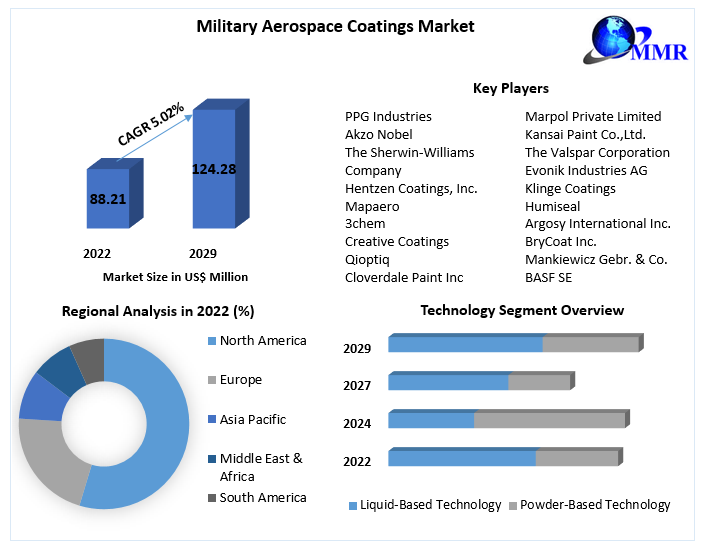

Military Aerospace Coatings Market is expected to grow at a CAGR of 5.02% during the forecast period. Global Military Aerospace Coatings Market is expected to reach US$ 124.28 Mn by 2029. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology :- Request Free Sample Report

Military Aerospace Coatings Market Dynamics:

The major driver in the global military aerospace coatings market is the Increasing demand for military aerospace coatings across various industrial sectors like original equipment manufacturer and maintenance repair & overhaul. Increasing the application scope in the aerospace & defense sector is another key factor estimated to support revenue growth of the global market over the forecast period. Furthermore, different properties offered by products like weather resistance and high strength is another factor estimated to boost the implementation of the products, which in turn anticipated to drive the growth of the target market over the forecast period. Superior coverage on inner corners, smoother, and uniform finish are key factors expected to increase demand for liquid-based coating technology, which is expected to drive growth of the global market over the forecast period.Global Military Aerospace Coatings Market Segment Analysis:

Based on the technology segment, the global military aerospace coatings market is based upon various technologies, like liquid and powder. Furthermore, the liquid technology segment is sub-segmented into solvent-based and water-based technology. The superior coverage on the inner corners and hard-to-reach places, smoother and more uniform finish are factors leading to the growing demand for the liquid-based coating technology, which is expected to drive the growth of the global military aerospace coatings market in the liquid technology segment during the forecast period. On the basis of resin type segment, the PU resin type is estimated to hold largest market share during forecast period, because of the demand for global military aerospace coatings market for fixed-wing and rotary-wing military aircraft. PU is used as a top coat and epoxy is usually used as a primer. The UV-resistant property leads to the high request for the PU resin.Global Military Aerospace Coatings Market Regional Insights:

In terms of region, North America is expected to contribute the largest market share during the forecast period. But, the global military aerospace coatings market because of the growing amount of aircraft distributions and growing budgets of defense sectors of China and India. China is estimated to be the leading country in the APAC global military aerospace coatings market, because of the increase in demand from the OEM and MRO user types. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data, and projections with a suitable set of assumptions and methodology. The report also helps in understanding global military aerospace coatings market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also provides PEST analysis, PORTER’s analysis, and SWOT analysis to address the question of shareholders to prioritizing the efforts and investment in the near future to the emerging segment in global military aerospace coatings market.Global Military Aerospace Coatings Market, Key Highlights:

• Global Military Aerospace Coatings Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Global Military Aerospace Coatings Market • Global Military Aerospace Coatings Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Global Military Aerospace Coatings Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Global Military Aerospace Coatings Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Global Military Aerospace Coatings Market are also profiled.Military Aerospace Coatings Market Report Scope: Inquire before buying

Military Aerospace Coatings Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 88.21 Bn. Forecast Period 2023 to 2029 CAGR: 5.02% Market Size in 2029: US $ 124.28 Bn. Segments Covered: by Product • PU • Epoxy • Others by Type • Liquid-Based Technology o Solvent-Based Technology o Water-Based Technology • Powder-Based Technology by Application • Fixed-Wing Aircraft • Rotary Wing Aircraft by End-User • Original Equipment Manufacturer • Maintenance, Repair & Overhaul Military Aerospace Coatings Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Military Aerospace Coatings Market, Key Players

• PPG Industries • Akzo Nobel • The Sherwin-Williams Company • Hentzen Coatings, Inc. • Mapaero • 3chem • Creative Coatings • Qioptiq • Cloverdale Paint Inc • Marpol Private Limited • Kansai Paint Co.,Ltd. • The Valspar Corporation • Evonik Industries AG • Klinge Coatings • Humiseal • Argosy International Inc. • BryCoat Inc. • Mankiewicz Gebr. & Co. • Henkel AG & Company KGaA • BASF SE Frequently Asked Questions: 1. Which region has the largest share in Global Military Aerospace Coatings Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Military Aerospace Coatings Market? Ans: The Global Military Aerospace Coatings Market is growing at a CAGR of 5.02% during forecasting period 2023-2029. 3. What is scope of the Global Military Aerospace Coatings Market report? Ans: Global Military Aerospace Coatings Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Military Aerospace Coatings Market? Ans: The important key players in the Global Military Aerospace Coatings Market are – PPG Industries, Akzo Nobel, The Sherwin-Williams Company, Hentzen Coatings, Inc., Mapaero, 3chem, Creative Coatings, Qioptiq, Cloverdale Paint Inc, Marpol Private Limited, Kansai Paint Co.,Ltd., The Valspar Corporation, Evonik Industries AG, Klinge Coatings, Humiseal, Argosy International Inc., BryCoat Inc., Mankiewicz Gebr. & Co., Henkel AG & Company KGaA, BASF SE 5. What is the study period of this Market? Ans: The Global Military Aerospace Coatings Market is studied from 2022 to 2029.

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Military Aerospace Coatings Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Global Military Aerospace Coatings Market Industry Trends 4.8. Global Military Aerospace Coatings Market Competitive Landscape 5. Supply Side and Demand Side Indicators 6. Global Military Aerospace Coatings Market Analysis and Forecast 6.1. Global Military Aerospace Coatings Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Military Aerospace Coatings Market Analysis and Forecast, by Resin Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Military Aerospace Coatings Market Value Share Analysis, by Resin Type 7.4. Global Military Aerospace Coatings Market Size (US$ Mn) Forecast, by Resin Type 7.5. Global Military Aerospace Coatings Market Analysis, by Resin Type 7.6. Global Military Aerospace Coatings Market Attractiveness Analysis, by Resin Type 8. Global Military Aerospace Coatings Market Analysis and Forecast, by Technology 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Military Aerospace Coatings Market Value Share Analysis, by Technology 8.4. Global Military Aerospace Coatings Market Size (US$ Mn) Forecast, by Technology 8.5. Global Military Aerospace Coatings Market Analysis, by Technology 8.6. Global Military Aerospace Coatings Market Attractiveness Analysis, by Technology 9. Global Military Aerospace Coatings Market Analysis and Forecast, by Aircraft Type 9.1. Introduction and Definition 9.2. Key Findings 9.3. Global Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 9.4. Global Military Aerospace Coatings Market Size (US$ Mn) Forecast, by Aircraft Type 9.5. Global Military Aerospace Coatings Market Analysis, by Aircraft Type 9.6. Global Military Aerospace Coatings Market Attractiveness Analysis, by Aircraft Type 10. Global Military Aerospace Coatings Market Analysis and Forecast, by User Type 10.1. Introduction and Definition 10.2. Key Findings 10.3. Global Military Aerospace Coatings Market Value Share Analysis, by User Type 10.4. Global Military Aerospace Coatings Market Size (US$ Mn) Forecast, by User Type 10.5. Global Military Aerospace Coatings Market Analysis, by User Type 10.6. Global Military Aerospace Coatings Market Attractiveness Analysis, by User Type 11. Global Military Aerospace Coatings Market Analysis, by Region 11.1. Global Military Aerospace Coatings Market Value Share Analysis, by Region 11.2. Global Military Aerospace Coatings Market Size (US$ Mn) Forecast, by Region 11.3. Global Military Aerospace Coatings Market Attractiveness Analysis, by Region 12. North America Military Aerospace Coatings Market Analysis 12.1. Key Findings 12.2. North America Military Aerospace Coatings Market Overview 12.3. North America Military Aerospace Coatings Market Value Share Analysis, by Resin Type 12.4. North America Military Aerospace Coatings Market Forecast, by Resin Type 12.4.1. PU 12.4.2. Epoxy 12.4.3. Others 12.5. North America Military Aerospace Coatings Market Value Share Analysis, by Technology 12.6. North America Military Aerospace Coatings Market Forecast, by Technology 12.6.1. Liquid-Based Technology 12.6.1.1. Solvent-Based Technology 12.6.1.2. Water-Based Technology 12.6.2. Powder-Based Technology 12.7. North America Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 12.8. North America Military Aerospace Coatings Market Forecast, by Aircraft Type 12.8.1. Fixed-Wing Aircraft 12.8.2. Rotary Wing Aircraft 12.9. North America Military Aerospace Coatings Market Value Share Analysis, by User Type 12.10. North America Military Aerospace Coatings Market Forecast, by User Type 12.10.1. Original Equipment Manufacturer 12.10.2. Maintenance, Repair & Overhaul 12.11. North America Military Aerospace Coatings Market Value Share Analysis, by Country 12.12. North America Military Aerospace Coatings Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.13. North America Military Aerospace Coatings Market Analysis, by Country 12.14. U.S. Military Aerospace Coatings Market Forecast, by Resin Type 12.14.1. PU 12.14.2. Epoxy 12.14.3. Others 12.15. U.S. Military Aerospace Coatings Market Forecast, by Technology 12.15.1. Liquid-Based Technology 12.15.1.1. Solvent-Based Technology 12.15.1.2. Water-Based Technology 12.15.2. Powder-Based Technology 12.16. U.S. Military Aerospace Coatings Market Forecast, by Aircraft Type 12.16.1. Fixed-Wing Aircraft 12.16.2. Rotary Wing Aircraft 12.17. U.S. Military Aerospace Coatings Market Forecast, by User Type 12.17.1. Original Equipment Manufacturer 12.17.2. Maintenance, Repair & Overhaul 12.18. Canada Military Aerospace Coatings Market Forecast, by Resin Type 12.18.1. PU 12.18.2. Epoxy 12.18.3. Others 12.19. Canada Military Aerospace Coatings Market Forecast, by Technology 12.19.1. Liquid-Based Technology 12.19.1.1. Solvent-Based Technology 12.19.1.2. Water-Based Technology 12.19.2. Powder-Based Technology 12.20. Canada Military Aerospace Coatings Market Forecast, by Aircraft Type 12.20.1. Fixed-Wing Aircraft 12.20.2. Rotary Wing Aircraft 12.21. Canada Military Aerospace Coatings Market Forecast, by User Type 12.21.1. Original Equipment Manufacturer 12.21.2. Maintenance, Repair & Overhaul 12.22. Glass North America Military Aerospace Coatings Market Attractiveness Analysis 12.22.1. By Resin Type 12.22.2. By Technology 12.22.3. By Aircraft Type 12.22.4. By User Type 12.23. PEST Analysis 12.24. Key Trends 12.25. Key Developments 13. Europe Military Aerospace Coatings Market Analysis 13.1. Key Findings 13.2. Europe Military Aerospace Coatings Market Overview 13.3. Europe Military Aerospace Coatings Market Value Share Analysis, by Resin Type 13.4. Europe Military Aerospace Coatings Market Forecast, by Resin Type 13.4.1. PU 13.4.2. Epoxy 13.4.3. Others 13.5. Europe Military Aerospace Coatings Market Value Share Analysis, by Technology 13.6. Europe Military Aerospace Coatings Market Forecast, by Technology 13.6.1. Liquid-Based Technology 13.6.1.1. Solvent-Based Technology 13.6.1.2. Water-Based Technology 13.6.2. Powder-Based Technology 13.7. Europe Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 13.8. Europe Military Aerospace Coatings Market Forecast, by Aircraft Type 13.8.1. Fixed-Wing Aircraft 13.8.2. Rotary Wing Aircraft 13.9. Europe Military Aerospace Coatings Market Value Share Analysis, by User Type 13.10. Europe Military Aerospace Coatings Market Forecast, by User Type 13.10.1. Original Equipment Manufacturer 13.10.2. Maintenance, Repair & Overhaul 13.11. Europe Military Aerospace Coatings Market Value Share Analysis, by Country 13.12. Europe Military Aerospace Coatings Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Rest of Europe 13.13. Europe Military Aerospace Coatings Market Analysis, by Country 13.14. Germany Military Aerospace Coatings Market Forecast, by Resin Type 13.14.1. PU 13.14.2. Epoxy 13.14.3. Others 13.15. Germany Military Aerospace Coatings Market Forecast, by Technology 13.15.1. Liquid-Based Technology 13.15.1.1. Solvent-Based Technology 13.15.1.2. Water-Based Technology 13.15.2. Powder-Based Technology 13.16. Germany Military Aerospace Coatings Market Forecast, by Aircraft Type 13.16.1. Fixed-Wing Aircraft 13.16.2. Rotary Wing Aircraft 13.17. Germany Military Aerospace Coatings Market Forecast, by User Type 13.17.1. Original Equipment Manufacturer 13.17.2. Maintenance, Repair & Overhaul 13.18. U.K. Military Aerospace Coatings Market Forecast, by Resin Type 13.18.1. PU 13.18.2. Epoxy 13.18.3. Others 13.19. U.K. Military Aerospace Coatings Market Forecast, by Technology 13.19.1. Liquid-Based Technology 13.19.1.1. Solvent-Based Technology 13.19.1.2. Water-Based Technology 13.19.2. Powder-Based Technology 13.20. U.K. Military Aerospace Coatings Market Forecast, by Aircraft Type 13.20.1. Fixed-Wing Aircraft 13.20.2. Rotary Wing Aircraft 13.21. U.K. Military Aerospace Coatings Market Forecast, by User Type 13.21.1. Original Equipment Manufacturer 13.21.2. Maintenance, Repair & Overhaul 13.22. France Military Aerospace Coatings Market Forecast, by Resin Type 13.22.1. PU 13.22.2. Epoxy 13.22.3. Others 13.23. France Military Aerospace Coatings Market Forecast, by Technology 13.23.1. Liquid-Based Technology 13.23.1.1. Solvent-Based Technology 13.23.1.2. Water-Based Technology 13.23.2. Powder-Based Technology 13.24. France Military Aerospace Coatings Market Forecast, by Aircraft Type 13.24.1. Fixed-Wing Aircraft 13.24.2. Rotary Wing Aircraft 13.25. France Military Aerospace Coatings Market Forecast, by User Type 13.25.1. Original Equipment Manufacturer 13.25.2. Maintenance, Repair & Overhaul 13.26. Italy Military Aerospace Coatings Market Forecast, by Resin Type 13.26.1. PU 13.26.2. Epoxy 13.26.3. Others 13.27. Italy Military Aerospace Coatings Market Forecast, by Technology 13.27.1. Liquid-Based Technology 13.27.1.1. Solvent-Based Technology 13.27.1.2. Water-Based Technology 13.27.2. Powder-Based Technology 13.28. Italy Military Aerospace Coatings Market Forecast, by Aircraft Type 13.28.1. Fixed-Wing Aircraft 13.28.2. Rotary Wing Aircraft 13.29. Italy Military Aerospace Coatings Market Forecast, by User Type 13.29.1. Original Equipment Manufacturer 13.29.2. Maintenance, Repair & Overhaul 13.30. Spain Military Aerospace Coatings Market Forecast, by Resin Type 13.30.1. PU 13.30.2. Epoxy 13.30.3. Others 13.31. Spain Military Aerospace Coatings Market Forecast, by Technology 13.31.1. Liquid-Based Technology 13.31.1.1. Solvent-Based Technology 13.31.1.2. Water-Based Technology 13.31.2. Powder-Based Technology 13.32. Spain Military Aerospace Coatings Market Forecast, by Aircraft Type 13.32.1. Fixed-Wing Aircraft 13.32.2. Rotary Wing Aircraft 13.33. Spain Military Aerospace Coatings Market Forecast, by User Type 13.33.1. Original Equipment Manufacturer 13.33.2. Maintenance, Repair & Overhaul 13.34. Rest of Europe Military Aerospace Coatings Market Forecast, by Resin Type 13.34.1. PU 13.34.2. Epoxy 13.34.3. Others 13.35. Rest of Europe Military Aerospace Coatings Market Forecast, by Technology 13.35.1. Liquid-Based Technology 13.35.1.1. Solvent-Based Technology 13.35.1.2. Water-Based Technology 13.35.2. Powder-Based Technology 13.36. Rest of Europe Military Aerospace Coatings Market Forecast, by Aircraft Type 13.36.1. Fixed-Wing Aircraft 13.36.2. Rotary Wing Aircraft 13.37. Rest Of Europe Military Aerospace Coatings Market Forecast, by User Type 13.37.1. Original Equipment Manufacturer 13.37.2. Maintenance, Repair & Overhaul 13.38. Europe Military Aerospace Coatings Market Attractiveness Analysis 13.38.1. By Resin Type 13.38.2. By Technology 13.38.3. By Aircraft Type 13.38.4. By User Type 13.39. PEST Analysis 13.40. Key Trends 13.41. Key Developments 14. Asia Pacific Military Aerospace Coatings Market Analysis 14.1. Key Findings 14.2. Asia Pacific Military Aerospace Coatings Market Overview 14.3. Asia Pacific Military Aerospace Coatings Market Value Share Analysis, by Resin Type 14.4. Asia Pacific Military Aerospace Coatings Market Forecast, by Resin Type 14.4.1. PU 14.4.2. Epoxy 14.4.3. Others 14.5. Asia Pacific Military Aerospace Coatings Market Value Share Analysis, by Technology 14.6. Asia Pacific Military Aerospace Coatings Market Forecast, by Technology 14.6.1. Liquid-Based Technology 14.6.1.1. Solvent-Based Technology 14.6.1.2. Water-Based Technology 14.6.2. Powder-Based Technology 14.7. Asia Pacific Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 14.8. Asia Pacific Military Aerospace Coatings Market Forecast, by Aircraft Type 14.8.1. Fixed-Wing Aircraft 14.8.2. Rotary Wing Aircraft 14.9. Asia Pacific Military Aerospace Coatings Market Value Share Analysis, by User Type 14.10. Asia Pacific Military Aerospace Coatings Market Forecast, by User Type 14.10.1. Original Equipment Manufacturer 14.10.2. Maintenance, Repair & Overhaul 14.11. Asia Pacific Military Aerospace Coatings Market Value Share Analysis, by Country 14.12. Asia Pacific Military Aerospace Coatings Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. ASEAN 14.12.5. Rest of Asia Pacific 14.13. Asia Pacific Military Aerospace Coatings Market Analysis, by Country 14.14. China Military Aerospace Coatings Market Forecast, by Resin Type 14.14.1. PU 14.14.2. Epoxy 14.14.3. Others 14.15. China Military Aerospace Coatings Market Forecast, by Technology 14.15.1. Liquid-Based Technology 14.15.1.1. Solvent-Based Technology 14.15.1.2. Water-Based Technology 14.15.2. Powder-Based Technology 14.16. China Military Aerospace Coatings Market Forecast, by Aircraft Type 14.16.1. Fixed-Wing Aircraft 14.16.2. Rotary Wing Aircraft 14.17. China Military Aerospace Coatings Market Forecast, by User Type 14.17.1. Original Equipment Manufacturer 14.17.2. Maintenance, Repair & Overhaul 14.18. India Military Aerospace Coatings Market Forecast, by Resin Type 14.18.1. PU 14.18.2. Epoxy 14.18.3. Others 14.19. India Military Aerospace Coatings Market Forecast, by Technology 14.19.1. Liquid-Based Technology 14.19.1.1. Solvent-Based Technology 14.19.1.2. Water-Based Technology 14.19.2. Powder-Based Technology 14.20. India Military Aerospace Coatings Market Forecast, by Aircraft Type 14.20.1. Fixed-Wing Aircraft 14.20.2. Rotary Wing Aircraft 14.21. India Military Aerospace Coatings Market Forecast, by User Type 14.21.1. Original Equipment Manufacturer 14.21.2. Maintenance, Repair & Overhaul 14.22. Japan Military Aerospace Coatings Market Forecast, by Resin Type 14.22.1. PU 14.22.2. Epoxy 14.22.3. Others 14.23. Japan Military Aerospace Coatings Market Forecast, by Technology 14.23.1. Liquid-Based Technology 14.23.1.1. Solvent-Based Technology 14.23.1.2. Water-Based Technology 14.23.2. Powder-Based Technology 14.24. Japan Military Aerospace Coatings Market Forecast, by Aircraft Type 14.24.1. Fixed-Wing Aircraft 14.24.2. Rotary Wing Aircraft 14.25. Japan Military Aerospace Coatings Market Forecast, by User Type 14.25.1. Original Equipment Manufacturer 14.25.2. Maintenance, Repair & Overhaul 14.26. ASEAN Military Aerospace Coatings Market Forecast, by Resin Type 14.26.1. PU 14.26.2. Epoxy 14.26.3. Others 14.27. ASEAN Military Aerospace Coatings Market Forecast, by Technology 14.27.1. Liquid-Based Technology 14.27.1.1. Solvent-Based Technology 14.27.1.2. Water-Based Technology 14.27.2. Powder-Based Technology 14.28. ASEAN Military Aerospace Coatings Market Forecast, by Aircraft Type 14.28.1. Fixed-Wing Aircraft 14.28.2. Rotary Wing Aircraft 14.29. ASEAN Military Aerospace Coatings Market Forecast, by User Type 14.29.1. Original Equipment Manufacturer 14.29.2. Maintenance, Repair & Overhaul 14.30. Rest of Asia Pacific Military Aerospace Coatings Market Forecast, by Resin Type 14.30.1. PU 14.30.2. Epoxy 14.30.3. Others 14.31. Rest of Asia Pacific Military Aerospace Coatings Market Forecast, by Technology 14.31.1. Liquid-Based Technology 14.31.1.1. Solvent-Based Technology 14.31.1.2. Water-Based Technology 14.31.2. Powder-Based Technology 14.32. Rest of Asia Pacific Military Aerospace Coatings Market Forecast, by Aircraft Type 14.32.1. Fixed-Wing Aircraft 14.32.2. Rotary Wing Aircraft 14.33. Rest of Asia Pacific Military Aerospace Coatings Market Forecast, by User Type 14.33.1. Original Equipment Manufacturer 14.33.2. Maintenance, Repair & Overhaul 14.34. Asia Pacific Military Aerospace Coatings Market Attractiveness Analysis 14.34.1. By Resin Type 14.34.2. By Technology 14.34.3. By Aircraft Type 14.34.4. By User Type 14.35. PEST Analysis 14.36. Key Trends 14.37. Key Developments 15. Middle East & Africa Military Aerospace Coatings Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Military Aerospace Coatings Market Overview 15.3. Middle East & Africa Military Aerospace Coatings Market Value Share Analysis, by Resin Type 15.4. Middle East & Africa Military Aerospace Coatings Market Forecast, by Resin Type 15.4.1. PU 15.4.2. Epoxy 15.4.3. Others 15.5. Middle East & Africa Military Aerospace Coatings Market Value Share Analysis, by Technology 15.6. Middle East & Africa Military Aerospace Coatings Market Forecast, by Technology 15.6.1. Liquid-Based Technology 15.6.1.1. Solvent-Based Technology 15.6.1.2. Water-Based Technology 15.6.2. Powder-Based Technology 15.7. Middle East & Africa Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 15.8. Middle East & Africa Military Aerospace Coatings Market Forecast, by Aircraft Type 15.8.1. Fixed-Wing Aircraft 15.8.2. Rotary Wing Aircraft 15.9. Middle East & Africa Military Aerospace Coatings Market Value Share Analysis, by User Type 15.10. Middle East & Africa Military Aerospace Coatings Market Forecast, by User Type 15.10.1. Original Equipment Manufacturer 15.10.2. Maintenance, Repair & Overhaul 15.11. Middle East & Africa Military Aerospace Coatings Market Value Share Analysis, by Country 15.12. Middle East & Africa Military Aerospace Coatings Market Forecast, by Country 15.12.1. GCC 15.12.2. South Africa 15.12.3. Rest of Middle East & Africa 15.13. Middle East & Africa Military Aerospace Coatings Market Analysis, by Country 15.14. GCC Military Aerospace Coatings Market Forecast, by Resin Type 15.14.1. PU 15.14.2. Epoxy 15.14.3. Others 15.15. GCC Military Aerospace Coatings Market Forecast, by Technology 15.15.1. Liquid-Based Technology 15.15.1.1. Solvent-Based Technology 15.15.1.2. Water-Based Technology 15.15.2. Powder-Based Technology 15.16. GCC Military Aerospace Coatings Market Forecast, by Aircraft Type 15.16.1. Fixed-Wing Aircraft 15.16.2. Rotary Wing Aircraft 15.17. GCC Military Aerospace Coatings Market Forecast, by User Type 15.17.1. Original Equipment Manufacturer 15.17.2. Maintenance, Repair & Overhaul 15.18. South Africa Military Aerospace Coatings Market Forecast, by Resin Type 15.18.1. PU 15.18.2. Epoxy 15.18.3. Others 15.19. South Africa Military Aerospace Coatings Market Forecast, by Technology 15.19.1. Liquid-Based Technology 15.19.1.1. Solvent-Based Technology 15.19.1.2. Water-Based Technology 15.19.2. Powder-Based Technology 15.20. South Africa Military Aerospace Coatings Market Forecast, by Aircraft Type 15.20.1. Fixed-Wing Aircraft 15.20.2. Rotary Wing Aircraft 15.21. South Africa Military Aerospace Coatings Market Forecast, by User Type 15.21.1. Original Equipment Manufacturer 15.21.2. Maintenance, Repair & Overhaul 15.22. Rest of Middle East & Africa Military Aerospace Coatings Market Forecast, by Resin Type 15.22.1. PU 15.22.2. Epoxy 15.22.3. Others 15.23. Rest of Middle East & Africa Military Aerospace Coatings Market Forecast, by Technology 15.23.1. Liquid-Based Technology 15.23.1.1. Solvent-Based Technology 15.23.1.2. Water-Based Technology 15.23.2. Powder-Based Technology 15.24. Rest of Middle East & Africa Military Aerospace Coatings Market Forecast, by Aircraft Type 15.24.1. Fixed-Wing Aircraft 15.24.2. Rotary Wing Aircraft 15.25. Rest of Middle East & Africa Military Aerospace Coatings Market Forecast, by User Type 15.25.1. Original Equipment Manufacturer 15.25.2. Maintenance, Repair & Overhaul 15.26. Middle East & Africa Military Aerospace Coatings Market Attractiveness Analysis 15.26.1. By Resin Type 15.26.2. By Technology 15.26.3. By Aircraft Type 15.26.4. By User Type 15.27. PEST Analysis 15.28. Key Trends 15.29. Key Developments 16. South America Military Aerospace Coatings Market Analysis 16.1. Key Findings 16.2. South America Military Aerospace Coatings Market Overview 16.3. South America Military Aerospace Coatings Market Value Share Analysis, by Resin Type 16.4. South America Military Aerospace Coatings Market Forecast, by Resin Type 16.4.1. PU 16.4.2. Epoxy 16.4.3. Others 16.5. South America Military Aerospace Coatings Market Value Share Analysis, by Technology 16.6. South America Military Aerospace Coatings Market Forecast, by Technology 16.6.1. Liquid-Based Technology 16.6.1.1. Solvent-Based Technology 16.6.1.2. Water-Based Technology 16.6.2. Powder-Based Technology 16.7. South America Military Aerospace Coatings Market Value Share Analysis, by Aircraft Type 16.8. South America Military Aerospace Coatings Market Forecast, by Aircraft Type 16.8.1. Fixed-Wing Aircraft 16.8.2. Rotary Wing Aircraft 16.9. South America Military Aerospace Coatings Market Value Share Analysis, by User Type 16.10. South America Military Aerospace Coatings Market Forecast, by User Type 16.10.1. Original Equipment Manufacturer 16.10.2. Maintenance, Repair & Overhaul 16.11. South America Military Aerospace Coatings Market Value Share Analysis, by Country 16.12. South America Military Aerospace Coatings Market Forecast, by Country 16.12.1. Brazil 16.12.2. Mexico 16.12.3. Rest of South America 16.13. South America Military Aerospace Coatings Market Analysis, by Country 16.14. Brazil Military Aerospace Coatings Market Forecast, by Resin Type 16.14.1. PU 16.14.2. Epoxy 16.14.3. Others 16.15. Brazil Military Aerospace Coatings Market Forecast, by Technology 16.15.1. Liquid-Based Technology 16.15.1.1. Solvent-Based Technology 16.15.1.2. Water-Based Technology 16.15.2. Powder-Based Technology 16.16. Brazil Military Aerospace Coatings Market Forecast, by Aircraft Type 16.16.1. Fixed-Wing Aircraft 16.16.2. Rotary Wing Aircraft 16.17. Brazil Military Aerospace Coatings Market Forecast, by User Type 16.17.1. Original Equipment Manufacturer 16.17.2. Maintenance, Repair & Overhaul 16.18. Mexico Military Aerospace Coatings Market Forecast, by Resin Type 16.18.1. PU 16.18.2. Epoxy 16.18.3. Others 16.19. Mexico Military Aerospace Coatings Market Forecast, by Technology 16.19.1. Liquid-Based Technology 16.19.1.1. Solvent-Based Technology 16.19.1.2. Water-Based Technology 16.19.2. Powder-Based Technology 16.20. Mexico Military Aerospace Coatings Market Forecast, by Aircraft Type 16.20.1. Fixed-Wing Aircraft 16.20.2. Rotary Wing Aircraft 16.21. Mexico Military Aerospace Coatings Market Forecast, by User Type 16.21.1. Original Equipment Manufacturer 16.21.2. Maintenance, Repair & Overhaul 16.22. Rest of South America Military Aerospace Coatings Market Forecast, by Resin Type 16.22.1. PU 16.22.2. Epoxy 16.22.3. Others 16.23. Rest of South America Military Aerospace Coatings Market Forecast, by Technology 16.23.1. Liquid-Based Technology 16.23.1.1. Solvent-Based Technology 16.23.1.2. Water-Based Technology 16.23.2. Powder-Based Technology 16.24. Rest of South America Military Aerospace Coatings Market Forecast, by Aircraft Type 16.24.1. Fixed-Wing Aircraft 16.24.2. Rotary Wing Aircraft 16.25. Rest of South America Military Aerospace Coatings Market Forecast, by User Type 16.25.1. Original Equipment Manufacturer 16.25.2. Maintenance, Repair & Overhaul 16.26. South America Military Aerospace Coatings Market Attractiveness Analysis 16.26.1. By Resin Type 16.26.2. By Technology 16.26.3. By Aircraft Type 16.26.4. By User Type 16.27. PEST Analysis 16.28. Key Trends 16.29. Key Developments 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Application and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Application 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. PPG Industries. 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Developing Footprint 17.3.2. Akzo Nobel 17.3.3. The Sherwin-Williams Company 17.3.4. Hentzen Coatings, Inc. 17.3.5. Mapaero 17.3.6. 3chem 17.3.7. Creative Coatings 17.3.8. Qioptiq 17.3.9. Cloverdale Paint Inc 17.3.10. Marpol Private Limited 17.3.11. Kansai Paint Co.,Ltd. 17.3.12. The Valspar Corporation 17.3.13. Evonik Industries AG 17.3.14. Klinge Coatings 17.3.15. Humiseal 17.3.16. Argosy International Inc. 17.3.17. BryCoat Inc. 17.3.18. Mankiewicz Gebr. & Co. 17.3.19. Henkel AG & Company KGaA 17.3.20. BASF SE 18. Primary Key Insights