Mobility Scooters Market size was valued at US$ 1.94 Bn. in 2022 and the total revenue is expected to grow at 6.5% through 2023 to 2029, Mobility Scooters Market is reaching nearly US$ 3.02 Bn. by 2029.Mobility Scooters Market Overview

Mobility scooters are electric-powered mobility aids that are comparable to motorcycles and can be used as an alternative or auxiliary to a power wheelchair. They are multi-featured, electrically propelled vehicles that allow people with restricted mobility and independence to navigate both indoors and outside. Mobility scooters come in three or four wheeled versions and are primarily used by older people who have lost their strength and balance. Front-wheel drive and rear-wheel drive mobility scooters are both available. Front-wheel drive scooters are smaller and used mostly indoors, but rear-wheel drive scooters are used both outside and indoors.To know about the Research Methodology :- Request Free Sample Report

Mobility Scooters Market Dynamics:

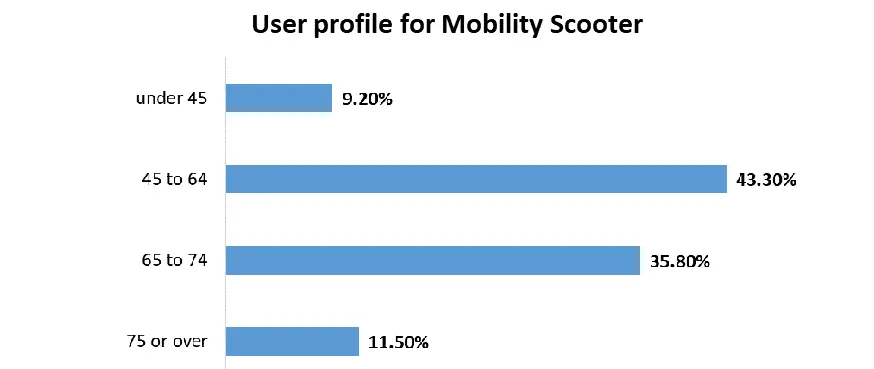

Factors such as a preference for electric mobility scooters as an environmentally clean and effective option, an increase in the % age of older individuals, and expanding awareness for innovative mobility gadgets all contribute to the market's global expansion. Issues such as the lack of EV charging standardisation and the high cost of batteries may limit the market's growth throughout the forecast period. Increasing R&D investments for improved battery technology, as well as increased credit and financing choices, give profitable potential for market expansion over the forecast period. Continuously rising global fuel emissions have been one of governments' and environmentalists' top worries in recent years. This boosts demand for electric driven mobility scooters around the world, contributing to the market's growth. Furthermore, technological breakthroughs in the field of smart mobility have opened up several potential for the global mobility scooters market to grow. Firms in the mobility scooter sector have created and produced a variety of mobility scooters for usage in various industries, consequently augmenting the market's growth. The geriatric population is becoming more prone to mobility issues as they age, which is expected to drive market growth over the forecast period. The world's growing disabled population is predicted to grow the number of persons who require these scooters. According to a 2019 U.S. Census Bureau estimate, 40 % of Americans aged 65 and older have mobility disabilities, meaning they have difficulty walking or standing. Congenital abnormalities, accidents, orthopaedic impairments, and neuromuscular problems are all possible causes of mobility disability. Mobility scooter sales are predicted to grow in the future years, thanks to rapidly expanding technological innovation in scooter designs and the release of many mobility goods, such as powered scooters, by significant corporations. There is no alternate source of charging for electric vehicles' batteries. The lack of charging stations in most places is a major stumbling block to the global mobility scooter market's growth. In addition, inconsistencies in infrastructure and range anxiety can be a concern for electric vehicles, putting passengers in risk. The development of supportive infrastructure for electric vehicles is weaker in developing countries. Charging such vehicles in rural locations is a significant problem because many individuals don't have access to a dedicated charging station, making charging an electric mobility scooter at home problematic. Because the technology is not yet mature, electric car sales are exceedingly low in comparison to other vehicle sales outside of China.

Mobility Scooters Market Segment Analysis:

Based on no of Wheel, the market is sub-segmented into 3-wheeler, 4-wheeler and 5-wheeler. 4 Wheel, one of the segments, is expected to grow at a 5.6 % CAGR during the forecast period. Following an early assessment of the pandemic's business ramifications and the resulting economic crisis, the 3 Wheel segment's growth is revised to a revised 6.9% CAGR for the following seven years.Based on Distribution Channel, market is sub-segmented into online and offline. Online segment is estimated to hold the xx% market share as growing the popularity of e-commerce, usage of smartphones, and use of the internet. Online retailing provides more discounts and wider options to purchase, the online platform becomes popular owing to that it provides the delivery to the doorstep by order of products. Because of this difference in service, it is widely accepted that internet vendors may sell mobility scooters at significantly reduced pricing. Retailers aren't confident in their ability to communicate this difference in service to customers, and as a result, some customers are feeling insecure. According to anecdotal evidence, some customers appear to be visiting merchants for evaluation and assistance on acceptable models before purchasing them online.

Mobility Scooters Market Regional Analysis:

In the year 2022, the Mobility Scooters market in the United States is expected to be worth US$ 398.7 million. China, the world's second largest economy, is expected to reach a projected market size of US$ 389 million by 2029, representing a 5.5 % CAGR from 2023 to 2029. Japan and Canada are two more important geographic markets, with forecasted growth rates of 5.5 % and 4.7 %, respectively, from 2023 to 2029. Germany is expected to expand at a CAGR of around 4.9 % in Europe. Because of government policies and increasing demand for mobility scooters, North America dominates the market. Other major aspects benefiting the market in North America include the baby boomer effect, sophisticated reimbursement procedures, and high awareness of the technology. Due to increased knowledge and rising disposable income, Europe accounted for the second highest proportion of the global mobility scooters market, trailing only North America. However, due to a large untapped population and increased patient awareness of health care, Asia Pacific is predicted to develop at a faster rate. The objective of the report is to present a comprehensive analysis of the global Mobility Scooters Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Mobility Scooters Market dynamics, structure by analyzing the market segments and project the global Mobility Scooters Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Mobility Scooters Market make the report investor’s guide.Mobility Scooters Market Scope: Inquire before buying

Global Mobility Scooters Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.94 Bn. Forecast Period 2023 to 2029 CAGR: 6.5 % Market Size in 2029: US $ 3.02 Bn. Segments Covered: by Type Boot scooters Mid-type scooters Road scooters by No of Wheel 3-wheeler 4-wheeler 5-wheeler by Distribution Channel Online Offline Mobility Scooters Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Mobility Scooters Market, Key Players are

1. Quingo 2. Invacare 3. Drive medical 4. Afikim Electric Vehicles 5. Amigo Mobility International 6. Golden Technologies 7. Hoveround 8. KYMCO 9. Merits Health Products 10. Sunrise Medical 11. TGA Mobility 12. Pride Mobility Products 13. Electric Mobility Euro 14. Van Os Medical 15. Roma Medical 16. VermeirenFrequently Asked Questions:

1) What was the market size of Global Market in 2022? Ans - Global Global Mobility Scooters Market was worth US$ 1.94 Bn. 2022. 2) What is the market segment of the Mobility Scooters Market? Ans -The market segments are based on Type, Number of wheel and distribution channel. 3) What is the forecast period considered for Global Mobility Scooters Market? Ans -The forecast period for Global Mobility Scooters Market is 2023 to 2029. 4) What is the market size of Global Mobility Scooters Market markets in 2029? Ans – Global Mobility Scooters Market is estimated as worth US$ 3.02 Bn. 5) Which region is dominated in Global Mobility Scooters Market? Ans -In 2022, North America region dominated the Global Mobility Scooters Market.

1. Mobility Scooters Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Mobility Scooters Market: Dynamics 2.1. Mobility Scooters Market Trends by Region 2.1.1. North America Mobility Scooters Market Trends 2.1.2. Europe Mobility Scooters Market Trends 2.1.3. Asia Pacific Mobility Scooters Market Trends 2.1.4. Middle East and Africa Mobility Scooters Market Trends 2.1.5. South America Mobility Scooters Market Trends 2.2. Mobility Scooters Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Mobility Scooters Market Drivers 2.2.1.2. North America Mobility Scooters Market Restraints 2.2.1.3. North America Mobility Scooters Market Opportunities 2.2.1.4. North America Mobility Scooters Market Challenges 2.2.2. Europe 2.2.2.1. Europe Mobility Scooters Market Drivers 2.2.2.2. Europe Mobility Scooters Market Restraints 2.2.2.3. Europe Mobility Scooters Market Opportunities 2.2.2.4. Europe Mobility Scooters Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Mobility Scooters Market Drivers 2.2.3.2. Asia Pacific Mobility Scooters Market Restraints 2.2.3.3. Asia Pacific Mobility Scooters Market Opportunities 2.2.3.4. Asia Pacific Mobility Scooters Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Mobility Scooters Market Drivers 2.2.4.2. Middle East and Africa Mobility Scooters Market Restraints 2.2.4.3. Middle East and Africa Mobility Scooters Market Opportunities 2.2.4.4. Middle East and Africa Mobility Scooters Market Challenges 2.2.5. South America 2.2.5.1. South America Mobility Scooters Market Drivers 2.2.5.2. South America Mobility Scooters Market Restraints 2.2.5.3. South America Mobility Scooters Market Opportunities 2.2.5.4. South America Mobility Scooters Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Mobility Scooters Industry 2.8. Analysis of Government Schemes and Initiatives For Mobility Scooters Industry 2.9. Mobility Scooters Market price trend Analysis (2021-22) 2.10. Mobility Scooters Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Mobility Scooters 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Mobility Scooters 2.11. Mobility Scooters Production Analysis 2.12. The Global Pandemic Impact on Mobility Scooters Market 3. Mobility Scooters Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2022-2029 3.1. Mobility Scooters Market Size and Forecast, by Type (2022-2029) 3.1.1. Boot scooters 3.1.2. Mid-type scooters 3.1.3. Road scooters 3.2. Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 3.2.1. 3-wheeler 3.2.2. 4-wheeler 3.2.3. 5-wheeler 3.3. Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Online 3.3.2. Offline 3.4. Mobility Scooters Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Mobility Scooters Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 4.1. North America Mobility Scooters Market Size and Forecast, by Type (2022-2029) 4.1.1. Boot scooters 4.1.2. Mid-type scooters 4.1.3. Road scooters 4.2. North America Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 4.2.1. 3-wheeler 4.2.2. 4-wheeler 4.2.3. 5-wheeler 4.3. North America Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Online 4.3.2. Offline 4.4. North America Mobility Scooters Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Mobility Scooters Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Boot scooters 4.4.1.1.2. Mid-type scooters 4.4.1.1.3. Road scooters 4.4.1.2. United States Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 4.4.1.2.1. 3-wheeler 4.4.1.2.2. 4-wheeler 4.4.1.2.3. 5-wheeler 4.4.1.3. United States Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Online 4.4.1.3.2. Offline 4.4.2. Canada 4.4.2.1. Canada Mobility Scooters Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Boot scooters 4.4.2.1.2. Mid-type scooters 4.4.2.1.3. Road scooters 4.4.2.2. Canada Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 4.4.2.2.1. 3-wheeler 4.4.2.2.2. 4-wheeler 4.4.2.2.3. 5-wheeler 4.4.2.3. Canada Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Online 4.4.2.3.2. Offline 4.4.3. Mexico 4.4.3.1. Mexico Mobility Scooters Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Boot scooters 4.4.3.1.2. Mid-type scooters 4.4.3.1.3. Road scooters 4.4.3.2. Mexico Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 4.4.3.2.1. 3-wheeler 4.4.3.2.2. 4-wheeler 4.4.3.2.3. 5-wheeler 4.4.3.3. Mexico Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Online 4.4.3.3.2. Offline 5. Europe Mobility Scooters Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 5.1. Europe Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.2. Europe Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.3. Europe Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Mobility Scooters Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.1.3. United Kingdom Mobility Scooters Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.2. France 5.4.2.1. France Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.2.3. France Mobility Scooters Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.3.3. Germany Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.4.3. Italy Mobility Scooters Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.5.3. Spain Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.6.3. Sweden Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.7.3. Austria Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Mobility Scooters Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 5.4.8.3. Rest of Europe Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Mobility Scooters Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 6.1. Asia Pacific Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.3. Asia Pacific Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Mobility Scooters Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.1.3. China Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.2.3. S Korea Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.3.3. Japan Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.4.3. India Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.5.3. Australia Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.6.3. Indonesia Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.7.3. Malaysia Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.8.3. Vietnam Mobility Scooters Market Size and Forecast, by Distribution Channel(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.9.3. Taiwan Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Mobility Scooters Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 6.4.10.3. Rest of Asia Pacific Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Mobility Scooters Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 7.1. Middle East and Africa Mobility Scooters Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 7.3. Middle East and Africa Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Mobility Scooters Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Mobility Scooters Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 7.4.1.3. South Africa Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Mobility Scooters Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 7.4.2.3. GCC Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Mobility Scooters Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 7.4.3.3. Nigeria Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Mobility Scooters Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 7.4.4.3. Rest of ME&A Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Mobility Scooters Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 8.1. South America Mobility Scooters Market Size and Forecast, by Type (2022-2029) 8.2. South America Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 8.3. South America Mobility Scooters Market Size and Forecast, by Distribution Channel(2022-2029) 8.4. South America Mobility Scooters Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Mobility Scooters Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 8.4.1.3. Brazil Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Mobility Scooters Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 8.4.2.3. Argentina Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Mobility Scooters Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Mobility Scooters Market Size and Forecast, by No of Wheel (2022-2029) 8.4.3.3. Rest Of South America Mobility Scooters Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Mobility Scooters Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Mobility Scooters Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Mobility Scooters Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Quingo 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Invacare 10.3. Drive medical 10.4. Afikim Electric Vehicles 10.5. Amigo Mobility International 10.6. Golden Technologies 10.7. Hoveround 10.8. KYMCO 10.9. Merits Health Products 10.10. Sunrise Medical 10.11. TGA Mobility 10.12. Pride Mobility Products 10.13. Electric Mobility Euro 10.14. Van Os Medical 10.15. Roma Medical 10.16. Vermeiren 11. Key Findings 12. Industry Recommendations 13. Mobility Scooters Market: Research Methodology 14. Terms and Glossary