Global Bike and Scooter Rental Market is expected to grow at a CAGR of 18.70% during the forecast period and is expected to reach US$ 14.23 Bn by 2029.Bike and Scooter Rental Market Overview

Bike and Scooter Rental Market growth is defined by the massive demand of ridesharing activities globally in forecasted period. The constructive Economic growth of shared small vehicles has estimated for low brake even point for Global market. The rental industry is expanding further prompt expansion of the market in estimated period. Shared Bike and Scooter market is defined as shared micro mobility. The US, Europe and China region automotive sector is anticipated to grow at a faster rate.To know about the Research Methodology :- Request Free Sample Report

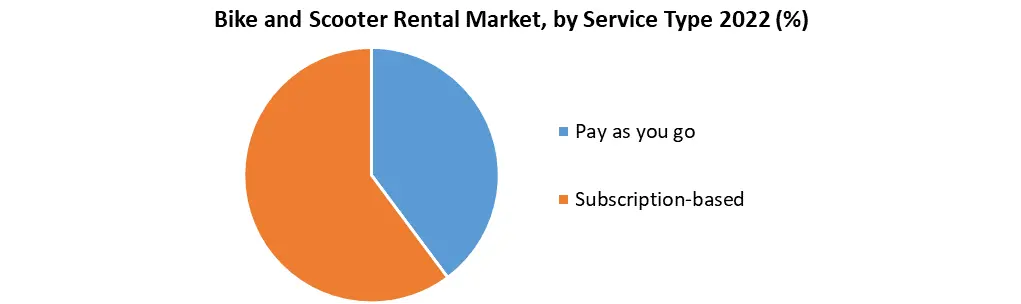

Bike and Scooter Rental Market Service Type

By Service Type, the Global market is segmented into pay as you go and Subscription-based. The Global market is majorly driven by Pay as you go market is expected to grow due to convenience it offers to customers. Pay as you go market is growing with a CAGR of xx%. The Subscription-based Global market are growing as the rental service is providing discount coupons offers to the monthly customers. These will create customer base in future market.Market Development:

Ofo, China-based bike sharing company included ecommerce features on their app in February 2020. Cash back and discount offered by company using their ecommerce features and deposit free Bike and Scooter Rental service. Grab Holdings Inc, Singapore, February 2020, Grab Holding ridesharing company announced acquisition of Bento. This acquisition is formed to expand Grab services and increase wealth management and increase investment by merchant partners and driver partner.

Bike and Scooter Rental Market Dynamics:

Increasing pollution concern is growing necessity for convenient and easy solution such as rental bike and scooter market. The electric vehicle is the major segment growing in rental scooter market due to its low maintenance and operational cost driving the Global market. Pay as you go type service provide convenience to customer to get service as they need, and frequent user can save major cost by this service. The Bike and Scooter Rental service provider gives discount coupons to the regular customers to get customer base intact and gather new customer by this offering. The major threat to the small Bike and Scooter Rental service provider is from major vehicle manufacturers as they are also expected to get into this market and offer their services in some region.Regional Overview:

Global market is segmented region-wise into Asia Pacific, North America, Europe, South America and Middle East & Africa. The Asia Pacific market is the largest market for the rental bike and scooter service, owing to growth in China, India, South Korea, and Japan. Governments are taking initiatives and promoting renewable energy use in order to reduce pollution which is driving the electric vehicle segment in market in this region. Lower cost of operation and low maintenance offered by electric vehicle is best choice for micro mobility increasing market growth rate.Segment Analysis:

Global Bike and Scooter Rental Market is segmented into By Propulsion (Pedal, Electric, Gasoline, Other Propulsion), By Service Type (Pay as you go, Subscription-based), By Vehicle Type (Bike, Scooter, Other Vehicle Type), By Operational Model (Dockless, Station-Based) and Region (North America, Europe, Asia pacific, Middle East & Africa, and Latin America). The Dockless type operational model is majorly growing in Global market with xx% CAGR. By Vehicle type segment scooter is leading and expected to grow with 45% CAGR. The report also helps in understanding market dynamics, structure by analyzing the market segments and projects the Bike and Scooter Rental Market size. Clear representation of competitive analysis of key players by Supply Chain, price, financial position, Product portfolio, growth strategies, and regional presence in the Bike and Scooter Rental Market make the report investor’s guide.Bike and Scooter Rental Market Scope: Inquire before buying

Bike and Scooter Rental Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.28 Bn. Forecast Period 2023 to 2029 CAGR: 18.70% Market Size in 2029: US $ 14.23 Bn. Segments Covered: by Propulsion Pedal Electric Gasoline Other Propulsion by Service Type Pay as you go Subscription-based by Vehicle Type Bike Scooter Other Vehicle Type by Operational Model Dockless Station-Based Bike and Scooter Rental Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argetina and Rest of South America)Bike and Scooter Rental Market Key Players

1. Bird 2. Jump 3. Grow Mobility 4. Lime 5. Ofo 6. Nextbike 7. COUP 8. Cityscoot 9. Lyft Inc 10. Uber 11. Lyft 12. Gett 13. Grab 14. Olacabs 15. YANDEXFrequently Asked Questions:

1. Which region has the largest share in Global Bike and Scooter Rental Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Bike and Scooter Rental Market? Ans: The Global market is expected to grow at a CAGR of 18.70% during forecast period 2023-2029. 3. What is scope of the Global Bike and Scooter Rental market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Bike and Scooter Rental market? Ans: The important key players in the Global market are – Bird, Jump, Grow Mobility, Lime, Ofo, Nextbike, COUP, Cityscoot, Lyft Inc, Uber, Lyft, Gett, Grab, Olacabs, and YANDEX 5. What is the study period of this market? Ans: The Global market is studied from 2022 to 2029.

Global Bike and Scooter Rental Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Bike and Scooter Rental Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Bike and Scooter Rental Market Analysis and Forecast 6.1. Bike and Scooter Rental Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Bike and Scooter Rental Market Analysis and Forecast, By Propulsion 7.1. Introduction and Definition 7.2. Key Findings 7.3. Bike and Scooter Rental Market Value Share Analysis, By Propulsion 7.4. Bike and Scooter Rental Market Size (US$ Mn) Forecast, By Propulsion 7.5. Bike and Scooter Rental Market Analysis, By Propulsion 7.6. Bike and Scooter Rental Market Attractiveness Analysis, By Propulsion 8. Bike and Scooter Rental Market Analysis and Forecast, By Service Type 8.1. Introduction and Definition 8.2. Key Findings 8.3. Bike and Scooter Rental Market Value Share Analysis, By Service Type 8.4. Bike and Scooter Rental Market Size (US$ Mn) Forecast, By Service Type 8.5. Bike and Scooter Rental Market Analysis, By Service Type 8.6. Bike and Scooter Rental Market Attractiveness Analysis, By Service Type 9. Bike and Scooter Rental Market Analysis and Forecast, By Vehicle Type 9.1. Introduction and Definition 9.2. Key Findings 9.3. Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 9.4. Bike and Scooter Rental Market Size (US$ Mn) Forecast, By Vehicle Type 9.5. Bike and Scooter Rental Market Analysis, By Vehicle Type 9.6. Bike and Scooter Rental Market Attractiveness Analysis, By Vehicle Type 10. Bike and Scooter Rental Market Analysis and Forecast, By Operational Model 10.1. Introduction and Definition 10.2. Key Findings 10.3. Bike and Scooter Rental Market Value Share Analysis, By Operational Model 10.4. Bike and Scooter Rental Market Size (US$ Mn) Forecast, By Operational Model 10.5. Bike and Scooter Rental Market Analysis, By Operational Model 10.6. Bike and Scooter Rental Market Attractiveness Analysis, By Operational Model 11. Bike and Scooter Rental Market Analysis, by Region 11.1. Bike and Scooter Rental Market Value Share Analysis, by Region 11.2. Bike and Scooter Rental Market Size (US$ Mn) Forecast, by Region 11.3. Bike and Scooter Rental Market Attractiveness Analysis, by Region 12. North America Bike and Scooter Rental Market Analysis 12.1. Key Findings 12.2. North America Bike and Scooter Rental Market Overview 12.3. North America Bike and Scooter Rental Market Value Share Analysis, By Propulsion 12.4. North America Bike and Scooter Rental Market Forecast, By Propulsion 12.4.1. Pedal 12.4.2. Electric 12.4.3. Gasoline 12.4.4. Other Propulsion 12.5. North America Bike and Scooter Rental Market Value Share Analysis, By Service Type 12.6. North America Bike and Scooter Rental Market Forecast, By Service Type 12.6.1. Pay as you go 12.6.2. Subscription-based 12.7. North America Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 12.8. North America Bike and Scooter Rental Market Forecast, By Vehicle Type 12.8.1. Bike 12.8.2. Scooter 12.8.3. Other Vehicle Type 12.9. North America Bike and Scooter Rental Market Value Share Analysis, By Operational Model 12.10. North America Bike and Scooter Rental Market Forecast, By Operational Model 12.10.1. Dockless 12.10.2. Station-Based 12.11. North America Bike and Scooter Rental Market Value Share Analysis, by Country 12.12. North America Bike and Scooter Rental Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.13. North America Bike and Scooter Rental Market Analysis, by Country 12.14. U.S. Bike and Scooter Rental Market Forecast, By Propulsion 12.14.1. Pedal 12.14.2. Electric 12.14.3. Gasoline 12.14.4. Other Propulsion 12.15. U.S. Bike and Scooter Rental Market Forecast, By Service Type 12.15.1. Pay as you go 12.15.2. Subscription-based 12.16. U.S. Bike and Scooter Rental Market Forecast, By Vehicle Type 12.16.1. Bike 12.16.2. Scooter 12.16.3. Other Vehicle Type 12.17. U.S. Bike and Scooter Rental Market Forecast, By Operational Model 12.17.1. Dockless 12.17.2. Station-Based 12.18. Canada Bike and Scooter Rental Market Forecast, By Propulsion 12.18.1. Pedal 12.18.2. Electric 12.18.3. Gasoline 12.18.4. Other Propulsion 12.19. Canada Bike and Scooter Rental Market Forecast, By Service Type 12.19.1. Pay as you go 12.19.2. Subscription-based 12.20. Canada Bike and Scooter Rental Market Forecast, By Vehicle Type 12.20.1. Bike 12.20.2. Scooter 12.20.3. Other Vehicle Type 12.21. Canada Bike and Scooter Rental Market Forecast, By Operational Model 12.21.1. Dockless 12.21.2. Station-Based 12.22. North America Bike and Scooter Rental Market Attractiveness Analysis 12.22.1. By Propulsion 12.22.2. By Service Type 12.22.3. By Vehicle Type 12.22.4. By Operational Model 12.23. PEST Analysis 12.24. Key Trends 12.25. Key Developments 13. Europe Bike and Scooter Rental Market Analysis 13.1. Key Findings 13.2. Europe Bike and Scooter Rental Market Overview 13.3. Europe Bike and Scooter Rental Market Value Share Analysis, By Propulsion 13.4. Europe Bike and Scooter Rental Market Forecast, By Propulsion 13.4.1. Pedal 13.4.2. Electric 13.4.3. Gasoline 13.4.4. Other Propulsion 13.5. Europe Bike and Scooter Rental Market Value Share Analysis, By Service Type 13.6. Europe Bike and Scooter Rental Market Forecast, By Service Type 13.6.1. Pay as you go 13.6.2. Subscription-based 13.7. Europe Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 13.8. Europe Bike and Scooter Rental Market Forecast, By Vehicle Type 13.8.1. Bike 13.8.2. Scooter 13.8.3. Other Vehicle Type 13.9. Europe Bike and Scooter Rental Market Value Share Analysis, By Operational Model 13.10. Europe Bike and Scooter Rental Market Forecast, By Operational Model 13.10.1. Dockless 13.10.2. Station-Based 13.11. Europe Bike and Scooter Rental Market Value Share Analysis, by Country 13.12. Europe Bike and Scooter Rental Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Norway 13.12.7. Russia 13.12.8. Rest of Europe 13.13. Germany Bike and Scooter Rental Market Forecast, By Propulsion 13.13.1. Pedal 13.13.2. Electric 13.13.3. Gasoline 13.13.4. Other Propulsion 13.14. Germany Bike and Scooter Rental Market Forecast, By Service Type 13.14.1. Pay as you go 13.14.2. Subscription-based 13.15. Germany Bike and Scooter Rental Market Forecast, By Vehicle Type 13.15.1. Bike 13.15.2. Scooter 13.15.3. Other Vehicle Type 13.16. Germany Bike and Scooter Rental Market Forecast, By Operational Model 13.16.1. Dockless 13.16.2. Station-Based 13.17. U.K. Bike and Scooter Rental Market Forecast, By Propulsion 13.17.1. Pedal 13.17.2. Electric 13.17.3. Gasoline 13.17.4. Other Propulsion 13.18. U.K. Bike and Scooter Rental Market Forecast, By Service Type 13.18.1. Pay as you go 13.18.2. Subscription-based 13.19. U.K. Bike and Scooter Rental Market Forecast, By Vehicle Type 13.19.1. Bike 13.19.2. Scooter 13.19.3. Other Vehicle Type 13.20. U.K. Bike and Scooter Rental Market Forecast, By Operational Model 13.20.1. Dockless 13.20.2. Station-Based 13.21. France Bike and Scooter Rental Market Forecast, By Propulsion 13.21.1. Pedal 13.21.2. Electric 13.21.3. Gasoline 13.21.4. Other Propulsion 13.22. France Bike and Scooter Rental Market Forecast, By Service Type 13.22.1. Pay as you go 13.22.2. Subscription-based 13.23. France Bike and Scooter Rental Market Forecast, By Vehicle Type 13.23.1. Bike 13.23.2. Scooter 13.23.3. Other Vehicle Type 13.24. France Bike and Scooter Rental Market Forecast, By Operational Model 13.24.1. Dockless 13.24.2. Station-Based 13.25. Italy Bike and Scooter Rental Market Forecast, By Propulsion 13.25.1. Pedal 13.25.2. Electric 13.25.3. Gasoline 13.25.4. Other Propulsion 13.26. Italy Bike and Scooter Rental Market Forecast, By Service Type 13.26.1. Pay as you go 13.26.2. Subscription-based 13.27. Italy Bike and Scooter Rental Market Forecast, By Vehicle Type 13.27.1. Bike 13.27.2. Scooter 13.27.3. Other Vehicle Type 13.28. Italy Bike and Scooter Rental Market Forecast, By Operational Model 13.28.1. Dockless 13.28.2. Station-Based 13.29. Spain Bike and Scooter Rental Market Forecast, By Propulsion 13.29.1. Pedal 13.29.2. Electric 13.29.3. Gasoline 13.29.4. Other Propulsion 13.30. Spain Bike and Scooter Rental Market Forecast, By Service Type 13.30.1. Pay as you go 13.30.2. Subscription-based 13.31. Spain Bike and Scooter Rental Market Forecast, By Vehicle Type 13.31.1. Bike 13.31.2. Scooter 13.31.3. Other Vehicle Type 13.32. Spain Bike and Scooter Rental Market Forecast, By Operational Model 13.32.1. Dockless 13.32.2. Station-Based 13.33. Norway Bike and Scooter Rental Market Forecast, By Propulsion 13.33.1. Pedal 13.33.2. Electric 13.33.3. Gasoline 13.33.4. Other Propulsion 13.34. Norway Bike and Scooter Rental Market Forecast, By Service Type 13.34.1. Pay as you go 13.34.2. Subscription-based 13.35. Norway Bike and Scooter Rental Market Forecast, By Vehicle Type 13.35.1. Bike 13.35.2. Scooter 13.35.3. Other Vehicle Type 13.36. Norway Bike and Scooter Rental Market Forecast, By Operational Model 13.36.1. Dockless 13.36.2. Station-Based 13.37. Russia Bike and Scooter Rental Market Forecast, By Propulsion 13.37.1. Pedal 13.37.2. Electric 13.37.3. Gasoline 13.37.4. Other Propulsion 13.38. Russia Bike and Scooter Rental Market Forecast, By Service Type 13.38.1. Pay as you go 13.38.2. Subscription-based 13.39. Russia Bike and Scooter Rental Market Forecast, By Vehicle Type 13.39.1. Bike 13.39.2. Scooter 13.39.3. Other Vehicle Type 13.40. Russia Bike and Scooter Rental Market Forecast, By Operational Model 13.40.1. Dockless 13.40.2. Station-Based 13.41. Rest of Europe Bike and Scooter Rental Market Forecast, By Propulsion 13.41.1. Pedal 13.41.2. Electric 13.41.3. Gasoline 13.41.4. Other Propulsion 13.42. Rest of Europe Bike and Scooter Rental Market Forecast, By Service Type 13.42.1. Pay as you go 13.42.2. Subscription-based 13.43. Rest of Europe Bike and Scooter Rental Market Forecast, By Vehicle Type 13.43.1. Bike 13.43.2. Scooter 13.43.3. Other Vehicle Type 13.44. Rest of Europe Bike and Scooter Rental Market Forecast, By Operational Model 13.44.1. Dockless 13.44.2. Station-Based 13.45. Europe Bike and Scooter Rental Market Attractiveness Analysis 13.45.1. By Propulsion 13.45.2. By Service Type 13.45.3. By Vehicle Type 13.45.4. By Operational Model 13.46. PEST Analysis 13.47. Key Trends 13.48. Key Developments 14. Asia Pacific Bike and Scooter Rental Market Analysis 14.1. Key Findings 14.2. Asia Pacific Bike and Scooter Rental Market Overview 14.3. Asia Pacific Bike and Scooter Rental Market Value Share Analysis, By Propulsion 14.4. Asia Pacific Bike and Scooter Rental Market Forecast, By Propulsion 14.4.1. Pedal 14.4.2. Electric 14.4.3. Gasoline 14.4.4. Other Propulsion 14.5. Asia Pacific Bike and Scooter Rental Market Value Share Analysis, By Service Type 14.6. Asia Pacific Bike and Scooter Rental Market Forecast, By Service Type 14.6.1. Pay as you go 14.6.2. Subscription-based 14.7. Asia Pacific Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 14.8. Asia Pacific Bike and Scooter Rental Market Forecast, By Vehicle Type 14.8.1. Bike 14.8.2. Scooter 14.8.3. Other Vehicle Type 14.9. Asia Pacific Bike and Scooter Rental Market Value Share Analysis, By Operational Model 14.10. Asia Pacific Bike and Scooter Rental Market Forecast, By Operational Model 14.10.1. Dockless 14.10.2. Station-Based 14.11. Asia Pacific Bike and Scooter Rental Market Value Share Analysis, by Country 14.12. Asia Pacific Bike and Scooter Rental Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. South Korea 14.12.5. Australia 14.12.6. Malaysia 14.12.7. Indonesia 14.12.8. Rest of Asia Pacific 14.13. China Bike and Scooter Rental Market Forecast, By Propulsion 14.13.1. Pedal 14.13.2. Electric 14.13.3. Gasoline 14.13.4. Other Propulsion 14.14. China Bike and Scooter Rental Market Forecast, By Service Type 14.14.1. Pay as you go 14.14.2. Subscription-based 14.15. China Bike and Scooter Rental Market Forecast, By Vehicle Type 14.15.1. Bike 14.15.2. Scooter 14.15.3. Other Vehicle Type 14.16. China Bike and Scooter Rental Market Forecast, By Operational Model 14.16.1. Dockless 14.16.2. Station-Based 14.17. India Bike and Scooter Rental Market Forecast, By Propulsion 14.17.1. Pedal 14.17.2. Electric 14.17.3. Gasoline 14.17.4. Other Propulsion 14.18. India Bike and Scooter Rental Market Forecast, By Service Type 14.18.1. Pay as you go 14.18.2. Subscription-based 14.19. India Bike and Scooter Rental Market Forecast, By Vehicle Type 14.19.1. Bike 14.19.2. Scooter 14.19.3. Other Vehicle Type 14.20. India Bike and Scooter Rental Market Forecast, By Operational Model 14.20.1. Dockless 14.20.2. Station-Based 14.21. Japan Bike and Scooter Rental Market Forecast, By Propulsion 14.21.1. Pedal 14.21.2. Electric 14.21.3. Gasoline 14.21.4. Other Propulsion 14.22. Japan Bike and Scooter Rental Market Forecast, By Service Type 14.22.1. Pay as you go 14.22.2. Subscription-based 14.23. Japan Bike and Scooter Rental Market Forecast, By Vehicle Type 14.23.1. Bike 14.23.2. Scooter 14.23.3. Other Vehicle Type 14.24. Japan Bike and Scooter Rental Market Forecast, By Operational Model 14.24.1. Dockless 14.24.2. Station-Based 14.25. South Korea Bike and Scooter Rental Market Forecast, By Propulsion 14.25.1. Pedal 14.25.2. Electric 14.25.3. Gasoline 14.25.4. Other Propulsion 14.26. South Korea Bike and Scooter Rental Market Forecast, By Service Type 14.26.1. Pay as you go 14.26.2. Subscription-based 14.27. South Korea Bike and Scooter Rental Market Forecast, By Vehicle Type 14.27.1. Bike 14.27.2. Scooter 14.27.3. Other Vehicle Type 14.28. South Korea Bike and Scooter Rental Market Forecast, By Operational Model 14.28.1. Dockless 14.28.2. Station-Based 14.28.3. Plastics, Rubber, & Chemicals 14.28.4. Food & Beverages 14.28.5. Other industry 14.29. Australia Bike and Scooter Rental Market Forecast, By Propulsion 14.29.1. Pedal 14.29.2. Electric 14.29.3. Gasoline 14.29.4. Other Propulsion 14.30. Australia Bike and Scooter Rental Market Forecast, By Service Type 14.30.1. Pay as you go 14.30.2. Subscription-based 14.31. Australia Bike and Scooter Rental Market Forecast, By Vehicle Type 14.31.1. Bike 14.31.2. Scooter 14.31.3. Other Vehicle Type 14.32. Australia Bike and Scooter Rental Market Forecast, By Operational Model 14.32.1. Dockless 14.32.2. Station-Based 14.33. Malaysia Bike and Scooter Rental Market Forecast, By Propulsion 14.33.1. Pedal 14.33.2. Electric 14.33.3. Gasoline 14.33.4. Other Propulsion 14.34. Malaysia Bike and Scooter Rental Market Forecast, By Service Type 14.34.1. Pay as you go 14.34.2. Subscription-based 14.35. Malaysia Bike and Scooter Rental Market Forecast, By Vehicle Type 14.35.1. Bike 14.35.2. Scooter 14.35.3. Other Vehicle Type 14.36. Malaysia Bike and Scooter Rental Market Forecast, By Operational Model 14.36.1. Dockless 14.36.2. Station-Based 14.37. Indonesia Bike and Scooter Rental Market Forecast, By Propulsion 14.37.1. Pedal 14.37.2. Electric 14.37.3. Gasoline 14.37.4. Other Propulsion 14.38. Indonesia Bike and Scooter Rental Market Forecast, By Service Type 14.38.1. Pay as you go 14.38.2. Subscription-based 14.39. Indonesia Bike and Scooter Rental Market Forecast, By Vehicle Type 14.39.1. Bike 14.39.2. Scooter 14.39.3. Other Vehicle Type 14.40. Indonesia Bike and Scooter Rental Market Forecast, By Operational Model 14.40.1. Dockless 14.40.2. Station-Based 14.41. Rest of Asia Pacific Bike and Scooter Rental Market Forecast, By Propulsion 14.41.1. Pedal 14.41.2. Electric 14.41.3. Gasoline 14.41.4. Other Propulsion 14.42. Rest of Asia Pacific Bike and Scooter Rental Market Forecast, By Service Type 14.42.1. Pay as you go 14.42.2. Subscription-based 14.43. Rest of Asia Pacific Bike and Scooter Rental Market Forecast, By Vehicle Type 14.43.1. Bike 14.43.2. Scooter 14.43.3. Other Vehicle Type 14.44. Rest of Asia Pacific Bike and Scooter Rental Market Forecast, By Operational Model 14.44.1. Dockless 14.44.2. Station-Based 14.45. Asia Pacific Bike and Scooter Rental Market Attractiveness Analysis 14.45.1. By Propulsion 14.45.2. By Service Type 14.45.3. By Vehicle Type 14.45.4. By Operational Model 14.46. PEST Analysis 14.47. Key Trends 14.48. Key Developments 15. Middle East & Africa Bike and Scooter Rental Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Bike and Scooter Rental Market Overview 15.3. Middle East & Africa Bike and Scooter Rental Market Value Share Analysis, By Propulsion 15.4. Middle East & Africa Bike and Scooter Rental Market Forecast, By Propulsion 15.4.1. Pedal 15.4.2. Electric 15.4.3. Gasoline 15.4.4. Other Propulsion 15.5. Middle East & Africa Bike and Scooter Rental Market Value Share Analysis, By Service Type 15.6. Middle East & Africa Bike and Scooter Rental Market Forecast, By Service Type 15.6.1. Pay as you go 15.6.2. Subscription-based 15.7. Middle East & Africa Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 15.8. Middle East & Africa Bike and Scooter Rental Market Forecast, By Vehicle Type 15.8.1. Bike 15.8.2. Scooter 15.8.3. Other Vehicle Type 15.9. Middle East & Africa Bike and Scooter Rental Market Value Share Analysis, By Operational Model 15.10. Middle East & Africa Bike and Scooter Rental Market Forecast, By Operational Model 15.10.1. Dockless 15.10.2. Station-Based 15.11. Middle East & Africa Bike and Scooter Rental Market Value Share Analysis, by Country 15.12. Middle East & Africa Bike and Scooter Rental Market Forecast, by Country 15.12.1. GCC 15.12.2. South Africa 15.12.3. Rest of Middle East & Africa 15.13. GCC Bike and Scooter Rental Market Forecast, By Propulsion 15.13.1. Pedal 15.13.2. Electric 15.13.3. Gasoline 15.13.4. Other Propulsion 15.14. GCC Bike and Scooter Rental Market Forecast, By Service Type 15.14.1. Pay as you go 15.14.2. Subscription-based 15.15. GCC Bike and Scooter Rental Market Forecast, By Vehicle Type 15.15.1. Bike 15.15.2. Scooter 15.15.3. Other Vehicle Type 15.16. GCC Bike and Scooter Rental Market Forecast, By Operational Model 15.16.1. Dockless 15.16.2. Station-Based 15.17. South Africa Bike and Scooter Rental Market Forecast, By Propulsion 15.17.1. Pedal 15.17.2. Electric 15.17.3. Gasoline 15.17.4. Other Propulsion 15.18. South Africa Bike and Scooter Rental Market Forecast, By Service Type 15.18.1. Pay as you go 15.18.2. Subscription-based 15.19. South Africa Bike and Scooter Rental Market Forecast, By Vehicle Type 15.19.1. Bike 15.19.2. Scooter 15.19.3. Other Vehicle Type 15.20. South Africa Bike and Scooter Rental Market Forecast, By Operational Model 15.20.1. Dockless 15.20.2. Station-Based 15.21. Rest of Middle East & Africa Bike and Scooter Rental Market Forecast, By Propulsion 15.21.1. Pedal 15.21.2. Electric 15.21.3. Gasoline 15.21.4. Other Propulsion 15.22. Rest of Middle East & Africa Bike and Scooter Rental Market Forecast, By Service Type 15.22.1. Pay as you go 15.22.2. Subscription-based 15.23. Rest of Middle East & Africa Bike and Scooter Rental Market Forecast, By Vehicle Type 15.23.1. Bike 15.23.2. Scooter 15.23.3. Other Vehicle Type 15.24. Rest of Middle East & Africa Bike and Scooter Rental Market Forecast, By Operational Model 15.24.1. Dockless 15.24.2. Station-Based 15.25. Middle East & Africa Bike and Scooter Rental Market Attractiveness Analysis 15.25.1. By Propulsion 15.25.2. By Service Type 15.25.3. By Vehicle Type 15.25.4. By Operational Model 15.26. PEST Analysis 15.27. Key Trends 15.28. Key Developments 16. South America Bike and Scooter Rental Market Analysis 16.1. Key Findings 16.2. South America Bike and Scooter Rental Market Overview 16.3. South America Bike and Scooter Rental Market Value Share Analysis, By Propulsion 16.4. South America Bike and Scooter Rental Market Forecast, By Propulsion 16.4.1. Pedal 16.4.2. Electric 16.4.3. Gasoline 16.4.4. Other Propulsion 16.5. South America Bike and Scooter Rental Market Value Share Analysis, By Service Type 16.6. South America Bike and Scooter Rental Market Forecast, By Service Type 16.6.1. Pay as you go 16.6.2. Subscription-based 16.7. South America Bike and Scooter Rental Market Value Share Analysis, By Vehicle Type 16.8. South America Bike and Scooter Rental Market Forecast, By Vehicle Type 16.8.1. Bike 16.8.2. Scooter 16.8.3. Other Vehicle Type 16.9. South America Bike and Scooter Rental Market Value Share Analysis, By Operational Model 16.10. South America Bike and Scooter Rental Market Forecast, By Operational Model 16.10.1. Dockless 16.10.2. Station-Based 16.11. South America Bike and Scooter Rental Market Value Share Analysis, by Country 16.12. South America Bike and Scooter Rental Market Forecast, by Country 16.12.1. Brazil 16.12.2. Mexico 16.12.3. Argentina 16.12.4. Rest of South America 16.13. Brazil Bike and Scooter Rental Market Forecast, By Propulsion 16.13.1. Pedal 16.13.2. Electric 16.13.3. Gasoline 16.13.4. Other Propulsion 16.14. Brazil Bike and Scooter Rental Market Forecast, By Service Type 16.14.1. Pay as you go 16.14.2. Subscription-based 16.15. Brazil Bike and Scooter Rental Market Forecast, By Vehicle Type 16.15.1. Bike 16.15.2. Scooter 16.15.3. Other Vehicle Type 16.16. Brazil Bike and Scooter Rental Market Forecast, By Operational Model 16.16.1. Dockless 16.16.2. Station-Based 16.17. Argentina Bike and Scooter Rental Market Forecast, By Propulsion 16.17.1. Pedal 16.17.2. Electric 16.17.3. Gasoline 16.17.4. Other Propulsion 16.18. Argentina Bike and Scooter Rental Market Forecast, By Service Type 16.18.1. Pay as you go 16.18.2. Subscription-based 16.19. Argentina Bike and Scooter Rental Market Forecast, By Vehicle Type 16.19.1. Bike 16.19.2. Scooter 16.19.3. Other Vehicle Type 16.20. Argentina Bike and Scooter Rental Market Forecast, By Operational Model 16.20.1. Dockless 16.20.2. Station-Based 16.21. Mexico Bike and Scooter Rental Market Forecast, By Propulsion 16.21.1. Pedal 16.21.2. Electric 16.21.3. Gasoline 16.21.4. Other Propulsion 16.22. Mexico Bike and Scooter Rental Market Forecast, By Service Type 16.22.1. Pay as you go 16.22.2. Subscription-based 16.23. Mexico Bike and Scooter Rental Market Forecast, By Vehicle Type 16.23.1. Bike 16.23.2. Scooter 16.23.3. Other Vehicle Type 16.24. Mexico Bike and Scooter Rental Market Forecast, By Operational Model 16.24.1. Dockless 16.24.2. Station-Based 16.25. Rest of South America Bike and Scooter Rental Market Forecast, By Propulsion 16.25.1. Pedal 16.25.2. Electric 16.25.3. Gasoline 16.25.4. Other Propulsion 16.26. Rest of South America Bike and Scooter Rental Market Forecast, By Service Type 16.26.1. Pay as you go 16.26.2. Subscription-based 16.27. Rest of South America Bike and Scooter Rental Market Forecast, By Vehicle Type 16.27.1. Bike 16.27.2. Scooter 16.27.3. Other Vehicle Type 16.28. Rest of South America Bike and Scooter Rental Market Forecast, By Operational Model 16.28.1. Dockless 16.28.2. Station-Based 16.29. South America Bike and Scooter Rental Market Attractiveness Analysis 16.29.1. By Propulsion 16.29.2. By Service Type 16.29.3. By Vehicle Type 16.29.4. By Operational Model 16.30. PEST Analysis 16.31. Key Trends 16.32. Key Developments 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Vehicles, and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Vehicles 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. Bird 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Product Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Development Footprint 17.3.2. Jump 17.3.3. Grow Mobility 17.3.4. Lime 17.3.5. Ofo 17.3.6. Nextbike 17.3.7. COUP 17.3.8. Cityscoot 17.3.9. Lyft Inc 17.3.10. Uber 17.3.11. Lyft 17.3.12. Gett 17.3.13. Grab 17.3.14. Olacabs 17.3.15. YANDEX 18. Primary Key Insights