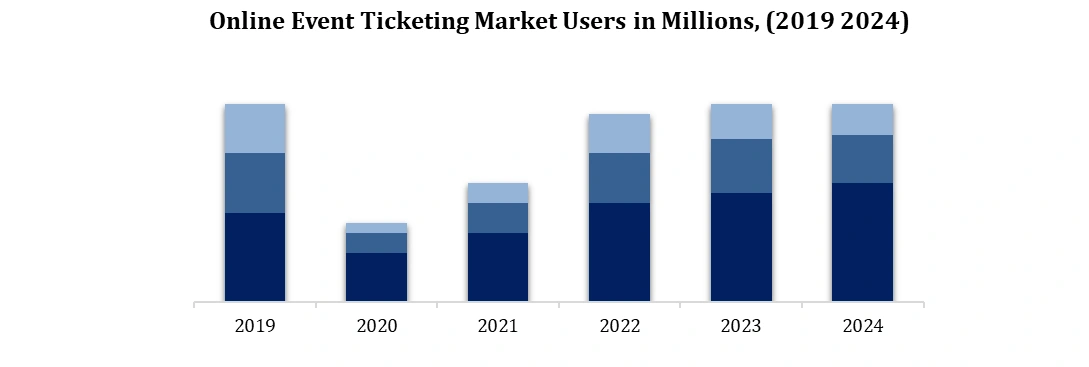

The Online Event Ticketing Market size was valued at USD 64.52 Billion in 2025 and the total Online Event Ticketing revenue is expected to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 89.58 Billion by 2032.Online Event Ticketing Market Overview:

The Global Online Event Ticketing Market streamlines the attendee experience by facilitating advance event registrations, digital ticket booking, and effortless venue check-ins. The surge in internet usage, mobile ticketing apps, and the demand for online event ticketing platforms for movies, sports events, concerts, and live shows has significantly boosted market growth. Online tickets are primarily sold through desktop platforms and mobile applications, enabling consumers to purchase tickets online for diverse events, including sports matches, musical concerts, and film screenings. The Online Event Ticketing Market has revolutionized the ticket-purchasing experience, allowing users to buy tickets online, access digital tickets, and validate entries via QR codes. Growth is fueled by mobile ticketing solutions, cloud-based ticketing platforms, and AI-driven ticketing systems, offering convenient, contactless ticket purchase experiences. Leading platforms also provide discounts, pre-sales offers, and loyalty incentives while improving user engagement through intuitive websites and mobile applications. Enhanced features like seat selection, home printing of tickets, and seat-view previews are elevating the customer experience. The market is further propelled by promotional campaigns, online advertising, and hybrid event ticketing solutions, ensuring seamless access across concerts, sports events, festivals, and corporate events. Key players focus on Android and iOS ticketing apps, online ticketing software, and smart digital ticketing systems, driving the global online event ticketing industry forward.To know about the Research Methodology :- Request Free Sample Report

Global Online Event Ticketing Market Dynamics:

The Online Event Ticketing Market is witnessing significant growth with technological advancements in ticketing software, mobile ticketing solutions, and cloud-based event ticketing platforms. The widespread use of the Internet, smartphones, and the increasing reliance on mobile applications for online ticket reservations are key factors driving the growth of the global online event ticketing market. Additionally, the development of user-centric ticketing apps, AI-driven ticket platforms, and virtual event ticketing solutions is expected to further boost the market during the forecast period. The provision of attractive deals, pre-sales offers, discounts, and promotions via digital ticketing platforms is anticipated to create lucrative opportunities for the Online Event Ticketing Market. These factors collectively underscore heightened consumer awareness, growing smartphone penetration, and increasing purchasing power, propelling the demand for online ticket booking services, enhancing digital ticketing adoption, and fostering market growth throughout the forecast period. Mobile App Utilization: The rising adoption and user-friendliness of mobile apps have streamlined the ticket booking process, facilitating quicker and more convenient transactions. Robust Internet Access: High Internet penetration rates have enabled more users to access the online event ticketing Market seamlessly. Shift to Digital Transactions: The increasing preference for paperless transactions, coupled with the banking sector's integration of online event ticketing Market platforms, has propelled the issuance and acceptance of e-tickets via email or text. Loyalty Programs: Many ticketing service providers are leveraging mobile platforms to roll out enticing loyalty programs, encouraging repeat business from subscribers. Growing Online Preference: The escalating demand for online reservations for movies, concerts, and sports events is poised to sustain and amplify market growth in the foreseeable future. The music events segment accounts for a large share of the online event ticketing market. This includes sales for all music-related events, such as concerts, musicals, music shows, festivals, and operas. Ticketmaster has reported that music accounts for about 80% of their gross transacted value growth in year. Concerts are the primary source of income for online ticketing providers. High fee charges by ticketing platform - Ticketing platforms frequently impose high fees for their services, potentially diminishing event profitability and elevating ticket costs for attendees. Also, the increasing adoption of alternative ticketing solutions like social media and messaging apps is posing a restraint to the traditional online event ticketing market. Security and fraud concerns pose restraints to the credibility and trustworthiness of the online event ticketing market.Challenges:

The online event ticketing market faces challenges such as relying heavily on ticket vendors to secure popular artists and the susceptibility of the business to data breaches. The online event ticketing market is witnessing growth due to trends like the rise in sports events, customer behaviour analysis through mobile applications, augmented reality enhancing customer experiences, and the potential of blockchain technology. Emerging markets - Emerging markets present significant growth opportunities for players in the online event ticketing market, as these regions remain largely untapped. Advancements in technology – Various technologies such as blockchain and artificial intelligence are creating new opportunities for growth in the market. Additionally, partnering and collaborating with event organizers, venues, and other stakeholders can expand the customer base of the online event ticketing market.

Online Event Ticketing Market Segment Analysis:

Based on Event Type, the online event ticketing market is segmented into music concerts & festivals, sports events, movies & theatres, conferences & seminars, exhibitions & trade shows, and others. Music concerts & festivals dominated due to the rising popularity of live entertainment and global tours, especially post-pandemic. Sports events are also a significant driver, with leagues and tournaments adopting digital-first ticketing solutions for accessibility and fraud prevention. Movies & theatres continue to be a large segment, supported by multiplexes and online ticketing platforms. Conferences & seminars and exhibitions & trade shows are shifting online as professional audiences increasingly prefer digital booking channels. Other niche events, including cultural and community programs, are also adopting online ticketing to expand audience reach.Based on Platform, the online event ticketing market is segmented into desktop/laptop, mobile applications, and others. Mobile applications led the market as consumers increasingly prefer on-the-go booking and digital QR-based entry. Mobile-first solutions also integrate loyalty programs, digital wallets, and instant updates, enhancing the user experience. Desktop/laptop platforms remain relevant for users who prefer larger interfaces for browsing multiple event options or bulk bookings. Other channels, such as kiosks and integrated partner platforms, serve specific user groups. The dominance of mobile platforms highlights the industry’s shift toward convenience, personalization, and app-based ticketing ecosystems. Mobile apps and websites now boast user-friendly interfaces, tailored recommendations, and instantaneous updates on ticket status. These tech-driven enhancements empower music aficionados with timely information and swift ticket acquisition capabilities, bolstering the segment's growth. Sports enthusiasts widely follow events like the FIFA World Cup, the National Football League (NFL), ICC Cricket World Cup, the Olympics Games, and the Premier League (PL). They prefer to using online event ticketing bypassing the need to endure long queues. Growth in the sports segment expects to grow at 5.3% CAGR for the forecast period. In the U.S., the movie ticketing sector witnesses intense competition among service providers. Companies like Fandango, Movietickets.com, and Atom compete aggressively to capture the most significant customer base. They achieve this by partnering with premier cinema halls and presenting enticing discounts to patrons. The movie segment forecasts a 4.5% CAGR to reach $16.7 billion in forecast period. The music event dominate the online event ticketing market, which comprise the profitable sales for all music related event, including concert, festivals, musicals, music shows and operas. According to MMR search the music event segment is responsible nearly 75 % of growth. Also, the performances of global and domestic singers at music events draw in the younger generation who are passionate about music. Growth in the sports segment expects to grow at 6.3% CAGR for the forecast period.

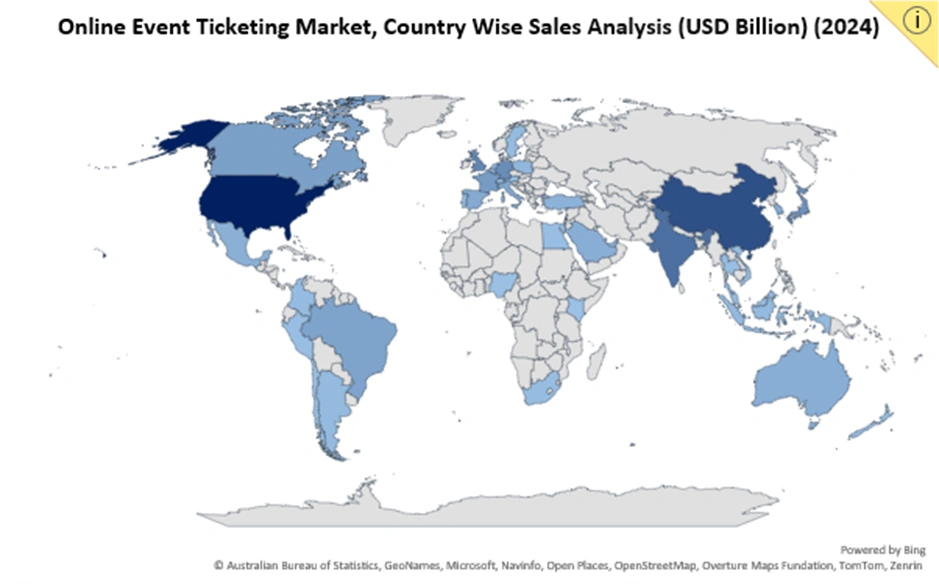

Online Event Ticketing Market Regional Insights:

The Online Event Ticketing Market is segmented across Asia Pacific, North America, Latin America, Europe, and the Middle East & Africa. During the forecast period, North America is expected to dominate, driven by high per capita income, rapid internet penetration, and the increasing adoption of mobile ticketing apps in countries such as the U.S. and Canada. Consumers in this region widely prefer digital movie ticket booking, online sports ticketing, and concert ticketing platforms due to their convenience, real-time access, and seamless online checkout experience. The Asia-Pacific region is poised to hold a significant share, driven by smartphone penetration, growing disposable incomes, urbanization, and improved internet connectivity. Customers in countries such as China, India, Japan, and South Korea are increasingly using mobile event ticketing platforms, e-tickets, and digital passes to avoid queues, while theatres and organizers adopt QR code-based ticket validation. Loyalty programs and personalized online ticketing services further enhance customer retention. The Middle East & Africa (MEA) is projected to experience growth due to the adoption of mobile devices, online ticketing platforms, and digital payment solutions in countries like UAE, Qatar, and Turkey. Globally, the Online Event Ticketing Market growth is fueled by the rising demand for concerts, sports events, festivals, and virtual events, the preference for contactless ticketing, and the increasing use of AI-driven ticket management systems, making ticket purchases more accessible and efficient for consumers. North America dominates the Online Event Ticketing Market, driven by high per capita income, widespread internet penetration, and strong consumer preference for mobile-based ticketing across movies, sports, concerts, and live events.

Online Event Ticketing Market Scope: Inquiry Before Buying

Global Online Event Ticketing Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 64.52 Bn. Forecast Period 2026 to 2032 CAGR: 4.8% Market Size in 2032: USD 89.58 Bn. Segments Covered: by Event Type Music Concerts & Festivals Sports Events Movies & Theatres Conferences & Seminars Exhibitions & Trade Shows Others by Platform Desktop/Laptop Mobile Applications Others by Payment Mode Online Payment Cash on Delivery Others by End-User Individual Users Corporate/Institutional Buyers Event Organizers Online Event Ticketing Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Online Event Ticketing Market, Key Players

1. Razorgato (Greater Los Angeles Area, West Coast, Western US) 2. Live Nation Entertainment Inc. (Beverly Hills, California, U.S.) 3. Cinemark Holdings Inc. (Plano, TX) 4. Eventbrite (San Francisco , United States) 5. StubHub (New York, United States) 6. Tickpick (New York, United States) 7. EasyMovies (New York City, New York) 8. Fandango (Beverly Hills, California, U.S.) 9. AOL Inc. (New York, United States) 10. Atom Tickets LLC (Santa Monica, CA.) 11. Movietickets.com (Boca Raton, Florida, USA.) 12. Viagogo (UK) 13. Ticketek (Australia) 14. Eventim (Germany) 15. Big Cinemas 16. Vue Entertainment (London, England, United Kingdom) 17. BookMyShow.com (Gulmohar, Mumbai.) 18. Kyazoonga (Lodhi Road, Delhi) 19. Bigtree Entertainment Pvt Ltd (Mumbai) 20. Inox Leisure Ltd. (Mumbai) 21. Ticketplease (Mumbai, Maharashtra, India) 22. VOX Cinemas (Dubai, United Arab Emirates ) 23. Ticketmaster Live Nation Entertainment Inc. 24. MtimeFrequently Asked Questions:

1. Which region has the largest share in Global Market? Ans. Aisa Pacific has the largest market share in 2025. 2. What is the growth rate of Global Market? Ans: The Global Market is growing at a CAGR of 4.8% during forecasting period 2026-2032. 3. What is scope of the Global market report? Ans. Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans. The important key players in the Global Market are – Razorgato, StubHub, Ticketmaster, Tickpick, Fandango, AOL Inc., Atom Tickets LLC, Movietickets.com, Big Cinemas, Cinemark Holdings Inc., Eventbrite, Live Nation Entertainment Inc., BookMyShow.com, Vue Entertainment, Mtime, Kyazoonga, Bigtree Entertainment Pvt. Ltd, Inox Leisure Ltd., EasyMovies, Ticketplease, and VOX Cinemas. 5. What is the study period of this market? Ans. The Global Market is studied from 2025 to 2032.

1. Online Event Ticketing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Online Event Ticketing Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Profit Margin(%) 2.2.8. Growth rate [Y-o-Y(%)] 2.2.9. Technologies Advancements 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Online Event Ticketing Market: Dynamics 3.1. Online Event Ticketing Market Trends 3.2. Online Event Ticketing Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Technology Insights 4.1. Overview of mobile ticketing applications and web-based platforms. 4.2. AI and machine learning integration in ticket distribution processes. 4.3. Blockchain and QR code technologies for secure digital ticketing. 4.4. Cloud computing benefits for real-time ticketing and data analytics. 4.5. Innovations in NFC-enabled and contactless event ticketing solutions. 5. Regional Market Analysis 5.1. Market share and growth trends across North America. 5.2. Asia Pacific adoption trends with mobile ticketing penetration analysis. 5.3. Europe market growth driven by hybrid and virtual events. 5.4. MEA adoption influenced by smartphone penetration and urbanization. 5.5. Latin America market trends and regional consumer behavior insights. 6. Customer Insights and Behavior 6.1. Analysis of consumer adoption patterns and purchasing preferences. 6.2. Impact of mobile apps on consumer ticket booking behavior. 6.3. Customer loyalty programs, incentives, and retention strategies. 6.4. Influence of social media and digital marketing on ticket sales. 6.5. Behavioral analysis across music, sports, theatre, and corporate events. 7. Investment and ROI Analysis 7.1. Key investment trends in online ticketing platforms globally. 7.2. Forecast of revenue growth, ROI, and profit margins. 7.3. Risk assessment and mitigation strategies for investors. 7.4. Opportunities for venture capital and private equity in the market. 7.5. Cost-benefit analysis of technology adoption in ticketing solutions. 8. Cost Structure Analysis 8.1. Breakdown of operational and software development costs for platforms. 8.2. Marketing and promotional expenditure for online ticketing growth. 8.3. Payment gateway and transaction-related cost structures. 8.4. Cost optimization strategies through automation and cloud solutions. 8.5. Maintenance and customer support costs associated with digital platforms. 9. Sustainability and Environmental Impact 9.1. Reduction of paper usage through digital and mobile ticketing solutions. 9.2. Eco-friendly initiatives by ticketing platforms to minimize carbon footprint. 9.3. Energy-efficient server infrastructure supporting online ticketing operations. 9.4. Social responsibility programs and community engagement by vendors. 9.5. Environmental impact assessment of hybrid and virtual event adoption. 10. Online Event Ticketing Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 10.1. Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 10.1.1. Music Concerts & Festivals 10.1.2. Sports Events 10.1.3. Movies & Theatres 10.1.4. Conferences & Seminars 10.1.5. Exhibitions & Trade Shows 10.1.6. Others 10.2. Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 10.2.1. Desktop/Laptop 10.2.2. Mobile Applications 10.2.3. Others 10.3. Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 10.3.1. Online Payment 10.3.2. Cash on Delivery 10.3.3. Others 10.4. Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 10.4.1. Individual Users 10.4.2. Corporate/Institutional Buyers 10.4.3. Event Organizers 10.5. Online Event Ticketing Market Size and Forecast, By Region (2025-2032) 10.5.1. North America 10.5.2. Europe 10.5.3. Asia Pacific 10.5.4. Middle East and Africa 10.5.5. South America 11. North America Online Event Ticketing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 11.1. North America Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 11.1.1. Music Concerts & Festivals 11.1.2. Sports Events 11.1.3. Movies & Theatres 11.1.4. Conferences & Seminars 11.1.5. Exhibitions & Trade Shows 11.1.6. Others 11.2. North America Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 11.2.1. Desktop/Laptop 11.2.2. Mobile Applications 11.2.3. Others 11.3. North America Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 11.3.1. Online Payment 11.3.2. Cash on Delivery 11.3.3. Others 11.4. North America Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 11.4.1. Individual Users 11.4.2. Corporate/Institutional Buyers 11.4.3. Event Organizers 11.5. North America Online Event Ticketing Market Size and Forecast, by Country (2025-2032) 11.5.1. United States 11.5.1.1. United States Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 11.5.1.1.1. Music Concerts & Festivals 11.5.1.1.2. Sports Events 11.5.1.1.3. Movies & Theatres 11.5.1.1.4. Conferences & Seminars 11.5.1.1.5. Exhibitions & Trade Shows 11.5.1.1.6. Others 11.5.1.2. United States Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 11.5.1.2.1. Desktop/Laptop 11.5.1.2.2. Mobile Applications 11.5.1.2.3. Others 11.5.1.3. United States Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 11.5.1.3.1. Online Payment 11.5.1.3.2. Cash on Delivery 11.5.1.3.3. Others 11.5.1.4. United States Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 11.5.1.4.1. Individual Users 11.5.1.4.2. Corporate/Institutional Buyers 11.5.1.4.3. Event Organizers 11.5.2. Canada 11.5.2.1. Canada Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 11.5.2.1.1. Music Concerts & Festivals 11.5.2.1.2. Sports Events 11.5.2.1.3. Movies & Theatres 11.5.2.1.4. Conferences & Seminars 11.5.2.1.5. Exhibitions & Trade Shows 11.5.2.1.6. Others 11.5.2.2. Canada Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 11.5.2.2.1. Desktop/Laptop 11.5.2.2.2. Mobile Applications 11.5.2.2.3. Others 11.5.2.3. Canada Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 11.5.2.3.1. Online Payment 11.5.2.3.2. Cash on Delivery 11.5.2.3.3. Others 11.5.2.4. Canada Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 11.5.2.4.1. Individual Users 11.5.2.4.2. Corporate/Institutional Buyers 11.5.2.4.3. Event Organizers 11.5.3. Mexico 11.5.3.1. Mexico Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 11.5.3.1.1. Music Concerts & Festivals 11.5.3.1.2. Sports Events 11.5.3.1.3. Movies & Theatres 11.5.3.1.4. Conferences & Seminars 11.5.3.1.5. Exhibitions & Trade Shows 11.5.3.1.6. Others 11.5.3.2. Mexico Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 11.5.3.2.1. Desktop/Laptop 11.5.3.2.2. Mobile Applications 11.5.3.2.3. Others 11.5.3.3. Mexico Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 11.5.3.3.1. Online Payment 11.5.3.3.2. Cash on Delivery 11.5.3.3.3. Others 11.5.3.4. Mexico Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 11.5.3.4.1. Individual Users 11.5.3.4.2. Corporate/Institutional Buyers 11.5.3.4.3. Event Organizers 12. Europe Online Event Ticketing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 12.1. Europe Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.2. Europe Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.3. Europe Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.4. Europe Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5. Europe Online Event Ticketing Market Size and Forecast, by Country (2025-2032) 12.5.1. United Kingdom 12.5.1.1. United Kingdom Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.1.2. United Kingdom Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.1.3. United Kingdom Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.1.4. United Kingdom Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.2. France 12.5.2.1. France Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.2.2. France Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.2.3. France Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.2.4. France Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.3. Germany 12.5.3.1. Germany Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.3.2. Germany Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.3.3. Germany Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.3.4. Germany Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.4. Italy 12.5.4.1. Italy Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.4.2. Italy Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.4.3. Italy Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.4.4. Italy Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.5. Spain 12.5.5.1. Spain Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.5.2. Spain Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.5.3. Spain Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.5.4. Spain Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.6. Sweden 12.5.6.1. Sweden Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.6.2. Sweden Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.6.3. Sweden Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.6.4. Sweden Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.7. Russia 12.5.7.1. Russia Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.7.2. Russia Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.7.3. Russia Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.7.4. Russia Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 12.5.8. Rest of Europe 12.5.8.1. Rest of Europe Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 12.5.8.2. Rest of Europe Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 12.5.8.3. Rest of Europe Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 12.5.8.4. Rest of Europe Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13. Asia Pacific Online Event Ticketing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 13.1. Asia Pacific Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.2. Asia Pacific Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.3. Asia Pacific Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.4. Asia Pacific Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5. Asia Pacific Online Event Ticketing Market Size and Forecast, by Country (2025-2032) 13.5.1. China 13.5.1.1. China Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.1.2. China Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.1.3. China Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.1.4. China Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.2. S Korea 13.5.2.1. S Korea Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.2.2. S Korea Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.2.3. S Korea Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.2.4. S Korea Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.3. Japan 13.5.3.1. Japan Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.3.2. Japan Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.3.3. Japan Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.3.4. Japan Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.4. India 13.5.4.1. India Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.4.2. India Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.4.3. India Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.4.4. India Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.5. Australia 13.5.5.1. Australia Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.5.2. Australia Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.5.3. Australia Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.5.4. Australia Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.6. Indonesia 13.5.6.1. Indonesia Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.6.2. Indonesia Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.6.3. Indonesia Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.6.4. Indonesia Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.7. Malaysia 13.5.7.1. Malaysia Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.7.2. Malaysia Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.7.3. Malaysia Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.7.4. Malaysia Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.8. Philippines 13.5.8.1. Philippines Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.8.2. Philippines Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.8.3. Philippines Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.8.4. Philippines Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.9. Thailand 13.5.9.1. Thailand Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.9.2. Thailand Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.9.3. Thailand Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.9.4. Thailand Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.10. Vietnam 13.5.10.1. Vietnam Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.10.2. Vietnam Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.10.3. Vietnam Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.10.4. Vietnam Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 13.5.11. Rest of Asia Pacific 13.5.11.1. Rest of Asia Pacific Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 13.5.11.2. Rest of Asia Pacific Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 13.5.11.3. Rest of Asia Pacific Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 13.5.11.4. Rest of Asia Pacific Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14. Middle East and Africa Online Event Ticketing Market Size and Forecast (by Value in USD Million) (2025-2032 14.1. Middle East and Africa Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.2. Middle East and Africa Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.3. Middle East and Africa Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.4. Middle East and Africa Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14.5. Middle East and Africa Online Event Ticketing Market Size and Forecast, by Country (2025-2032) 14.5.1. South Africa 14.5.1.1. South Africa Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.5.1.2. South Africa Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.5.1.3. South Africa Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.5.1.4. South Africa Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14.5.2. GCC 14.5.2.1. GCC Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.5.2.2. GCC Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.5.2.3. GCC Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.5.2.4. GCC Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14.5.3. Egypt 14.5.3.1. Egypt Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.5.3.2. Egypt Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.5.3.3. Egypt Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.5.3.4. Egypt Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14.5.4. Nigeria 14.5.4.1. Nigeria Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.5.4.2. Nigeria Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.5.4.3. Nigeria Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.5.4.4. Nigeria Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 14.5.5. Rest of ME&A 14.5.5.1. Rest of ME&A Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 14.5.5.2. Rest of ME&A Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 14.5.5.3. Rest of ME&A Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 14.5.5.4. Rest of ME&A Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15. South America Online Event Ticketing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032 15.1. South America Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.2. South America Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.3. South America Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.4. South America Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15.5. South America Online Event Ticketing Market Size and Forecast, by Country (2025-2032) 15.5.1. Brazil 15.5.1.1. Brazil Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.5.1.2. Brazil Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.5.1.3. Brazil Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.5.1.4. Brazil Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15.5.2. Argentina 15.5.2.1. Argentina Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.5.2.2. Argentina Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.5.2.3. Argentina Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.5.2.4. Argentina Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15.5.3. Colombia 15.5.3.1. Colombia Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.5.3.2. Colombia Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.5.3.3. Colombia Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.5.3.4. Colombia Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15.5.4. Chile 15.5.4.1. Chile Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.5.4.2. Chile Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.5.4.3. Chile Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.5.4.4. Chile Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 15.5.5. Rest Of South America 15.5.5.1. Rest Of South America Online Event Ticketing Market Size and Forecast, By Event Type (2025-2032) 15.5.5.2. Rest Of South America Online Event Ticketing Market Size and Forecast, By Platform (2025-2032) 15.5.5.3. Rest Of South America Online Event Ticketing Market Size and Forecast, By Payment Mode (2025-2032) 15.5.5.4. Rest Of South America Online Event Ticketing Market Size and Forecast, By End-User (2025-2032) 16. Company Profile: Key Players 16.1. Razorgato (Greater Los Angeles Area, West Coast, Western US) 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.1.6. Recent Developments 16.2. Live Nation Entertainment Inc. (Beverly Hills, California, U.S.) 16.3. Cinemark Holdings Inc. (Plano, TX) 16.4. Eventbrite (San Francisco , United States) 16.5. StubHub (New York, United States) 16.6. Tickpick (New York, United States) 16.7. EasyMovies (New York City, New York) 16.8. Fandango (Beverly Hills, California, U.S.) 16.9. AOL Inc. (New York, United States) 16.10. Atom Tickets LLC (Santa Monica, CA.) 16.11. Movietickets.com (Boca Raton, Florida, USA.) 16.12. Viagogo (UK) 16.13. Ticketek (Australia) 16.14. Eventim (Germany) 16.15. Big Cinemas 16.16. Vue Entertainment (London, England, United Kingdom) 16.17. BookMyShow.com (Gulmohar, Mumbai.) 16.18. Kyazoonga (Lodhi Road, Delhi) 16.19. Bigtree Entertainment Pvt Ltd (Mumbai) 16.20. Inox Leisure Ltd. (Mumbai) 16.21. Ticketplease (Mumbai, Maharashtra, India) 16.22. VOX Cinemas (Dubai, United Arab Emirates ) 16.23. Ticketmaster Live Nation Entertainment Inc. 16.24. Mtime 17. Key Findings 18. Industry Recommendations 19. Online Event Ticketing Market: Research Methodology