Global Mobile Security Market size was valued at USD 12.72 Bn. in 2023 and the total Mobile Security revenue is expected to grow by 19.4 % from 2024 to 2030, reaching nearly USD 44.01 Bn.Mobile Security Market Overview:

Mobile security is a crucial element of modern mobile technology that provides tablets, laptops, and smartphones with improved security capabilities. The industry is getting bigger as more people have mobile devices and they need to use them professionally to store their sensitive data like credit card numbers, social security numbers, and financial information. In the case of mobile security, a vulnerability allows the hacker to dig in right away to extract the user’s data, including but not limited to the user’s current location, bank account details, personal information, and any other form of information stored. Older technology like feature phones commonly use operating systems tailored for them, the likes of Java, Nokia's Symbian, and Blackberry OS. Such technologies help to secure the applications from not being hacked and private data is restricted only to those who are eligible.To know about the Research Methodology:-Request Free Sample Report There is an increase in mobile security breaches, data thefts, malware attacks, and phishing attacks in tandem with the growing accessibility or privatization of mobile devices. Moreover, the development of stricter rules and regulations and the growth in complexities of information technology also augments the demand in the Mobile Security Market. Advanced cyberattacks that are staged by collectives that are knowledgeable of sophisticated attacks are multiplying too. The criminals are constantly becoming cruel as their attacks are aimed at individual consumers as well as small and large-scale businesses by capitalizing on their various vulnerabilities in mobile device infrastructures, solutions, and web services. The market key players in the Mobile Security industry play an essential role, in driving industry trends and influencing market dynamics. The major key players in the market are Apple Inc., Intel Security (McAfee), Symantec Corporation, VMware, Inc., Microsoft Corporation, Citrix, Systems, Inc., Google, etc. are offering a wide range of security solutions for consumers, businesses, and enterprises.

Global Mobile Security Market Dynamics:

One of the main factors affecting the Mobile Security Industry is the rise in the usage of smartphones, tablets, laptops, & other portable devices for both personal and business use. Additionally, the rise of the BYOD (bring your own device) movement in businesses has increased security risks for both the company & its workers. As a result, businesses are increasingly adopting mobile unified endpoint security technologies, which comprise firewall tools, malware & antivirus protection solutions, organization-size security solutions, and mobile device management tools. The Mobile Security Market is expected to grow even more as work-from-home policies become more popular. Businesses of all sizes are utilizing their business strategy to enable remote work for their staff. As employees are more likely to connect to networks via public Wi-Fi when working in remote regions, the security ecosystem becomes more vulnerable. 82 % of employees prefer working from home, making remote work the new standard. According to the report, 82% of respondents say they prefer working from home versus working in an office. The study also found that 64% of workers indicated they are more productive and feel less stressed when they work from home. It was mentioned that the move from face-to-face interaction to remote employee engagement has become the new norm for HR. According to the report, more than 80% of HR managers acknowledged that it is growing harder to find workers who can commit to full-time office attendance. With the increase in cyber-attacks using mobile devices, the market as a whole is growing. With the development of technologies & operational expertise, hackers in the mobile ecosystem have improved. Hackers are currently using sophisticated malware to target mobile users & steal personal info from them. Several instances of Mage cart attacks—digital credit card skimmer incidents—were reported globally. To skim their money transactions, the Magecart assaults targeted mobile users of e-commerce platforms & websites for booking hotels. Magecart's growing vulnerabilities & public awareness prompted people & companies to adopt security-enhancing measures. With the changing mobile device environment & secure mobile operating system (OS) patches, the industry keeps expanding. Currently, mobile OS embeds security fixes & tools more frequently to decrease downloads of unreliable 3rd party apps. Another aspect driving Mobile Security Market growth is an increase in mobile malware threats from third-party advertisements. The number of smartphone users in the world who use their gadgets to load some applications to the smartphones they own is in billions. Quite a large number of users need consciousness on the websites' privacy policies, and sources from which they get the apps. The population is found online by visiting non-trusted sites that are downloaded in unsecured software and are more prone to cyberattacks. The market growth is expected to be hampered by a deficit in the number of people who care about mobile devices and understand the dangers and the security solutions these devices present. The past decade has seen a rise in the use of mobile devices, partly due to technological progress. An obvious happening that leads to the significant implementation of these tools in business, education, and personal purposes. To sum up, the absorption by the telecommunication sector of mobile or remote connection infrastructure will be prompted by the rising embrace of IoT and enterprise mobility. Almost three-quarters of American mobile digitally connected workers of the present time will be mobile shortly according to an analysis conducted by Soti, Inc. Just about 20% (almost) of workplaces that provide mobility have experienced insecurity connected with risks and problems. Hence, these are the factors that create an opportunity for the new entrants and the businesses in the Mobile Security Market. AI implementation for fraud detection The leaders in the fintech industry developed & used ever-more-advanced AI (Artificial Intelligence) and ML (Machine Learning) technology to anticipate & prevent financial fraud. By evaluating massive amounts of data more quickly & spotting illicit use, AI can assist increase security as more and more breakthrough technologies enter & disrupt the financial industry.Global Mobile Security Market Segment Analysis

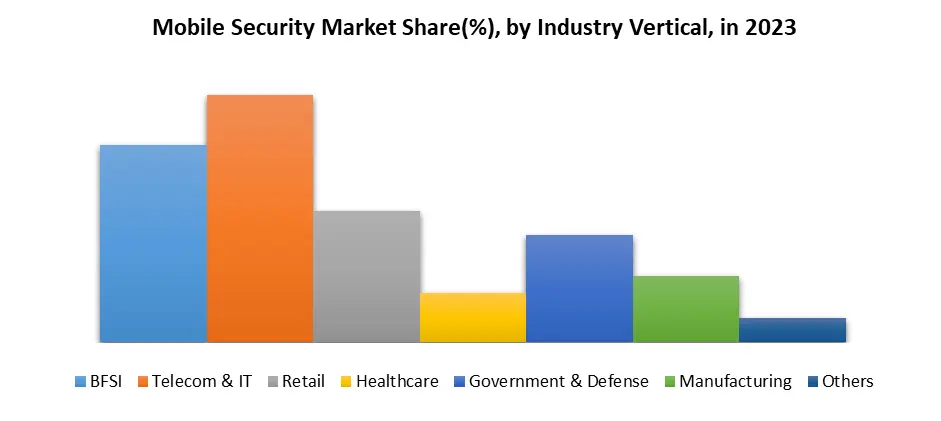

Based on the Operating System, an Android segment of the operating system dominated the Mobile Security Market in the year 2023 by providing the maximum revenue share. Android OS usage has spiked tremendously just like one of the below lines up that led to the disarray of Android frauds. The introduction of RASP (Runtime Application Self Protection) technology for Mobile operation system security has been completely transformed by a range of technologies. On-duty while the software runs, threat detection and removal are guaranteed unlike in other types of malware protection approaches. In sum, the demand for the special organic foods segment has increased as a result of their marketing. The upper limit of iOS is projected to reach the maximum CAGR during the projection period. The sophisticated function of face ID & touch ID is likely to promote the mobile security industry with the other ones as well, such as the better protection of email ID and web browsing. First, iOS came with comprehensive security options such as protection against identity theft and personal information leakage. Specifically, the aforementioned characteristics impact positively the segment’s growth.Based on Industry Vertical, the mobile security market is segmented by BFSI, telecom and IT, retail, healthcare, government and defense, manufacturing, and other sectors. In the year 2023, the telecom and IT sector held the largest Mobile Security Market share. Large amounts of consumer and business data are kept on file by telecom and IT companies. The risk of malware & data theft has increased for enterprises with the introduction of digital automation technologies. Over the past few years, BFSI (Banking, Financial Service, and Insurance) firms have continued to be a top target for hackers. The BFSI sector must prioritize cybersecurity above all else because of the volume of sensitive data it handles, making it an obvious gold mine for hackers. The Sixth Annual Bank Survey found that more than 70% of FinTech companies named information security as their top issue. BFSI organizations must therefore implement a thorough security plan to address the growing cybersecurity issues. Knowing the most recent cybersecurity developments is undoubtedly very beneficial. The BFSI industry will be greatly impacted by some of the biggest cybersecurity issues in the year 2023. Below is one of the trends that our analysts have highlighted in our BFSI cybersecurity trends.

Mobile Security Market Regional Insights:

North America accounted for the largest revenue in the Mobile Security Market in 2023. Regional acceptance is projected to grow at a satisfactory rate due to the increasing expenditure on IT security products among organizations. The adoption of mobility devices from the government & defense sector to the retail sector is propelling the regional market. North American countries' high embracement of this technology is due to the government programs, being the main driver, that fight against cybercrime and cyber security threats at all the federal departments and agencies. This draws more Americans and Canadians to implement mobile security. Asia Pacific is expected to register a robust CAGR during the forecast period. The economy of Asia-Pacific has to develop a robust cyber-defense plan to guard against the attacks resulting from data breaches and thefts. A legal gap among the countries of the Asian-Pacific region has been present, creating the most diverse and complex cyber environment in the region, which has thus forced business entities to adopt cutting-edge cybersecurity measures. The federal authorities of Asian nations such as China, Singapore, and Japan are setting aside substantial shares of their respective budgets for improving the overall cybersecurity of their countries.Competitive Landscape: Apple, a U.S. based enterprise, operates among very competitive lines of global technology companies fighting to the hilt in the different market categories trying to find their market position. In the phone market, competition is mostly with Samsung, Google, and Huawei where manufacturing technology and the ecology of ecosystems are the major determiners of consumer preference. Symantec Corporation is a top player in the market, with its major competitors being other internationally focused companies, in end-point security, encryption, and threat intelligence, respectively. Its competitors are companies such as McAfee, Trend Micro, and Kaspersky Lab, these firms furnish cybersecurity products to both the consumer sector and enterprises. VMware, Inc. of the United States, the main contender in the very competitive market of virtualization and cloud computing software, is an active player herein. Its peers include the likes of Microsoft, Citrix Systems, and Red Hat who all offer similar virtualization and cloud management solutions for businesses. Citrix System Inc., based in the United States and the cybercultural sphere of networked communication and cloud computing software, operates in a highly competitive environment within these macro areas. Companies such as VMware, Microsoft, and Red Hat pose competition to Salesforce that are providing similar virtualization and cloud management solutions. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Mobile Security Market dynamic, and structure by analyzing the market segments and projecting the Global Mobile Security Market size. Clear representation of competitive analysis of key players By Price Range, price, financial position, product portfolio, growth strategies, and regional presence in the Global Mobile Security Market make the report an investor’s guide.

Mobile Security Market Scope: Inquire before buying

Mobile Security Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 12.72 Bn. Forecast Period 2024 to 2030 CAGR: 19.4% Market Size in 2030: US$ 44.01 Bn. Segments Covered: by Offerings Solutions Services by Operation System IOS Android Windows by End-user Personal Users Business Users by Industry Vertical BFSI Telecom & IT Retail Healthcare Government & Defense Manufacturing Others Mobile Security Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Mobile Security Market, Key Players are

Mobile Security Market Key Players for North America 1. Apple Inc. - United States 2. Intel Security (McAfee) - United States 3. Symantec Corporation - United States 4. VMware, Inc. - United States 5. Microsoft Corporation - United States 6. Citrix Systems, Inc. - United States 7. innoPath Software - United States 8. Google - United States 9. MobileIron - United States Mobile Security Market Key Players for Europe 1. F-Secure Corporation - Finland 2. Nokia - Finland 3. Orange – France 4. AVG Technologies - Czech Republic 5. Sophos Ltd. - United Kingdom 6. Kaspersky Lab - Russia Mobile Security Market Key Players for Asia Pacific 1. Trend Micro, Inc. - Japan Frequently Asked Questions: 1. Which region has the largest share in the Global Mobile Security Market? Ans: The North America region held the highest share in 2023. 2. What is the growth rate of the Global Mobile Security Market? Ans: The Global Market is expected to grow at a CAGR of 19.4 % during the forecast period 2024-2030. 3. What is the scope of the Global Mobile Security Market report? Ans: The Global Mobile Security Market report helps with the PESTLE, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Mobile Security Market? Ans: The important key players in the Global Mobile Security Market are – Apple Inc., Intel Security (McAfee), Symantec Corporation, VMware, Inc., Microsoft Corporation, Citrix Systems, Inc., innoPath Software, Google, MobileIron, F-Secure Corporation, Nokia, Orange, AVG Technologies, Sophos Ltd., Kaspersky Lab, Trend Micro, Inc. 5. What is the study period of this market? Ans: The Global Mobile Security Market is studied from 2023 to 2030.

1. Mobile Security Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Mobile Security Market: Dynamics 2.1. Mobile Security Market Trends by Region 2.1.1. North America Mobile Security Market Trends 2.1.2. Europe Mobile Security Market Trends 2.1.3. Asia Pacific Mobile Security Market Trends 2.1.4. Middle East and Africa Mobile Security Market Trends 2.1.5. South America Mobile Security Market Trends 2.2. Mobile Security Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Mobile Security Market Drivers 2.2.1.2. North America Mobile Security Market Restraints 2.2.1.3. North America Mobile Security Market Opportunities 2.2.1.4. North America Mobile Security Market Challenges 2.2.2. Europe 2.2.2.1. Europe Mobile Security Market Drivers 2.2.2.2. Europe Mobile Security Market Restraints 2.2.2.3. Europe Mobile Security Market Opportunities 2.2.2.4. Europe Mobile Security Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Mobile Security Market Drivers 2.2.3.2. Asia Pacific Mobile Security Market Restraints 2.2.3.3. Asia Pacific Mobile Security Market Opportunities 2.2.3.4. Asia Pacific Mobile Security Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Mobile Security Market Drivers 2.2.4.2. Middle East and Africa Mobile Security Market Restraints 2.2.4.3. Middle East and Africa Mobile Security Market Opportunities 2.2.4.4. Middle East and Africa Mobile Security Market Challenges 2.2.5. South America 2.2.5.1. South America Mobile Security Market Drivers 2.2.5.2. South America Mobile Security Market Restraints 2.2.5.3. South America Mobile Security Market Opportunities 2.2.5.4. South America Mobile Security Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Mobile Security Industry 2.8. Analysis of Government Schemes and Initiatives For Mobile Security Industry 2.9. Mobile Security Market Trade Analysis 2.10. The Global Pandemic Impact on Mobile Security Market 3. Mobile Security Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Mobile Security Market Size and Forecast, by Offering (2023-2030) 3.1.1. Solutions 3.1.2. Services 3.2. Mobile Security Market Size and Forecast, by Operating System (2023-2030) 3.2.1. IOS 3.2.2. Android 3.2.3. Windows 3.3. Mobile Security Market Size and Forecast, by End User (2023-2030) 3.3.1. Personal Users 3.3.2. Business Users 3.4. Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 3.4.1. BFSI 3.4.2. Telecom & IT 3.4.3. Retail 3.4.4. Healthcare 3.4.5. Government & Defense 3.4.6. Manufacturing 3.4.7. Others 3.5. Mobile Security Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Mobile Security Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Mobile Security Market Size and Forecast, by Offering (2023-2030) 4.1.1. Solutions 4.1.2. Services 4.2. North America Mobile Security Market Size and Forecast, by Operating System (2023-2030) 4.2.1. IOS 4.2.2. Android 4.2.3. Windows 4.3. North America Mobile Security Market Size and Forecast, by End User (2023-2030) 4.3.1. Personal Users 4.3.2. Business Users 4.4. North America Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 4.4.1. BFSI 4.4.2. Telecom & IT 4.4.3. Retail 4.4.4. Healthcare 4.4.5. Government & Defense 4.4.6. Manufacturing 4.4.7. Others 4.5. North America Mobile Security Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Mobile Security Market Size and Forecast, by Offering (2023-2030) 4.5.1.1.1. Solutions 4.5.1.1.2. Services 4.5.1.2. United States Mobile Security Market Size and Forecast, by Operating System (2023-2030) 4.5.1.2.1. IOS 4.5.1.2.2. Android 4.5.1.2.3. Windows 4.5.1.3. United States Mobile Security Market Size and Forecast, by End User (2023-2030) 4.5.1.3.1. Personal Users 4.5.1.3.2. Business Users 4.5.1.4. United States Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.1.4.1. BFSI 4.5.1.4.2. Telecom & IT 4.5.1.4.3. Retail 4.5.1.4.4. Healthcare 4.5.1.4.5. Government & Defense 4.5.1.4.6. Manufacturing 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Mobile Security Market Size and Forecast, by Offering (2023-2030) 4.5.2.1.1. Solutions 4.5.2.1.2. Services 4.5.2.2. Canada Mobile Security Market Size and Forecast, by Operating System (2023-2030) 4.5.2.2.1. IOS 4.5.2.2.2. Android 4.5.2.2.3. Windows 4.5.2.3. Canada Mobile Security Market Size and Forecast, by End User (2023-2030) 4.5.2.3.1. Personal Users 4.5.2.3.2. Business Users 4.5.2.4. Canada Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.2.4.1. BFSI 4.5.2.4.2. Telecom & IT 4.5.2.4.3. Retail 4.5.2.4.4. Healthcare 4.5.2.4.5. Government & Defense 4.5.2.4.6. Manufacturing 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Mobile Security Market Size and Forecast, by Offering (2023-2030) 4.5.3.1.1. Solutions 4.5.3.1.2. Services 4.5.3.2. Mexico Mobile Security Market Size and Forecast, by Operating System (2023-2030) 4.5.3.2.1. IOS 4.5.3.2.2. Android 4.5.3.2.3. Windows 4.5.3.3. Mexico Mobile Security Market Size and Forecast, by End User (2023-2030) 4.5.3.3.1. Personal Users 4.5.3.3.2. Business Users 4.5.3.4. Mexico Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 4.5.3.4.1. BFSI 4.5.3.4.2. Telecom & IT 4.5.3.4.3. Retail 4.5.3.4.4. Healthcare 4.5.3.4.5. Government & Defense 4.5.3.4.6. Manufacturing 4.5.3.4.7. Others 5. Europe Mobile Security Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.2. Europe Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.3. Europe Mobile Security Market Size and Forecast, by End User (2023-2030) 5.4. Europe Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5. Europe Mobile Security Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.1.2. United Kingdom Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.1.3. United Kingdom Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.1.4. United Kingdom Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.2.2. France Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.2.3. France Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.2.4. France Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.3.2. Germany Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.3.3. Germany Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.3.4. Germany Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.4.2. Italy Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.4.3. Italy Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.4.4. Italy Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.5.2. Spain Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.5.3. Spain Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.5.4. Spain Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.6.2. Sweden Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.6.3. Sweden Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.6.4. Sweden Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.7.2. Austria Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.7.3. Austria Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.7.4. Austria Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Mobile Security Market Size and Forecast, by Offering (2023-2030) 5.5.8.2. Rest of Europe Mobile Security Market Size and Forecast, by Operating System (2023-2030) 5.5.8.3. Rest of Europe Mobile Security Market Size and Forecast, by End User (2023-2030) 5.5.8.4. Rest of Europe Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6. Asia Pacific Mobile Security Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.2. Asia Pacific Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.3. Asia Pacific Mobile Security Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5. Asia Pacific Mobile Security Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.1.2. China Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.1.3. China Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.1.4. China Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.2.2. S Korea Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.2.3. S Korea Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.2.4. S Korea Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.3.2. Japan Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.3.3. Japan Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.3.4. Japan Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.4.2. India Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.4.3. India Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.4.4. India Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.5.2. Australia Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.5.3. Australia Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.5.4. Australia Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.6.2. Indonesia Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.6.3. Indonesia Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.6.4. Indonesia Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.7.2. Malaysia Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.7.3. Malaysia Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.7.4. Malaysia Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.8.2. Vietnam Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.8.3. Vietnam Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.8.4. Vietnam Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.9.2. Taiwan Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.9.3. Taiwan Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.9.4. Taiwan Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Mobile Security Market Size and Forecast, by Offering (2023-2030) 6.5.10.2. Rest of Asia Pacific Mobile Security Market Size and Forecast, by Operating System (2023-2030) 6.5.10.3. Rest of Asia Pacific Mobile Security Market Size and Forecast, by End User (2023-2030) 6.5.10.4. Rest of Asia Pacific Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 7. Middle East and Africa Mobile Security Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Mobile Security Market Size and Forecast, by Offering (2023-2030) 7.2. Middle East and Africa Mobile Security Market Size and Forecast, by Operating System (2023-2030) 7.3. Middle East and Africa Mobile Security Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 7.5. Middle East and Africa Mobile Security Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Mobile Security Market Size and Forecast, by Offering (2023-2030) 7.5.1.2. South Africa Mobile Security Market Size and Forecast, by Operating System (2023-2030) 7.5.1.3. South Africa Mobile Security Market Size and Forecast, by End User (2023-2030) 7.5.1.4. South Africa Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Mobile Security Market Size and Forecast, by Offering (2023-2030) 7.5.2.2. GCC Mobile Security Market Size and Forecast, by Operating System (2023-2030) 7.5.2.3. GCC Mobile Security Market Size and Forecast, by End User (2023-2030) 7.5.2.4. GCC Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Mobile Security Market Size and Forecast, by Offering (2023-2030) 7.5.3.2. Nigeria Mobile Security Market Size and Forecast, by Operating System (2023-2030) 7.5.3.3. Nigeria Mobile Security Market Size and Forecast, by End User (2023-2030) 7.5.3.4. Nigeria Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Mobile Security Market Size and Forecast, by Offering (2023-2030) 7.5.4.2. Rest of ME&A Mobile Security Market Size and Forecast, by Operating System (2023-2030) 7.5.4.3. Rest of ME&A Mobile Security Market Size and Forecast, by End User (2023-2030) 7.5.4.4. Rest of ME&A Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 8. South America Mobile Security Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Mobile Security Market Size and Forecast, by Offering (2023-2030) 8.2. South America Mobile Security Market Size and Forecast, by Operating System (2023-2030) 8.3. South America Mobile Security Market Size and Forecast, by End User(2023-2030) 8.4. South America Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 8.5. South America Mobile Security Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Mobile Security Market Size and Forecast, by Offering (2023-2030) 8.5.1.2. Brazil Mobile Security Market Size and Forecast, by Operating System (2023-2030) 8.5.1.3. Brazil Mobile Security Market Size and Forecast, by End User (2023-2030) 8.5.1.4. Brazil Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Mobile Security Market Size and Forecast, by Offering (2023-2030) 8.5.2.2. Argentina Mobile Security Market Size and Forecast, by Operating System (2023-2030) 8.5.2.3. Argentina Mobile Security Market Size and Forecast, by End User (2023-2030) 8.5.2.4. Argentina Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Mobile Security Market Size and Forecast, by Offering (2023-2030) 8.5.3.2. Rest Of South America Mobile Security Market Size and Forecast, by Operating System (2023-2030) 8.5.3.3. Rest Of South America Mobile Security Market Size and Forecast, by End User (2023-2030) 8.5.3.4. Rest Of South America Mobile Security Market Size and Forecast, by Industry Vertical (2023-2030) 9. Global Mobile Security Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Mobile Security Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Apple Inc. - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Intel Security (McAfee) - United States 10.3. Symantec Corporation - United States 10.4. VMware, Inc. - United States 10.5. Microsoft Corporation - United States 10.6. Citrix Systems, Inc. - United States 10.7. innoPath Software - United States 10.8. Google - United States 10.9. MobileIron - United States 10.10. F-Secure Corporation - Finland 10.11. Nokia - Finland 10.12. Orange – France 10.13. AVG Technologies - Czech Republic 10.14. Sophos Ltd. - United Kingdom 10.15. Kaspersky Lab - Russia 10.16. Trend Micro, Inc. - Japan 11. Key Findings 12. Industry Recommendations 13. Mobile Security Market: Research Methodology 14. Terms and Glossary