Healthcare • Government and Defense • Retail • Education • Others 5. North America Patch Management Market (2022-2029) 5.1 North America Patch Management Market, by Component (2022-2029) • Support and Integration • Training and Education • Consulting 5.2 North America Patch Management Market, by Deployment (2022-2029) • On-premises • Cloud 5.3 North America Patch Management Market, by Vertical (2022-2029) • Banking, Financial Services, and Insurance (BFSI) • Information Technology (IT) and Telecom • Healthcare • Government and Defense • Retail • Education • Others 5.4 North America Patch Management Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Patch Management Market (2022-2029) 6.1. Europe Patch Management Market, by Component (2022-2029) 6.2. Europe Patch Management Market, by Deployment (2022-2029) 6.3. Europe Patch Management Market, by Vertical (2022-2029) 6.4. Europe Patch Management Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Patch Management Market (2022-2029) 7.1. Asia Pacific Patch Management Market, by Component (2022-2029) 7.2. Asia Pacific Patch Management Market, by Deployment (2022-2029) 7.3. Asia Pacific Patch Management Market, by Vertical (2022-2029) 7.4. Asia Pacific Patch Management Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. South America Patch Management Market (2022-2029) 8.1. South America Patch Management Market, by Component (2022-2029) 8.2. South America Patch Management Market, by Deployment (2022-2029) 8.3. South America Patch Management Market, by Vertical (2022-2029) 8.4. South America Patch Management Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 9. Middle East and Africa Patch Management Market (2022-2029) 9.1 Middle East and Africa Patch Management Market, by Component (2022-2029) 9.2. Middle East and Africa Patch Management Market, by Deployment (2022-2029) 9.3. Middle East and Africa Patch Management Market, by Vertical (2022-2029) 9.4. Middle East and Africa Patch Management Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 10. Company Profile: Key players 10.1 IBM (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Microsoft (US) 10.3 Symantec (US) 10.4 Micro Focus (UK) 10.5 Qualys (US) 10.6 SolarWinds (US) 10.7 Ivanti (US) 10.8 ManageEngine (US) 10.9 ConnectWise (US) 10.10 Avast (Czech Republic) 10.11 Automox (US 10.12 SecPod (India) 10.13 GFI Software (US) 10.14 Jamf (US) 10.15 Chef Software (US) 10.16 SysAid Technologies (Israel)