The Global Electric Mobility Market was valued at US $501.3 Billion in 2022. The market is expected to grow at a CAGR of 10.37% valuing at US $978.12 Billion by 2030.Electric Mobility Market: Overview

The current buzz encircling the EV industry is largely attributable to Tesla, whose lithium-ion battery-powered Roadster debuted in 2008 and reignited public interest. Not only for Tesla, but also for other U.S. companies that received generous funding from the U.S. Department of Energy, this proved to be a turning point. Tesla used the funds to develop the immensely popular Model S, providing the groundwork for increased adoption of electric vehicles.To know about the Research Methodology :- Request Free Sample Report Despite the enthusiasm encircling electric vehicles, the market has experienced numerous false starts over the past decade. Since 2021, EV adoption rates have comprised approximately 7% of the global automobile market, indicating that the global market is still very much in the 'innovator' phase of the product adoption curve. This is primarily due to concerns regarding range, price, charging infrastructure, and sometimes safety. In addition, there is a general consumer reluctance to abandon the internal combustion engine (ICE), which has dominated the automotive industry for decades. In addition, the sharp decline in global oil prices has substantially reduced the total cost of owning ICE vehicles, boosting their sales.

Electric Mobility Market Research Methodology

The report includes primary research, secondary research, market analysis, competitive analysis, forecasting and expert interview. Primary data is collected by directly surveying industry participants through methods such as surveys, interviews, and focus groups. This approach provides detailed insights into the market and can be used to validate secondary research findings. Secondary data is sourced from industry reports, government publications, and academic research. This approach helps identify trends and industry dynamics and provides context for primary research findings. Market data is analysed using quantitative and qualitative methods, including market size and growth projections, market segmentation, and competitive landscape analysis. This helps identify key trends and drivers in the market and informs strategic decision-making. The competitive analysis involves analysing the competitive landscape of the electric mobility industry, including identifying key players, analysing their market share and competitive strategies, and tracking industry developments such as mergers and acquisitions. This approach informs market positioning and strategy. Statistical models are used to forecast market size and growth over a given period of time, which helps inform strategic planning and investment decisions.Market scope

Landscape analysis of the E-Mobility (Electric mobility) market, competitive benchmarking, past and current status of the industry with forecasted market size and trends, evaluation of potential key players, including market leaders, followers, and new entrants, technology trends, the potential impact of micro-economic factors on the market, external and internal factors affecting the market have been examined. The research also analyses market segments to estimate the electric mobility market size and dynamics. The study provides investors with a clear competitive analysis of key players by product, price, financial condition, product portfolio, growth plans, and regional presence in the reclining Sofa market. Market research provides PESTEL, PORTER, COVID-19 Impact analysis, investor and leader recommendations, and projected market estimation. Market Overview: This section covers the electric mobility market's size, growth predictions, vehicle type and charging infrastructure segmentation, and key trends and drivers. Market Segmentation: This section breaks down the electric mobility industry by vehicle type (electric cars, buses, scooters, etc.), charging infrastructure (charging stations, battery swapping, wireless charging, etc.), and region. Competitive Landscape: This section analyses electric mobility market players such automakers, charging infrastructure providers, battery manufacturers, and others. Market share analysis, competitive tactics, and M&As are also covered. Regional Analysis: This section examines the electric mobility market in North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Market size, growth predictions, main drivers and obstacles, and significant players in each region are covered. Industry Trends The electric mobility market is shaped by battery technology, shared transportation, and sustainability. This section provides a comprehensive overview of the electric mobility industry, including market size and growth projections, market segmentation by vehicle type and charging infrastructure, and major trends and drivers. Market Segmentation: The market segmentation section provides a detailed analysis of the electric mobility market by vehicle type (electric cars, electric buses, electric scooters, etc.), by charging infrastructure (charging stations, battery swapping, wireless charging, etc.), and by region.Electric Mobility Market Dynamics

The electric mobility market is rapidly evolving, driven by a combination of technological advancements, government policies, consumer demand, and industry competition. Here are some of the key dynamics shaping the electric mobility market: Government Policies: Government policies play a major role in shaping the electric mobility market. Many countries have implemented incentives and subsidies to promote the adoption of electric vehicles, such as tax credits and rebates. Other policies, such as emissions regulations and zero-emissions vehicle mandates, are also driving the growth of the market. The extent and nature of government support varies by region, but overall, it is a key driver of market growth. Technological Advancements: Advancements in battery technology and charging infrastructure are key drivers of the electric mobility industry. As battery costs decrease and battery ranges increase, electric vehicles are becoming more competitive with traditional gas-powered vehicles. Improvements in charging infrastructure, such as faster charging times and more widespread availability of charging stations, are also making electric vehicles more practical for everyday use. Consumer Demand: Consumer demand is a key driver of the electric mobility market. As more consumers become aware of the benefits of electric vehicles, such as lower operating costs and reduced environmental impact, demand for these vehicles is increasing. Automakers are responding to this demand by developing new electric vehicle models and improving existing ones. Industry Competition: Competition among automakers and other industry players is driving innovation and growth in the electric mobility market. Established automakers are investing heavily in electric vehicle development, while new players are entering the market with innovative electric vehicle designs and business models. The growth of the market is also leading to increased competition among charging infrastructure providers and battery manufacturers. Supply Chain Dynamics: The electric mobility market is dependent on a complex supply chain, which includes everything from the mining of raw materials for batteries to the manufacture and distribution of electric vehicles. As the market grows, supply chain dynamics are becoming increasingly important, with companies looking to secure access to critical resources and develop efficient and sustainable supply chain models.Electric Mobility Market Drivers

There are five main market drivers for electric vehicles: government policies, the Tesla effect, lower battery costs, and increasing battery range. In addition, 5G deployments and the battery-as-a-service model. Governments are attempting to meet their emission targets outlined in various global agreements and have devised a number of incentive programmes to promote the sale of electric vehicles. While electric vehicles are a significant step towards achieving environmental objectives, Tesla is able to alter their image by placing a greater emphasis on high performance and aesthetic appeal. In addition, 5G deployments and novel business models, such as Battery-as-a-Service, are anticipated to fuel future expansion. Electric Mobility Market Challenges Lack of infrastructure (such as charging stations), high up-front costs, lack of consumer knowledge and incorrect perceptions, pressure from oil companies and the car manufacturer lobby, and the potential long-term effects of the COVID-19 pandemic are the five primary obstacles to the widespread adoption of electric vehicles. Not only are charging stations still extremely scarce, but they are typically manufactured by a variety of vendors without a standardised charging and payment system. In addition, high initial costs make electrical vehicles less appealing than conventional internal-combustion engine automobiles, primarily due to the high battery costs, which account for as much as 50 percent of the total vehicle price. Electric Mobility Market Trends Thanks to easier integration and component control, it is easier to realize self-driving cars using electric vehicles rather than vehicles with internal-combustion engines. Despite the challenges, lithium-ion batteries are still expected to dominate the battery market for electric vehicles. Due to their low operating costs, electric vehicles are also part of the ride-sharing movement. Moreover, the U.S. and Europe are expected to gain more control over the lithium-ion supply chain. Interestingly, quantum computing is expected to significantly disrupt the electric vehicle industry resulting in higher battery ranges, new product launches and autonomous driving. Due to their low operating costs, electric vehicles are also part of the ride-sharing movement. Moreover, demand for related electronics and software is expected to grow over the next few years.Electric Mobility Market Segment Analysis

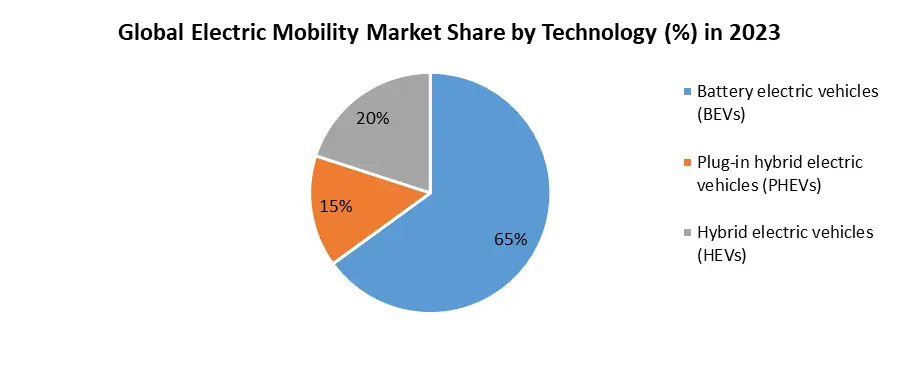

By Product, Electric Mobility Market is categorized into Electric Bikes, Electric Scooters, Electric Motorized Scooters, Electric Motorcycles among this segments the dominance of specific segments within the electric mobility market may vary based on regional preferences and market dynamics. However, electric bikes and electric scooters have been prominent segments due to their widespread adoption in urban environments. Electric scooters, in particular, have gained popularity for short-distance commuting, driven by factors such as ease of use and environmental consciousness. Recent developments in this segment include advancements in battery technology, improved safety features, and increased connectivity options. For instance, major companies are investing in swappable battery technology for electric scooters, enhancing user convenience and addressing range anxiety. Additionally, innovations in electric bike design and features, such as foldable models and integrated smart technology, contribute to their market growth.By Technology The dominance among Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs) can vary by region and market conditions. However, BEVs have been gaining significant traction and are often considered a dominant segment. The growing emphasis on sustainability and the push for zero-emission transportation has fuelled the popularity of BEVs. Recent developments in the BEV segment include advancements in battery technology, leading to increased driving ranges, faster charging times, and more affordable batteries. Major automotive manufacturers are heavily investing in the development of BEVs, introducing new models and expanding charging infrastructure to address range anxiety concerns. The BEV segment's dominance is further supported by government initiatives promoting clean energy and stringent emission regulations, driving consumers and businesses towards fully electric solutions. As the electric mobility market evolves, BEVs are positioned to play a pivotal role in shaping the future of sustainable transportation.

Electric Mobility Market Regional Analysis

North America: The North American electric mobility market has seen significant growth in recent years, with government incentives and infrastructure investments helping to drive adoption. The United States is the largest market in the region, with California leading the way in terms of EV sales and infrastructure development. Canada is also seeing growth in the market, with provinces such as British Columbia offering incentives and rebates for EV purchases. Europe: Europe is the largest electric vehicle market in the world, with Norway and the Netherlands leading the way in terms of EV adoption. Countries such as Germany, France, and the UK have also made significant investments in charging infrastructure, and are seeing growth in the EV market. The European Union has set aggressive emissions targets, which is driving further investment in the electric mobility market. Asia-Pacific: The Asia-Pacific region is a significant market for electric vehicles, with China leading the way in terms of EV sales and production. The Chinese government has set ambitious targets for EV adoption, and is investing heavily in charging infrastructure. Other countries in the region, such as Japan and South Korea, are also seeing growth in the market. Latin America: The electric mobility market in Latin America is still in its early stages, but is expected to see growth in the coming years. Brazil is the largest market in the region, with a growing number of EVs on the road and increasing investments in charging infrastructure. Mexico and Argentina are also seeing growth in the market. Middle East and Africa: The electric mobility market in the Middle East and Africa is still developing, with limited infrastructure and government support. However, there are some promising signs of growth, with countries such as Morocco and South Africa making investments in the market. The UAE is also seeing growth in the market, with the government setting targets for EV adoption and investing in charging infrastructure. Electric Mobility Market Competitive Landscape The competitive landscape of electric mobility comprises the companies involved in the production and distribution of electric vehicles (EVs) and related technologies. As new companies enter the market and existing companies develop new products and services, this landscape is constantly changing. Automakers: Many traditional automakers have entered the electric mobility market, including General Motors, Ford, and Volkswagen. These companies are investing heavily in the development of electric vehicles, and are competing with each other to bring new products to market. Tesla, which is solely focused on electric vehicles, is also a major player in the market Battery Manufacturers: The development of more efficient and cost-effective batteries is a critical part of the electric mobility landscape. Companies such as Panasonic, LG Chem, and Samsung SDI are major players in the battery manufacturing industry, providing batteries for use in electric vehicles. Charging Infrastructure Providers: The growth of the electric mobility market is heavily dependent on the availability of charging infrastructure. Companies such as ChargePoint, Electrify America, and EVgo operate networks of electric vehicle charging stations, and are investing in the development of new charging technologies to support the growing number of EVs on the road. Ride-Sharing and Mobility Service Providers: The rise of ride-sharing and mobility services has led to new opportunities for electric mobility. Companies such as Uber and Lyft have launched electric vehicle initiatives, and are working with automakers and charging infrastructure providers to develop new ways to integrate EVs into their services. Other companies, such as Bird and Lime, offer electric scooters and bicycles as part of their mobility services. Technology Providers: The development of new technologies, such as autonomous driving and vehicle-to-grid communication, is also a critical part of the electric mobility landscape. Companies such as Waymo and Aurora are working to develop autonomous driving technology, while companies like NIO and Tesla are incorporating advanced technology features into their electric vehicles.Electric Mobility Market Scope: Inquire before buying

Global Electric Mobility Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 501.3 Bn. Forecast Period 2024 to 2030 CAGR: 11.2% Market Size in 2030: US $ 978.12 Bn. Segments Covered: by Product Electric Bikes Electric Scooters Electric Motorized Scooters Electric Motorcycles by Technology Battery electric vehicles (BEVs) Plug-in hybrid electric vehicles (PHEVs) Hybrid electric vehicles (HEVs) by End Use Personal Commercial Electric Mobility Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electric Mobility Market Key Players are:

North America: 1. Tesla - USA 2. General Motors - USA 3. Ford Motor Company - USA 4. Rivian - USA 5. Fisker Inc. - USA 6. Lucid Motors - USA 7. Proterra - USA 8. NIO - Canada Europe: 1. Volkswagen Group - Germany 2. BMW Group - Germany 3. Daimler AG - Germany 4. Renault-Nissan-Mitsubishi Alliance - France/Japan 5. Volvo Cars - Sweden 6. Polestar - Sweden 7. Jaguar Land Rover - UK 8. Aston Martin - UK 9. Rimac Automobili - Croatia Asia-Pacific: 1. BYD - China 2. SAIC Motor - China 3. Geely - China 4. Tesla - China 5. Toyota - Japan 6. Honda - Japan 7. Hyundai-Kia - South Korea 8. Mahindra & Mahindra – India Africa: 1. Mobius Motors - Kenya 2. Kiira Motors - Uganda 3. Laraki Motors - Morocco 4. Electricite de France (EDF) - Egypt/Morocco/Senegal/South Africa Middle East: 1. FMS Tech - United Arab Emirates 2. Careem - United Arab Emirates 3. Tesla - United Arab Emirates/Saudi Arabia 4. EKar - Saudi Arabia 5. Emaar Properties - Saudi Arabia South America: 1. WEG - Brazil 2. Ambev - Brazil 3. Itaipu Binacional - Brazil/Paraguay 4. BYD - Brazil/Argentina/Chile FAQs 1: What is electric mobility? Ans: Electric mobility refers to the use of electric vehicles (EVs) as a means of transportation. This includes all types of electric vehicles, including passenger cars, buses, trucks, and even bicycles. 2: What are the benefits of electric mobility? Ans: Electric mobility has several benefits, including lower emissions, reduced noise pollution, improved air quality, and decreased reliance on fossil fuels. EVs can also be cheaper to operate and maintain than traditional vehicles, and can offer a smoother and more responsive driving experience. 3: How long does it take to charge an electric vehicle? Ans: The time it takes to charge an electric vehicle depends on several factors, including the size of the battery, the charging method used, and the charging speed. Most EVs can be fully charged overnight using a standard household outlet, but faster charging options are also available, such as Level 2 chargers and DC fast chargers, which can charge a vehicle in a matter of hours or even minutes. 4: How far can electric vehicles travel on a single charge? Ans: The range of an electric vehicle depends on the size of the battery and the driving conditions, such as speed, terrain, and temperature. Most modern EVs have a range of 100-300 miles on a single charge, with some models capable of traveling up to 400 or 500 miles. 5: How much do electric vehicles cost? Ans: The cost of electric vehicles can vary widely depending on the make and model, as well as any available incentives or tax credits. Generally, EVs can be more expensive upfront than traditional vehicles, but they can also save money on fuel and maintenance costs over the lifetime of the vehicle. 6: Are there enough charging stations for electric vehicles? Ans: The availability of charging stations for electric vehicles varies widely by location and region, but in general, the infrastructure for charging electric vehicles is rapidly expanding. Governments and private companies are investing in new charging stations, and many public areas, such as parking lots and shopping centers, are installing EV charging stations to meet growing demand. 7: Are electric vehicles as safe as traditional vehicles? Ans: Electric vehicles are subject to the same safety regulations and standards as traditional vehicles, and many EVs have advanced safety features, such as lane departure warning, automatic emergency braking, and blind spot monitoring. In addition, EVs do not carry the same risks associated with fuel leaks or explosions that are inherent to traditional vehicles.

1. Electric Mobility Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electric Mobility Market: Dynamics 2.1. Electric Mobility Market Trends by Region 2.1.1. North America Electric Mobility Market Trends 2.1.2. Europe Electric Mobility Market Trends 2.1.3. Asia Pacific Electric Mobility Market Trends 2.1.4. Middle East and Africa Electric Mobility Market Trends 2.1.5. South America Electric Mobility Market Trends 2.2. Electric Mobility Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electric Mobility Market Drivers 2.2.1.2. North America Electric Mobility Market Restraints 2.2.1.3. North America Electric Mobility Market Opportunities 2.2.1.4. North America Electric Mobility Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electric Mobility Market Drivers 2.2.2.2. Europe Electric Mobility Market Restraints 2.2.2.3. Europe Electric Mobility Market Opportunities 2.2.2.4. Europe Electric Mobility Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electric Mobility Market Drivers 2.2.3.2. Asia Pacific Electric Mobility Market Restraints 2.2.3.3. Asia Pacific Electric Mobility Market Opportunities 2.2.3.4. Asia Pacific Electric Mobility Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electric Mobility Market Drivers 2.2.4.2. Middle East and Africa Electric Mobility Market Restraints 2.2.4.3. Middle East and Africa Electric Mobility Market Opportunities 2.2.4.4. Middle East and Africa Electric Mobility Market Challenges 2.2.5. South America 2.2.5.1. South America Electric Mobility Market Drivers 2.2.5.2. South America Electric Mobility Market Restraints 2.2.5.3. South America Electric Mobility Market Opportunities 2.2.5.4. South America Electric Mobility Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electric Mobility Industry 2.8. Analysis of Government Schemes and Initiatives For Electric Mobility Industry 2.9. Electric Mobility Market Trade Analysis 2.10. The Global Pandemic Impact on Electric Mobility Market 3. Electric Mobility Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electric Mobility Market Size and Forecast, by Product (2023-2030) 3.1.1. Electric Bikes 3.1.2. Electric Scooters 3.1.3. Electric Motorized Scooters 3.1.4. Electric Motorcycles 3.2. Electric Mobility Market Size and Forecast, by Technology (2023-2030) 3.2.1. Battery electric vehicles (BEVs) 3.2.2. Plug-in hybrid electric vehicles (PHEVs) 3.2.3. Hybrid electric vehicles (HEVs) 3.3. Electric Mobility Market Size and Forecast, by End USE (2023-2030) 3.3.1. Personal 3.3.2. Commercial 3.4. Electric Mobility Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Electric Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electric Mobility Market Size and Forecast, by Product (2023-2030) 4.1.1. Electric Bikes 4.1.2. Electric Scooters 4.1.3. Electric Motorized Scooters 4.1.4. Electric Motorcycles 4.2. North America Electric Mobility Market Size and Forecast, by Technology (2023-2030) 4.2.1. Battery electric vehicles (BEVs) 4.2.2. Plug-in hybrid electric vehicles (PHEVs) 4.2.3. Hybrid electric vehicles (HEVs) 4.3. North America Electric Mobility Market Size and Forecast, by End USE (2023-2030) 4.3.1. Personal 4.3.2. Commercial 4.4. North America Electric Mobility Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Electric Mobility Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Electric Bikes 4.4.1.1.2. Electric Scooters 4.4.1.1.3. Electric Motorized Scooters 4.4.1.1.4. Electric Motorcycles 4.4.1.2. United States Electric Mobility Market Size and Forecast, by Technology (2023-2030) 4.4.1.2.1. Battery electric vehicles (BEVs) 4.4.1.2.2. Plug-in hybrid electric vehicles (PHEVs) 4.4.1.2.3. Hybrid electric vehicles (HEVs) 4.4.1.3. United States Electric Mobility Market Size and Forecast, by End USE (2023-2030) 4.4.1.3.1. Personal 4.4.1.3.2. Commercial 4.4.2. Canada 4.4.2.1. Canada Electric Mobility Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Electric Bikes 4.4.2.1.2. Electric Scooters 4.4.2.1.3. Electric Motorized Scooters 4.4.2.1.4. Electric Motorcycles 4.4.2.2. Canada Electric Mobility Market Size and Forecast, by Technology (2023-2030) 4.4.2.2.1. Battery electric vehicles (BEVs) 4.4.2.2.2. Plug-in hybrid electric vehicles (PHEVs) 4.4.2.2.3. Hybrid electric vehicles (HEVs) 4.4.2.3. Canada Electric Mobility Market Size and Forecast, by End USE (2023-2030) 4.4.2.3.1. Personal 4.4.2.3.2. Commercial 4.4.3. Mexico 4.4.3.1. Mexico Electric Mobility Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Electric Bikes 4.4.3.1.2. Electric Scooters 4.4.3.1.3. Electric Motorized Scooters 4.4.3.1.4. Electric Motorcycles 4.4.3.2. Mexico Electric Mobility Market Size and Forecast, by Technology (2023-2030) 4.4.3.2.1. Battery electric vehicles (BEVs) 4.4.3.2.2. Plug-in hybrid electric vehicles (PHEVs) 4.4.3.2.3. Hybrid electric vehicles (HEVs) 4.4.3.3. Mexico Electric Mobility Market Size and Forecast, by End USE (2023-2030) 4.4.3.3.1. Personal 4.4.3.3.2. Commercial 5. Europe Electric Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.2. Europe Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4. Europe Electric Mobility Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.2. France 5.4.2.1. France Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Electric Mobility Market Size and Forecast, by End USE (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Electric Mobility Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Electric Mobility Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6. Asia Pacific Electric Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4. Asia Pacific Electric Mobility Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.4. India 6.4.4.1. India Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Electric Mobility Market Size and Forecast, by End USE (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Electric Mobility Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Electric Mobility Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Electric Mobility Market Size and Forecast, by End USE (2023-2030) 7. Middle East and Africa Electric Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electric Mobility Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Electric Mobility Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Electric Mobility Market Size and Forecast, by End USE (2023-2030) 7.4. Middle East and Africa Electric Mobility Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Electric Mobility Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Electric Mobility Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. South Africa Electric Mobility Market Size and Forecast, by End USE (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Electric Mobility Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Electric Mobility Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. GCC Electric Mobility Market Size and Forecast, by End USE (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Electric Mobility Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Electric Mobility Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Nigeria Electric Mobility Market Size and Forecast, by End USE (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Electric Mobility Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Electric Mobility Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. Rest of ME&A Electric Mobility Market Size and Forecast, by End USE (2023-2030) 8. South America Electric Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electric Mobility Market Size and Forecast, by Product (2023-2030) 8.2. South America Electric Mobility Market Size and Forecast, by Technology (2023-2030) 8.3. South America Electric Mobility Market Size and Forecast, by End USE(2023-2030) 8.4. South America Electric Mobility Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Electric Mobility Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Electric Mobility Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. Brazil Electric Mobility Market Size and Forecast, by End USE (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Electric Mobility Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Electric Mobility Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. Argentina Electric Mobility Market Size and Forecast, by End USE (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Electric Mobility Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Electric Mobility Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest Of South America Electric Mobility Market Size and Forecast, by End USE (2023-2030) 9. Global Electric Mobility Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electric Mobility Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tesla - USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. General Motors - USA 10.3. Ford Motor Company - USA 10.4. Rivian - USA 10.5. Fisker Inc. - USA 10.6. Lucid Motors - USA 10.7. Proterra - USA 10.8. NIO - Canada 10.9. Volkswagen Group - Germany 10.10. BMW Group - Germany 10.11. Daimler AG - Germany 10.12. Renault-Nissan-Mitsubishi Alliance - France/Japan 10.13. Volvo Cars - Sweden 10.14. Polestar - Sweden 10.15. Jaguar Land Rover - UK 10.16. Aston Martin - UK 10.17. Rimac Automobili - Croatia 10.18. BYD - China 10.19. SAIC Motor - China 10.20. Geely - China 10.21. Tesla - China 10.22. Toyota - Japan 10.23. Honda - Japan 10.24. Hyundai-Kia - South Korea 10.25. Mahindra & Mahindra – India 10.26. Mobius Motors - Kenya 10.27. Kiira Motors - Uganda 10.28. Laraki Motors - Morocco 10.29. Electricite de France (EDF) - Egypt/Morocco/Senegal/South Africa 10.30. FMS Tech - United Arab Emirates 10.31. Careem - United Arab Emirates 10.32. Tesla - United Arab Emirates/Saudi Arabia 10.33. EKar - Saudi Arabia 10.34. Emaar Properties - Saudi Arabia 10.35. WEG - Brazil 10.36. Ambev - Brazil 10.37. Itaipu Binacional - Brazil/Paraguay 10.38. BYD - Brazil/Argentina/Chile 11. Key Findings 12. Industry Recommendations 13. Electric Mobility Market: Research Methodology 14. Terms and Glossary