The Global Microwave Oven Market size was valued at USD 4.15 Bn. In 2022 the total Global Microwave Oven Market revenue is growing by 4.6% from 2023 to 2029, reaching nearly USD 5.69 Bn.Microwave Oven Market Overview:

A microwave Oven is a kitchen appliance that converts electricity into electromagnetic waves called a microwave. The heat produced by the microwave causes water molecules present in the food to vibrate and then cook food. Different types of microwaves present in the market are built-in microwaves, convection microwave ovens, over-the-range microwaves, and smart microwaves. These are used to reheat food microwaves are a safe and highly effective way of cooking method, help preserve nutrients, reduce cooking time, and use less energy compared to the conventional method. The Microwave Oven Market has seen a trend towards innovative features and advanced technology in microwave ovens. Smart microwave ovens, equipped with IoT capabilities and voice control, have gained traction.To know about the Research Methodology :- Request Free Sample Report

Microwave Market Dynamics

Convenience And Time-Saving Are Significantly Drives In The Microwave Oven Market. Microwave ovens are known for their quick food preparation, catering to busy schedules and facilitating reheating, defrosting, and various cooking tasks. They streamline modern on-the-go lifestyles, significantly reducing cooking time and enabling kitchen multitasking. This efficiency is essential for people in work and study environments, where quick, hot meals are a necessity. Microwave ovens are popular for late-night snacks or quick meals, offering a time-saving solution when there's limited time and energy to cook a full meal. Their energy efficiency and the ability to provide consistent heating contribute to further time and energy savings. Moreover, easy clean-up after use adds to their appeal, as they are relatively simple to clean compared to stovetops and ovens. In a fast-paced world, people increasingly value appliances that offer convenience and time efficiency, making microwave ovens a sought-after kitchen appliance for reheating, defrosting, and swift meal preparation. Manufacturers highlight these features when marketing their microwave oven products to consumers who prioritize convenience and time-saving in their daily routines. For Example, The Microwave cooking time is comparatively lower than Conventional cooking Time.Inverter Technology Driving the Microwave Oven Market The growth of microwaves with inverter technology driving force in the microwave oven market, revolutionizing the way we cook and reheat food. This innovative technology has introduced several compelling factors that influence the market dynamics. The continuous advancements in inverter technology have significantly impacted the market. This technology allows for precise and consistent control of microwave power, resulting in superior cooking results. The ability to cook food evenly is a standout feature of inverter microwaves, making them increasingly popular among consumers who demand high-quality microwave cooking. Inverter technology has improved the quality of food prepared in microwaves. By preserving the texture and flavor of meals better than traditional models, it has become a compelling factor for those who prioritize the taste and quality of their food. To energy efficiency, inverter technology has broadened the range of cooking options available in microwave ovens. Precise defrosting, simmering, and gentle cooking are now on the menu, expanding the capabilities of these appliances and attracting consumers looking for versatility. These factors are responsible for the growth of the Inverter technology microwave market. Limited Cooking Capabilities Restraint the Microwave Oven Market The constraint of limited cooking capabilities in microwave ovens restrains the microwave oven market by limiting their appeal to consumers who require versatile and comprehensive cooking options. While microwave ovens are exceptional at reheating, defrosting, and quickly cooking certain foods, their primary limitation lies in their inability to handle complex cooking tasks such as baking, roasting, or grilling. The distinct taste and texture associated with traditional cooking methods often overshadow the efficiency and speed of microwave cooking, deterring culinary enthusiasts who seek a superior cooking experience. The preference for traditional methods, along with the perception that microwave cooking affects the quality and nutritional value of food, hinders the widespread adoption of microwave ovens. Additionally, microwave ovens are not suitable for consumers who value the art and versatility of traditional cooking methods and do not view microwave ovens as their primary culinary appliance, impacting the market's growth. Innovative Smart Microwave Ovens Create Lucrative Growth Opportunities in the Microwave Oven Market The introduction of smart technology into microwave ovens has sparked a transformation in the industry, creating substantial growth opportunities. Smart microwave ovens, equipped with digital displays, touchscreens, and internet connectivity, offer consumers an enhanced and intuitive cooking experience. They allow remote control, making it possible to manage cooking from smartphones or through voice commands, appealing to busy individuals who value convenience. They come with pre-programmed settings and recipes that are updated via the Internet, providing for diverse cooking needs. Energy efficiency features and integration with smart homes further enhance their appeal, as they align with the growing trend of connected living spaces. Smart microwaves are integrated into broader ecosystems, communicating with other smart appliances and home automation systems. One of the significant advantages is data collection. Smart microwaves gather usage data and cooking preferences, enabling manufacturers to refine their products and offer personalized recommendations. The competitiveness in the market has also surged, driving innovation, better performance, and competitive pricing. The ability to receive software updates ensures that these appliances remain relevant over time. Their appeal to tech-savvy consumers and the opportunities for diverse marketing strategies further contribute to their market growth. With the confluence of convenience, connectivity, and versatility, smart microwave ovens are poised to continue their impact on the market, offering numerous prospects for expansion and innovation.

Food Microwave cooking time Conventional cooking Time Chilli 15 Minute 40 Minute Baked Apple 3-4 Minute 45 Minute Stuffed Peppers 22 Minute 60 Minute Fresh Asparagus 9 Minute 22 Minute Lasagna 17 Minute 45 Minute Brownies 4-7 Minute 25-30 Minute Microwave Oven Market Segment Analysis

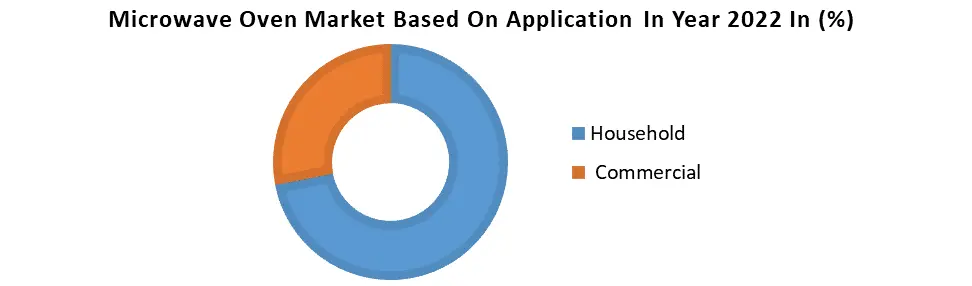

Based on the Oven Type, The market is segmented as convection, grill, and solo. Convection oven dominated the Microwave Market in the year 2022. Convection ovens consist of fans that circulate air around the food for quick heating so these ovens cook 25% faster than a traditional oven. Some of the factors driving the global market are faster cook times, the self-cleaning feature, no flavor transfer, and high functional features, which are adding advantages to the global market. Grill ovens are the fastest-growing segment during the forecast period. It consists of a radiant heating element to cook food and is used for simple cooking purposes like making popcorn, and heating milk, Microwave Oven, and tea. Stainless steel grill microwave oven is the highly demanded oven that is expected to dominate the grill segment in the forecast period.Based on the Application, The household segment dominated the Microwave Market in the year 2022. The household oven market dominates the global market by having a share of more than 60%. Factors attracting the household oven market growth are less expensive compared to the commercial oven, quick use, consists of a turntable, easy to control, and easy to clean, commercial microwave ovens are designed to fulfill the professional demand and they use stirrer systems to distribute energy. Microwaves are essential kitchen appliances in most homes, serving multiple purposes such as reheating, cooking, and defrosting. Their convenience and time-saving attributes align well with the busy lifestyles of households. Microwave technology has become more affordable, making it accessible to a broader consumer base.

Microwave Oven Market Regional insight

North-America region dominated the global Microwave Oven market in the year 2022. Because of the richness of the country, change in the lifestyle of the younger age, popularity of modular kitchens, growing restaurant market, control of cooking time, presence of global key players, etc. The number of microwaves sold in the US was 14.86 Mn. in 2022. Asia-Pacific is the fastest-growing market for global microwave market and is expected to grow during the forecast period. Major drivers of the market in this region are China and India. Increasing the number of households, the shift in purchasing power of families, attraction towards modern kitchen appliances, government initiatives such as June 2014 the Certification and Accreditation of the People’s Republic of China (CNCA) imposed certain regulations to use household electronic items which covering microwave ovens also. For Example, The disposable income per household in India and the US has been increasing from the year 2018 to 2022 and it has significantly helped to boost the Microwave Oven industry.Competitive landscape

The Competitive Landscape of the Microwave Oven market covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the Microwave Oven industry. The global Microwave Oven markets include several market players at the country, regional, and global levels. Some of the key players are Panasonic Corporation, Whirlpool Corporation, LG Electronics, Samsung Electronics, Alto-Shaam Inc., and AB Electrolux, Sharp Corporation. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.Microwave Oven Market Scope: Inquiry Before Buying

Microwave Oven Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.15 Bn. Forecast Period 2023 to 2029 CAGR: 4.6% Market Size in 2029: US $ 5.69 Bn. Segments Covered: by Oven Type Convection Grill Solo by Application Household Commercial by Structure Built-in Countertop Microwave Oven Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Microwave Oven Market

1. Panasonic Corporation ( Osaka, Japan) 2. Samsung Electronics ( Seoul, South Korea) 3. LG Electronics ( Seoul, South Korea) 4. Whirlpool Corporation (Benton Harbor, Michigan, USA) 5. Sharp Corporation ( Sakai, Japan) 6. Breville Group (Sydney, Australia) 7. GE Appliances (Louisville, Kentucky, USA) 8. Electrolux AB (Stockholm, Sweden) 9. Daewoo Electronics (Seoul, South Korea) 10. Midea Group (Foshan, China) 11. Bosch Home Appliances (Munich, Germany) 12. Haier Group ( Qingdao, China) 13. Toshiba Corporation (Tokyo, Japan) 14. Emerson Electric Co. ( Ferguson, Missouri, USA) 15. Sunbeam Products (Boca Raton, Florida, USA) 16. Vestel Group ( Manisa, Turkey) 17. Galanz Group (Shunde, China)FAQ

1] What segments are covered in the Global Microwave Oven Market report? Ans. The segments covered in the Microwave Oven Market report are based on oven type, application, structure, and Region. 2] Which region is expected to hold the highest share of the Global Microwave Oven Market? Ans. The North American region is expected to hold the highest share of the Microwave Oven Market. 3] What is the market size of the Global Microwave Oven Market by 2029? Ans. The market size of the Spa Market by 2029 is expected to reach US$ 5.69 Bn. 4] What was the market size of the Global Microwave Oven Market in 2022? Ans. The market size of the Spa Market in 2022 was valued at US$ 4.15 Bn. 5] Key players in the Global Microwave Oven Market. Ans. Samsung Electronics ( Seoul, South Korea), LG Electronics ( Seoul, South Korea), Whirlpool Corporation (Benton Harbor, Michigan, USA), Sharp Corporation ( Sakai, Japan), Breville Group (Sydney, Australia), GE Appliances (Louisville, Kentucky, USA), Electrolux AB (Stockholm, Sweden), Daewoo Electronics (Seoul, South Korea), Midea Group (Foshan, China) Bosch Home Appliances (Munich, Germany), Haier Group (Qingdao, China) Toshiba Corporation (Tokyo, Japan)

1. Microwave Oven Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Microwave Oven Market: Dynamics 2.1. Microwave Oven Market Trends by Region 2.1.1. North America Microwave Oven Market Trends 2.1.2. Europe Microwave Oven Market Trends 2.1.3. Asia Pacific Microwave Oven Market Trends 2.1.4. Middle East and Africa Microwave Oven Market Trends 2.1.5. South America Microwave Oven Market Trends 2.2. Microwave Oven Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Microwave Oven Market Drivers 2.2.1.2. North America Microwave Oven Market Restraints 2.2.1.3. North America Microwave Oven Market Opportunities 2.2.1.4. North America Microwave Oven Market Challenges 2.2.2. Europe 2.2.2.1. Europe Microwave Oven Market Drivers 2.2.2.2. Europe Microwave Oven Market Restraints 2.2.2.3. Europe Microwave Oven Market Opportunities 2.2.2.4. Europe Microwave Oven Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Microwave Oven Market Drivers 2.2.3.2. Asia Pacific Microwave Oven Market Restraints 2.2.3.3. Asia Pacific Microwave Oven Market Opportunities 2.2.3.4. Asia Pacific Microwave Oven Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Microwave Oven Market Drivers 2.2.4.2. Middle East and Africa Microwave Oven Market Restraints 2.2.4.3. Middle East and Africa Microwave Oven Market Opportunities 2.2.4.4. Middle East and Africa Microwave Oven Market Challenges 2.2.5. South America 2.2.5.1. South America Microwave Oven Market Drivers 2.2.5.2. South America Microwave Oven Market Restraints 2.2.5.3. South America Microwave Oven Market Opportunities 2.2.5.4. South America Microwave Oven Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Microwave Oven Industry 2.8. Analysis of Government Schemes and Initiatives For Microwave Oven Industry 2.9. The Global Pandemic Impact on Microwave Oven Market 2.10. Microwave Oven Price Trend Analysis (2021-22) 2.11. Global Microwave Oven Market Trade Analysis (2017-2022) 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Microwave Manufacturers: Global Installed Capacity 3. Microwave Oven Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 3.1.1. Convection 3.1.2. Grill 3.1.3. Solo 3.2. Microwave Oven Market Size and Forecast, by Application (2022-2029) 3.2.1. Household 3.2.2. Commercial 3.3. Microwave Oven Market Size and Forecast, by Structure (2022-2029) 3.3.1. Built-in 3.3.2. Countertop 3.4. Microwave Oven Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Microwave Oven Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 4.1.1. Convection 4.1.2. Grill 4.1.3. Solo 4.2. North America Microwave Oven Market Size and Forecast, by Application (2022-2029) 4.2.1. Household 4.2.2. Commercial 4.3. North America Microwave Oven Market Size and Forecast, by Structure (2022-2029) 4.3.1. Built-in 4.3.2. Countertop 4.4. Microwave Oven Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 4.4.1.1.1. Convection 4.4.1.1.2. Grill 4.4.1.1.3. Solo 4.4.1.2. United States Microwave Oven Market Size and Forecast, by Application (2022-2029) 4.4.1.2.1. Household 4.4.1.2.2. Commercial 4.4.1.3. United States Microwave Oven Market Size and Forecast, by Structure (2022-2029) 4.4.1.3.1. Built-in 4.4.1.3.2. Countertop 4.4.2. Canada 4.4.2.1. Canada Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 4.4.2.1.1. Convection 4.4.2.1.2. Grill 4.4.2.1.3. Solo 4.4.2.2. Canada Microwave Oven Market Size and Forecast, by Application (2022-2029) 4.4.2.2.1. Household 4.4.2.2.2. Commercial 4.4.2.3. Canada Microwave Oven Market Size and Forecast, by Structure (2022-2029) 4.4.2.3.1. Built-in 4.4.2.3.2. Countertop 4.4.2.4. Canada Microwave Oven Market Size and Forecast, by Industry Vertical (2022-2029) 4.4.2.4.1. Smartphones and Tablets 4.4.2.4.2. PC and Laptop 4.4.2.4.3. Television 4.4.2.4.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 4.4.3.1.1. Convection 4.4.3.1.2. Grill 4.4.3.1.3. Solo 4.4.3.2. Mexico Microwave Oven Market Size and Forecast, by Application (2022-2029) 4.4.3.2.1. Household 4.4.3.2.2. Commercial 4.4.3.3. Mexico Microwave Oven Market Size and Forecast, by Structure (2022-2029) 4.4.3.3.1. Built-in 4.4.3.3.2. Countertop 5. Europe Microwave Oven Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.2. Europe Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.3. Europe Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4. Europe Microwave Oven Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.1.2. United Kingdom Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.1.3. United Kingdom Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.2. France 5.4.2.1. France Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.2.2. France Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.2.3. France Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.3.2. Germany Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.3.3. Germany Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.4.2. Italy Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.4.3. Italy Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.5.2. Spain Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.5.3. Spain Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.6.2. Sweden Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.6.3. Sweden Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.7.2. Austria Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.7.3. Austria Microwave Oven Market Size and Forecast, by Structure (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 5.4.8.2. Rest of Europe Microwave Oven Market Size and Forecast, by Application (2022-2029) 5.4.8.3. Rest of Europe Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6. Asia Pacific Microwave Oven Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.2. Asia Pacific Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4. Asia Pacific Microwave Oven Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.1.2. China Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.1.3. China Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.2.2. S Korea Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.2.3. S Korea Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.3.2. Japan Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.4. India 6.4.4.1. India Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.4.2. India Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.4.3. India Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.5.2. Australia Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Australia Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.6.2. Indonesia Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Indonesia Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.7.2. Malaysia Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Malaysia Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.8.2. Vietnam Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Vietnam Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.9.2. Taiwan Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.9.3. Taiwan Microwave Oven Market Size and Forecast, by Structure (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 6.4.10.2. Rest of Asia Pacific Microwave Oven Market Size and Forecast, by Application (2022-2029) 6.4.10.3. Rest of Asia Pacific Microwave Oven Market Size and Forecast, by Structure (2022-2029) 7. Middle East and Africa Microwave Oven Market Size and Forecast (by Value in USD Million) (2022-2029) 7.1. Middle East and Africa Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 7.2. Middle East and Africa Microwave Oven Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Microwave Oven Market Size and Forecast, by Structure (2022-2029) 7.4. Middle East and Africa Microwave Oven Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 7.4.1.2. South Africa Microwave Oven Market Size and Forecast, by Application (2022-2029) 7.4.1.3. South Africa Microwave Oven Market Size and Forecast, by Structure (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 7.4.2.2. GCC Microwave Oven Market Size and Forecast, by Application (2022-2029) 7.4.2.3. GCC Microwave Oven Market Size and Forecast, by Structure (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 7.4.3.2. Nigeria Microwave Oven Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Nigeria Microwave Oven Market Size and Forecast, by Structure (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 7.4.4.2. Rest of ME&A Microwave Oven Market Size and Forecast, by Application (2022-2029) 7.4.4.3. Rest of ME&A Microwave Oven Market Size and Forecast, by Structure (2022-2029) 8. South America Microwave Oven Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. South America Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 8.2. Middle East and Africa Microwave Oven Market Size and Forecast, by Application (2022-2029) 8.3. Middle East and Africa Microwave Oven Market Size and Forecast, by Structure (2022-2029) 8.4. Middle East and Africa Microwave Oven Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 8.4.1.2. Brazil Microwave Oven Market Size and Forecast, by Application (2022-2029) 8.4.1.3. Brazil Microwave Oven Market Size and Forecast, by Structure (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 8.4.2.2. Argentina Microwave Oven Market Size and Forecast, by Application (2022-2029) 8.4.2.3. Argentina Microwave Oven Market Size and Forecast, by Structure (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Microwave Oven Market Size and Forecast, by Oven Type(2022-2029) 8.4.3.2. Rest Of South America Microwave Oven Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Rest Of South America Microwave Oven Market Size and Forecast, by Structure (2022-2029) 9. Global Microwave Oven Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Microwave Oven Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Panasonic Corporation ( Osaka, Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Samsung Electronics ( Seoul, South Korea) 10.3. LG Electronics ( Seoul, South Korea) 10.4. Whirlpool Corporation (Benton Harbor, Michigan, USA) 10.5. Sharp Corporation ( Sakai, Japan) 10.6. Breville Group (Sydney, Australia) 10.7. GE Appliances (Louisville, Kentucky, USA) 10.8. Electrolux AB (Stockholm, Sweden) 10.9. Daewoo Electronics (Seoul, South Korea) 10.10. Midea Group (Foshan, China) 10.11. Bosch Home Appliances (Munich, Germany) 10.12. Haier Group ( Qingdao, China) 10.13. Toshiba Corporation (Tokyo, Japan) 10.14. Emerson Electric Co. ( Ferguson, Missouri, USA) 10.15. Sunbeam Products (Boca Raton, Florida, USA) 10.16. Vestel Group ( Manisa, Turkey) 10.17. Galanz Group (Shunde, China) 11. Key Findings 12. Industry Recommendations 13. Microwave Oven Market: Research Methodology 14. Terms and Glossary