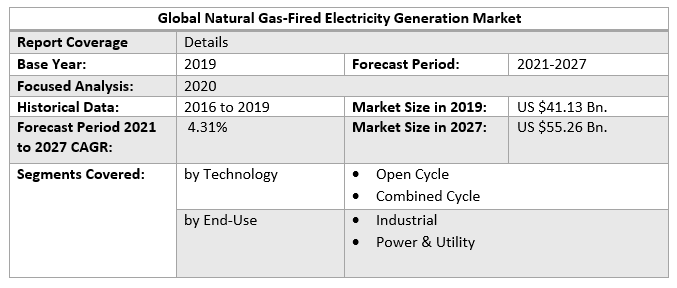

By 2027, the Global Natural Gas-Fired Electricity Generation Market is expected to reach US $55.26 Bn., thanks to growth in the Technology, and End-Use segment. The report analyzes market dynamics by region and end-user industries.Global Natural Gas-Fired Electricity Generation Market Overview:

The global natural gas-fired electricity generation market size was valued at US $41.13 Bn. in 2019, and it is expected to reach US $55.26 Bn. by 2027 with a CAGR of 4.31% during the forecast period. Natural gas is a naturally occurring hydrocarbon gas mixture primarily composed of methane with different proportions of other higher alkanes, as well as a minor quantity of carbon dioxide, nitrogen, hydrogen sulphide, or helium. Across the globe, it is a key source of electricity generation through the implementation of gas turbines, steam turbines, and co-generation. It is one of the ideal fuels for power generation since it is both clean and efficient; it emits 30% less CO2 (Carbon dioxide) than burning petroleum and 45 % less CO2 kWh (per kilowatt-hour) than burning coal. However, natural gas generates more energy than its alternatives like oil and coal.To know about the Research Methodology :- Request Free Sample Report 2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated based on the real numbers and the outputs of the key players across the globe. The past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and is analyzed especially with the impact of lockdown by region.

Global Natural Gas-Fired Electricity Generation Market Dynamics:

Availability of abundant natural gas & supporting government policies As environmental concerns about the high carbon emissions from coal-fired electricity generation plants have grown natural gas-fired power stations have become a cleaner option for baseload electricity generation. Some of the world's major countries in the Asia Pacific, Europe, and North America expect to be able to replace coal with natural gas as the primary source of electricity generation. Natural gas production in the United States has increased as technology for extracting natural gas from shale gas reserves has enhanced. For example, the natural gas production in the country reached 9.8 billion cubic feet per day in 2019, up 10% from 2018. The country's market for natural gas-fired electricity generation has been driven by the availability of natural gas. In 2019, natural gas is been USA's primary electricity generation fuel, contributing to approximately 38% of the total electricity generation. Also, the government of various nations across the globe has taken the relevant regulatory and policy initiatives like EPI (Energy Policy of India), EPE (Energy Plan for Europe) to encourage the use of natural gas as an electricity generation source in the country. The reduced natural gas costs as a result of cost-effective production from some unconventional gas resources in significant quantities are expected to drive market growth throughout the forecast period. The physical nature of natural gas is a challenge Natural gas is difficult to transport because of its physical properties, making it more expensive than oil and coal. Internationally, pipelines were used for the gas flows, but LNG (Liquified Natural Gas) has gained favor. LNG requires upfront capital investment in liquefaction, ships, and regasification facilities. As a result, LNG is less expensive than pipelines over vast distances. Many LNG facilities have been built in the past as alternatives to natural gas pipelines. Also, the presence of coal-based economies, particularly in the Asia Pacific, and inappropriate gas infrastructure in some countries. Thus, the mentioned factors are expected to challenge the market growth over the forecast period.Global Natural Gas-Fired Electricity Generation Market Segment Analysis:

Based on Technology, the global natural gas-fired electricity generation market is segmented into two types as follows, Open Cycle, and Combined Cycle. In 2019, the Combined Cycle segment was dominant and held 78.2% of the overall market share. Natural gas-fired combined cycle power generation is now the cleanest possible source of power from hydrocarbon fuels, and this technology is becoming more actively used as natural gas becomes more affordable. This technology has gained popularity as a result of its capacity to improve a plant's overall efficiency. In addition, compared to open cycle technology, combined cycle technology uses less fuel to produce the same amount of electricity. Air is extracted from the environment, compressed in a compressor, and then fed into a combustion chamber in open cycle technology. In addition, fuel is added and burnt at constant pressure and air temperature.Based on End-Use, the global natural gas-fired electricity generation market is segmented into two types as follows, Industrial, and Power & Utility. In 2019, the Power & Utility segment was dominant and held 85.8% of the overall market share in terms of revenue because of the need for large-scale power stations to meet the rising baseload power demand. Also, the increased demand for electricity from the residential, commercial, industrial sectors, as well as the decommissioning of outdated coal-fired power plants, is expected to drive the development of natural gas-fired electricity generation plants. These factors are also expected to contribute to the power and utility segment's growth over the forecast period.

Global Natural Gas-Fired Electricity Generation Market Regional Insights:

In 2019, Asia Pacific was the dominant region and held the highest share 35% of the global natural gas-fired electricity generation market in terms of revenue. China and Japan are expected to make a significant contribution to the region's industrial sector growth in the future years. Furthermore, governments in such nations are always working to reduce carbon emissions, encouraging the electricity generation sector to use natural gas rather than coal as a fuel. In 2019, North America also held a considerable share of xx% in terms of revenue. A surge in shale gas extraction across the region has driven the electricity generation industry to shift its interest toward natural gas. Also, the presence of rules and regulations targeted at lowering carbon emissions and converting to natural gas as a power generating source over coal is expected to drive natural gas-fired power plants in the region. During the forecast period, these elements are expected to drive growth in North America. Thanks to a series of projects in the pipeline in countries such as Saudi Arabia, Iraq, and the United Arab Emirates, the Middle East, and Africa are expected to grow significantly throughout the forecast period. Furthermore, the majority of the countries in the region are attempting to improve access to energy in their own countries. During the forecast period, these variables are expected to contribute to the region's growth. The objective of the report is to present a comprehensive analysis of the global natural gas-fired electricity generation market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global natural gas-fired electricity generation market dynamics, structure by analyzing the market segments and project the global natural gas-fired electricity generation market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global natural gas-fired electricity generation market make the report investor’s guide.Global Natural Gas-Fired Electricity Generation Market Scope: Inquire before buying

Global Natural Gas-Fired Electricity Generation Market, by Region

• North America • Europe • Asia Pacific • The Middle East and Africa • South AmericaGlobal Natural Gas-Fired Electricity Generation Market Key Players

• General Electric • Siemens AG • Mitsubishi Hitachi Power Systems Ltd. • Kawasaki Heavy Industries Ltd. • Ansaldo Energia S.P.A. • Power Grid Corporation • National Thermal Power Corporation • Damodar Valley Corporation • Royal Dutch Shell • BP PLC • Novatek • Albama Power • Decatur Utilities • Arizona Public Service • Public Service Company of Colorado • Direct Energy • Georgia Power • Solar Turbines Inc. • Centrax Gas Turbines • Opra Turbines • OthersFrequently Asked Questions:

1. What is the forecast period considered for the natural gas-fired electricity generation market report? Ans. The considered forecast period for the natural gas-fired electricity generation market is 2021-2027. 2. Which key factors are hindering the growth of the natural gas-fired electricity generation market? Ans. The increasing coal-based economies and expensiveness of natural gas are the key factors expected to hinder the growth of the natural gas-fired electricity generation market over the forecast period. 3. What is the compound annual growth rate (CAGR) of the natural gas-fired electricity generation market for the next 6 years? Ans. The global natural gas-fired electricity generation market is expected to grow at a CAGR of 4.72% during the forecast period (2021-2027). 4. What are the key factors driving the growth of the natural gas-fired electricity generation market? Ans. The ample availability of natural gas and supporting government policies are expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered for the natural gas-fired electricity generation market report? Ans. General Electric, Siemens AG, Mitsubishi Hitachi Power Systems Ltd., Kawasaki Heavy Industries Ltd., Ansaldo Energia S.P.A, Power Grid Corporation, National Thermal Power Corporation, Damodar Valley Corporation, Royal Dutch Shell, BP PLC, Novatek, Albama Power, Decatur Utilities, Arizona Public Service, Public Service Company of Colorado, Direct Energy, Georgia Power, Solar Turbine Inc., Centrax Gas Turbines, Opra Turbines, and Others.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Natural Gas-Fired Electricity Generation Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Natural Gas-Fired Electricity Generation Market 3.4. Geographical Snapshot of the Natural Gas-Fired Electricity Generation Market, By Manufacturer share 4. Global Natural Gas-Fired Electricity Generation Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Natural Gas-Fired Electricity Generation Market 5. Supply Side and Value Side Indicators 6. Global Natural Gas-Fired Electricity Generation Market Analysis and Forecast, 2019-2027 6.1. Global Natural Gas-Fired Electricity Generation Products Market Size & Y-o-Y Growth Analysis. 7. Global Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 7.1.1. Open Cycle 7.1.2. Combined Cycle 7.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 7.2.1. Industrial 7.2.2. Power & Utility 8. Global Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2027 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 9.1.1. Open Cycle 9.1.2. Combined Cycle 9.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 9.2.1. Industrial 9.2.2. Power & Utility 10. North America Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 12. Canada Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 13. Mexico Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 13.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 14. Europe Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 14.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 15. Europe Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 16.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 17. France Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 17.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 17.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 18. Germany Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 18.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 18.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 19. Italy Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 19.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 19.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 20. Spain Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 20.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 20.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 21. Sweden Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 21.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 21.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 22. CIS Countries Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 22.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 22.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 23. Rest of Europe Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 23.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 23.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 24. Asia Pacific Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 24.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 24.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 25. Asia Pacific Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Natural Gas Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 26.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 26.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 27. India Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 27.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 27.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 28. Japan Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 28.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 28.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 29. South Korea Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 29.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 29.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 30. Australia Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 30.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 30.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 31. ASEAN Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 31.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 31.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 32. Rest of Asia Pacific Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 32.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 32.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 33. Middle East Africa Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 33.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 33.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 34. Middle East Africa Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 35.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 35.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 36. GCC Countries Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 36.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 36.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 37. Egypt Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 37.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 37.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 38. Nigeria Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 38.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 38.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 39. Rest of ME&A Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 39.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 39.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 40. South America Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 40.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 40.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 41. South America Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 42.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 42.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 43. Argentina Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 43.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 43.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 44. Rest of South America Natural Gas-Fired Electricity Generation Market Analysis and Forecasts, 2019-2027 44.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 44.2. Market Size (Value) Estimates & Forecast By End-Use, 2019-2027 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Natural Gas-Fired Electricity Generation Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, End-Use, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment, and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. General Electric 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Siemens AG 45.3.3. Mitsubishi Hitachi Power Systems Ltd. 45.3.4. Kawasaki Heavy Industries Ltd. 45.3.5. Ansaldo Energia S.P.A. 45.3.6. Power Grid Corporation 45.3.7. National Thermal Power Corporation 45.3.8. Damodar Valley Corporation 45.3.9. Royal Dutch Shell 45.3.10. BP PLC 45.3.11. Novatek 45.3.12. Albama Power 45.3.13. Decatur Utilities 45.3.14. Arizona Public Service 45.3.15. Public Service Company of Colorado 45.3.16. Direct Energy 45.3.17. Georgia Power 45.3.18. Solar Turbine Inc. 45.3.19. Centrax Gas Turbines 45.3.20. Opra Turbines 45.3.21. Others 46. Primary Key Insights