Miniloaders Market was valued at USD 202.31 Mn. in 2024 and the total Global Miniloaders Market revenue is Expected to grow at a CAGR of 3.4% from 2025 to 2032 reaching nearly USD 264.35 Mn. by 2032. The report covers an in-depth analysis of COVID 19 pandemic impact on Global Miniloaders Market by region and on the key players’ revenue affected till July 2020 and expected short term and long-term impact on the market. A miniloader is excellent for any projects that include levelling or earthmoving soil. Miniloaders are used for gardening and excavation purposes. This generally contains three wheels or four wheels vehicles.To know about the Research Methodology :- Request Free Sample Report

Miniloaders Market Dynamics

The global market for miniloaders is expected to gain market growth from 2023 to 2030 thanks to new technological developments which are improving to develop precise, compact, and cost-saving mini-loaders. Major developments have taken place after the industrial and agricultural revolution to expand construction and farming machinery to achieve extreme productivity. However, the increasing competition from other equipment like excavators, forklifts and backhoe, is hindering the market growth to the extent.Miniloaders Market Segment Analysis

Based on Power Rating the Miniloaders Market is segmented into 0 hp-12 hp, 13 hp-20 hp, 25 hp-28 hp, 29 hp-35 hp, 40 hp-50 hp and 58 hp-75 hp. 40 hp-50 hp segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to machines in this range provide the right balance of power, fuel efficiency, and versatility, making them suitable for construction, agriculture, and landscaping tasks. Their adaptability across multiple applications drives stronger demand compared to lower- or higher-powered categories. Based on Operating Capacity the Miniloaders Market is segmented into Up to 1000 kg, 1000–1500 kg and Above 1500 kg. 1000–1500 kg segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to This range offers an ideal mix of lifting strength, compact size, and versatility, making it highly suitable for construction, agriculture, and industrial applications. It balances cost and performance, which drives higher adoption compared to smaller or heavier capacity machines.

Miniloaders Market Regional Insights

By region, North America accounted for the largest market share in 2023, with a market value of US$ 38 million; the regional market is expected to register a CAGR of 7% during 2024-2030. This is attributed to the obtainability of advanced farming techniques and refurbishment of organization plans. Economies in Europe like the U.K., Italy, Germany, and France are expected to witness an increase in demand for miniloaders thanks to the rapid industrialization. South America is anticipated to account for the moderate market share in the global miniloaders market. Countries in South America such as Mexico and Brazil are expected to witness an upsurge in demand for miniloaders thanks to the rapid urbanization. The competitive landscape section in the miniloaders market offers a deep dive into the profiles of the leading companies operating in the global market landscape. It offers captivating insights on the key developments, differential strategies, and other crucial aspects about the key players having a stronghold in the miniloaders market. The objective of the report is to present a comprehensive analysis of the Global Microgrid Monitoring Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Microgrid Monitoring Market dynamics, structure by analyzing the market segments and projects the Global Microgrid Monitoring Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Microgrid Monitoring Market make the report investor’s guide.Miniloaders Market Scope: Inquire before buying

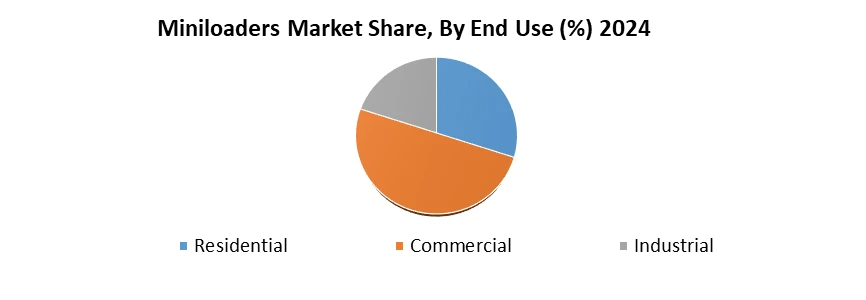

Global Miniloaders Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 202.31 Mn. Forecast Period 2025 to 2032 CAGR: 3.4% Market Size in 2032: USD 264.35 Mn. Segments Covered: by Power Rating 0 hp-12 hp 13 hp-20 hp 25 hp-28 hp 29 hp-35 hp 40 hp-50 hp 58 hp-75 hp by Engine Type Diesel LPG Electric by Operating Capacity Up to 1000 kg 1000–1500 kg Above 1500 kg by Application Construction Agriculture Landscaping & Gardening Industrial & Warehousing Mining & Quarrying Municipal Services by End Use Residential Commercial Industrial Miniloaders Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Miniloaders Market, Key players

1.Kanga Loaders 2.John Deere 3.New Holland 4.Bobcat Company (U.S) 5.JCB 6.Hyundai 7.Multitone 8.Case CE (Netherlands) 9.Caterpillar Inc. (U.S) 10.Komatsu Ltd. (Japan) 11.Terex Corporation (U.S) 12.LinGong Machinery Co. Ltd. (China) 13.Lonking Holdings Limited (China) 14.J C Bamford Excavators Ltd. (U.K) 15.Liebherr Group (Switzerland) 16.Hitachi Ltd. (Japan)Frequently Asked Questions:

1. Which region has the largest share in Global Miniloaders Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Miniloaders Market? Ans: The Global Miniloaders Market is growing at a CAGR of 3.4% during forecasting period 2025-2032. 3. What is scope of the Global Miniloaders Market report? Ans: Global Miniloaders Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What was the Global Miniloaders Market size in 2024? Ans: The Global Miniloaders Market was valued at US$ 202.31 Mn. In 2024. 5. What is the study period of this Market? Ans: The Global Miniloaders Market is studied from 2024 to 2032.

1. Miniloaders Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Miniloaders Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Miniloaders Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Miniloaders Market: Dynamics 3.1. Miniloaders Market Trends by Region 3.1.1. North America Miniloaders Market Trends 3.1.2. Europe Miniloaders Market Trends 3.1.3. Asia Pacific Miniloaders Market Trends 3.1.4. Middle East and Africa Miniloaders Market Trends 3.1.5. South America Miniloaders Market Trends 3.2. Miniloaders Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Miniloaders Market Drivers 3.2.1.2. North America Miniloaders Market Restraints 3.2.1.3. North America Miniloaders Market Opportunities 3.2.1.4. North America Miniloaders Market Challenges 3.2.2. Europe 3.2.2.1. Europe Miniloaders Market Drivers 3.2.2.2. Europe Miniloaders Market Restraints 3.2.2.3. Europe Miniloaders Market Opportunities 3.2.2.4. Europe Miniloaders Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Miniloaders Market Drivers 3.2.3.2. Asia Pacific Miniloaders Market Restraints 3.2.3.3. Asia Pacific Miniloaders Market Opportunities 3.2.3.4. Asia Pacific Miniloaders Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Miniloaders Market Drivers 3.2.4.2. Middle East and Africa Miniloaders Market Restraints 3.2.4.3. Middle East and Africa Miniloaders Market Opportunities 3.2.4.4. Middle East and Africa Miniloaders Market Challenges 3.2.5. South America 3.2.5.1. South America Miniloaders Market Drivers 3.2.5.2. South America Miniloaders Market Restraints 3.2.5.3. South America Miniloaders Market Opportunities 3.2.5.4. South America Miniloaders Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Miniloaders Industry 3.8. Analysis of Government Schemes and Initiatives For Miniloaders Industry 3.9. Miniloaders Market Trade Analysis 3.10. The Global Pandemic Impact on Miniloaders Market 4. Miniloaders Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 4.1.1. 0 hp-12 hp 4.1.2. 13 hp-20 hp 4.1.3. 25 hp-28 hp 4.1.4. 29 hp-35 hp 4.1.5. 40 hp-50 hp 4.1.6. 58 hp-75 hp 4.2. Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 4.2.1. Diesel 4.2.2. LPG 4.2.3. Electric 4.3. Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 4.3.1. Up to 1000 kg 4.3.2. 1000–1500 kg 4.3.3. Above 1500 kg 4.4. Miniloaders Market Size and Forecast, by Application (2024-2032) 4.4.1. Construction 4.4.2. Agriculture 4.4.3. Landscaping & Gardening 4.4.4. Industrial & Warehousing 4.4.5. Mining & Quarrying 4.4.6. Municipal Services 4.5. Miniloaders Market Size and Forecast, by End Use (2024-2032) 4.5.1. Residential 4.5.2. Commercial 4.5.3. Industrial 4.6. Miniloaders Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Miniloaders Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 5.1.1. 0 hp-12 hp 5.1.2. 13 hp-20 hp 5.1.3. 25 hp-28 hp 5.1.4. 29 hp-35 hp 5.1.5. 40 hp-50 hp 5.1.6. 58 hp-75 hp 5.2. North America Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 5.2.1. Diesel 5.2.2. LPG 5.2.3. Electric 5.3. North America Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 5.3.1. Up to 1000 kg 5.3.2. 1000–1500 kg 5.3.3. Above 1500 kg 5.4. North America Miniloaders Market Size and Forecast, by Application (2024-2032) 5.4.1. Construction 5.4.2. Agriculture 5.4.3. Landscaping & Gardening 5.4.4. Industrial & Warehousing 5.4.5. Mining & Quarrying 5.4.6. Municipal Services 5.5. North America Miniloaders Market Size and Forecast, by End Use (2024-2032) 5.5.1. Residential 5.5.2. Commercial 5.5.3. Industrial 5.6. North America Miniloaders Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 5.6.1.1.1. 0 hp-12 hp 5.6.1.1.2. 13 hp-20 hp 5.6.1.1.3. 25 hp-28 hp 5.6.1.1.4. 29 hp-35 hp 5.6.1.1.5. 40 hp-50 hp 5.6.1.1.6. 58 hp-75 hp 5.6.1.2. United States Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 5.6.1.2.1. Diesel 5.6.1.2.2. LPG 5.6.1.2.3. Electric 5.6.1.3. United States Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 5.6.1.3.1. Up to 1000 kg 5.6.1.3.2. 1000–1500 kg 5.6.1.3.3. Above 1500 kg 5.6.1.4. United States Miniloaders Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Construction 5.6.1.4.2. Agriculture 5.6.1.4.3. Landscaping & Gardening 5.6.1.4.4. Industrial & Warehousing 5.6.1.4.5. Mining & Quarrying 5.6.1.4.6. Municipal Services 5.6.1.5. United States Miniloaders Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. Residential 5.6.1.5.2. Commercial 5.6.1.5.3. Industrial 5.6.2. Canada 5.6.2.1. Canada Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 5.6.2.1.1. 0 hp-12 hp 5.6.2.1.2. 13 hp-20 hp 5.6.2.1.3. 25 hp-28 hp 5.6.2.1.4. 29 hp-35 hp 5.6.2.1.5. 40 hp-50 hp 5.6.2.1.6. 58 hp-75 hp 5.6.2.2. Canada Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 5.6.2.2.1. Diesel 5.6.2.2.2. LPG 5.6.2.2.3. Electric 5.6.2.3. Canada Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 5.6.2.3.1. Up to 1000 kg 5.6.2.3.2. 1000–1500 kg 5.6.2.3.3. Above 1500 kg 5.6.2.4. Canada Miniloaders Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Construction 5.6.2.4.2. Agriculture 5.6.2.4.3. Landscaping & Gardening 5.6.2.4.4. Industrial & Warehousing 5.6.2.4.5. Mining & Quarrying 5.6.2.4.6. Municipal Services 5.6.2.5. Canada Miniloaders Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. Residential 5.6.2.5.2. Commercial 5.6.2.5.3. Industrial 5.6.3. Mexico 5.6.3.1. Mexico Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 5.6.3.1.1. 0 hp-12 hp 5.6.3.1.2. 13 hp-20 hp 5.6.3.1.3. 25 hp-28 hp 5.6.3.1.4. 29 hp-35 hp 5.6.3.1.5. 40 hp-50 hp 5.6.3.1.6. 58 hp-75 hp 5.6.3.2. Mexico Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 5.6.3.2.1. Diesel 5.6.3.2.2. LPG 5.6.3.2.3. Electric 5.6.3.3. Mexico Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 5.6.3.3.1. Up to 1000 kg 5.6.3.3.2. 1000–1500 kg 5.6.3.3.3. Above 1500 kg 5.6.3.4. Mexico Miniloaders Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Construction 5.6.3.4.2. Agriculture 5.6.3.4.3. Landscaping & Gardening 5.6.3.4.4. Industrial & Warehousing 5.6.3.4.5. Mining & Quarrying 5.6.3.4.6. Municipal Services 5.6.3.5. Mexico Miniloaders Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. Residential 5.6.3.5.2. Commercial 5.6.3.5.3. Industrial 6. Europe Miniloaders Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.2. Europe Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.3. Europe Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.4. Europe Miniloaders Market Size and Forecast, by Application (2024-2032) 6.5. Europe Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Miniloaders Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.1.2. United Kingdom Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.1.3. United Kingdom Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.1.4. United Kingdom Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.2.2. France Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.2.3. France Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.2.4. France Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.3.2. Germany Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.3.3. Germany Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.3.4. Germany Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.4.2. Italy Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.4.3. Italy Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.4.4. Italy Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.5.2. Spain Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.5.3. Spain Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.5.4. Spain Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.6.2. Sweden Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.6.3. Sweden Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.6.4. Sweden Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.7.2. Austria Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.7.3. Austria Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.7.4. Austria Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Miniloaders Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 6.6.8.2. Rest of Europe Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 6.6.8.3. Rest of Europe Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 6.6.8.4. Rest of Europe Miniloaders Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Miniloaders Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Miniloaders Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.2. Asia Pacific Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.3. Asia Pacific Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.4. Asia Pacific Miniloaders Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Miniloaders Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.1.2. China Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.1.3. China Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.1.4. China Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.2.2. S Korea Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.2.3. S Korea Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.2.4. S Korea Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.3.2. Japan Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.3.3. Japan Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.3.4. Japan Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.4.2. India Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.4.3. India Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.4.4. India Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.5.2. Australia Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.5.3. Australia Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.5.4. Australia Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.6.2. Indonesia Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.6.3. Indonesia Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.6.4. Indonesia Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.7.2. Malaysia Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.7.3. Malaysia Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.7.4. Malaysia Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.8.2. Vietnam Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.8.3. Vietnam Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.8.4. Vietnam Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.9.2. Taiwan Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.9.3. Taiwan Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.9.4. Taiwan Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Miniloaders Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 7.6.10.2. Rest of Asia Pacific Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 7.6.10.4. Rest of Asia Pacific Miniloaders Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Miniloaders Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Miniloaders Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 8.2. Middle East and Africa Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 8.3. Middle East and Africa Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 8.4. Middle East and Africa Miniloaders Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Miniloaders Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Miniloaders Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 8.6.1.2. South Africa Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 8.6.1.3. South Africa Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 8.6.1.4. South Africa Miniloaders Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Miniloaders Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 8.6.2.2. GCC Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 8.6.2.3. GCC Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 8.6.2.4. GCC Miniloaders Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Miniloaders Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 8.6.3.2. Nigeria Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 8.6.3.3. Nigeria Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 8.6.3.4. Nigeria Miniloaders Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Miniloaders Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 8.6.4.2. Rest of ME&A Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 8.6.4.3. Rest of ME&A Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 8.6.4.4. Rest of ME&A Miniloaders Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Miniloaders Market Size and Forecast, by End Use (2024-2032) 9. South America Miniloaders Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 9.2. South America Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 9.3. South America Miniloaders Market Size and Forecast, by Operating Capacity(2024-2032) 9.4. South America Miniloaders Market Size and Forecast, by Application (2024-2032) 9.5. South America Miniloaders Market Size and Forecast, by End Use (2024-2032) 9.6. South America Miniloaders Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 9.6.1.2. Brazil Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 9.6.1.3. Brazil Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 9.6.1.4. Brazil Miniloaders Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Miniloaders Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 9.6.2.2. Argentina Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 9.6.2.3. Argentina Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 9.6.2.4. Argentina Miniloaders Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Miniloaders Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Miniloaders Market Size and Forecast, by Power Rating (2024-2032) 9.6.3.2. Rest Of South America Miniloaders Market Size and Forecast, by Engine Type (2024-2032) 9.6.3.3. Rest Of South America Miniloaders Market Size and Forecast, by Operating Capacity (2024-2032) 9.6.3.4. Rest Of South America Miniloaders Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Miniloaders Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Kanga Loaders 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. John Deere 10.3. New Holland 10.4. Bobcat Company (U.S) 10.5. JCB 10.6. Hyundai 10.7. Multitone 10.8. Case CE (Netherlands) 10.9. Caterpillar Inc. (U.S) 10.10. Komatsu Ltd. (Japan) 10.11. Terex Corporation (U.S) 10.12. LinGong Machinery Co. Ltd. (China) 10.13. Lonking Holdings Limited (China) 10.14. J C Bamford Excavators Ltd. (U.K) 10.15. Liebherr Group (Switzerland) 10.16. Hitachi Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Miniloaders Market: Research Methodology 14. Terms and Glossary