Military Simulation Virtual Training Market was valued at US$ 15.08 Bn. in 2022. Global Military Simulation Virtual Training Market size is estimated to grow at a CAGR of 6.1% over the forecast period.Military Simulation Virtual Training Market Overview:

The Military simulation and virtual training help to enhance military techniques for applications including ground-based, naval, and aerial platforms, by giving soldiers strategic experience. Military simulation and virtual training are important components of combat operations. Soldiers' general comprehension and training capacities are improved by military simulation training. Defense ministries across the globe are looking for military simulation and virtual training tools to teach their workforce in the marine, air, and land-based domains. Military simulators in the areas of unmanned vehicle systems, combat operations, maintenance, and medical treatment allow for virtual training in various scenarios. Various governments across the globe are taking steps to give military forces cost-effective and accurate simulation and virtual training technologies.To know about the Research Methodology:- Request Free Sample Report

Military Simulation Virtual Training Market Dynamics:

The military simulation and virtual training market are showing continuous northward direction growth, thanks to the increasing political and social unrest, rising demand for conventional and innovative military weapons, a growing need for qualified workers, and a growing desire to cut training costs all contribute to the overall market's growth. Military simulation and virtual training systems are expected to grow in demand as a result of beneficial efforts introduced by numerous countries across the globe. The emergence of portable simulation systems leads to the usage of flight simulators is fast expanding around the world, boosting the total market's growth. The growing aircraft production costs and a focus on reducing flying time at a lower cost are driving the military simulation and virtual training market growth. Military simulation and virtual training systems are becoming more popular as the demand for trained personnel grows and existing military infrastructure is modernized. In addition, the broader market is being driven by a greater focus on less expensive and more effective military solutions. Defense ministries are increasingly turning to virtual training and simulation games that use artificial intelligence (AI), big data, and cloud data, which is expected to boost the military simulation and virtual training market throughout the forecast period. According to MMR research, technological corporations in Europe and the United States, such as Boeing, CAE, Lockheed Martin, L-3 Link Simulation & Training, and Saab Sensis Corporation, control the majority of the highly focused Training Market. These companies operate on a global scale through established subsidiaries in key countries such as the United States, Canada, and the United Kingdom. Military simulation can be used for training of soon-to-be soldiers and to show a real-time scenario using realistic computerized scenarios. Increased investments in simulation software are expected to be one of the major drivers of market growth. In addition, various countries' defense ministries are reorganizing and modernizing their military using innovative solutions, which is pushing the industry In addition, owing to dwindling financial resources, governments all around the world are cutting military spending. Many countries' military ministries are cutting training funds and downscaling their militaries. As a result, the military's attention has shifted to finding less expensive and more effective answers to their needs. These factors are expected to continue to drive the market growth during the forecast period.Segment Analysis:

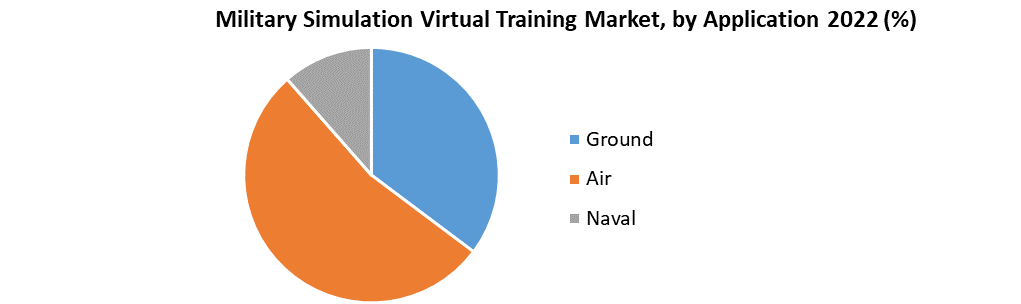

Based on the Platform Type, the Military Virtual Training Market is segmented into Flight, Vehicle, Battlefield, and Virtual Boot Camp. The Flight segment held the largest market share, accounting for 52% in 2022. The segment growth is attributed to the increasing penetration of flight in the commercial industry and growing military flight training techniques. The high cost of flying a real plane, the great risk of human lives being lost, and the ever-increasing cost of aircraft construction are all boosting the adoption of flight simulator acceptance across the globe. The Virtual Boot camp segment is expected to witness significant growth at a CAGR of 5.81% during the forecast period. The Air Force, Navy, and Army all use virtual boot camp simulators to help soldiers acquire important physical fitness routines and kill drill requirements, which are driving the market growth for this segment. Based on the Application, the Military Simulation Vrtual Training Market is segmented into Ground, Air, and Naval. The Air segment held the largest market share, accounting for 43.7% in 2022. Due to increased demand for border surveillance and battlefield operations, the air application sector led the market. In-flight deck simulators and rear crew mission simulators are linked electronically to give both missions practice and crew resource management training to mission crews using airborne simulators. Simulators assist military pilots in practicing for circumstances like as climate change, malfunctioning internal aircraft systems, engine failures, hydraulic and brake malfunctions, wind shears on short final, and navigation radio breakdowns through airborne training exercises, which leads to the growing adoption of air military simulation and virtual reality, which in turn boosting the market growth for this segment. The Ground segment is expected to witness significant growth at a CAGR of 5.41% during the forecast period. Border disputes and natural resource disputes have prompted the military to focus on modernizing its personnel. The demand for ground-based military simulation and virtual training is predicted to increase, making it the second-largest market. Tanks are an important part of ground warfare, but their usage in training comes at a heavy cost. In addition, owing to lower training costs and increased accuracy in measuring training objectives, ground-based simulators are becoming more popular

Regional Insights:

North America region held the largest market share accounted for 34.92% in 2022. With the strategy of maintaining army personnel available for deployment in war-like conditions at short notice, North American countries have ordered the procurement of these solutions. To save time and money, the US Air Force is focusing on reducing flight hours. Live Training Transformation (LT2) systems for the army, F-35 aircraft simulators, the US Air Force's F-16 Training System, and Long-Range Strike-B simulators are just a few of their programs. These factors are driving the market growth in the region. The Asia Pacific region is expected to experience significant growth at a CAGR of 5.2% during the forecast period. Countries like China and India have boosted their military spending, allowing for the purchase of sophisticated weapons. Additionally, the regional demand is projected to be fueled by an emphasis on providing forces with cost-effective and best-in-class training. The objective of the report is to present a comprehensive analysis of the global Military Simulation Virtual Training Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Military Simulation Virtual Training Market dynamic, structure by analyzing the market segments and projecting the Military Simulation Virtual Training Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Military Simulation Virtual Training Market make the report investor’s guide.Military Simulation Virtual Training Market Scope: Inquire before buying

Military Simulation Virtual Training Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 15.08 Bn. Forecast Period 2023 to 2029 CAGR: 6.1% Market Size in 2029: US $ 22.84 Bn. Segments Covered: by Platform Type Flight Vehicle Battlefield Virtual Boot Camp by Application Ground Air Naval by Technology IoT 5G Big Data Analytics Artificial Intelligence Cloud Computing and Master Data Management AR & VR Digital Twin Robotic Process Automation Military Simulation Virtual Training Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players are:

1.Northrop Grumman Corporation 2.Cubic Corporation 3.CAE 4.AAI Corporation 5.Rockwell Collins Inc. 6.Lockheed Martin Corporation 7.BAE Systems 8.L3 Link Training & Simulation 9.Thales Group 10.Bohemia Interactive Simulations 11.Boeing 12.Saab Sensis Corporation 13.Alenia Aeronautica 14.Kratos Defense and Security SolutionsFrequently Asked Questions:

1] What segments are covered in the Military Simulation Virtual Training Market report? Ans. The segments covered in the Military Simulation Virtual Training Market report are based on Platform Type, Application and Technology. 2] Which region is expected to hold the highest share in the Military Simulation Virtual Training Market? Ans. The North America region is expected to hold the highest share in the Military Simulation Virtual Training Market. 3] What is the market size of the Military Simulation Virtual Training Market by 2029? Ans. The market size of the Military Simulation Virtual Training Market by 2029 is expected to reach US$ 22.84 Bn. 4] What is the forecast period for the Military Simulation Virtual Training Market? Ans. The forecast period for the Military Simulation Virtual Training Market is 2023-2029. 5] What was the market size of the Military Simulation Virtual Training Market in 2022? Ans. The market size of the Military Simulation Virtual Training Market in 2022 was valued at US$ 15.08 Bn.

1. Global Military Simulation Virtual Training Market: Research Methodology 2. Global Military Simulation Virtual Training Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Military Simulation Virtual Training Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Military Simulation Virtual Training Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Military Simulation Virtual Training Market Segmentation 4.1 Global Military Simulation Virtual Training Market, by Platform Type (2022-2029) • Flight • Vehicle • Battlefield • Virtual Boot Camp 4.2 Global Military Simulation Virtual Training Market, by Application (2022-2029) • Ground • Air • Naval 4.3 Global Military Simulation Virtual Training Market, by Technology (2022-2029) • IoT • 5G • Big Data Analytics • Artificial Intelligence • Cloud Computing and Master Data Management • AR & VR • Digital Twin • Robotic Process Automation 5. North America Military Simulation Virtual Training Market(2022-2029) 5.1 North America Military Simulation Virtual Training Market, by Platform Type (2022-2029) • Flight • Vehicle • Battlefield • Virtual Boot Camp 5.2 North America Military Simulation Virtual Training Market, by Application (2022-2029) • Ground • Air • Naval 5.3 North America Military Simulation Virtual Training Market, by Technology (2022-2029) • IoT • 5G • Big Data Analytics • Artificial Intelligence • Cloud Computing and Master Data Management • AR & VR • Digital Twin • Robotic Process Automation 5.4 North America Military Simulation Virtual Training Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Military Simulation Virtual Training Market (2022-2029) 6.1. European Military Simulation Virtual Training Market, by Platform Type (2022-2029) 6.2. European Military Simulation Virtual Training Market, by Application (2022-2029) 6.3. European Military Simulation Virtual Training Market, by Technology (2022-2029) 6.4. European Military Simulation Virtual Training Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Military Simulation Virtual Training Market (2022-2029) 7.1. Asia Pacific Military Simulation Virtual Training Market, by Platform Type (2022-2029) 7.2. Asia Pacific Military Simulation Virtual Training Market, by Application (2022-2029) 7.3. Asia Pacific Military Simulation Virtual Training Market, by Technology (2022-2029) 7.4. Asia Pacific Military Simulation Virtual Training Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Military Simulation Virtual Training Market (2022-2029) 8.1 Middle East and Africa Military Simulation Virtual Training Market, by Platform Type (2022-2029) 8.2. Middle East and Africa Military Simulation Virtual Training Market, by Application (2022-2029) 8.3. Middle East and Africa Military Simulation Virtual Training Market, by Technology (2022-2029) 8.4. Middle East and Africa Military Simulation Virtual Training Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Military Simulation Virtual Training Market (2022-2029) 9.1. South America Military Simulation Virtual Training Market, by Platform Type (2022-2029) 9.2. South America Military Simulation Virtual Training Market, by Application (2022-2029) 9.3. South America Military Simulation Virtual Training Market, by Technology (2022-2029) 9.4 South America Military Simulation Virtual Training Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Northrop Grumman Corporation 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Cubic Corporation 10.3 CAE 10.4 AAI Corporation 10.5 Rockwell Collins Inc. 10.6 Lockheed Martin Corporation 10.7 BAE Systems 10.8 L3 Link Training & Simulation 10.9 Thales Group 10.10 Bohemia Interactive Simulations 10.11 Boeing 10.12 Saab Sensis Corporation 10.13 Alenia Aeronautica 10.14 Kratos Defense and Security Solutions