The off-road Motorcycle Market was valued at US$ 9.97 Bn. in 2023 and the total revenue is expected to grow at 6.5% of CAGR from 2024 to 2030, reaching nearly US$ 15.50 Bn.Off-Road Motorcycle Market Overview:

A motor vehicle designed or modified for off-road use is considered an off-road vehicle. Some off-road vehicles are classified as all-terrain vehicles (ATVs) or snowmobiles, and each has its own set of regulations. Off-road vehicles include dune buggies and dirt motorcycles. All off-road vehicles must be registered and have the correct license plates while in operation. There are several motorcycles in this off-road motorcycle market category, which is also known as Dual-Sport or Dual-Purpose. They resembled dirt or MX bikes in many aspects, but they are designed for usage on streets and highways as well as off-road. As public land becomes scarcer and riding areas become more difficult to reach, the street-licensed dual-sport provides additional options for riding locations. Dual-Sports, like any motorcycle designed for several uses, is always a compromise between lightweight off-road motorcycle performance and comfortable street capabilities. Dirt motorcycles are built for difficult ground, with long-travel suspension, knobby tires, and a high seating position. The more challenging the terrain, the better. These lightweight single-cylinder bikes can tackle anything from single-track in the forests, desert, or mountains to high-flying motocross action. Honda, Kawasaki, KTM, Husqvarna, Suzuki, and Yamaha are the most popular dirt bike, off-road, and motocross motorcycle manufacturers in the off-road motorcycle market.To know about the Research Methodology:-Request Free Sample Report

Off-Road Motorcycle Market Dynamics:

Off-Road Motorcycle Market analyses by key market players The aftermarket players that sell off-road conversion kits have divided the global market for off-road motorcycles. The market is growing as a result of rising off-road motorbike awareness globally and the development of training facilities to improve riding abilities. As a result, there is more competition among well-established manufacturers of off-road bikes. Thanks to the rising demand for recreational and adventure sports vehicles, the level of competition is expected to increase. In several countries' defense industries, there has been an increase in demand for the off-road motorcycle market. The off-road motorcycle Market OMEs are focused on the introduction of new off-road motorbike models to grow their product portfolio and strengthen their position in the off-road motorcycle market. Some of the biggest market key players include Benelli QJSrl, BMW AG, and Ducati Motor Holding Spa. Although the growing growth momentum is expected to provide new oppurchunityes, regulations on the usage of off-road motorbikes help to limit the market growth. Companies can focus more on the growth opportunities in the fast-growing categories while retaining their positions in the slow-growing segments to improve their off-road motorbike market share.Honda is one of the world's top vehicle manufacturers. It produces high-quality, effective vehicles including cars, motorbikes, and power tools. In terms of volume, it is also the biggest manufacturer of internal combustion engines globally. KTM- CROSS Industries and Bajaj Auto are the owners of the Austrian motorcycle manufacturer KTM. More than 260 world championship records and five manufacturer's titles have been won by KTM bikes. Off-road motorbike sales at the firm have grown over time. In 2015, the company sold 71,854 off-road motorbikes, with 22,674 of those being motocross bikes and 49,180 being enduro bikes Key strategy and improvement capability drive market growth. The development of the off-road motorcycle market is expected to be significantly influenced by advancements in off-road motorcycle capabilities. The market's manufacturers are focusing more attention on the advancement of improved powertrain, brake, transmission, and combustion technologies as well as the creation of better engine designs and suspension systems. They have high-speed and high suspension systems with compression dampening that are adjustable and self-adjust to the motorcycle's speed.Off-road bikes' high ground clearance and skid plates also contribute to their durability. Off-road motorbike tires also include broad grooves and reinforced carcasses that are designed for usage on a variety of surfaces and circumstances. The Off-road motorcycle skills will be improved, stress on bikes and riders will be reduced, and they will be more fit for use on comfortable and developed roads. Automobile suspension systems are an essential component, especially in off-road vehicles that must navigate harsh terrain. To enhance the off-road capabilities of off-road bikes, a number of industry suppliers are concentrating on the development of reducing suspension technology. Off-road motorcycles may operate well under tremendous stress thanks to the innovative custom shock absorbers and springs offered by TFX Suspension Technology. Advanced fork springs, shock springs, and shock absorbers are available for off-road motorcycles from K-Tech Suspension Ltd. One of the most important off-road motorcycle market trends is the employment of such cutting-edge suspension technology, which will help market manufacturers in differentiating their products and, as a result, drive the market's growth over the forecast period. Women penetrating the off-road motorcycle market According to the most recent Motorcycle Industry Council data, female motorcycle ownership is at an all-time high. According to the MIC's most recent Motorcycle Owner Survey, women account for as per data of off-road motorcycles 15-25% of road fund license evasion, there are about 1.3 million active riders for every million registered motorbikes on the road each year. In England, there are 5 million full motorcycle license holders, which indicates that 4/5ths are inactive. There are presently 525,000 female full motorbike license holders within this group. The Motorcycle Industry Council in the United States recorded a 52% increase in female bike riders between 2020 and 2021. According to Women Riders Now magazine, the number of female motorcycle owners has increased by 37%. According to MIC's Owner Survey, women currently account for 14% of all motorcycle owners in the United States, a figure that is steadily increasing since 2018 by 8%.

Off-road motorbikes are more famous among women, and thanks to these riding are risk-taking also Off-road riding (cross-country trail riding) or motocross (on a dirt race course with jumps) is more physical, similar to mountain biking—but without the pedals. In addition, the risks differ significantly from those found on the pavement. Users may come across rocks, trees, branches, stumps, grit, rushing water, heat fatigue, or "roost" depending on where you ride (dirt and rocks kicked up from other riders). Users also need more range of motion and airflow because you're moving faster around and standing up on the bike to adapt to directional and topographical changes when riding. This is why motorcyclists who are fully equipped for a dirt ride appear to be superheroes. The rising material cost forces OMEs to increase the prices Companies struggle to accurately assess the risk of dramatically fluctuating raw material costs. A market structure is unavoidable if they pass on rising costs just marginally, slowly, or too cautiously, or if rising raw material costs coincide with falling sales prices. The sustainability of a corporation can be seriously challenged by rapidly shifting raw material costs and poor price management. For example, Bayer expects a loss of almost €500 million in 2020 as a result of rising raw material costs. The situation facing the steel sector is similar. For one significant German steel company, a pricing differential of just €30 per ton for the year's remaining capacity is sufficient to result in either a modest profit increase or a considerable loss.

For example. Bajaj Auto, the leading manufacturer of high-end motorcycles in India, has raised prices by Rs 500 across the board, and TVS Motor Company and Hero Motocorp are likely to follow suit. Aluminum and copper prices increased by 5.25 percent and 12.25 percent, respectively, to $2,006 and $6,352 per tonne in the second quarter, while domestic steel prices barely increased by 2 percent to Rs 41,817 per tonne. According to auto experts, car manufacturers still have the freedom to significantly raise prices in order to recover costs, but for motorbike manufacturers, even a minor price increase is significant due to close competition. Taiwan has declared a 5.21% increase in the minimum wage, which would result in higher labor expenses for the manufacture of bicycles. Taiwan's minimum wage has been rising every year for the previous six years, but this rise is particularly significant and represents the greatest increase in 15 years. Beginning on January 1, 2022, the minimum salary will increase from NT$24,000 to NT$25,250 ($899.42USD) each month, while hourly compensation will increase from NT$160 to NT$168 ($5.98USD). The initiative is expected to benefit over 2.1 million households. Shipping rates and huge lead time also affect the off-road motorcycle market growth.

Off-Road Motorcycle Market Segment Analysis:

Based on Type, the Off-Road Motorcycle Market is segmented into Motocross motorcycles, Enduro Motorcycles, Trail Motorcycles, and Track Racing motorcycles. Track racing motorcycles held the largest market share in 2023. Similar to touring automobiles, customized production motorbikes are used in superbike racing, a type of motorcycle road racing. Motorcycles used in superbike racing must have four-stroke engines with displacements of between 750 and 1000 cc for four-cylinder models and between 800 and 1200 cc for twin-cylinder models. Similar to their road-going counterparts, motorbikes must maintain their profile. Despite changes to the machine's technical components, the general look as seen from the front, back, and sides must still match that of the bike that has been homologous for usage on public roads. the rising popularity of electric two-wheelers, the expansion of the motorbike, and the expanding global desire for inexpensive private transportation. Motorcycle racing is a form of motorcycling competition (also spelled moto racing and motorbike racing). A significant variation includes motorcycle road racing, off-road racing on either closed or open courses, and track racing. Other categories include competitions for land speed records, drag racing, and hill climbs. The cyclist who crosses the finish line first wins each race, which comprises a certain number of laps. Based on their finish position in each race, riders are awarded points. Every year, the rider with the most points wins the championship driving the off-road motorcycle market. MotoGP and the FIM Superbike World Championship (WSBK) are both world-class motorcycle championships with large fan bases that engage spectators all year with high-speed, edge-of-your-seat motorcycle racing. Based on the Application, the Off-Road Motorcycle Market is segmented into Less Than 500cc, 500cc to 1000cc, and More than 1000cc. Less Than 500cc is expected to dominate the market during the forecast period. The engine capacity of a motorbike is critical since it directly correlates to the amount of power it produces. The engine capacity of a motorbike is measured in cubic capacity. Vehicle cubic capacity, generally known as "cc," typically varies from 50cc to 1500cc. It is also thought that the larger the chamber on a two-wheeler, the greater its power. The capacity of a bike is calculated in the same manner as the engine capacity of a four-wheeler vehicle is measured in liters. As a result, a two-wheeler with a 250cc engine really has a capacity of 0.25 liters. On the other side, the engine capacity of a two-wheeler is important in determining other engine outputs such as power output, torque, and mileage. The engine capacity is the amount of space/volume available inside the tank to burn the air-fuel mixture. The larger the cylinder, the more mixing that may occur. Larger bikes often have larger containers, which allows them to create more power and have more gasoline space: the larger the engine capacity, the higher your fuel expenditure. Smaller engine capacity is often more efficient and provides more mileage per liter of gasoline. To summarize, the bike engines with the best mileage are those with displacements of up to 100cc. Engines with capacities ranging from 110cc to 150cc get good mileage, whilst engines with capacities ranging from 150cc to 200cc have intermediate mileage rates. Engines with capacities ranging from 200cc to 500cc have lesser mileage, while engines with capacities greater than 500cc have the lowest mileage these factors drive the off-road motorcycle market during the forecast period.Off-Road Motorcycle Market Regional Insights:

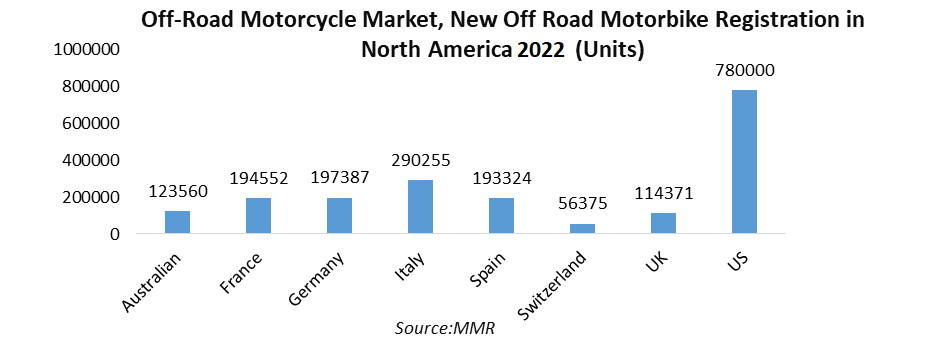

The North American region is expected to dominate the market with a 45 % share in 2023. In 2021, Australian motorcyclists purchased 123,530 motorcycles of all types, a 13.4 percent rise over the total sales in 2020. Off-road motorcycles accounted for almost 43 percent of those sales, which is not unexpected considering the various and different locations throughout the country that are best (and maybe only) seen on an off-road motorcycle market. In the French off-road motorcycle market, 194,552 new motorcycles were registered in 2021, a 9.2 percent rise over sales in 2020. France, in particular, reported supply chain bottlenecks that hampered motorcycle sales, and local analysts speculate that even more registrations would have happened if the quantity of accessible bikes on the ground had been larger. New bike registrations increased by 32% in 2020 compared to 2019, owing in significant part to the pandemic's increased demand for personalized transportation. However, 197,387 new motorcycle registrations were recorded in Germany off- road Motor cyle market for 2021, representing a 9.72 percent decline in registrations compared to 2020. Still, a 32 percent increase in one year followed by a 10 percent drop the next year appears to be a correction instead of a true negative. In Italy, numbers dropped more or less in 2020 but surged over even 2019 levels in 2021. A total of 290,255 new motorcycles were registered, representing a 14% increase over 2019. Among these, 119,079 motorcycle registrations and 151,153 scooter registrations were recorded. Those who follow motorcycle racing in most disciplines are aware that Spain develops racing talent in the same way that the United States develops football potential. With that in mind, it's perhaps no surprise that new motorcycle registrations totaled 193,324 units in 2021 off-road motorcycle market. This is a 5% increase over 2020, yet it is still lower than pre-pandemic levels from 2019. Above all, 125cc scooters ruled supreme—and eight of the top ten models sold in Spain in 2021 were 125cc scooter types. New motorcycle sales totals for 2021 are not yet available as of January 20, 2022. However, considering the statistics for 2020, they will be interesting to watch. In the United States, 780,000 new motorcycles were sold in 2020. Given that just 467,780 new bikes were sold in 2019, it will be interesting to watch if the trend continues in 2021.While this roundup is mostly about data, several new bike retailers in the United States appeared to have problems maintaining new bikes in stock throughout 2021. Furthermore, several bikes appeared to sell almost as fast as dealers could get their hands on them. We look forward to updating this area with the most recent figures as they become available.

Off-road Motorcycles Market Scope: Inquire before buying

Global Off-road Motorcycles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.97 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 15.50 Bn. Segments Covered: by Application Recreational Defence by Type Dirt Bikes Adventure Bikes Trial Bikes Enduro Bikes Kids Motorbikes Others by Engine Capacity Less Than 500 cc 500 cc to 1000 cc More Than 1000 cc by Price Range Low to Mid High Off-Road Motorcycle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leaders in the Off-road Motorcycles Market Manufacturing are:

1. Bayerische Motoren Werke AG (Germany) 2. Triumph Motorcycles Ltd (UK) 3. Sherco (France) 4. GasGas (Spain) 5. Rieju (Spain) 6. TM RACING SPA (Italy) 7. Aprilia (Italy) 8. Benelli (Italy) 9. Ducati Motor Holding S.p.A. (Italy) 10. Beta Motorcycles (Italy) 11. KTM AG (Austria) 12. Husqvarna Motorcycles (Sweden) 13. Kuberg s.r.o. (Czechia) 14. Ural Motorcycles (Russia) 15. Kawasaki Heavy Industries Ltd. (Japan) 16. Yamaha Motor Co., Ltd. (Japan) 17. Suzuki Motor Corporation (Japan) 18. Honda Motor Co., Ltd. (Japan) 19. Bajaj Group (India) 20. Royal Enfield (India) 21. Hero MotoCorp Limited (India) 22. TVS Motor Company (India) 23. Harley-Davidson, Inc (US) 24. SSR Motorsports (US) 25. Chritini Technologies (US) 26. Rokon (US) Frequently Asked Questions: 1] What segments are covered in the Global Off-Road Motorcycle Market report? Ans. The segments covered in the Off-Road Motorcycle Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Off-Road Motorcycle Market? Ans. The North America region is expected to hold the highest share of the Off-Road Motorcycle Market. 3] What is the market size of the Global Off-Road Motorcycle Market by 2030? Ans. The market size of the Off-Road Motorcycle Market by 2030 is expected to reach US$ 15.50 Bn. 4] What is the forecast period for the Global Off-Road Motorcycle Market? Ans. The forecast period for the Off-Road Motorcycle Market is 2024-2030. 5] What was the market size of the Global Off-Road Motorcycle Market in 2023? Ans. The market size of the Off-Road Motorcycle Market in 2023 was valued at US$ 9.97 Bn.

1. Global Off-road Motorcycles Market: Research Methodology 2. Global Off-road Motorcycles Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Off-road Motorcycles Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Off-road Motorcycles Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Off-road Motorcycles Market Segmentation 4.1 Global Off-road Motorcycles Market, by Application (2023-2030) • Recreational • Defence 4.2 Global Off-road Motorcycles Market, by Type (2023-2030) •Dirt Bikes • Adventure Bikes • Trial Bikes • Enduro Bikes • Kids Motorbikes • Others 4.3 Global Off-road Motorcycles Market, by Engine Capacity (2023-2030) • Less Than 500 cc • 500 cc to 1000 cc • More Than 1000 cc 4.4 Global Off-road Motorcycles Market, by Price Range (2023-2030) • Low to Mid • High 5. North America Off-road Motorcycles Market(2023-2030) 5.1 North America Off-road Motorcycles Market, by Application (2023-2030) • Recreational • Defence 5.2 North America Off-road Motorcycles Market, by Type (2023-2030) •Dirt Bikes • Adventure Bikes • Trial Bikes • Enduro Bikes • Kids Motorbikes • Others 5.3 North America Off-road Motorcycles Market, by Engine Capacity (2023-2030) • Less Than 500 cc • 500 cc to 1000 cc • More Than 1000 cc 5.4 North America Off-road Motorcycles Market, by Price Range (2023-2030) • Low to Mid • High 5.5 North America Off-road Motorcycles Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Off-road Motorcycles Market (2023-2030) 6.1. European Off-road Motorcycles Market, by Application (2023-2030) 6.2. European Off-road Motorcycles Market, by Type (2023-2030) 6.3. European Off-road Motorcycles Market, by Engine Capacity (2023-2030) 6.4. European Off-road Motorcycles Market, by Price Range (2023-2030) 6.5. European Off-road Motorcycles Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Off-road Motorcycles Market (2023-2030) 7.1. Asia Pacific Off-road Motorcycles Market, by Application (2023-2030) 7.2. Asia Pacific Off-road Motorcycles Market, by Type (2023-2030) 7.3. Asia Pacific Off-road Motorcycles Market, by Engine Capacity (2023-2030) 7.4. Asia Pacific Off-road Motorcycles Market, by Price Range (2023-2030) 7.5. Asia Pacific Off-road Motorcycles Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Off-road Motorcycles Market (2023-2030) 8.1 Middle East and Africa Off-road Motorcycles Market, by Application (2023-2030) 8.2. Middle East and Africa Off-road Motorcycles Market, by Type (2023-2030) 8.3. Middle East and Africa Off-road Motorcycles Market, by Engine Capacity (2023-2030) 8.4. Middle East and Africa Off-road Motorcycles Market, by Price Range (2023-2030) 8.5. Middle East and Africa Off-road Motorcycles Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Off-road Motorcycles Market (2023-2030) 9.1. South America Off-road Motorcycles Market, by Application (2023-2030) 9.2. South America Off-road Motorcycles Market, by Type (2023-2030) 9.3. South America Off-road Motorcycles Market, by Engine Capacity (2023-2030) 9.4. South America Off-road Motorcycles Market, by Price Range (2023-2030) 9.5. South America Off-road Motorcycles Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Bayerische Motoren Werke AG (Germany) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Triumph Motorcycles Ltd (UK) 10.3 Sherco (France) 10.4 GasGas (Spain) 10.5 Rieju (Spain) 10.6 TM RACING SPA (Italy) 10.7 Aprilia (Italy) 10.8 Benelli (Italy) 10.9 Ducati Motor Holding S.p.A. (Italy) 10.10 Beta Motorcycles (Italy) 10.11 KTM AG (Austria) 10.12 Husqvarna Motorcycles (Sweden) 10.13 Kuberg s.r.o. (Czechia) 10.14 Ural Motorcycles (Russia) 10.15 Kawasaki Heavy Industries Ltd. (Japan) 10.16 Yamaha Motor Co., Ltd. (Japan) 10.17 Suzuki Motor Corporation (Japan) 10.18 Honda Motor Co., Ltd. (Japan) 10.19 Bajaj Group (India) 10.20 Royal Enfield (India) 10.21 Hero MotoCorp Limited (India) 10.22 TVS Motor Company (India) 10.23 Harley-Davidson, Inc (US) 10.24 SSR Motorsports (US) 10.25 Chritini Technologies (US) 10.26 Rokon (US)